TIDMINX

RNS Number : 5688V

i-nexus Global PLC

04 December 2019

4 December 2019

i-nexus Global plc

("i-nexus", the "Company" or the "Group")

Preliminary Results

i-nexus Global plc (AIM: INX), a provider of cloud-based

Strategy Execution software solutions designed for the Global 5000,

is pleased to provide its preliminary results for the year ended 30

September 2019.

Financial Highlights

-- Group Revenue of GBP4.8m (2018: GBP4.7m)

-- Loss before tax of GBP4.3m (2018: GBP1.0m)

-- Adjusted EBITDA Loss for the financial year of GBP4.1m (2018: Loss* GBP0.6m)

-- Cash & cash equivalents as at 30 September 2019: GBP1.5m (30 September 2018 of GBP6.9m)

Operational Highlights

-- Encouraging increase in upsells and cross sells to existing

clients, delivering over GBP35k of additional Monthly Recurring

Revenue (MRR) (FY18: GBP10k)

-- Significant enhancements to product capabilities, including

the launch of two additional products into an early adopter

program; Pulse and Advisor, designed to reduce the complexity of

data entry and improving strategic insight immediately improving

customers' ROI

-- Positive progress with our partner programme with focused

discussions with several leading strategy consulting organisations

joining the programme

Post year end

-- Approximately GBP20k of additional MRR secured with existing

accounts since the start of the current financial year. Continuing

the trend seen in FY19 and helping to offset slow new deal

conversion.

*After adjusting for the non-recurring administrative expenses

of (GBP0.11m) in 2019 and (GBP0.18m) and share based payment

expense (GBP0.03m) in 2018

Simon Crowther, Chief Executive, of i-nexus Global plc,

commented: "While we did not achieve the level of overall revenue

growth we had expected in reported period, the new financial year

has started satisfactorily. Despite slower than expected

progression, we have a stronger platform from which to grow, having

created many exciting developments in our product, extended the

reach within our existing accounts, improved partner channel

relationships and have received great feedback from new and

exciting customers.

We are operating in an attractive, global market, with a wide

scope of application for the Group's proven technology, and in

which the Group is well placed.

With a clear growth strategy, strong leadership, careful cash

management, good governance and a significantly modernised product

suite, i-nexus is well positioned to build on our progress to

date."

For further information please contact:

i-nexus Global N+1 Singer (Nominated Adviser Alma PR

plc and Broker)

Via: Alma PR Tel: +44 (0)207 496 3000 Tel: +44 (0)203 405

0205

Simon Crowther, Lauren Kettle (Corporate Finance) Caroline Forde

CEO Tom Salvesen (Corporate Broking) Josh Royston

Alyson Levett,

CFO

About i-nexus Group plc

i-nexus supports some of the largest global companies in

running, improving and changing their businesses through the

provision of a scalable, enterprise-grade, cloud-based Continuous

Improvement ("CI") and Strategy Execution ("SE") software platform.

The platform is in use at global blue-chip businesses,

predominantly based across the US and Europe, helping customers

execute key strategic goals throughout all levels and divisions of

their organisations.

The Group's software supports Hoshin Kanri, a strategy

development methodology first introduced in the 1960s in Japan and

born out of lean, six sigma and operational improvement theory.

Hoshin Kanri (directly translated as "direction execution") is a

systematic planning, implementation and review methodology which,

when implemented, aims to ensure that the strategic goals of a

company are properly communicated to all employees and that they

drive progress and action at every level of the business.

i-nexus is headquartered in Coventry, UK with a sales office in

New York, and employs over 90 staff.

Chairman's Statement

This is our first full year as a plc after our IPO in June 2018

and whilst recognising that in certain respects it has been a

challenging year, with new client conversion being slower than

anticipated, the team have focused on developing our product range

in order to broaden our applicability to clients. I am pleased that

the team continue to rise to the challenge of building an

international enterprise SaaS business. Many aspects of the

business have been transformed from a year ago.

The Company remains focused on developing, delivering and

implementing cloud-based Operational Excellence (OE) and Strategic

Execution (SE) software as a service ("SaaS") solutions to

digitalise our customers' enterprise programmes. Our customers are

typically Global 5000 companies running large, complex OE and SE

programmes; it is within this setting that our technology platform

has the greatest applicability and where it can add most value.

