TIDMICON

RNS Number : 8922R

Iconic Labs PLC

31 October 2019

31 October 2019

Iconic Labs Plc ("Iconic Labs" or the "Company")

Preliminary Results

Iconic Labs (LSE:ICON), a multi-divisional new media and

technology business, is pleased to announce its unaudited

preliminary results for the 18 month period ending 30 June 2019. A

copy of the full report will be available on the Company's website

www.iconiclabs.co.uk/investor-relations.

Chairman's Statement:

I am pleased to report these report and accounts which cover the

eighteen-month period to 30 June 2019, during which profound change

has occurred at the Company. The new team lead by John Quinlan has

spent significant energy in cleaning up liabilities attached to

Widecells Group Plc, the previous operational business, and

securing a platform from which to implement the new strategy of

building a multi-divisional new media and technology business.

The previous business

The Company was originally founded to pursue an opportunity

relating to stem cell storage and evolved into planning to promote

an insurance product related to the stem cell activity. It never

achieved any commercial traction, with total revenues for the

period of just GBP21,000, set against administrative expenses for

the discontinued business of GBP5,801,450 together with substantial

accrued liabilities.

Clearly this was unsustainable, and even with the convertible

secured debenture facility that they entered into with the European

High Growth Opportunities Securitization Fund ('EHGOSF'), and which

we inherited, it is hard to see how the business could have

survived. As if that were not bad enough, the actual number for

administrative expenses could have been much higher as prior to

taking control, we negotiated with many large creditors to

substantially reduce liabilities.

On taking control, we made available a modest sum to the

existing team to see if they could gain traction on revenues, but

after a short period they communicated that they were not confident

about taking that business forward and so we took the decision to

shut it down to focus entirely on the new media strategy.

The bulk of the legacy liabilities have now been paid off, with

some remaining debts being settled on a termed basis. These amount

to approximately GBP400,000 as at the date of this letter. Without

the work of the team and the funding that was put in place to deal

with these debts there would inevitably have been a catastrophic

loss for both shareholders and creditors.

New business and management team

As part of the plan, the board put in place a new team to

develop a multi divisional new media and technology business within

the Company. The team have an excellent background, having been

instrumental in building UNILAD into the largest social media

publisher in the world, all on the back of just two hundred pounds

of share capital.

Unfortunately, for the first months the team had to spend more

time dealing with unexpected legacy issues and liabilities, which

have impacted the implementation of the new strategy. However, I

believe over the last few months we have begun to see traction for

the services and execution of the model. The acquisition of Gay

Star News, a top three UK LGBTI publisher and the management

agreement with The Tab, the UK's leading youth and student culture

focussed publisher, have played a major part in this, and the team

continues to seek out publishers and platforms to work with or even

acquire.

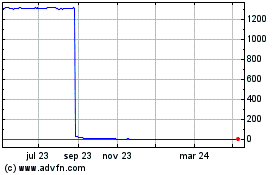

Capital Structure

We are very aware that the capital structure of the Company is a

source of frustration to shareholders, albeit the convertible

facility with EHGOSF is one that we inherited. Our aim as a board

is to move the Company towards a conventional, simplified capital

structure with no convertible or other facilities. While we need to

keep all options open while we resolve the final parts of the

legacy issues and the overhang of securities held by EHGOSF, we are

confident that once through these final issues, we will be in a

position to finance the growth of the Company from conventional

debt and equity issuance if needed.

Outlook

We have a team in place that has a track record of building

social media focussed businesses. The implementation of the

strategy has been slower than we anticipated, and we have been

constrained by capital being diverted to legacy issues. However, I

believe we have turned the corner and we ask that shareholders bear

with us while we complete the final parts of the transition and

move the Company to where we and you want to go, that being a

leading profitable new media and technology business.

David Sefton

Chairman

31 October 2019

Chief Executive's Statement

Dear Shareholder

Our plans and strategy remain to build a leading new media and

technology division and we are now beginning to see real progress.

The restructuring and ultimately winding down of the legacy stem

cell and insurance operations took more of our focus over the last

months than we had originally planned, but with this process now

close to completion, I am delighted that the team are now able to

focus on the new media and technology business that is Iconic

Labs.

Our plan for the business has two related elements: organic

growth based upon deploying the team's skills and commercial

experience in the sector alongside acquiring publishing platforms

which we can leverage to sell those skills. As such, the critical

first steps have been to acquire control (whether through a

management contract or outright acquisition) of strategic

publishing platforms.

The first of these has been through the acquisition of leading

LGBTI publisher Gay Star News ('GSN'), and we have also agreed

heads of terms for the acquisition of social media agency Social

Alchemist Limited. Finally, we have entered into an agreement with

Medium Channel Media Limited ("MCM") a media focussed investment

company, to provide management services to The Tab, the largest

social media publisher in the student market.

The acquisition of GSN is the first part of Iconic Labs'

strategy to build critical mass and in particular expand its

proprietary targeted distribution channels that the Company can

utilise under the Iconic Labs brand offering. This strategy of

acquiring digital brands and audiences will help contribute

revenues in the short and medium term but also build capital value

in the long term through the further development of these brands

and the revenue potential they bring.

We believe GSN represents excellent value at GBP33,000 having

generated revenues of over GBP500,000 last year. After careful due

diligence we concluded that it is possible to achieve the similar

levels of revenue but with a fraction of the historical cost base.

We are currently working hard at relaunching GSN and this will

immediately allow us to generate revenue from on-site digital

advertising. However, we believe the greater revenue long term will

come from combining the access to the GSN audience and data with

the consulting services that the central Iconic Labs team offer;

importantly we have already booked revenues in excess of the

purchase price.

We see the GSN acquisition as representing a model for many

future acquisitions. Buying established digital brands which have

substantial revenue potential and then using our skills, experience

and contacts to increase the Company's profitability and grow its

long-term value as a brand while also crucially contributing to the

central Iconic Labs business.

Our progress on organic revenue generation logically trails the

work on publishing platforms but we are fully focused on business

development. We are now seeing success in developing a pipeline and

beginning to close on a variety of revenue contracts. The contract

with MCM is due to be worth a minimum of GBP25,000 a month as soon

as they conclude their acquisition of The Tab and we are looking

forward to closing more contracts in Q4 which is traditionally a

busy and profitable period for the industry.

While there has been no formal launch or trade PR around Iconic

Labs, we have already had significant interest and a pipeline of

opportunities for a variety of contracts that we are looking to

close and execute. The current pipeline and interest give us

confidence that our strategy and offering of creative fee-based

services to potential clients is the right one. As previously

announced, we have negotiated a marketing consultancy engagement

with a Fintech company on a long-term retainer basis, and although

this has yet to be formally signed, we believe that this model will

become increasingly in demand across the industry.

I believe the future looks positive as we execute our plans and

focus on building a pipeline of organic revenues as well as making

good value acquisitions and investments. The media and advertising

industries are in a state of flux and the opportunities for a

disruptive new business like ours that combines owning valuable

audiences with being able to offer a unique product suite and

content creation to clients puts us in a great position for the

future.

Overall, we are seeing some real signs of progress on both the

revenue generation and acquisition parts of the business and we are

looking forward to building on this in the future.

