TIDMWTE

RNS Number : 7109R

Westmount Energy Limited

31 October 2019

31 October 2019

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Final Results & Notice of AGM

The Company is pleased to announce its Final Results for the

year ended 30 June 2019, and hereby gives notice that the Annual

General Meeting of Westmount Energy Limited will be held at No 2

The Forum, Grenville Street, St Helier, Jersey JE1 4HH, Channel

Islands on 11 December 2019 at 11.00 am.

Copies of the Company's results and Notice of AGM are available

on the Company's website, www.westmountenergy.com, and will be

posted to shareholders today.

CHAIRMAN'S REVIEW

2019 Highlights

-- Operating Profit of GBP2,013,415 for the Year Ended June 30, 2019

-- Material new investments in single asset private companies,

JHI Associates Inc and Cataleya Energy Corp increasing exposure to

ExxonMobil operated drilling on the Canje and Kaieteur Blocks in

2020.

-- Exposure to multi-well, funded, drilling portfolio offshore

Guyana, during 2019-2020 has yielded two oil discoveries (Jethro-1

and Joe-1) to date

-- Investments in Eco (Atlantic) Oil and Gas Limited and Ratio Petroleum performed strongly

-- Post Year End - Subscription offer and Subscription Extension

(at 13 pence per share) yields GBP5.57m in aggregate

-- Focus remains on deploying capital in the prolific, emerging, Guyana-Suriname Basin

The year under review was one of material progress for your

Company as our early toehold investments in the Guyana offshore

space continued to deliver capital gains.

The financial results show an operating profit of GBP2,013,415

for the year, a significant +350% increase on the 2018 operating

profit. As reported at the interim results stage the main driver of

the operating profit was the strong share price performance of your

company's investments in Guyana focused Eco (Atlantic) Oil &

Gas Limited ("EOG") and Ratio Petroleum Energy Limited Partnership

("Ratio Petroleum"), both publicly listed companies.

During the year your Company raised GBP1.6m by way of a 10% p.a.

Unsecured Convertible Loan Note 2021 Issue ("CLN") to provide

capital to access Guyanese investment opportunities without

diluting shareholders at what would have been unacceptably low

share price levels via an equity issue. The Convertible Loan Note

proceeds enabled your board to inter alia take advantage of

opportunities to make material investments in JHI Associates Inc

("JHI") and Cataleya Energy Corp ("CEC").

It should be noted the actual interest cost during the period

was lower than 10%, as approximately 59% of the Convertible Loan

Notes were redeemed during the period, as noted below, with all

interest waived by the Noteholder.

Subsequent to the CLN issue, and a positive AIM market response

in our share price, the board was able to announce on February 27,

2019 the early repayment of GBP940,000 principal of the CLN by way

of a share subscription at 9 pence per share. The residual CLN

principal at year end was GBP660,000.

In addition, the strong share price performance of EOG in the

first half of 2019 enabled the crystallization of a +400% gain via

a part disposal of our EOG holding realising a further GBP1.34m in

proceeds for reinvestment in CEC.

Offshore Guyana has continued to capture global exploration

headlines during this period with an additional 6 exploration

successes (Hammerhead, Pluma, Tilapia, Haimara, Yellowtail and

Tripletail) reported on the Stabroek Block by ExxonMobil and 2

exploration successes (Jethro and Joe) on the Orinduik Block

announced by Tullow Oil. Fifteen of the sixteen successes,

announced to date, have been reported as oil discoveries with the

exception of Haimara-1, in the southeast of the Stabroek Block,

reported as a gas-condensate discovery in February 2019. Although

the Upper Cretaceous Liza play continues to dominate, the

discoveries made so far have proved the presence of 4 separate

hydrocarbon plays and, when combined with an exploration drilling

success rate in excess of 87%, confirm the deepwater

Guyana-Suriname Basin as a prolific, emerging, hydrocarbon

province. ExxonMobil is currently reporting an aggregate discovered

resource in excess of six billion oil equivalent barrels, on the

Stabroek Block, since early 2015.

These discoveries have the potential to be transformational for

Guyana and its people. The arrival of the Liza Destiny FPSO,

offshore Guyana, in late August 2019 heralds the commencement of

'first oil production' from the Liza Phase 1 Development (120,000

BOPD) in Q1 2020 - less than 5 years after discovery. Industry

analysis indicates that continued accelerated development of these

discoveries will propel Guyana to become a 'top 5 global'

deep-water oil producer by 2026 with the potential to produce in

excess of 1 million barrels of oil per day at peak.

Access to opportunities in offshore Guyana remains one of the

key challenges for both the industry and investors. No new offshore

deep-water licences have been awarded since January 2016 and Total

remains the only major player to gain access (post Liza-1

Discovery) to direct licence interests via its 2018 multi-block

farm-in to the Orinduik, Kanuku and Canje Licences. On 27th August

2019 Total announced that Qatar Petroleum had acquired a 40%

interest in its subsidiary holding company with respect to the

Orinduik and Kanuku Blocks.

Eco (Atlantic) Oil & Gas ("EOG")

The investment made in EOG on its AIM Initial Public Offering in

early 2017 provided our shareholders with a material toehold in the

Guyana offshore story. This investment has turned out to be the

star performer to date.

Subsequent to our financial year end, EOG and its partners on

the Orinduik block, Tullow (operator) and Total, announced the

drilling of two successful wells, Jethro-1 and Joe-1, which

represent the first discoveries, offshore Guyana, to be made

outside the Stabroek Block where ExxonMobil is operator.

In August it was announced that the Jethro-1 exploration well

had been drilled by the Stena Forth drillship to a total depth of

14,331 feet (4,400 meters) in approximately 1,350 meters of water.

This well encountered a net oil pay of 55m in a high-quality

sandstone reservoir of Lower Tertiary age, which exceeded pre-drill

expectations. A March 2019 Competent Person's Report ("CPR")

commissioned by EOG indicates pre-drill P50 recoverable volume

estimates of approximately 220 MMboe for the Jethro prospect.

A second discovery on the Orinduik Block was announced in

September 2019 with the drilling of the Joe-1 exploration well by

the Stena Forth drillship to a total depth of 7,176 feet (2,175

meters) in approximately 2,546 feet (780 meters) of water. This

well encountered 16m of net oil pay in a high-quality sandstone

reservoir of Upper Tertiary age and the result has been confirmed

by EOG as falling within their pre-drill estimated volumetric range

for the Joe prospect of 75-150 MMboe.

