TIDMNEX

RNS Number : 1441Q

National Express Group PLC

17 October 2019

National Express Group PLC: Trading Update

17 October 2019

STRONG TRADING OVER KEY SUMMER PERIOD

National Express Group PLC (or "the Group") today reports its

Trading Update for the period from 1 July 2019 to 30 September

2019.

Dean Finch, Group Chief Executive said:

"We had another good trading performance in our key summer

period. ALSA performed particularly well and our UK coach business

grew despite lapping a very strong comparative period last year.

North America posted strong growth, boosted by both our WeDriveU

acquisition and a good back-to-school performance including

improved wage control.

"With these results, the further delay to Spanish concession

renewal and our recent successes in winning, retaining and

mobilising significant contracts, our outlook remains positive. We

will continue to focus on operational excellence as the foundation

of our strategy to drive growing shareholder returns and maintain

profit growth in the coming years."

Group highlights

A good summer's trading, with all divisions growing revenue and

profit. Our Spanish and Moroccan division, ALSA, performed

particularly well. This drove a strong Group performance:

-- Group revenue was up 14.5% in reported terms (11.8% in constant currency);

-- Group Operating Profit grew 14.3% in reported terms (15.0% in constant currency);

-- Group Operating Margin was also up in the period.

This performance has been complemented by significant new

contract wins, renewals and mobilisations in the period which will

help sustain momentum in the medium term (as referred to in

yesterday's statement):

-- A EUR1 billion, 700 bus contract in Casablanca, for up to 15

years. Having doubled our presence in Morocco with our Rabat

contract, which started in August, Casablanca nearly doubles our

presence again.

-- The renewal and expansion of our second largest North

American transit contract, in Boston. This renewal is for up to 7.5

years, starts in January 2020 and will nearly double revenue to

$420 million across the contract.

-- Our new National Express Accessible Transport (NEAT) business

successfully started operations in the period, in the West

Midlands. This 400 vehicle operation helps build a strong

credential to target expansion in this interesting and growing

market.

The Spanish concession renewal process has been further delayed,

after a successful legal challenge by another operator against the

live tenders. These and future tenders will now be revised to

address the legal challenge. This further delay only reinforces our

previous guidance that any significant impact from the renewal

process on ALSA's earnings will not be felt for a number of

years.

Divisional highlights

ALSA: strong summer trading and significant new Moroccan

contracts

-- Revenue increased by 8.5% in constant currency, overwhelmingly driven by organic growth.

-- Passenger numbers for the division grew by 9.5%.

-- Every segment of ALSA's business grew both revenue and passengers in the period;

-- Revenue per kilometre for the Spanish operation grew by 7.9%.

-- A very successful mobilisation of our over 400 bus Rabat,

Morocco contract in August. After our success in Casablanca, ALSA

will be the sole operator in five of Morocco's six largest cities

and we are targeting further growth in both urban services and

entry in to the inter-urban market.

North America: the best ever back-to-school wage performance and

a major transit award

-- Revenue increased by 20.6% in constant currency, with our

recent acquisition WeDriveU performing in line with expectations

and therefore driving the majority of this growth.

-- A good back-to-school period was exemplified by the early

success of our wage control initiative:

o This delivered the best ever September wage-to-revenue ratio,

helping to drive an increase in school bus margin;

o It was achieved through a new standardised and audited driver

scheduling system, developed through the Delivering Excellence

programme;

o As well as firmly embedding and enhancing this approach, 2020

will see further Delivering Excellence initiatives to drive

efficiency and operational improvements.

-- In addition to our successful renewal and expansion of our

Boston paratransit contract, we have two small contract wins in New

York and another in Connecticut continuing our hub strategy,

growing efficiently from existing locations in major urban

areas.

UK: a good summer performance, despite lapping a very strong

comparative period

-- Positive trading across both our bus and coach businesses,

against a very strong comparative period last year, saw revenue

increase by 3.2%.

-- UK coach performed well in its key summer period:

o Core revenue was up 3.1%;

o Core passengers was up 3.9%;

o Core revenue per mile was up 3.0%.

