TIDMMOS

RNS Number : 3940S

Mobile Streams plc

06 November 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN MOBILE STREAMS PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION.

6 November 2019

Mobile Streams PLC

("Mobile Streams" or the "Company")

Placing

Proposed Board Changes

Circular and Notice of General Meeting

Mobile Streams PLC ("Mobile Streams" or the "Company") is

pleased to announce that it has today agreed a conditional Placing

to raise GBP250,000 (before the deduction of fees and expenses)

through the issue of 221,238,938 ordinary shares at 0.113 pence per

share (the "Placing"). The Placing is conditional on the approval

of certain resolutions by Shareholders at a General Meeting of the

Company, as further set out below. The Resolutions seek Shareholder

approval to allow for a Capital Reorganisation to affect the

Placing, seek to give Directors' authority to issue the Placing

Shares and also propose certain Board changes. All resolutions

proposed are inter-conditional.

Accordingly, the Company has today published the Circular which

will be posted to Shareholders on 8 November 2019, along with the

accompanying Form of Proxy in relation to a General Meeting of the

Company.

The Circular contains notice of the General Meeting ("Notice"),

which will be held at the offices of Peterhouse Capital Limited at

3rd Floor, 80 Cheapside, London EC2V 6EE at 10.00 a.m. on 26

November 2019. A copy of the Circular and the Form of Proxy will

shortly be made available on the Company's website at

www.mobilestreams.com.

The Placing is conditional, amongst other things, on the passing

by shareholders of the resolutions set out in the Notice, further

details of which are included below.

Application will be made to the London Stock Exchange for the

New Ordinary Shares, including the Placing Shares, to be admitted

to trading on AIM and, subject to approval of the Resolutions and

appointment by the Company of a Nominated Adviser pursuant to AIM

Rule 1, it is expected that Admission will become effective and

that dealings in the New Ordinary Shares, including the Placing

Shares, will commence on AIM at 8.00 a.m. on 27 November 2019.

The Letter from the Chairman of the Company, the Expected

Timetable of Principal Events and the Placing Statistics contained

in the Circular have been extracted and included as an Appendix to

this announcement below.

For further information, please contact:

Mobile Streams plc +1 347 669 9068

Simon Buckingham, Chief Executive Officer

Enrique Benasso, Chief Financial Officer

Peterhouse Corporate Finance

Eran Zucker +44 (0) 20 7469 0930

Appendix (all terms in the below have been extracted from the

Circular)

LETTER FROM THE CHAIRMAN

1. Introduction

The Company announced on 6 November 2019 a conditional placing

with certain institutional and other investors, to raise GBP250,000

before expenses through the issue of 221,238,938 New Ordinary

Shares at the Issue Price (referred to in this document as, the

"Placing Shares").

The Placing Price is at a discount of approximately 24.6% per

cent. to the closing middle market price of 0.15 pence per Existing

Ordinary Share on 28 October 2019 (being the last practicable date

before suspension of the Company's shares from trading on AIM).

The purpose of this document is to provide you with details of

the Placing, to explain the background to and the reasons for the

Placing and why the Directors recommend that Shareholders vote in

favour of the Resolutions to be proposed at the General Meeting. As

the Placing Price is below the nominal value of the Company's

Existing Ordinary Shares, the Company needs to effect the Share

Reorganisation to facilitate the Placing, and further details of

the Share Reorganisation are set out in paragraph 5 below. In

addition, the Company currently has insufficient authority to issue

the Placing Shares and is seeking Shareholder approval to give the

Directors the authority to allot the Placing Shares and to

dis-apply statutory pre-emption rights in respect thereof.

Furthermore, the Company proposes to issue 28,500,000 New

Ordinary Shares to Simon Buckingham, CEO, in satisfaction of

accrued director's fees amounting to GBP100,860 (the "Settlement

Shares"), as a result which, Simon Buckingham would be interested

in 44,618,650 New Ordinary Shares representing 11.43% of the

Company's Enlarged Share Capital. The issue of the Settlement

Shares would be a related party transaction under AIM Rule 13 and

accordingly the Directors independent of the transaction, being

Peter Tomlinson and Jonathan Bill, will, prior to the issue of

these shares liaise with the Company's Nominated Adviser, when

appointed, with a view to considering whether the terms are fair

and reasonable as far as Shareholders are concerned. A further

announcement will be made in this regard in due course.