These discoveries have confirmed that the petroleum system

extends beyond the Stabroek Block and substantially derisk the

Tertiary plays across the Orinduik Block. This has resulted in

further appreciation in the EOG share price given EOG's 15%

participating interest in the block and with EOG being fully funded

for at least 3 additional high impact exploration wells in

Orinduik. Westmount continues to retain 1.5m shares in EOG which

provides our shareholders with exposure to discovered oil resources

and further upside via a 2020 pre-funded drilling campaign on

Orinduik.

Cataleya Energy Corporation ("CEC")

Our initial investment in CEC was announced on May 14 2019 via

the purchase of 253,685 common shares at US$ 10 per share for an

aggregate investment of US $2,536,850 (equivalent to GBP1,949,324)

to acquire a 2.4% fully diluted stake in CEC.

Subsequent to the financial year end, on August 30, 2019 your

Board announced that it had acquired an additional 313,500 common

shares in CEC at a price of US $10 per share, for a total

consideration of US$3,135,000 (equivalent to GBP2,582,372)

including transaction costs. As a result of this share purchase,

Westmount holds a total of 567,185 common shares in CEC,

representing approximately 5.4% of the fully diluted share capital

of CEC.

CEC is a private, Canadian registered company established in

2015 and focused on oil exploration opportunities in the emerging

Guyana-Suriname Basin. CEC's main asset is a 25% participating

interest in the Kaieteur Block, which it holds through its wholly

owned subsidiary Cataleya Energy Limited ("CEL"). The 13,500 km2

Kaieteur Block is located outboard of, and adjacent to, the Ranger

Oil Discovery which is located on the Stabroek Block, offshore

Guyana.

The Kaieteur Block is currently operated by an ExxonMobil

subsidiary, Esso Production & Exploration Guyana Limited (35%),

with CEL (25%), Ratio Guyana Limited (25%) and a subsidiary of Hess

Corporation (15%) as partners.

Ratio Petroleum Energy Limited Partnership ("Ratio

Petroleum")

Your company holds 1.2m units in Ratio Petroleum which has a 25%

Gross interest in the Kaieteur Block offshore Guyana. This

investment provided a toehold in the Kaieteur block that has since

been augmented by the CEC investment.

On 14th May 2019, Ratio Petroleum announced that ExxonMobil and

partners are planning to spud the first well in the Kaieteur Block

on the Tanager Prospect in the first half of 2020. Ratio Petroleum

also published a CPR by NSAI which describes the Tanager Prospect

as a stacked reservoir prospect (Maastrichtian to Turonian

reservoir intervals) and assigns a 'Best Estimate' Unrisked Gross

(100%) Prospective Oil Resource of 256.2 MMBBLs to the prospect

(Low to High Estimates 135.6 MMBBLs to 451.6 MMBBLs), with an

aggregate Probability of Geologic Success (POSg) of 72%.

Ratio Petroleum is fully funded for the ExxonMobil operated

drilling of the Tanager-1 well in the first half of 2020.

As a result of our investments in CEC and Ratio Petroleum, we

look forward to the drilling of the Tanager-1 well which has the

potential to de-risk the Kaieteur block and provide Westmount

shareholders with exposure to a potentially significant capital

gain should it be successful.

JHI Associates Inc ("JHI")

During the period your Company announced that it had increased

its equity position in JHI to approximately 3% of the issued share

capital as of 21st December 2018. JHI's main asset is a 17.5%

carried interest in the Canje Block covering over 6,000 square

kilometres, immediately outboard of the Stabroek Block. As a result

of a farm-in by Total, announced in February 2018, JHI is carried

for the drilling of up to four wells and is funded for the drilling

of additional wells. It is anticipated that the first wells in the

Canje Block will be drilled in early 2020, with Total recently

indicating that the Bulletwood and Jabillo prospects, located in

the north-west portion of the block, as the most likely initial

drilling targets.

We look forward to the Exxon Mobil operated drilling campaign on

Canje which has the potential for transformational value uplifts

should it be successful.

Share Subscription

After the year end, on August 23rd and 28th, 2019 your Board

announced the raising of GBP5.573m in total at 13p per share, by

way of a share subscription to pursue Westmount's ongoing

investment strategy, focused on the Guyana-Suriname Basin. This

financing inter alia enabled the completion of our second CEC

investment announced on the 30th August 2019.

I would like to welcome our new institutional and private

shareholders and thank our new and existing investors for their

support. We believe that the successful financing in August is a

testament to the Guyana specific story and access that Westmount

offers to the opportunity. I wish all our shareholders success with

their investment over the coming year.

Summary/Outlook

Your Board remains focused on accessing investment opportunities

and deploying capital that gives additional exposure to the

emerging Guyana Suriname basin. We have been focusing on Guyana for

over 3 years and in spite of rising valuations and limited access,

opportunities remain. Guyana is emerging as a hydrocarbon province

with first oil production from the Liza field expected in the

coming months. Our initial toehold investments have proven

successful and our investments in the private single asset

companies hold the potential for transformational value uplift

should the ExxonMobil operated drilling campaign in 2020 be

successful.

As we have demonstrated recently, there is capital available in

London for Guyana and besides EOG, Westmount Energy is the only

other London listed junior company focused on the Guyana offshore

space and offering investors material exposure to this emerging

basin.

Westmount continues to offer the opportunity for private

companies, with assets in offshore Guyana, to gain access to London

capital markets via RTO or to provide a liquidity event for their

shareholders. While these private companies decide on their path

forward, our strategy of investing across four different companies

(EOG, Ratio, JHI, CEC) with interests in three different

exploration blocks, (Orinduik, Canje, Kaieteur), continues to

provide our shareholders with exposure to the two discoveries on

Orinduik, already announced this year, and a potential further 3 to

7 funded high impact wells over the next 12-15 months.

History has shown that small percentages in big assets can reap

material returns. The upcoming exploration wells and their

respective geological risks are independent of each other and

therefore our strategy provides shareholders with some risk

diversification and a portfolio effect. Success in some of these

wells could result in transformational value changes. The condensed

drilling time frame and number of exploration wells points to

exciting times ahead for shareholders.

