TIDMMATD

RNS Number : 3933Q

Petro Matad Limited

21 October 2019

THIS DOCUMENT AND THE ENCLOSED FORM OF PROXY ARE IMPORTANT AND

REQUIRE YOUR IMMEDIATE ATTENTION. If you are in any doubt about the

contents of this document or as to the action you should take you

are recommended to seek your own personal financial advice from an

independent financial adviser authorised under the Financial

Services and Markets Act 2000, as amended (FSMA) who specialises in

advising in connection with shares and other securities if you are

resident in the United Kingdom or, if not, from another

appropriately authorised independent financial adviser.

If you have sold or otherwise transferred all your ordinary

shares in Petro Matad Limited (the Company) please forward this

document, together with the accompanying form of proxy, to the

purchaser or transferee, or to the bank, stockbroker or other agent

through whom the sale or transfer was effected for onward

transmission to the purchaser or transferee. Such documents should

not, however, be forwarded or transmitted in or to any jurisdiction

in which such act would constitute a violation of the relevant laws

in such jurisdiction. If you have sold or transferred only part of

your holding of ordinary shares in the Company, you should retain

these documents and consult the stockbroker, bank or other agent

through whom the sale or transfer was effected immediately.

This document should be read in conjunction with the Annual

Report and Accounts (as hereinafter defined) of the Company in

respect of the year ended 31 December 2018 available at

http://www.petromatadgroup.com/.

Petro Matad Limited

(Incorporated in the Isle of Man under the Isle of Man Companies

Act 2006 with company number 001483V)

Notice of Annual General Meeting

to be held on 19 November 2019

Notice of the annual general meeting of the Company to be held

on 19 November 2019 at 4.00 p.m. local time (8.00 a.m. GMT) at Blue

Sky Tower, Topaz Conference Hall, Peace Avenue 17, Sukhbaatar

District, Ulaanbaatar, Mongolia (the Annual General Meeting) is set

out on pages 6 to 9 of this document. A form of proxy for use in

relation to the Annual General Meeting is enclosed.

The action to be taken by Shareholders is set out on page 4.

Whether or not you propose to attend the Annual General Meeting you

are requested to complete and return the enclosed form of proxy in

accordance with the instructions printed thereon and return it by

post or, by hand, to: 6th Floor, Victory House, Prospect Hill,

Douglas, Isle of Man, IM1 1EQ, or by email to

externalproxyqueries@computershare.co.uk, or via the CREST system,

in each case as soon as possible but in any event so as to be

received not less than 48 hours (not taking into account any part

of a day which is not a working day in the Isle of Man) before the

time appointed for the Annual General Meeting. Completion of a form

of proxy will not preclude you from attending and voting at the

Annual General Meeting in person. To appoint one or more proxies or

to give an instruction to a proxy (whether previously appointed or

otherwise) via the CREST system, CREST messages must be received by

Computershare Investor Services (Jersey) Limited (ID number 3RA50),

acting as the Company's agent not later than 48 hours (not taking

into account any part of a day which is not a working day in the

Isle of Man) before the time appointed for holding the Annual

General Meeting. For this purpose, the time of receipt will be

taken to be the time (as determined by the timestamp generated by

the CREST system) from which the issuer's agent is able to retrieve

the message. The Company may treat as invalid a proxy appointment

sent by CREST in the circumstances set out in Regulation 18(4)(a)

of the Uncertificated Securities Regulations 2006 of the Isle of

Man (SD No. 743/06).

Directors:

Enkhmaa Davaanyam (Chairperson)

Michael Buck (Chief Executive Officer)

John Henriksen (Chief Financial Officer)

Timothy Bushell (Non-Executive Director)

Shinezaya Batbold (Non-Executive Director)

21 October 2019

Dear Shareholder

Annual General Meeting

I am writing to inform you that an Annual General Meeting (the

AGM) of Petro Matad Limited (the Company) will be held at 4.00 p.m.

local time (8.00 a.m. GMT) on 19 November 2019 at Blue Sky Tower,

Topaz Conference Hall, Peace Avenue 17, Sukhbaatar District,

Ulaanbaatar, Mongolia. The formal notice of the AGM and resolutions

to be proposed are set out on pages 6 to 9 of this document.