John Quinlan

Chief Executive

31 October 2019

Strategic Report:

Introduction

Iconic Labs PLC is a company domiciled in England. The Company

was incorporated on 24 May 2016 and this is the third set of

financial statements prepared by the Company. The Company has

raised from a variety of means in the past, including a number of

equity placings and debt facilities.

During this financial year the company has evolved from a stem

cell and insurance company called Widecells Group PLC into a media

and technology company, and has been renamed Iconic Labs PLC.

Change in Business Model

The business model for the Company has changed dramatically from

the original Widecells business to the new Iconic labs business.

The original Widecells company was founded to pursue an opportunity

relating to stem cell storage and evolved into planning to promote

an insurance product related to the stem cell activity. This has

now been shut down and the business discontinued.

The new Iconic Labs is a media and technology business focused

on providing online marketing, content and technology driven

products. The Company plans to create complimentary divisions that

will allow it to provide a broad-based, all-encompassing offering

allowing clients to build their online branding and awareness,

generate significant revenues as well as building its own brand

platforms and products that have long term capital value.

Principal Activities and Business Review

The Market Opportunity

The directors believe that years of sustained technological

innovation across the globe has fundamentally changed consumer

buying habits; the way they interact with each other; and the way

they consume content. This sets the scene for fundamentally changed

market, not only for content producers and publishers; commerce and

advertisers; but for all.

This change has been driven by, and capitalised upon, by key

technological companies, primarily focused on online advertising

and other internet related services, software and hardware but have

a much wider reaching impact on our everyday lives. Google,

Facebook, Amazon, Apple, Microsoft, Samsung, Snapchat, Netflix

& Tencent are the notable companies in the space, and will be

for the foreseeable future, with entire business ecosystems reliant

on their services and key influence and impact in policy and

regulation at the highest level.

Digital Publishing

The demand for online content and entertainment services is

increasing with people spending more time online and consuming more

content than ever before. Social media usage across the UK

continues to increase, alongside overall internet use which has

doubled in the last 10 years from 12 hours a week in 2007 to 24

hours a week in 2017. Despite a sizeable and staunch audiences, it

is clear traditional content creators have failed to adapt to the

technological changes and effectively monetise on digital

distribution channels and platforms. Social Media platforms such as

Facebook & Twitter have transformed the way content in

particular news is discovered, disseminated, and digested. In this

new era a key component in building an engaged audience and

effectively monetising it, is understanding and navigating the

ever-changing social media landscape.

Advertising

As audiences continue to shift online, so too does advertising

revenue, as the WARC Expenditure report states, "at GBP13.4 billion

in 2018, it now accounts for 57% of the UK's total advertising

expenditure of GBP23.6 billion." Behind search, the largest slice

of online advertising is display advertising, and an increasing

amount is spent on social media, with spend on social platforms

increasing more than three-fold from GBP861m in 2015 to GBP3

billion in 2018.

Current Business Strategy

The directors believe that there is a significant opportunity in

the publishing and advertising market because of technological and

structural changes. The directors feel a staged roll-out of

complementary divisions that work together and as standalone

propositions will allow the Company to take advantage of a number

of industry trends with the scale to service the biggest clients

but also the flexibility to work with a variety of partners in the

industry.

The directors believe the planned structure of Iconic labs is an

example of a new operating model of that will be desirable to

partners and clients, and critical to establishing a successful

modern media company.

Current Business

Online Media Brands and Complimentary Agency and Consultancy

Services

The Consultancy and Agency:

The first phase of the Company's strategy has been launching the

agency and consultancy offering. This has already been soft

launched to some clients and has achieved a promising

reception.

This is a product based on the teams unique expertise and

experience that is in high demand in the industry that involves a

consulting approach to advise clients on their businesses but also

with the agency capabilities to actually deliver campaigns and

creative services in line with a client's needs.

Monthly Insights

Data analysis enables the brand to have a better understanding

of what was working on their own digital and social channels whilst

also being prepared to react to their competitors' content

Content Creation & Distribution

Work closely with insights to produce content that can be

distributed across various social channels

Post Campaign Analysis

Analysis to establish sentiment & content performance to

ensure insightful, creative and efficient future campaigns

Combining with Online Media Brands

This is a powerful offering in its own right but we believe that

its effectiveness and demand is multiplied many times by being used

in conjunction with the ownership and access to established online

media brands and their access to consumer data, talent and

audience.

The ability to offer potential clients and partners unique

access to audience, data and insights with the backing and

credibility of an established and trusted brand is a unique selling

point to brands and the company believes this will be best way of

establishing a strong client base and selling numerous products and

services.

Future Growth and Potential Roll Up Opportunity

The directors believe that a result of this model of pairing an

online media brand with a consultancy offering the company will

need to be selective in which brands and markets the Company looks

to target and have strict criteria for any growth in this area.

The Company is targeting established brands in high growth

markets that complement the skill and experience of its team. While

these involve the development of new brands in areas in line but

will be predominantly based around a 'roll up' of available brands

in the sector. The desire to own and operate established brands is

a crucial part of the reasoning behind a 'roll up'.

Additional Business Divisions:

The directors are confident in achieving success with the first

parts of the business and then will look to add in additional

business divisions and revenue streams over time:

-- E commerce - Work in collaboration with online media brands

division and utilise the feedback loops to inform production and

sale of consumer products

-- Content Studio - Create original video formats that are

piloted on social media and further developed for viewing on TV and

platforms such as Netflix

-- Content Licensing - License User Generated Content ('UGC')

created by users who have posted it to social media and resell

brands, & production houses internationally

-- Tech Product Development - Use insights gained from owned and

operated media audiences to drive development of innovative &

forward-thinking products

Key strengths of Team and Strategy:

Team:

The Directors believe the biggest strength of the Company is the

team. They have a unique set of skills, experience and contacts,

having established UNILAD in 2014 and developing it into the

world's largest social media publisher. UNILAD showed year-on-year

annual revenue growth in excess of 100% with revenues reaching more

than GBP10 million and the Directors believe the team can help

Iconic Labs grow substantial revenues.

Strategy:

-- To compete effectively in a competitive advertising space

achieving some consolidation of similar businesses and scale is

very important:

-- This allows the company to be of a size and offer enough

relevant services that it becomes a viable proposition in terms of

its ability to deliver for larger brands with significant

budgets.

-- Opportunity for cross and up selling to the different

business units with client portfolios and pipelines

-- Cost synergies across all the businesses with an ability to centralise finance, tech,

-- Increased efficiency and effectiveness with shared access to

single tech, data and insights platform

-- Legacy Issues

Legacy Issues:

Upon taking control, a modest sum of funding was made available

to the existing Widecells team to see if they could get some

traction on revenues. However, after a short period of time they

communicated that they were not confident about taking the business

forward and so we shut it down.

There were significant legacy issues, some of which were not

known to the new management upon taking control of the business. An

audit of the true creditor position of the company was taken and an

assessment made of how to restructure the company's debts and its

subsidiaries. The Company has received legal and professional

advice at every stage is fully confident that it is in control of

the liabilities and any processes required to manage them.

The management negotiated with creditors, some of whom were

former directors and secured legally binding settlement agreements

to substantially reduce the debt position of PLC.

There were some debts, such as to HMRC, the pensions regulator

and the LSE that the company has paid or plans to pay in full.

There are still around GBP400k of legacy debts that the Company is

in the final stage of discharging in accordance with agreed payment

plans.

