TIDMIGE

RNS Number : 4079V

Image Scan Holdings PLC

03 December 2019

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

PRELIMINARY RESULTS FOR THE YEARED 30 SEPTEMBER 2019

Image Scan (AIM: IGE), the specialist supplier of X-ray

screening systems to the security and industrial inspection

markets, today announces preliminary results for the year ended 30

September 2019.

HIGHLIGHTS

-- Strong order bookings of GBP3.9m (2018: GBP2.8m)

-- Gross margin increased to 54% (2018: 47%)

-- Operating loss before tax GBP403k (2018: operating profit of GBP48k)

-- Period-end orderbook more than tripled to GBP1.7m (2018: GBP465k)

-- Year-end cash balance of GBP640k (2018: GBP782k) and high level of stock

-- Significant portable X-ray order from a European customer

-- New security screening system in development

-- New international sales partners appointed

Bill Mawer, Chairman and Chief Executive of Image Scan,

commented: "It is disappointing to be reporting a decline in sales

and profits. However, while the portable X-ray market has

undoubtably become more competitive, recent orders show that our

strong product range and focused international sales activity can

still deliver. I am pleased to report that we start the new

financial year with an order book that includes more portable

systems than were delivered in all of last year.

In FY 2020 we will continue our focus on expanding the security

product range and filling gaps in our international partner network

as we look to drive organic growth in our key markets. We will also

seek out larger security screening projects that build on our

capability and expertise. The industrial screening market continues

to present opportunities for growth as emissions control

legislation tightens in key markets and we look for new customers

for our sophisticated X-ray systems.

The company has started the new year strongly and we expect to

see a material improvement in our performance in the year."

--

Image Scan Holdings plc Tel: +44 (0) 1509 817400

William Mawer, Chairman

Sarah Atwell-King, Company Secretary

Cantor Fitzgerald Europe Tel: +44 (0) 207 894 7000

Rick Thompson / William Goode (Corporate Finance)

Caspar Shand Kydd (Sales)

Person responsible: The person responsible for arranging the

release of this announcement on behalf of Image Scan is William

Mawer.

About Image Scan Holdings plc

Image Scan Holdings plc (AIM: IGE) is focused on the development

and commercialisation of market leading real-time X-ray solutions

for use in the global Security and Industrial inspection markets.

The Company's Security portfolio includes the ThreatScan(R) range

of portable bomb and suspect package detection systems; the Axis

range of baggage inspection systems; and SVXi, a small vehicle

inspection system. The Industrial inspection solutions include the

MDXi product range, cabinet X-ray systems for laboratories and

production lines. The Company was founded in 1996 and joined AIM in

2002.

For further information on the Company, please visit:

www.ish.co.uk - and for further information on its products, please

visit: www.3dx-ray.com

CHAIRMANS STATEMENT

OVERVIEW

The results for the Image Scan Group for the year ending 30

September 2019 reflect the low order book with which the Group

started the year and a long period where order intake continued at

a relatively subdued level. Orders were impacted by delays or

cancellations to procurement programmes by key international

customers. Additionally, sales of industrial systems returned to a

more normal level after the record high of the previous year.

However, the final quarter saw a turnaround in order intake, with

some significant portable X-ray contracts being received, and the

Group finished the period with a strong order book.

FINANCIAL RESULTS

Following an intensive effort by the sales team, total order

booking in the year was up 39% at GBP3.9m (2018: GBP2.8m).

Sales reduced to GBP2.4m (2018: GBP3.5m) impacted by delays in

Government orders and a fall in sales to the Indian subcontinent

where, for the second year, budgets have been tight. This region

did, however, see a number of deployments of industrial units.

Margins strengthened to 54% (2018: 47%) partly driven by new

service contracts on the exceptionally high number of industrial

units deployed in FY 2018.

Overheads rose slightly to GBP1.68m (2018: GBP1.60m) largely due

to small, planned increases in research & development and

marketing spend. The pre-tax trading loss for the year was GBP403k

(2018: operating profit of GBP48k).

The financial position of the Group remained strong with net

assets of GBP1.27m (2018: GBP1.63m) at the year end which includes

a cash balance of GBP640k (2018: GBP782k). The Group has been able

to meet its working capital requirements for the year under review.

