TIDMPPC

RNS Number : 0462O

President Energy PLC

30 September 2019

30 September 2019

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

Unaudited Interim Results for H1 2019 and Group outlook

President (AIM:PPC), the oil and gas upstream company with a

diverse portfolio of production and exploration assets focused

primarily in Argentina, announces its unaudited interim results for

the six months ended 30 June 2019.

Commenting on today's announcement, Peter Levine, Chairman

said:

"President continues with its business in a focussed, calm,

determined and confident way.

"Despite an unforeseen confluence of challenges this year, we

have in H1 2019 delivered demonstrable improvements in all our key

performance indicators over the same period last year.

"In this context, this solid set of results and continuing

profitable operations are a reflection of the strength of President

and its assets and a stark contrast to the disconnected share price

performance of late."

Group Summary

Highlights

-- Group turnover increased by 6.4% over the same period last

year to US$23.3 million despite realisation prices on average

approximately 11% lower

-- Adjusted EBITDA* up 29% from H1 2018 to nearly US$8 million

-- Free cash flow from core operations increased by 11.4% year on year to US$9.7 million

-- Net Group average production up 19.3% from same period 2018

at 2,461 boepd, notwithstanding operational challenges during the

period. The approximate split across our assets was: Rio Negro 76%,

Salta 17% and Louisiana 7% with gas representing less than 5% of

the total

-- Group administration expenses per boe fell by 12.7% to US$6.4 per boe over H1 2018

Outlook

-- President views the outlook for the Company positively and with confidence.

-- Whilst the macro circumstances in Argentina have been

volatile of late, there have been early signs that stability is

returning. Furthermore, we are comforted by the fact that all

Presidential candidates acknowledge that the domestic hydrocarbon

industry needs continued investment with satisfactory returns for

investors and remains key to the future prosperity of

Argentina.

-- Current net Group production is 2,422 boepd with a further

250 boepd due to be brought online from Rio Negro in October. The

Rio Negro assets are contributing the lions share at approximately

79%, followed by Salta at 18% and the balance representing reduced

production from Louisiana. Of the total still less than 5%

represents gas though this will now start to increase in October as

gas production starts to come online with the first Estancia Vieja

gas sales.

-- The Company remains operationally profitable, free cash flow

generative at field level with, in Argentina, unaudited operational

profits in the first three months of H2 still projected to be some

US$3.5 million on a reduced level of G&A compared with the

prior three months.

-- The next four or so months will see continued growth for the

Group as President develops a more balanced portfolio including

profitable, low cost gas developments which we expect, all factors

being equal, to deliver from our existing well stock an additional

ca. 1,850 boepd in spring 2020.

-- Net Group average production for the full year 2019 is now

projected to be ca. 2,600 boepd, up 13.5% year on year (2018: 2,279

boepd), with the benefits of the substantially increased gas

production only being felt from the end of the year once the

building of the enlarged pipeline between Puesto Prado and Las

Bases is completed.

-- Internal projections for 2020 therefore show a materially

increased average in the range 4-5,000 boepd with a significantly

increased proportion of gas all from our Rio Negro assets rising

from less than 5% currently to some 30% of the next year.

* Adjusted EBITDA means Operating Profit before depreciation,

depletion and amortisation, adjusted for non-cash share based

expenses and certain non-recurring items. Non-recurring items

include workovers, one off legal expenses in 2018 and a

discretionary staff bonus award in 2019.

The 2019 Interim Report and Financial Statements will be made

available at www.presidentenergyplc.com

Management will be hosting a conference call at 10.30 a.m. on 30

September 2019 on the following dial-in;

United Kingdom: +44 (0)333 300 0804

PIN: 10921780#

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014.

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets. The Company has independently assessed 1P

reserves in excess of 15 MMboe and 2P reserves of more than 27

MMboe.

The Company has operated interests in the Puesto Flores and

Estancia Vieja, Puesto Prado and Las Bases Concessions, Rio Negro

Province, in the Neuquén Basin of Argentina and in the Puesto

Guardian Concession, in the Noreste Basin in NW Argentina. The

Company is focused on growing production in the near term in

Argentina. Alongside this, President Energy has cash generative

production assets in Louisiana, USA and further significant

exploration and development opportunities through its acreage in

Paraguay and Argentina.

