TIDMWPP

RNS Number : 0937R

WPP PLC

25 October 2019

FOR IMMEDIATE RELEASE 25 October 2019

WPP

Third Quarter Trading Update[1]

Improved performance in Q3; LFL revenue less pass-through costs

+0.5%

(+0.7% incl. Kantar); full-year guidance reiterated

Q3 GBP million[2] reported constant LFL LFL incl. Kantar

================================= =============== ========= ========= ===== =================

Reported revenue 3,291 5.2% 1.9% 1.9% 1.8%

================================= =============== ========= ========= ===== =================

Revenue less pass-through costs 2,725 3.7% 0.5% 0.5% 0.7%

================================= =============== ========= ========= =====

YTD

================================= ====== ===== ====== ====== ------

Reported revenue 9,659 2.8% 0.5% 0.0% 0.2%

================================= ====== ===== ====== ====== ======

Revenue less pass-through costs 7,924 1.1% -1.2% -1.5% -1.1%

================================= ====== ===== ====== ======

n Improvement in Q3 in major markets and sectors

n Global Integrated Agencies back to growth in third quarter

n Significant improvement in North America and China

n Net new business of $3.9 billion in first nine months

Mark Read, Chief Executive Officer of WPP, said:

"WPP's performance in the third quarter is another important

step in the strategy we outlined in December 2018 to return the

Company to sustainable growth in line with our peers in 2021.

"Our growth in Q3 is encouraging but we are focused on

delivering these longer-term goals and know there will be twists

and turns along the way. Our guidance for 2019 remains

unchanged.

"It continues to be a successful year for new business, with

major wins in the quarter including Mondelez and eBay, but just as

importantly we are growing and retaining longstanding clients, such

as the US Marine Corps and Centrica, who value the depth of our

understanding and the longevity of the relationship.

"Yesterday, WPP shareholders voted to approve the Kantar

transaction, which will further simplify our business and

significantly strengthen our balance sheet, while creating a new

partnership for Kantar's future growth and development.

"In the last 12 months, WPP has taken decisive action and made

substantial progress on many fronts: we have fewer, stronger agency

brands; new leadership in many of our companies; enhanced central

teams supporting our companies; and a renewed commitment to

creativity, powered by technology. We have cemented our position as

the largest partner to the world's leading technology firms and,

most importantly, the work we do continues to be highly valued by

our clients as we adapt to their changing needs in a dynamic

marketplace."

Revenue analysis

GBP million 2019 reported constant[3] LFL[4] Acquisitions 2018 LFL incl. Kantar

================================= ======= ========= ============ ======= ============= ====== =================

First quarter 2,992 1.0% -0.8% -1.7% 0.9% 2,964 -1.3%

================================= ======= ========= ============ ======= ============= ====== =================

Second quarter 3,376 2.2% 0.3% -0.3% 0.6% 3,303 0.1%

--------------------------------- ------- --------- ------------ ------- ------------- ------ -----------------

First half 6,368 1.6% -0.3% -0.9% 0.6% 6,267 -0.6%

================================= ======= ========= ============ ======= ============= ====== =================

Third quarter 3,291 5.2% 1.9% 1.9% 0.0% 3,129 1.8%

--------------------------------- ------- --------- ------------ ------- ------------- ------ -----------------

First 9 months[5] 9,659 2.8% 0.5% 0.0% 0.5% 9,396 0.2%

--------------------------------- ------- --------- ------------ ------- ------------- ------ -----------------

Kantar first 9 months[6] 1,898 2.4% 1.2% 1.3%

================================= ======= ========= ============ ======= ============= ====== =================

Group first 9 months incl.

