TIDMNESF

RNS Number : 3477T

NextEnergy Solar Fund Limited

14 November 2019

14 November 2019

NextEnergy Solar Fund Limited

("NESF" or the "Company")

Interim Results for the period ended 30 September 2019

NextEnergy Solar Fund announces its interim results for the

six-month period ended 30 September 2019.

Financial highlights

-- Net asset value per ordinary share of 111.2p (31 March 2019: 110.9p)

-- Ordinary shareholder total return of 6.7% (30 September 2018: 3.4%)

-- Gearing of 39% (31 March 2019: 36%)

-- Cash dividend cover before scrip of 1.3x (30 September 2018: 1.2x)

-- Ordinary shareholders' NAV of GBP649m (31 March 2019: GBP645m)

-- Dividends per ordinary share of 3.44p (30 September 2018: 3.325p)

Operational highlights

-- Total capacity installed of 705 MW (31 March 2019: 691 MW)

-- Total electricity generation of 515 GWh (30 September 2018: 480 GWh)

-- 89 operating solar assets (31 March 2019: 87)

-- Electricity generation +5.0% above budget (30 September 2018: +7.9%)

ESG highlights

-- 134,000 UK homes powered for six months (30 September 2018: 125,000)

-- 131,000 tonnes of CO2 emissions avoided (30 September 2018: 123,000)

Kevin Lyon, Chairman of NESF, commented:

"NextEnergy Solar Fund's robust first half results were

characterised by another period of outperformance, resulting not

only from high levels of solar irradiation but also from technical,

financial and operational improvements across the portfolio. In

particular, we continued to focus on optimising our portfolio of

assets, including extending the useful life of more of our assets,

reducing operating costs, making technical improvements and

executing our electricity sales strategy to reduce power price

risk.

We are particularly proud of our maiden subsidy-free plant, Hall

Farm II of 5.4MW, which was energised during the period and is the

UK's first subsidy-free solar plant owned by a listed investment

company. Its successful development and commissioning gives us

industry leadership in this space, and work is underway on our next

subsidy-free plant - a 50 MW plant currently under construction and

due for commissioning by the end of the financial year.

During the period we also issued GBP100m of preference shares

and partially used this to repay financial debt, which resulted in

enhanced returns for ordinary shareholders, whilst providing

financial stability for the future."

Interim Report

There will be an analyst presentation and conference call at

10.00am this morning for analysts. To register for the call, please

contact MHP Communications on 020 3128 8100 or

nextenergy@mhpc.com.

For further information:

020 3746

NextEnergy Capital Limited 0700

Michael Bonte-Friedheim

Aldo Beolchini

020 7894

Cantor Fitzgerald Europe 7719

Robert Peel

020 7408

Shore Capital 4090

Anita Ghanekar

020 3128

MHP Communications 8100

Oliver Hughes

Apex Fund and Corporate Services (Guernsey) Limited 01481 735 827

Nicholas Robilliard

Notes to Editors:

NESF is a specialist investment company that invests primarily

in operating solar power plants in the UK. It is able to invest up

to 15% of its Gross Asset Value in operating solar power plants in

OECD countries outside the UK. The Company's objective is to secure

attractive shareholder returns through RPI-linked dividends and

long-term capital growth. The Company achieves this by acquiring

solar power plants on agricultural, industrial and commercial

sites.

As at 30 September 2019, NESF raised equity proceeds of GBP792m

(including GBP200m of preference shares) since its initial public

offering on the main market of the London Stock Exchange in April

2014. The Company's subsidiaries had financial debt outstanding of

GBP211m, on a look-through basis including project level debt. Of

the financial debt, GBP197m was long-term fully amortising debt,

and GBP14m was drawn under a short-term credit facility.

NESF is differentiated by its access to NextEnergy Capital Group

(NEC Group), its Investment Manager, which has a strong track

record in sourcing, acquiring and managing operating solar assets.

WiseEnergy is NEC Group's specialist operating asset management

division and over the course of its activities has provided

operating asset management, monitoring, technical due diligence and

other services to over 1,300 utility-scale solar power plants with

an installed capacity in excess of 1.9 GW.

Further information on NESF, NEC Group and WiseEnergy is

available at nextenergysolarfund.com, nextenergycapital.com and

wise-energy.eu.

NextEnergy Solar Fund Limited

Interim Report and Condensed Interim Financial Statements

for the six months ended 30 September 2019

Contents

Highlights 1

Chairman's Statement 3

Company Overview and Principal Risks 7

Investment Adviser's Report 9

Statement of Directors' Responsibilities 26

Condensed Interim Financial Statements 27

Notes to the Condensed Interim Financial Statements 31

Independent Review Report 49

Corporate Information 50

Alternative Performance Measures 52

Glossary 55

Performance Highlights

Financial Highlights

111.2p (31 March 2019: 110.9p) 6.7% (30 September 2018: 3.4%)

NAV per ordinary share Ordinary shareholder total return

as at 30 September 2019 for the six months ended 30 September

2019

39% (31 March 2019: 36%) 1.3x (30 September 2018: 1.2x)

Gearing Cash dividend cover before scrip

as at 30 September 2019 for the six months ended 30 September

2019

GBP649m (31 March 2019: GBP645m) 3.44p (30 September 2018: 3.325p)

Ordinary shareholder's NAV Dividends per ordinary share

as at 30 September 2019 for the six months ended 30 September

2019

Operational Highlights

705 MW (31 March 2019: 691 MW) 515 GWh (30 September 2018: 480 GWh)

Total capacity installed Total electricity generation

as at 30 September 2019 during the six months ended 30 September

2019

89 (31 March 2019: 87) +5.0% (30 September 2018: +7.9%)

Operating solar assets Generation above budget

as at 30 September 2019 for the six months ended 30 September

2019

ESG Highlights

134,000 (30 September 2018: 125,000) 131,000 (30 September 2018: 123,000)

UK homes (equivalent to Bournemouth Tonnes of CO(2) emissions avoided

and during the six months ended 30 september

Bradford combined) powered for six 2019

months

Key Performance Indicators ("KPIs")

The Company sets out below its KPIs which it utilises to track

its performance over time against its objectives. Alternative

Performance Measures used by the Company are defined on page

52.

Six months

ended Year ended Year ended Year ended Year ended

30 September 31 March 31 March 31 March 31 March

Financial KPI 2019 2019 2018 2017 2016

Ordinary shares in issue 583.6m 581.7m 575.7m 456.4m 278.0m

Ordinary share price 122.0p 117.5p 111.0p 110.5p 97.75p

Market capitalisation of ordinary

shares GBP712m GBP683m GBP639m GBP504m GBP272m

NAV per ordinary share* 111.2p 110.9p 105.1p 104.9p 98.5p

Total ordinary NAV GBP649m GBP645m GBP605m GBP479m GBP274m

Premium/(discount) to NAV* 9.7% 6.0% 5.6% 5.3% (0.8%)

Earnings per ordinary share 3.62p 12.37p 5.88p 13.81p 0.78p

Dividends per ordinary share 3.44p 6.65p 6.42p 6.31p 6.25p

Dividend yield* 5.63% 5.66% 5.78% 5.71% 6.39%

Cash dividend cover - pre-scrip

dividends* 1.3x 1.3x 1.1x 1.1x 1.2x

Preference shares in issue 200m 100m - - -

Debt outstanding at subsidiaries

level GBP211m GBP269m GBP270m GBP270m GBP217m

Gearing level (debt + preference

shares/GAV)* 39% 36% 31% 36% 44%

GAV GBP1,060m GBP1,014m GBP875m GBP749m GBP489m

Weighted average cost of capital 5.5% 5.4% 5.8% 5.9% 5.8%

Weighted average lease life 25.5 years 25.2 years 23.3 years 24.6 years 25.7 years

Ordinary shareholder total return

-

cumulative since IPO 54.6% 46.7% 33.6% 26.7% 6.1%

Ordinary shareholder total return

-

annualised since IPO 10.0% 9.5% 8.5% 9.1% 3.2%

Ordinary shareholder total return 6.7% 11.8% 6.2% 21.1% 0.2%

FTSE All-Share total return 4.0% 8.8% 1.4% 20.9% (3.6%)

Ordinary NAV total return* 3.23% 11.8% 6.3% 14.4% 3.7%

Ordinary NAV total return - annualised

since IPO* 8.0% 8.1% 7.0% 4.9% 1.9%

Invested capital* GBP932m GBP896m GBP734m GBP522m GBP481m

Ongoing charges ratio* 1.1% 1.1% 1.1% 1.2% 1.2%

Weighted average discount rate 7.0% 7.0% 7.3% 7.9% 7.7%

Operational KPI

Number of assets 89 87 63 41 33

Total installed capacity 705 MW 691 MW 569 MW 454 MW 414 MW

Electricity production (generation) 515 GWh 693 GWh 451 GWh 394 GWh 225 GWh

% increase (period-on-period) 7% 6% 14% 75% 878%

Generation since IPO 2.3 TWh 1.8 TWh 1.1 TWh 0.6 TWh 0.2 TWh

Irradiation (delta vs. budget) +4.8% +9.0% (0.9%) (0.3%) +0.4%

Generation (delta vs. budget) +5.0% +9.1% +0.9% +3.3% +4.1%

Asset Management Alpha* +0.2% +0.1% +1.8% +3.6% +3.7%

* Alternative Performance Measures

Chairman's Statement

"NextEnergy Solar Fund's robust first half results were

characterised by another period of outperformance, resulting not

only from high levels of solar irradiation but also from technical,

financial and operational improvements across the portfolio. In

particular, we continued to focus on optimising our portfolio of

assets, including extending the useful life of more of our assets,

reducing operating costs, making technical improvements and

executing our electricity sales strategy to reduce power price

risk.

