TIDMPRIM

RNS Number : 0348T

Primorus Investments PLC

12 November 2019

Primorus Investments plc

("Primorus" or the "Company")

Quarterly Investor Update

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide the quarter ending 30 September 2019 ("Q3" or the

"Quarter") investor update regarding its current holdings and

activities acquired and managed as per its investing policy.

Executive Director's Quarterly Comment - Alastair Clayton

In a Quarter when it has been almost too painful to switch on

the 6 o'clock news to witness the political paralysis afflicting

the UK, Primorus managed to generate a very positive Quarter.

Notably we completed our exit from the Zuuse Series B Loan Notes

and saw significant news flow from a diverse range of our

investments including Engage, Fresho and WeShop.

With the UK IPO market becalmed, we continue to observe a trend

away from public company investing and toward private and venture

equity. Despite some rather prominent failures in the space

recently, the Board of Primorus continue to believe that model of

offering a publicly listed company structure investing in largely

private companies is attractive on the proviso that methods used to

value these investments are conservative. To this end, we continue

to value our investments in a manner that doesn't inflate potential

gains based on potentially unjustifiable valuation events.

With our total Zuuse Series B investment outlay of GBP275,000

returned to treasury and 57,205 fully paid shares and 1m A$0.50

(26p) options now on the balance sheet it is likely this trade will

generate an excellent profit in the next set of accounts given we

understand that Zuuse has just closed an A$16m capital raise at

circa A$1 per share. Furthermore, a deep "grey" market exists for

these shares and options and as such we believe the ability to

realise value for these holdings in advance of any IPO or other

liquidity event is substantial. This has been a very pleasing trade

and my only regret is Primorus was unable to take a larger

investment.

Elsewhere Greatland Gold ("GGP.L") reported yet more significant

news from its Havieron JV with Newcrest Mining ("NCM.AX"). We

continue to see this investment as hugely undervalued and believe

the UK market is failing to understand the significance of the

drilling reported to date. More importantly we believe that given

the proximity and feed requirements of the large Telfer Gold/Copper

Mine, the eventual owner of the entire Havieron Project may be

somewhat self-evident.

In the last few days we have received updates from Fresho

("Fresho") and SOA Energy ("SOA") and elsewhere many of our

investments continue to perform well whilst some seem to be a

little stuck when it comes to securing further growth capital. We

shall discuss this in further detail below.

Following approval at an EGM on 16 October 2019, we completed a

1 for 20 share consolidation in an attempt to narrow the quoted

spread for our shares. We believe over time this will prove

successful.

The 23 November will mark the second anniversary since Primorus

last issued equity. Since then members of the Board have invested

significant sums buying shares in the Company. We continue to see

no short to medium term requirement to raise capital thereby

reducing the risk of any potential dilution to all of us existing

shareholders.

Highlights

-- As announced on 25 September 2019, Primorus exited its Zuuse

Series B Loan Note investment by fully redeeming the GBP275,000

face value of the notes and putting 57,205 fully paid shares and 1m

A$0.50 options on the balance sheet.

-- Further outstanding Gold and Copper assays reported from the

Havieron JV between Greatland Gold (GGP.L) and Newcrest Mining

(NCZ.AX) ('Newcrest"). Six rigs now drilling and 15 further holes

either complete or in train, doubling the hole count at the

project. We are expecting further updates soon.

-- Fresho Gross Order Volume up by 60% since April to nearly

A$500m in annualised orders now through the platform. Invoice

finance feature Freshopay launched. First UK user signed and we

expect Fresho to make huge inroads into the UK fresh food market

where a direct competitor has as yet to be identified.

-- Post-period we again topped up our investment in Engage

Technology Partners ("Engage") by GBP50,000 to GBP1.50m. We

recently received an update from Engage highlighting outstanding

growth in monthly recurring revenues and billable transactions on

the back of the first Self-Serve truly scalable SaaS products.

-- SOA Energy reports formation of Joint Operating Committee

("JOC") and completed rig inspection for the upcoming appraisal and

production testing programme with Delek Drilling at the Ofek Field.

We have been informed that rig mobilisation will occur early next

year and drilling not long thereafter.

-- Company finishes the quarter debt-free and the Board still

foresees no short to medium term need or intention to raise

capital.

Update on Investments

As described in some detail above, the Zuuse trade is an example

of the trades that Primorus aspires to. It was a highlight of the

Company's third quarter and one we hope to replicate when next such

an opportunity arises. Again, our frustration only lies in the fact

we don't have a larger balance sheet to take on larger such

investments in outstanding opportunities with outstanding companies

like Zuuse. We aim to rectify this.

We talk a lot about Greatland Gold and it features strongly on

our @priminvestments twitter page primarily because the company is

already AIM-listed. Australia's largest gold miner, Newcrest,

continues to report superb drill results of huge widths of high

tenor Gold and Copper mineralisation at Havieron. When initially

building our position in Greatland Gold we did recognise that the

share register being so disparate was a potential drag on the share

price. To be frank, we have been surprised at how much the apparent

high-volume, low conviction trading has affected the share price

over the last 12 months.

Clearly we would prefer to see the Greatland share price better

reflect the value and potential at Havieron and elsewhere across

their project portfolio. We are also mindful that the fundamentals

underpinning our investment have actually exceeded our initial

expectations.

As a previous Director of Extract Resources representing

Kalahari Minerals, I know this is not the first time a critical

resource was discovered near to a major mining houses' large but

depleting operating asset. In 2012 we achieved an incredible return

for our shareholders by being patient and we remain so with

Greatland Gold. It is our firm view that with continued exploration

success the ownership of Havieron may eventually change to fit the

production requirements of Newcrest's Telfer Mine just 40km

away.