The Placing and Share Reorganisation are each conditional, inter

alia, on the passing of the Resolutions by Shareholders at the

General Meeting, notice of which is set out at the end of this

document. If the Resolutions are passed, admission of the Placing

Shares to trading on AIM is expected to occur at 8.00 a.m. on 27

November 2019.

2. Background to and reasons for the Placing

As detailed in the Company's announcement of 30 September 2019,

Shareholders voted against the Company delisting from AIM and we

have been working to appoint new advisers to retain the Company's

AIM listing. As part of this process, the Company has identified a

near term requirement for additional funding. Furthermore, trading

at the Company's existing operations remains challenging with an

expected EBITDA loss for the three months to September 2019 of

GBP36,000.

Accordingly, the proposed Placing meets the requirement to

provide working capital for the Group whilst the issue of the

Settlement Shares will extinguish a significant amount of the

Group's indebtedness. In addition, to provide the Group with a

second, complementary revenue stream, the Company has today reached

agreement in principle with Krunchdata Ltd ("Krunch") whereby it

has agreed with Krunch to licence the Krunch platform as more

specifically detailed below. The Company currently has

approximately 2 billion 'data sets' accumulated over the last 15

years. It anticipates that it can utilise the Krunch platform to

monetise this data in the regions in which it operates, being

Argentina, India and Mexico.

Subject only to the finalisation of formal legal documentation,

the Company has agreed to a licence with Krunch on a revenue share

basis; specifically, in the initial 12 months the Company will

retain all incremental revenue generated by its partnership with

Krunch whilst paying Krunch the standard client set-up fees

recharged at cost and thereafter on an agreed split of revenue

basis.

About Krunch:

Krunch.ai is a business intelligence and insight platform that

has been developed over the last two years. Pulling together

cutting edge intelligence into a single place, so users can track

performance and discover real-time information, the platform

provides immediate data intelligence, insight & automation.

Krunch builds data stories for organisations enabling faster growth

through clearer information. The insight available from millions of

Mobile Streams data records will add both behavioural and credit

insights which the Board expects will provide companies with

powerful data driven intelligence for personalised targeting and

decision making. Clients currently using the Krunch platform

include Mortgages for Businesses, The Disasters & Emergency

Committee and Unite the Union.

As part of the agreement with Krunch, it is proposed that Mark

Epstein joins the Board as Chief Operating Officer and Tom

Gutteridge and Annabel Jamieson, co-founders of Krunch alongside

Mark, join the Company as part-time employees to assist with the

development of this new revenue stream.

Accordingly, the Directors intend to use the Placing proceeds to

support the proposed new venture with Krunch, to assist with growth

of the Company's current mobile gaming business, and to provide

working capital. The use of proceeds of the Placing are set out in

paragraph 6 below.

The Directors believe the Placing to be the most appropriate way

to provide the capital necessary to meet the Company's future

requirements. As at 5 November 2019, the Company held cash and cash

equivalents of approximately GBP63,000 (unaudited), and had

external debt of approximately GBP106,000.

The Placing is being conducted with the intention of minimising

the associated costs, both direct and in terms of limited

management time. Taking that into account, the Company has

reluctantly decided not to make an offer for subscription to the

Shareholders on this occasion.

3. Details of the Placing

3.1. Placing

As announced on 6 November 2019 the Company has conditionally

raised GBP250,000 before expenses through the Placing. Application

will be made to the London Stock Exchange for the New Ordinary

Shares, including the Placing Shares, to be admitted to trading on

AIM and, subject to approval of the Resolutions and appointment by

the Company of a Nominated Adviser pursuant to AIM Rule 1, it is

expected that Admission will become effective and that dealings in

the New Ordinary Shares, including the Placing Shares, will

commence on AIM at 8.00 a.m. on 27 November 2019. Assuming no

options are exercised prior to Admission, the Placing Shares will

represent approximately 56.7% of the ordinary share capital of the

Company in issue immediately following Admission.

In addition, it is proposed that 28,500,000 New Ordinary Shares

will be issued in satisfaction of accrued fees amounting to

GBP100,680 to Simon Buckingham, Chief Executive Officer.

Additionally, the Company will issue Peterhouse with broker

warrants over 5% of the number of Ordinary Shares issued in

relation to the Placing or any subsequent fundraising by

Peterhouse, exercisable at the relevant Placing Price and valid for

one year.