We are particularly proud of our maiden subsidy-free plant, Hall

Farm II of 5.4MW, which was energised during the period and is the

UK's first subsidy-free solar plant owned by a listed investment

company. Its successful development and commissioning gives us

industry leadership in this space, and work is underway on our next

subsidy-free plant - a 50 MW plant currently under construction and

due for commissioning by the end of the financial year.

During the period we also issued GBP100m of preference shares

and partially used this to repay financial debt, which resulted in

enhanced returns for ordinary shareholders, whilst providing

financial stability for the future."

I am pleased to present, on behalf of the Board, the Interim

Report and Condensed Interim Financial Statements for NextEnergy

Solar Fund Limited for the period ended 30 September 2019.

We energised our maiden subsidy-free asset in the UK, Hall Farm

II, in August 2019, the first listed solar company to do so,

marking a defining moment on the solar sector's path to a

subsidy-free environment. Construction of this asset began in March

2019 and the plant was fully connected to the grid on 5 August

2019. This 5.4MW plant, adjacent to our existing Hall Farm plant,

has benefited from the original site's oversized planning

permission and previously built grid access infrastructure.

The construction of our second subsidy-free plant, Staughton,

has progressed smoothly and is on track to be connected to the grid

by the end of this financial year. This 50MW subsidy-free plant

located on the Bedfordshire/Cambridgeshire border will be the

largest plant in our portfolio. These achievements are notable as

they demonstrate the economic case for subsidy-free solar PV assets

in the UK compared to other energy generation technologies, many of

which still require extensive and expensive subsidies.

Asset prices on the whole remained at levels we deem

unattractive. Nevertheless, during the period, we have acquired one

operating solar plant, Ballygarvey in Northern Ireland, which

demonstrates our Investment Adviser's expertise in finding value in

a somewhat saturated UK market. The 8.2MW plant benefits from

subsidies under the Northern Irish ROC ('NIROCS') regulatory

framework, and gives the Company a presence in England, Scotland,

Wales and now Northern Ireland.

During the period we completed the innovative approach to the

financing of our portfolio. In August 2019 we raised a further

GBP100m of preference shares on similar terms to the GBP100m

issuance in November 2018. The combined GBP200m of preference

shares have a fixed 4.75% p.a. coupon, resulting in significantly

lower all-in annual cash costs to the Company over the regulatory

regime period of our assets, when compared to issuance of ordinary

shares or long-term amortising financial debt products. Further

details can be found in the Investment Adviser's Report.

Over the past six months our Investment Adviser and Asset

Manager have continued to optimise the returns from the portfolio

by:

-- extending the useful life of more of our assets;

-- reducing operating costs through re-negotiating contractual

terms and entering into new agreements;

-- making technical improvements; and

-- executing our electricity sales strategy to maximise revenue and reduce power price risk.

Our financial performance continues to be robust. Over the five

and a half years since IPO, NESF has achieved an annualised

ordinary shareholder total return of 10% and an annualised NAV

total return of 8.0%, in line with or in excess of the target range

of 7% - 9% equity return for investors, based on the IPO price.

Financial Results

Profit before tax was GBP21.1m (30 September 2018: GBP18.7m)

with earnings per ordinary share of 3.62p (30 September 2018:

3.23p). Cash dividend cover pre-scrip dividends was 1.3x (30

September 2018: 1.2x).

Portfolio Performance

Energy generated was 515 GWh (30 September 2018: 480GWh), 5.0%

above budget. During the period, solar irradiation across the

portfolio was 4.8% above expectation (30 September 2018: 8.4%).

Asset Management Alpha for the period was 0.2% (30 September 2018:

-0.5%), which would have been 1.0% (30 September 2018: 0.5%) if we

excluded distributor network outages.

Our UK portfolio performed above expectations with generation

outperformance of 5.1% (30 September 2018: 8.2%) and an Asset

Management Alpha of 0.1% (30 September 2018: -0.8%).

Our Italian portfolio also performed well during the period with

1.8% (30 September 2018: 3.6%) extra generation over budget and an

Asset Management Alpha of 1.4% (30 September 2018: 2.4%). The

portfolio was acquired with long-term debt of EUR76.9m (GBP68.1m)

which was fully repaid following the issuance of the preference

shares in November 2018. The vast majority of the future expected

cash flows from the portfolio have been hedged at an average

forward exchange rate of 0.89 EUR/GBP for the period up to 2032

which includes all hedging costs.

The electricity generated by our portfolio during the period

based on the current 705MW is equivalent to a saving of 131,000 (30

September 2018: 123,000) tonnes of CO(2) emissions and sufficient

to power some 134,000 (30 September 2018: 125,000) UK homes for six

months. This is roughly equivalent to powering a city with 643,000

inhabitants (e.g. Bournemouth and Bradford combined) for six

months.

Net Asset Value

At the period end, the Company's ordinary NAV was GBP649m,

equivalent to 111.2p per ordinary share (31 March 2019: NAV of

GBP645m, 110.9p per ordinary share).

Portfolio Growth

During the period, the portfolio's installed capacity increased

by 14MW with the additions of Hall Farm II and Ballygarvey. The

construction of Staughton is well-advanced and is expected to add a

further 50MW by the end of the financial year. The Investment

Adviser is in negotiations on further pipeline assets, the majority

of which are subsidy-free. Our strategy envisages adding a total of

between 100MW and 150MW in subsidy-free capacity to the portfolio

by the end of calendar year 2020. This amounts to an estimated

investment of between GBP55m and GBP80m (5% - 8% of GAV). Assuming

125MW of subsidy-free capacity and average generation levels, our

subsidy-free portfolio would be equivalent to c.15% of 2018/19

generation. We have identified and are progressing on strategies

for the sale of electricity from these subsidy-free plants.

Capital Raising and Debt Financing

In August 2019 the Company successfully issued a second tranche

of GBP100m of preference shares. The proceeds were deployed to

partially repay a HoldCo level short-term credit facility, finance

the acquisition of Ballygarvey and invest in the construction of

Staughton.

As at 30 September 2019, the Company's subsidiaries had

financial debt outstanding of GBP211m (31 March 2019: GBP269m). Of

the financial debt, GBP197m was long-term fully amortising debt,

and GBP14m was drawn under a short-term credit facility. The total

financial debt, together with the preference shares, represented a

gearing level of 39% (31 March 2019: 36%), which is below the

stated maximum debt-to-GAV level of 50%.

Dividends

The Company continues to achieve its dividend objective which is

to increase dividends annually in line with RPI over the long term.

For the year ending 31 March 2020, we are targeting a total

dividend of 6.87p per ordinary share.

The Directors have approved a second interim dividend of 1.7175p

per ordinary share, which will be payable on 30 December 2019 to

ordinary shareholders on the register as at the close of business

on 22 November 2019.

The Company offers scrip dividends, details of which can be

found on the Company's website.

The cash dividend cover pre-scrip dividends remained robust at

1.3x (2018:1.2x).

Environmental, Social and Governance

We are committed to ESG principles and responsible investment.

We continue to develop our ESG policy and are committed to evolving

it and delivering sustainable growth across the Company. As well as

reduction of CO(2) emissions provided by solar power, one

particular area we have focused on is biodiversity. Solar PV assets

represent an excellent opportunity to secure long-term biodiversity

across the countryside. In the area protected by the fencing around

our assets, we are able to create sectors fostering local plant and

wildlife. This approach includes initiatives such as: pairing up

with a local beekeeper association to locate beehives seasonally on

our sites, encouraging local pollinators by planting wild flower

mixes/under-panel planting, erecting bird and bat boxes and

briefing landowners with our newly devised biodiversity management

plan.

Auditors

On 27 September 2019, following a competitive audit tender, the

Company announced the appointment of KPMG Channel Islands Limited

as its auditor for the financial year ending 31 March 2020 for the

Company and its subsidiaries. PWC CI LLP has resigned as the

Company's auditor, and the Board would like to take the opportunity

to thank PWC for its service as auditor over the last five years

since IPO.

Distribution of Reports and Communications

This Interim Report is accessible on the Company's website. As

part of our principles of environmental responsibility, the Company

no longer issues printed copies of reports or communications,

except where a shareholder has expressly requested a hard copy.

Outlook

The Company will continue to focus on generating attractive

financial returns for our shareholders, while having positive

social and environmental impacts.

The Company continues to extend the useful life of its assets on

the remaining portfolio, and is targeting 31 assets.

The completion of Hall Farm II, has provided us with the

expertise to construct further subsidy-free assets with attractive

risk-adjusted returns using electricity sales agreements, corporate

PPAs or direct-wire agreements with off-takers, from the Company's

pipeline of development opportunities. We continue to target a

total of between 100 MW and 150 MW in subsidy-free solar

plants.