RESOLUTIONS TO BE PROPOSED AT THE AGM

ORDINARY BUSINESS

Annual Report and Accounts (Resolution 1)

Shareholders will be asked to receive and adopt the audited

accounts of the Company for the year ended 31 December 2018

together with the report of the directors of the Company and the

auditor's report for the financial year (the Annual Report and

Accounts). The reports of the directors and the audited accounts

have been approved by the directors, and the report of the auditor

has been approved by the auditor, and a copy of each of these

documents may be found in section 2 and section 11 respectively of

the Company's 2018 Annual Report. A copy of the Company's 2018

Annual Report is available at

http://www.petromatadgroup.com/investors/reports-and-presentations/.

Appointment of the auditor and power of Directors to fix the

auditor's remuneration (Resolution 2)

Bentleys (WA) Pty Ltd has been acting as the Company's auditor

since 2016. Bentleys (WA) Pty Ltd has indicated its willingness to

continue in office. Accordingly, Resolution 2 confirms the

appointment of Bentleys (WA) Pty Ltd as auditor of the Company to

hold office until further notice and authorises the Directors to

fix the auditor's remuneration.

Re-appointment of Director (Resolutions 3 to 4)

In accordance with Article 89 of the Company's articles of

association (the Articles), one third of the Directors of the

Company are required to retire from office at each annual general

meeting of the Company and may submit themselves for re-election at

each annual general meeting of the Company. In accordance with the

Articles, Ms Enkhmaa Davaanyam, being the Director who has been

longest in office since her last re-appointment, shall retire and

be submitted for re-election at the AGM.

In accordance with Article 83, any Director who has been

appointed by the Directors, either to fill a vacancy or as an

addition to the existing board of Directors, shall hold office

until the next annual general meeting of the Company following such

appointment and shall then be eligible for election but shall not

be taken into account in determining the number of Directors to

retire by rotation at the meeting. Accordingly, Ms Shinezaya

Batbold is submitted for election at the AGM.

Brief biographical details of the Director standing for

re-election at the AGM appear at Appendix 1. The Board has

considered the position of the Director and recommend their

re-election at the AGM.

SPECIAL BUSINESS

Power of directors to allot shares (Resolution 5)

Under Article 5.1 of the Articles, the Directors may only allot

such number of ordinary shares in the Company (the Ordinary Shares)

as shall be prescribed from time to time by resolutions of the

members. Pursuant to the annual general meeting of the Company held

on 20 September 2018, the Directors currently have authority to

allot such number of Ordinary Shares as may result in the Company

having an issued share capital of 882,874,332 Ordinary Shares. As

at the date of this notice, there are 662,196,306 Ordinary Shares

in issue.

Resolution 4 will be proposed to grant a new authority to the

Directors to allot Ordinary Shares and grant options, warrants or

other rights over Ordinary Shares up to an aggregate nominal amount

of US$2,207,321.02. This amount represents approximately 33.3% of

the total issued Ordinary Share capital of the Company as at the

date of this notice. The power conferred by this resolution will

expire at the conclusion of the next annual general meeting of the

Company or, if sooner, 15 months after the date of the passing of

the resolution. This general authority will be subject to the

pre-emption provisions in the Articles (as amended by Resolution 6

if passed).

Amendments to the Articles - disapplication of pre-emption

rights (Resolution 6)

Under Article 6 of the existing Articles, the Directors have the

power and authority (without the need for further approval from

shareholders) to allot and issue ordinary shares in the Company

(the Ordinary Shares on a non pre-emptive basis:

(a) if they are, or are to be, paid up wholly or partly otherwise than in cash;

(b) pursuant to awards granted under the Company's long term

incentive plan or any other share option scheme adopted by the

Company; and

(c) otherwise than as provided in paragraphs (a) and (b) up to 66,219,631 Ordinary Shares.

In accordance with the Articles, this authority will expire at

the end of the AGM of the Company.

We are asking shareholders to approve certain amendments to the

Articles to renew the authority to disapply pre-emption rights on

the issuing of Ordinary Shares representing approximately 10% of

the total issued Ordinary Share capital of the Company as at the

date of this notice. Resolution 6 will be proposed as a special

resolution.

Resolution 6, if passed will replace the existing disapplication

of pre-emption rights set out in Articles 6.4 and 6.5 of the

existing Articles with substitute authority to the Directors to

disapply the pre-emption rights for issues of Ordinary Shares:

(a) if they are, or are to be, paid up wholly or partly otherwise than in cash;

(b) pursuant to awards granted under the Company's long term

incentive plan or any other share option scheme adopted by the

Company; and

(c) otherwise than as provided in paragraphs (a) and (b) up to

an aggregate nominal amount of US$662,196.31.