Despite our relative size and stage of development, we count a

growing number of large, well established enterprises as customers,

which are increasingly using i-nexus at the core of their business

processes.

As a Board, at IPO we defined three crucial areas of business

development to take the business to the next stage, being:

-- Enhance the Company's go to market capabilities

-- Develop our products capabilities

-- Scale the Company's partner programme

The Group has invested significantly in all areas, but the

substantial investment made in our go to market teams has not yet

delivered the returns we had expected. However, we remain confident

that our differentiated and enhanced technology offering, growing

applicability and evolving customer relationships leave us well

positioned for the future.

The Group has also invested heavily in our Customer Success

teams in order to reduce churn and allow us to drive service and

upsell revenues. Whilst frustrating that client churn, in

particular at the start of the year, offset the progress made with

new customer wins and upsells, this investment has resulted in a

higher level of engagement with a greater number of prospects and

stronger relationships with our existing customer base.

The quality, functionality and evolution of our product is

critical to our ability to grow our applicability, retain and

expand with our current customers and attract new ones. New EVP of

Product, James Davies, has refocused our product strategy to meet

the needs of the three distinct sets of users of i-nexus. Details

of the advancements made will be covered in detail elsewhere in

this report, but as a Board we are excited about where this can

take us.

Part of our defined growth strategy is to efficiently expand our

market reach through growing our partnerships with specialist

consulting organisations. Pleasingly, we have seen a positive

response from several organisations wishing to use our platform to

replace the currently manual processes with a digital offering to

deploy within their corporate clients. Potential partners see this

as offering a competitive edge and embedding them more deeply with

the organisations they support. It is early days, but traction is

increasing and we expect to benefit from delivering lower-cost,

high-quality leads for i-nexus.

Notwithstanding the positive progress made, the Board recognises

that during this period, sales have fallen short of our

expectations. We expect good levels of cash inflows in Q2 from

recently secured customer renewals (in some cases also benefiting

from improved adoption), however it is vital that the business

focuses on tight cash management, as such this is an ongoing key

priority of Board and management discussions.

On behalf of the Board, I would like to thank all i-nexus staff

for the contribution they have made to the successful growth and

development of the Group in 2019 through their hard work and

collaboration.

In 2020, the Board and management of i-nexus Global plc are

focused on improving the execution of our go-to-market strategy and

continuing the progress made in 2019 on the other core strategic

areas of development identified above, while maintaining the

principle of careful cash management and sound governance.

Despite the challenging global headwinds, we look forward to the

next 12 months with cautious optimism. During tough economic times

large enterprises will focus unremittingly on being ever more

competitive and we believe Operational Excellence and Strategy

Execution are at the core of achieving these goals. For these

enterprises to successfully implement such programmes requires

automation and the i-nexus products offer a market leading solution

to this challenge.

I look forward to engaging further with shareholders at our AGM

in February.

CEO Statement

Though last year was a year of strategic progress across many

fronts, as a result of both internal and external factors, this

progress did not translate into the level of overall revenue growth

we had originally expected.

What we did see as encouraging, and testament to our strategic

focus on Customer Success, was a substantial increase in upsells

and cross sells to existing clients as our teams worked with

customers to unlock the full potential of i-nexus' SaaS solution.

This increase in upsells and cross sells and associated service

revenue has helped offset slower than expected new deal conversion

and the previously reported customer churn early in the year. The

benefits of our platform when deployed effectively within

method-mature clients is demonstrated by this increasing adoption

at our existing client base.

Our Growth Strategy

Strategy Execution is increasingly recognised as a fundamentally

important process at the core of every enterprise which only

becomes more complex and challenging to manage as the organisation

grows. i-nexus' mission is to be synonymous with Strategy

Execution; when organisations talk of delivering on their strategy,

they should see i-nexus as a preferred solution.

At i-nexus we have a well-developed Hoshin Kanri strategic plan,

which we have spent the past year executing on. This has been

essential for us to deploy growth capital appropriately and

carefully manage our own transformation.

The detail of the priorities we have had this year in terms of

delivering on these Strategic Objectives are extensive, however I

would like to pull out some key highlights that I think frame this

year's result.

