TIDMNFX

RNS Number : 9506X

Nuformix PLC

24 December 2019

Nuformix plc

("Nuformix" or "the Group"),

Unaudited Half Year Results

for the six months ended 30 September 2019

Significant Progress in Lead Programmes

Cambridge, UK, 24 December 2019: Nuformix (LSE: NFX), the

pharmaceutical development Group using cocrystal technology to

unlock the therapeutic potential of approved small molecule drugs,

announces the Group's unaudited results for the six months ended 30

September 2019.

Financial Highlights

-- Net assets at period end of GBP3,980,126 (2018: GBP4,616,176)

which includes cash at bank of GBP132,764 (2018: GBP32,660).

-- Total revenue in the period of GBP535,000 (2018: GBP610,000).

-- Loss on ordinary activities in the period of GBP131,842

(2018: loss of GBP642,633) and the loss per share was 0.03p (2018:

loss of 0.14p). The reported loss in 2019 included share-and

warrant-based charges of GBP56,933 (2018: GBP765,667).

-- Successful placing on 23 December 2019 raising cash of

GBP1.25 million before issue expenses.

Operational Highlights

-- Successful outcome of NXP001 pilot bioequivalence study

o NXP001 programme completed in accordance with Newsummit

Biopharma agreement

o Additional out-licensing and development opportunities for

NXP001 are currently under evaluation

-- Completion of Ebers Strategic Cannabinoid Development agreement

o First patent filed from the collaboration and progress remains

on track to deliver further milestones within the current financial

year

-- NXP002 progression towards clinic

o Partnerships in place to support development of NXP002 as an

inhaled therapy for Idiopathic Pulmonary Fibrosis ("IPF") and

IPF-induced cough

o Discussions with development partners commenced

o Assembling expert team to progress to patient studies

-- Pipeline Update

o Continued growth of early-stage portfolio following discovery

of new drug cocrystals with applications in fibrosis and

oncology

o NXP004 entered into pipeline for a new indication with a high

unmet need

Commenting on the outlook, Dr Dan Gooding, CEO, Nuformix plc

said: "We have achieved significant progress during the period,

both operationally and within our lead programmes. Our results

strongly validate the Group's strategy to retain low operational

costs whilst generating revenues from both out-licensing and

collaborative development. We have reached a significant milestone

for our NXP001 programme and our attention now turns to NXP002 and

progression towards the clinic and patients. Commercially, we look

forward to further progress in our cannabinoid development

agreement with Ebers whilst progressing out-licensing discussions

with multiple parties for NXP002 and our wider portfolio."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Enquiries:

Nuformix plc

Dr Dan Gooding, Chief Executive

Officer

Email: info@nuformix.com +44 (0)1223 627222

Novum Securities Limited

Jon Belliss / Colin Rowbury +44 (0)20 7399 9427

About Nuformix plc

Nuformix is a pharmaceutical development Group using cocrystal

technology to unlock the therapeutic potential of approved small

molecule drugs. Nuformix's risk-mitigated development strategy has

resulted in a pipeline of discoveries through which it has

developed and patented novel cocrystal forms of approved small

molecules.

Nuformix has created an IP portfolio of granted patents covering

cocrystal forms of five small molecule drugs. Nuformix is targeting

high-value unmet needs with its lead programmes in oncology

supportive care: NXP001 and fibrosis: NXP002.

Nuformix was established in Cambridge in 2009 and has invested

in pharmaceutical cocrystal R&D, establishing world-class

capability and know-how in cocrystal discovery and development,

yielding multiple product opportunities.

Nuformix plc shares are traded on the London Stock Exchange's

Official List under the ticker: NFX.L.

For further information please visit www.nuformix.com

Half Year Report

Nuformix plc ("the Company") and its subsidiary (together, "the

Group") is pleased to update shareholders regarding the Group's

developments during the first half of the year ending 30 September

2019 and subsequent events to date in the second half.

Operational Highlights

-- NXP001

o NXP001 programme completed in accordance with Newsummit

Biopharma agreement

o NSB has provided written confirmation of its intention to pay

the remaining amounts owed

-- Completion of Ebers Strategic Cannabinoid Development agreement

o Partnership with Ebers for cannabinoid therapeutics

development, licensing and commercialisation for up to GBP51

million in upfront, R&D and milestone payments, plus long-term

royalties of 20% of net sales

o GBP535,000 income received year-to-date

o First patent filed from the collaboration and progress remains

on track to deliver further milestones within the current financial

year

-- NXP002 progression towards clinic

o Partnerships in place to support development of NXP002 as an

inhaled therapy for Idiopathic Pulmonary Fibrosis (IPF) and

IPF-induced cough

o Discussions with development partners commenced

o Assembling expert team to progress to patient studies

-- Continued pipeline development

o Growth of early-stage portfolio following discovery of new

drug cocrystals with applications in fibrosis and oncology

o NXP004 entered into pipeline for a new indication with a high

unmet need

Half Year Overview

The Group operates in the field of complex scientific research,

specifically drug development through the use of

cocrystallisation.

