U.S. Dollar Lower On Global Growth Concerns

14 Noviembre 2019 - 1:40AM

RTTF2

The U.S. dollar declined against its most major counterparts in

the European session on Thursday, as U.S.-China trade worries and

weak data from China and Japan stoked worries that a global

slowdown is deepening.

Chinese industrial output and retail sales figures for October

came in below estimates, while Japan's economy grew at the slowest

pace in a year in the third quarter.

Trade worries intensified after the Wall Street Journal reported

that trade talks have hit a snag over Chinese purchases of U.S.

agricultural products.

The report said that China is reluctant to commit to a specific

amount of agricultural products as part of the phase one trade

deal.

The news raised doubts about finalizing interim deal between

Beijing and Washington.

The currency showed mixed trading against its major counterparts

in the Asian session. While it was steady against the euro and the

franc, it fell against the yen. Versus the pound, it rose.

The greenback declined to a 10-day low of 0.9870 against the

franc, from a high of 0.9908 seen at 8:45 pm ET. The next possible

support for the greenback is seen around the 0.96 level.

The greenback fell to a 9-day low of 108.57 against the yen,

after reaching as high as 108.86 at 8:45 pm ET. If the greenback

slides further, it may find support around the 106.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary industry activity rose in September.

The tertiary industry activity index rose 1.8 percent

month-on-month in September. Economists had forecast 1.1 percent

rise.

The greenback depreciated to a 2-day low of 1.2867 against the

pound, from yesterday's closing value of 1.2849. The greenback is

seen finding support around the 1.30 level.

Data from the Office for National Statistics showed that UK

retail sales decreased in October as a now-delayed Brexit deadline

approached, defying expectations for an increase, and suggest a

soft start for household spending in the fourth quarter.

Including automotive fuel, retail sales decreased 0.1 percent

monthly in October after a 0.2 percent decline in the previous

month.

In contrast, the greenback climbed to a 5-week high of 1.0989

against the euro, reversing from a low of 1.1016 hit at 3:15 am ET.

The currency is likely to locate resistance around the 1.06

level.

Data from Eurostat showed that Eurozone economy grew in the

third quarter as initially estimated.

Gross domestic product grew 0.2 percent from the second quarter,

when the economy expanded at the same rate.

The greenback rose to 1.3268 against the loonie and 0.6386

against the kiwi, from its early low of 1.3248 and a 9-day low of

0.6419, respectively. If the greenback rises again, it may test

resistance around 1.35 against the loonie and 0.62 against the

kiwi.

Extending early rally, the greenback appreciated to a 4-week

high of 0.6782 against the aussie. Next immediate resistance for

the greenback is seen around the 0.645 level.

Looking ahead, Canada new housing price index for September,

U.S. producer prices for October and weekly jobless claims for the

week ended November 9 will be featured in the New York session.

At 10:00 am ET, Federal Reserve Chair Jerome Powell will testify

on the economy before the House Budget Committee in Washington

DC.

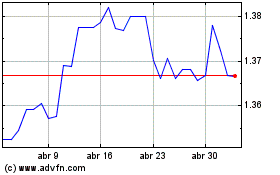

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024