TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

30 October 2019

Armadale Capital Plc ('Armadale' or 'the Company')

Further Strategic Financing

Armadale Capital plc (LON: ACP) the AIM quoted investment

company focused on natural resource projects in Africa, is pleased

to announce a further strategic financing update which

significantly strengthens the Company's financial position and

provides flexibility pending the delivery of the Mahenge Liandu

Graphite Project's ("Mahenge Liandu" or "the Project") Definitive

Feasibility Study ("DFS") and the acceleration of subsequent

development activities following its completion.

In particular, the package will enable the Company to implement

important steps to prepare the Project for production at the

earliest opportunity, delivering product that complies with the

expectations and needs of potential high purity graphite

customers.

In total the Company has secured a further GBP700,000 financing

package as outlined below.

Highlights:

-- New convertible loan note ("CLN") of GBP400,000 secured with clients of SI Capital Limited, joint broker to the Company

-- Two new drawdown facilities have been secured providing additional working capital of up to GBP300,000, should the Company wish to access further capital for accelerated project development

-- Original drawdown facilities, on which a balance of GBP150,000 was drawn down, are to be repaid in full thereby immediately removing the security arrangements associated with the original drawdown facilities

-- Overall, net additional working capital available to the Company amounts to GBP550,000 before expenses, significantly bolstering the financial strength of the Company at this highly important stage of project development

Nick Johansen, Director of Armadale said: "The Company's

principle investment, the Mahenge Liandu Graphite Project, is

entering a key stage as we move from explorer to emerging producer.

As such and recognising the advanced status of the Project, it is

important to ensure the Company has access to a balanced portfolio

of working capital.

"With our financial position significantly strengthened by the

recent placing of and subscription raising GBP500,000, and by the

measures announced today, we remain focused on the remaining and

ongoing work streams to compete the DFS.

"Equally important is the ability to accelerate project

development activities following completion of the DFS as the Board

believes that the economics of the Project will be strongly

demonstrated in the DFS findings and make Mahenge Liandu both a

compelling investment and a leading East African graphite project,

supplying demand for high purity graphite.

"I look forward to reporting further as each DFS and subsequent

development milestone is completed and as we take the steps to

becoming a significant graphite producer."

FURTHER FINANCIAL INSTRUMENT INFORMATION

New Convertible Loan Note - GBP400,000

Fixed rate and unsecured loan notes carrying an interest rate of

10% per annum to the expiry date of 6 November 2020. CLN holders

may convert into new Armadale Capital plc Ordinary Shares at a

price of 3.0 pence or at 90% of the average previous 10 trading

days published volume weighted average share price ("VWAP") on the

conversion date.

New Draw Down Facilities - up to GBP300,000

Draw down facility carries a term of 12 months from execution.

Funds drawn down will carry a face value of 110% of the drawn down

amount ("Face Value"). Armadale may elect to repay the Face Value

at any time and the borrower then has a 5 day window to elect

instead of a cash repayment to convert the Face Value into new

Armadale Capital plc Ordinary Shares at 3.0 pence or at 90% of the

average previous 10 Trading Days published VWAP.

Mahenge Liandu Graphite Project, Tanzania

Armadale Capital's wholly-owned Mahenge Liandu Graphite Project

is located in a highly prospective region, with a high-grade JORC

compliant inferred, indicated and measured mineral resource

estimate announced October 2019 - 59.5Mt at 9.8% TGC. This includes

15.90Mt inferred at 9.75% TGC, 32.06Mt indicated at 9.58% TGC and

11.52MT measured at 10.54% TGC making it one of the largest

high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

Currently, Armadale Capital is completing a Definitive

Feasibility Study based on the results of a Scoping Study that was

completed in March 2018. The study was based on a throughput of

400,000tpa over a 32-year mine life and showed the project has

robust economics and warrants further development.

The Scoping Study verified Mahenge Liandu could produce a coarse

flake, high-purity graphite product underpinning a compelling

business case to progress commercialisation plans.

The Scoping Study, based on a 400,000tpa throughput, highlighted

the following key positive metrics:

-- Producing an average of 49,000tpa of high-quality graphite products for a 32-year mine life

-- Near surface nature of the deposit produced a low 1:1 strip ratio for the life of the mine

-- Low operating cost of US$408/t, based on an average 12.5% TGC life of mine grade

-- Pre-tax IRR of 122% and NPV of US$349m, with a low development capex of US$35m

-- Maximum draw-down during the construction of the project is US$34.9m and the after-tax payback period is 1.2 years

There remains significant scope to further improve returns, with

staged expansions as the current mine plan is based on circa 25% of

the total resource.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc +44 (0) 20 7236 1177

Paul Johnson, Non-Executive Director (UK)

Tim Jones, Company Secretary

Nomad and broker: FinnCap Ltd +44 (0) 20 7220 0500

Christopher Raggett / Max Bullen-Smith

Joint Broker: SI Capital Ltd +44 (0) 1483 413500

Nick Emerson

Press Relations: St Brides Partners Ltd +44 (0) 20 7236 1177

Isabel de Salis / Juliet Earl

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20191030005461/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

October 30, 2019 06:15 ET (10:15 GMT)

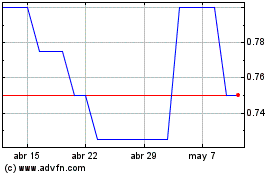

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024