3.2. General

All Placing Shares will be issued credited as fully paid and

will rank pari passu in all respects with the Ordinary Shares in

issue from time to time, including the right to receive all

dividends and other distributions declared on or after the date on

which they are issued.

For details as to the expected date and times by which certain

events (e.g. Admission, the crediting of CREST accounts and the

dispatch of share certificates) are expected to happen in relation

to the Placing Shares and the Share Reorganisation, please refer to

the information on page 4 (Expected Timetable of Principal Events)

of this document.

4. Prospective Board and Senior Management Changes

Conditional on the approval of the Resolutions at the General

Meeting and completion of the proposed Placing and subject to and

following approval from the Company's prospective Nominated

Advisor, it is intended that Mark Epstein, Charles Goodfellow and

Nigel Burton will join the Board as Chief Operating Officer,

Non-Executive Director and Chairman respectively.

Charles Edouard Goodfellow

Charles Goodfellow has over 30 years' experience in the London

capital markets, having worked initially in equity sales and then

in corporate finance for various London investment banks and

corporate finance specialists. He specialises in assisting smaller

companies across a range of sectors in raising growth capital, as

well as targeting industry partners capable of taking strategic

stakes and control.

Nigel John Burton

Following over 14 years as an investment banker at leading City

institutions including UBS Warburg and Deutsche Bank, including as

the Managing Director responsible for the energy and utilities

industries, Nigel spent 15 years as Chief Financial Officer or

Chief Executive Officer of a number of private and public

companies. Nigel is currently a Non-Executive Director of AIM

listed companies Remote Monitored Systems plc, Digitalbox plc,

Regency Mines plc and Alexander Mining plc.

Mark Alexander Epstein, Chief Operating Officer

Mark is an experienced CEO, director, entrepreneur, expert in

marketing, communications, technology and mobile. Mark is the

co-founder of Krunch.ai a next generation insight and intelligence

platform, IgniteAMT a digital transformation company and IgniteCAP

an incubation and investment business. Mark also co-founded and was

CEO on its AIM listing of The People's Operator PLC, a cause-based

mobile phone network that had operations the UK and USA. Prior to

that Mark co-founded Mass1 which he grew into one of the UK's most

successful campaign agencies. He has also held numerous senior

management positions in his career.

Subject to the passing of each of the Resolutions, Jonathan Bill

will step down from the board while Peter Tomlinson will assume the

role of Non-Executive Director. Charles Goodfellow will be

appointed as Non-Executive Director and Nigel Burton will be

appointed as Chairman. Simon Buckingham will remain as Chief

Executive Officer.

Senior Management

Annabel Jamieson

Annabel Jamieson is a digital marketing and tech strategist with

over 25 years' experience working in the digital environment

driving transformation and growth, managing budgets in excess of

GBP25 million, latterly holding senior global exec positions within

publishing companies including DMGT and DeAgostini. Annabel is a

keynote speaker and has spoken at conferences across UK, Europe and

North America. She is a Co-founder and Director of IgniteAMT which

specialises in digital transformation services, as well as

IgniteCAP a private incubation and investment business.

Tom Gutteridge

Tom is a multiple award-winning technologist who has over 20

years' experience building ideas, products and businesses. As a

digital pioneer, he built his experience through creating

engagement technologies for brands such as Nokia, Pepsi, Vodafone,

Sony and Adobe and was voted one of Marketing Weeks Rising Stars.

He moved onto to pursue his own ventures, co-founding and listing

the world's first Ethical Mobile Phone Network, co-founding the UKs

largest digital voter registration project and co-founding multiple

digital agencies that work with clients such as Channel 4, WWF and

NHS.

The regulatory disclosures in respect of the appointment of

Nigel, Mark and Charles to the Board, as required by AIM Rule 17,

will be provided shortly before or on their appointment to the

Board.

5. Share Reorganisation

5.1. General

The nominal value of the Existing Ordinary Shares is currently

0.2 pence per share. As a matter of English law, the Company is

unable to issue the Placing Shares at an issue price which is below

their nominal value. It is therefore proposed to sub-divide the

entire existing share capital, both issued and to be issued,

consisting of 140,752,533 Ordinary Shares of 0.2 pence nominal

value each, into 140,752,533 Ordinary Shares of 0.01 pence nominal

value each and 140,752,533 Deferred Shares of 0.19 pence nominal

value each, thus enabling the Company to lawfully implement the

Placing at the Issue Price. As a result, the Company's articles of

association will be required to be updated to reflect the proposed

new share structure of the Company following the Share

Reorganisation.