Such authority, if given, will expire at the conclusion of the

next annual general meeting of the Company, without prejudice to

the allotment of shares pursuant to any offer or agreement made or

entered into prior to such expiry. The replacement of current

Articles 6.4 and 6.5 of the Articles shall be without prejudice to

the allotment of shares pursuant to offers or agreements made under

the current authority contained in the existing Articles.

Copies of the existing Articles and the proposed new Articles

are available for inspection at www.petromatadgroup.com and may be

inspected during normal business hours at the registered office of

the Company until the date of the AGM or upon request. Copies will

also be available at the AGM until its conclusion.

Authority to make market purchases (Resolution 7)

Article 14.1(b)(iii) provides that the shareholders may grant a

general mandate to the Directors to exercise all of the powers of

the Company to repurchase such number of shares in the open market

as the shareholders may so authorise. On 20 September 2018, the

Company passed a special resolution granting the Directors a

general mandate to repurchase shares in the open market with an

aggregate nominal value of not more than 15 per cent of the

aggregate nominal value of the share capital of the Company in

issue as at 24 August 2018. This general mandate will expire at the

conclusion of the AGM.

Resolution 7 will be proposed as a special resolution and, if

approved, will renew the existing share repurchase authority. It is

proposed that the Directors be granted a general mandate to

exercise all of the powers of the Company to repurchase shares in

the open market with an aggregate nominal value of not more than 15

per cent of the aggregate nominal value of the share capital of the

Company in issue at the date hereof. Pursuant to the Articles, if

Resolution 7 is passed, this general mandate will continue in force

until the earlier of (a) the conclusion of the Company's next

annual general meeting or (b) the revocation or variation of this

general mandate by a subsequent special resolution. The Directors

currently have no present intention of exercising the authority

granted pursuant to Resolution 7.

ACTION TO BE TAKEN

You will find enclosed a form of proxy for use at the AGM.

Please complete, sign and return the enclosed form of proxy as

soon as possible in accordance with the instructions printed

thereon, whether or not you intend to be present at the AGM. Forms

of proxy should be returned either by post or, by hand, to: 6th

Floor, Victory House, Prospect Hill, Douglas, Isle of Man, IM1 1EQ

or by email to externalproxyqueries@computershare.co.uk or via the

CREST system, in each case so as to be received by Computershare

Investor Services (Jersey) Limited (ID number 3RA50), acting as the

Company's agent as soon as possible and in any event no later than

48 hours (not taking into account any part of a day which is not a

working day in the Isle of Man) before the time appointed for

holding the AGM. Completion and return of the form of proxy will

not preclude you from attending the AGM and voting in person should

you subsequently find that you are able to be present.

To appoint one or more proxies or to give an instruction to a

proxy (whether previously appointed or otherwise) via the CREST

system, CREST messages must be received by the issuer's agent (ID

number 3RA50) not later than 48 hours (not taking into account any

part of a day which is not a working day in the Isle of Man) before

the time appointed for holding the AGM. For this purpose, the time

of receipt will be taken to be the time (as determined by the

timestamp generated by the CREST system) from which the issuer's

agent is able to retrieve the message. The Company may treat as

invalid a proxy appointment sent by CREST in the circumstances set

out in Regulation 18(4)(a) of the Uncertificated Securities

Regulations 2006 of the Isle of Man (SD No. 743/06).

RECOMMATION

Your Directors consider that the proposals described in this

letter are in the best interests of the Company and its

Shareholders as a whole and unanimously recommend shareholders to

vote in favour of all the resolutions to be proposed at the AGM, as

they intend to do (other than in respect of their own appointment

as directors) in respect of their own current beneficial holdings

amounting in aggregate to 15,532,932 Ordinary Shares, representing

approximately 2.35 per cent. of the Company's issued share capital

as at the date of this notice.

Yours sincerely

D. Enkhmaa

Chairperson

Appendix 1

Director's biography

Enkhmaa Davaanyam, Chairperson

Ms. Enkhmaa is the CEO of Petrovis Group, Mongolia's largest

fuel supplier. Ms. Enkhmaa has over 21 years of international

experience in financing and risk management of mining,

infrastructure and energy projects and commodities trading. She

serves as Deputy Chair of Board of Directors of Petrovis Group

since 2011 and was appointed as the CEO in August 2013. Prior to

joining Petrovis Group, Ms. Enkhmaa worked as a Managing Director

at Macquarie Group for over 10 years, responsible for risk

management in the energy sector in the United States. Ms. Enkhmaa

was appointed as Petro Matad's Chairperson in 2015.