The period ended with an orderbook of GBP1.7m (2018: GBP465k), most

of which should be delivered in the first half of FY 2020.

The Group currently holds high levels of stock, particularly

part-complete portable X-ray systems. With most of this stock

allocated to the recently received orders, the stock level is

expected to decline over the next few months. A stock control

policy, constantly reviewed by management, strikes a balance

between control of working capital and the need to offer short

delivery times to customers.

BUSINESS REVIEW

The business started the year with only a small order book and

much of this was delivered in the first quarter. Some significant

orders that had been expected during the year were delayed, in some

cases until late in the final quarter, leaving the business with an

overall reduction in sales but a strong year end order book.

Throughout the year the business worked very closely with a key

partner in a European country on a large portable X-ray project.

The customer's procurement process involved extensive trials and

evaluations over a long period and, as might be expected for such a

significant project, attracted a large field of portable X-ray

competitors. The contract, worth over GBP800k was eventually

received only in the final month of the year, too late for sales to

be delivered in the reporting period. An additional significant

contract won close to the year end, this time from an Asian

customer, further added to the order book. The Group aims to

deliver both of these orders in the first half of FY 2020.

An intensive marketing effort saw the Group undertake

demonstrations and trials across the globe and especially in in

Europe, South America, Asia and the Middle East. New partners were

taken on in a number of important territories and opportunities

were identified in new markets.

The research and development team continued to develop upgrades

to the range of portable X-ray systems, including new digital

communications technology and an "Image Stitching" feature which

allows a series of images taken of a large object to be combined

into a single high-resolution picture of the threat. Additionally,

the team produced an engineering development model for a completely

new X-ray system using the core "Linescan" detector technology for

a new application, quite separate from portable X-ray. Following

extensive engineering evaluation, a full prototype is now in

development and the product should be released in FY 2020.

A new measurement technique has been developed for the MDXi

range of industrial X-ray systems and is currently being marketed

to our key customers with a view to deploying the algorithms into

our large installed base of systems during FY 2020. Deliveries of

industrial systems were down from the record seen in FY 2018 but

the order book is again building in this area. The number of

support contracts increased as the systems deployed in FY 2018 came

into service and this work provides valuable, and growing,

sustainable income, with the support team regularly visiting our

key customers' international manufacturing sites and carrying out

preventative maintenance.

OPERATIONAL IMPROVEMENTS

The Group continued to upgrade and improve its internal

processes during the period, in line with its ISO 9001:2015

compliant quality system. The Continuous Improvement process drove

on-time delivery and quality performance. An extensive review of

the supply chain was carried out with potential improvements in

cost and quality identified and implemented. A UK based supplier

for a large machined component, hitherto sourced from Belgium, was

identified and vetted, reducing the scope for post Brexit

disruption of supply for this important item. Other initiatives

focussed on cross functional teamwork within the business and

improvements to the working environment within the Group's factory

units near Loughborough.

OUR STRATEGY

The core strategy continues to be to build the Group through a

combination of organic and acquisition growth. However, the Board

recognizes that the opportunities for acquisition will be limited

by the current low share price and market capitalisation. For these

reasons the short-term strategy is focussed on organic growth, with

the immediate target of returning sales and profits to the 2017

level, while laying the foundations for further growth beyond

this.

The key elements of this organic growth strategy are the further

enhancement of the portable X-ray range in order to strengthen the

position in this highly competitive market; the development of new

products based on the Group's core technologies and the further

expansion of the product range through partnering with other

security technology companies. We will continue to look for new and

stronger sales partners in the more attractive regional markets and

will seek out additional users for our portable X-ray systems

beyond the conventional "bomb squad" market.

The Group will look to further strengthen the industrial product

range and increase its deployment into the international

manufacturing operations of current customers, while looking to add

new customers in this important sector. We will continue to develop

the product line and recently added important new analysis

techniques which we hope to deploy during FY 2020.

The Board's longer-term ambition to increase the critical mass

of the business through carefully selected acquisitions

remains.