Kantar 11,557 2.7% 0.6% 0.2%

--------------------------------- ------- --------- ------------ -------

Revenue less pass-through costs analysis

GBP million 2019 reported constant LFL Acquisitions 2018 LFL incl. Kantar

=================================== ====== ========= ========= ====== ============= ====== =================

First quarter 2,471 -1.0% -2.8% -3.3% 0.5% 2,496 -2.8%

=================================== ====== ========= ========= ====== ============= ====== =================

Second quarter 2,728 0.6% -1.3% -1.7% 0.4% 2,713 -1.4%

----------------------------------- ------ --------- --------- ------ ------------- ------ -----------------

First half 5,199 -0.2% -2.0% -2.5% 0.5% 5,209 -2.0%

=================================== ====== ========= ========= ====== ============= ====== =================

Third quarter 2,725 3.7% 0.5% 0.5% 0.0% 2,628 0.7%

----------------------------------- ------ --------- --------- ------ ------------- ------ -----------------

First 9 months(5) 7,924 1.1% -1.2% -1.5% 0.3% 7,837 -1.1%

----------------------------------- ------ --------- --------- ------ ------------- ------ -----------------

Kantar first 9 months(6) 1,442 1.9% 0.8% 0.8%

=================================== ====== ========= ========= ====== ============= ====== =================

Group first 9 months incl. Kantar 9,366 1.2% -0.9% -1.1%

----------------------------------- ------ --------- --------- ------

Third Quarter Review

Revenue

In the third quarter of 2019, reported revenue from continuing

operations (i.e. excluding Kantar) was up 5.2% at GBP3.291 billion.

Revenue in constant currency was up 1.9% compared with last year,

the difference to the reported number reflecting the weakening of

the pound sterling against a number of currencies, but particularly

the US dollar. On a like-for-like basis, revenue was also up 1.9%,

compared with -0.9% in the first half. Geographically,

like-for-like revenue growth in the third quarter was stronger in

Asia Pacific, Latin America, Africa & the Middle East and

Central & Eastern Europe, with Western Continental Europe and

the United Kingdom up strongly, partly offset by North America.

South East Asia, Latin America and the Middle East were

particularly strong with Africa and ANZ more difficult. By sector,

the Group's Global Integrated Agencies were up strongly, but Public

Relations and the Group's Specialist Agencies performed less

well.

In the third quarter, there was an improvement in revenue less

pass-through costs from continuing operations, with constant

currency and like-for-like growth of 0.5%, the first quarter of

growth since the second quarter of 2018, and significantly stronger

than the -2.5% in the first half. All regions showed improvement

compared with the first half.

Regional review

Revenue analysis - Third Quarter

LFL incl.

GBP million 2019 reported constant[7] LFL[8] 2018 Kantar

================= ====== ========= ============ ======= ====== ----------

N. America 1,243 3.8% -1.8% -1.9% 1,197 -1.9%

================= ====== ========= ============ ======= ====== ----------

United Kingdom 426 1.4% 1.4% 1.5% 420 1.2%

================= ====== ========= ============ ======= ====== ----------

W. Cont Europe 613 4.6% 3.6% 1.9% 586 1.8%

================= ====== ========= ============ ======= ====== ----------

AP, LA, AME,

CEE[9] 1,009 9.0% 5.8% 6.9% 926 6.4%

================= ====== ========= ============ ======= ====== ----------

Total Group[10] 3,291 5.2% 1.9% 1.9% 3,129 1.8%

----------------- ------ --------- ------------ ------ ----------

Kantar[11] 650 3.4% 1.0% 1.4%

================= ====== ========= ============ =======

Group incl.

Kantar 3,941 4.9% 1.7% 1.8%

----------------- ------ --------- ------------

Revenue less pass-through costs analysis - Third Quarter

LFL incl.

GBP million 2019 reported constant LFL 2018 Kantar

================= ====== ============= ========= ====== ====== ----------

N. America 1,034 3.2% -2.3% -3.5% 1,001 -3.2%

================= ====== ============= ========= ====== ====== ----------

United Kingdom 334 0.6% 0.6% 3.1% 332 2.1%

================= ====== ============= ========= ====== ====== ----------

W. Cont Europe 518 3.4% 2.4% 1.7% 501 1.8%

================= ====== ============= ========= ====== ====== ----------

AP, LA, AME,

CEE 839 5.7% 2.7% 4.0% 794 4.1%

================= ====== ============= ========= ====== ====== ----------

Total Group(10) 2,725 3.7% 0.5% 0.5% 2,628 0.7%

----------------- ------ ------------- --------- ------ ----------

Kantar(11) 492 3.8% 1.3% 1.6%

================= ====== ============= ========= ======

Group incl.