During FY19 the Company invested significantly in its Sales and

Marketing capabilities. Despite this, our new business performance

in the year was below our expectations. This is clearly very

disappointing, but we remain encouraged and optimistic as to the

quality and the development of our pipeline of new customer

opportunities. As a result of the lessons learned in FY19, we are

constantly reviewing and refining our approach to new business

conversion. We believe that our ability to capitalise on the

increased quality and volume of opportunities, both within existing

and for new accounts, will improve as we implement further

enhancements to our go-to-market strategy.

Where we have seen a stronger return on our investment is our

reach within existing accounts. A strong team of Customer Success

Executives coupled with experienced new Account Executives have

made great inroads in both growing the recurring revenue from our

existing accounts and enhancing the visibility in and knowledge of

our existing accounts to help de-risk churn.

We now have 100% coverage across all of our customer accounts,

both in terms of regular senior level interaction and engagement.

The introduction of a market leading success tool means we now have

a live dashboard covering a variety of success measures to

understand the health of all our accounts. These two things ensure

that we really understand the health of a deployment both in terms

of driving increasing adoption but also the potential risks or

early warning signs that could lead to churn or a reduced renewal.

Whilst our success in embedding our solutions with customers and

driving reduction in churn will only truly be seen in this coming

year, we have seen improved adoption across our customer accounts

already.

This expanded reach within our customers and improved adoption

provides i-nexus with the opportunity to add incremental service

and recurring SaaS revenues. During FY19, we benefitted from both

upsells and cross sells within a number of our existing accounts,

delivering over GBP35k of additional Monthly Recurring Revenue

(MRR), comparing favourably to the previous year (FY18: GBP10k). We

are seeing a continuation of this trend so far in FY20.

Driving an innovative approach in Product development has also

been a strong focus this year in order to grow our applicability to

clients and verticals that we can target.

Following a strategic product review earlier this year, i-nexus

is pleased to announce that two new products, i-nexus Pulse and

i-nexus Advisor, have been made available to select customers as

beta products. The revised product suite now includes i-nexus

Workbench (historically the company's flagship solution) and the

two new products, i-nexus Pulse and i-nexus Advisor, both built on

a new cloud-native architecture and both designed as mobile-fast

applications supporting a range of different devices.

I-nexus Pulse targets the majority of i-nexus users who need to

quickly and easily enter updates to metrics and projects. i-nexus

Advisor, on the other hand, provides executives and strategy

leaders with real-time visibility through data visualisation into

the robustness of strategic plans, delivery of projects against

these plans, and the measurable value attributed to the projects

towards strategic objectives.

I-nexus Workbench remains focused on the needs of expert users

and practitioners. A major release of Workbench is planned for 1H

CY20, introducing a new user experience to match the modern

interface introduced in i-nexus Pulse and i-nexus Advisor

We have continued to develop relationships with potential

channel partners, which is a critical adjunct to our direct sales

capabilities. New partners are typically specialist operational

excellence and strategy execution consulting firms looking to

digitalise their current manual implementations. Across the sector,

partners have acknowledged the need for such digitalisation if

customers are to realise the true benefits of their operational

excellence and strategy execution programmes, also recognising that

manual implementation of complex, growing OE and SE programmes is

unsustainable. What is positive is that these consulting firms are

actively seeking us out, in search of a digital solution to offer

their customers to differentiate them within their competitive

landscape. This was a significant change in FY19 that we are

looking to capitalise on. The challenge is to persuade partners and

customers to move from predominantly in-house developed solutions.

Although early days, these relationships are leading to

opportunities for i-nexus with mature operational excellence and

strategy execution customers who recognise the challenges of

in-house implementation platforms.

Our people

Our people are pivotal in driving us forwards and delivering on

our goals. We have invested substantially in new employees this

year to support our core strategies and to build out the structures

and departments needed by i-nexus going forward. Our employee

numbers have increased from 62 at the end of FY18 to 94 as at 30

September 2019. This growth has been tempered in the light of our

rate of sales delivery; and the Board has always and continues to

consider it key to maintain a careful, balanced approach to growing

the business and prudent cash management.