There were and are a number of subsidiaries that had incurred

significant debts. The Company has taken substantial legal and

professional advice and is confident it is not responsible for

these debts and does not intend to pay them.

Status of Subsidiaries:

-- Widecells Brazil - Dissolved April 2018

-- Widecells Limited - Has entered liquidation process; Antony

Batty and Co appointed liquidator

-- WideAcademy - Dormant

-- Widecells Espana - Dormant

-- Widecells Portugal - Directors are absent but are responsible

for producing accounts. Company is working to produce these in

their absence.

-- Cellplan International LDA - Directors are absent but are

responsible for producing accounts. Company is working to produce

these in their absence.

-- Cellplan Limited - Shareholder of Cellplan International LDA. Dormant

-- Widecells International Limited - Dormant

Key Performance Indicators:

Given the change of business in the period the historic KPIs are

no longer relevant as they form part of the Widecells business and

are will not be brought forward from the prior year. The new Iconic

labs business is at an early stage of development and will be

focused on the areas of cash management and operating results.

The board is focused on increasing revenues and increasingly

getting towards profitability over time, so these will be key

operating performance indicators in the future.

Financial Review:

Financial Review of Widecells Group PLC

The Widecells Group PLC business has been discontinued and the

group had administrative expenses of GBP5,801,450 and a total loss

for the period ending June 30 2019 of GBP5,809,942.

Financial review of Ionic Labs

On March 18th 2019 a new media and technology division of the

business called Iconic Labs was formed and which became the main

division of the business.

The administration expenses of Iconic Labs were GBP303,902 till

the end of the period. These costs are related to cleaning up to

time of management and team in restructuring old business as well

as the launch of the new media and technology business.

Iconic Labs had yet to record any revenue by the end of the

period and the total loss was GBP307,952.

Notes Period Period ended

ended 30 June

30 June 2019

2019 Discontinuing

Continuing GBP

GBP

Revenue - 21,081

Administrative expenses 5 (303,902) (5,801,450)

------------ ---------------

Loss from operating activities (303,902) (5,780,369)

Finance

income 7 - 2,174

Finance

costs 7 (4,050) (31,747)

------------ ---------------

Loss before taxation (307,952) (5,809,942)

Taxation 8 - -

------------ ---------------

Loss for the period (307,952) (5,809,942)

Exchange translation on - -

foreign operations

Total comprehensive loss

for the period (307,952) (5,809,942)

============ ===============

The results for 2017 relate entirely to discontinued

operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2019

Notes Period Period ended Period Year ended

ended 30 June ended 31 December

30 June 2019 30 June 2017

2019 Discontinuing 2019 GBP

Continuing GBP Total

GBP GBP

Revenue - 21,081 21,081 50,765

Administrative expenses 5 (303,902) (5,801,450) (6,105,352) (2,840,228)

------------ ---------------

Loss from operating activities (303,902) (5,780,369) (6,084,271) (2,789,463)

Finance

income 7 - 2,174 2,174 -

Finance

costs 7 (4,050) (31,747) (35,797) (17,264)

------------ --------------- ------------ -------------

Loss before taxation (307,952) (5,809,942) (6,117,894) (2,806,727)

Taxation 8 - - - (2,126)

------------ --------------- ------------ -------------

Loss for the period (307,952) (5,809,942) (6,117,894) (2,808,853)

Exchange translation on

foreign operations - - - (32,798)

Total comprehensive loss

for the period (307,952) (5,809,942) (6,117,894) (2,841,651)

============ =============== ============ =============

Loss per ordinary share

Basic and diluted 9 - (0.02) (0.02) (0.05)

============ =============== ============ =============

The results for 2017 relate entirely to discontinued operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019

30 June 31 December

2019 2017

Notes GBP GBP

Non-current assets

Property, plant and equipment 10 7,093 466,591

Intangible assets 11 - 139,106

7,093 605,697

------------- ------------

Current assets

Stock 13 - 27,850

Trade and other receivables 14 - 9,551

VAT recoverable 14 15,922 173,703

Cash and cash equivalents 15 15,597 615,219

------------- ------------

31,519 826,323

------------- ------------

Total assets 38,612 1,432,020

============= ============

Equity

Share capital 19 3,498,257 162,053

Share premium 20 5,124,900 3,460,854

Merger reserve 20 - (185,728)

Translation reserve 20 - (32,798)

Share-based payment reserve 20 - 331,975

Retained deficit 20 (10,297,770) (4,305,132)

------------- ------------

(1,674,613) (568,776)

Non-current liabilities

Loans and borrowings 17 11,141 207,551

------------- ------------

11,141 207,551

------------- ------------

Current liabilities

Trade and other payables 16 1,633,806 935,536

Loans and borrowings 17 68,278 857,709

1,702,084 1,793,245

------------- ------------

Total liabilities 1,713,225 2,000,796

------------- ------------

Total equity and liabilities 38,612 1,432,020

============= ============

.............................................

John Quinlan

Director

31 October 2019

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2019

Share-

based

Share Share Merger Translation payment Retained Total

capital premium reserve reserve reserve deficit Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 31

December 2016 135,145 2,159,000 (185,728) - 211,513 (1,496,279) 823,651

------------ ------------ ------------ -------------- ---------- -------------- --------------

Loss for the

period - - - - - (2,808,853) (2,808,853)

Foreign

exchange

translation - - - (32,798) - - (32,798)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Total

comprehensive

loss for the

period - - - (32,798) - (2,808,853) (2,841,651)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Transactions

with

owners:

Share-based

payment

charges - - - - 120,462 - 120,462

Issue of shares 26,908 1,371,789 - - - - 1,398,697

Costs of

placings - (69,935) - - - - (69,935)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Total

contribution

by and

distribution

to owners 26,908 1,301,854 - - 120,462 - 1,449,224

------------ ------------ ------------ -------------- ---------- -------------- --------------

Balance at 31

December 2017 162,053 3,460,854 (185,728) (32,798) 331,975 (4,305,132) (568,776)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Loss for the

period - - - - - (6,117,894) (6,117,894)

Foreign

exchange - - - - - - -

translation

------------ ------------ ------------ -------------- ---------- -------------- --------------

Total

comprehensive

loss for the

period - - - - - (6,117,894) (6,117,894)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Transactions

with

owners:

Share-based

payment

charges - - - - 11,807 - 11,807

Issue of shares 3,336,204 1,894,621 - - - - 5,230,825

Costs of

placings - (230,575) - - - - (230,575)

------------ ------------ ------------ -------------- ---------- -------------- --------------

Total

contribution

by and

distribution

to owners 3,336,204 1,664,046 - - 11,807 - 5,012,057

------------ ------------ ------------ -------------- ---------- -------------- --------------

Transfer

between

reserves - - 185,728 32,798 (343,782) 125,256 -

Balance at 30

June 2019 3,498,257 5,124,900 - - - (10,297,770) (1,674,613)

============ ============ ============ ============== ========== ============== ==============

The currency translation reserve comprises all foreign currency

adjustments arising from the translation of the financial

statements of the foreign operation. During the year, the Board

decided that a number of the reserves related to historic balances

which are no longer relevant given the changes in the group during

the period. The merger reserve, translation reserve and share-based

payment reserve have been transferred to retained deficit during

the period.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2019

Period

ended Year ended

30 June 31 December

2019 2017

Notes GBP GBP

Cash flows from operating activities

Total comprehensive loss for

the period (6,117,894) (2,808,853)