We will continue to review deployment of ancillary solar

technologies to mitigate the generation risks of individual assets,

whilst adapting our portfolio to the changing dynamics of the UK

solar market.

Continued focus on developing our electricity sales strategy

will enable us to leverage our in-house expertise to maximise value

from our assets and deliver further cost efficiencies.

ESG continues to be an important part of our mission. As

activities mitigating climate change accelerate globally, execution

of our ESG policy will ensure we continue to lead by example. Our

Company and stakeholders are aligned to create a better environment

for this generation and future generations.

With the underlying quality and performance of our robust

portfolio, coupled with the success of our first subsidy-free plant

and the construction programme ahead, the outlook for the Company

continues to remain strong.

Kevin Lyon

Chairman

13 November 2019

Company Overview and Principal Risks

Structure

The Company is a Guernsey registered closed-ended investment

company.

The Company has a premium listing and its ordinary shares are

traded on the London Stock Exchange under the ticker "NESF". The

Group comprises the Company and HoldCos which invest in SPVs which

hold the underlying solar PV assets.

Investment Objective

The Company seeks to provide investors with a sustainable and

attractive dividend that increases in line with RPI over the long

term. In addition, the Company seeks to provide ordinary

shareholders with an element of capital growth through the

reinvestment of net cash generated in excess of the target dividend

in accordance with the Company's investment policy.

Investment Policy

The Company's investment policy can be viewed on the Company's

website.

The Investment Manager, Investment Adviser and Asset Manager

The Company's Investment Manager is NextEnergy Capital IM

Limited. The Investment Manager has appointed NextEnergy Capital

Limited to act as Investment Adviser in relation to the Company.

Michael Bonte-Friedheim, Aldo Beolchini and Abid Kazim comprise the

Investment Committee of the Investment Adviser, whose role is to

consider and, if thought fit, recommend actions to the Investment

Manager in respect of the Company's potential and actual

investments.

The Company has entered into an asset management framework

agreement with the asset manager, WiseEnergy, a member of the NEC

Group. Under the framework agreement, WiseEnergy enters into

individual asset management contracts with each solar power plant

entity acquired by the Company and performs a broad and defined set

of asset management activities for each entity. The collective

experience of the NEC Group in managing and monitoring solar PV

assets best positions the Company to implement efficiencies at both

the investment and operating asset level. The technical and

operating outperformance of the portfolio to date underlines the

benefits of this comprehensive strategic relationship.

The NEC Group is a privately-owned specialist investment and

asset manager focused on the solar sector. It was formed in 2007

and has developed a unique track record in the European solar

sector. Prior to the IPO of the Company, it had developed,

financed, managed the construction of and owned 14 solar projects

in the UK and Italy. Its asset management activities have included

the management and monitoring of more than 1,300 utility-scale

solar power plants for a total capacity of over 1.9GW on behalf of

third-party equity investors and financing banks. Its clients

include listed solar funds (in addition to the Company), private

equity, family offices, renewable energy specialists and other

equity investors as well as some of Europe's leading lenders and

financiers in the solar sector. It has developed proprietary

hardware and software products and solutions to facilitate delivery

of its services to its client base. The NEC Group also manages two

private equity funds: NextPower II LP, a EUR232m fund dedicated to

solar PV asset investments in Italy, and NextPower III LP, a

USD117m fund dedicated to solar PV asset investments globally.

The NEC Group consists of over 160 dedicated staff focused on

the solar sector. The team has significant experience in energy and

infrastructure transactions not only in the UK but also in other

jurisdictions.

Principal Risks

The Company has in place risk management procedures and internal

controls to monitor and mitigate the main risks faced as well as a

process to review the effectiveness of those controls over the

Company and its subsidiaries as a whole. The Investment Manager and

Investment Adviser assists the Company in regularly identifying,

assessing and mitigating those risks likely to impact the financial

or strategic position of the Company.

Under the FCA's Disclosure Guidance and Transparency Rules, the

Board is required to identify those material risks to which the

Company is exposed and take appropriate steps to mitigate those

risks. The material risks identified by the Board can be

categorised as follows:

-- portfolio management and performance risks;

-- operational and strategic risks; and

-- external risks.

The principal risks and uncertainties, which are unchanged from

31 March 2019, remain the risks most likely to affect the Company

for the remaining six months of the financial year. Each of these

categories of risk, together with the principal risks, can be found

on pages 13-15 of the 31 March 2019 Annual Report.

Investment Adviser's Report

Portfolio Highlights

During the period, the portfolio grew from 87 to 89 assets,

which represented an increase of 14MW to the total capacity.

On 5 August 2019, our first subsidy-free asset Hall Farm II was

connected to the grid after a five-month construction period. The

5.4MW plant is the first subsidy-free plant to be energised by a

UK-listed investment company.

During the period, construction also began on Staughton, a 50MW

subsidy-free asset located on the Cambridgeshire/Bedfordshire

border. Construction progressed as scheduled during the period, and

grid connection is currently expected to take place by the end of

this financial year.

In early August 2019, the Company announced the acquisition of

Ballygarvey, an 8.2MW plant located in Northern Ireland. The plant

receives subsidies under the Northern Irish ROCS ("NIROCS")

regulatory framework and receives 1.4 NIROCS per MWh generated.

In the UK, the summer of 2019 was one of the hottest on record,

with the highest ever UK temperature of 38.7 degrees Celsius

recorded in Cambridge on 25 July. Whilst the extra irradiation

drove a greater than expected level of generation, the Asset

Manager had to cope with the adverse effects of high temperatures

on the technical performance of solar PV components, which perform

optimally at temperatures below 25 degrees Celsius. In addition,

certain plants suffered from grid curtailment, as generation peaks

driven by exceptional irradiation levels exceeded, at times, the

export capacity allocated by the grid authority to each plant.

In Italy, as the weather pattern was not unusual during the

period, the Solis portfolio had an irradiation delta of +0.4% and a

generation delta of +1.8% which resulted in an Asset Management

Alpha of +1.4%.

Overall, the operational performance of the portfolio during the

period was positive and above budget. The resulting Asset

Management Alpha of +0.2% was an expected outcome of these

exceptional weather conditions and does not represent any change in

the ability to achieve a greater level of outperformance in the

future.

As at 30 September 2019, the actual performance versus

expectations for 85 of the solar PV assets had been monitored by

the asset manager for at least two months post completion. The

three rooftop portfolios were excluded as irradiation was not

monitored.

The Asset Management Alpha measurement allows the Company to

identify the "real" outperformance of the portfolio due to active

management, as it excludes the effect of variation in solar

irradiation.

Portfolio Optimisation

During the period, we secured options or rights to extend the

leases on ten individual plants. The positive impact on NAV of

these life-extensions amounted to c.+1.3p per ordinary share at the

period end. We continue to work on extending the life of the

remaining portfolio, with a further five sites expected to secure

extensions by the end of the calendar year.

Irradiation Generation Asset

Assets (delta vs. (delta vs. Management

Period monitored budget) budget) Alpha

First Half 2015/16 17 +2.9% +5.7% +2.8%

First Half 2016/17 31 +0.0% +3.2% +3.2%

First Half 2017/18 41 +0.5% +2.0% +1.5%

First Half 2018/19 84 +8.4% +7.9% -0.5%

First Half 2019/20 85 +4.8% +5.0% +0.2%

Cumulative from IPO to September

2019 +2.5% +5.0% +2.5%

We have continued a programme of re-structuring and implementing

new contracts across the portfolio. Re-negotiating the contracts

means we are able to make savings, refine service levels and

maximise revenue. Further Operations and Maintenance ("O&M")

contract replacements and renegotiations have taken place during

the period, with seven contracts terminated or renegotiated

securing a cost saving of GBP100,000 p.a. across these assets. In

addition to the ongoing work to drive down operating costs, a

further eight PPAs have been renewed during the period.

Preference Shares

On 8 November 2018, ordinary shareholders agreed to amend the

Company's Articles of Incorporation to create a class of preference

share and approved the allotment of up to GBP200m of shares with no

pre-emption rights. Subsequently, on 13 November 2018, the Company

issued an initial tranche of GBP100m of preference shares. The

Company issued a further GBP100m of preference shares on 12 August

2019. The rights of the preference shares are the same as those

issued in November 2018, save that the second tranche benefit from

certain additional undertakings and covenants given by the

Company.

The preference shares are only redeemable at the option of the

holders in the event of a change in control or delisting of the

Company. They are generally non-voting and carry a fixed preferred

dividend of 4.75% p.a. as well as a preferred capital entitlement

at nominal value (100p). From 1 April 2036, the preference

shareholders have the right to convert all or some of their

preference shares into either ordinary shares or B shares, at the

election of the holder, with B shares being unlisted shares

carrying the same rights to dividends and capital in a liquidation

as the ordinary shares. The conversion price will be based on the

ratio of the nominal value (100p) (plus unpaid dividends, if any)

per preference share relative to NAV per ordinary share at the date

of conversion. Accordingly, conversion of the preference shares

will not result in any dilution of the NAV per ordinary share.

From 1 April 2030, the Company may elect to redeem all or some

of the preference shares. Dividends and, save as referred to in the

preceding paragraph, redemption will remain at the sole discretion

of the Board during the life of the preference shares. Should more

competitive sources of capital become available, the Company may

choose at its sole discretion to issue new capital (debt or equity)

to fund a full or partial redemption after March 2030.