GERARD WALSH

Chairman

30 October 2019

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0)1534 823133

Jane Vlahopoulou

Cenkos Securities plc Nomad and Broker Tel: +44 (0)20 7397

8900

Nicholas Wells / Harry Hargreaves (Corporate

Finance)

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2019

Year ended Year ended

30 June 30 June

2019 2018

Notes GBP GBP

Net fair value gains on financial

assets held at fair value through

profit or loss 2,654,137 722,333

Net fair value losses on financial

liabilities held at fair value through

profit or loss

Impairment of intangible assets (183,753) -

Finance costs 6 (66,667) -

Administrative expenses 7 (79,987) -

4 (229,462) (150,166)

Share options expensed 14 (80,853) (11,087)

Operating profit 2,013,415 561,080

Profit before tax 2,013,415 561,080

Tax - -

Profit after tax 2,013,415 561,080

Other comprehensive income - -

------------ ------------

Total comprehensive income for the

year 2,013,415 561,080

============ ============

Basic earnings per share (pence)

continuing and total operations 5 3.83 1.34

------------ ------------

Diluted earnings per share (pence)

continuing and total operations 5 3.51 1.34

------------ ------------

The Company has no items of other comprehensive income.

STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019

As at As at

30 June 30 June 2018

2019

Notes GBP GBP

ASSETS

Non-current assets

Intangible assets 6 33,333 -

Financial assets held at fair value

through profit or loss 8 6,745,797 1,727,539

---------- -------------

6,779,130 1,727,539

---------- -------------

Current assets

Receivables 9 7,001 8,213

Cash and cash equivalents 10 63,374 557,182

---------- -------------

70,375 565,395

---------- -------------

Total assets 6,849,505 2,292,934

========== =============

LIABILITIES AND EQUITY

Non-current liabilities

Derivative financial instruments 11 221,411 -

Borrowings 11 598,375 -

---------- -------------

819,786 -

---------- -------------

Current liabilities

Trade and other payables 12 45,422 43,170

Derivative financial instruments 11 3,592 -

Borrowings 11 50,967 -

---------- -------------

99,981 43,170

---------- -------------

Total Liabilities 919,767 43,170

---------- -------------

EQUITY

Stated capital 13 5,829,872 4,244,166

Share based payment 14 444,846 363,993

Retained earnings (344,980) (2,358,395)

---------- -------------

Total equity 5,929,738 2,249,764

---------- -------------

Total liabilities and equity 6,849,505 2,292,934

========== =============

These financial statements were approved and authorised for issue

by the Board of Directors on October 2019 and were signed on its

behalf by:

D R King

Director

30 October 2019

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2019

Stated Share-based Retained Total

Notes capital payment reserve earnings equity

GBP GBP GBP GBP

As at 1 July 2017 3,772,244 352,906 (2,919,475) 1,205,675

Comprehensive income

Total Comprehensive income

for the year ended 30 June

2018 - - 561,080 561,080

Transactions with owners

Warrants converted 13 471,922 - - 471,922

Share options expensed 14 - 11,087 - 11,087

As at 30 June 2018 4,244,166 363,993 (2,358,395) 2,249,764

---------- ---------------- ------------ ----------

Comprehensive income

Total Comprehensive income

for the year ended 30 June

2019 - - 2,013,415 2,013,415

Share issue 13 1,585,706 - - 1,585,706

Transactions with owners

Share options expensed 14 - 80,853 - 80,853

As at 30 June 2019 5,829,872 444,846 (344,980) 5,929,738

---------- ---------------- ------------ ----------

STATEMENT OF CASH FLOWS

FOR THE YEARED 30 JUNE 2019

Year ended Year ended

30 June 30 June

2019 2018

Notes GBP GBP

Cash flows from operating activities

Profit for the year 2,013,415 561,080

Adjustments for:

Net gain on financial assets at fair

value through profit or loss (2,654,137) (722,333)

Net loss on financial liabilities

at fair value through profit or loss 183,753 -

Impairment of intangible assets 6 66,667 -

Interest on borrowings 79,987 -

Share options expensed 14 80,853 11,087

Movement in other receivables 1,212 2,565

Movement in trade and other payables 2,252 (30,566)

Proceeds from sale of investments 1,499,100 -

Purchase of investments (3,317,515) (284,615)

------------ -----------

Net cash used in operating activities (2,044,413) (462,782)

------------ -----------

Cash flows from financing activities

Proceeds from borrowings 11 1,600,000 -

Interest and charges on borrowings 11 (49,395) -

Proceeds from issue of ordinary shares 13 - 471,922

Net cash generated from financing

activities 1,550,605 471,922

Net (decrease) / increase in cash

and cash equivalents (493,808) 9,140

------------ -----------

Cash and cash equivalents at beginning

of year 557,182 548,042

Cash and cash equivalents at end

of year 10 63,374 557,182

------------ -----------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

1. GENERAL INFORMATION AND STATEMENTS OF COMPLIANCE WITH INTERNATIONAL

FINANCIAL REPORTING STANDARDS AS ADOPTED BY THE EUROPEAN UNION

Westmount Energy Limited (the "Company") operates solely as an energy

investment company. The investment strategy of the Company is to

invest in and provide follow on capital to small and medium sized

companies that have significant growth possibilities.

The Company was incorporated in Jersey on 1 October 1992 under the

Companies (Jersey) Law 1991, as amended, and is a public company

with registered number 53623. The Company is listed on the London

Stock Exchange Alternative Investment Market ("AIM").

Basis of Preparation

The financial statements are prepared on a going concern basis in

accordance with International Financial Reporting Standards as adopted

by the European Union ("IFRS") and applicable legal and regulatory

requirements of the Companies (Jersey) Law 1991. The financial statements

have been prepared under the historical cost convention as modified

by the valuation of financial assets held at fair value through

profit or loss.

2. ACCOUNTING POLICIES

The significant accounting policies that have been applied in the

preparation of these financial statements are summarised below.

These accounting policies have been used throughout all periods

presented in the financial statements.

Standards, amendments and interpretations to existing standards

that are effective and have been adopted by the Company

The Company has applied the following standards and amendments for

the first time for their annual reporting period commencing 1 July

2018:

IFRS 9 Financial Instruments (effective 1 January 2018)

In preparing these financial statements the Directors have applied

IFRS 9, Financial Instruments. Under IFRS 9 the classification of

financial assets is based both on the business model within which

the asset is held and the contractual cash flow characteristics

of the asset. There are three principal classification categories

for financial assets that are debt instruments: (i) amortised cost,

(ii) fair value through other comprehensive income (FVTOCI) and

(iii) fair value through profit or loss (FVTPL). Equity investments

in the scope of IFRS 9 are measured at fair value with gains and

losses recognised in profit or loss unless an irrevocable election

is made to recognise gains or losses in other comprehensive income.