Depreciation and amortisation 5 417 113,191

Impairment of assets 5 629,616 -

Share-based payment charge 22 11,807 120,462

Net interest expense 7 33,623 17,264

(5,442,431) (2,557,936)

Decrease/(Increase) in stock 27,850 (24,963)

Decrease/(Increase) in trade

and other receivables 167,333 (101,133)

Increase/(decrease) in trade

and other payables 698,270 543,205

Net cash used in operating

activities (4,548,978) (2,140,827)

---------------- -------------

Cash flows from investing

activities

Purchase of tangible fixed

assets 10 (31,429) (323,989)

Net cash used in investing

activities (31,429) (323,989)

Cash flows from financing

activities

Issue of share capital 5,230,825 1,398,697

Costs of issuing share capital (230,575) (69,935)

Interest received 7 2,174 -

Interest paid 7 (35,797) (17,264)

Convertible debt issued - 50,000

Issue of finance leases - 153,003

Repayment of finance leases (174,787) -

Proceeds from borrowings - 150,000

Repayment of borrowings (313,877) (198,604)

Net cash flows from financing

activities 4,477,963 1,465,897

Net decrease in cash and cash

equivalents (102,444) (998,919)

Cash and cash equivalents

at beginning of period 118,041 1,149,758

Effect of foreign exchange

rate changes - (32,798)

------------ -------------

Cash and cash equivalents

at period end 15 15,597 118,041

------------ -------------

COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019

30 June 31 December

2019 2017

Notes GBP GBP

Non-current assets

Property, plant and equipment 10 7,093 42,477

Investments - 76,000

Non-current assets 7,093 118,477

------------- ------------

Current assets

Trade and other receivables 14 - 1,696,772

Cash and cash equivalents 15 4,339 -

------------- ------------

4,339 1,696,772

------------- ------------

Total assets 11,432 1,815,249

============= ============

Equity

Share capital 19 3,498,257 162,053

Share premium 20 5,124,900 3,460,854

Share-based payment reserve 20 - 331,975

Retained deficit 20 (10,162,141) (3,352,643)

------------- ------------

(1,538,984) 602,239

Non-current liabilities

Loans and borrowings 17 11,141 113,321

------------- ------------

11,141 113,321

------------- ------------

Current liabilities

Trade and other payables 16 1,470,997 833,805

Bank debt and commercial loans 17 - 25,000

Directors loans 17 - 100,000

Loans and borrowings 17 68,278 140,884

------------- ------------

1,539,275 1,099,689

------------- ------------

Total liabilities 1,550,416 1,213,010

------------

Total equity and liabilities 11,432 1,815,249

============= ============

The Company's loss and total comprehensive loss for the period

ended 30 June 2019 was GBP7,153,280 (December 2017: GBP2,310,506

)

................................................

John Quinlan

Director

31 October 2019

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2019

Share-based

Share Share payments Retained Total

capital premium reserve deficit equity

GBP GBP GBP GBP GBP

Balance at 31 December

2016 135,145 2,159,000 211,513 (1,042,137) 1,463,521

---------- ------------ ------------ ------------- ------------

Loss for the year - - - (2,310,506) (2,310,506)

---------- ------------ ------------ ------------- ------------

Total comprehensive loss

for period - - - (2,310,506) (2,310,506)

---------- ------------ ------------ ------------- ------------

Transactions with owners

Share-based payment charge - - 120,462 - 120,462

Issue of shares 26,908 1,371,789 - - 1,398,697

Cost of placings - (69,935) - - (69,935)

---------- ------------ ------------ ------------- ------------

Total contributions by

and distributions to

owners 26,908 1,301,854 120,462 - 1,449,224

---------- ------------ ------------ ------------- ------------

Balance at 31 December

2017 162,053 3,460,854 331,975 (3,352,643) 602,239

Loss for the period - - - (7,153,280) (7,153,280)

---------- ------------ ------------ ------------- ------------

Total comprehensive loss

for period - - - (7,153,280) (7,153,280)

---------- ------------ ------------ ------------- ------------

Transactions with owners

Share-based payment charge - - 11,807 - 11,807

Issue of shares 3,336,204 1,894,621 - - 5,230,825

Cost of placings - (230,575) - - (230,575)

---------- ------------ ------------ ------------- ------------

Total contributions by

and distributions to

owners 3,336,204 1,664,046 11,807 - 5,012,057

---------- ------------ ------------ ------------- ------------

Transfer between reserves - - (343,782) 343,782 -

Balance at 30 June 2019 3,498,257 5,124,900 - (10,162,141) (1,538,984)

========== ============ ============ ============= ============

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIODED 30 JUNE 2019

1. Accounting Policies

Basis of preparation and going concern

Iconic Labs plc is a public company incorporated and domiciled

in England and Wales. The address of the Company's registered

office is 27-28 Eastcastle Street, London, W1W 8DH. The

consolidated financial statements of the Group as at and for the

period ended 30 June 2019 comprise the financial statements of the

Company and its subsidiary undertakings.

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') as issued by the International Accounting Standards Board

and as adopted by the European Union.

The Company's individual statement of comprehensive income has

been omitted from the Group's annual financial statements having

taken advantage of the exemption not to disclose under Section

408(3) of the Companies Act 2006.

The consolidated financial statements have been prepared on the

historical cost basis.

These consolidated financial statements are presented in Pounds

Sterling ('GBP'), which is considered by the directors to be the

functional and most appropriate presentation currency.

The directors have, at the time of approving the financial

statements, a reasonable expectation that the Company and the Group

have adequate resources to continue in operational existence for

the foreseeable future, which is defined as twelve months from the

signing of this report. For this reason, the directors continue to

adopt the going-concern basis of accounting in preparing the

financial statements.

New standards and interpretations not yet adopted

Certain standards, amendments to published standards and

interpretations have been issued that are mandatory for accounting

periods beginning on or after 1 January 2019 or later periods, but

which the Group has not early adopted.

IFRS 16 - Leases

The standard has been developed to provide information to the

users of the financial statements on the lease transactions

undertaken by the entity, in order for them to assess the amount,

timing and uncertainty of cash flows arising from leases.

The standard is effective for periods beginning on or after 1

January 2019.

On application of the standard, the company will be required to

recognise assets and liabilities for all leases with a term of more

than 12 months, unless the underlying asset is of low value.

The directors consider that the effect of IFRS16 will be that

some of the Group's leases will be capitalised and recognised on

the balance sheet. The effect has not yet been fully documented by

the directors.

Basis of consolidation

The Group financial statements consolidate those of the parent

company and all of its subsidiaries. Subsidiaries are entities

controlled by the Group. The parent company controls a subsidiary

if it has power over the investee to significantly direct the

activities, exposure, or rights, to variable returns from its

involvement with the investee, and the ability to use its power

over the investee to affect the amount of the investors returns.

The financial statements of subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date that control ceases.

Intra-group balances and transactions, and any unrealised income

and expenses arising from intra-group transactions, are eliminated

in preparing the consolidated financial statements.

