TIDMPPP

RNS Number : 1745O

Pennpetro Energy PLC

30 September 2019

30 September 2019

Pennpetro Energy plc

("Pennpetro", the "Company" or the "Group")

Results for the 6 months ended 30 June 2019 (Unaudited)

Pennpetro Energy, an independent oil and gas company focusing on

production in the Gonzales Oil Field in Texas, USA, announces today

its financial results for the six months ended 30 June 2019.

Financial summary

-- The financial results for the six months ended 30 June 2019

show a loss after tax of $929,000 (at H1 2018: loss $457,000).

-- The Group's borrowings, which were non-current, at 30 June

2019 were $5,996,000 (at H1 2018: $6,021,000).

-- The Group expects to generate revenue in H2 2019 from its

first horizontal well and intends to use its cash balances and

cashflow from oil production to fund additional development of its

lease interests in Gonzales.

-- During the period the Company raised net proceeds of $945k

through the issue of 1,433,702 new shares.

Operational summary

-- Secured increased ownership of City of Gonzales license, with

working interest increasing from 75% to 100%. This translates into

an uplifted interest of 4,000 MBBL and 2,000 MMcf of gas from 2,000

MBBL of oil and 1,000 MMcF of gas, of proven petroleum

reserves.

-- The Group's undiscounted Net Revenue Interest increases to

$124,000,000 (at H1 2018: $62,000,000) as a result of the

additional acquired interests, based upon most recent CPR prepared

in December 2017 out to 2031 at an average price of oil of $55,

non-escalated, per barrel West Texas Intermediate.

-- Following disruption in pumping activities during the period,

due to issues in the City of Gonzales electrical grid, operations

have now resumed, leading towards commencement of production from

COG#1-H.

Outlook

In line with our strategy, all our operations are in highly

active plays where the economics of drilling and producing remain

attractive at sub-US$30 oil prices. This highlights the success we

have had in taking advantage of the prior industry downturn to

accelerate the positioning of our South Texas leasehold position in

favour of the Austin Chalk and Eagleford Shale. We can now add the

unexpected bonus of the Buda Limestone formation reserves which we

can now confidently state will increase our overall proved oil

reserves, albeit we await a formal new CPR to be prepared in this

regard. Pennpetro's priorities for the remainder of 2019 are

focused on project delivery:

-- Commence full production of the COG#1-H well

-- Acquire additional land leases and carry out a 3-D seismic survey

Chairman's Statement

I am pleased to advise that, following an interruption to

pumping activities, the Company has resumed steady progress towards

bringing the first well COG#1-H into production. During this

reporting period the Company also issued 1,433,702 new shares,

raising net proceeds of $945k.

During the period under review the Company encountered

electricity delivery issues due to redevelopment work required for

the City of Gonzales electrical grid system within the area of the

production facility, and electrical surges which caused damage to

our jet pumping unit, together with various ancillary units,

rendering them inoperable. All ancillary units have been replaced

and a new unit incorporating anti-surge protection technologies has

been successfully installed with pumping being resumed.

The testing of this infrastructure is ongoing. Test oil will be

delivered into the tanks, with salt water being disposed by a daily

tanker pickup from site.

Ongoing negotiations with the pumping unit supplier, Tech Flo,

are ongoing with regard to the technical liability issues pursuant

to this issue, as it is the Company's position that the systems

supplied were inadequate to account for higher electrical

currents.

The Operator, pursuant to the State of Texas petroleum reporting

requirements, has formally advised the Texas Railroad Commission

that the COG#1-H is completed as a producer initially to the Buda

formation, with initial Buda oil having been delivered into the

tanks. As we near decisions regarding the timing of the drilling of

the second horizontal well, which will be located in the northern

section of the leases, the Company took the decision to enable its

subsidiary Nobel Petroleum USA, Inc., ("Nobel") to take over as

Operator. Filings have been delivered to the Texas Railroad

Commission. Current Operator management will continue to be

utilised alongside the Nobel management team. In conjunction with

this development, as reported recently, we have increased our

interest in the City of Gonzales oilfield leases to 100% from our

previous 75% holding.