The proceeds of the initial GBP100m of preference shares were

used to repay a portion of the existing long-term project financing

facilities associated with portfolio investments. Benefits of the

second tranche of preference shares for NESF include:

-- the net subscription proceeds were applied promptly to repay

existing short-term debt facilities (GBP90m due in February 2020

and July 2020), removing any short-term refinancing risk, with the

balance of the proceeds being available to invest in pipeline

opportunities;

-- the fixed preferred dividend of 4.75p per preference share is

a significantly lower all-in annual cash cost to the Company

compared to issuing ordinary shares (2019/20 target dividend of

6.87p per ordinary share, expected to increase with RPI annually);

and

-- the issue allows the Company to further optimise its capital

structure and increase cash flows over the long-term compared to

refinancing with conventional long-term amortising financing,

thereby increasing the cash dividend cover and increasing the IRR

for ordinary shareholders.

For accounting purposes, the preference shares are treated as

liabilities. The investment management fee is calculated based on

ordinary shareholders' NAV and, accordingly, no management fee is

payable in respect of the preference shares.

Italian Portfolio

After repaying the project finance debt during the year ended 31

March 2019, the Company, through a HoldCo, increased the size of

the EUR/GBP foreign currency hedging structure to cover 92% of the

expected cash flows generated by the portfolio over the next 15

years; this reduces currency fluctuation exposure on returns. The

average forward exchange rate is 0.89 EUR/GBP which includes all

hedging fees and costs. This FX hedging structure is particularly

effective as the Company is not obliged to provide any cash

collateral or margin calls.

Total

Amount per pre-scrip

ordinary dividends

Dividends declared Month of payment share (p) GBP'000

For the period 2014/15 5.2500 10,946

For the year 2015/16 6.2500 17,372

For the year 2016/17 6.3100 25,039

For the year 2017/18 6.4200 36,840

First quarterly dividend for the year 2018/19 Sep-18 1.6625 9,608

Second quarterly dividend for the year

2018/19 Dec-18 1.6625 9,646

Third quarterly dividend for the year 2018/19 Mar-19 1.6625 9,666

Fourth quarterly dividend for the year

2018/19 Jun-19 1.6625 9,671

First quarterly dividend for the year 2019/20 Sep-19 1.7175 10,002

Total dividends declared to date 32.5985 138,790

Second quarterly dividend for year 2019/20 Dec-19 1.7175 10,023

Pre-scrip

dividends

Cash income(1)(2) GBP'000 GBP'000

Cash income for period to 30 September

2019 32,906(1)

Net operating expenses for period to 30

September 2019 (3,596)

Preference shares dividend (3,032)

Net cash income available for distribution 26,278

Ordinary shares dividend paid during the

period 19,673

Cash dividend cover 1.3x

(1) Cash income differs from the Income in the Statement of

Comprehensive Income. This is because the Statement of

Comprehensive Income is on an accruals basis.

(2) Alternative Performance Measure.

The ordinary dividend calendar is set out in the table

below:

Expected

Expected amount

date of per ordinary

Ordinary dividend for year 2019/20 payment share (p)

First interim Paid 1.1715

Second interim December 2019 1.7175

Third interim March 2020 1.7175

Fourth interim June 2020 1.7175

Total 6.8700

Operating Expenses

The net operating expenses of the Company for the period

amounted to GBP6.6m (30 September 2018: GBP3.3m). The Company's OCR

was 1.1% (31 March 2019: 1.1%). The budgeted OCR for the year

ending 31 March 2020 is 1.1%. The OCR has been calculated in

accordance with AIC recommended methodology. OCR is an Alternative

Performance Measure.

NAV Movement

The Company's ordinary NAV is calculated on a quarterly basis

based on the valuation of the investment portfolio provided by the

Investment Adviser and the other assets and liabilities of the

Company provided by the Administrator. The ordinary NAV is reviewed

and approved by the Investment Manager and the Board of Directors.

All variables relating to the performance of the underlying assets

are reviewed and incorporated in the process of identifying

relevant drivers of the DCF valuation. The Company reports its

financial results on a non-consolidated basis under IFRS 10 (see

note 4c) and the change in fair value of its assets during the

period is taken through the statement of comprehensive income.

During the period the ordinary NAV per share increased from

110.9p to 111.2p. The movement was driven by the following

factors:

-- the downward revisions in the forecasts for long-term power

prices adopted by the Company, being 4.6% lower compared to the

assumptions employed at 31 March 2019 (taking into account the most

recent forecasts released by the Consultants up to the date of

preparation of this Interim Report);

-- the value uplift generated by acquisitions of assets whose

IRR at acquisition was higher than the Company's discount rate;

-- the operating results achieved by the Company's solar PV assets;

-- the dividends paid by the Company during the period and the Company's operating costs; and

-- the uplift arising from lease extensions.

Sensitivity Analysis

Sensitivities on the Company's ordinary NAV and detailed

disclosure on the asset valuation methodologies are provided below

and in note 14 of the Interim Financial Statements.

In the event that Ofgem's Targeted Charging Review results in

the removal of embedded benefits from April 2021 onwards, the

Company's NAV would decline by c.1.4p per ordinary share.

The chart shows the percentage change in the portfolio resulting

from a change in the underlying variables and its impact on the NAV

per ordinary share.

Current and Long-Term Power Prices

The Investment Adviser continuously reviews multiple inputs for

power price forecasts and takes the average of two of the leading

independent energy market consultants' long-term projections to

derive the power curve adopted in the valuation of the Company's

portfolio. This approach allows mitigation of inevitable

forecasting errors as well as any delay in response from the

Consultants in publishing periodic (quarterly) or ad hoc updates

following any significant market development.

During the period, the Consultants revised their forecasts for

the UK wholesale power price downwards in the short-term and the

long-term. Short-term projections are mainly driven by the decrease

in the commodity prices of gas and coal. In the long-term,

wholesale prices are expected to move downwards as more low-cost

generation is being deployed, notably offshore wind and solar

PV.

The power price forecasts used by the Company also reflect an

assumed "solar capture" discount which reflects the difference

between the prices available on the market in the daylight hours of

operation of a solar plant vs. the baseload prices included in the

power price estimates. This solar capture discount is estimated by

the Consultants on the basis of a typical load profile of a solar

plant and is reviewed as frequently as the baseload power price

forecasts. The application of such a discount results in a lower

long-term price being assumed for the energy generated by NESF's

assets compared to the baseload price, driven by the expected

further deployment of low-cost renewable capacity. This lower price

is included in the financial estimates that drive the Company's

NAV.

The Company's current long-term power price forecast implies an

average growth rate of approximately +0.9% in real terms over the

20-year period and an average price of c.GBP53.8/MWh in today's

terms. This represents a decrease of 4.6% compared to those used at

the end of the previous financial year (and 38% below the

assumptions employed at IPO).

Compared to the previous interim period end, electricity day

ahead prices in the UK decreased from c.GBP67/MWh in September 2018

to c.GBP36/MWh in September 2019. The Company continues to secure

attractive prices for the energy generated by its portfolio through

its electricity sales strategy with short to medium term prices

significantly above the projections provided by its

Consultants.

Following a similar trend, the price of electricity in Italy

decreased from c.EUR76/MWh in September 2018 to c.EUR51/MWh in

September 2019.

Power Purchase Agreements

NEC Group's specialist energy trader, along with the external

brokers, continues to ensure that the electricity sales strategy

maximises revenues whilst mitigating the negative impact of

short-term fluctuations in the power markets. The Investment

Adviser has executed a range of short-term PPA hedges from three

months to one year on multiple assets through a wider competitive

tendering process resulting in more counterparts with reduced fees

and increased pass-through value of ROCs, FiTs and embedded

benefits.

Valuation of the Investment Portfolio

Introduction

The Investment Manager is responsible for carrying out the fair

market valuation of the Company's underlying investment portfolio

which is presented to the Company's Board for its review and

approval. The valuation is carried out quarterly or more often if

capital increases or other relevant events arise. The valuation

principles used are based on a discounted cash flow methodology and

take into account IPEV guidelines.

Assets not yet operational or where the completion of the

acquisition is not imminent at the time of valuation use the

acquisition cost as a proxy for fair value.

The Board reviews the operating and financial assumptions used

in the valuation of the Company's underlying portfolio and approves

them based on the recommendation of the Investment Manager.

Discount rate

During the period, the solar PV market continued to experience

increased competition for operating and subsidised assets on the

secondary market. In the context of high liquidity provided to

international investors, a maturing renewable market, a scarcity of

subsidised assets and lack of any incentive framework for new

installations, demand for operating solar assets remained strong

resulting in sustained pressure on prices in the last year. These

changing dynamics were evidenced by the experience of the

Investment Adviser when bidding for solar PV assets in the UK.

As a result, the Company maintained its discount rate for

unlevered operating solar PV assets in the UK at 6.5%.

For those operating solar PV assets with debt, the Company

adopts a levered discount rate to capture the greater level of

volatility risk associated with the cash flows available to equity

investors after debt service. The appropriate level of risk premium

due to project level debt was evaluated taking into account various

factors for each specific asset, including the level of financial

gearing, maturity profile, cost of debt and other factors mentioned

above. This range was unchanged from the previous period (0.7% -

1.0%).