One of President Energy's largest shareholders is the IFC, part

of the World Bank Group. The Company is actively pursuing

development of high quality production and assets capable of

delivering positive cash flows and shareholder returns. With a

strong institutional base of support and an in-country management

teams, President Energy has world class standards of corporate

governance, environmental and social responsibility.

Contact:

President Energy PLC

Peter Levine, Chairman

Rob Shepherd, Finance Director +44 (0) 207 016 7950

finnCap (Nominated Advisor

Christopher Raggett, Scott Mathieson +44 (0) 207 220 0500

Whitman Howard (Broker) +44 (0) 207 659 1234

Hugh Rich, Grant Barker

Tavistock (Financial PR) +44 (0) 207 920 3150

Nick Elwes, Simon Hudson

Chairman's Statement

Summary

The first half of 2019 saw a noticeable improvement compared to

what was itself a significantly improved H1 2018 in all the Group's

key performance indicators including turnover, adjusted EBITDA and

production costs.

Such solid year on year results were delivered notwithstanding

an unforeseen combination of challenging headwinds producing a

deluge of adverse events beyond President's control, affecting both

Argentina and Louisiana. These included:

-- In Argentina, a series of down-hole issues affecting some of

the high impact production wells and electrical outages impacting

average field performances in our core Puesto Flores field on top

of natural declines; and

-- in Louisiana, unprecedented levels of flooding resulting in

the shutting-in of the entire production from all wells there for

some three months which straddled the period under review as well

as the first part of H2.

In total 10 workovers at the main Puesto Flores field were

completed in the period with the objective of stemming both the

expected and unexpected losses in production and to make production

less reliant on the relatively few high impact wells in the core

Rio Negro province. Whilst these met with mixed success, the

learnings were very valuable and the work was beginning to show

positive signs towards the end of the first half which has now

continued into H2 2019. The frac conducted in well PF0-16 has

proved successful with production still double the pre-frac level.

Further fracs will be effected in the field in due course and

studies continue in this regard.

In other work, the Puesto Prado field and associated facilities

were recommissioned and placed into operation and the Las Bases gas

facilities were successfully tested and further detailed

sub-surface studies were conducted in relation to the Paraguay

exploration areas.

Post period, a further eight workovers have been completed at

the Company's fields in the Rio Negro Province with work currently

continuing at the Puesto Flores field. The Estancia Vieja field and

necessary facilities have now also been brought back into

production after some eight years lying idle. Gas sales from that

field will commence shortly. Elsewhere in Argentina, the Puesto

Guardian field production remains stable.

Work has now also started on the building, completion and

commissioning of a brand new 16 km section of 6" steel pipeline to

be laid between Puesto Prado and Las Bases, replacing the limited

capacity 3" flexible pipeline between those points. This will

enable the significant increase in gas sales in the new year with a

projected additional 1,850 boepd in spring 2020.

The Presidential elections are due to take place in Argentina on

27 October 2019. On 11 August 2019 the primary elections took

place, the result of which saw the Peronist Frente de Todos party

securing 47.65% of the electoral vote; a 15.57% margin over the

Macri administration. This result was not anticipated by the

investing community and global markets with a significant fall

occurring in both the Merval index and US Dollar:Peso exchange rate

following the announcement. This was likewise reflected in the

sharp and, in our view, overdone drop in the Company's share price.

Such a fall, at least in the currency, has to a certain extent

corrected and the peso has strengthened from a low of over 63 to

the Dollar to approximately 57 currently.

In an aim to reduce pressure on consumers in the short-term, the

Government passed a Decree on 16 August 2019 which fixed the crude

oil and gasoline prices for 90 days (to mid-November). The original

Decree set a Brent reference price of US$59/bbl and a US

Dollar:Peso exchange rate of 45.19. Following pressure from

Provinces, unions and producers, this fixed exchange rate has now

been increased via a series of decrees to the present level of

49.30 pesos to the Dollar; there is media speculation that further

positive adjustments will follow although nothing concrete can be

said at this stage.