Testing of the Austin Chalk horizontal formation which delivered

oil over the shakers during drilling, will be initiated once a full

longer-term test of the lower located Buda reservoir has been

finalised. The Buda limestone reserves have never been included in

our evaluation of our reserves, nor in the Competent Persons Report

(CPR) that accompanied the prospectus. We are aware that the Buda

has been and is currently a successful target for vertical

completions in the Gonzales area. Generally, the Buda limestone

formation has an EUR of between 140,000 - 175,000 bbls, and thus as

now having been proved as a flowing production formation within the

Company's acreage can be included within the Company's future

technical evaluations and further vertical infill drilling

locations on reduced spacing parameters.

As previously reported, Nobel Petroleum UK Limited, the

Company's wholly owned subsidiary, through its US-based

subsidiaries owns a portfolio of leasehold petroleum mineral

interests centred on the City of Gonzales, in southeast Texas,

comprising the undeveloped central portion of the Gonzales Oil

Field. It is intended that this legacy structure be simplified by

the transfer of the US subsidiaries direct to the Company and the

removal of Nobel UK from ownership. We have written to HMRC

advising that we have requested Companies House to remove Nobel UK

from registry. The petroleum assets include approximately 1,000

leases covering 2,500 acres of land and contain proven oil

condensates.

We have once again increased our holding in the oil asset and

whereas at IPO we owned 50% of the total reserves we now own 100%.

The CPR prepared in advance of the acquisition estimated that, as a

result of the acquisition, Pennpetro Group would now have a Working

Interest in the portfolio of petroleum mineral leases of 4,000 MBBL

of oil and 2,000 MMcf of gas.

The period under review has been challenging due to a period of

cessation of our pumping activities but one of real progress in our

increased ownership and the Company is now well placed to

capitalise on the recovery in sentiment within the US and global

petroleum sectors.

We remain confident in our petroleum assets and our US

operations, and the Board will continue to build upon what has been

a promising and busy period for the Group.

Keith Edelman

Non-Executive Director, Chairman

30 September 2019

Executive Director's Statement

Operations

As reported in the prior period, we had begun completion

operations which entailed the construction of a new tankerage farm

and the Operator was pump testing to remove accumulated water from

the reservoirs, while at the same time recovering oil as the

oil-cut progressively increased. As reported in the Chairman's

Statement, we encountered issues with the pumping unit and certain

ancillary installations due to factors out of our control, namely

problems associated with the electrical delivery to the production

site from the City of Gonzales electricity grid which necessitated

the City to overhaul its grid systems. This further resulted in the

destabilization of the electrical engineering to the production

facility which rendered the pumping units and certain ancillary

units inoperable due to overload failures. We are in negotiations

with Tech Flo, from whom the jet pumping unit was purchased, as we

consider the facility supplied should not have been compromised

with differing electrical inputs.

We have addressed this electrical hiatus with new built

componentry incorporating anti-surge protection to both the jet

pumping units and ancillary equipment. Pumping is ongoing with the

removal of the built-up reservoir water during the period of

pumping inactivity with a view to returning to oil deliveries and

sales.

As prior reported the Operator filed formal completion

certificates with the Texas Railroad Commission confirming that the

COG#1-H well is being completed as an initial producer, albeit full

testing is ongoing. In addition, the Operator had also filed the

requisite Pooling and Divisional Orders necessary. In the context

of looking forward to the drilling of the second horizontal well

which is designated as COG#3H and will be located within the

northern leases section, in conjunction with our increasing our

ownership of the oilfield leases from 75% to 100%, we are taking

steps to assume the Operatorship of the project. We have filed with

the Texas Railroad Commission and wait formal transfer. Our

management team will also have alongside the current Operator's

management team to expand and assist our ongoing activities.

Our land management team has continued to acquire contiguous

acreage. We also agreed with the City of Gonzales administration

(formal council meeting approvals) to reposition certain of our

petroleum leases by amending certain boundaries and at the same

time we have been able to extend our drilling timelines for those

particular leases by another initial twelve months. This

re-programming has enabled the revisions that will be necessary for

the 3-D seismic operations that we are in current discussions over.

Permitting for this well is ongoing and is expected to be completed

by the year's end.