The application of IFRS 9 has had no material impact on the financial

statements as the principal activity of the Company is to invest

in listed and non-listed companies and the management has not made

the irrevocable election to recognise gains or losses in other comprehensive

income.

New standards, amendments and interpretations to existing standards

that are not yet effective and have not been adopted early by the

Company

At the date of authorisation of these financial statements there

are no other standards that are not yet effective and that would

be expected to have a material impact on the Company in the current

or future reporting periods and on foreseeable future transactions.

Use of estimates and judgements

The preparation of financial statements in conformity with IFRS

requires the use of accounting estimates and the exercise of judgement

by management while applying the Company's accounting policies in

relation to the impairment of intangible assets, value of options

issued and derivative financial instruments, as set out in notes

6, 11 and 15. Derivative financial instruments, which are embedded

in the convertible loan notes issued by the Company, have been presented

separately from the host contract. The bifurcation of the embedded

derivative financial instruments requires judgement by management

to estimate the fair value of the derivatives on initial recognition

of the financial instrument. The valuation and subsequent impairment

reviews of the Company's intangible assets requires the use

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

2. ACCOUNTING POLICIES (continued)

Use of estimates and judgements (continued)

of accounting estimates and judgement by the management. These estimates

are based on the management's best knowledge of the events which

existed at the date of issue of the financial statements and at

the statement of financial position date however, the actual results

may differ from these estimates.

Financial assets at fair value through profit and loss that are

not listed have been valued in accordance with IFRS using the International

Private Equity and Venture Capital ("IPEVC") Guidelines and information

received from the investment entity. The inputs to value these assets

require significant estimates and judgements to be made by the Directors.

Functional and presentation currency

The functional currency of the Company is United Kingdom Pounds

Sterling ("Sterling"), the currency of the primary economic environment

in which the Company operates. The presentation currency of the

Company for accounting purposes is also Sterling.

Foreign currency monetary assets and liabilities are translated

into Sterling at the rate of exchange ruling on the last day of

the Company's financial year. Foreign currency non-monetary items

that are measured at fair value in a foreign currency are translated

into Sterling using the exchange rates at the date when the fair

value was determined. Foreign currency transactions are translated

at the exchange rate ruling on the date of the transaction. Gains

and losses arising on the currency translation are included in administrative

expenses in the Statement of Comprehensive Income in the year in

which they arise.

Financial instruments

Financial assets and financial liabilities are recognised when the

Company becomes party to the contractual provisions of the instrument.

(a) Classification

The Company classifies its financial assets in the following measurement

categories:

- those to be measured subsequently at fair value (either through

other comprehensive income or through profit or loss); and

- those to be measured at amortised cost.

The classification depends on the entity's business model for managing

the financial assets and the contractual terms of the cash flows.

The Company determines the classification of its financial assets

and financial liabilities at initial recognition.

Financial liabilities which are not financial liabilities held at

fair value through profit or loss are classified as other financial

liabilities and held at amortised cost.

(b) Recognition and measurement

Financial assets and financial liabilities are initially measured

at fair value. Transaction costs that are directly attributable

to the acquisition or issue of financial assets and financial liabilities

(other than financial assets and financial liabilities at fair value

through profit or loss) are added to or deducted from the fair value

of the financial assets or financial liabilities, as appropriate,

on initial recognition. Transaction costs directly attributable

to the acquisition of financial assets or financial liabilities

at fair value through profit or loss are recognised immediately

in the statement of comprehensive income.

Subsequent to initial recognition, financial assets at fair value

through profit or loss are re-measured at fair value. For listed

investments, fair value is determined by reference to stock exchange

quoted market bid prices at the close of business at the end of

the reporting year, without deduction for transaction costs necessary

to realise the asset. For non-listed investments fair value is determined

by using recognised valuation methodologies, in accordance with

the IPEVC Guidelines. Gains or losses arising from changes in the

fair value of financial assets at fair value through profit or loss

are presented in the statement of comprehensive income in the period

in which they arise.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

2. ACCOUNTING POLICIES (continued)

(b) Recognition and measurement (continued)

Subsequent measurement of the Company's debt instruments depends

on the model for managing the asset and the cash flow characteristics

of the asset.

The Company measures debt instruments at amortised cost if they

are held for collection of contractual cash flows where those cash

flows represent solely payments of principal and interest are measured

at amortised cost. The Company recognises any impairment loss on

initial recognition and any subsequent movement in the impairment

provision in the statement of comprehensive income, see Note 6.

Debt instruments which do not represent solely payments of principal

and interest are measured at fair value through profit or loss.

Financial liabilities, which includes borrowings, are measured at

amortised cost using the effective interest method. The effective

interest rate is the rate that exactly discounts estimated future

cash payments through the expected life of the financial liability

or, where appropriate, a shorter period, to the net carrying amount

on initial recognition.

Financial liabilities at fair value through profit or loss are re-measured

at fair value. The fair value of the derivative financial instruments

is determined by reference to stock exchange quoted market bid prices

at the close of business at the end of the reporting year, without

deduction for transaction costs incurred by the Company on realisation

of the liability, see note 11. Gains or losses arising from changes

in fair value of financial liabilities at fair value through profit

or loss are presented in the statement of comprehensive income in

the period in which they arise.

(c) Impairment

Under IFRS 9, the new impairment model requires the recognition

of impairment provisions based on expected credit losses ("ECL")

rather than only incurred credit losses as is the case under IAS

39. IFRS 9 permits a simplified approach to trade and other receivables

which allows the Company to recognise the loss allowance at initial

recognition and throughout its life at an amount equal to lifetime

ECL. ECL are a probability-weighted estimate of credit losses. A

credit loss is the difference between the cash flows that are due

to an entity in accordance with the contract and the cash flows

that the entity expects to receive discounted at the original effective

interest rate. ECL consider the amount and timing of payments, thus

a credit loss arises even if the entity expects to be paid in full

but later than when contractually due.

(d) Derecognition

A financial asset or part of a financial asset is derecognised when

the rights to receive cash flows from the asset have expired and

substantially all risks and rewards of the asset have been transferred.

The Company derecognises a financial liability when the obligation

under the liability is discharged, cancelled or expired.

Intangible assets

Separately acquired Net Profit Interest licences ("NPI licences")

are classified as intangible assets and are shown at historical

cost. Such NPI licences, which are not subject to amortisation,

allow the Company to benefit from exploration and extraction of

energy resources, if successful, from investee companies granting

such NPI licences.

