Barclays CTO Helps Spearhead Female-Entrepreneurs Program

17 Octubre 2019 - 3:55PM

Noticias Dow Jones

By Sara Castellanos

Barclays PLC and venture-capital firm Anthemis Group are looking

for women with ideas for financial-technology startups, hoping some

of them can start businesses that can eventually sell the

London-based bank new software or other products.

The idea behind the Female Innovators Lab is to connect women

entrepreneurs with their first round of venture-capital

funding.

The initiative is spearheaded in part by John Stecher, group

chief technology officer at Barclays. "In my career, I've seen how

having a really diverse leadership team, and varied perspectives in

general, leads to better products," said Mr. Stecher, who is also

the bank's chief innovation officer.

The organizations will select several women by the first quarter

of 2020 to work at Anthemis's New York offices. Once they have a

business model, they will be able to move into Barclays's

64,000-square-foot workspace for startups in Manhattan.

Last year, women-founded companies received 2.3% of the total

capital invested in venture-backed startups in the U.S., according

to data firm PitchBook Data Inc. About $131 billion was invested

across about 8,950 deals in 2018.

Businesses founded by women deliver more than twice as much

revenue per dollar invested than those founded by men, according to

a 2018 Boston Consulting Group study.

The goal is for participants to ultimately build businesses that

will become Barclays vendors, Mr. Stecher said: "We have a number

of things we need to accomplish that we don't want to build

proprietary."

For example, Barclays is looking for software that could help

when onboarding new customers and clients, such as identity

validation, he said. The company also is interested in

customer-facing software that appeals to specific target-age

demographics, such as mobile apps for different banking

services.

Barclays and Anthemis will connect participants with mentors

within the two organizations to help them build out their ideas and

get venture-capital funding.

The founders also will get access to mentorship from a broader

network of startups that Barclays has invested in over the past

five years.

"Something that can't be discounted when you're an entrepreneur

is how little access you have to a wide mentoring network," Mr.

Stecher said.

Barclays and Anthemis will select entrepreneurs for the program

who have a strong sense of purpose and a high level of conviction

around their ideas, said Amy Nauiokas, founder and chief executive

of Anthemis, which invests in early-stage financial technology

startups.

"It doesn't take rocket science to recognize there's some real

opportunity to spend time helping fund, nurture and build

up...women's companies," Ms. Nauiokas said, who was a Barclays

executive from 2004 to 2008.

Write to Sara Castellanos at sara.castellanos@wsj.com

(END) Dow Jones Newswires

October 17, 2019 16:40 ET (20:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

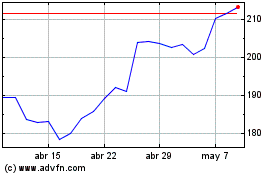

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

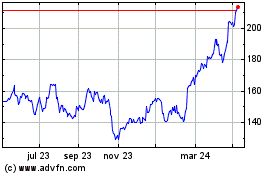

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024