For the Solis portfolio a 8.0% discount rate was applied. This

reflects the additional country risk premium to the UK considering

the differences in risk-free rates in the long-term. It is worth

noting that the Solis portfolio debt was fully repaid, and the

current currency hedge effectively mitigates the revenue exposure

to foreign exchange movements.

The resulting weighted average discount rate for the Company's

portfolio was 7.0%.

The Company does not adopt WACC as a discount rate for its

investments, as it believes that the reduction in WACC deriving

from the introduction of long-term debt financing does not reflect

the greater level of risk to equity investors associated with

levered assets or levered portfolios. However, for the purposes of

transparency, the Company's pre-tax WACC as of 30 September 2019

was 5.5%. Compared to 31 March 2019 WACC of 5.4% this value

reflects a increase in the overall gearing from 36% to 39%, as

further described below.

Asset life

The DCF methodology implemented in the portfolio valuation

assumes a valuation time-horizon capped to the current terms of the

lease or, if earlier, planning permission on the properties where

each individual solar PV asset is located. These leases have been

typically entered into for a 25-year period from commissioning of

the relevant PV plants (specific terms may vary).

However, the useful operating life of the Company's portfolio of

solar PV assets is expected to be longer than 25 years. This is due

to many factors, including: (i) solar PV assets with technology

components similar to the ones deployed in the Company's portfolio

have been demonstrated to be capable of operating for over 40

years, with levels of technical degradation lower than those

assumed or guaranteed by the manufacturers; (ii) local planning

authorities have already granted initial planning consents that do

not expire and/or have granted permissions to extend initial

consented periods; and (iii) the Company owns rights to supply

electricity into the grid through connection agreements that do not

expire. The Company continues to seek to extend the useful life of

its assets, mainly by extending the terms of the land leases for

some projects with the intention of extending leases for others in

due course.

As at 30 September 2019, the remaining weighted average lease

life of the Company's portfolio was 25.5 years. The DCF valuation

assumes a zero-terminal value at the end of the lease term for each

asset or the end of the planning permission, whichever is the

earlier.

Operating performance

The Company values each solar PV asset on the basis of (i) the

minimum Performance Ratio ("PR") guaranteed by the vendor or (ii)

the PR estimated by the appointed technical adviser during due

diligence. These estimates are generally lower than the actual PR

that the Company has been experiencing during subsequent

operations. The Investment Adviser deems it appropriate to adopt

the actual PR after two years of operating history when, typically,

the plants have satisfied tests and received final acceptance

certification ("FAC").

As at 30 September 2019, 60 UK solar PV assets and all Italian

solar PV assets in the investment portfolio had achieved FAC and

their actual PR was used in the DCF valuation. This represents

510MW of the portfolio, with the remaining assets expecting to

reach FAC according to the timeline below.

Financial quarter ending December 2019: 105 MW

Financial quarter ending March 2020: 29 MW

Financial quarter ending June 2020: 14 MW

Period from July 2020 to June 2021: 47 MW

As at 30 September 2019, the Company's issued share capital

comprised 583,617,503 ordinary shares (including shares issued by

way of scrip dividends) and 200,000,000 preference shares. The

Company's capital raises are shown below:

Shares Amount Amount

Date issued raised (GBPm) invested Time to deployment

100% by September

April 2014 85,600,000 85.6 2014 5 months

November/December 100% by January

2014 95,000,000 99.6 2015 6 weeks

February 2015 59,750,000 61.4 100% by April 2015 6 weeks

100% by November

September 2015 37,607,105 38.8 2015 6 weeks

July/August/September Used to repay debt

2016 64,100,926 64.7 facility Immediate

100% by August

November 2016 110,300,000 115.3 2017 10 months

100% by August 1 year 2

June 2017 115,000,000 126.5 2018 months

Partially used

November 2018 100,000,000(1) 100.0 to repay debt facility 2 months

Partially used

August 2019 100,000,000(1) 100.0 to repay debt facility Immediate

(1) Preference shares

Status at

Debt raised 30 September

Date (GBPm) Lender Amount deployed 2019

July 2015 22.7 NIBC 100% Repaid

January 2016 45.4 Bayern Landesbank 100% Repaid

March 2016 55.0 MIDIS 100% Drawn

February 2017 150.0 Macquarie/NAB/CBA 100% Drawn

November 2017 68.1 UniCredit & ING 100% Repaid

February 2018 20.0 NIBC Not drawn Not Drawn

July 2018 40.0 Santander Not drawn Not Drawn

July 2018 58.3 Bayern Landesbank 100% Repaid

January 2019 30.0 Santander 100% Partially repaid

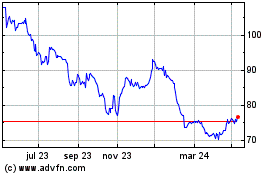

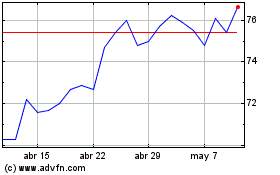

During the period the ordinary share price increased from 117.5p

to 122.0p. The table below shows the returns:

Half year Total Annualised

2019/20 since IPO since IPO

Ordinary shareholder total return 6.7% 54.6% 10.0%

NAV total return per ordinary share 3.2% 43.7% 8.0%

The annualised returns since IPO are in line with the target

range of 7% - 9% equity return for ordinary shareholders (at IPO

both initial issue price and NAV per ordinary share were 100p).

Since April 2019, the ordinary shares have been included in the

FTSE 250 Index. NESF's ordinary shares outperformed the FTSE

All-Share Index by 18.8% pts over the period from the IPO to 30

September 2019.

Ordinary shareholder total return and ordinary share NAV total

return are used to review the Company's performance against its

objectives.

Financing and Cash Management

At the period end, the Company's subsidiaries had financial debt

outstanding of GBP211m (31 March 2019: GBP269m). Of the financial

debt, GBP197m was long-term fully amortising debt, and GBP14m was

drawn under a short-term credit facility. The total financial debt,

together with the GBP200m preference shares, represented a gearing

level of 39% (31 March 2019: 36%), which is below the stated

maximum debt-to-GAV level of 50%.

During the period, GBP56m of the Santander RCF facility was

re-paid. Consequent to the repayment of debt facilities during the

period and prior periods, the HoldCos now have GBP300m Eurobonds

issued on TISE, which the Company has acquired to optimise the

group capital structure.

The following table is a summary of the financial debt

outstanding:

Termination

Facility Amount (including

Provider/ amount outstanding options Applicable

arranger Type Borrower Tranches GBPm GBPm to extend) rate

Fully-amortising

long-term

MIDIS/CBA/NAB debt NESH Medium-term 48.4 48.4 Dec-26 2.91%(1)

Floating long-term 24.2 24.2 Jun-35 3.68%(1)

Index linked RPI index

long-term 38.7 36.4 Jun-35 + 0.36%

Fixed long-term 38.7 38.7 Jun-35 3.82%

Debt Service

Reserve Facility 7.5 0.0 Jun-26 1.50%

Fully-amortising

long-term RPI index

MIDIS debt NESH IV Inflation linked 27.5 23.7 Sep-34 + 1.44%

Fixed long-term 27.5 25.9 Sep-34 4.11%

Total long-term debt 197.3

LIBOR

NIBC RCF NESH II n/a 20.0 - Feb-20 +2.20%

LIBOR

Santander RCF NESH VI n/a 70.0 14.0 Jul-20 +1.30%

Total short-term debt 14.0

Total debt 211.3

(1) Applicable rate represents the swap rate.

As at 30 September 2019, the Company held cash of GBP5.3m at

financial institutions in the UK with a credit rating at A-1 or

above.

Events After the Reporting Period

On 13 November 2019, the Directors approved a dividend of 1.7175

pence per ordinary share for the period ended 30 September 2019 to

be announced on 14 November 2019, and paid on 30 December 2019 to

ordinary shareholders on the register as at the close of business

on 22 November 2019.

