TIDMNBB

RNS Number : 6907N

Norman Broadbent PLC

26 September 2019

26 September 2019

Norman Broadbent plc

("Norman Broadbent" "NBB" "the Company" or "the Group")

Interim Results

The Board (the "Board") of Norman Broadbent plc (AIM: NBB) - a

leading London quoted Professional Services firm offering a

diversified portfolio of integrated Leadership Acquisition &

Advisory Services (Board & Leadership Search, Senior Interim

Management, Research & Insight, Leadership Consulting &

Assessment, and executive level Talent Solutions) - is pleased to

announce the Group's unaudited interim results for the six months

ended 30 June 2019

Highlights

-- The Group posted a small profit before tax

-- Group revenue increased by GBP0.6m (+13%) to GBP5.2m

-- Net Fee Income (NFI) increased by GBP0.2m (+7%) to GBP3.5m

-- Group Operating Profit was GBP55,000 against a Group

Operating Loss of GBP234,000 in H1 2018

-- PBT was GBP16,000 against a loss of GBP265,000 in H1 2018

-- Interim Management NFI for H1 2019 was GBP900,000, an

increase of GBP101,000 from H1 2018 (+13%)

-- Following a change in leadership, Solutions H1 2019 NFI was

GBP901,000, an increase of GBP283,000 (+46%) on the prior six

months, and the best ever NFI and PBT results

-- New and enhanced Working Capital Facility agreed with Bibby Financial Services

Mike Brennan, Norman Broadbent Group CEO, said:

"I am pleased to report that the first six months of 2019 have

seen continued positive top line growth. We also recorded a small

profit before tax - the first for many years. The return to

profitability in H1 is an extremely important milestone for the

Group. Having posted a loss of GBP0.3m in H1 2018, and a loss of

GBP0.5m in H2 2018, I am pleased with the significant improvement

in H1 2019 which saw the Group return to profit.

These results validate our strategy of building a more

diversified business supplying high value, more relevant services

to clients. As we build a disruptive, market leading Professional

Services business, we continue to attract, and invest in,

high--quality Talent keen to join us on our journey.

On achieving this milestone, I would like to again thank my

colleagues for their continued hard work, innovation and

commitment, our clients for placing their continued trust in us,

and our supportive shareholders"

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

For further information please contact:

Norman Broadbent plc

Mike Brennan/Will Gerrand 020 7484 0000

WH Ireland Limited

Adrian Hadden/Darshan Patel

020 7220 1666

About Norman Broadbent plc:

Norman Broadbent plc (AIM: NBB) is a leading Professional

Services firm focusing on Talent Acquisition & Advisory

Services. Since its formation nearly 40 years ago, NBB has

developed a portfolio of complementary service centered on Board

& Leadership & Executive Search, Senior Interim Management,

Research & Insight, Leadership Consulting & Assessment, and

executive level Recruitment Solutions. Unusually, NBB is one of the

few businesses of its type offering clients an integrated Executive

Search and Interim Management offering. This innovative approach

gives clients access to business critical executive-level Talent,

meeting both short and longer-term needs.

CEO Review:

In the six months to 30 June 2019, the Group posted an operating

profit of GBP55,000 (2018: loss GBP234,000) on turnover of

GBP5,260,000 (2018: GBP4,667,000). The achievement of operating

profit for the first six months is a major landmark in our

strategic journey.

The Group has changed from a predominantly single service

executive search business to an enterprise providing our clients

with an integrated range of complementary, progressive, and

sophisticated offerings geared specifically to their needs. This

not only helps us serve our clients better, but also enables us to

differentiate ourselves in what is becoming an increasingly

transactional/commoditised traditional executive search market.

This also helps build a more balanced Group with complementary,

high-quality recurring annuity type revenue streams.

The rebalancing of our service mix saw our established Executive

Search business, (including Insight and Research revenue),

contribute 46% of Net fee Income (56% in the year to 31 December

2018) with Interim and Solutions both growing and increasing their

percentage share of Group Net Fee Income. This continued overall

growth across the Group, and the introduction of new services has

created a more relevant and balanced business.

Our aim is to continue strategically scaling all of the business

units via the development of our existing resources and, where

appropriate, the selective recruitment of high quality Talent to

the Group. As we continue to grow, we will maintain our focus on

innovation, client-service, enhancing our established brand, the

growth of high-quality recurring revenues, and a return to

profitability.

Summarised Financial Results:

The table below summarises the results for the Group.