Within this oil price environment, Pennpetro has emerged from

the downturn as a low-cost, asset-backed US onshore oil and gas

business. Subject to oil prices, market conditions and sentiment, I

remain confident that we can deliver our strategy by acquiring

leases in active and producing US onshore plays and proving up the

reserves by drilling new wells. In furtherance of this agenda, our

subsidiary Pennpetro USA Corp., with a mandate to seek out

additional conventional producing petroleum assets only, which

possess the ability to be upscaled with the adoption of

unconventional horizontal drilling techniques, is currently

examining a number of Texas opportunities in the Gulf Coast Region,

where unconventional technology can be applied to conventional

reservoirs in established fields which have been de-risked by prior

vertical drilling. This will be fully reported on when

progressed.

This platform is one that has, at its core, the active

management of all types of risk associated with the oil and gas

industry. Broadly speaking development risk is managed by focusing

on proven formations; execution risk is managed by participating in

drilling activities alongside established industry partners and

operators. Additionally, our operations offset those of major

industry players, such as EOG Resources, Inc., a $67.5 billion

goliath; individual well risk is managed by building a diversified

portfolio of leases and wells and limiting the amount of interest

the Group holds in any one well; meanwhile oil price risk is

managed by focusing on areas that require relatively low oil prices

to breakeven and ensuring our cost base, capital commitments and

financing costs remain low, manageable and flexible.

As prior reported, EOG Resources has now also turned its full

attention to the Austin Chalk formations both in Texas and its

continuance into Louisiana with recent acquisitions by

Conoco-Phillips, Marathon Oil Corp, alongside the recent formation

of Magnolia Oil by TPG Pace Energy and EnerVest to specifically

focus on the Austin Chalk, as the Austin Chalk has a higher oil

content then Permian drilled completions. Gonzales County sits

right in the middle of the Austin Chalk trend.

Pennpetro's Board currently comprises four Directors, who

collectively have extensive international experience and a proven

track record in investment, corporate finance and business

acquisition, operation and development and are well placed to

implement the Company's business objectives and strategy.

We believe the Company's Board and US management team is strong

in terms of having the right mix of industry expertise covering all

key areas of the business, including lease acquisition, geology,

engineering, and finance.

Oil Price

West Texas Intermediate ("WTI") has continued its strength

throughout the period under review averaging US$57.31 /bbl. The

value of WTI as at 18 September 2019 was US$58.25/bbl (source:

Bloomberg Markets). We will receive a premium of approximately

US$5/bbl for Gonzales crude oil deliveries.

Outlook

In line with our strategy, all our operations are in highly

active plays where the economics of drilling and producing remain

attractive at sub-US$30 oil prices. This highlights the success we

have had in taking advantage of the prior industry downturn to

accelerate the positioning of our South Texas leasehold position in

favour of the Austin Chalk and Eagleford Shale. To this we can now

add the unexpected bonus of the Buda Limestone formation reserves

which we can now confidently state will increase our overall proved

oil reserves, albeit we await a formal new CPR to be prepared in

this regard.

With a strategic foothold in these prolific, low-cost plays

established and a proven management team in place, we will look to

further expand our position in this US onshore sweet spot, as and

when management considers it most advantageous to do so.

For 2019, our main City of Gonzales objectives are to commence

full production of the COG#1-H well, acquire additional land leases

and basis a review of legacy 2D seismic to carry out a 3-D seismic

survey of our land interests. I look forward to providing updates

on our progress in the year ahead.

Finally, I would like to thank the Board, management team and

all our advisers for their hard work over the period under review

and also to our shareholders for their continued support.

Thomas Evans

Executive Director

30 September 2019

For further information, please contact:

Pennpetro Energy plc

Thomas Evans tme@pennpetroenergy.co.uk

Instinctif

David Simonson +44 (0)20 7457 2020 pennpetro@instinctif.com

NOTES TO EDITORS

Pennpetro Energy is an independent oil and gas company focusing

on production in the Gonzales Oil Field in Texas, USA. Shares in

the company were admitted to the Official List of the London Stock

Exchange by way of a Standard Listing on 21 December 2017.