With the US Dollar:Peso exchange rate currently fixed at 49.30,

being lower than the current rate of exchange the original Decree

as amended, has had and is having an impact on the Company due to

the fact that all domestic oil sales contracts are paid in Pesos.

Accordingly realised sales revenues in H2 will be lower than

expected at the start of this year. This decline has however been

partially offset by lower Peso denominated costs.

It remains difficult to forecast where the domestic oil price

for producers will land after the end of the temporary restrictions

in November (if they are at that stage still in place) as well as

the future of the temporary exchange control issues brought in

recently. Nevertheless, there is a cautious but increasing and

welcome air of realism and understanding from both the major

political parties as to the importance to Argentina of its

hydrocarbon industry, specifically the need for it to continue to

be attractive for investors. Whatever happens, President's laser

focus on delivery, margins and cash management means its stress

tested business model remains solid and robust.

In Louisiana, the wells have now been placed back in production

after an extensive workover of the highest producing Triche well

due to lower oil and gas and higher water flow. This and the

historic flooding led to production in the period falling by 42.2%.

After the workover, the Triche well, which is considered to be

still cleaning up, is at present delivering reduced production

compared to pre flood levels. This is down from 260 bopd gross at

the start of the year to some 55 bopd gross currently with a

similar reduction in gas sales. Whilst remaining profitable at

these reduced levels, President is monitoring progress at the

Triche well after its long shut-down and workover period and

considering future action and strategy regarding these non-core and

non-material assets. The Company is scheduled to start drilling in

Q4 2019 at Jefferson Island, where it has a 20% operated

interest.

It remains to extend the Director's appreciation to our

management and staff, our shareholders, our partners, EDHIPSA and

all the Government, Provincial and Regulatory authorities wherever

we conduct business for their continued support.

Financial

-- Group turnover in H1 2019 increased by 6.4% to US$23.3

million against the same period in 2018. This is in spite of lower

realised prices (approximately 11% lower on average year on year

and 12% less than the last half of 2018) as well as production

losses suffered in both Argentina and Louisiana.

-- Adjusted EBITDA for the period increased by 29% over the same

period last year to nearly US$8 million.

-- Free cash from core operations increased by 11.4% year on year to US$9.7 million.

-- Net Group average production in the H1 period increased by

19.3% over same period last year to 2,461 boepd notwithstanding the

issues referred to above. This was approximately split between Rio

Negro assets 76%, Salta 17% and Louisiana 7% with gas representing

less than 5% of the total

-- Group well operating costs per boe (excluding royalties and

production taxes) fell by 15% over the previous year to US$19.9 per

boe.

-- Group administration expenses per boe fell by 12.7% to US$6.4

per boe over the same period in 2018.

-- In the first part of H1 2019 the Company raised US$4.1

million net after expenses by way of a placing of shares at 8p per

share.

-- The Company remains operationally profitable, free cash flow

generative at field level with operational profits for the first

three months of H2 in Argentina still projected, taking into

account reduced realisation prices, to be approximately US$3.5

million on a reduced level of G&A compared with the previous

three months.

-- Accordingly, whilst the results for the whole of H2 2019 are

not currently projected to materially improve upon the levels for

the same period in 2018, the present period is expected to be

operationally profitable on a month by month basis with progress on

a number of fronts including gas production.

Argentina

-- The 10 well workovers completed in the period in the Puesto

Flores field partially mitigated both natural declines, disruptions

to productions and unexpected issues in high impact oil producing

wells. Another three to four workovers will be carried out by the

end of H2 2019.

-- Both the Puesto Prado and Las Bases Concessions together with

the strategic pan-regional pipeline were integrated into the Group

and both fields are contributing to production.

-- As previously advised, whilst the current economic and

political volatility in Argentina prevails, we have deferred this

year's drilling campaign in favour of greater near term emphasis on

progressing and expanding our existing gas project. It is now

anticipated well drilling will commence in H1 2020 with an initial

emphasis on new gas wells.

