UniCredit Shares Climb After 3Q Beat

07 Noviembre 2019 - 4:02AM

Noticias Dow Jones

By Pietro Lombardi

UniCredit SpA (UCG.MI) shares trade higher Thursday after the

bank posted better-than-expected third-quarter results ahead of its

new strategic plan.

The improved earnings were anticipated, as they come against a

previous-year quarter that was hit by an impairment related to the

lender's stake in Turkish bank Yapi Kredi and provisions. However,

net profit grew more than analysts had forecast.

UniCredit shares traded 4.3% higher at 0922 GMT.

The results cap a busy week for Italy's largest bank, which has

sold its entire stake in Mediobanca SpA (MB.MI) and made further

progress on asset quality.

Net profit for the period was 1.10 billion euros ($1.22 billion)

compared with a profit of EUR29 million a year earlier, the bank

said Thursday. On an adjusted basis, which excludes one-offs, net

profit rose almost 26% on year.

Revenue rose 1.7% to EUR4.70 billion, benefiting from higher

fees and trading income, which offset a 5% decline in net interest

income.

Analysts had expected a net profit of EUR1.03 billion on revenue

of EUR4.58 billion, according to a consensus forecast provided by

the bank.

"This is another strong quarter from UniCredit," Jefferies

said.

Capital was above expectations, the P&L showed solid core

trends and the bank sped up the reduction of nonperforming loans,

it said. UniCredit reported lower operating costs and a 19% decline

in provisions for bad loans.

This was the bank's best quarter in a decade, Chief Executive

Jean Pierre Mustier said.

"We have already met or will exceed our key targets by the end

of this year," he said.

The strong performance comes as the lender gears up for a new

plan, dubbed "Team 23", that it will present in December.

Under the current strategy, it cut costs, disposed of bad loans

worth billions of euros and sold assets, including Polish lender

Bank Pekao SA and asset manager Pioneer. The bank also raised EUR13

billion of fresh capital. More recently, it sold its stake in

online lender FinecoBank SpA (FBK.MI), and, this week, it sold its

stake in Mediobanca for EUR785 million.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 07, 2019 04:47 ET (09:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

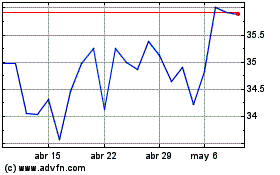

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Unicredit (BIT:UCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024