Looking ahead

I am excited about the future. While we did not achieve the

level of overall revenue growth we had expected in reported period,

the new financial year has started satisfactorily. Despite slower

than expected progression, we have a stronger platform from which

to grow, having created many exciting developments in our product,

extended the reach within our existing accounts, improved partner

channel relationships and have received great feedback from new and

exciting customers.

We are operating in an attractive, global market, with a wide

scope of application for the Group's proven technology, and in

which the Group is well placed.

With a clear growth strategy, strong leadership, careful cash

management, good governance and a significantly modernised product

suite, i-nexus is well positioned to build on our progress to

date

CFO's Report

Reported revenue

Revenue was flat at GBP4.8m (FY18: GBP4.7m) as both internal and

external factors adversely affected our rate of new deal

conversion. The Group signed 8 new customers (FY18: 10), all under

recurring contracts of at least one year in length, typically paid

annually in advance. Upsells and cross sells in our existing

accounts were substantially higher in FY19, having added GBP35k

Monthly Recurring Revenue ("MRR") (FY18: GBP10k). This is clearly

encouraging and demonstrates a good initial return on our

investments in Customer Success, however some exceptional and in

part unexpected customer churn largely outweighed this growth, and

we exited FY19 with closing MRR of GBP340k (FY18 exit MRR:

GBP335k).

Revenue from recurring contracted software subscriptions was

GBP4.0m (FY18: GBP4.0m) and from associated professional services

was GBP0.8m (FY18: GBP0.7m). After a sound start to the year in

terms of professional services billing, this also weakened in the

second half, due to the lack of new deals, giving us the

opportunity to invest resource in developing relationships with

potential Channel Partners and existing accounts.

Gross Margin

Gross margin in the year was GBP3.5m, or 74% (FY18: GBP3.3m, or

69%) after accounting for commission payable to the Group's

business partners. This improvement in margin demonstrates the

results of our investment program, as anticipated. Reported gross

margin is the combined gross margin over both recurring software

subscriptions and professional services.

Overheads

Overhead (de ned as the aggregate of staff costs, other

operating expenses but excluding those costs included in cost of

sale, depreciation of tangible assets and amortisation of

intangible assets, and share based payment charges) increased in

the year from GBP4.1m to GBP7.8m. We have managed our post IPO

investments in the light of weaker sales delivery to protect our

cash position and overall P&L result and savings to our

originally projected investment plan have been made without

jeopardising our overall strategy for future growth. Included in

these overheads was GBP0.1m of non-recurring administrative

expenses. Interest expense at GBP67k is down on the previous year

as debt has been repaid.

Capitalised development costs amounted to GBP0.6m in the year.

The additional development capacity is contributing to the Groups'

products marketability and the product enhancements made recently

are strategically important to us and our current customers and

prospects.

Group Loss before taxation rose from GBP1.0m in FY18 to GBP4.3m,

a result that reflects the rate of investments made. At this

critical stage in i-nexus growth, the investment has been necessary

to fuel our ambition to become the leading enterprise software

provider in the Strategy Execution market.

Cash Flow

The Group has cash & cash equivalents at the period end of

GBP1.5m (2018: GBP6.9m). Gross debt at 30 September was GBP0.4m of

which GBP0.2m was payable within one year.

The Group experienced a net out ow of funds from operating

activities of GBP4.2m (2018 GBP0.6m). The Group had a cash out ow

of GBP0.4m (2018 GBP1.5m) from the servicing of its debt nance.

The Group continues to apply treasury and foreign currency

exposure management policies to minimise both the cost of nance and

our exposure to foreign currency exchange rate uctuations.

Careful cash management will continue to be a priority focus for

management and the Board for the foreseeable future. We regularly

undertake scenario planning and create contingency plans

accordingly.

The Board's assessment in relation to going concern is included

in Note 2 of the financial information. The Group's principal risks

and uncertainties are set out in Note 8 of the financial

information.

Capital expenditure

The Group operates an asset light strategy and has low capital

requirements, therefore expenditure on tangible xed assets is low

at 5% of revenue (2018: 3.4%).