Six months Six months Year ended

to 30 June to 30 June 31 Dec

2019 2018 2018

GBP000's GBP000's GBP000's

Continuing operations

Revenue 5,260 4,667 9,414

Cost of sale (1,738) (1,377) (2,770)

------------ ------------ -----------

Gross profit / Net Fee Income 3,522 3,290 6,644

Operating expenses (3,467) (3,524) (7,308)

Group operating profit / (loss) 55 (234) (664)

------------ ------------ -----------

Net finance cost (39) (31) (77)

Profit / (Loss) before tax 16 (265) (741)

Income tax - - -

------------ ------------ -----------

Profit / (Loss) after tax 16 (265) (741)

------------ ------------ -----------

Norman Broadbent Executive Search ("NBES")

Net Fee Income for H1 2019 was GBP1,612,000, a decrease of

GBP163,000 from H1 2018 (-9%). NBES made a loss of GBP71,000 for H1

2019 compared with a loss of GBP18,000 in H1 2018.

Research & Insight ("R&I")

NBES revenues shown above include those generated by our R&I

Practice where we continue to invest. The R&I Practice not only

serves our own internal requirements, but also provides

complementary services to our other businesses, and increasingly to

external clients who buy our stand-alone Research & Insight

services.

Norman Broadbent Interim Management ("NBIM")

NBIM continues to grow. Net Fee Income for H1 2019 was

GBP900,000, an increase of GBP101,000 from H1 2018 (+13%), and up

GBP215,000 (+31%) from the underlying H2 2018 Net Fee income. We

have continued to invest into NBIM and our aim is to selectively

and carefully scale as and when appropriate. Profit in H1 was

GBP13,000 (GBP118,000 in H1 2018).

NB Solutions ("NBS")

NBS Net Fee Income for H1 2019 was GBP901,000, an increase of

GBP283,000 from H1 2018 (+46%). NBS posted a Profit before Tax of

GBP258,000 compared with a profit of GBP66,000 in H1 2018.

Following a change in leadership within NBS, this part of the

business posted its "best ever" results in H1 2019 and indeed NBS

H1 Net Fee Income was 56% up as compared to that achieved in H2

2018.

Norman Broadbent Leadership Consulting ("NBLC")

NBLC Net Fee Income for H1 2019 was GBP108,000, an increase of

GBP10,000 (+10%) from H1 2018. NBLC reported a loss of GBP30,000

for H1 2019 compared to a loss of GBP44,000 in H1 2018.

Financial Position

Equity shareholders' funds were GBP1,294,000 as at 30 June 2019

(GBP1,268,000 at 31 December 2018), with net current liabilities of

(GBP418,000) (net current liabilities GBP454,000 at 31 December

2018). Cash and cash equivalents at 30 June 2019 amounted to

GBP258,000 (GBP684,000 at 31 December 2018, GBP260,000 at 30 June

2018).

Net cash outflow from operations was GBP529,000 (Net cash inflow

from operation was GBP354,000 at 31 December 2018) and net cash

inflow from financing activities amounted to GBP160,000 (GBP103,000

outflow at 31 December 2018).

Outlook

These are positive results and evidence our progression. We

remain confident that we will see continued top line and Net Fee

Income growth, along with an improved bottom line for 2019. I would

like to thank my colleagues for their hard work, innovation and

commitment, our clients for placing their continued trust in us,

and our supportive shareholders.

Michael J. Brennan

Group Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six month period ended 30 June 2019

Note Six months Six months Year ended

ended 30 ended 30

June 2019 June 2018

(unaudited) (unaudited) 31 December

2018

(audited)

GBP000 GBP000 GBP000

Continuing operations

Revenue 5,260 4,667 9,414

Cost of Sales (1,738) (1,377) (2,770)

-------------- -------------- --------------

Gross profit / Net Fee Income 3,522 3,290 6,644

Operating expenses (3,467) (3,524) (7,308)

Group operating Profit / (Loss) 55 (234) (664)

Net finance cost (39) (31) (77)

Profit / (Loss) on ordinary

activities before income tax 16 (265) (741)

Income tax expense - - -

Profit / (Loss) for the period 16 (265) (741)

============== ============== ==============

Other comprehensive income - - -

Total comprehensive Profit

/ (Loss) 16 (265) (741)

============== ============== ==============

Profit / (Loss) attributable

to:

Owners of the Company 13 (294) (763)

Non-controlling interests 3 29 22

-------------- -------------- --------------

Profit / (Loss) for the period 16 (265) (741)

