TIDMIMM

RNS Number : 0455X

Immupharma PLC

17 December 2019

RNS |17 December 2019

ImmuPharma PLC

("ImmuPharma" or the "Company")

Publication of Information Note

In advance to admission to trading on Euronext Growth

Brussels

ImmuPharma PLC (LSE:IMM), a specialist drug discovery and

development company, is pleased to announce that, further to the

announcement of 13 December 2019, that its shares will be admitted

to trading on Euronext Growth Brussels ("Euronext") under ticker

'ALIMM', it has today published the Information Note, as required

by the Euronext Growth Market Rules Book and Belgian financial

regulations.

The Information Note is available on ImmuPharma's website

www.immupharma.co.uk. Attention is drawn to certain financial

information on a period subsequent to that notified in our Interim

Results which is included in Parts II and IV of the Information

Note which is notifiable under AIM Rule 11. This information is set

out in the Appendix below.

Admission to Euronext is expected to take effect from 19

December 2019. This new listing does not affect the trading of

ImmuPharma's shares on AIM, nor is there any intention from the

Company to raise additional funds from either AIM or Euronext.

The dual listing on Euronext Growth Brussels aims to further

increase the visibility of ImmuPharma's shares in continental

Europe and with European investors, following the Company's recent

deal with Avion Pharmaceuticals, who are now funding an

international Phase III trial for the lead programme, Lupuzor(TM).

The investment thesis for ImmuPharma and specifically Lupuzor(TM)

has been repositioned and the Company looks forward to providing

further progress updates on the Phase III program with Avion, as

well as entering into additional partnerships outside of the

US.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. ("MAR")

For further information please contact:

ImmuPharma PLC (www.immupharma.com)

Tim McCarthy, Chairman + 44 (0) 207 152 4080

Dimitri Dimitriou, Chief Executive Officer

Lisa Baderoon, Head of Investor Relations + 44 (0) 7721 413496

SPARK Advisory Partners Limited (NOMAD)

Neil Baldwin +44 (0) 203 368 8974

Vassil Kirtchev

Stanford Capital Partners (Joint Broker)

Patrick Claridge, John Howes +44 (0) 203 815 8880

SI Capital (Joint Broker)

Nick Emerson +44 (0) 1483 413500

4Reliance (Euronext Growth Listing Sponsor) +32 (0) 2 747 02 60

Jean-Charles Snoy

Degroof Petercam (Liquidity Provider) +32 (0) 2 287 95 34

Erik De Clippel

Backstage Communication

Olivier Duquaine +32 (0) 477 504 784

Jean-Louis Dubrule +32 (0) 497 50 84 03

Notes to Editors

About ImmuPharma PLC

ImmuPharma PLC (LSE AIM: IMM - Euronext Growth: ALIMM) is a

specialty biopharmaceutical company that discovers and develops

peptide-based therapeutics. The Company's portfolio includes novel

peptide therapeutics for autoimmune diseases, metabolic diseases

and cancer. The lead program, Lupuzor(TM), is a first-in class

autophagy immunomodulator which is in Phase III for the treatment

of lupus and preclinical analysis suggest therapeutic activity for

many other autoimmune diseases that share the same autophagy

mechanism of action. ImmuPharma and Avion Pharmaceuticals signed on

29 November 2019, an exclusive licence and development agreement

and trademark agreement for Lupuzor(TM) to fund a new international

Phase III trial for Lupuzor(TM) and commercialise in the US. For

additional information about ImmuPharma please visit

www.immupharma.com.

About Avion Pharmaceuticals

Avion Pharmaceuticals, LLC is a US-based specialty

pharmaceutical company formed to develop, acquire and market a

portfolio of innovative pharmaceutical products in the Women's

Health and other therapeutic categories aligned with our mission to

improve the quality of patient lives. Avion Pharmaceuticals focuses

on identifying opportunities to develop, acquire and enhance the

market potential of innovative, commercially available therapeutics

and late-stage development drugs to fulfil unmet medical needs. For

additional information about Avion Pharmaceuticals, visit

www.avionrx.com.

About Lupuzor(TM) and Lupus

Lupuzor(TM) is ImmuPharma's lead compound, a peptide therapeutic

and a first-in class autophagy immunomodulator for systemic lupus

erythematosus (SLE or lupus) a potentially life-threatening

auto-immune disease. Lupus is a chronic inflammatory disease which

is thought to affect some 5 million individuals worldwide. The

current standard of care still consists of drugs which have many

side-effects and limited efficacy. Despite the need for an

effective treatment, only one new therapy, namely GlaxoSmithKline's

Benlysta, has been approved to treat the condition over the past 50

years. As such, there clearly exists an unmet medical need for a

drug that has a strong efficacy and safety profile.

Appendix

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 SEPTEMBER

2019

Unaudited Audited

9 months Year

ended 30 ended 31

September December

2019 2018

GBP GBP

Cash flows from operating activities

Cash used in operations (2,549,281) (5,606,138)

Taxation (543,668) 889,787

Interest paid (3,208) (4,783)

Net cash used in operating

activities (3,096,157) (4,721,134)

------------------------- ----------------------------

Investing activities

Purchase of property plant

and equipment (6,003) (102,880)

Purchase of investments - (2,000,000)

Interest received 4,986 12,491

Net cash used in investing

activities (1,017) (2,090,389)

------------------------- ----------------------------

Financing activities

(Decrease)/increase in bank

overdraft (253) (72)

Loan repayments (68,861) (138,809)

Settlements from Sharing agreement 74,901 -

Gross proceeds from issue of

new share capital - 10,000,000

Share capital issue costs - (713,929)

Net cash generated from/ (used

in) financing activities 5,787 9,147,190

------------------------- ----------------------------

Net increase/(decrease) in

cash and cash equivalents (3,091,387) 2,335,667

Cash and cash equivalents at

beginning of year 4,911,448 2,729,468

Effects of exchange rates on

cash and cash equivalents 180,367 (153,687)

Cash and cash equivalents at

period end 2,000,428 4,911,448

========================= ============================

Capitalisation and Indebtedness Statement

The following is the consolidated unaudited statement

of Capitalisation and Indebtedness

as of 30 September 2019

Current liabilities

Financial borrowings GBP 51,949

Trade and other payables GBP 277,262

Total current liabilities GBP 329,211

----------------

Non current liabilities GBP -

Equity

Ordinary shares GBP 13,946,744

Share premium GBP 27,320,145

Merger reserve GBP 106,148

GBP 3,157,

Other reserves 963

Retained earnings -GBP 38,040,631

Total equity GBP 6,490,369

----------------

The Company liabilities are all unsecured and not guaranteed by

collateral.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFFUFMMFUSEFE

(END) Dow Jones Newswires

December 17, 2019 02:00 ET (07:00 GMT)

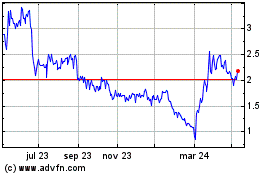

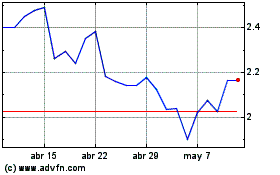

Immupharma (LSE:IMM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Immupharma (LSE:IMM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024