Further information on the Company can be found at

www.pennpetroenergy.co.uk

IMPORTANT NOTICE - FORWARD-LOOKING STATEMENTS

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements may be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or

comparable terminology, or by discussions of strategy, plans,

objectives, goals, future events or intentions. These

forward-looking statements include all matters that are not

historical facts and involve predictions. Forward-looking

statements may and often do differ materially from actual results.

In addition, even if results or developments are consistent with

the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or

developments in subsequent periods. Any forward-looking statements

reflect the Group's current view with respect to future events and

are subject to risks relating to future events and other risks,

uncertainties and assumptions relating to the Group's business,

results of operations, financial position, liquidity, prospects,

growth or strategies and the industry in which it operates.

Forward-looking statements speak only as of the date they are made

and cannot be relied upon as a guide to future performance.

Strategic report and business review

To the members of Pennpetro Energy plc

Cautionary statement

This business review has been prepared solely to provide

additional information to shareholders to assess the Company's

strategies and the potential for those strategies to succeed.

The business review contains certain forward-looking statements.

These statements are made by the Directors in good faith based on

the information available to them up to the time of their approval

of this report and such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward looking

information.

This business review has been prepared for the Group as a whole

and therefore gives greater emphasis to those matters which are

significant to Pennpetro Energy plc and its subsidiary undertakings

when viewed as a whole.

The Group's business model

Pennpetro's intention is to become an active independent North

American development production company.

The key elements of Pennpetro's strategy for achieving this goal

are:

-- The creation of value through production development success

and operational strengths, commencing with the Group's COGLA

assets.

-- Focusing on commercialisation and monetisation of oil and gas

discoveries, and potentially utilising cash flows from initial

projects to fund the acquisition or development of future

projects.

-- Active asset portfolio management.

-- Positioning the Company as a competent partner of choice to

maximise opportunities and value throughout the E&P

lifecycle.

Summary results for the 2019 interim financial period

A summary of the key financial results is set out in the table

below:

Half year Full year Half year

ended ended ended

30 Jun 2019 31 Dec 2018 30 Jun 2018

$'000 $'000 $'000

--------------------- ------------------------- ------------ ------------

Revenue - - -

Operating expenses (645) (595) (321)

--------------------- ------------------------- ------------ ------------

Operating loss (645) (595) (321)

Finance income - 273 -

Finance costs (284) (467) (136)

--------------------- ------------------------- ------------ ------------

Loss before tax (929) (789) (457)

Taxation - - -

--------------------- ------------------------- ------------ ------------

Loss for the period (929) (789) (457)

Interest

The net interest cost for the Group for the period was $0.3m

(2018: $0.1m).

Loss before tax

Loss before tax for the period was $0.9m (2018: $0.5m).

Taxation

Taxation charge was $nil for the period (2018: $nil).

Earnings per share

Basic and diluted earnings per share for the period were 1.29c

loss (2018: 0.64c loss).

Financial position

The Group's balance sheet as at 30 June 2019 can be summarised

as set out in the table below:

Assets

Liabilities Net assets

GBP'm GBP'm GBP'm

$'000 $'000 $'000

-------------------------------- ------- ------------ -----------

Non-current assets 5,499 - 5,499

Current assets and liabilities 814 (142) 672

Loans and provisions - (5,996) (5,996)

Total as at 30 June 2019 6,313 (6,138) 175

-------------------------------- ------- ------------ -----------

Total as at 31 December 2018 5,977 (6,002) (25)

-------------------------------- ------- ------------ -----------

Total as at 30 June 2018 6,385 (6,128) 257

-------------------------------- ------- ------------ -----------

Cash flow

Net cash inflow for 2019 was $nil (2018: $nil).

Consolidated Income Statement

For the six months ended 30 June 2019

Notes Unaudited Audited Unaudited

Half year Full year Half year

ended ended ended

31 Dec 30 Jun

30 Jun 2019 2018 2018

Continuing operations $'000 $'000 $'000

Revenue - - -

Cost of sales - - -

---------------------------------- ------ ------------ ----------- -----------

Gross profit - - -

---------------------------------- ------ ------------ ----------- -----------

Operating expenses (645) (595) (321)

---------------------------------- ------ ------------ ----------- -----------

Operating loss (645) (595) (321)

Finance income - 273 -

Finance expense (284) (467) (136)