Kantar 3,217 3.7% 0.6% 0.7%

----------------- ------ ------------- ---------

North America, although still negative, improved, with

like-for-like revenue less pass-through costs from continuing

operations down 3.5%, compared with -8.8% in the first quarter and

-5.9% in the second quarter. Wunderman Thompson, VMLY&R, Grey

and AKQA showed significant improvement compared with the first

half.

The United Kingdom continued to grow, with like-for-like revenue

less pass-through costs from continuing operations up 3.1%,

compared with +2.9% in the second quarter and +1.2% for the first

half, as Wunderman Thompson, VMLY&R, BCW and AKQA showed

significant improvement.

Western Continental Europe grew for the first time this year,

with like-for-like revenue less pass-through costs from continuing

operations up 1.7% in the third quarter, compared with -0.2% in

both quarter one and quarter two. Germany, the Group's largest

market in the region, showed significant improvement, together with

Austria, Belgium, Portugal, Spain, Switzerland and Turkey, with

France, Italy and the Netherlands more challenging.

Asia Pacific, Latin America, Africa & the Middle East and

Central & Eastern Europe was the strongest performing region,

with like-for-like revenue less pass-through costs from continuing

operations, up 4.0% in the third quarter, compared with 0.7% growth

in the second quarter and 1.1% for the first half. Latin America,

the Middle East and Central & Eastern Europe performed

particularly well, with Asia Pacific and Africa more difficult. In

Asia Pacific, all of the Group's major markets, except China and

Thailand, grew, with India, the Group's second largest market in

the region, up over 15%. Australia & New Zealand performed

below the Group average in the third quarter, with some of the

Group's creative and specialist businesses under pressure.

Business sector review

Revenue analysis - Third Quarter

GBP million 2019 reported constant[12] LFL[13] 2018

========================== ====== ========= ============= ======== ======

Global Int. Agencies[14] 2,542 7.0% 3.7% 3.4% 2,376

========================== ====== ========= ============= ======== ======

Public Relations 241 6.0% 2.0% 0.4% 227

========================== ====== ========= ============= ======== ======

Specialist Agencies 508 -3.5% -6.3% -4.8% 526

========================== ====== ========= ============= ======== ======

Total Group[15] 3,291 5.2% 1.9% 1.9% 3,129

-------------------------- ------ --------- ------------- -------- ------

Kantar[16] 650 3.4% 1.0% 1.4% 629

========================== ====== ========= ============= ======== ======

Group incl. Kantar 3,941 4.9% 1.7% 1.8% 3,758

-------------------------- ------ --------- ------------- -------- ------

Revenue less pass-through costs analysis - Third Quarter

GBP million 2019 reported constant LFL 2018

====================== ====== ========= ========= ====== ======

Global Int. Agencies 2,036 4.9% 1.7% 1.7% 1,941

====================== ====== ========= ========= ====== ======

Public Relations 225 4.5% 0.6% -0.9% 215

====================== ====== ========= ========= ====== ======

Specialist Agencies 464 -1.7% -4.7% -3.4% 472

====================== ====== ========= ========= ====== ======

Total Group(15) 2,725 3.7% 0.5% 0.5% 2,628

---------------------- ------ --------- --------- ------ ------

Kantar(16) 492 3.8% 1.3% 1.6% 475

====================== ====== ========= ========= ====== ======

Group incl. Kantar 3,217 3.7% 0.6% 0.7% 3,103

---------------------- ------ --------- --------- ------ ------

In the third quarter of 2019, like-for-like revenue less

pass-through costs in the Group's Global Integrated Agencies was up

1.7%, compared with -3.4% in quarter one and -0.3% in quarter two.

This improvement came largely from North America, the United

Kingdom and Continental Europe, with Wunderman Thompson, VMLY&R

and Grey showing significant improvement compared with the first

half. Following the merger, VMLY&R grew in the third quarter

both globally and in the United States.

Public Relations, with like-for-like revenue less pass-through

costs -0.9%, showed some improvement compared with -1.5% in the

first half and -2.6% in quarter two. This was driven by an

improving trend in the United Kingdom and Western Continental

Europe, partly offset by slightly weaker performance in North

America and Asia Pacific.