The consolidated financial statements consist of the results of

the following entities:

Entity Summary description

------------------------------------------------- -------------------------------------------

Iconic Labs plc (previously Widecells Ultimate holding company

Group plc)

WideCells International Limited Holding company of subsidiaries

WideCells Limited Trading company

WideCells Portugal SA Trading company

WideCells Espana SL Trading company

WideAcademy Limited Trading company

CellPlan Limited Holding company

CellPlan International Lda Trading company

Revenue

The Group recognises the introduction of IFRS 15 for the

accounting period under review and does not consider that it has a

material impact on the Group's income.

Revenue represents the fair value of consideration received or

receivable in the period, net of discounts and sales taxes.

Sales income derives from the procurement and marketing of cord

blood stem cell storage. Revenue is recognised as detailed

below:

Revenue is recognised when it is probable that the economic

benefits associated with a transaction will flow to the Group and

the amount of revenue and associated costs can be measured

reliably. Where the work has been carried out and it is certain

that the income is due, appropriate adjustments are made through

deferred and accrued income on a percentage of completion basis.

Deferred income comprises of income received in advance of the

consideration being due and has been included within current

liabilities on the basis that the revenue becomes due within 12

months from the balance sheet date. Accrued income includes the

value of work performed during the period and where a right to

consideration has arisen, which was not invoiced until after the

period end.

Interest is recognised, in profit and loss, using the

effective-interest rate method.

Foreign currency

Transactions in foreign currencies are translated to the

respective functional currencies of Group entities at exchange

rates at the dates of the transactions. Monetary assets and

liabilities denominated in foreign currencies at the reporting date

are retranslated to the functional currency at the exchange rate at

that date. .

Non-monetary items in a foreign currency that are measured based

on historical cost are translated using the exchange rate at the

date of the transaction.

Foreign currency differences arising on retranslation are

recognised in the statement of comprehensive income.

The adjustment in 'Other comprehensive income' arises because of

the difference between the value of the assets and liabilities of

foreign operations (including goodwill and the fair-value

adjustments arising on acquisition) when acquired compared to the

value when translated to GBP at exchange rates at the reporting

date. The income and expenditure earned and incurred by the Group's

overseas operations are translated to GBP at the average exchange

rate at the date of each transaction.

Financial assets

The group does not have any financial assets which it would

classify as fair value through profit or loss, available for sale

or held to maturity. Therefore, all financial assets are classed as

loans and receivables as defined below:

Loans and receivables

Loans and receivables are financial assets with fixed or

determinable payments that are not quoted in an active market. Such

assets are recognised initially at fair value plus any directly

attributable transaction costs. Subsequent to initial recognition,

loans and receivables are measured at amortised cost using the

effective interest method, less any impairment losses.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the asset's original effective interest rate. Losses

are recognised in profit or loss and reflected in an allowance

against loans and receivables. Interest on the impaired asset

continues to be recognised. When an event occurring after the

impairment was recognised causes the amount of impairment loss to

decrease, the decrease in impairment loss is reversed through

profit or loss.

Loans and receivables comprise trade and other receivables.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits, and other short-term highly liquid investments that are

readily convertible to a known amount of cash and are subject to an

insignificant risk of changes in their fair value. These are

initially and subsequently recorded at fair value.

Bank overdrafts are shown within loans and borrowings in current

liabilities on the statement of financial position.

Financial liabilities

The group does not have any financial liabilities that would be

classified as fair value through profit or loss. Therefore, these

financial liabilities are classified as financial liabilities at

amortised cost, as defined below:

Other financial liabilities include the following items:

-- Borrowings are initially recognised at fair value net of any

transaction costs directly attributable to the issue of the

instrument. Such interest-bearing liabilities are subsequently

measured at amortised cost using the effective interest method,

which ensures that any interest expense over the period to

repayment is at a constant rate on the balance of the liability

carried in the statement of financial position. Interest expense in

this context includes initial transaction costs and premium payable

on redemption, as well as any interest or coupon payable while the

liability is outstanding.

-- Trade payables and other short-term monetary liabilities,

which are initially recognised at fair value and subsequently

carried at amortised cost using the effective interest method.

Share capital

The group's ordinary shares are classified as equity

instruments.

Tangible fixed assets

Items of plant and equipment are initially recognised at cost.

As well as purchase price, cost includes directly attributable

costs.

Depreciation is provided on all other items of property, plant

and equipment, so as to write off their carrying value over their

expected useful economic lives. It is provided at the following

rates:

Plant & machinery 33% straight line basis

-

Leasehold improvements 33% straight line basis

-

Computer hardware 33% straight line basis

-

Intangible fixed assets

Intangible assets comprise capitalised computer software and are

initially recognised at cost.

Amortisation is provided so as to write off their carrying value

over their expected useful economic lives. It is provided at the

following rates:

Computer software 33% straight line basis

-

Leased assets

Where substantially all of the risks and rewards incidental to

the ownership of a leased asset have been transferred to the group,

the asset is treated as if it had been purchased outright. The

amount initially recognised as an asset is the lower of the fair

value of the leased property and the present value of the minimum

lease payments payable over the term of the lease. The

corresponding lease commitment is shown as a liability. Lease

payments are analysed between capital and interest. The interest

element is charged to the statement of comprehensive income over

the period of the lease and is calculated so that it represents a

constant proportion of the lease liability. The capital element

reduces the balance owed by the lessor.

Where substantially all of the risks and rewards incidental to

ownership are not transferred to the group, the total rentals

payable under the lease are charged to the statement of

consolidated income on a straight-line basis over the lease

term.

Inventories

Inventories are initially recognised at cost, and subsequently

at the lower of cost or net realisable value. Cost comprises all

costs of purchase, costs of conversion and other costs incurred in

bringing the inventories to their present location and

condition.

Share-based payments

Where equity settled share-based payments are awarded to

employees, the fair value of the options at the date of grant is

charged to the statement of comprehensive income over the vesting

period. Non-market vesting conditions are taken into account by

adjusting the number of equity instruments expected to vest at each

reporting date so that, ultimately, the cumulative amount

recognised over the vesting period is based on the number of

options that eventually vest. Non-vesting conditions and market

vesting conditions are factored into the fair value of the options

granted. As along as all other vesting conditions are satisfied, a

charge is made irrespective of whether the market vesting

conditions are satisfied. The cumulative expense is not adjusted

for failure to achieve a market vesting condition or where a

non-vesting condition is not satisfied.

Where terms and conditions of options are modified before they

vest, the increase in the fair value of the options, measured

immediately before and after the modification, is also charged to

the statement of consolidated income over the remaining vesting

period.

2. Critical Accounting estimates and judgements

The group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. There are no estimates or

assumptions that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities within

the next financial period.

3. Revenue

Revenue in all periods principally arises from the provision of

services. In 2016 this was from the planning phase of an R&D

contract with Qiginex, which ran through 2017 and 2018 in the UK.

Revenues also include sales of Cellplan and INDUS products.

4. Segment Information

Operating segments are components of the entity that:

-- Engages in business activity from which it earns revenues and incurs expenses;

-- Of which discrete financial information is available;

-- Whose operating results are reviewed regularly by the chief operating decision maker

Until sales begin in the new operating divisions of CellPlan and

Wideacademy, the group has 3 main operating segments, all of which

have the same intended source of revenue from the WideCells

division:

-- United Kingdom

-- Portugal

-- Spain

The group's reportable segments are geographical business units

that offer WideCells products and services into different markets.

