NewRiver REIT PLC Completion of acquisition of Poole Retail Park (1449Q)

17 Octubre 2019 - 1:00AM

UK Regulatory

TIDMNRR

RNS Number : 1449Q

NewRiver REIT PLC

17 October 2019

NewRiver REIT plc

("NewRiver" or the "Company")

Completion of acquisition of Poole Retail Park in a Joint

Venture with BRAVO

NewRiver is pleased to announce that its joint venture (the

"JV") with BRAVO Strategies III LLC ("BRAVO") has completed the

acquisition of Poole Retail Park in Dorset from LS Poole Retail

Limited, for total consideration of GBP44.7 million, reflecting a

net initial yield of 8.0%. This follows the announcement on 12

September 2019 that the JV had exchanged contracts for the

acquisition.

NewRiver will hold a 10% interest in the asset (NRR share:

GBP4.5 million) and will benefit from 10% of the net rental income

(NRR share: GBP0.4 million per annum). NewRiver will be appointed

as asset manager, in return for a management fee calculated with

reference to the gross rental income of the asset, and will also

receive a promote based on financial performance.

The gross asset value subject to the transaction is GBP44.7

million and NewRiver's share of the transaction will be satisfied

from existing resources and available credit facilities.

Including this acquisition, the JV established in May 2019 has

acquired GBP105.1 million of assets (NRR share: GBP34.7 million),

reflecting a net initial yield of 9.0%.

For further information

NewRiver REIT plc +44 (0)20 3328 5800

Allan Lockhart (Chief Executive)

Mark Davies (Chief Financial Officer)

Tom Loughran (Investor Relations)

+44 (0)20 7251

Finsbury 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing, developing and

recycling convenience-led, community-focused retail and leisure

assets throughout the UK.

Our GBP1.3 billion portfolio covers over 9 million sq ft and

comprises 33 community shopping centres, 23 conveniently located

retail parks and over 650 community pubs. Having hand-picked our

assets since NewRiver was founded in 2009, we have deliberately

focused on the fastest growing and most sustainable sub-sectors of

the UK retail market, with grocery, convenience stores, value

clothing, health & beauty and discounters forming the core of

our retail portfolio. This focus, combined with our affordable

rents and desirable locations, delivers sustainable and growing

returns for our shareholders, while our active approach to asset

management and in-built 1.9 million sq ft development pipeline

provide further opportunities to extract value from our

portfolio.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR) and is a constituent of the FTSE 250

and EPRA indices. Visit www.nrr.co.uk for further information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQLLFSRISLRLIA

(END) Dow Jones Newswires

October 17, 2019 02:00 ET (06:00 GMT)

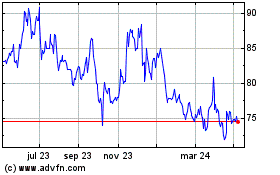

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

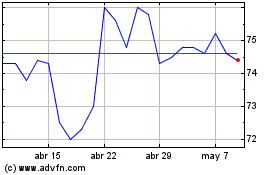

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024