Shinezaya Batbold, Non-Executive Director

Ms. Shinezaya is the CEO of Petrovis Venture Capital LLC, one of

the first local venture capital funds investing into multiple SME

sectors in Mongolia. She was a Vice President of Petrovis LLC from

2010 to 2012 and currently holds a number of board and chair

positions in diversified business sectors in Mongolia, including

Board Member of Petrovis LLC and Chairperson of UNIGAS LLC, a gas

distribution company in Ulaanbaatar. She is a graduate of

Northeastern University, Boston, MA.

Petro Matad Limited

(the Company)

(Incorporated in the Isle of Man under the Isle of Man Companies

Act 2006 with company number 001483V)

Notice of Annual General Meeting

NOTICE IS HEREBY GIVEN that the Annual General Meeting of the

Company (the Meeting) will be held at 4.00 p.m. local time (8.00

a.m. GMT) on 19 November 2019 at Blue Sky Tower, Topaz Conference

Hall, Peace Avenue 17, Sukhbaatar District, Ulaanbaatar, Mongolia

for the transaction of the following business:

RESOLUTIONS

To consider and, if thought fit, pass the following

resolutions:

1 To receive and adopt the accounts of the Company for the

financial year ended 31 December 2018 together with the report of

the directors of the Company and the auditor's report for the

financial year.

2 To confirm the appointment of Bentleys (WA) Pty Ltd as auditor

of the Company to hold office until further notice and authorises

the Directors to fix their remuneration.

3 THAT, Enkhmaa Davaanyam who, being eligible, offers herself

for re-election be re-appointed a director of the Company in

accordance with the Company's articles of association.

4 THAT, Shinezaya Batbold who, being eligible, offers herself

for re-election be re-appointed a director of the Company in

accordance with the Company's articles of association.

5 THAT, pursuant to and for the purposes of Article 5.1 of the

Company's articles of association (the "Articles"), the directors

of the Company (the "Directors") be and are hereby generally and

unconditionally authorised to exercise all the powers of the

Company to allot Ordinary Shares and to grant options, warrants or

other rights over Ordinary Shares up to an aggregate nominal amount

of US$2,207,321.02 provided that this authority shall expire

(unless and to the extent previously revoked, varied or renewed by

the Company in general meeting) at the conclusion of the next

annual general meeting of the Company or, if shorter, 15 months

after the date of the passing of this resolution, save that the

Company may, before such expiry make any offer or agreement which

would or might require Ordinary Shares to be allotted or rights to

be granted, after such expiry and the Directors may allot Ordinary

Shares, or grant options, warrants or other rights over Ordinary

Shares, in pursuance of any such offer or agreement as if the

authority conferred by this resolution had not expired.

SPECIAL RESOLUTIONS

To consider and, if thought fit, pass the following resolutions

as special resolutions:

6 THAT the Company's articles of association be amended by the

substitution of the current articles 6.4 and 6.5 with the following

words:

"6.4 The Directors shall have (notwithstanding the restrictions

set forth in Article 6.1) the power and authority (without the need

for further sanction) to allot and issue Ordinary Shares on a non

pre-emptive basis:

(a) if they are, or are to be, paid up wholly or partly

otherwise than in cash;

(b) pursuant to awards granted under the Company's long term

incentive plan or any other share option scheme adopted by the

Company; and

(c) otherwise than as provided in paragraphs (a) and (b) up to

an aggregate nominal amount of US$662,196.31.

6.5 provided that such authority, unless renewed, shall expire

at the end of the next annual general meeting of the Company, but

shall extend to the making, before such expiry, of an offer or

agreement which would or might require shares to be allotted after

such expiry and the Directors may allot shares in pursuance of such

offer or agreement as if the authority conferred hereby had not

expired and the replacement of the previous Articles 6.4 and 6.5 by

this Article shall be without prejudice to the allotment of shares

pursuant to offers or agreements made under any prior

authority."

7 THAT the directors be granted, pursuant to Article

14.1(b)(iii) of the Company's articles of association, a general

mandate to exercise all of the powers of the Company to repurchase

ordinary shares in the Company in the open market with an aggregate

nominal value of not more than 15 per cent of the aggregate nominal

value of the share capital of the Company in issue as at the date

of this Notice.