-- Initial gas sales from Estancia Vieja will commence shortly;

the sales will then ramp up significantly once the new section of

pipeline is completed towards the end of this year.

Paraguay

-- The farm-out process in Paraguay also continues without at

this stage any material developments.

-- Extensive sub-surface work was carried out in the period

under review to identify drilling locations for the first well and

volumetrics. A brief summary presentation of part of such work

issued in June 2019 can be found on the Company's website

www.presidentenergypc.com. The work re-validates the prospectivity

of the Pirity block and in particular the mean oil in place

estimations for the initial Delray complex targets which are over

220 million barrels of oil.

-- It remains the intention that exploration drilling will

commence in 2020. Further details in relation to timing will be

given before the end of this year.

Louisiana

-- Louisiana continues to contribute production, profits and

cash to President, albeit substantially less than last year due to

the above referred to factors.

-- Net production to President is currently approximately 75

boepd, solely due to the reduced performance of the Triche well.

This gives a projected monthly cash contribution back to the UK of

approximately US$50,000 cash at present oil prices.

-- USA average realised oil prices decreased in period by 10% to

US$58.5 per barrel and are currently realising around US$60 per

barrel.

Outlook

-- President views the outlook for the Company positively and with confidence.

-- Whilst the macro circumstances in Argentina have been

volatile of late, there have been early signs that stability is

returning. Furthermore, we are comforted by the fact that all

Presidential candidates acknowledge that the domestic hydrocarbon

industry needs continued investment with satisfactory returns for

investors and remains key to the future prosperity of

Argentina.

-- Current net Group production is 2,422 boepd with a further

250 boepd due to be brought online from Rio Negro in October. The

Rio Negro assets are contributing the lions share at approximately

79%, followed by Salta at 18% and the balance representing reduced

production from Louisiana. Of the total still less than 5%

represents gas though this will now start to increase in October as

gas production starts to come online with the first Estancia Vieja

gas sales.

-- The Company remains operationally profitable, free cash flow

generative at field level with, in Argentina, unaudited operational

profits in the first three months of H2 still projected to be some

US$3.5 million on a reduced level of G&A compared with the

prior three months.

-- The next four or so months will see continued growth for the

Group as President develops a more balanced portfolio including

profitable, low cost gas developments which we expect, all factors

being equal, to deliver from our existing well stock an additional

ca. 1,850 boepd in spring 2020.

-- Net Group average production for the full year 2019 is now

projected to be ca. 2,600 boepd, up 13.5% year on year (2018: 2,279

boepd), with the benefits of the substantially increased gas

production only being felt from the end of the year once the

building of the enlarged pipeline between Puesto Prado and Las

Bases is completed.

-- Internal projections for 2020 therefore show a materially

increased average in the range 4-5,000 boepd with a significantly

increased proportion of gas all from our Rio Negro assets rising

from less than 5% currently to some 30% of the next year.

Peter Levine

Executive Chairman

30 September 2019

Glossary of terms

MMboe Million barrels of oil equivalent

Boepd Barrels of oil equivalent per day

Bopd Barrels of oil per day

MMbbls Million barrels of oil

MMBtu Million British Therman Units (gas)

Tcf Trillion cubic feet (gas)

Production means the production that a Concession owner has the

legal and contractual right to retain

Condensed Consolidated Statement of Comprehensive Income

Six months ended 30 June 2019

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

Note US$000 US$000 US$000

Continuing Operations

Revenue 23,315 21,907 47,181

Cost of sales

Depletion, depreciation & amortisation (4,332) (3,511) (7,245)

Other cost of sales (13,891) (13,821) (25,207)

Total cost of sales 3 (18,223) (17,332) (32,452)

------------ ------------ ----------

Gross profit/(loss) 5,092 4,575 14,729

Administrative expenses 4 (2,866) (2,752) (6,059)

Operating profit / (loss) before

impairment charge

------------ ------------ ----------

and non-operating gains / (losses) 2,226 1,823 8,670

Presented as:

Adjusted EBITDA 7,931 6,128 16,660

Non-recurring items (1,201) (634) (2,275)