They are managed separately as each business is operated from a

different location.

Measurement of operating segment profit or loss, assets and

liabilities

The accounting policies of the operating segments are the same

as those described in the summary of significant accounting

policies.

The group evaluates performance on the basis of profit or loss

from operations but excluding non-recurring losses and the effects

of share-based payments.

UK Portugal Spain Cellplan Wideacademy Total

2019 GBP GBP GBP GBP GBP GBP

Sales and services

provided 20,761 - - 320 - 21,081

Total revenue

from external

customers 20,761 - - 320 - 21,081

Total gross profit 20,761 - - 320 - 21,081

Segment EBITDA (5,050,075) (34,885) (9,003) (292,258) (68,019) (5,454,240)

Depreciation,

amortisation and

impairment (466,504) - - (163,529) - (630,033)

Loss from operations (5,516,579) (34,885) (9,003) (455,786) (68,019) (6,084,272)

Finance income/(expense) (27,778) 1,297 - - (7,141) (33,622)

Tax - - - - - -

------------ --------- -------- ------------ ------------ ------------

Group loss after

tax (5,544,357) (33,588) (9,003) (455,786) (75,160) (6,117,894)

------------ --------- -------- ------------ ------------ ------------

Total assets 34,712 621 580 2,699 - 38,612

Total liabilities 1,650,050 - - 63,175 - 1,713,225

All of the activities outside of the UK have been discontinued.

The results of the UK operation relate to continuing and

discontinued operations as follows:

2019 UK UK UK

Continuing Discontinued Total

GBP GBP GBP

Sales and services provided - 20,761 20,761

Total revenue from external

customers - 20,761 20,761

Total gross profit - 20,761 20,761

Segment EBITDA (303,485) (4,746,590) (5,050,075)

Depreciation, amortisation

and impairment (417) (466,087) (466,504)

Loss from operations (303,902) (5,212,677) (5,516,579)

Finance income/(expense) (4,050) (23,728) (27,778)

Tax - - -

------------ -------------- ------------

Group loss after tax (307,952) (5,236,405) (5,544,357)

------------ -------------- ------------

UK Portugal Spain Cellplan Wideacademy Total

2017 GBP GBP GBP GBP GBP GBP

Sales and services

provided 49,501 1,264 - - - 50,765

Total revenue

from external

customers 49,501 1,264 - - - 50,765

Total gross profit 49,501 1,264 - - - 50,765

Segment EBITDA (2,311,794) (352,110) (12,368) - - (2,676,272)

Depreciation and

amortisation (107,555) (5,636) - - - (113,191)

Loss from operations (2,419,349) (357,746) (12,368) - - (2,789,463)

Finance expense (17,185) (80) 1 - - (17,264)

Tax - (2,126) - - - (2,126)

------------ ---------- --------- --------- ------------ ------------

Group loss after

tax (2,436,534) (359,952) (12,367) - - (2,808,853)

------------ ---------- --------- --------- ------------ ------------

Total assets 1,341,263 82,690 8,067 - - 1,432,020

Total liabilities 1,913,128 80,691 6,977 - - 2,000,796

The results for 2017 relate entirely to discontinued

operations.

5. Loss from Operations

Period ended Year ended

30 June 31 December

2019 2017

GBP GBP

The loss for the period is stated after charging/(crediting):

Depreciation 417 113,721

Impairment of assets 629,616 -

Auditors remuneration - group 42,000 44,427

Auditors remuneration - company - 25,149

Operating lease - property 81,473 114,152

Share-based payments expense 11,807 120,462

Foreign exchange gains 6,273 (54,881)

Expenses by nature: GBP GBP

Supplies and external services 2,425,820 1,568,974

Other expenses 1,366,623 (46,938)

Staff costs 1,682,876 1,205,001

---------- ----------

Total operating expenses 5,475,319 2,727,037

---------- ----------

Depreciation, amortisation and impairment

of assets 630,033 113,191

---------- ----------

6,105,352 2,840,228

---------- ----------

6. Staff Costs

Period ended Year ended

30 June 31 December

2019 2017

GBP GBP

Staff costs (including directors) comprise:

Wages and salaries 1,473,681 900,811

Defined contribution pension cost 53,315 44,427

Benefits - 25,149

Social security contributions and similar

taxes 144,073 114,152

Share-based payments expense 11,807 120,462

1,682,876 1,205,001

-------------

Employee Numbers 2019 2017

The average number of staff employed by the

group during the period amounted to:

General and administration 15 17

----- -----

15 17

----- -----

Key management personnel compensation

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities, and are the directors of the company.

Remuneration of the directors and highest paid director is shown

in the corporate governance report. In addition to the amounts

disclosed in the corporate governance report, the full share-based

payment charge of GBP11,807 (2017: GBP120,462) relates to key

management personnel.

7. Finance Income and Expense

Period ended Year ended

30 June 31 December

2019 2017

GBP GBP

Finance income

Other interest received 2,174 -

------------- -------------

Total finance income 2,174 -

------------- -------------

Finance expense

Bank loans and overdrafts 35,797 17,264

------------- -------------

Total finance expense 35,797 17,264

------------- -------------

8. Taxation

Period ended Year ended

30 June 31 December

2019 2017

GBP GBP

Current tax

Overseas taxation payable on profits for

the period - 2,126

-------------- -------------

Total current tax and tax credit - 2,126

-------------- -------------

The reason for the difference between the actual tax charge for

the period and the standard rate of corporation tax in the United

Kingdom applied to losses for the period are as follows:

2019 2017

GBP GBP

Loss before taxation (6,117,894) (2,806,727)

Tax using the parent company's domestic tax

rate of 19% (2017: 19,25%) (1,162,400) (540,295)

Effects of:

Unrelieved tax losses and other deductions

arising in the period 693,403 463,295

Expenses not deductible for taxation purposes 468,997 77,000

Local overseas taxes - (2,126)

------------ ------------

Total tax charged in the income statement - (2,126)

------------ ------------

The deferred taxation of GBP1,154,625 (2017: GBP534,212)

attributable to losses arising in the period and for losses carried

forward has not been recognised in these accounts due to the

uncertainty over whether this will be recovered.

9. Loss per share

Period ended Year ended

30 June 31 December

2019 2017

GBP GBP

Numerator

Loss for the period (6,117,894) (2,808,853)

Denominator

Weighted average number of ordinary shares

used in basic EPS 282,378,357 59,993,454

Effects of:

Employee share options 2,808,454 3,485,518

Conversion share warrants - 205,479

Broker share warrants - 727,272

------------- -------------

Weighted average number of ordinary shares

used in diluted EPS 285,186,811 64,411,723

------------- -------------

Basic and diluted loss per share (0.02) (0.05)