Consolidated statement of comprehensive income for the year

ended 30 September 2019

Year ended As restated

30 September Year ended

2019 30 September

GBP 2018

Notes GBP

Revenue 3 4,759,072 4,741,916

Cost of sales (1,212,175) (1,488,028)

Gross profit 3,546,897 3,253,887

Administrative expenses (7,817,864) (4,139,628)

Operating loss (4,270,966) (885,741)

Adjusted EBITDA 4 (4,050,689) (626,916)

--------------- ---------------

Depreciation and profit/loss on disposal (105,977) (53,737)

Share based payment expense - (30,000)

Non-underlying items (114,300) (175,088)

Finance income 6,904 1,847

Finance costs (66,838) (124,384)

Loss before taxation (4,330,901) (1,008,278)

Tax expense 401,164 186,957

Loss for the year (3,929,738) (821,321)

Other comprehensive income:

Exchange differences arising on translation

of foreign operations 163,438 (54)

Loss on net investment hedge (92,158) (28,529)

Total comprehensive loss for the year (3,858,458) (849,903)

--------------- ---------------

Attributable to equity holders of

company (3,858,458) (849,903)

--------------- ---------------

GBP GBP

--------------- ---------------

Basic and diluted loss per share 5 (0.13) (0.05)

--------------- ---------------

Consolidated statement of financial position as at 30 September

2019

ASSETS Notes 30 September As restated

2019 30 September

GBP 2018

GBP

Non-current assets

Intangible assets 618,609 55,011

Property, plant and equipment 339,131 199,222

Total non-current assets 957,740 254,233

-------------- --------------

Current assets

Trade and other receivables 1,418,293 1,751,956

Current tax receivable 400,000 183,162

Cash and cash equivalents 1,533,323 6,940,573

-------------- --------------

Total current assets 3,351,616 8,875,691

-------------- --------------

Total assets 4,309,356 9,129,924

-------------- --------------

LIABILITIES

Current liabilities

Borrowings 6 159,730 298,998

Trade and other payables 942,210 904,668

Deferred income 1,541,109 2,064,295

Total current liabilities 2,643,049 3,267,961

-------------- --------------

Non-current liabilities

Borrowings 243,500 403,230

Provisions 80,702 80,702

-------------- --------------

Total non-current liabilities 324,202 483,932

-------------- --------------

Total liabilities 2,967,251 3,751,893

-------------- --------------

Net assets 1,342,105 5,378,031

Equity

Share capital 7 2,957,161 2,957,161

Share premium 7,256,188 7,256,188

Capital redemption reserve - -

Share based payment reserve - -

Foreign exchange reserve (23,538) (9,508)

Merger reserve 10,653,881 10,653,881

Accumulated losses (19,501,587) (15,479,691)

-------------- --------------

Total equity 1,342,105 5,378,031

============== ==============

Consolidated statement of changes in equity for the year ended

30 September 2019

Issued Share Capital Share Foreign Merger Accumulated Total

capital premium redemption based exchange reserve losses equity

reserve payment reserve

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 October

2017 1,417,216 4,086,013 6,468,287 23,578 (9,454) - (14,307,385) (2,321,745)

Effective new

standards

adopted in

year

Effective - - - - - - (140,108) (140,108)

prior year

adjustments - - - - - - (235,929) (235,929)

As restated at

1 October

2017 1,417,216 4,086,013 6,468,287 23,578 (9,454) - (14,683,422) (2,697,782)

Loss for

period - - - - - - (821,318) (821,318)

Other

comprehensive

income - - - - (54) - (28,529) (28,583)

Transfer to

merger

reserve - (4,085,249) (6,468,287) - - 10,553,536 - -

Transfer to

losses - - - (53,578) - - 53,578 -

Issue of share

capital 1,539,945 8,461,426 - - - 100,345 - 10,101,716

Issue costs - (1,206,002) - - - - - (1,206,002)

Share based

payment

expense - - - 30,000 - - - 30,000

At 30

September

2018 2,957,161 7,256,188 - - (9,508) 10,653,881 (15,479,691) 5,378,031

Loss for the

year - - - - - - (3,929,738) (3,929,738)

Other

comprehensive

income - - - - (14,030) - (92,158) (106,188)

Share based - - - - - - - -

payments

At 30

September

2019 2,957,161 7,256,188 - - (23,538) 10,653,881 (19,501,587) 1,342,105

============ ============ ============ ========= ========== =========== =============== ==============