OUTLOOK

The substantial portable X-ray orders won towards the end of the

period demonstrate that our product technology and our sales team

and our strong network of international partners, can continue to

create and win opportunities in the security marketplace. However,

some countries, including the UK, have decreased their assessment

of the security threat level, which might be expected to lead to

softness of budgets for security equipment. Additionally, portable

X-ray is a small, niche market, within which many governments have

sufficient equipment to meet their short-term needs and face an

increasing choice of suppliers when they do run procurement

programmes in this category. In response to this, the Group is

planning upgrades to its portable X-ray systems and is focussing

attention on less highly penetrated markets such as those in South

America and Eastern Europe. The strength of our partner network

should allow us rapidly to get new products into the market as they

become available.

While sales of industrial systems returned to a more normal

level in FY 2019, we continue to see opportunity in the market for

inspecting automotive catalytic converters and diesel particulate

filters. Our key customers are building capacity in a number of

territories, not least China and India, and we are seeing new

orders for systems to be deployed in these markets.

In the longer term, the Board continues to believe that a blend

of organic and acquisition growth is the best way to deliver

shareholder value, as the greater scale will provide both

protection from market shocks and stronger amortisation of the

relatively high fixed costs associated with a stock market

listing.

STAFF

The Board values greatly the considerable efforts made by our

staff and, on behalf of the Directors, I would like to take this

opportunity to personally thank staff and shareholders for their

continued commitment to Image Scan.

William Mawer

CHAIRMAN

3 December 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note As restated

2019 2018

GBP GBP

REVENUE 2,365,202 3,464,910

Cost of sales (1,086,595) (1,819,617)

Gross profit 1,278,607 1,645,293

Operating expenses (1,272,779) (1,213,842)

Research and development

expenses (408,531) (383,187)

Total administrative expenses (1,681,310) (1,597,029)

OPERATING (LOSS)/ PROFIT

BEFORE EXCEPTIONAL COSTS (402,703) 48,264

Exceptional costs - (250,458)

OPERATING LOSS (402,703) (202,194)

Finance income 892 344

LOSS BEFORE TAXATION (401,811) (201,850)

Taxation 33,939 (17,839)

LOSS AND TOTAL COMPREHENSIVE

INCOME FOR THE YEAR FROM

CONTINUING OPERATIONS ATTRIBUTABLE

TO THE EQUITY OWNERS OF THE

PARENT COMPANY (367,872) (219,689)

Pence Pence

Earnings per share 3

Basic (0.27) (0.16)

Diluted (0.27) (0.16)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As restated

2019 2018

GBP GBP

NON-CURRENT ASSETS

Intangible Assets 25,334 18,877

Property, plant and equipment 11,575 15,067

Deferred Tax Asset 7,150 37,344

44,059 71,288

CURRENT ASSETS

Inventories 783,089 938,639

Trade and other receivables 663,959 783,470

Cash and cash equivalents 640,489 781,635

2,087,537 2,503,744

TOTAL ASSETS 2,131,596 2,575,032

CURRENT LIABILITIES

Trade and other payables 848,037 909,966

Warranty provision 16,000 34,999

864,037 944,965

NET ASSETS 1,267,559 1,630,067

EQUITY

Share capital 1,363,546 1,363,546

Share premium account 8,327,910 8,327,910

Retained earnings (8,423,897) (8,061,389)

TOTAL EQUITY ATTRIBUTABLE

TO SHAREHOLDERS 1,267,559 1,630,067

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

CONSOLIDATED Share capital Share premium Retained

GBP GBP earnings Total

GBP GBP

As at 1 October 2017 1,357,046 8,317,410 (7,853,357) 1,821,099

Loss for the year and total

comprehensive income/(expenditure)

for the year - - (219,689) (219,689)

Transactions with owners:

Shares issued during the

year 6,500 10,500 - 17,000

Share issue Costs - - -

Share-based transactions - - 11,657 11,657

As at 30 September 2018 1,363,546 8,327,910 (8,061,389) 1,630,067

Loss for the year and total

comprehensive income/(expenditure)

for the year - - (367,872) (367,872)

Transactions with owners:

Shares issued during the - - - -

year

Share issue Costs - - - -

Share-based transactions - - 5,364 5,364

As at 30 September 2019 1,363,546 8,327,910 (8,423,897) 1,267,559

CONSOLIDATED CASH FLOW STATEMENT

As restated

2019 2018

GBP GBP

Cash flows from operating activities

Operating profit before research

and development expenditure and exceptional

costs 5,828 431,451

Research and development expenditure (408,531) (383,187)