NextEnergy Capital Limited

13 November 2019

Investment Portfolio

Remaining

Installed life of

Announcement Regulatory capacity Investment the plant

Power plant Location date regime(1) (MWp) cost (GBPM) (years)

1 Higher Hatherleigh Somerset 01/05/2014 1.6 6.1 7.3(5) 18.5

2 Shacks Barn Northamptonshire 09/05/2014 2.0 6.3 8.2(5) 17.8

3 Gover Farm Cornwall 23/06/2014 1.4 9.4 11.1(5) 29.4

4 Bilsham West Sussex 03/07/2014 1.4 15.2 18.9(5) 20.1

5 Brickyard Warwickshire 14/07/2014 1.4 3.8 4.1(5) 35.5

6 Ellough Suffolk 28/07/2014 1.6 14.9 20.0(5) 20.5

7 Poulshot Wiltshire 09/09/2014 1.4 14.5 15.7(5) 20.5

8 Condover Shropshire 29/10/2014 1.4 10.2 11.7(5) 24.7

9 Llywndu Ceredigion 22/12/2014 1.4 8.0 9.4 19.4

10 Cock Hill Farm Wiltshire 22/12/2014 1.4 20.0 23.6 20.2

11 Boxted Airfield Essex 31/12/2014 1.4 18.8 20.6(5) 20.1

12 Langenhoe Essex 12/03/2015 1.4 21.2 22.9(5) 20.2

13 Park View Devon 19/03/2015 1.4 6.5 7.7(5) 35.3

14 Croydon Cambridgeshire 27/03/2015 1.4 16.5 17.8(5) 30.2

15 Hawkers Farm Somerset 13/04/2015 1.4 11.9 14.5(5) 19.7

16 Glebe Farm Bedfordshire 13/04/2015 1.4 33.7 40.5(5) 35.5

17 Bowerhouse Somerset 18/06/2015 1.4 9.3 11.1(5) 35.2

18 Wellingborough Northamptonshire 18/06/2015 1.6 8.5 10.8(5) 20.7

19 Birch Farm Essex 21/10/2015 FiT 5.0 5.3(5) 36.5

20 Thurlestone Leicester Leicestershire 21/10/2015 FiT 1.8 2.3 41.0

21 North Farm Dorset 21/10/2015 1.4 11.5 14.5(5) 21.3

Ellough Phase

22 2 Suffolk 03/11/2015 1.3 8.0 8.0(5) 30.2

23 Hall Farm Leicestershire 03/11/2015 FiT 5.0 5.0(5) 19.9

24 Decoy Farm Lincolnshire 03/11/2015 FiT 5.0 5.2(5) 13.6

25 Green Farm Essex 26/11/2015 FiT 5.0 5.8 20.8

26 Fenland Cambridgeshire 11/01/2016 1.4 20.4 23.9(2,3) 20.9

27 Green End Cambridgeshire 11/01/2016 1.4 24.8 29.0(2,3) 20.5

28 Tower Hill Gloucestershire 11/01/2016 1.4 8.1 8.8(2,3) 21.5

29 Branston Lincolnshire 05/04/2016 1.4 18.9 35.7

30 Great Wilbraham Cambridgeshire 05/04/2016 1.4 38.1 22.0

31 Berwick East Sussex 05/04/2016 1.4 8.2 97.9(2,4) 25.5

32 Bottom Plain Dorset 05/04/2016 1.4 10.1 40.6

33 Emberton Buckinghamshire 05/04/2016 1.4 9.0 25.4

34 Kentishes Essex 22/11/2016 1.2 5.0 4.5 22.2

35 Mill Farm Hertfordshire 04/01/2017 1.2 5.0 4.2 37.2

36 Bowden Somerset 04/01/2017 1.2 5.0 5.6 22.4

37 Stalbridge Dorset 04/01/2017 1.2 5.0 5.4 37.5

38 Aller Court Somerset 21/04/2017 1.2 5.0 5.5 22.5

39 Rampisham Dorset 21/04/2017 1.2 5.0 5.8 22.2

40 Wasing Berkshire 21/04/2017 1.2 5.0 5.3 28.3

41 Flixborough South Humberside 21/04/2017 1.2 5.0 5.1 23.0

42 Hill Farm Oxfordshire 21/04/2017 1.2 5.0 5.5 20.7

43 Forest Farm Hampshire 21/04/2017 1.2 3.0 3.3 32.5

44 Birch CIC Essex 12/06/2017 FiT 1.7 1.7 32.4

45 Barnby Nottinghamshire 12/06/2017 1.2 5.0 5.4 22.8

46 Bilsthorpe Nottinghamshire 12/06/2017 1.2 5.0 5.4 23.2

47 Wickfield Wiltshire 12/06/2017 1.2 4.9 5.6 23.6

48 Bay Farm Suffolk 18/08/2017 1.6 8.1 10.5 34.3

49 Honington Suffolk 18/08/2017 1.6 13.6 16.0 34.4

50 Macchia Rotonda Apulia 01/11/2017 FiT 6.6 27.0

51 Iacovangelo Apulia 01/11/2017 FiT 3.5 22.4

52 Armiento Apulia 01/11/2017 FiT 1.9 25.1

53 Inicorbaf Apulia 01/11/2017 FiT 3.0 116.2(2,6) 27.9

54 Gioia del Colle Campania 01/11/2017 FiT 6.5 26.4

55 Carinola Apulia 01/11/2017 FiT 3.0 26.7

56 Marcianise Campania 01/11/2017 FiT 5.0 16.3

57 Riardo Campania 01/11/2017 FiT 5.0 16.6

58 Gilley's Dam Cornwall 18/12/2017 1.3 5.0 6.4 16.6

59 Pickhill Bridge Clwyd 18/12/2017 1.2 3.6 3.7 16.4

60 North Norfolk Norfolk 01/02/2018 1.6 11.0 14.6 17.1

61 Axe View Devon 01/02/2018 1.2 5.0 5.6 17.1

62 Low Bentham Lancashire 01/02/2018 1.2 5.0 5.4 17.0

63 Henley Shropshire 01/02/2018 1.2 5.0 5.2 17.0

64 Pierces Farm Berkshire 30/05/2018 FiT 1.7 1.2 19.6

65 Salcey Farm Buckinghamshire 30/05/2018 1.4 5.5 6.5 19.6

66 Thornborough Buckinghamshire 25/06/2018 1.2 5.0 5.7 21.5

67 Temple Normaton Derbyshire 25/06/2018 1.2 4.9 5.6 21.8

Fiskerton Phase

68 1 Lincolnshire 25/06/2018 1.3 13.0 16.6 30.5

69 Huddlesford HF Staffordshire 25/06/2018 1.2 0.9 0.9 21.3

70 Little Irchester Northamptonshire 25/06/2018 1.2 4.7 5.9 22.3

71 Balhearty Clackmannanshire 25/06/2018 FiT 4.8 2.6 22.2

72 Brafield Northamptonshire 25/06/2018 1.2 4.9 5.8 21.5

73 Huddlesford PL Staffordshire 25/06/2018 1.2 0.9 0.9 21.6

74 Sywell Northamptonshire 25/06/2018 1.2 5.0 5.9 21.6

75 Coton Park Derbyshire 25/06/2018 FiT 2.5 1.1 31.3

76 Hook Somerset 11/07/2018 1.6 15.3 21.9(2) 34.5

77 Blenches Wiltshire 11/07/2018 1.6 6.1 7.8(2) 19.2

78 Whitley Somerset 11/07/2018 1.6 7.6 10.5(2) 19.5

79 Burrowton Devon 11/07/2018 1.6 5.4 7.3(2) 19.0

80 Saundercroft Devon 11/07/2018 1.6 7.2 9.6(2) 34.4

81 Raglington Hampshire 11/07/2018 1.6 5.7 8.1(2) 34.3

82 Knockworthy Cornwall 11/07/2018 FiT 4.6 6.6(2) 18.5

83 Chilton Canetello Somerset 11/07/2018 FiT 5.0 9.0(2) 17.8

84 Crossways Dorset 11/07/2018 FiT 5.0 10.1(2) 32.8

85 Wyld Meadow Dorset 11/07/2018 FiT 4.8 7.1(2) 33.8

86 Ermis - rooftops Multiple 07/08/2018 FiT 1.0 3.0 17.1

87 Angelia - rooftops Multiple 07/08/2018 FiT 0.2 0.6 17.0

88 Ballygarvey Northern Ireland 07/08/2019 1.4NIROCS 8.2 8.5 28.3

89 Hall Farm II Leicestershire 07/08/2019 None 5.4 2.5 39.8

Total 705 905

To be built/under construction

A Francis/Gourton Clwyd 12/06/2017 None 10.0 - -

B Strensham Worcestershire 12/06/2017 None 19.6 - -

C Radbrook Warwickshire 12/06/2017 None 20.7 - -

D Moss Cheshire 12/06/2017 None 9.5 - -

E Staughton Bedfordshire 13/06/2018 None 50.0 27 -

F Llanwern Gwent 13/06/2018 None 62.5 - -

Total 172 27 -

Grand Total 932 -

(1) An explanation of ROC regime is available at ofgem.gov.uk/environmental-programmes/renewables-obligation-ro.

(2) Acquired with project level debt.

(3) Part of the Thirteen Kings portfolio.

(4) Part of the Radius portfolio.

(5) Part of the Apollo portfolio.

(6) Part of the Solis portfolio.