Loss before income tax (929) (789) (457)

Taxation - - -

Loss for the period attributable

to the owners of the Company (929) (789) (457)

---------------------------------- ------ ------------ ----------- -----------

Loss per share attributable

to owners of the Company

From continuing operations:

Basic & diluted (cents per

share) 2 (1.29) (1.11) (0.64)

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2019

Unaudited Audited Unaudited

Half year Full year Half year

ended ended ended

30 Jun 2019 31 Dec 2018 30 Jun 2018

$'000 $'000 $'000

--------------------------------- ----------- ----------- -----------

Loss for the period (929) (789) (457)

Other comprehensive income

--------------------------------- ----------- ----------- -----------

Items that may be subsequently

reclassified as profit or loss

Currency translation differences 4 (27) (16)

--------------------------------- ----------- ----------- -----------

Total comprehensive loss for the

year attributable to the owners

of the Company (925) (816) (473)

--------------------------------- ----------- ----------- -----------

Consolidated Balance Sheet

As at 30 June 2019

Notes Unaudited Audited Unaudited

30 Jun 2019 31 Dec 2018 30 Jun 2018

$'000 $'000 $'000

Non-current assets

------------------------------- ------ ------------- ------------- -------------

Property, plant & equipment 3 1,335 1,280 1,267

Intangible assets 4 4,163 4,007 2,597

------------------------------- ------ ------------- ------------- -------------

Total non-current assets 5,498 5,287 3,864

------------------------------- ------ ------------- ------------- -------------

Current assets

------------------------------- ------ ------------- ------------- -------------

Trade and other receivables 345 524 1,703

Short term investments 470 166 796

Cash - - 22

------------------------------- ------ ------------- ------------- -------------

Total current assets 815 690 2,521

------------------------------- ------ ------------- ------------- -------------

Total assets 6,313 5,977 6,385

=============================== ====== ============= ============= =============

Equity and liabilities

------------------------------- ------ ------------- ------------- -------------

Share capital 5 927 908 908

Share premium 5 1,551 625 625

Convertible reserve 6,022 6,022 6,022

Reorganisation reserve (6,578) (6,578) (6,578)

Foreign exchange reserve (3) (7) 4

Share based payment reserve 240 60 -

Retained losses (1,984) (1,055) (724)

------------------------------- ------ ------------- ------------- -------------

Total equity 175 (25) 257

------------------------------- ------ ------------- ------------- -------------

Non-current liabilities

------------------------------- ------ ------------- ------------- -------------

Borrowings 5,996 5,863 6,021

------------------------------- ------ ------------- ------------- -------------

Total non-current liabilities 5,996 5,863 6,021

------------------------------- ------ ------------- ------------- -------------

Current liabilities

------------------------------- ------ ------------- ------------- -------------

Trade and other payables 142 139 107

------------------------------- ------ ------------- ------------- -------------

Total current liabilities 142 139 107

------------------------------- ------ ------------- ------------- -------------

Total Equity and Liabilities 6,313 5,977 6,385

=============================== ====== ============= ============= =============

Consolidated statement of changes in equity

For the six months ended 30 June 2019

Share Share premium Convertible Share based Re-organisation Foreign Retained Total

capital reserve payment reserve exchange losses Equity

reserve reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Balance at 1

January 2018 908 625 6,022 - (6,578) 20 (266) 731

Loss for the period - - - - - - (457) (457)

Currency

translation

differences - - - - - (16) - (16)

Total comprehensive

loss for

the period - - - - - (16) (457) (473)

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Balance at 30 June

2018 908 625 6,022 - (6,578) 4 (723) 258

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Loss for the period - - - - - - (332) (332)

Currency

translation

differences - - - - - (11) - (11)

Total comprehensive

loss for

the period - - - - - (11) (332) (343)

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Share based

payments - - - 60 - - - 60

Balance at 31

December 2018 908 625 6,022 60 (6,578) (7) (1,055) (25)

Loss for the period - - - - - - (929) (929)

Currency

translation

differences - - - - - 4 - 4

Total comprehensive

loss for

the period - - - - - 4 (929) (925)

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Shares issued 19 1,002 - - - - - 1,021

Cost of shares

issued - (76) - - - - - (76)

