Primorus Investments PLC Greatland Gold Investment Update (4302W)

11 Diciembre 2019 - 1:00AM

UK Regulatory

TIDMPRIM

RNS Number : 4302W

Primorus Investments PLC

11 December 2019

Primorus Investments plc

("Primorus" or the "Company")

Greatland Gold Investment Update

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide an investor update regarding its current holding in

Greatland Gold PLC ("Greatland") (AIM: GGP) following a meeting

with the Greatland executive team subsequent to the Annual General

Meeting attended by Primorus on 3 December 2019.

Highlights

-- Newcrest drilling expands already very large Havieron footprint 300m to the North.

-- Primorus believes Havieron is a Tier 1 Australian Gold/Copper deposit that may host 20Moz+.

-- High priority project with 6 rigs to work throughout the Australian summer.

-- 100% owned Scallywag a potential second Havieron

-- Look to add to investment as the Board believes Greatland shares currently undervalued.

Background

Greatland Gold PLC is an AIM-listed precious and base metals

exploration and development company with several active projects in

Western Australia and Tasmania. Greatland has a market

capitalisation of circa GBP59 million at the time of writing. The

Havieron Gold/Copper Project near the Telfer mine in the Paterson

Province region of Western Australia is Greatland's most advanced

exploration project to date and is subject to an up to US$65

million farm-in agreement ("Farm-in Agreement") with the owner of

the Telfer mine, Newcrest Mining Limited ("Newcrest") (ASX: NCM),

Australia's largest ASX-listed gold producer.

Primorus began buying shares in Greatland in October 2018 and

now holds circa 37 million shares at an average price of 1.71p per

share representing approximately 1.03% of the issued capital of

Greatland. The Shares of Greatland have traded between 1.49p and

2.5p with a price at the time of writing of 1.64p. The Greatland

investment at circa GBP607,000 "mark to market" value is currently

Primorus's largest listed investment.

Alastair Clayton, Executive Director of Primorus summarised the

meetings:

"We came away from the Greatland Gold AGM and follow-on

management meeting with a new sense of excitement as to the

potential scale of Havieron. Drilling reported last week from hole

HAD023 has demonstrated that Havieron continues at least 300m to

the North of the initial discovery area around HAD005. A review of

drill plans in the AGM presentation and publicly available

Satellite data suggest that even today current drilling is still

working to find the limits of the deposit.

With a working geological model now developed at Havieron, we

also look with some excitement at GGP's nearby Scallywag Project

where analogous geology and new geophysical modelling make the case

for similar mineralisation but at levels much closer to the surface

than at Havieron. Importantly the Scallywag Project is not subject

to the Newcrest Farm-in Agreement and is thus 100% owned by

Greatland.

Back in late 2018 we took an investment position based on a

handful of exciting drill holes and a belief that Havieron may

prove to be a meaningful deposit. Twelve months later, with

Newcrest now farming in to Havieron is, in our opinion, shaping up

as a truly Tier 1 Australian Gold/Copper discovery that with

continued exploration success has the potential to deliver in

excess of 20Moz of gold and associated copper.

We are not aware of any other exposure for investors to

Australian Tier 1 mining projects on the London Stock Exchange

outside of Rio Tinto (RIO.L), Anglo American (AAL.L) and BHP

(BHP.L).

From a purely financial perspective incongruously the Greatland

Share price is actually below where it was the same time last year.

With gold prices still buoyant this goes against what we would

expect. The norms of gold exploration suggest that drilling ounces

are "banked" with each success and the asset value growth is

reflected in the share price.

The Primorus Board believes Greatland is a highly unusual

outlier in a market consumed by liquidity concerns and devoid of

the traditional small to medium institutional investors that

elsewhere in the world invest in maturing but pre-resource gold

companies. Regardless, we understand that drilled ounces don't just

disappear, and we are at a loss to explain why the overall market

is discounting the strong drill results each time they are released

by Newcrest.

Given our views on Havieron stated above, we see this as an

opportunity and may add to our investment should funds be available

to do so. I would like to thank the executive team at Greatland for

their hard work in 2019 and believe 2020 will be the year in which

we will reap the rewards of patience and belief in our investment

in Greatland Gold."

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3657 0050

Turner Pope Investments

Andy Thacker / Zoe Alexander

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFFSFASFUSESE

(END) Dow Jones Newswires

December 11, 2019 02:00 ET (07:00 GMT)

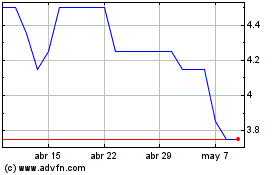

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024