Each New Ordinary Share resulting from the Share Reorganisation

will have the same rights (including voting and dividend rights and

rights on a return of capital) as each Existing Ordinary Share

except that they will have a nominal value of 0.01 pence each.

The Deferred Shares will, as their name suggests, have very

limited rights which are deferred to the Ordinary Shares and will

effectively carry no value as a result. Accordingly, the holders of

the Deferred Shares will not be entitled (unless they also hold

Ordinary Shares) to receive notice of, attend or vote at general

meetings of the Company, nor be entitled to receive any dividends

or any payment on a return of capital until at least GBP10,000,000

has been paid on each Ordinary Share. No application will be made

for the Deferred Shares to be admitted to trading on AIM.

The Company will also be given power to arrange for all the

Deferred Shares to be transferred to a custodian or to be purchased

for nominal consideration only without the prior sanction of the

holders of the Deferred Shares. No share certificates for the

Deferred Shares will be issued.

No new certificates for the Existing Ordinary Shares will be

dispatched if the Share Reorganisation becomes effective.

A request will be made to the London Stock Exchange to reflect

on AIM the sub-division of the Existing Ordinary Shares into New

Ordinary Shares of 0.01 pence each. Each Existing Ordinary Share

standing to the credit of a CREST account will be subdivided into

one New Ordinary Share of 0.01 pence and one Deferred Share of 0.19

pence at 6 p.m. on 26 November 2019.

Following the Share Reorganisation, the ISIN code for the

Ordinary Shares will remain unchanged.

5.2. Taxation

Any person who is in any doubt as to his tax position or who is

subject to tax in a jurisdiction other than the United Kingdom is

strongly recommended to consult his professional tax adviser

immediately.

6. Use of Proceeds

The Company is raising funds to:

i) fund the marketing and associated development costs of the Krunch joint venture;

ii) provide funds to increase the marketing budget for the

Company's existing mobile gaming business; and

iii) fund general working capital.

To make the most effective use of the proceeds, each of Nigel

Burton, Peter Tomlinson, Charles Goodfellow, Mark Epstein, Annabel

Jamieson and Tom Gutteridge have agreed to accept payment for their

services in New Ordinary Shares, subject to deduction and payment

of all necessary taxes, until such time as the Directors are

satisfied that the Company is able to make these payments out of

operating cashflow. These New Ordinary Shares will be issued at the

end of December and June on an accrued basis and at a price based

on the volume weighted average price ("VWAP") of the Ordinary

Shares traded during the relevant six month periods.

7. Nominated Adviser and Broker

Following the resignation of the Company's former Nominated

Adviser and Broker, N+1 Singer, trading in the Company's Ordinary

Shares on AIM was suspended under AIM Rule 1 on 28 October 2019.

The Company has arranged to appoint a replacement Nominated Adviser

subject inter alia to the passing of all Resolutions at the General

Meeting, such appointment to become effective following the General

Meeting. On this basis, it is expected that, should the Resolutions

be passed at the General Meeting, trading in the New Ordinary

Shares will commence on 27 November 2019.

In addition, the Company has today appointed Peterhouse Capital

as Broker with immediate effect.

8. Shareholder Approval

The Company is seeking Shareholder approval at the General

Meeting to:

(a) amend the articles of association of the company to reflect

the share structure of the Company following the Share

Reorganisation;

(b) effect the Share Reorganisation; and

(c) give the Directors the authority to allot New Ordinary

Shares up to an aggregate nominal value of GBP35,000 and to

dis-apply statutory pre-emption rights in respect thereof; and

(d) Appoint Mark Epstein, Charles Goodfellow and Nigel Burton as

directors of the Company.

In order to obtain the necessary Shareholder approval, a General

Meeting of the Company is to be held at which the Resolutions will

be proposed. Further information regarding the General Meeting is

set out in paragraph 9 below.

The Directors believe the Placing to be the most appropriate way

to provide the capital necessary to meet the Company's future

requirements. Should the Placing not proceed for any reason, the

Company would need to find alternative funding and face future

uncertainty. The Directors urge Shareholders to vote in favour of

the Resolutions set out in the Notice.

9. General Meeting

A notice convening the General Meeting to be held at the offices

of Peterhouse Capital Limited at 3rd Floor, 80 Cheapside, London,

EC2V 6EE, at 10.00 a.m. on 26 November 2019 is set out at the end

of this document.

