Attorney General Drops Two Exxon Fraud Counts -- WSJ

08 Noviembre 2019 - 2:02AM

Noticias Dow Jones

By Corinne Ramey

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 8, 2019).

The New York attorney general's office Thursday dropped part of

its securities-fraud case against Exxon Mobil Corp. on the final

day of a rare climate-change-related trial that has pushed the oil

giant's accounting practices into public view.

Attorney general's office lawyers withdrew two fraud counts at

the end of a nearly three-week trial examining Exxon's public and

private estimates of potential climate-change regulations on its

future business. But the attorney general's office proceeded with

two counts that require the elements of the Martin Act, a New York

state antifraud law with a lower bar of proof: that Exxon made

misrepresentations to investors and that those deceptions

mattered.

The attorney general's office pulled back the civil fraud counts

during closing arguments of a trial that has been closely watched

for its implications for the largest American oil company and the

energy industry in general.

Attorney General Letitia James has accused Exxon of deceiving

its investors about its financial modeling for policies that

countries might enact to combat climate change. The oil company

told investors it used one formula to account for these future

regulations, but internally used lower numbers, the office has

argued.

Jonathan Zweig, a lawyer in the attorney general's office, said

the case wasn't about whether Exxon's employees were good people,

as the company's lawyers suggested. "The question in this case is

whether Exxon's disclosures were accurate," Mr. Zweig said. "And

the evidence shows that they were not."

Lawyers for Exxon have called the case meritless and said

reasonable investors wouldn't expect to know such proprietary

calculations. "Exxon Mobil did not have two sets of books,"

Theodore Wells Jr., a lawyer for Exxon, said Thursday. "Exxon Mobil

had two distinct metrics that were used for different

purposes."

In court Thursday, Mr. Wells, who represents Exxon, asked the

judge not to drop the fraud counts, saying the company had a right

to receive a ruling on those claims. The claims had damaged the

reputation of the company and its executives, he said.

"That leaves a cloud over the reputation of the people," he

said. "Because of this case, and it's all connected, we have got

copycat cases tracking this case word-for-word in private

federal-securities cases, books and record cases," Mr. Wells

said.

Mr. Wells said the Massachusetts attorney general had recently

sued the company as well. A spokeswoman for the Massachusetts

attorney general didn't respond to a request for comment.

State Supreme Court Justice Barry Ostrager said that while he

believed the New York attorney general had a right to withdraw the

claims, he would read the lawyers' written arguments on the matter.

He has indicated he would rule on the case in as little as a

month.

If Justice Ostrager rules in favor of the attorney general, it

could spur further lawsuits or investigations into Exxon and other

oil companies. A ruling in Exxon's favor would likely insulate the

company against such claims, and, from the company's perspective,

bolster its reputation on climate-change issues.

Either side would likely appeal the judge's ruling.

Write to Corinne Ramey at Corinne.Ramey@wsj.com

(END) Dow Jones Newswires

November 08, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

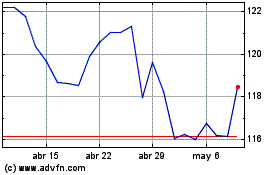

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

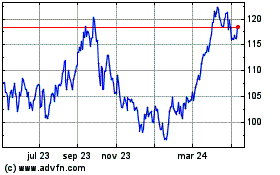

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024