It was with some pleasure that we received notification from the

CEO of SOA Energy that the JOC for the Ofek re-entry and appraisal

programme has commenced and that rig inspections and planning were

in full swing to kick off drilling early next year. Planning,

permitting and approvals for such activities across a range of

Government stakeholders always takes significant time and effort

and we would pay compliments to SOA for their doggedness and

persistence in moving the company forward to the point where the

real value accretion (drilling) for us as shareholders can

commence. I expect our Q1 2020 shareholder update to potentially

hold the first hard data for the initial outcomes of the Ofek

programme and on the back of that the likely timing to IPO or

exit.

As alluded to in our last shareholder report, Fresho has now

signed its first UK customer with planned product roll out to begin

in early 2020. We have been told anecdotally there is no known

direct competitor for the Fresho platform. We find this very

exciting and to this end expect a huge push into the UK market by

Fresho in 2020.

Elsewhere, the business is gathering pace. Gross Order Volume

("GOV") has now grown some 60% since April with nearly A$500m in

annualised sales through the platform at the end of October.

Furthermore, with the launch of FreshoPay, an innovative invoice

financing module unique to the fresh food industry, the overall

Fresho product suite is expanding into new areas.

Fresho have now cemented, and are leveraging off, their place in

their home market of Australia and are pushing hard into New

Zealand with the UK and North America to follow in 2020. Fresho are

choosing to grab market share by growing GOV as fast as possible

and aim to monetise much of that platform volume later on. This has

been done thus far from a balanced EBIDTA footing. By managing to

keep real EBIDTA at near neutral levels, Fresho is most definitely

not an endless consumer of operational cashflow. We expect a

further capital raise to occur before the end of 2019 to provide

additional funds to expand rapidly into the UK and examine the

North American opportunity. We have already been informed this

would be only available to existing shareholders.

In terms of monetising our Fresho investment, we are very much

of the opinion that the best multiples of growth will soon be

before us. We expect to be in a position to consider at least a

partial exit in 2020 having turned down one offer earlier this

year. We would stress however, that with continued outstanding

growth as evidenced above and disciplined management at the helm

our expectations of fair value have increased again.

Engage Technology Partners is our largest investment, now with a

total of GBP1.5m invested across four funding rounds. Engage has

great potential in the SME market for temporary and also permanent

recruitment, agency back office and payment and billing if it is

able to develop and release a pure SaaS, mass-market scalable

platform. This is very much a case of sitting back and watching the

Engage team execute this clearly defined business plan.

As flagged in our last report Engage recently undertook a modest

rolling fund-raising of circa GBP1m in equity (and debt) at GBP24

per share. We took another small amount of the equity, GBP50,000,

and may look to take another small amount in the coming months.

We will return to Engage as a separate update in the coming

period with a more detailed information as we did on the 1 October

2019.

In the quarter under review StreamTV has been focussing on the

financial and capital management side of the business. Whilst chip

manufacture and product commercialisation activities are moving

ahead. We are limited in what else we can say regarding StreamTV

until the outcomes of the various commercial funding and management

initiatives are clear.

WeShop had a very significant update to all shareholders during

the quarter. Primorus has invested a total of GBP875,000 in WeShop.

Recently Two Shields Investments ("TSI") made a further GBP400,000

investment into WeShop.

As evidenced by our July WeShop update, the company gained

considerable momentum in finalising the product and proposition for

user acquisition later this summer. Some significant commercial and

product agreements, and integration, have also been achieved.

As mentioned in our introduction, several investments in our

portfolio seem to have generated little material news we can report

to shareholders for some time. This doesn't mean that these

companies are static, it just means the material news we can report

has not eventuated yet. We are aware TruSpine and Sport80 are

actively working on funding packages to undertake vital product

development and in Sport80's case grow the already revenue

generating business through capital deployment. I can attest to how

difficult the capital markets are for small, early-stage companies

seeking to raise money in the UK. On the flip side all our investee

companies have thus far been able to raise sufficient capital or

are generating sufficient revenues to keep afloat without a call on

existing shareholders. This in itself is a good result. Elsewhere,

NOMAD Energy ("NOMAD") remains actively engaged in negotiations

with Government and VITOL. We do not as yet have any verifiable

outcomes to report to shareholders, however we have spoken to

NOMAD, and are, despite the prolonged timetable, hopeful that the

next Quarter may see some movement in at least one of these

commercial outcomes for NOMAD.

In terms of being judged by our shareholders this is still

disappointing as several of our long-term investments remain in

need of that all-important growth capital. To this end we remain

supportive of our investee companies and always assist when asked

in terms of commercial advice and introductions. Quite simply it is

in our interests to do so.

Summary

So as we head towards Christmas, the Quarter has been another

one of very significant progress at the majority of our core

holdings, a very satisfying result from the Zuuse Loan exit and

more frustrating news from some of our investments. We have managed

to generate returns and grow the balance sheet in a manner that has

not required us to raise capital for nearly two years, thereby

avoiding diluting shareholders. To this end we can tolerate the

share price not reflecting the underlying investments for a limited

amount of time but believe this has persisted for far too long. As

evidenced by the above report, there are plenty of reasons to be

very optimistic about the outlook for the Company's investment

portfolio going forward, even in these uncertain times. The Board

would like to thank shareholders once again for their support and

reiterate that it is committed to delivering shareholder returns

via share price appreciation and/or direct distributions to

shareholders when it is in a position to responsibly do so.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DOCBRBDBIXBBGCB

(END) Dow Jones Newswires

November 12, 2019 02:01 ET (07:01 GMT)

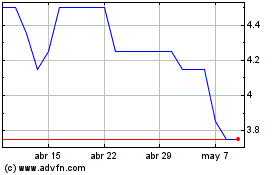

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024