By order of the Board,

Dated 21 October 2019

D. Enkhmaa

Chairperson

Registered Office: 6th Floor, Victory House, Prospect Hill,

Douglas, Isle of Man IM1 1EQ

Notes:

1 A member entitled to attend and vote at the Meeting is

entitled to appoint one or more proxies to exercise all or any of

the member's rights to attend, speak at and vote at the Meeting

instead of him/her. A proxy need not be a member of the Company. If

a member appoints more than one proxy in relation to the Meeting,

each proxy must be appointed to exercise the rights attached to a

different share or shares held by that member.

2 In the case of joint holders of shares, the vote of the first

name in the register of members who tenders a vote whether in

person or by proxy, should be accepted to the exclusion of the

votes of other joint holders.

3 A Form of Proxy is enclosed with this notice. Completion and

return of the Form of Proxy will not prevent a member from

attending the Meeting and voting in person at the Meeting should

they wish to do so.

4 To be effective, the Form of Proxy and any power of attorney

or other authority under which it is signed (or a notarially

certified copy of such authority) must be duly completed, signed

and sent either by post, or, by hand, to: 6th Floor, Victory House,

Prospect Hill, Douglas, Isle of Man IM1 1EQ or by email to

externalproxyqueries@computershare.co.uk, or via the CREST system,

in each case so as to be received by Computershare Investor

Services (Jersey) Limited (ID number 3RA50), acting as the

Company's agent not less than 48 hours (not taking into account any

part of a day which is not a working day in the Isle of Man) before

the time appointed for holding the Meeting or any adjournment

thereof.

5 CREST members who wish to appoint a proxy or proxies through

the CREST electronic proxy appointment service may do so for the

Meeting and any adjournment(s) thereof by using the procedures

described in the CREST Manual. CREST personal members or other

CREST sponsored members, and those CREST members who have appointed

a voting service provider should refer to their CREST sponsors or

voting service provider(s), who will be able to take the

appropriate action on their behalf.

6 In order for a proxy appointment or instruction made by means

of CREST to be valid, the appropriate CREST proxy instruction must

be properly authenticated in accordance with Euroclear UK &

Ireland Limited's (Euroclear) specifications and must contain the

information required for such instructions, as described in the

CREST Manual. To appoint one or more proxies or to give an

instruction to a proxy (whether previously appointed or otherwise)

via the CREST system, CREST messages must transmitted so as to be

received by the issuer's agent (CREST participation ID 3RA50) not

later than 48 hours (not taking into account any part of a day

which is not a working day in the Isle of Man) before the time

appointed for holding the Meeting. For this purpose, the time of

receipt will be taken to be the time (as determined by the

timestamp generated by the CREST system) from which the issuer's

agent is able to retrieve the message by enquiry to CREST in the

manner prescribed by CREST.

7 The Company may treat as invalid a proxy instruction sent by

CREST in the circumstances set out in Regulation 18(4)(a) of the

Uncertificated Securities Regulations 2006 of the Isle of Man (SD

No. 743/06).

8 CREST members and, where applicable, their CREST sponsor or

voting service provider should note that Euroclear does not make

available special procedures in CREST for any particular messages.

Normal system timings and limitations will therefore apply in

relation to the input of CREST proxy instructions. It is the

responsibility of the CREST member concerned to take (or, if the

CREST member is a CREST personal member or sponsored member or has

appointed a voting service provider, to procure that his CREST

sponsor or voting service provider takes) such action as shall be

necessary to ensure that a message is transmitted by means of the

CREST system by any particular time. In this connection, CREST

members and, where applicable, their CREST sponsor or voting

service provider are referred in particular to those sections of

the CREST Manual concerning practical limitations of the CREST

system and timings.

9 To appoint as a proxy a person other than the Chairperson of

the Meeting, a member must insert the proxy's full name in the box

on the proxy form. If a member signs and returns a proxy form with

no name inserted in the box, the Chairperson of the meeting will be

deemed to be the member's proxy. Where a member appoints as a proxy

someone other than the Chairperson, the member Is responsible for

ensuring that the proxy attends the Meeting and is aware of the

member's voting intentions. If a member wishes a proxy to make any

comments on the member's behalf, the member will need to appoint

someone other than the Chairperson and give them the relevant

instructions directly.