10. Action to be taken by Shareholders

Whether or not you intend to be present at the meeting you are

requested to complete a proxy vote You will find enclosed with this

Document a Form of Proxy for use at the General Meeting. Whether or

not you propose to attend the General Meeting in person, you are

requested to complete and return the Form of Proxy to the

Computershare Investor Services PLC, The Pavilions, Bridgwater

Road, Bristol BS99 6ZY, in accordance with the instructions printed

thereon as soon as possible but, in any event, to be received no

later than 10.00 a.m. on 22 November 2019. Completion and return of

a Form of Proxy will not preclude you from attending and voting at

the General Meeting in person if you so wish.

11. Recommendation

The Directors consider that the Placing will promote the success

of the Company for the benefit of its members as a whole.

Accordingly, the Directors unanimously recommend and strongly urge

Shareholders to vote in favour of the Resolutions at the General

Meeting as they intend to do in respect of their own beneficial

holdings of 45,702,062 Ordinary Shares representing approximately

12.22 per cent. of the Existing Ordinary Shares in issue as at the

last practicable date before publication of this document.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2019

Announcement of the General Meeting 6 November

Date of publication of this document 5 November

Date of posting of this document 8 November

Last date and time for receipt of Forms 10.00 a.m. 22 November

of Proxy

General Meeting 10.00 a.m. 26 November

Share Reorganisation effective 6.00 p.m. 26 November

Creation of the Deferred Shares 6.00 p.m. 26 November

Admission and commencement of dealings 8.00 a.m. 27 November

in Placing Shares (and Ordinary Shares

(post Share Reorganisation)) on AIM

CREST accounts credited with Placing 27 November

Shares in uncertificated form

No new share certificates will be issued in relation to the

Existing Ordinary Shares.

If any of the details contained in the timetable above should

change, the revised times and dates will be notified to

Shareholders by means of a Regulatory Information Service

announcement. All events listed in the above timetable following

the General Meeting are conditional on the passing of the

resolutions at the General Meeting.

References to time in this document and the Notice of General

Meeting are to Greenwich Mean Time.

KEY STATISTICS

Existing Ordinary Shares in issue as at the date of the Document 140,752,533

Par value of Existing Ordinary Shares 0.2 pence

Number of Ordinary Shares following the Share Reorganisation 140,752,533

Par value of the New Ordinary Shares following the Share Reorganisation 0.01 pence

Par value of the Deferred Shares following the Share Reorganisation 0.19 pence

New Ordinary Shares to be issued as part of the Placing 221,238,938

New Ordinary Shares to be issued for fees and in satisfaction of accrued liabilities in relation

to the Proposals 28,500,000

Enlarged Share Capital following the Placing and the Share Reorganisation 390,491,471

Placing Shares as a percentage of the Enlarged Share Capital 56.7 per cent.

Placing Price of the New Ordinary Shares 0.113 pence

Expected market capitalisation following the Share Reorganisation and Placing GBP441,256

Gross proceeds of the Placing GBP250,000

Notes:

The figures assume that no options are exercised prior to

Admission.

DEFINITIONS

The following definitions apply throughout this announcement

unless the context otherwise requires:

"Act" the Companies Act 2006;

"Admission" the admission of the Placing Shares to trading

on AIM having become effective in accordance

with the AIM Rules;

---------------------------------------------------

"AIM" the AIM Market, a market operated by the

London Stock Exchange;

---------------------------------------------------

"AIM Rules" together, the rules published by the London

Stock Exchange governing the admission to,

and the operation of, AIM, consisting of

the AIM Rules for Companies (including the

guidance notes thereto) and the AIM Rules

for Nominated Advisers, published by the

London Stock Exchange from time-to-time;

---------------------------------------------------

"Articles" the articles of association of the Company

(as amended from time to time);

---------------------------------------------------

"Board" or "Directors" the board of directors of the Company, as

at the date of this document, whose names

are set out on page 8 of this document;

---------------------------------------------------

"Circular" or this document, including the Notice at the

"this Document" end of this document and the Form of Proxy;

---------------------------------------------------

"City Code" City Code on Takeover and Mergers;

---------------------------------------------------

"Company" or "Mobile Mobile Streams Plc, incorporated and registered

Streams Plc" in England & Wales under the Companies Act

1985, with registered number 03696108;

---------------------------------------------------

"CREST" the relevant system for paperless settlement

of share transfers and the holding of shares

in uncertificated form, which is administered

by Euroclear UK & Ireland Limited;