-- UK bus maintained its revenue and passenger growth in the West Midlands:

o Commercial revenue increased by 0.7%;

o Commercial passengers increased by 0.4%;

o Revenue per mile was up 2.9%;

o Overall UK bus revenue was up 4.3%, after the inclusion of our

NEAT services.

-- National Express West Midlands was judged the safest public

transport company of all those audited across the world by the

British Safety Council.

Enquiries

National Express Group PLC

Chris Davies, Group Finance Director 0121 460 8655

Anthony Vigor, Director of Policy and External

Affairs 07767 425822

Louise Richardson, Head of Investor Relations 07827 807766

Maitland/AMO 020 7379 5151

James McFarlane 07584 142665

There will be a conference call for investors and analysts at

0900 on 17 October 2019. Dial in details are as follows:

UK Toll Number: +44 33 3300 0804

UK Toll-Free Number: 0800 358 9473

URL for international dial in numbers:

http://events.arkadin.com/ev/docs/NE_W2_TF_Events_International_Access_List.pdf

Participant pin: 12078241#

Legal Entity Identifier: 213800A8IQEMY8PA5X34.

Classification (referencing DTR6 Annex 1R): 3.1.

Notes

All revenue, profit and margin data are based on the Group's

continuing operations and refer to normalised results, which

exclude intangible amortisation for acquired businesses and results

for the period from discontinued operations. The Board believes

that this gives a more comparable year-on-year indication of the

operating performance of the Group and allows users of this

information to understand management's key performance

measures.

Unless otherwise stated, financial data are presented on a

constant currency basis, comparing the current period's results

with the prior period's results translated at the current period's

exchange rates. The Board believes that this gives a better

comparison of the underlying performance of the Group.

Cautionary statement

Information set forth in this announcement may contain certain

'forward-looking statements' with respect to National Express Group

PLC ('Company' or 'Group') and the Group's financial condition,

results of its operations and business, and certain plans,

strategy, objectives, goals and expectations with respect to these

items and the economies and markets in which the Group

operates.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'should', 'will',

'would', 'expects', 'believes', 'intends', 'plans', 'targets',

'goal' or 'estimates' or, in each case, their negative or other

variations or comparable terminology. Forward-looking statements

are not guarantees of future performance. By their very nature,

forward-looking statements are inherently unpredictable,

speculative and involve risk and uncertainty because they relate to

events and depend on circumstances that will occur in the future.

Many of these assumptions, risks and uncertainties relate to

factors that are beyond the Group's ability to control or estimate

precisely. There are a number of such factors that could cause

actual results and developments to differ materially from those

expressed or implied by these forward-looking statements. These

factors include, but are not limited to, changes in the political

conditions, economies and markets in which the Group operates

(including the outcome of the negotiations to leave the EU);

changes in the legal, regulatory and competition frameworks in

which the Group operates; changes in the markets from which the

Group raises finance; the impact of legal or other proceedings

against or which affect the Group; changes in accounting practices

and interpretation of accounting standards under IFRS, and changes

in interest and exchange rates.

Any forward-looking statements made in this announcement, or

made subsequently, which are attributable to the Company or any

other member of the Group, or persons acting on their behalf, are

expressly qualified in their entirety by the factors referred to

above. Each forward-looking statement speaks only as of the date it

is made. Except as required by its legal or statutory obligations,

the Company does not intend to update any forward-looking

statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTMFBFTMBJBBLL

(END) Dow Jones Newswires

October 17, 2019 02:00 ET (06:00 GMT)

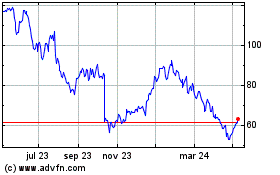

Mobico (LSE:MCG)

Gráfica de Acción Histórica

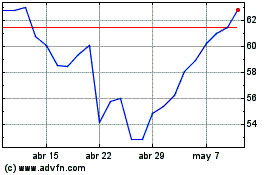

De Mar 2024 a Abr 2024

Mobico (LSE:MCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024