H1 2020 was a year of progress. The Group has focused all

efforts and resources into progressing its lead programmes and

successfully completed its first clinical development study for

Nuformix's lead product NXP001, demonstrating rapid translation of

its applications of cocrystal technology into human use in line

with its strategy.

The Group is developing an innovative pipeline of products using

its cocrystal technology platform. This exciting platform can

unlock the potential of existing small molecule drugs for new uses

in areas of high unmet medical need. Nuformix is working with drugs

already shown to be safe and accesses existing pre-clinical and

clinical data to progress its programmes. This approach

significantly de-risks the traditional biopharma business model by

enabling dramatically accelerated entry into clinical trials at

reduced cost with drug safety already demonstrated.

The Group is focused on creating value from its growing

intellectual property portfolio. It aims to out-licence lead

programmes after proof-of-concept studies and to reinvest revenue

into its pipeline to maximise mid- to long-term shareholder value.

IP licensing and collaborative development revenues are sufficient

to fund further pipeline development into 2021 thereby maximising

shareholder value.

Nuformix is operating under a lean burn business model as a

semi-virtual organisation. The discovery of new cocrystals is

conducted in-house, with onward development then managed through

external expert CROs to minimise costs. Speed is a key

differentiator in clinical development; known drug compounds allow

for shorter clinical trial pathways with known approval hurdles at

lower cost.

During H1 2020 the Group has completed a significant new deal,

generated revenues and hit important milestones within its

partnerships, with further payments expected to come in H2

2020.

As a result, the Group is able to report net assets at period

end of GBP3,980,126 (2018: GBP4,616,176) which includes cash at

bank of GBP132,764 (2018: GBP32,660). Total revenue in the period

is GBP535,000 (2018: GBP610,000). Loss on ordinary activities in

the period is GBP131,842 (2018: loss of GBP642,633) and which in

2019 included share- and warrant-based charges of GBP56,933 (2018:

GBP765,667). The loss per share is 0.03p (2018: loss of 0.14p).

Team

During the period, the Group has begun to broaden and strengthen

its team as it prepares to commence clinical activities in IPF,

with Dr Muhunthan Thillai joining the Group's Advisory Panel. This

addition provides the Group with invaluable experience in the

design and execution of clinical studies in IPF.

Outlook

Going forward the Group expects an exciting H2 2020. The first

major milestone for this year has already been achieved following

the successful completion of the first clinical trial with NXP001,

validating the Group's platform and demonstrating it can rapidly

translate its applications of cocrystal technology into human

use.

The pre-clinical and clinical data generated for NXP001

completes Nuformix's activities within the programme in accordance

with its agreement with Newsummit Biopharma and Nuformix has

received written confirmation of Newsummit Biopharma's intention to

pay the amounts owed as part of ongoing discussions to extend its

working relationship with the Group. Nuformix continues to explore

additional development opportunities within oncology supportive

care programmes with discussions at an early stage with additional

development partners.

A second major achievement for the year involves the deal with

Ebers Tech Inc to develop cannabinoid cocrystals covering a wide

range of cannabinoid molecules and potential indications. The deal

has brought in immediate revenue, with further payments driven by

on-going research activities, patent filings and pre-clinical

milestones. Multiple cannabinoids are currently under development

using Nuformix's technology platform. Income from Ebers-related

activities continues to support Nuformix's low operating costs.

After the period, Ebers raised an undisclosed sum to support the

development of products emerging from this collaboration which are

at an early stage whilst Nuformix and Ebers focus on securing

further IP.

In fibrosis, the Group has recently announced its intentions to

develop NXP002 as a potential inhaled therapy for IPF and

IPF-induced cough, an untreated side effect of IPF that severely

affects over 80 per cent of patients. Inhaled IPF treatment offers

the prospect of reduced competition, increased efficacy and reduced

side effects; overall a more commercially attractive product. The

inclusion of IPF-induced cough reduces development risk with

proof-of-concept demonstrated. Nuformix will continue to work with

its advisors and partners to finalise its overall clinical

development strategy. The Group aims to secure development

partnerships that will accelerate its path to clinic and inflection

points in its key fibrosis programmes.