Exceptional costs - (250,458)

Operating loss (402,703) (202,194)

Adjustments for:

Depreciation 13,482 14,763

Amortisation of intangible assets 10,458 1,081

Impairment of inventories 13,297 43,602

Decrease in inventories 142,253 112,638

Decrease in trade and other receivables 119,511 774,208

Decrease in trade and other payables (61,929) (1,256,282)

Decrease in warranty provisions (18,999) (12,978)

Share-based payments 5,364 11,657

Cash generated used in operating

activities (179,266) (513,505)

Corporation tax 64,133 47,628

Net cash flows used in operating

activities (115,133) (465,877)

Cash flows from investing activities

Interest received 892 344

Purchase of intangibles (16,915) (19,958)

Purchase of property, plant and

equipment (9,990) (2,988)

Net cash used in investing activities (26,013) (22,602)

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from issue of share

capital - 17,000

Financial costs of fundraising - -

Net cash generated from financing

activities - 17,000

Net DECREASE in cash and cash equivalents (141,146) (471,479)

Cash and cash equivalents at beginning

of year 781,635 1,253,114

Cash and cash equivalents at end

of year 640,489 781,635

Notes to the preliminary statement:

1. Basis of preparation

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 30 September 2019

and 30 September 2018 but is derived from those accounts. Statutory

accounts for 2018 have been delivered to the Registrar of

Companies, and those for 2019 will be delivered following the

Company's Annual General Meeting. The auditors have reported on

those accounts; their reports were unqualified and did not contain

statements under Section 498 of the Companies Act 2006.

Restatement of comparative period results

The directors have reassessed the classification of the R&D

tax credit in the statement of comprehensive income and decided to

present this within taxation expense for the year ended 30

September 2019 rather than other operating income. The comparative

period has been restated to be consistent and GBP47,628 previously

reported as other operating income has been reclassified and

included in taxation expense. This reclassification has also

resulted in a restatement of the operating profit before research

and development expenditure and exceptional costs and the corporate

tax receipt in the cash flow statement.

In addition the directors have reassessed the classification of

software and licensing and reclassified the presentation of this

from property plant and equipment to intangible assets for the year

ended 30 September 2019. The comparative period figures have been

restated to be consistent resulting in GBP19,958 being reclassified

from property, plant and equipment to intangible assets for the

year ended 30 September 2019.

The reclassifications explained above have not affected

previously reported profit after tax or earnings per share.

2. IFRS 2 'Share-based payments'

Operating expenses includes a charge of GBP5,364 (2018:

GBP11,657) after valuation of the Group's employee share options

schemes in accordance with IFRS 2 'Share-based payments. Under this

standard, the fair value of the options at the grant date is spread

over the vesting period. These items have been added back in the

statement of changes in equity.

3. Earnings per share

Diluted profit per share is calculated by adjusting the weighted

average number of ordinary shares in issue on the assumption of

conversion of dilutive potential ordinary shares. The Company's

dilutive potential ordinary shares are shares issued under the

Company's Enterprise Management Incentive (EMI) scheme and options

issued under the Company's Unapproved scheme. The share options

could potentially dilute basic earnings per share in the future,

but were not included in a calculation of diluted earnings per

share in the current year because they are antidilutive.

2019 2018

GBP GBP

Loss for the year (367,872) (219,689)

Weighted average number of ordinary

shares in issue 136,354,577 135,774,838

Number of diluted shares 141,966,352 141,207,627

Basic loss per share (0.27p) (0.16p)

Diluted loss per share (0.27p) (0.16p)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UGGBCPUPBGMP

(END) Dow Jones Newswires

December 03, 2019 02:00 ET (07:00 GMT)

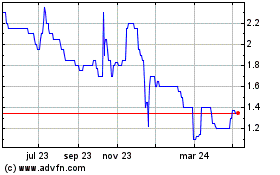

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

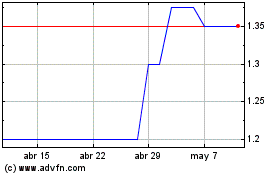

De Mar 2024 a Abr 2024

Image Scan (LSE:IGE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024