Consolidated Statement of cash flows for the year ending 30

September 2019

Group Group

Year ended Year ended

Notes 30 September 30 September

2019 2018

GBP GBP

Cash flows from operating activities

Loss before taxation (4,330,901) (1,008,275)

Adjustments for non-cash/non-operating

items:

Depreciation and profit on disposals 105,977 53,737

IPO Costs - 175,088

Share based payments - 30,000

Finance income (6,904) (1,847)

Finance charges 66,838 124,384

------------- -------------

(4,164,990) (626,390)

------------- -------------

Changes in working capital:

(Increase) in trade and other

receivables 216,825 (250,945)

(Decrease)/increase in trade

and other payables (485,645) (976,966)

Taxation 301,164 282,671

------------- -------------

Net cash from operating activities (4,224,804) (1,571,630)

------------- -------------

Cash flows from investing activities

Purchase of property, plant and

equipment (245,886) (118,141)

Purchase of development costs (563,598) (55,011)

Interest received 6,904 1,847

------------- -------------

Net cash flow from investing

activities (802,580) (171,305)

------------- -------------

Cash flows from financing activities

Proceeds from shares - 9,982,508

Less issue costs - (1,381,090)

Proceeds from borrowings - 1,299,863

Repayment of borrowings (298,998) (1,338,486)

Interest paid (66,838) (124,384)

------------- -------------

Net cash flow from financing

activities (365,836) 8,438,411

------------- -------------

Net increase in cash and cash

equivalents (5,393,220) 6,694,953

------------- -------------

Cash and cash equivalents beginning

of period 6,940,573 245,674

Effect of foreign exchange rate

changes (14,030) (54)

------------- -------------

Cash and cash equivalents at

the end of the period 1,533,323 6,940,573

============= =============

1. General information

i-nexus Global PLC is a public company limited by shares

incorporated in England and Wales (registration number 11321642).

The registered office and principal place of business is i-nexus,

i-nexus Suite, George House, Herald Avenue, Coventry Business Park,

Coventry, CV5 6UB.

The principal activity of i-nexus Global plc and its

subsidiaries (the Group) is that of development and sale of

Enterprise cloud-based software on a software-as-a-service (SaaS)

basis and associated maintenance, support, software customisation

and professional consultancy services.

2. Significant accounting policies

The following principal accounting policies have been used

consistently in the preparation of consolidated financial

statements.

Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union, in accordance with the IFRS Interpretations

Committee ("IFRIC") interpretations, and with those parts of the

Companies Act 2006 as applicable to companies reporting under IFRS.

The financial statements comply with IFRS as issued by the

International Accounting Standards Board (IASB).

The financial statements are prepared in sterling, which is the

presentational currency of the company. Monetary amounts in these

financial statements are rounded to the nearest GBP1.

Historical cost convention

The financial statements have been prepared under the historical

cost convention except for the following:

-- The business combination of i-Solutions Global Limited by

i-nexus Global plc is accounted for under the merger method

-- The use of fair value for financial instruments measured at fair value

Basis of consolidation

The financial statements incorporate the results of i-nexus

Global plc and all of its subsidiary undertakings as at 30

September 2019.

The accounting treatment in relation to the addition of i-nexus

Global plc as a new UK holding company of the Group fell outside

the scope of IFRS 3 'Business Combinations'. The share scheme

arrangement constituted a common control combination of the

entities. This was as a result of all the shareholders of i-nexus

Global plc being issued shares in the same proportion, and the

continuity of ultimate controlling parties. The Directors believe

that this approach presents fairly the financial performance,

financial position and cash flows of the Group.

Going concern

This historical financial information relating to i-nexus Global

plc has been prepared on the going concern basis.

The Group prepares regular business forecasts and monitors its

projected cash flows, which are reviewed by the Board. Forecasts

are adjusted for reasonable sensitivities that address the

principal risks and uncertainties to which the Group is exposed,

thus creating a number of different scenarios for the Board to

challenge. In those cases, where scenarios deplete the Group's cash

resources too rapidly, consideration is given to the potential

actions available to management to mitigate the impact of one or

more of these sensitivities, in particular the discretionary nature

of costs incurred by the Group, in order to ensure the continued

availability of funds. The Board have also taken into account that

the Group does not have access to bank debt and securing any

additional funding would rely on the future issue of shares or

access to non-bank debt.