10 Every member who (being an individual) is present in person

or (being a corporation) is present by a duly authorised

representative (not being himself a member entitled to vote), shall

on a show of hands have one vote and on a poll every member present

in person or by proxy or (being a corporation) by a duly authorised

representative shall have one vote for each share of which he is

the holder. A resolution is passed either (i) on a show of hands by

a majority of in excess of 50 per cent of such members as are

present and voting at the relevant meeting; or (ii) on a poll of

members of the Company holding in excess of 50 per cent of the

voting rights attributable to the shares held by the member or

members present and voting at the relevant meeting. A "special

resolution" is passed either (i) on a show of hands by a majority

of not less than 75 per cent of such members as are present and

voting at the relevant meeting; or (ii) on a poll of members of the

Company holding not less than 75 per cent of the voting rights

attributable to the shares held by the member or members present

and voting at the relevant meeting.

11 Pursuant to Regulation 22(1) of the Uncertificated Securities

Regulations 2006 of the Isle of Man (SD No. 743/06), the Company

has specified that only those members registered on the register of

members of the Company at 4.00 p.m. local time (8.00 a.m. (GMT)) 15

November 2019 shall be entitled to attend and vote at the Meeting

in respect of the number of shares registered in their name at that

time. Changes to the Company's register of members after this time

shall be disregarded in determining the rights of any person to

attend and vote at the Meeting. If the Meeting is adjourned, only

those members entered in the Company's register of members 48 hours

before the time and date of the adjourned meeting shall be entitled

to attend and vote at the adjourned meeting.

12 Where a corporation is to be represented at the Meeting by a

corporate representative, such corporation must deposit a certified

copy of the resolution of its directors or other governing body

authorising the appointment of the representative at the Company's

registered office address not less than 48 hours before the time

appointed for the Meeting.

13 A member which is a corporation is entitled to appoint one or

more corporate representatives to exercise the same powers on

behalf of the corporation as the corporation could exercise if it

were an individual member. If a member who is a corporation

appoints more than one corporate representative in relation to the

Meeting, each representative must exercise the rights attached to a

different share or shares held by that member.

14 If the Chairperson, as a result of any proxy appointments, is

given discretion as to how the votes the subject of those proxies

are cast and the voting rights in respect of those discretionary

proxies, when added to the interests in the Company's securities

already held by the Chairperson, result in the Chairperson holding

such number of voting rights that he has a notifiable obligation

under the Disclosure Guidance and Transparency Rules published by

the Financial Conduct Authority, the Chairperson will make the

necessary notifications to the Company and the Financial Conduct

Authority. As a result, any member holding 3 per cent. or more of

the voting rights in the Company who grants the Chairperson a

discretionary proxy in respect of some or all of those voting

rights and so would otherwise have a notification obligation under

the Disclosure Guidance and Transparency Rules, need not make a

separate notification to the Company and the Financial Conduct

Authority.

15 As at 18 October 2019, being the last practicable date prior

to the printing of this notice, the Company's issued share capital

consisted of 662,196,306 Ordinary Shares carrying one vote each.

Therefore, the total number of voting rights in the Company as at

21 October 2019, are 662,196,306.

16 Copies of the service agreements and letters of appointment

between the Company and its Directors and copy of the proposed new

Articles of Association of the Company with copy of the existing

Memorandum and Articles of Association marked to show the changes

being proposed in Resolution 5 and 6 will be available for

inspection at the registered office of the Company during usual

business hours on any weekday (Saturdays, Sundays and Bank Holidays

excluded) until the date of the Meeting and also on the date and at

the place of the Meeting from 4.00 p.m. local time (8.00a.m.

GMT).

17 You may not use any electronic communication (within the

meaning of the Isle of Man Electronic Transactions Act 2000)

provided in this notice or in any related documents to communicate

with the Company for any purposes other than those expressly

stated.

18 Your personal data includes all data provided by you, or on

your behalf, which relates to you as a shareholder, including your

name and contact details, the votes you cast and your reference

number (as attributed to you by the Company or its registrars). The

Company determines the purposes for which, and the manner in which,

your personal data is to be processed. The Company and any third

party to which it discloses the data (including the Company's

registrars) may process your personal data for the purposes of

compiling and updating the Company's records, fulfilling its legal

obligations and processing the shareholder rights you exercise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NOAGGGUCUUPBUBR

(END) Dow Jones Newswires

October 21, 2019 02:00 ET (06:00 GMT)

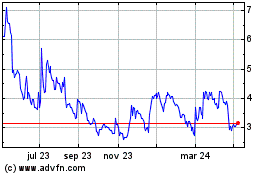

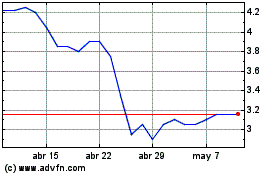

Petro Matad (LSE:MATD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petro Matad (LSE:MATD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024