The Group's Specialist Agencies, with like-for-like revenue less

pass-through costs down 3.4%, showed a significant improvement over

the -7.1% in quarter two and -5.7% in the first half, with

Geometry, AKQA, Brand Consulting and Commarco stronger.

Balance sheet highlights

Average net debt in the first nine months of 2019 was GBP4.477

billion, compared to GBP5.102 billion in 2018, at 2019 exchange

rates, a decrease of GBP625 million. This improvement is largely

explained by the disposal of various non-core associates and

subsidiaries over the last 12 months (including one of the Group's

freehold properties in New York), which in aggregate realised

GBP456 million. Net debt at 30 September 2019 was GBP4.469 billion,

compared to GBP4.962 billion on 30 September 2018, at 2019 exchange

rates, a decrease of GBP493 million.

No shares were purchased in the first 9 months of 2019.

Financial guidance

Our financial guidance for 2019 was previously given including

Kantar and remains unchanged, both including and excluding Kantar,

as follows:

n Like-for-like revenue less pass-through costs down 1.5% to

2.0%

n Headline operating margin to revenue less pass-through costs

down around 1.0 margin point on a constant currency basis

(excluding the impact of IFRS 16)

For further information:

Investors and analysts

Peregrine Riviere } +44 7909 907193

Lisa Hau } +44 7824 496015

Fran Butera (US) } +1 914 484 1198

Media

Chris Wade } +44 20 7282 4600

Kevin McCormack (US) } +1 212 632 2239

Juliana Yeh (APAC) } +852 2280 3790

Richard Oldworth, +44 20 7466 5000

Buchanan Communications +44 7710 130 634

wpp.com/investors

This announcement is being distributed to all owners of Ordinary

shares and American Depository Receipts. Copies are available to

the public at the Company's registered office.

The following cautionary statement is included for safe harbour

purposes in connection with the Private Securities Litigation

Reform Act of 1995 introduced in the United States of America. This

announcement may contain forward-looking statements within the

meaning of the US federal securities laws. These statements are

subject to risks and uncertainties that could cause actual results

to differ materially including adjustments arising from the annual

audit by management and the Company's independent auditors. For

further information on factors which could impact the Company and

the statements contained herein, please refer to public filings by

the Company with the Securities and Exchange Commission. The

statements in this announcement should be considered in light of

these risks and uncertainties.

Appendix

Regional Review

Revenue analysis - First Nine Months

LFL incl.