------------- -------------

10. Tangible Assets

Group

Plant & Leasehold Computer

Machinery Improvements Hardware Total

GBP GBP GBP GBP

Cost

Balance at 1 January 2017 225,708 154,620 27,715 408,043

Additions 119,782 29,130 32,788 181,700

Effect of foreign exchange - 2,099 1,445 3,544

----------- -------------- ---------- --------

Balance at 31 December 2017 345,490 185,849 61,948 593,287

----------- -------------- ---------- --------

Additions 10,282 - 21,147 31,429

----------- --------------

Balance at 30 June 2019 355,772 185,849 83,095 624,716

----------- -------------- ---------- --------

Amortisation

Balance at 1 January 2017 - 10,077 3,068 13,145

Charge for the year 43,868 53,103 16,220 113,191

Effect of foreign exchange - 21 339 360

----------- --------------

Balance at 31 December 2017 43,868 63,201 19,627 126,696

----------- -------------- ---------- --------

Charge for the period - - 417 417

Impairment in the period 311,904 122,648 55,958 490,510

----------- -------------- ---------- --------

Balance at 30 June 2019 355,772 185,849 76,002 617,623

----------- -------------- ---------- --------

Carrying amounts

Balance at 30 June 2019 - - 7,093 7,093

=========== ============== ========== ========

Balance at 31 December 2017 301,622 122,648 42,321 466,591

=========== ============== ========== ========

Company

Computer

Hardware Total

GBP GBP

Cost

Balance at 1 January 2017 16,659 16,659

Additions 46,031 46,031

---------- --------

Balance at 31 December 2017 62,690 62,690

---------- --------

Additions 14,231 14,231

Balance at 30 June 2019 76,921 76,921

---------- --------

Amortisation

Balance at 1 January 2017 473 473

Charge for the year 19,741 19,741

Balance at 31 December 2017 20,214 20,214

---------- --------

Charge for the period 417 417

Impairment in period 49,197 49,197

---------- --------

Balance at 30 June 2019 69,828 69,828

---------- --------

Carrying amounts

Balance at 30 June 2019 7,093 7,093

========== ========

Balance at 31 December 2017 42,477 42,477

========== ========

11. Intangible Assets

Computer

software Total

GBP GBP

Cost

Balance at 1 January 2017 - -

Additions 139,106 139,106

----------

Balance at 31 December 2017 and at 30

June 2019 139,106 139,106

---------- --------

Amortisation

Balance at 1 January 2017 - -

Charge for the year - -

Balance at 31 December 2017 - -

---------- --------

Impairment 139,106 139,106

Balance at 30 June 2019 139,106 139,106

---------- --------

Carrying amounts

Balance at 30 June 2019 - -

========== ========

Balance at 31 December

2017 139,106 139,106

========== ========

12. Subsidiaries

Country of Nature of

Entity Incorporation business Notes

--------------------------------- --------------------------------- --------------------------- -------------------

WideCells United Kingdom Holding company (c)

International Limited

WideCells Limited United Kingdom Trading company (a)

WideCells Portugal SA Portugal Trading company (a)

WideCells Espana SL Spain Trading company (a)

WideAcademy Limited United Kingdom Trading company (a)

CellPlan Limited United Kingdom Holding company (a)

CellPlan Portugal Trading company (b)

International Lda

Iconic Labs UK United Kingdom Trading company (c)

Limited

Iconic Labs IP United Kingdom Trading company (c)

Limited

Notes: (a) 100% owned by WideCells International Limited (b)

100% owned by CellPlan Limited

(c) 100% owned by Iconic Labs plc

Iconic Labs UK Limited was incorporated on 14(th) June 2019 and

Iconic Labs IP Limited was incorporated on 19(th) June 2019. The

companies did not trade in the period ended 30 June 2019.

13. Inventories

Group

30 June 31 December

2019 2017

GBP GBP

Raw materials and consumables - 27,850

========= ============

14. Trade and other receivables

Group

30 June 31 December

2019 2017

GBP GBP

Trade receivables - 2,029

Other receivables - 7,522

-------- ------------

Trade and other receivables - 9,551

VAT recoverable 15,922 173,703

-------- ------------

Total receivables 15,922 183,254

======== ============

Trade and other receivables do not contain any impaired assets.

The group does not hold any collateral as security and the maximum

exposure to credit risk at the consolidated statement of financial

position date is the fair value of each class of receivable. No

trade receivables are overdue but not impaired.

Book values approximate to fair value at 30 June 2019 and 31

December 2017.

Company

30 June 31 December

2019 2017

GBP GBP

Amounts due from group companies - 1,580,016

Other receivables - 116,756

--------- ------------

- 1,696,772

============================================ ============

15. Cash and cash equivalents

Group

30 June 31 December

2019 2017

GBP GBP

Cash at bank available on demand 15,694 615,219

Bank overdraft (97) (497,178)

-------- ------------

Total cash and cash equivalents 15,597 118,041

-------- ------------

Company

30 June 31 December

2019 2017

GBP GBP

Cash at bank available on demand 4,339 615,219

Bank overdraft - (497,178)

-------- ------------

Total cash and cash equivalents 4,339 118,041

-------- ------------

16. Trade and other payables

Group

30 June 31 December

2019 2017

GBP GBP

Trade payables 544,558 634,310

Other payables and accruals 884,687 234,713

Tax and social security 204,561 66,434

Deferred revenue - 79

---------- ------------

Total 1,633,806 935,536

---------- ------------

Book values approximate to fair values at 30 June 2019 and 31

December 2017.

Company

30 June 31 December

2019 2017

GBP GBP

Trade payables 381,749 601,276

Other payables and accruals 884,687 188,313

Tax and social security 204,561 44,216

---------- ------------

1,470,997 833,805

---------- ------------

Book values approximate to fair values at 30 June 2019 and 31

December 2017.

17. Loans and borrowings

Group

30 June 31 December

2019 2017

Non-current GBP GBP

Bank loans - 66,667

Other loans - -

Finance leases 11,141 140,884

-------- ------------

Total 11,141 207,551

-------- ------------

30 June 31 December

2019 2017

Current GBP GBP

Bank overdraft - 497,178

Bank loans - 72,210

Other loans - 25,000

Finance leases 68,278 113,321

Directors' loans - 100,000

Convertible loans - 50,000

-------- ------------

Total 68,278 857,709

-------- ------------

Book values approximate to fair values at 30 June 2019 and 31

December 2017.

The convertible loans converted to equity following the share

placing in June 2018.

Finance leases are secured on the relevant assets.

Company

30 June 31 December

2019 2017

Non-current GBP GBP

Other loans - -

Finance leases 11,141 113,321

-------- ------------

Total 11,141 113,321

-------- ------------

30 June 31 December

2019 2017

Current GBP GBP

Other loans - -

Bank debt and commercial loans - 25,000

Directors' loans - 100,000

Finance leases 68,278 140,884

Total 68,278 265,884

--------

18. Financial Instruments - Risk Management

The group is exposed through its operations to the following

financial risks:

-- Credit risk

-- Market risk

-- Liquidity risk

In common with other businesses, the group is exposed to risks

that arise from use of financial instruments. This note describes

the group's objectives, policies and processes for managing those

risks and the methods used to measure them.