On the basis of this analysis, after challenging and requiring

suitable variations be made to the scenarios presented, the Board

has concluded that there is a reasonable expectation that the Group

will have adequate resources to continue in operational existence

for the foreseeable future being a period of at least twelve months

from the balance sheet date.

Accordingly, the Group has continued to adopt the going concern

basis in preparing its financial statements for the year ended 30

September 2019.

Abridged financial information

The financial information in this announcement which was

approved by the Board of Directors does not constitute the

Company's statutory accounts for the year ended 30 September 2018.

This is the first set of accounts since incorporation of the

company on 20 April 2018.

This preliminary announcement has been prepared in accordance

with the accounting policies under IFRS as adopted by the EU.

Whilst the financial information included in this preliminary

announcement has been prepared in accordance with IFRS, this

announcement does not itself contain sufficient information to

comply with IFRS. This preliminary announcement constitutes a

dissemination announcement in accordance with Section 6.3 of the

Disclosures and Transparency Rules (DTR).

3. Revenue and segmental reporting

The Group has one single business segment and therefore all

revenue is derived from the rendering of services as stated in the

principal activity. The group operates four geographical segments,

as set out below. This is consistent with the internal reporting

provided to the chief operating decision maker. The chief operating

decision maker, who is responsible for allocating resources and

assessing performance, has been identified as the management team

comprising the executive directors who make strategic

decisions.

Year ended As restated

30 September Year ended

2019 30 September

GBP 2018

GBP

United Kingdom 928,733 805,941

Rest of Europe 1,624,195 1,927,849

United States 2,029,839 1,917,689

Rest of the World 176,305 90,437

--------------- --------------

4,759,072 4,741,916

=============== ==============

The Group has two main revenue streams in each of the years

presented, as detailed below:

Year ended As restated

30 September Year ended

2019 30 September

GBP 2018

GBP

Licence 4,027,129 4,033,811

Services 731,943 708,105

4,759,072 4,741,916

=============== ==============

4. Adjusted EBITDA

Year ended Year ended

30 September 30 September

2019 2018

GBP GBP

Operating loss (4,270,966) (885,738)

Add back:

Depreciation and profit/loss on disposal 105,977 53,737

Share based payment expense - 30,000

Non-underlying items 114,300 175,088

-------------- --------------

Adjusted EBITDA (4,050,689) (626,913)

============== ==============

5. Loss per share

The loss per share has been calculated using the loss for the

year and the weighted average number

of ordinary shares outstanding during the year, as follows:

Year ended Year ended

30 September 30 September

2019 2018

GBP GBP

Loss for the period attributable to equity

holders of the company (3,858,458) (849,806)

-------------- --------------

Weighted average number of ordinary shares 29,571,610 18,495,089

-------------- --------------

Loss per share (0.13) (0.05)

============== ==============

6. Borrowings

Group

At 30 September At 30 September

2019 2018

GBP GBP

Current

Venture debt 159.730 298,998

159,730 298,998

---------------- ----------------

Non-current

Venture debt 243,500 403,230

243,500 403,230

---------------- ----------------

Total borrowings 403,230 702,228

================ ================

Venture debt

The venture debt is secured by way of a fixed and floating

charges over the title of all assets held by i-Solutions Global

Limited. The venture debt has a fixed interest rate of the higher

of 11.5 per cent. per annum or LIBOR plus 8 per cent. per

annum.

The Group borrowings are repayable as follows:

At 30 September As restated

2019 At 30 September

GBP 2018

GBP

Within 1 year 159,730 298,998

Between 1 year and 2 years 179,098 159,730

Between 2 years and 5 years 64,402 243,500

403,230 702,228

================ =================

The directors consider the value of all financial liabilities to

be equivalent to their fair value.

7. Share capital

Group

At At

30 September 30 September

2019 2018

GBP GBP

Authorised, allotted, called

up and fully paid

29,571,605 Ordinary shares

of GBP0.10 each 2,957,161 2,957,161

2,957,161 2,957,161

============== ==============

Fully paid shares, which have a par value of GBP0.10, carry one

vote per share and carry rights to a dividend.