============== ============== ==============

Total comprehensive profit

/ (loss) attributable to:

Owners of the Company 13 (294) (763)

Non-controlling interests 3 29 22

-------------- -------------- --------------

Total comprehensive profit

/ (loss) for the period 16 (265) (741)

============== ============== ==============

Profit /(Loss) per share 4

- Basic 0.02p (0.55p) (1.42)p

- Diluted 0.02p (0.55p) (1.42)p

Adjusted profit/ (loss) per

share

- Basic 0.04p (0.53p) (1.38)p

- Diluted 0.04p (0.53p) (1.38)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2019

Note As at As at As at

30 June 30 June 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 1,363 1,363 1,363

Property, plant and equipment 127 174 155

Trade and other receivables 153 168 135

Deferred tax 69 69 69

Total non-current assets 1,712 1,774 1,722

Current assets

Trade and other receivables 2,732 2,597 2,175

Cash and cash equivalents 258 260 684

------------ ------------ ---------------

Total current assets 2,990 2,857 2,859

Total assets 4,702 4,631 4,581

------------ ------------ ---------------

Current Liabilities

Trade and other payables (1,959) (1,599) (2,025)

Provisions 5 (240) (125) (240)

Loan Note (233) (300) (272)

Bank overdraft and interest

bearing loans (976) (872) (776)

Total current liabilities (3,408) (2,896) (3,313)

Net current assets / (liabilities) (418) (39) (454)

Total liabilities (3,408) (2,896) (3,313)

------------ ------------ ---------------

Total assets less total liabilities 1,294 1,735 1,268

------------ ------------ ---------------

Equity

Issued share capital 6,266 6,266 6,266

Share premium account 13,706 13,706 13,706

Retained earnings (18,644) (18,207) (18,667)

Equity attributable to owners

of the Company 1,328 1,765 1,305

Non-controlling interests (34) (30) (37)

Total equity 1,294 1,735 1,268

------------ ------------ ---------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six month period ended 30 June 2019

Attributable to owners of

the Company

------------------------------------------------

CONSOLIDATED GROUP

Share Capital Share Retained Total Non-controlling Total

Premium Earnings Equity interests Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January 2018 6,266 13,706 (17,923) 2,049 (59) 1.990

Loss for the period - - (294) (294) 29 (265)

Adjustment for discontinued - - - - - -

operation

Total other comprehensive - - - - - -

income

-------------- --------- ---------- --------- ---------------- --------

Total comprehensive income

for the period - - (294) (294) (29) (265)

-------------- --------- ---------- --------- ---------------- --------

Transactions with owners of the Company,

recognised directly in equity:

Issue of ordinary shares - - - - - -

Credit to equity for share

based payments - - 10 10 - 10

-------------- --------- ---------- --------- ---------------- --------

Total transactions with - - - - - -

owners of the Company, recognised

directly in equity

-------------- --------- ---------- --------- ---------------- --------

Balance at 30 June 2018 6,266 13,706 (18,207) 1,765 (30) 1,735

============== ========= ========== ========= ================ ========

Balance at 1 July 2018 6,266 13,706 (18.207) 1,765 (30) 1,735

Loss for the period - - (469) (469) (7) (476)

Total other comprehensive - - - - - -

income

-------------- --------- ---------- --------- ---------------- --------

Total comprehensive income

for the period - - (469) (469) (7) (476)

-------------- --------- ---------- --------- ---------------- --------

Transactions with owners

of the Company, recognised

directly in equity:

Issue of ordinary shares - - - - - -

Credit to equity for share

based payments - - 9 9 - 9

Total transactions with

owners of the Company, recognised

directly in equity - - 9 9 - 9

-------------- --------- ---------- --------- ---------------- --------

Changes in ownership interest - - - - - -

in subsidiaries

-------------- --------- ---------- --------- ---------------- --------

Total transactions with - - - - - -

owners of the Company

-------------- --------- ---------- --------- ---------------- --------

Balance at 31 December 2018 6,266 13,706 (18,667) 1,305 (37) 1,268

============== ========= ========== ========= ================ ========

Balance at 1 January 2019 6,266 13,706 (18,667) 1,305 (37) 1,268

Profit for the period - - 13 13 3 16

Total other comprehensive - - - - - -

income

-------------- --------- ---------- --------- ---------------- --------

Total comprehensive income

for the period - - 13 13 3 16

-------------- --------- ---------- --------- ---------------- --------

Transactions with owners

of the Company, recognised

directly in equity:

Credit to equity for share

based payments - - 10 10 - 10

Balance at 30 June 2019 6,266 13,706 (18,644) 1,328 (34) 1,294

-------------- --------- ---------- --------- ---------------- --------

CONSOLIDATED STATEMENT OF CASH FLOW

For the six month period ended 30 June 2019

Notes Six months ended 30 June 2019 (unaudited) Six months ended 30 June 2018 (unaudited) Year ended 31 December 2018

(audited)

GBP000 GBP000 GBP000

Net cash generated / (used) in operating activities (i) (528) (255) 354

Cash flows from investing activities and servicing of finance

Net finance cost (39) (31) (77)

Payments to acquire tangible fixed assets (20) (152) (168)

Net cash used in investing activities (59) (183) (245)

------------------------------------------ ------------------------------------------ ---------------------------------

Cash flows from financing activities

Repayment of borrowings (39) - (28)

Net cash inflows from equity placing - - -

Increase / (decrease) in invoice discounting 200 20 (75)

Net cash from financing activities 161 20 (103)

------------------------------------------ ------------------------------------------ ---------------------------------

Net (decrease)/increase in cash and cash equivalents (426) (418) 6

Net cash and cash equivalents at beginning of period 684 678 678

Effects of exchange rate changes on cash balances held in foreign - - -

currencies

------------------------------------------ ------------------------------------------ ---------------------------------

Net cash and cash equivalents at end of period 258 260 684

========================================== ========================================== =================================

Analysis of net funds

Cash and cash equivalents 258 260 684

Borrowings due within one year (1,209) (1,171) (1,048)

Net funds (951) (911) (364)

========================================== ========================================== =================================

Note (i)

Reconciliation of operating profit to net cash from operating activities Six months ended 30 June 2019 (unaudited) Six months ended 30 June 2018 (unaudited) Year ended 31 December 2018

(audited)

------------------------------------------ ------------------------------------------ ---------------------------------

Operating profit / (loss) from continued operations 55 (234) (664)

Depreciation/ impairment of property, plant and equipment 46 23 60

Share based payment charge 10 10 19

Increase in trade and other receivables (573) (477) (22)

Increase/(decrease) in trade and other payables (66) 423 846

Increase/(decrease) in Provisions - - 115

Net cash generated / (used) in operating activities (528) (255) 354

========================================== ========================================== =================================

NOTES TO THE FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

1.1 Basis of preparation

The financial information set out in this interim report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 31 December 2018, prepared under International

Financial Reporting Standards (IFRS), have been filed with the

Registrar of Companies. The auditor's report on those statements

was unqualified.

The interim financial information for the six months ended 30

June 2019, has been prepared in accordance with the AIM Rules for

Companies. The Group has not elected to apply IAS 34 'Interim

Financial Reporting'. The principal accounting policies used in

preparing the interim results are those the Group expects to apply

in its financial statements for the year ending 31 December 2019

and are unchanged from those disclosed in the Group's Annual Report

for the year ended 31 December 2018. The interim financial

statements have not been audited.

1.2 Basis of consolidation and business combinations

Group financial statements consolidate those of the Company and

of the following subsidiary undertakings:

Principal Group investments: Country of incorporation or

registration and operation Description and proportion

of shares held by the

Principal activities Company

---------------------------- --------------------------- ---------------------------- ---------------------------

Norman Broadbent Executive England and Wales Executive Search 100 per cent ordinary

Search Ltd shares

Norman Broadbent Overseas England and Wales Executive Search 100 per cent ordinary

Ltd shares

Norman Broadbent England and Wales Assessment, coaching and 100 per cent ordinary

Leadership Consulting Ltd Talent Mgmt. shares

Norman Broadbent Solutions England and Wales Mezzanine Level Search 100 per cent ordinary

Ltd shares

Norman Broadbent Interim England and Wales Interim Management 75 per cent ordinary shares

Management Ltd

Norman Broadbent (Ireland) Republic of Ireland Dormant 100 per cent ordinary

Ltd * shares

Bancomm Ltd England and Wales Dormant 100 per cent ordinary

shares

* 100 per cent of the issued share capital of this company is

owned by Norman Broadbent Overseas Ltd.

2. copies of the unaudited interim report

Copies of this report are available on request from the

Company's registered office at 10(th) Floor, Portland House,

Bressenden Place, London, SW1E 5BH and are also available on the

Company's website at www.normanbroadbent.com.