The principal financial instruments used by the group, from

which the financial instrument risks arise, are as follows:

-- Trade receivables

-- Cash and cash equivalents

-- Trade and other payables

-- Loans and borrowings

A summary of the financial instruments held by category is

provided below:

-- Financial assets - loans and receivables

-- Financial liabilities - amortised cost

Group:

2019 2017

GBP GBP

Cash and cash equivalents 15,599 615,219

Trade receivables - 2,029

------- --------

Total financial assets 15,599 617,248

------- --------

2019 2017

GBP GBP

Trade and other payables 1,429,245 869,023

Loans and borrowings 79,419 1,065,260

---------- ----------

Total liabilities - amortised cost 1,508,664 1,934,283

---------- ----------

Company:

2019 2017

GBP GBP

Cash and cash equivalents 4,339 -

Trade receivables - -

------ -----

Total financial assets 4,339 -

------ -----

2019 2017

GBP GBP

Trade and other payables 1,266,436 789,589

Loans and borrowings 79,419 379,205

---------- ----------

Total liabilities - amortised cost 1,345,855 1,168,794

---------- ----------

The Board has overall responsibility for the determination of

the group's risk management objectives and policies and, whilst

retaining ultimate responsibility for them, it has delegated the

authority for designing and operating processes that ensure the

effective implementation of the objectives and policies to the

Group's Management Committee. The Board received quarterly reports

from the Management Committee.

The overall objective of the Board is to set policies that seek

to reduce risk as far as possible without unduly affecting the

groups' competitiveness and flexibility. Further details regarding

these policies are set out below:

Credit risk

Credit risk is the risk of financial loss to the group if a

development partner or a counterparty to the financial instrument

fails to meet its contractual obligations. The group is mainly

exposed to credit risk from credit sales. It is group policy,

implemented locally, to assess the credit risk of new customers

before entering into contracts.

Credit risk also arises from cash and cash equivalents and

deposits with banks and financial institutions. For banks and

financial institutions, only independently rated parties with high

credit status are accepted.

The group does not enter into derivatives to manage credit

risk.

Cash in bank

Group

2019 2017

GBP GBP

Cash held at HSBC - S&P Rating AA 11,444 610,707

Cash held at Santander - S&P rating A 4,153 4,512

------- --------

Total financial assets 15,597 615,219

------- --------

Company

2019 2017

GBP GBP

Cash held at HSBC - S&P Rating AA 4,339 -

Cash held at Santander - S&P rating A - -

------ -----

Total financial assets 4,339 -

------ -----

The group is continually reviewing the credit risk associated

with holding money on deposit in banks and seeks to mitigate this

risk by holding deposits with banks with high credit status.

Market risk

Cash flow interest rate risk

The group is exposed to cash flow interest rate risk from short

term borrowings at variable rate.

It is group policy that all borrowings are approved by the

directors to ensure that it is not taking on significant risk

related to possible movements in interest rates. Although the Board

accepts that this policy neither protects the group entirely from

the risk of paying rates in excess of current market rates nor

eliminates fully cash flow risk associated with variability in

interest payments, it considers that it achieves appropriate

balance of exposure to these risks.

During the period, the Groups borrowings at variable rate were

denominated in sterling.

Foreign exchange risk

Foreign exchange risk arises because the group has operations in

Portugal and Spain, whose functional currency is not the same as

the functional currency of the group. The group's net assets

arising from such overseas operations are exposed to currency risk

resulting in gains or losses on retranslation into sterling. Given

the levels of materiality, the group does not hedge its net

investments in overseas operations as the cost of doing so is

disproportionate to the exposure.

Foreign exchange risks also arise when individual group entities

enter into transactions denominated in a currency other than their

functional currency; the group has several customers and a regular

supplier who are invoiced in currency other than sterling. These

transactions are not hedged because the cost of doing so is

disproportionate to the risk.

As of 30 June 2019 and 31 December 2017 the group's exposure to

foreign exchange risk was not material.

Liquidity risk

Liquidity risk arises from the group's management of working

capital. It is the risk that the group will encounter difficulty in

meeting its financial obligations as they fall due.

It is the group's aim to settle balances as they become due.

The Board will continue to monitor long term cash projections in

light of its development plan and will consider raising funds as

required to fund long term development projects. Development

expenditure can be curtailed as necessary to preserve

liquidity.

The following table sets out the contractual maturities

(representing undiscounted contractual cash-flows) of financial

liabilities:

Group:

Between Between Between Over

Up to 3 and 1 and 2 and 5 years

3 months 12 2 5 years GBP

2019 GBP months years GBP

GBP GBP

Trade and other payables 1,463,818 169,988 - - -

Finance leases 32,127 36,151 11,141 - -

Total 1,495,945 206,139 11,141 - -

----------- -------- -------- ---------

Between Between Between Over

Up to 3 and 1 and 2 and 5 years

3 months 12 2 5 years GBP

2017 GBP months years GBP

GBP GBP

Trade and other payables 869,023 - - - -

Bank loans and overdrafts 514,890 53,137 70,749 - -

Finance leases 35,237 88,167 115,359 37,223 -

Directors' and other loans 114,037 10,963 - - -

Convertible loans - 54,000 - - -

----------- -------- -------- --------- ---------

Total 1,533,187 206,267 186,108 37,223 -

----------- -------- -------- --------- ---------

More details in regard to the line items are included in the

respective notes:

-- Trade and other payables - note 16

-- Loan and borrowings - note 17

Capital risk management

The group monitors capital which comprises all components of

equity (i.e. share capital, share premium and accumulated

deficit).

The group's objectives when maintaining capital are:

-- To safeguard the entity's ability to continue as a going

concern and continue to provide returns for shareholders and

benefits for other stakeholders

-- To provide an adequate return to shareholders by pricing

products and services commensurably with the level of risk.

At present the directors do not intend to pay dividends but will

reconsider the position in future periods, as the group becomes

profitable.

19. Share Capital

30 June 2019 31 December

2017

Number GBP Number GBP

Authorised, allotted and fully

paid - classified as equity

Ordinary shares of GBP0.0025 each 1,399,302,698 3,498,257 64,821,010 162,053

------------------------- ---------- -------------- ---------

Total 1,399,302,698 3,498,257 64,821,010 162,053

------------------------- ---------- -------------- ---------

The following shares issues took place during the period:

-- 28 June 2018 - 68,698,355 shares issued at a premium of 2.75p per shares

-- 26 October 2018 - 2,500,000 shares issued in respect of a

conversion of a convertible band, at a premium of 0.15p per

share

-- 26 October 2018 - 3,333,333 shares issued in respect of a

conversion of a convertible band, at a premium of 0.5p per

share

-- 6 November 2018 - 2,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 12 November 2018 - 10,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 11 March 2019 - 60,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 12 March 2019 - 80,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 18 March 2019 - 115,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 21 March 2019 - 150,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 21 March 2019 - 19,200,000 shares issued in respect of

settlement of outstanding fees with a supplier, at par

-- 21 March 2019 - 210,000,000 shares issued, at par

-- 2 April 2019 - 5,000,000 shares issued in respect of

settlement of outstanding fees with a supplier, at par

-- 29 April 2019 - 200,000,000 shares issued, at par

-- 21 May 2019 - 100,000,000 shares issued in respect of a

conversion of a convertible band, at par

-- 31 May 2019 - 108,750,000 shares issued in respect of a

conversion of a convertible band, at par

-- 19 June 2019 - 200,000,000 shares issues, at par

In accordance with the Companies Act 2006, the company has no

limit on its authorised share capital.

Pursuant to a resolution passed on 16 June 2016, the Company

resolved that:

-- The directors be generally authorised in accordance with the

Articles to exercise all powers of the company to allot Ordinary

shares, or grant rights to subscribe for, or convert any security

into Ordinary shares, up to a maximum aggregate nominal value of

GBP500,000, provided always that such authority conferred on the