Share based

payments - - - 180 - - - 180

------------------- -------- ------------- ----------- ----------- --------------- ---------- -------- -------

Balance at 30 June

2019 927 1,551 6,022 240 (6,578) (3) (1,984) 175

=================== ======== ============= =========== =========== =============== ========== ======== =======

Consolidated Cash Flow Statement

For the six months ended 30 June 2019

Unaudited Audited Unaudited

Half year Full year Half year

ended ended ended

30 Jun 2019 31 Dec 2018 30 Jun 2018

$'000 $'000 $'000

-------------------------------------- ------------ ------------ ------------

Cash flows from operating activities

-------------------------------------- ------------ ------------ ------------

Loss for the period (929) (789) (457)

Adjustment for:

Depreciation 1 3 -

Amortisation 45 100 55

Unrealised foreign exchange 4 (183) -

Finance income - (273) -

Finance costs 284 467 136

Share based payment charge 180 60 -

(Increase)/decrease in receivables (13) (169) (219)

Increase/(decrease) in payables (47) (71) (103)

Interest paid (102) (196) (136)

Net cash used in operating activities (577) (1,051) (724)

-------------------------------------- ------------ ------------ ------------

Cash flows from investing activities

-------------------------------------- ------------ ------------ ------------

Purchase of development expenditure (8) (750) (481)

Purchase of property, plant &

equipment (56) (56) -

Short-term investments (304) 1,906 1,277

Net cash used in investing activities (368) 1,100 796

-------------------------------------- ------------ ------------ ------------

Cash flows from financing activities

-------------------------------------- ------------ ------------ ------------

Shares issued 1,021 - -

Cost of shares issued (76) - -

(Repayment)/proceeds from borrowings - (71) (72)

Net cash generated from financing

activities 945 (71) (72)

-------------------------------------- ------------ ------------ ------------

Net increase/(decrease) in cash

and cash equivalents - (22) -

-------------------------------------- ------------ ------------ ------------

Cash and cash equivalents brought

forward - 22 22

-------------------------------------- ------------ ------------ ------------

Exchange gain on cash and cash

equivalents - - -

-------------------------------------- ------------ ------------ ------------

Cash and cash equivalents carried

forward - - 22

-------------------------------------- ------------ ------------ ------------

General Information

The Consolidated Financial Statements of Pennpetro Energy plc

("the Company") consists of the following companies (together "the

Group"):

Pennpetro Energy plc UK registered company

Nobel Petroleum UK Limited UK registered company

Nobel Petroleum USA Inc US registered company

Nobel Petroleum LLC US registered company

Pennpetro USA Corp US registered company

The Company is a public limited company which is listed on the

standard market of the London Stock Exchange and incorporated and

domiciled in England and Wales. Its registered office address is

First Floor, 88 Whitfield Street, London, W1T 4EZ.

The Group is an oil and gas developer with assets in Texas,

United States. The Company's US-based subsidiaries own a portfolio

of leasehold petroleum mineral interests centred on the City of

Gonzalez, in southeast Texas, comprising the undeveloped central

portion of the Gonzales Oil Field.

Responsibility statement

Each of the Directors of the Company confirms that to the best

of his or her knowledge:

a. the condensed set of financial statements has been prepared

in accordance with IAS 34 "Interim Financial Reporting";

b. the half year report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year);

c. the half year report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein.

Summary of significant accounting policies

Except as described below, the accounting policies applied in

these interim financial statements are the same as those applied in

the Group's consolidated financial statements as at and for the

year ended 31 December 2018.

The changes in accounting policy set out below will also be

reflected in the Group's consolidated financial statements for the

year ended 31 December 2019, if any.

1. New standards, interpretations and amendments effective from 1 January 2019

There are no material adjustments required to be made to the

Group's consolidated financial statements as a result of the

application of IFRS 16 from 1 January 2019.

2. Earnings per share

Basic and diluted

Earnings per share is calculated by dividing the loss

attributable to the equity holders of the Company by the weighted

average number of ordinary shares in issue during the period,

excluding ordinary shares purchased by the Company and held as

treasury shares.