3. SEGMENTAL ANALYSIS

Management has determined the operating segments based on the

reports reviewed regularly by the Board for use in deciding how to

allocate resources and in assessing performance. The Board

considers Group operations from both a class of business and

geographic perspective.

Each class of business derives its revenues from the supply of a

particular recruitment related service, from retained executive

search through to executive assessment and coaching. Business

segment results are reviewed primarily to operating profit level,

which includes employee costs, marketing, office and accommodation

costs and appropriate recharges for management time.

Group revenues are primarily driven from UK operations, however

when revenue is derived from overseas business the results are

presented to the Board by geographic region to identify potential

areas for growth or those posing potential risks to the Group.

i) Class of Business:

The analysis by class of business of the Group's turnover and

profit before taxation is set out below:

BUSINESS SEGMENTS

Six months Un

ended NBES NBLC NBS NBIM allocated Total

30 June 2019 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ---------------- -------- -------- -------- --------------- --------

Revenue 1,617 130 901 2,611 - 5,259

Cost of sales (5) (22) - (1,711) - (1,738)

--------------- ---------------- -------- -------- -------- --------------- --------

Gross profit /

Net Fee

Income 1,612 108 901 900 - 3,521

Operating

expenses (1,631) (136) (640) (879) (134) (3,420)

Other - - - - - -

operating

income

Finance costs (8) (2) (2) (7) (20) (39)

Depreciation

and

amort. (44) (1) (1) - (46)

Profit/(Loss)

before tax (71) (30) 258 13 (154) 16

--------------- ---------------- -------- -------- -------- --------------- --------

Six months Un

ended NBES NBLC NBS NBIM allocated Total

30 June 2018 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------- ---------------- -------- -------- -------- --------------- --------

Revenue 1,778 161 618 2,110 - 4,667

Cost of sales (3) (63) - (1,311 - (1,377)

--------------- ---------------- -------- -------- -------- --------------- --------

Gross profit /

Net Fee

Income 1,775 98 618 799 - 3,290

Operating

expenses (1,760) (139) (548) (675) (379) (3,501)

Other - - - - - -

operating

income

Finance costs (11) (3) (3) (6) (8) (31)

Depreciation

and

amort. (22) (1) - - (23)

Profit/(Loss)

before tax (18) (44) 66 118 (387) (265)

--------------- ---------------- -------- -------- -------- --------------- --------

Year ended Un

31 December NBES NBLC NBS NBIM allocated Total

2018 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---------------- -------- -------- -------- --------------- --------

Revenue 3,737 345 1,196 4,136 - 9,414

Cost of sales (12) (106) - (2,652) - (2,770)

---------------- ---------------- -------- -------- -------- --------------- --------

Gross profit /

Net Fee Income 3,725 239 1,196 1,484 - 6,644

Operating

expenses (3,908) (272) (1,115) (1,384) (569) (7,248)

Other operating - - - - - -

income

Finance costs (57) - (2) (1) (35) (60)

Depreciation

and amort. (20) (5) (5) (12) - (77)

Profit/(Loss)

before tax (260) (38) 74 87 (604) (741)

---------------- ---------------- -------- -------- -------- --------------- --------

ii) Revenue and gross profit by geography:

Revenue GBP'000 Gross Profit GBP'000

Six Months Ended Year Ended Six Months Ended Year Ended

30 June 30 June 31 Dec 30 June 30 June 31 Dec

2018 2018 2018 2018 2018 2018

---------------- --------- -------- ----------- --------- -------- -----------

United Kingdom 4,902 4,486 8,671 3,165 3,119 5,901

Rest of

the World 357 181 743 356 171 743

Total 5,259 4,667 9,414 3,521 3,290 6,644

----------------- --------- -------- ----------- --------- -------- -----------

4. earnings PER ORDINARY SHARE

i) Basic earnings per share:

This is calculated by dividing the profit attributable to equity

holders of the Company by the weighted average number of ordinary

shares in issue during the period:

Six months Year ended

ended 31 December

Six months ended 30 June 2019 30 June 2018 2018

(unaudited) (unaudited) (audited)

------------------------------ -------------------- ---------------------------

Profit / (loss) attributable to

shareholders 13,000 (294,000) (763,000)

------------------------------ -------------------- ---------------------------

Weighted average number of

ordinary shares 53,885,570 53,885,570 53,885,570

============================== ==================== ===========================

ii) Diluted earnings per share:

This is calculated by adjusting the weighted average number of

ordinary shares outstanding to assume conversion of all dilutive

potential ordinary shares. The Company has issued share options

which are potentially dilutive. A calculation is done to determine

the number of shares that could have been acquired at fair value

(determined as the average annual market share price of the

Company's shares) based on the monetary value of the subscription

rights attached to the outstanding options. The number of shares

calculated as above is compared with the number of shares that

would have been issued assuming the exercise of the share

options.