EBITDA excluding share options 6,730 5,494 14,385

Depreciation, depletion & amortisation (4,347) (3,526) (7,291)

Release of abandonment provision - - 1,817

Share based payment expense (157) (145) (241)

Operating profit / (loss) 2,226 1,823 8,670

----------------------------------------- ----- ------------ ------------

Impairment charge 5 - - 2,610

Non-operating gains /(losses) 6 33 (79) (29)

Profit/(loss) after impairment

and non-operating

------------ ------------ ----------

gains and (losses) 2,259 1,744 11,251

Finance income 7 221 215 394

Finance costs 7 (2,231) (2,386) (5,565)

Profit / (loss) before tax 249 (427) 6,080

Income tax (charge)/credit

Current tax income tax (charge)/credit - - (19)

Deferred tax being a provision

for future taxes (1,607) (4,164) (5,941)

Total income tax (charge)/credit (1,607) (4,164) (5,960)

Profit/(loss) for the period from

continuing operations (1,358) (4,591) 120

Other comprehensive income

- Items that may be reclassified

subsequently

to profit or loss

Exchange differences on translating

foreign operations - - -

Total comprehensive profit/(loss)

for the period

attributable to the equity holders

of the Parent Company (1,358) (4,591) 120

============ ============ ==========

Earnings/ (loss )per share from

continuing operations US cents US cents US cents

Basic earnings/ (loss) per share 8 (0.12) (0.47) 0.01

Diluted earnings / (loss) per share 8 (0.12) (0.47) 0.01

============ ============ ==========

Condensed Consolidated Statement of Financial Position

As at 30 June 2019

30 June 30 June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Note

ASSETS

Non-current assets

Intangible exploration and

evaluation assets 9 104,027 103,470 103,950

Goodwill 705 705 705

Property, plant and equipment 9 93,945 72,197 92,117

------------ ------------ ----------

198,677 176,372 196,772

Deferred tax 1,726 950 1,800

Other non-current assets 351 351 351

200,754 177,673 198,923

------------ ------------ ----------

Current assets

Trade and other receivables 10 13,756 10,643 10,658

Stock - 82 84

Cash and cash equivalents 197 2,054 1,970

13,953 12,779 12,712

------------ ------------ ----------

TOTAL ASSETS 214,707 190,452 211,635

============ ============ ==========

LIABILITIES

Current liabilities

Trade and other payables 22,448 18,294 23,739

Lease liability (IFRS16) 479 - -

Borrowings 11 4,236 2,460 3,792

27,163 20,754 27,531

------------ ------------ ----------

Non-current liabilities

Long-term provisions 4,507 5,239 4,509

Lease liability (IFRS16) 625 - -

Borrowings 11 23,692 18,698 26,306

Deferred tax 8,390 4,230 6,857

37,214 28,167 37,672

------------ ------------ ----------

TOTAL LIABILITIES 64,377 48,921 65,203

============ ============ ==========

EQUITY

Share capital 24,353 23,642 23,654

Share premium 245,304 240,822 240,904

Translation reserve (50,240) (5,624) (50,240)

Profit and loss account (76,427) (124,396) (75,069)

Other reserve 7,340 7,087 7,183

TOTAL EQUITY 150,330 141,531 146,432

============ ============ ==========

TOTAL EQUITY AND LIABILITIES 214,707 190,452 211,635

============ ============ ==========

Condensed Consolidated Statement of Changes in Equity

Share Share Translation Profit Other Total

capital premium reserve and reserve

loss

account

US$000 US$000 US$000 US$000 US$000 US$000

Balance at 1 January

2018 23,642 240,822 (50,240) (75,189) 6,942 145,977

--------- --------- ------------ ---------- --------- --------

Convertible loan

equity - - - - - -

Transfer to P&L

account - - 44,616 (44,616) - -

Share-based payments - - - - 145 145

Transactions with

owners - - 44,616 (44,616) 145 145

Loss for the period - - - (4,591) - (4,591)

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - (4,591) - (4,591)