Reconciliation of movement in shares during the year

Group

Ordinary Ordinary

number number

GBP1 shares GBP0.10 shares

At 1 October 2017 1,417,216 10

Subdivision of shares (1,417,216) 14,172,160

Exercise of options - 2,186,920

Conversion of loan notes - 188,620

IPO share issue - 13,023,895

------------

At 30 September 2018 - 29,571,605

============ ===============

Company

At 30 September At 30 September

2019 2018

GBP GBP

Authorised, allotted, called up and

fully paid

29,571,605 Ordinary shares of GBP0.10

each 2,957,161 2,957,161

2,957,161 2,957,161

--------------------------------- ================

Fully paid shares, which have a par value of GBP0.10, carry one

vote per share and carry rights to a dividend.

The company issued no new shares in the year.

8. Principle risks and uncertainties

Although the directors seek to minimise the impact of risk

factors, the Group is subject to a number, of those most relevant

are as follows:

Customer churn

The Group has experienced falling revenues in relation to

certain customers in the past. The reasons for this are varied and

our historical ability to invest in our customers was limited. So

whilst the ramp up in investments is seeing benefits Customer churn

is still a risk for the Group and could affect the Group's trading

and financial position and prospects.

Failure of strategy execution market to grow at the rate

expected

The Directors believe that there is strong evidence supporting

the growth in the adoption of Strategy Execution software. However,

there can be no assurance that this growth will happen at the rate

envisaged by the Directors. If the market fails to adopt Strategy

Execution software at the rate envisaged then this will affect the

Group's future success and adversely affect its business, prospects

and results of operations and financial position.

The Group may face competition in a rapidly evolving market

The Group may face an increasing amount of competition in the

future as the market expands, making entry to it more attractive.

The entry into the market of strong, well-funded competitors,

including, but not limited to, in-house systems developed by either

internal IT departments or third-party consulting firms/system

integrators could have a negative impact on sales volumes or profit

margins achieved by the Company in the future.

Risks relating to growth plans

The Company's strategy depends upon market acceptance of its

solution to support its growth plans. There is a risk that if the

i-nexus solution is not accepted by the market as effectively as

the Board anticipate, the Company's investment in sales, marketing

and development of the i-nexus solution may exceed revenue growth,

which could likewise impact upon the Group's financial position and

prospects.

9. Forward-looking statements

This announcement may include certain forward-looking

statements, beliefs or opinions, including statements with respect

to the Group's business, financial condition and results of

operations. These forward-looking statements can be identified by

the use of forward-looking terminology, including the terms

"believes", "estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology. These statements are made by the

Directors in good faith based on the information available to them

at the date of this announcement and reflect the Directors' beliefs

and expectations. By their nature these statements involve risk and

uncertainty because they relate to events and depend on

circumstances that may or may not occur in the future. A number of

factors could cause actual results and developments to differ

materially from those expressed or implied by the forward-looking

statements, including, without limitation, developments in the

global economy, changes in government policies, spending and

procurement methodologies, and failure in health, safety or

environmental policies. No representation or warranty is made that

any of these statements or forecasts will come to pass or that any

forecast results will be achieved. Forward-looking statements speak

only as at the date of this

announcement and the Company and its advisers expressly disclaim

any obligations or undertaking to release any update of, or

revisions to, any forward-looking statements in this announcement.

No statement in the announcement is intended to be, or intended to

be construed as, a profit forecast or to be interpreted to mean

that earnings per share for the current or future financial years

will necessarily match or exceed the historical earnings. As a

result, you are cautioned not to place any undue reliance on such

forward-looking statements.

10. Availability of Report and Accounts

The audited report and accounts for the year ended 30 September

2019 will be published and posted to shareholders in due course.

Following publication a soft copy of the report and accounts will

also be available to download from the Company's website,

www.i-nexus.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR GMMGZGFLGLZZ

(END) Dow Jones Newswires

December 04, 2019 02:00 ET (07:00 GMT)

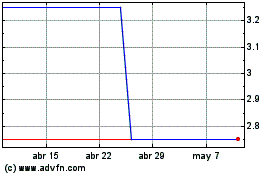

I-nexus Global (LSE:INX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

I-nexus Global (LSE:INX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024