Six months ended 30 June Six months ended 30 June Year ended 31 December

2019 2018 2018

(unaudited) (unaudited) (audited)

--------------------------- --------------------------- ---------------------------

Profit / (loss) attributable

to shareholders 13,000 (294,000) (763,000)

--------------------------- --------------------------- ---------------------------

Weighted average no. of

ordinary shares 53,885,570 53,885,570 53,885,570

- assumed conversion of

share options - - -

Weighted average number of

ordinary shares for diluted

earnings per share 53,885,570 53,885,570 53,885,570

=========================== =========================== ===========================

iii) Adjusted earnings per share

Adjusted earnings per share has also been calculated in addition

to the basic and diluted earnings per share and is based on

earnings adjusted to eliminate charges for share based payments. It

has been calculated to allow shareholders to gain a clearer

understanding of the trading performance of the Group.

Six months ended 30 June Six months ended 30 June 2018 Year ended 31 December 2018

2019

Basic Diluted Basic Diluted Basic Diluted

pence per pence per pence per pence per pence per pence per

share share share share share share

GBP000 GBP000 GBP000

-------- ---------- --------- -------- ---------- ---------- -------- ---------- ----------

Basic earnings

(Loss)/Profit

after tax 13 0.02 0.03 (294) (0.55) (0.55) (763) (1.42) (1.42)

-------- ---------- --------- -------- ---------- ---------- -------- ---------- ----------

Adjustment

======== ==========

Share based

payment

charge 10 0.02 0.02 10 0.02 0.02 19 0.04 0.04

Adjusted

earnings 23 0.04 0.05 (284) (0.53) (0.53) (744) (1.38) (1.38)

5. PROVISIONS

Six months ended 30 June Six months ended 30 June Year ended 31 December 2018

2019 2018 GBP000

GBP000 GBP000

---------------------------- ---------------------------- ---------------------------

Balance at beginning of

period 240 125 125

Provisions made during the

period - - 115

Balance at end of period 240 125 240

============================ ============================ ===========================

Non-Current - - -

Current 240 125 240

---------------------------- ---------------------------- ---------------------------

240 125 240

============================ ============================ ===========================

The Company moved offices on the 30(th) of April 2018.

Discussions are underway with the Landlord of St James Square to

finalise the dilapidation position, The Group expects to have all

negotiations concluded shortly.

6. RELATED PARTY TRANSACTIONS

i) Purchase of services: Six months ended 30 June Six months ended 30 June Year ended 31 December 2018

2019 2018 GBP000

GBP000 GBP000

---------------------------- ---------------------------- ---------------------------

Brian Stephens & Company

Limited 12 12 20

Total 12 12 20

============================ ============================ ===========================

Brian Stephens & Company Limited invoiced the Group for the

directors' fees and corporate finance services of B Stephens

(GBP12,000) and business related travel costs of GBP2,000. B

Stephens is a director of Brian Stephens & Company Limited.

All related party expenditure took place via "arms-length"

transactions.

ii) Period-end payables Six months ended 30 June Six months ended 30 June Year ended 31 December 2018

arising from the purchases 2019 2018 GBP000

of services: GBP000 GBP000

---------------------------- ---------------------------- ---------------------------

Brian Stephens & Company

Limited 2 4 2

Total 2 4 2

============================ ============================ ===========================

The payables to related parties arise from purchase transactions

and are due one month after date of purchase. The payables bear no

interest.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAKNSAEXNEFF

(END) Dow Jones Newswires

September 26, 2019 02:00 ET (06:00 GMT)

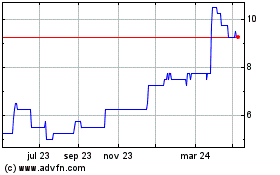

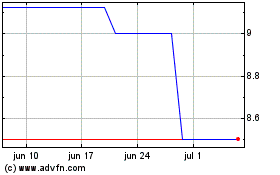

Norman Broadbent (LSE:NBB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Norman Broadbent (LSE:NBB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024