Balance at 30 June

2018 23,642 240,822 (5,624) (124,396) 7,087 141,531

Share-based payments - - - - 96 96

Issue of ordinary

shares 12 82 - - - 94

Cost of issue - - - - - -

Transfer to P&L

account - - (44,616) 44,616 - -

Transactions with

owners 12 82 (44,616) 44,616 96 190

Profit for the period - - - 4,711 - 4,711

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - 4,711 - 4,711

Balance at 1 January

2019 23,654 240,904 (50,240) (75,069) 7,183 146,432

Share-based payments - - - - 157 157

Debt conversion 130 907 1,037

Issue of ordinary

shares 569 3,985 - - - 4,554

Cost of issue - (492) - - - (492)

Transactions with

owners 699 4,400 - - 157 5,256

Loss for the period - - - (1,358) - (1,358)

Exchange differences

on

translation - - - - - -

Total comprehensive

income/(loss) - - - (1,358) - (1,358)

Balance at 30 June

2018 24,353 245,304 (50,240) (76,427) 7,340 150,330

========= ========= ============ ========== ========= ========

Condensed Consolidated Statement of Cash Flows

Six months ended 30 June 2019

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Cash flows from operating activities

- (Note 12)

Cash generated/(consumed) by operations 6,749 2,639 14,723

Taxes paid - - (5)

6,749 2,639 14,718

------------ ------------ ----------

Cash flows from investing activities

Expenditure on exploration and evaluation

assets (77) (171) (558)

Expenditure on development and production

assets

(excluding increase in provision

for decommissioning) (8,002) (4,359) (7,865)

Expenditure on decommissioning costs (280) 1 (33)

Proceeds from asset sales 19 1,098 503

Acquisition & licence extension in

Argentina (1,135) - (15,806)

USA acquisition - - (93)

Interest received 102 215 394

(9,373) (3,216) (23,458)

------------ ------------ ----------

Cash flows from financing activities

Proceeds from issue of shares (net

of expenses) 4,062 - -

Loan drawdown 1,948 615 11,670

Repayment of loan capital (3,081) (616) (2,206)

Payment of loan interest and fees (1,875) (1,195) (2,713)

Repayment of obligations under leases (242) - -

812 (1,196) 6,751

------------ ------------ ----------

Net increase/(decrease) in cash and

cash equivalents (1,812) (1,773) (1,989)

Opening cash and cash equivalents

at beginning of year 1,970 4,026 4,026

Exchange (losses)/gains on cash and

cash equivalents 39 (199) (67)

Closing cash and cash equivalents 197 2,054 1,970

============ ============ ==========

Notes to the Half-Yearly Financial Statements

Six months ended 30 June 2019

1 Nature of operations and general information

President Energy PLC and its subsidiaries' (together "the

Group") principal activities are the exploration for and the

evaluation and production of oil and gas.

President Energy PLC is the Group's ultimate parent company. It

is incorporated and domiciled in England. The Group has onshore oil

and gas production and reserves in Argentina and the USA. The Group

also has onshore exploration assets in Paraguay and Argentina. The

address of President Energy PLC's registered office is 1200 Century

Way, Thorpe Park Business Park, Leeds LS15 8ZA. President Energy

PLC's shares are listed on the Alternative Investment Market of the

London Stock Exchange.

These condensed consolidated interim financial statements (the

interim financial statements) have been approved for issue by the

Board of Directors on 30th September 2019. The financial

information for the year ended 31 December 2017 set out in this

interim report does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial information

for the six months ended 30 June 2019 and 30 June 2018 was neither

audited nor reviewed by the auditor. The Group's statutory

financial statements for the year ended 31 December 2018 have been

filed with the Registrar of Companies. The auditor's report on

those financial statements was unqualified and did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498(2) or (3) of the Companies Act 2006

2 Basis of preparation

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the consolidated financial

statements of the Group for the year ended 31 December 2018, which

have been prepared under IFRS as adopted by the European Union.

These financial statements have been prepared under the

historical cost convention, except for any derivative financial

instruments which have been measured at fair value. The accounting

policies adopted in the 2019 interim financial statements are the

same as those adopted in the 2018 Annual report and accounts other

than for the implementation of the new International Financial

Reporting Standard 16 on Leases. The Group implemented IFRS 16 on

Leases effective from 1 January 2019 and further details are

provided in note 13.