Half year Half year

ended (Audited) Full year ended ended

30 Jun 2019 31 Dec 2018 30 Jun 2018

Loss attributable to equity holders of the Company ($'000) (929) (789) (457)

Weighted average number of shares in issue

(Number '000) 71,977 70,900 70,900

----------------------------------------------------------- ----------- ------------------------- -----------

Earnings per share (cents) (1.29) (1.11) (0.64)

----------------------------------------------------------- ----------- ------------------------- -----------

3. Property, plant and equipment

Petroleum Office Total

(Mineral Leases) Equipment $

Cost $ $

At 1 January 2018 1,219,215 11,683 1,230,898

Additions 40,702 - 40,702

Currency translation - (327) (327)

At 30 June 2018 1,259,917 11,356 1,271,273

Additions 15,680 - 15,680

Currency translation - (213) (213)

At 31 December 2018 1,275,597 11,143 1,286,740

Additions 56,406 - 56,406

Currency translation - 25 25

At 30 June 2019 1,332,003 11,168 1,343,171

Accumulated Depreciation and Impairment

At 1 January 2018 - 4,251 4,251

Charge for the period - 1,460 1,460

Currency translation - (201) (201)

At 30 June 2018 - 5,510 5,510

Charge for the period - 1,447 1,447

Currency translation - (131) (131)

At 31 December 2018 - 6,826 6,826

Charge for the period - 1,411 1,411

Currency translation - (37) (37)

At 30 June 2019 - 8,200 8,200

Net Book Amount

At 1 January 2018 1,219,215 7,432 1,226,647

================== =========== ==========

At 30 June 2018 1,259,917 5,846 1,265,763

================== =========== ==========

At 31 December 2018 1,275,597 4,317 1,279,914

================== =========== ==========

At 30 June 2019 1,332,003 2,968 1,334,971

================== =========== ==========

4. Intangible assets

Drilling costs Loan arrangement fees Total

Cost $ $ $

At 1 January 2018 1,908,751 270,339 2,179,090

Additions 477,920 - 477,920

At 30 June 2018 2,386,671 270,339 2,657,010

Additions 272,553 - 272,553

Add: Reclassification from other receivables 1,183,017 - 1,183,017

At 31 December 2018 3,842,241 270,339 4,112,580

Additions 8,430 - 8,430

Add: Reclassification from other receivables 192,085 - 192,085

At 30 June 2019 4,042,756 270,339 4,313,095

Amortisation

At 1 January 2018 - 5,557 5,557

Amortisation charge for the year - 54,518 54,518

At 30 June 2018 - 60,075 60,075

Amortisation charge for the year - 45,057 45,057

At 31 December 2018 - 105,132 105,132

Amortisation charge for the year - 45,056 45,056

At 30 June 2019 - 150,188 150,188

Net Book Amount

At 1 January 2018 1,908,751 264,782 2,173,533

At 30 June 2018 2,386,671 210,264 2,596,935

At 31 December 2018 3,842,241 165,207 4,007,448

At 30 June 2019 4,042,756 120,151 4,162,907

5. Share capital and premium

Ordinary shares Share premium

Group Number of shares Value Value Value Value Total

GBP $ GBP $ $

At 1 January 2018 70,900,000 709,000 908,404 472,400 625,504 1,533,908

================== ======== ======== ========== ========== ==========

At 30 June 2018 70,900,000 709,000 908,404 472,400 625,504 1,533,908

================== ======== ======== ========== ========== ==========

At 31 December 2018 70,900,000 709,000 908,404 472,400 625,504 1,533,908

================== ======== ======== ========== ========== ==========

Share issue 1,433,702 14,337 18,558 774,198 1,002,136 1,020,694

Issue costs - - - (59,100) (76,500) (76,500)

At 30 June 2019 72,333,702 723,337 926,962 1,187,498 1,551,140 2,478,102

================== ======== ======== ========== ========== ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR LLFVLALIIVIA

(END) Dow Jones Newswires

September 30, 2019 07:35 ET (11:35 GMT)

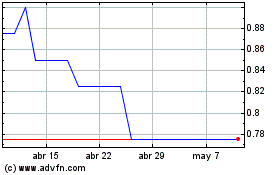

Pennpetro Energy (LSE:PPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pennpetro Energy (LSE:PPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024