---------------------------------------------------

"CREST Regulations" the Uncertificated Securities Regulations

2001 (S.I. 2001/3755), as amended from time

to time;

---------------------------------------------------

"Deferred Shares" deferred shares of 0.19 pence each in the

capital of the Company following the passing

of the Resolutions;

---------------------------------------------------

"Effective Time" 6.00 p.m. on 26 November 2019 (or, if the

General Meeting is adjourned, 6.00 p.m. on

the date of the adjourned General Meeting);

---------------------------------------------------

"Enlarged Share the 390,491,471 New Ordinary Shares in issue

Capital" following the Placing, Share Reorganisation

and issue of the Settlement Shares

---------------------------------------------------

"Existing Ordinary the 140,752,533 ordinary shares of 0.2 pence

Shares" each in issue at the date of this document;

---------------------------------------------------

"FCA" the Financial Conduct Authority, in its capacity

as the UK Listing Authority;

---------------------------------------------------

"Form of Proxy" the form of proxy for use by the Shareholders

in connection with the General Meeting

---------------------------------------------------

"General Meeting" the General Meeting of the Shareholders of

or "GM" the Company to be held at 10.00 a.m. on 26

November 2019 at the office of Peterhouse

Capital Limited at 3(rd) Floor, 80 Cheapside,

London, EC2V 6EE;

---------------------------------------------------

"Group" the Company together with its subsidiaries,

both directly and indirectly owned;

---------------------------------------------------

"Issue Price" 0.113 pence per Placing Share;

---------------------------------------------------

"London Stock London Stock Exchange plc;

Exchange"

---------------------------------------------------

"New Ordinary the ordinary shares of 0.01 pence each in

Shares" the capital of the Company upon the Share

Reorganisation becoming effective at the

Effective Time;

---------------------------------------------------

"Notice" the notice of the General Meeting, which

is set out at Part II of this document;

---------------------------------------------------

"Ordinary Shares" ordinary shares in the capital of the Company

having a nominal value of 0.2 pence each

prior to the Share Reorganisation becoming

effective at the Effective Time and having

a nominal value of 0.01 pence upon the Share

Reorganisation becoming effective at the

Effective Time;

---------------------------------------------------

"Placee" a subscriber for Placing Shares under the

Placing;

---------------------------------------------------

"Placing" the conditional placing of the Placing Shares

by Peterhouse with certain institutional

and other investors at the Issue Price;

---------------------------------------------------

"Placing Shares" the 221,238,938 New Ordinary Shares to be

issued pursuant to the Placing;

---------------------------------------------------

"Proposals" The Placing, the Share Reorganisation, the

appointment of Mark Epstein, Charles Goodfellow,

and Nigel Burton as directors of the Company,

and the adoption of the amended Articles;

---------------------------------------------------

"Registrars" Computershare Investor Services PLC;

---------------------------------------------------

"Resolutions" the resolutions to approve the Proposals,

which are set out in the Notice at the end

of this document;

---------------------------------------------------

"Settlement Shares" the 28,500,000 New Ordinary Shares to be

issued to Simon Buckingham, CEO, in satisfaction

of GBP100,860 of accrued director's fees;

---------------------------------------------------

"Share Reorganisation" the proposed subdivision of each Existing

Ordinary Share with a nominal value of 0.2

pence into one New Ordinary Share with a

nominal value of 0.01 pence and one Deferred

share with a nominal value of 0.19 pence,

further details of which are set out in paragraph

5 of the Letter from the Chairman in this

document;

---------------------------------------------------

"Shareholder(s)" holder(s) of the Ordinary Shares;

---------------------------------------------------

"United Kingdom" the United Kingdom of Great Britain and Northern

or "UK" Ireland; and

---------------------------------------------------

"Uncertificated" recorded on the register of Ordinary Shares

or "in Uncertificated as being held in uncertificated form in CREST,

Form" entitlement to which by virtue of the CREST

Regulations, may be transferred by means

of CREST.

---------------------------------------------------

END.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCCKPDBBBDBDDK

(END) Dow Jones Newswires

November 06, 2019 02:00 ET (07:00 GMT)

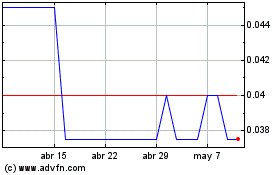

Mobile Streams (LSE:MOS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mobile Streams (LSE:MOS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024