Portfolio Assets

Period ended 30 September Since

2019 acquisition

Operational Acquisition Irradiation Generation Irradiation Generation

date date Generation delta delta Generation delta delta

Power plant (MWh) (%) (%) (MWh) (%) (%)

Higher

1 Hatherleigh Apr-14 May-14 4,448 3.4 4.9 34,171 0.2 4.6

2 Shacks Barn May-14 May-14 4,272 3.6 3.0 34,692 2.5 8.2

3 Gover Farm Jan-15 Jun-14 6,669 6.6 1.0 44,576 2.3 (0.4)

4 Bilsham Jan-15 Jul-14 11,692 6.7 4.7 79,468 4.3 5.6

5 Brickyard Jan-15 Jul-14 2,687 2.9 5.7 17,616 2.6 5.2

6 Ellough Jul-14 Jul-14 10,963 1.2 4.1 80,257 0.4 6.3

7 Poulshot Apr-15 Sep-14 10,198 2.9 4.5 60,837 (0.2) 4.0

8 Condover May-15 Oct-14 6,526 (0.8) (4.7) 42,541 (0.8) 0.3

9 Llywndu Jul-15 Dec-14 5,954 (0.5) 8.2 32,805 (4.2) 1.7

10 Cock Hill Farm Jul-15 Dec-14 14,644 3.8 5.7 85,051 2.1 3.4

Boxted

11 Airfield Apr-15 Dec-14 14,491 5.0 8.9 89,827 3.2 5.6

12 Langenhoe Apr-15 Mar-15 16,024 7.8 6.5 104,817 5.8 8.6

13 Park View Jul-15 Mar-15 4,438 (2.9) (6.6) 27,751 (3.6) (1.1)

14 Croydon Apr-15 Mar-15 11,793 9.3 9.5 75,804 5.8 7.0

15 Hawkers Farm Jun-15 Apr-15 9,036 3.5 6.2 52,751 (0.7) 3.0

16 Glebe Farm May-15 Apr-15 25,360 7.9 13.9 154,593 5.4 11.5

17 Bowerhouse Jul-15 Jun-15 6,632 7.7 1.6 39,224 1.9 1.2

18 Wellingborough Jun-15 Jun-15 5,706 4.0 0.6 35,944 1.9 3.5

19 Birch Farm Sep-15 Oct-15 3,807 6.3 7.4 20,438 3.8 5.6

Thurlestone

20 Leicester Oct-15 Oct-15 1,063 - (0.9) 7,243 - 0.5

21 North Farm Oct-15 Oct-15 9,086 1.7 2.7 48,296 (3.6) (1.9)

Ellough Phase

22 2 Aug-16 Nov-15 6,021 7.0 7.2 27,012 8.8 11.4

23 Hall Farm Apr-16 Nov-15 3,597 4.1 8.7 13,645 3.5 0.7

24 Decoy Farm Mar-16 Nov-15 3,654 6.7 6.4 15,332 4.4 8.5

25 Green Farm Dec-16 Nov-15 3,744 4.4 5.1 14,869 4.0 4.6

26 Fenland Jan-16 Jan-16 15,642 7.4 11.2 82,055 4.9 9.3

27 Green End Jan-16 Jan-16 18,189 7.5 6.6 95,958 4.6 5.4

28 Tower Hill Jan-16 Jan-16 5,995 5.4 6.6 31,379 2.6 6.0

29 Branston Mar-16 Apr-16 14,054 9.8 11.4 68,385 6.2 4.8

Great

30 Wilbraham Mar-16 Apr-16 28,297 7.7 8.4 141,706 5.2 5.7

31 Berwick Mar-16 Apr-16 6,799 6.8 10.0 34,690 5.4 8.8

32 Bottom Plain Mar-16 Apr-16 8,015 8.3 8.7 39,609 3.1 4.2

33 Emberton Mar-16 Apr-16 6,589 7.5 6.9 33,140 4.5 4.2

34 Kentishes Jul-17 Nov-16 3,786 5.3 3.3 13,726 5.5 5.4

35 Mill Farm Jul-17 Jan-17 3,846 8.6 10.3 13,661 8.6 10.3

36 Bowden Sep-17 Jan-17 3,854 2.1 (0.2) 10,981 0.2 0.4

37 Stalbridge Sep-17 Jan-17 3,916 2.2 4.6 11,196 0.6 5.5

38 Aller Court Sep-17 Apr-17 3,925 5.3 5.3 10,947 3.5 4.2

39 Rampisham Sep-17 Apr-17 3,989 (0.3) 0.9 10,869 (1.6) (1.9)

40 Wasing Aug-17 Apr-17 3,881 9.0 10.5 11,822 6.9 10.2

41 Flixborough Aug-17 Apr-17 3,641 6.1 7.7 10,996 5.6 7.9

42 Hill Farm Mar-17 Apr-17 3,757 7.9 11.4 10,548 7.6 10.3

43 Forest Farm Mar-17 Apr-17 2,292 6.7 8.3 6,401 5.1 8.3

44 Birch CIC May-17 Jun-17 1,292 6.6 3.9 4,547 5.3 4.4

45 Barnby Aug-17 Jun-17 3,571 5.4 8.2 10,649 5.6 7.7

46 Bilsthorpe Aug-17 Jun-17 3,593 5.8 7.3 10,883 5.1 8.2

47 Wickfield Mar-17 Jun-17 3,615 6.6 6.1 10,016 5.5 4.9

48 Bay Farm Sep-17 Aug-17 5,619 6.3 5.7 16,973 8.5 6.4

49 Honington Sep-17 Aug-17 9,720 2.9 3.9 28,598 4.4 3.6

Macchia

50 Rotonda Nov-17 Nov-17 5,998 4.5 2.4 18,281 3.2 3.3

51 Iacovangelo Nov-17 Nov-17 3,270 3.6 3.0 9,815 2.0 4.1

52 Armiento Nov-17 Nov-17 1,790 3.5 4.3 5,372 2.4 4.7

53 Inicorbaf Nov-17 Nov-17 2,807 2.7 3.4 8,567 2.1 4.1

Gioia del

54 Colle Nov-17 Nov-17 5,857 (4.7) (1.0) 17,642 (3.3) 0.6

55 Carinola Nov-17 Nov-17 2,691 (0.5) 3.1 7,987 (0.4) 3.4

56 Marcianise Nov-17 Nov-17 4,450 (0.6) 1.5 13,252 0.2 2.1

57 Riardo Nov-17 Nov-17 4,548 (0.7) 1.7 13,241 (0.2) (0.4)

58 Gilley's Dam Nov-17 Dec-17 3,638 (4.2) (3.4) 9,717 (4.9) (2.4)

Pickhill

59 Bridge Dec-17 Dec-17 2,578 3.0 5.3 6,987 5.6 8.5

60 North Norfolk Dec-17 Feb-18 8,489 7.1 10.0 21,952 7.5 10.2

61 Axe View Dec-17 Feb-18 3,776 6.9 7.5 9,778 5.5 6.8

62 Low Bentham Dec-17 Feb-18 3,426 1.4 1.3 8,991 2.4 3.7

63 Henley Jan-18 Feb-18 3,508 2.3 5.5 9,174 3.2 6.0

64 Pierces Farm May-18 May-18 1,233 4.2 4.1 2,641 6.5 7.4

65 Salcey Farm May-18 May-18 3,795 7.7 1.0 8,282 12.6 5.9

66 Thornborough Jun-18 Jun-18 3,328 0.8 (7.2) 6,181 7.9 (9.2)

Temple

67 Normaton Jun-18 Jun-18 3,332 1.6 (0.7) 6,283 7.1 (1.8)

Fiskerton

Phase

68 1 Jun-18 Jun-18 9,144 7.3 0.3 17,574 11.3 0.6

Huddlesford

69 HF Jun-18 Jun-18 617 2.7 2.3 1,200 8.5 4.4

Little

70 Irchester Jun-18 Jun-18 3,247 0.8 (4.5) 6,003 8.2 (7.9)

71 Balhearty Jun-18 Jun-18 2,828 (5.6) (11.5) 5,055 (1.6) (14.5)

72 Brafield Jun-18 Jun-18 3,432 2.7 (3.5) 6,684 9.0 (1.9)

Huddlesford

73 PL Jun-18 Jun-18 640 2.2 1.6 1,244 8.2 3.7

74 Sywell Jun-18 Jun-18 3,467 2.1 (2.4) 6,605 10.1 (3.0)

75 Coton Park Jun-18 Jun-18 1,663 2.6 3.6 3,256 7.4 6.5

76 Hook Jul-18 Jul-18 11,176 3.7 1.1 20,549 4.4 0.9

77 Blenches Jul-18 Jul-18 4,310 2.0 4.4 8,090 5.1 7.5

78 Whitley Jul-18 Jul-18 5,137 4.9 (5.8) 9,875 4.7 (0.9)

79 Burrowton Jul-18 Jul-18 9,206 3.8 (0.0) 17,194 3.3 1.3

80 Saundercroft Jul-18 Jul-18

81 Raglington Jul-18 Jul-18 4,048 5.4 (6.1) 7,888 6.4 (2.1)

82 Knockworthy Jul-18 Jul-18 3,431 3.1 (0.3) 6,397 3.0 1.0

Chilton

83 Canetello Jul-18 Jul-18 3,901 4.8 6.2 7,374 5.5 8.1

84 Crossways Jul-18 Jul-18 3,951 5.8 2.9 7,633 5.4 5.6

85 Wyld Medow Jul-18 Jul-18 3,619 (1.1) (0.2) 6,853 (1.1) 0.9

86 Ermis Aug-18 Aug-18 594 - (0.3) 1,004 - (0.9)

87 Angelia Aug-18 Aug-18 118 - 7.1 203 - 7.4

88 Ballygarvey Mar-18 Aug-19 1,344 2.1 3.7 1,344 2.1 3.7

89 Hall Farm II Aug-19 Aug-19 - - - - - -

Total 514,771 4.8 5.0 2,285,466 2.5 5.0

Rooftop assets are not monitored for irradiation

Statement of Directors' Responsibilities

To the best of their knowledge, the Directors of NextEnergy

Solar Fund Limited confirm that:

(a) the Interim Report and Condensed Interim Financial

Statements have been prepared in accordance with IAS 34 Interim

Financial Reporting;

(b) the Interim Report, comprising the Chairman's Statement and

the Investment Adviser's Report, meets the requirements of an

interim management report and includes a fair review of information

required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the period from 1 April 2019 to 30 September 2019 and their

impact on the Condensed Interim Financial Statements, and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the period from 1 April 2019 to 30 September 2019 and that have

materially affected the financial position or performance of the

Company during that period, and any material changes in the related

party transactions disclosed in the last Annual Report; and

(c) the Condensed Interim Financial Statements give a true and

fair view of the assets, liabilities, financial position and profit

of the Company as required by DTR 4.2.4R of the Disclosure Guidance

and Transparency Rules.