The Directors consider the Group as a going concern on the basis

of its financial performance and support it receives from its

principal funder IYA. Furthermore, the Directors consider that

issues surrounding Brexit will have no material effect on the

Group.

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

3 Cost of

Sales

Depreciation 4,332 3,511 7,245

Release of abandonment

provision - - (1,817)

Royalties & production

taxes 4,730 4,428 8,265

Well operating costs 9,161 9,393 18,759

18,223 17,332 32,452

============ ============ ==========

4 Administrative expenses

Directors and staff cost 2,399 1,904 3,673

Share-based payments 157 145 241

Depreciation 15 15 46

Other 295 688 2,099

2,866 2,752 6,059

============ ============ ==========

5 Impairment (credit) / charge

DP1002 well in Argentina - - (2,610)

- - (2,610)

============ ============ ==========

6 Non-operating gains / (losses)

Reversal of provision for

doubtful taxes - - 84

Other gains / (losses) 33 (79) (113)

33 (79) (29)

============ ============ ==========

7 Finance income & costs

Interest income 102 215 394

Exchange gains 119 - -

Finance income 221 215 394

============ ============ ==========

Interest & similar charges 2,231 1,419 3,089

Exchange losses - 967 2,476

Finance costs 2,231 2,386 5,565

============ ============ ==========

8 Earnings / (loss) per share

Net profit / (loss) for

the period attributable

to the equity holders

of the

Parent Company (1,358) (4,591) 120

============ ============ ==========

Number Number Number

'000 '000 '000

Weighted average number

of shares in issue 1,126,561 971,173 1,072,106

============ ============ ==========

Earnings /(loss) per share US cents US cents US cents

Basic (0.12) (0.47) 0.01

Diluted (0.12) (0.47) 0.01

============ ============ ==========

9 Non-current assets

Property

Plant

Intangible and Total

Equipment

US$000 US$000 US$000

Cost

At 1 January 2018 145,373 97,264 242,637

Additions 171 4,359 4,530

Disposals (662) (662)

At 30 June 2018 145,544 100,961 246,505

Additions 387 12,058 12,445

Acquisition & licence extension

in Argentina - 11,591 11,591

Acquisition USA 93 - 93

Disposals - 36 36

At 1 January 2019 146,024 124,646 270,670

Additions 77 4,829 4,906

Right of use assets (IFRS16) - 1,346 1,346

At 30 June 2019 146,101 130,821 276,922

=========== ========== ========

Depreciation/Impairment

At 1 January 2018 42,074 25,248 67,322

Disposals - (10) (10)

Charge for the period - 3,526 3,526

----------- ---------- --------

At 30 June 2018 42,074 28,764 70,838

Charge for the period - 3,765 3,765

----------- ---------- --------

At 1 January 2019 42,074 32,529 74,603

Charge for the period - 4,347 4,347

At 30 June 2019 42,074 36,876 78,950

=========== ========== ========

Net Book Value 30 June

2019 104,027 93,945 197,972

=========== ========== ========

Net Book Value 30 June

2018 103,470 72,197 175,667

=========== ========== ========

Net Book Value 31 December

2018 103,950 92,117 196,067

=========== ========== ========

No impairment indicators were noted at 31 December 2018 or

existed at that balance sheet date. Subsequent to year end there

has been increasing volatility and falls in the Merval index and US

Dollar: Peso exchange rate following the announcement. In an aim to

reduce pressure on consumers in the short-term, the government

passed a decree on 16 August 2019 which fixes the crude oil and

gasoline prices for 90 days. The decree sets a Brent reference

price of US$59/bbl and also set an exchange rate that would apply.