The value of the NPI licences are assessed periodically for possible

impairment when events indicate that the fair value of the intangible

asset may be below the Company's carrying value. When such a condition

is deemed to be other than temporary, the carrying value of the

investment is written down to its fair value, and the amount of

the write-down is included in net profit or loss on financial assets

held at fair value through profit or loss. In making the determination

as to whether a decline is other than temporary, the Company considers

such factors as the duration and extent of the decline, the investee

company's financial performance, and the Company's ability and intention

to retain its investment for a period that will be sufficient to

allow for any anticipated recovery in the NPI licences' market value.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

2. ACCOUNTING POLICIES (continued)

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held on

call with banks and cash with broker. For the purpose of the Statement

of Cash Flows, cash and cash equivalents are considered to be all

highly liquid investments with maturity of three months or less

at inception.

Equity, reserves and dividend payments

Ordinary shares are classified as equity. Transaction costs associated

with the issuing of shares are deducted from stated capital. Retained

earnings include all current and prior period retained profits.

Shares are classified as equity when there is no obligation to transfer

cash or other assets.

Expenditure

The expenses of the Company are recognised on an accruals basis

in the Statement of Comprehensive Income.

Share options

Equity-settled share-based payment transactions are measured at

the fair value of the goods and services received unless that cannot

be reliably estimated, in which case they are measured at the fair

value of the equity instruments granted. Fair value is measured

at the grant date and is estimated using valuation techniques as

set out in note 15. The fair value is recognised in the Statement

of Comprehensive Income, with a corresponding increase in equity

via the share option account. When options are exercised, the relevant

amount in the share option account is transferred to stated capital.

3. TAXATION

The Company is subject to income tax at a rate of 0%. The Company

is registered as an International Services Entity under the Goods

and Services Tax (Jersey) Law 2007 and a fee of GBP200 has been

paid, which has been included in administrative expenses.

4. ADMINISTRATIVE EXPENSES

2019 2018

GBP GBP

Administration and consultancy fees 47,439 34,094

Advisory fees 25,275 25,000

Audit fees 13,344 13,880

Directors' fees 15,000 12,000

Foreign exchange losses 25,814 -

Legal and professional fees 32,890 6,277

Printing and stationery 10,200 9,086

Registered agent's fees 16,726 16,902

Other expenses 42,774 32,927

229,462 150,166

-------- --------

5. EARNINGS PER SHARE Basic earnings per share (pence) 3.83 1.34

Diluted earnings per share (pence) 3.51 1.34

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

5. EARNINGS PER SHARE (continued)

The table below presents information on the profit attributable

to the shareholders and the weighted average number of shares

used in the calculating the basic and diluted earnings per

share.

2019 2018

Basic earnings per share GBP GBP

Profit attributable to the shareholders

of the Company 2,013,415 561,080

Diluted earnings per share

Profit attributable to the shareholders

of the Company:

Used in calculating basic earnings per

share 2,013,415 561,080

Add interest expense 79,987 -

Less fair value of share options not expensed (3,000) -

during the period

----------- --------

Profit attributable to the shareholders

of the Company used in calculating diluted

earnings per share 2,090,402 561,080

----------- --------

No. of shares No. of shares

Weighted average number of ordinary shares

used as the denominator in calculating basic

earnings per share 52,561,113 41,760,211

Adjustments for calculating of diluted earnings

per share:

Share options 687,786 -

Convertible loan notes 4,032,549 -

-------------- --------------

Weighted average number of ordinary shares

and potential ordinary shares used as the

denominator in calculating diluted earnings

per share 57,281,448 41,760,211

-------------- --------------

Share options

The share options have been included in the determination of

the diluted earnings per share to the extent to which they

are dilutive. The share options granted prior to 30 June 2018

did not have an impact on diluted earnings per share as the

option price was above the average share price.

The 1,500,000 options granted in April 2019 are not included

in the calculation of diluted earnings per share because they

are antidilutive as at 30 June 2019. These potentially dilute

earnings per share in the future as these may not be exercised

before their expiration date.

Convertible loan notes

Conversion options over convertible loan notes issued during

the year are considered to be potential ordinary shares and

have been included in the determination of diluted earnings

per share from their date of issue. Interest accrued on the

convertible loan notes, which may be converted to ordinary

shares, is also considered to be dilutive and is included in

the diluted earnings per share.

6. INTANGIBLE ASSETS

2019 2018

GBP GBP

At 1 July - -

Acquisition 100,000 -

Impairment (66,667) -

--------- -----

At 30 June 33,333 -

--------- -----

The Company acquired Net Profit Interest licences ("NPI") in

three offshore UK blocks for GBP100,000. The NPI licences allow

the Company to benefit from near term exploration and appraisal

drilling targets, with independent prospect risks, if such exploration

and drilling is successful. The NPI licences require no additional

investment from the Company. The licences are initially recorded

in the books of the Company at cost. An impairment test is performed

on an annual basis by the Directors and they are subsequently

measured at cost less any adjustments for impairment losses.

Two of the licences were deemed to be fully impaired by the

Directors, as the underlying operating licences had been relinquished

by the company granting each NPI licence at the date of this

report.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

7. FINANCE COSTS

The Company entered into a Loan Note Instrument (the 'Instrument')

on 24 October 2018, constituting GBP5 million nominal 10% p.a.

Convertible Unsecured Loan Notes 2021 of which GBP1.6 million was

advanced. Interest is payable to each of the relevant Noteholders

on the principal amount of the Loan Note for the time being outstanding

at a rate calculated in accordance with the Instrument. The interest

payable at 10% per annum on the Loan Notes held by any Noteholder

can be converted into a corresponding number of new fully paid

Ordinary Shares at the Company Conversion Price when certain conditions

within the Instrument are met.

On 18 March 2019 the Company repaid GBP940,000 of the principal

of the convertible loan notes, the interest accrued on the repaid

portion of the convertible loan note was waived by the holder.

The interest charge through the profit or loss account during the

year was GBP79,987.

8. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS

2019 2018

GBP GBP

Equity investments

Argos Resources Ltd ("Argos") 26,300 63,000

Cataleya Energy Corporation ("Cataleya") 1,993,317 -

Rockhopper Exploration plc ("Rockhopper") - 146,838

Pancontinental Oil & Gas NL ("Pancontinental") - 6,716

Eco Atlantic Oil & Gas Ltd ("Eco Atlantic") 1,050,000 987,500

JHI Associates Inc ("JHI") 2,662,304 110,555

Ratio Petroleum Energy Limited Partnership

("Ratio") 1,013,876 412,930

Total investments 6,745,797 1,727,539

---------- ----------

Net changes in fair value of financial assets designated at

fair value through profit or loss

2019 2018

GBP GBP

Beginning Balance (621,453) (1,343,786)

Net movement in fair value gains 2,654,137 722,333

Net fair value gain/ (loss) on financial

assets at fair value through profit or loss 2,032,684 (621,453)

---------- ------------

On 30 June 2019, the fair value of the Company's holding of 1,000,000

(2018: 1,000,000) ordinary fully paid shares in Argos, representing

0.46% (2018: 0.46%) of the issued share capital of the company,

was GBP26,300 (2018: GBP63,000) (2.63p per share (2018: 6.30p per

share)). No shares were disposed of in the current or prior year.

On 19 September 2018, the Company's entire holding of 358,142 shares

in Rockhopper was sold for GBP130,722.

On 24 September 2018, the Company's entire holding of 3,000,000

shares in Pancontinental was sold for GBP11,543.

On 30 June 2019, the fair value of the Company's holding of 1,500,000

(2018: 3,125,000) ordinary fully paid shares in Eco Atlantic, representing

0.94% (2018: 1.98%) of the issued share capital of the company,

was GBP1,050,000 (2018: GBP987,500) (70.00p per share (2018: 31.60p

per share)). During the year, the Company sold 1,625,000 shares

for GBP1,345,750.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

8. FINANCIAL ASSETS AT FAIR VALUE THROUGH PROFIT OR LOSS (continued)

During the year the Company purchased 253,685 ordinary fully paid

shares in Cataleya for GBP1,943,894 (GBP7.66 per share). On 30

June 2019, the Directors' estimate of the fair value of the Company's

holding of 253,685 shares in Cataleya was GBP1,993,317 (7.86p per

share). No shares were disposed of in the current year.

During the year the Company purchased 2,053,770 ordinary fully

paid shares in JHI for GBP1,908,369 (GBP0.93 per share) which includes

a share issue by the Company of 7,145,505 new nil par value ordinary

shares as part consideration for JHI shares received during the

year (see note 13). On 30 June 2019, the Directors' estimate of

the fair value of the Company's holding of 100,000 units (each

unit comprising one common share plus one half of one common share

purchase warrant) plus 2,113,770 shares (2018: 100,000 units plus

60,000 shares) in JHI was GBP2,662,304 (2018: GBP110,555) GBP1.20

per share (2018: 69.10p per share). No shares were disposed of

in the current or prior year.

On 30 June 2019, the fair value of the Company's holding of 1,200,000

(2018: 1,200,000) ordinary fully paid shares in Ratio, representing

0.70% (2018: 1.05%) of the issued share capital of the company,

was GBP1,013,876 (2018: GBP412,930).

9. OTHER RECEIVABLES AND PREPAYMENTS 2019 2018

GBP GBP

Prepayments 7,001 8,213

------ ------

10. CASH AND CASH EQUIVALENTS

2019 2018

GBP GBP

Cash at bank 63,362 303,204

Cash at broker 12 253,978

63,374 557,182

------- --------

11. DERIVATIVE FINANCIAL INSTRUMENTS AND BORROWINGS

The Company issued GBP1,600,000 10% convertible loan notes on 24

October 2018. The notes are convertible into ordinary shares of

the Company, at the option of the holder, or repayable on 31 March

2021. The conversion price is the higher of GBP0.08 per share or

a 25% discount on the volume weighted average price ("VWAP") 5

days prior to the repayment date. Interest accrued up to and payable

on 31 October 2019 may be converted into shares, at the option

of the Company, at a conversion price of a 10% discount of VWAP

5 days prior to the payment date. Interest accrued up to and payable

on 31 October 2020 may be converted into shares, at the option

of the holder, at a conversion price of the higher of GBP0.08 per

share or a 25% discount of VWAP 5 days prior to the payment date.

On 18 March 2019 the Company repaid GBP940,000 of the principal

of the convertible loan notes, the interest accrued on the repaid

portion of the convertible loan note was waived by the holder.

Current Non-current Total

GBP GBP GBP

Face value of notes issued - 1,600,000 1,600,000

Value of conversion rights - (100,000) (100,000)

Issue costs - (49,395) (49,395)

-------- ------------ ----------

- 1,450,605 1,450,605

-------- ------------ ----------

Repayment of convertible loan

notes - (852,230) (852,230)

Interest expense 50,967 - 50,967

Interest paid - - -

-------- ------------ ----------

Total borrowings 50,967 598,375 649,342

-------- ------------ ----------

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

11. DERIVATIVE FINANCIAL INSTRUMENTS AND BORROWINGS (Continued)

Current Non-current Total

GBP GBP GBP

Conversion rights measured

at fair value through profit

or loss

Opening balance at 1 July 2018 - - -

Initial recognition of conversion

rights from issue of convertible

loan notes - 100,000 100,000

Repayment of convertible loan

notes (cancellation of conversion

rights) - (58,750) (58,750)

Movement in fair value 3,592 180,161 183,753

-------- ------------ ---------

Total derivative financial

instruments at 30 June 2019 3,592 221,411 225,003

-------- ------------ ---------

The initial fair value of the derivative portion of the convertible

loan notes was determined by the potential loss on ordinary shares

if converted on the date the convertible loan notes were issued.

The derivative financial instruments are recognised as a financial

liability measured at fair value through profit or loss. The remainder

of the proceeds is allocated to the liability which is subsequently

recognised on an amortised cost basis until extinguished on conversion

or maturity of the convertible loan notes.

12. TRADE AND OTHER PAYABLES 2019 2018

GBP GBP

Accrued expenses 45,422 43,170

------- -------

13. STATED CAPITAL

Allotted, called up and fully Ordinary shares Ordinary

paid: shares

No. GBP

1 July 2017 40,855,502 3,772,244

Additions 6,292,294 471,922

---------------- ----------

1 July 2018 47,147,796 4,244,166

Additions 17,618,949 1,585,706

At 30 June 2019 64,766,745 5,829,872

---------------- ----------

On 26 February 2019, in accordance with the terms of the JHI share

purchase agreements, the Company issued a total of 7,174,505 new

nil par value ordinary shares and a cash consideration of GBP553,665

for 1,103,770 JHI shares. The total valuation of the Company's

share issue was GBP645,705.