GBP million 2019 reported constant LFL 2018 Kantar

================= ======= ========= ========= ======= ======= ==========

N. America 3,577 0.8% -4.9% -5.8% 3,550 -5.5%

================= ======= ========= ========= ======= ======= ==========

United Kingdom 1,334 1.4% 1.4% 1.4% 1,316 1.2%

================= ======= ========= ========= ======= ======= ==========

W. Cont Europe 1,876 2.2% 2.8% 1.2% 1,836 1.3%

================= ======= ========= ========= ======= ======= ==========

AP, LA, AME,

CEE 2,872 6.6% 5.8% 6.5% 2,694 5.9%

================= ======= ========= ========= ======= ======= ==========

Total Group[17] 9,659 2.8% 0.5% 0.0% 9,396 0.2%

----------------- ------- --------- --------- ------- ----------

Kantar[18] 1,898 2.4% 1.2% 1.3% 1,855

================= ======= ========= ========= ======= =======

Total Group

incl. Kantar 11,557 2.7% 0.6% 0.2% 11,251

----------------- ------- --------- --------- -------

Revenue less pass-through costs analysis - First Nine Months

LFL incl.grid

GBP million 2019 reported constant LFL 2018 Kantar

================= ====== ========= ========= ======== ====== --------------

N. America 2,985 0.9% -4.8% -6.1% 2,959 -5.7%

================= ====== ========= ========= ======== ====== --------------

United Kingdom 1,026 0.9% 0.9% 1.9% 1,018 0.8%

================= ====== ========= ========= ======== ====== --------------

W. Cont Europe 1,560 0.4% 0.9% 0.4% 1,553 0.5%

================= ====== ========= ========= ======== ====== --------------

AP, LA, AME,

CEE 2,353 2.0% 1.4% 2.1% 2,307 2.5%

================= ====== ========= ========= ======== ====== --------------

Total Group(17) 7,924 1.1% -1.2% -1.5% 7,837 -1.1%

----------------- ------ --------- --------- ------ --------------

Kantar(18) 1,442 1.9% 0.8% 0.8% 1,415

================= ====== ========= ========= ======== ======

Total Group

incl. Kantar 9,366 1.2% -0.9% -1.1% 9,252

----------------- ------ --------- --------- ------

Business Sector Review

Revenue analysis - First Nine Months

GBP million 2019 reported constant LFL 2018

===================== ======= ========= ========= ====== =======

Global Int Agencies 7,416 4.0% 1.7% 1.2% 7,130

===================== ======= ========= ========= ====== =======

Public Relations 712 4.6% 1.2% -0.6% 681

===================== ======= ========= ========= ====== =======

Spec. Agencies 1,531 -3.4% -5.5% -5.2% 1,585

===================== ======= ========= ========= ====== =======

Total Group(17) 9,659 2.8% 0.5% 0.0% 9,396

--------------------- ------- --------- --------- ------ -------

Kantar(18) 1,898 2.4% 1.2% 1.3% 1,855

===================== ======= ========= ========= ====== =======

Group incl.

Kantar 11,557 2.7% 0.6% 0.2% 11,251

--------------------- ------- --------- --------- ------ -------

Revenue less pass-through costs analysis - First Nine Months

GBP million 2019 reported constant LFL 2018

===================== ====== ========= ========= ====== ======

Global Int Agencies 5,894 1.9% -0.3% -0.6% 5,786

===================== ====== ========= ========= ====== ======

Public Relations 667 3.4% 0.1% -1.3% 645

===================== ====== ========= ========= ====== ======

Spec. Agencies 1,363 -3.1% -5.3% -5.3% 1,406

===================== ====== ========= ========= ====== ======

Total Group(17) 7,924 1.1% -1.2% -1.5% 7,837

--------------------- ------ --------- --------- ------ ------

Kantar(18) 1,442 1.9% 0.8% 0.8% 1,415

===================== ====== ========= ========= ====== ======

Group incl.

Kantar 9,366 1.2% -0.9% -1.1% 9,252

--------------------- ------ --------- --------- ------ ------

[1] As a result of the Board's decision on 12 July to enter into

an agreement to sell 60% of Kantar, Kantar is now categorized as an

"asset held for sale" in accordance with IFRS 5: Non-current assets

held for sale and discontinued operations. Accordingly, the Third

Quarter Update reports revenue and revenue less pass-through costs,

on a geographic and sector basis, excluding Kantar. 2018

comparators have been restated to exclude Kantar. For transparency,

we will continue to report results both including and excluding

Kantar until FY 2019.

[2] Continuing operations

[3] Percentage change at constant currency exchange rates

[4] Like-for-like growth at constant currency exchange rates and

excluding the effects of acquisitions and disposals

[5] Continuing operations

[6] Discontinued operations

[7] Percentage change at constant currency exchange rates

[8] Like-for-like growth at constant currency exchange rates and

excluding the effects of acquisitions and disposals

[9] Asia Pacific, Latin America, Africa & Middle East and

Central & Eastern Europe

[10] Continuing operations

[11] Discontinued operations

[12] Percentage change at constant currency exchange rates

[13] Like-for-like growth at constant currency exchange rates

and excluding the effects of acquisitions and disposals

[14] Global Integrated Agencies

[15] Continuing operations

[16] Discontinued operations

[17] Continuing operations

[18] Discontinued operations

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUSSKRKKARUAA

(END) Dow Jones Newswires

October 25, 2019 02:00 ET (06:00 GMT)

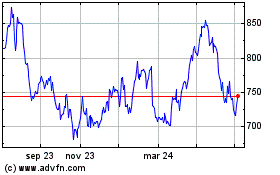

Wpp (LSE:WPP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

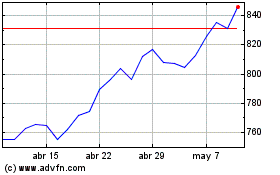

Wpp (LSE:WPP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024