TIDMRGO

RNS Number : 5039T

RiverFort Global Opportunities PLC

15 November 2019

15 November 2019

RiverFort Global Opportunities plc

("RGO" or the "Company")

Quarterly update to 30 September 2019

Further to the announcement of 31 October 2019, RiverFort Global

Opportunities plc is pleased to provide a detailed quarterly update

for Q3 to 30 September 2019.

Highlights

-- Total income generated in Q3 of GBP252,000, making a total of

GBP919,000 for the first nine months of 2019

-- Increase in net asset value since 30 June 2019 of around 3%,

or almost 9% over the first 9 months of 2019

-- NAV per share is at a 55% premium to the period end share price

-- GBP2.2 million of cash available for further investment

-- Very busy Q3 and start to Q4 with additional investments made

in companies including Savannah Petroleum plc, Anglo African Oil

& Gas plc, UK Oil and Gas plc, Infrastrata plc, Angus Energy

plc and Ascent Resources plc

-- Continued strong demand for the Company's investment capital

Chairman's review

The Company has had a very busy Q3 and start to Q4 and has

continued to build on its excellent 2019 interim results. Further

good progress has been made in Q3 2019, with the Company providing

capital to a number of companies for a variety of uses including

for working capital purposes and acquisitions. These companies

include some larger listed companies such as Savannah Petroleum plc

and UK Oil & Gas plc. The majority of our total investment

income is now being generated from this type of investment.

The analysis of income for the period is set out below:

Q3 to 30 September Half year to 30

2019 June 2019

GBP GBP

------------------- ----------------

Investment income 234 549

------------------- ----------------

Net income from financial instruments

at FVTPL 18 127

------------------- ----------------

Total investment income 252 676

------------------- ----------------

Total investment income of GBP252,000 was generated in the three

months to 30 September 2019, making a total of GBP919,000 for the

first nine months of 2019.

The key unaudited performance indicators are set out below:

Performance indicator 30 September 30 June 2019 Change

2019

------------------------------------- ---------------- ------------ ---------

Investment income GBP252,000 GBP549,000

------------------------------------- ---------------- ------------ ---------

Net asset value GBP7,869,823 GBP7,678,162 +2.6%

Net asset value - fully diluted per

share 0.116p 0.113p +2.6%

Closing share price 0.075p 0.076p -1.3%

Net asset value premium to the share

price 55% 49%

Market capitalisation GBP5,092,001 GBP5,159,895 -1.3%

------------------------------------- ---------------- ------------ ---------

The Company's net asset value has increased by 9% since the

beginning of the year and the Company has continued to build its

investment portfolio of RiverFort-arranged investments. Further

details about the Company's investment portfolio are set out on the

Company's website at www.riverfortglobalopportunities.com.

The Company's principal investment portfolio categories are

summarised below:

Category Cost or valuation

at 30 September

2019

Debt and equity-linked debt

investments 4,709,792

------------------

Equity investments 630,605

------------------

Other 200,000

------------------

Cash resources 2,166,906

------------------

Total 7,707,303

------------------

Despite increasing net asset value and generating a significant

level of investment income, the Company's shares continue to trade

at a very substantial discount to net asset value. As mentioned in

our interim results, the Board is working on ways to enhance

returns to shareholders that will, most likely, include the payment

of a dividend which, we believe, will help reduce the trading

discount to net asset value.

As the Company continues to build its investment portfolio and

investment income, it has been agreed with RiverFort, the Company's

investment adviser, that they will waive their annual retainer

fees, equivalent to two per cent. of the Company's net assets, and

performance fees, equivalent to 20 per cent. of the realised

profits generated on each new investment, for the second half 2019.

In consideration for this, the Company has agreed to extend the

current term of the investment adviser agreement with RiverFort by

an additional six months to 30 June 2022. Under the AIM Rules,

RiverFort, as the Company's investment adviser, is regarded as a

Related Party so the variation of the investment agreement is a

Related Party Transaction under the AIM Rules. To that end, the

Independent Directors (being all the Directors with the exception

of Mr Andrew Nesbitt who is a consultant to RiverFort) who have

consulted with the Company's nomad, believe that this variation of

the investment agreement is fair and reasonable in so far as the

shareholders are concerned.

There continues to be a good demand for the Company's investment

capital in situations that can generate attractive returns and we

have the necessary cash resources to deploy in order to benefit

from these opportunities. Furthermore, the Company is now starting

to build a track record of delivering significant levels of

investment income and building net asset value.

Philip Haydn-Slater

Non-Executive Chairman

15 November 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For more information, please contact:

RiverFort Global Opportunities plc: +44 (0) 20 3368 8978

Philip Haydn-Slater, Non-Executive Chairman

Nicholas Lee, Investment Director

Nominated Adviser:

Beaumont Cornish +44 (0) 20 7628 3396

Roland Cornish/Felicity Geidt

Joint Broker: +44 (0) 20 7601 6100

Shard Partners LLP

Damon Heath/Erik Woolgar

Joint Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDGGGCAGUPBPWC

(END) Dow Jones Newswires

November 15, 2019 02:00 ET (07:00 GMT)

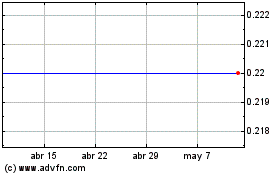

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

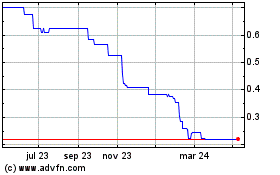

Riverfort Global Opportu... (LSE:RGO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024