On 18 March 2019 the Company issued a total of 10,444,444 new nil

par value ordinary shares for a total of GBP940,000 (note 11).

There were no share redemptions during the year ended 30 June 2019

(2018: GBPNil).

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

14. SHARE-BASED PAYMENT RESERVE

2019 2018

GBP GBP

At 1 July 363,993 352,906

Share options expensed 80,853 11,087

At 30 June 444,846 363,993

-------- --------

On 5 April 2019, the Company granted 1,500,000 share options at

a weighted average exercise price of 14.0p per share. The options

vested in the current financial year and are exercisable at the

option of the option holder, expiring 31 December 2024. The fair

value of the options granted was GBP74,854 using the Black Scholes

valuation model.

The following assumptions were used to determine the fair value

of the options:

Weighted average share price at grant date (pence) 13.75

Exercise price (pence) 14.0

Expected volatility (%) 42.2%

Average option life (years) 5.0

Risk free interest rate (%) 0.380%

The expected volatility is based on the historic volatility of

the Company's share prices over the last five years.

The number and weighted average exercise price of share options

are as follows:

2019 2019 2018 2018

Weighted Weighted

average average

exercise Number exercise Number

price of options price of options

(p) (p)

Outstanding at start

of the year 7.5 2,250,000 7.5 1,750,000

Granted during the

year 14.0 1,500,000 7.5 500,000

Exercised during the - - - -

year

Outstanding at end

of the year 10.10 3,750,000 7.5 2,250,000

---------- ------------ ---------- ------------

Exercisable at end

of the year 10.10 3,750,000 7.5 2,250,000

---------- ------------ ---------- ------------

15. FINANCIAL RISK

The Company's investment activities expose it to a variety of financial

risks: market risk (including foreign exchange risk, price risk

and interest rate risk), credit risk and liquidity risk. The Company's

overall risk management programme focuses on the unpredictability

of financial markets and seeks to minimise potential adverse effects

on the Company's financial performance.

a) Market risk

i) Foreign exchange risk

The Company's functional and presentation currency is sterling.

The Company is exposed to currency risk through its investments

in Cataleya, JHI and Ratio. The directors have not hedged this

exposure.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

15. FINANCIAL RISK (continued)

a) Market risk (continued)

Currency exposure as at 30 June: Assets and Assets and

net exposure net exposure

2019 2018

Currency GBP GBP

US Dollars 2,113,578 110,555

Australian Dollars - 6,716

Canadian Dollars 2,542,043 -

Israeli Shekel 1,013,876 412,930

Total 5,669,497 530,201

------------------------- -------------------------

If the value of sterling had strengthened by 5% against all of

the currencies, with all other variables held constant at the reporting

date, the equity attributable to equity holders and the profit

for the period would have decreased by GBP283,475 (2018: GBP25,250).

The weakening of sterling by 5% would have an equal but opposite

effect. The calculations are based on the foreign currency denominated

financial assets as at year end and are not representative of the

period as a whole.

ii) Price risk

Price risk is the risk that the fair value of the future cash flows

of a financial instrument will fluctuate due to changes in market

prices. The Company is exposed to price risk on the investments

held by the Company and classified by the Company on the Statement

of Financial Position as at fair value through profit or loss.

To manage its price risk, management closely monitor the activities

of the underlying investments.

The Company's exposure to price risk is as follows: Fair value

Fair Value Through Profit or Loss,

as at 30 June 2019 6,745,797

Fair Value Through Profit or Loss,

as at 30 June 2018 1,727,539

With the exception of JHI and Cateleya, the Company's investments

are all publicly traded and listed on either the AIM or the Tel

Aviv Stock Exchange. A 30% increase in market price would increase

the pre-tax profit for the year and the net assets attributable

to ordinary shareholders by GBP627,053 (2018: GBP485,095). A 30%

reduction in market price would have decreased the pre-tax profit

for the year and reduced the net assets attributable to shareholders

by an equal but opposite amount. 30% represents management's assessment

of a reasonably possible change in the market prices.

A 30% increase in the market price of JHI and Cataleya would increase

the pre-tax profit for the year and the net assets attributable

to ordinary shareholders by GBP1,396,686 (2018: GBP33,166). A 30%

reduction in market price would have decreased the pre-tax profit

for the year and reduced the net assets attributable to shareholders

by an equal but opposite amount. 30% represents management's assessment

of a reasonably possible change in the market price of JHI and

Cataleya based on the price of share purchases over the last two

years.

iii) Interest rate risk

Interest rate risk is the risk that the fair value or future cash

flows of a financial instrument will fluctuate because of changes

in market interest rates. The Company is not exposed to interest

rate risk as the interest rate on borrowings is fixed and the Company's

cash deposits do not currently earn interest.

b) Credit Risk

Credit risk is the risk that an issuer or counterparty will be

unable or unwilling to meet commitments it has entered into with

the Company. The Directors do not believe the Company is subject

to any significant credit risk exposure regarding trade receivables.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

15. FINANCIAL RISK (continued)

Credit Risk (continued)

At the end of the reporting period, the Company's financial assets

exposed to credit risk amounted to the following: 2019 2018

GBP GBP

Cash and cash equivalents 63,374 557,182

------- --------

The Company considers that all the above financial assets are not

impaired or past due for each of the reporting dates under review

and are of good credit quality.

c) Liquidity Risk

Liquidity risk is the risk that the Company cannot meet its liabilities

as they fall due. The Company's primary source of liquidity consists

of cash and cash equivalents and those financial assets which are

publicly traded and held at fair value through profit or loss and

which are deemed highly liquid.

The following table details the contractual, undiscounted cash flows

of the Company's financial liabilities:

As at 30 June 2019 Up to 3 months Up to 1 year Over 1 year Total

GBP GBP GBP GBP

Financial liabilities

Borrowings (1) - 45,205 660,000 705,205

Trade and other payables 45,422 - - 45,422

--------------- ------------- ------------ --------

45,422 45,205 660,000 750,627

--------------- ------------- ------------ --------

As at 30 June 2018 Up to 3 months Up to 1 year Over 1 year Total

GBP GBP GBP GBP

Financial liabilities

Trade and other payables 43,170 - - 43,170

--------------- ------------- ------------ -------

(1) Borrowings are presented in the above tables at their nominal

value which represents the undiscounted cash flow amount of the CLN.

The amount may differ from the discounted cash flow amount included

in the statement of financial position.