The Directors believe that the Company has adequate resources to

continue in operational existence for at least 12 months from the

date of approval of the Condensed Interim Financial Statements. The

Annual Report and Financial Statements for the year ended 31 March

2019 includes: the Company's objectives, policies and processes for

managing its capital; its financial risk management objectives; and

details of its financial instruments and its exposure to credit

risk and liquidity risk. The Directors believe the principal risks

and uncertainties have not changed materially since the date of the

Annual Report and Financial Statements and are not expected to

change materially for the remainder of the Company's financial

year. The Directors have undertaken a rigorous review of the

Company's ability to continue as a going concern including

reviewing the level of the Company's assets and significant areas

of financial risk including the timing of future investment

transactions, expenditure commitments and forecast income and

cashflows. As a result, the Directors have, at the time of

approving these Condensed Interim Financial Statements, a

reasonable expectation that the Company has adequate resources to

meet its liabilities and continue in operational existence for at

least 12 months from the date of approval of the Condensed Interim

Financial Statements. The Directors have therefore concluded that

it is appropriate to adopt the going concern basis of accounting in

preparing these Condensed Interim Financial Statements.

The maintenance and integrity of the Company's website is the

responsibility of the Directors. Legislation in Guernsey governing

the preparation and dissemination of financial statements may

differ from legislation in other jurisdictions.

By order of the Board

For NextEnergy Solar Fund Limited

Patrick Firth

Director

13 November 2019

Condensed Interim Financial Statements

Condensed Statement of Comprehensive Income

For the period ended 30 September 2019

Unaudited

Unaudited 1 April 2018 1 April 2018

1 April 2019 to to

to 30 September 31 March 30 September

2019 2019 2018

Notes GBP'000 GBP'000 GBP'000

Income

Income 5 34,238 55,613 26,349

Net changes in fair value of investments 6 (6,524) 24,538 (4,401)

Total net income 27,714 80,151 21,948

Expenditure

Preference share dividends 3,032 1,822 -

Management fees 16 2,834 5,402 2,675

Legal and professional fees 390 732 335

Administration fees 136 277 131

Audit fees 60 156 83

Directors' fees 19 104 173 86

Sundry expenses 38 27 3

Regulatory and listing fees 22 33 29

Insurance 12 15 7

Total expenses 6,628 8,637 3,349

Operating profit 21,086 71,514 18,599

Finance income - 65 55

Profit and comprehensive income for

the period/year 21,086 71,579 18,654

Earnings per ordinary share - basic 11 3.62p 12.37p 3.23p

Earnings per ordinary share - diluted 11 3.46p 11.93p 3.23p

All activities are derived from ongoing operations.

There is no other comprehensive income or expense apart from

those disclosed above and consequently a Condensed Statement of

Other Comprehensive Income has not been prepared.

The accompanying notes are an integral part of these condensed

interim financial statements.

Condensed Interim Statement of Financial Position

As at 30 September 2019

Unaudited Unaudited

30 September 31 March 30 September

2019 2019 2018

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Investments 6 818,352 722,763 590,448

Total non-current assets 818,352 722,763 590,448

Current assets

Cash and cash equivalents 5,270 19,285 3,836

Trade and other receivables 7 52,228 41,409 54,754

Total current assets 57,498 60,694 58,590

Total assets 875,850 783,457 649,038

Current liabilities

Trade and other payables 8 29,438 39,384 39,259

Total current liabilities (29,438) (39,384) (39,259)

Non-current liabilities

Preference shares 197,708 99,022 -

Total non-current liabilities (197,708) (99,022) -

Net assets 648,704 645,051 609,779

Equity

Share Capital and Premium 10 602,269 600,029 598,370

Retained earnings 46,435 45,022 11,409

Total equity attributable to shareholders 648,704 645,051 609,779

Net assets per ordinary share 13 111.2p 110.9p 105.1p

The accompanying notes are an integral part of these condensed

interim financial statements.

The condensed interim financial statements were approved and

authorised for issue by the Board of Directors on 13 November 2019

and signed on its behalf by:

Director Director

Condensed Statement of Changes in Equity

For the period ended 30 September 2019

Share capital Retained

and premium earnings Total equity

GBP'000 GBP'000 GBP'000

For the period 1 April 2019 to 30 September

2019 (unaudited)

Shareholders' equity at 1 April 2019 600,029 45,022 645,051

Profit and comprehensive income for the period - 21,086 21,086

Ordinary shares issued 2,240 - 2,240

Ordinary dividends declared - (19,673) (19,673)

Shareholders' equity at 30 September 2019 602,269 46,435 648,704

For the year 1 April 2018 to 31 March 2019

Shareholders' equity at 1 April 2018 593,388 11,602 604,990

Profit and comprehensive income for the year - 71,579 71,579

Ordinary shares issued 6,641 - 6,641

Ordinary dividends declared - (38,159) (38,159)

Shareholders' equity at 31 March 2019 600,029 45,022 645,051

For the period 1 April 2018 to 30 September

2018 (unaudited)

Shareholders' equity at 1 April 2018 593,388 11,602 604,990

Profit and comprehensive income for the period - 18,654 18,654

Ordinary shares issued 4,982 - 4,982

Ordinary dividends declared - (18,847) (18,847)

Shareholders' equity at 30 September 2018 598,370 11,409 609,779

The accompanying notes are an integral part of these condensed

interim financial statements.

Condensed Statement of Cash Flows

For the period ended 30 September 2019

Unaudited Unaudited

1 April 1 April

2019 to 30 1 April 2018 2018 to 30

September to 31 March September

2019 2019 2018

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit and comprehensive income for

the period/year 21,086 71,579 18,654

Adjustments for:

Investment proceeds from HoldCos - 4,654 4,654

Investment payments to HoldCos (99,862) (176,658) (70,573)

Change in fair value on investments 6 6,524 (24,538) 4,401

Finance income - (65) (55)

Amortisation 36 22 -

Operating cash flows before movements

in working capital (72,216) (125,006) (42,919)

Changes in working capital

Movement in trade receivables (13,069) (13,012) (26,357)

Movement in trade payables (9,946) 13,863 11,029

Net cash used in operating activities (95,231) (124,155) (58,247)

Cash flows from investing activities

Finance income - 65 55

Net cash generated from investing activities - 65 55

Cash flows from financing activities

Net proceeds from issuance of preference

shares 98,650 99,000 -

Dividends paid (17,434) (31,518) (13,865)

Net cash generated from financing activities 81,216 67,482 (13,865)

Net movement in cash and cash equivalents

during period/year (14,015) (56,608) (72,057)

Cash and cash equivalents at the beginning

of the period/year 19,285 75,893 75,893

Cash and cash equivalents at the end

of the period/year 5,270 19,285 3,836

The accompanying notes are an integral part of these condensed

financial statements.

Notes to the Condensed Interim Financial Statements

For the period ended 30 September 2019

1. General Information

The Company was incorporated with limited liability in Guernsey

under the Companies (Guernsey) Law, 2008, as amended, on 20

December 2013 with registered number 57739, and is regulated by the

GFSC as a registered closed-ended investment company. The

registered office and principal place of business of the Company is

1, Royal Plaza, Royal Avenue, St Peter Port, Guernsey, Channel

Islands, GY1 2HL.

On 16 April 2014, the Company announced the results of its

initial public offering, which raised net proceeds of GBP85.6

million. The Company's ordinary shares were admitted to the premium

segment of the UK Listing Authority's Official List and to trading

on the Main Market of the London Stock Exchange as part of its

initial public offering which completed on 25 April 2014.

Subsequent fundraisings and the take-up of the scrip dividend

option also took place, increasing total equity to GBP602.3m as at

30 September 2019 (31 March 2019: GBP600.0m). On 12 November 2018

the Company issued preference shares, raising GBP100m before

transaction costs. On 12 August 2019 the Company issued further

preference shares, raising GBP100m before transaction costs.

Details can be found in note 10.

The Company seeks to provide investors with a sustainable and

attractive dividend that increases in line with the Retail Price

Index over the long-term by investing in a diversified portfolio of

solar PV assets that are located in the UK and other OECD

countries. In addition, the Company seeks to provide investors with

an element of capital growth through the reinvestment of net cash

generated in excess of the target dividend in accordance with the

Company's investment policy.

The Company currently makes its investments through HoldCos and

SPVs, which are directly or indirectly wholly-owned by the Company.

The Company controls the investment policy of each of the HoldCos

and its wholly-owned SPV's in order to ensure that each will act in

a manner consistent with the investment policy of the Company.