These are short term developments subsequent to the year end that,

at today's date, do not indicate a long term issue to the

investment values held but will continue to be monitored by the

Directors

10 Trade and other receivables

30 June 30 June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Trade and other receivables 13,649 10,594 10,295

Prepayments 107 49 363

13,756 10,643 10,658

============ ============ ==========

11 Borrowings

Current

Bank loan 4,236 2,460 3,792

4,236 2,460 3,792

Non-Current

IYA Loan 19,373 13,735 19,851

Bank loan 4,319 4,963 6,455

23,692 18,698 26,306

------------ ------------ ----------

Total carrying value of

borrowings 27,928 21,158 30,098

============ ============ ==========

12 Reconciliation of operating profit to net cash outflow

from operating activities

6 months 6 months Year to

to 30 to 30

June June 31 Dec

2019 2018 2018

(Unaudited) (Unaudited) (Audited)

US$000 US$000 US$000

Loss from operations before taxation 249 (427) 6,080

Interest on bank deposits (102) (215) (394)

Interest payable and loan

fees 2,153 1,419 3,089

Depreciation and impairment

of property,

plant and equipment 4,347 3,526 7,291

Impairment charge - - (2,610)

Release of abandonment

provision - - (1,817)

Gain on non-operating transaction (33) 79 29

Share-based payments 157 145 241

Foreign exchange difference (119) 967 2,476

Operating cash flows before movements

in working capital 6,652 5,494 14,385

(Increase)/decrease in

receivables (3,427) (4,070) (4,483)

(Increase)/decrease in

stock 84 (5) (7)

(Decrease)/increase in

payables 3,440 1,220 4,828

Net cash generated by/(used in)

operating activities 6,749 2,639 14,723

============ ============ ==========

13 Adoption of new IFRS16 lease accounting standard

The Group adopted IFRS 16 Leases, which sets out the principles

for the recognition, measurement, presentation and disclosure of

leases, for the period commencing 1 January 2019. On adoption of

IFRS 16, the Group recognised lease liabilities in relation to

leases which were previously classified as operating leases under

the provisions of IAS 17 Leases. The Group has identified leases

predominantly for oil and gas production equipment but also for

property and transportation equipment.

In calculating the present value of lease payments, the Group

uses its incremental borrowing rate at the lease commencement date

if the interest rate implicit in the lease is not readily

determinable. The discount rates used on transition are the

incremental borrowing rates as appropriate for each lease based on

factors such as the lessee legal entity and lease term. The

incremental borrowing rate applicable for all of the leases for the

Group is between 5.0% and 14.9%. The determination of whether there

is an interest rate implicit in the lease, the calculation of the

Group's incremental borrowing rate, and whether any adjustments to

this rate are required, involves some judgement and is subject to

change over time. At the commencement date of leases management

consider whether the lease term will be the full term of the lease

or whether any option to break or extend the lease is likely to be

exercised. Leases are regularly reviewed and will be revalued if

the term is likely to change.

In accordance with the transition provisions in IFRS 16, the

modified retrospective approach has been adopted with the

cumulative effect of initially applying the new standard recognised

on 1 January 2019. Comparatives for the 2018 financial year have

not been restated. The financial impact of transition to IFRS 16

for the first half of financial year 2019 has been summarised

below. The Group has elected to use the recognition exemptions for

lease contracts that, at the commencement date, have a lease term

of 12 months or less and do not contain a purchase option, and

lease contracts for which the underlying asset is of low value

('low-value assets'). The Group recognises lease expenses for these

contracts on a straight-line basis as permitted by IFRS 16. Lease

liabilities related to operated Joint Ventures are disclosed gross

with the debit representing the partner's share disclosed in

amounts due from Joint Venture Partners.

On adoption

1 Jan 30 Jun

2019 2019

(Unaudited) (Unaudited)

US$000 US$000

Balance

sheet

ASSETS

Non-current assets 639 1,072

LIABILITIES

Current liabilities 339 479

Non-current liabilities 300 876

Income statement

Cost of sales 42

Administrative expense 4

Finance costs (78)

Deferred tax (251)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SESFAUFUSEFU

(END) Dow Jones Newswires

September 30, 2019 02:02 ET (06:02 GMT)

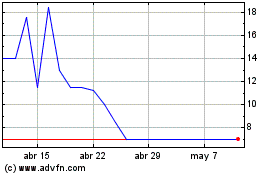

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024