Capital Management

The Company's objective when managing capital is to safeguard the

Company's ability to continue as a going concern in order to provide

optimum returns for shareholders and benefits for other stakeholders

and to maintain an optimal capital structure to reduce cost of capital.

In order to maintain or adjust the capital structure, the Company

may issue new shares, return capital to shareholders or sell assets.

The Company does not have any debt nor is the Company subject to

any external capital requirements.

Fair Value Estimation

The Company has classified its financial assets as fair value through

profit or loss and fair value is determined via one of the following

categories:

Level I - An unadjusted quoted price in an active market provides

the most reliable evidence of fair value and is used to measure fair

value whenever available. As required by IFRS 7, the Company will

not adjust the quoted price for these investments, (even in situations

where it holds a large position and a sale could reasonably impact

the quoted price).

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

15. FINANCIAL RISK (continued)

Fair Value Estimation (continued)

Level II - Inputs are other than unadjusted quoted prices in active

markets, which are either directly or indirectly observable as of

the reporting date, and fair value is determined through the use

of models or other valuation methodologies (see note 11).

Level III - Inputs are unobservable for the investment and include

situations where there is little, if any, market activity for the

investment. The inputs into the determination of fair value require

significant management judgment or estimation.

The following table shows the classification of the Company's financial

assets and liabilities:

Level I Level II Level III Total

GBP GBP GBP GBP

At 30 June 2019 2,090,176 (225,003) 4,655,621 6,547,268

At 30 June 2018 1,616,984 - 110,555 1,727,539

The Company has classified listed investments as Level I, derivative

financial instruments as Level II and unquoted investments as Level

III. The Level III investment is at an early stage of development

and therefore has been valued based on the recent price of investment.

The Directors have considered market expectations of future performance

of the entity's industry sector, in particular known interest in

the area of current exploration. As such, the Directors consider

that the recent price of investment in Cataleya and JHI fairly reflects

the value of the investments as at 30 June 2019.

A reconciliation of the movements in Level III investments is shown

below:

2019 2018

GBP GBP

At start of the year 110,555 76,987

Purchases 3,852,263 39,567

Change in fair value 692,803 (5,999)

At end of the year 4,655,621 110,555

---------- --------

16. DIRECTORS' REMUNERATION AND SHARE OPTIONS

2019 2018 2019 2018

Directors' Directors' Options Options

fees fees outstanding outstanding

GBP GBP GBP GBP

D R King 15,000 12,000 500,000 250,000

D Corcoran - - 1,000,000 500,000

G Walsh - - 1,000,000 500,000

T O'Gorman - - 750,000 500,000

M Bradlow

(resigned 11 April

2017) - - 500,000 500,000

15,000 12,000 3,750,000 2,250,000

----------- ----------- ------------- -------------

At the year end the Company owed GBPnil (2018: GBPnil) in outstanding

directors' fees.

1,500,000 share options were issued during the year ended 30 June

2019 (2018: 500,000) and nil (2018: nil) options were exercised during

the year. The options issued during the year are due to expire on

31 March 2024 and the remaining 2,250,000 outstanding options are

due to expire on 31 December 2019.

The Company does not employ any staff except for its Board of Directors.

The Company does not contribute to the pensions or any other long-term

incentive schemes on behalf of its Directors.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2019

17. RELATED PARTIES

Fees paid to the Directors are disclosed in note 16.

Gerard Walsh, a director of the Company, subscribed for GBP500,000

of the convertible loan notes issued on 24 October 2018. The total

loan payable to Gerard Walsh as at 30 June 2019 was GBP491,925 which

includes GBP34,110 of accrued interest and the fair value of the

conversion rights attributable to Gerard Walsh is GBP170,457. Details

of the convertible loan notes are disclosed in note 11.

On 26 February 2019, in accordance with the terms of the JHI share

purchase agreements between the Company and various JHI shareholders

including Gerard Walsh, the Company issued 3,250,000 new nil par

value ordinary shares and paid a cash consideration of GBP251,296

(CAN $437,500) for 500,000 JHI shares held by Gerard Walsh.

As detailed in Note 19 - Subsequent Events (below), Mr Gerard Walsh

subscribed GBP292,050 for 2,246, 538 Nil Par Value shares after the

year end.

Canaccord Genuity as a significant shareholder of the Company is

considered a related party under AIM rules.

On October 24 2018 Canaccord Genuity subscribed for GBP1,000,000

principal of the total GBP1,600,000 10% p.a. convertible unsecured

loan notes 2021 ("the Convertible Loan Notes") issued at that date.

On February 27 2019 Canaccord Genuity accepted early repayment of

GBP940,000 principal, and waived all interest payable, of the GBP1,000,000

principal of the Convertible Loan Notes held by them and made a subscription

for 10,444,444 new ordinary shares of nil par value in the Company

issued at a price of 9 pence per share.

At year end Canaccord Genuity retain GBP60,000 principal of the Convertible

Loan Notes and hold 28,161,946 Nil Par Value shares in the Company.

As detailed in Note 19 - Subsequent Events (below) Canaccord Genuity

subscribed GBP1,356,000 for 10,430,769 Nil Par Value shares after

the year end.

18. CONTROLLING PARTY

In the opinion of the Directors, the Company does not have a controlling

party.

19. SUBSEQUENT EVENTS

Share issue

On 23 August 2019 the Company raised GBP5.0 million through the issue

of 38,461,538 new ordinary shares of nil par value at 13p each.

Included in the GBP5.0 million share issue was a GBP292,050 subscription

from Mr Gerard Walsh in respect of 2,246,538 new ordinary Nil Par

Value shares and a GBP1,356,000 subscription from Canaccord Genuity

in respect of 10,430,769 new ordinary Nil Par Value Shares.

On 28 August 2019 the Company raised GBP0.573 million through the

issue of 4,409,999 new ordinary shares of nil par value at 13p each.

Additional investment in Cataleya

On 30 August 2019 Company acquired an additional 313,500 common shares

in Cataleya for a total consideration of USD 3,135,000 (GBP2,463,311).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR WGGPWUUPBPPU

(END) Dow Jones Newswires

October 31, 2019 03:00 ET (07:00 GMT)

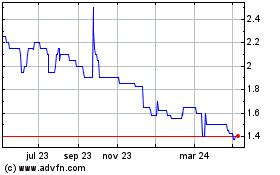

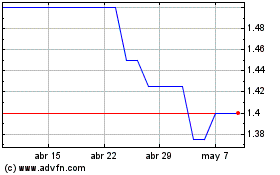

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024