After the period, the Group announced completion of a placing to

raise GBP1.25 million before expenses, allowing Nuformix to

strengthen its overall position during negotiations for NXP002 and

accelerate progress within two promising programmes following

recent research results. Funds from the Placing will allow Nuformix

to drive progress in its NXP002 and NXP004 programmes.

NXP004 is a new breakthrough entry to the Nuformix pipeline and

is based on a recently approved targeted oncology therapy currently

experiencing significant sales growth. The Group has identified

innovative applications for NXP004 in multiple new indications with

high unmet needs. Placing proceeds will be used to fast-track

NXP004 research and development activities, generating data to

secure patent protection and further validate the envisaged

applications, thus supporting commencement of commercial

discussions.

The validation in clinic established for our underlying

technology, the subsequent de-risking of Nuformix's growing

pipeline and the completion of the Ebers deal confirm our business

model is working to deliver significant growth in shareholder value

in 2019/2020.

Dr Dan Gooding, Dr David Tapolczay, Chairman

CEO

24 December 2019

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014.Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

For further information please contact:

Nuformix plc

Dr Dan Gooding, Chief Executive Officer +44(0)1223 423667

Nuformix plc

Unaudited Interim Results

Consolidated Income Statement and Statement of Comprehensive

Income for the

Half Year Ended 30 September 2019

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Note GBP GBP GBP

Revenue 535,000 610,000 610,000

Cost of sales (105,417) (79,433) (537,527)

------------- ------------- ------------

Gross profit 429,583 530,567 72,473

-------------------------------- ----- ------------- ------------- ------------

Administrative expenses before

exceptional items (500,110) (419,410) (911,683)

Exceptional items 4 (56,933) (765,667) (975,926)

-------------------------------- ----- ------------- ------------- ------------

Total administrative expenses (557,043) (1,185,077) (1,887,609)

Other operating income 1,800 2,863 4,624

------------- ------------- ------------

Operating loss (125,660) (651,647) (1,810,512)

Finance costs (6,182) (10,986) (32,210)

------------- ------------- ------------

(1,842,

Loss before tax (131,842) (662,633) 722)

Income tax receipt - 20,000 181,495

------------- ------------- ------------

Loss for the period and total

comprehensive income for the

period (131,842) (642,633) (1,661,227)

============= ============= ============

Loss per share - basic and

diluted 5 0.03p 0.14p 0.36p

Nuformix plc

Registration number: 09632100

Unaudited Interim Results

Consolidated Statement of Financial Position as at 30 September

2019

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Note GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 6 28,628 32,904 27,520

Intangible assets 7 4,255,755 4,272,257 4,260,353

------------ ------------ -----------

4,284,383 4,305,161 4,287,873

------------ ------------ -----------

Current assets

Trade and other receivables 134,152 702,640 162,865

Income tax asset - 146,796 179,850

Cash and cash equivalents 132,764 32,660 4,261

------------ ------------ -----------

266,916 882,096 346,976

------------ ------------ -----------

Total assets 4,551,299 5,187,257 4,634,849

============ ============ ===========

Equity and liabilities

Equity

Share capital 8 469,467 460,750 460,750

Share premium 3,163,578 2,932,590 2,932,590

Merger relief reserve 10,950,000 10,950,000 10,950,000

Reverse acquisition reserve (8,005,195) (8,005,195) (8,005,195)

Share option reserve 1,765,185 1,490,504 1,708,252

Retained earnings (4,362,909) (3,212,473) (4,231,067)

------------ ------------ -----------

Total equity 3,980,126 4,616,176 3,815,330

------------ ------------ -----------

Current liabilities

Trade and other payables 556,121 530,394 804,408

Loans and borrowings 15,052 40,687 15,111

571,173 571,081 819,519

Total equity and liabilities 4,551,299 5,187,257 4,634,849

============ ============ ===========

Nuformix plc

Unaudited Interim Results

Consolidated Statement of Changes in Equity for the Half Year

Ended 30 September 2019

Share Share Merger Reverse Share option Retained Total

capital premium Relief acquisition reserve earnings GBP

GBP GBP Reserve reserve GBP

GBP GBP

At 31 March

2018 460,750 2,932,590 10,950,000 (8,005,195) 724,837 (2,569,840) 4,493,142

Loss for the

half year

and total

comprehensive

loss - - - - - (642,633) (642,633)

Share and

warrant based

payment - - - - 765,667 - 765,667

As at 30

September

2018 460,750 2,932,590 10,950,000 (8,005,195) 1,490,504 (3,212,473) 4,616,176

Loss for the

half year

and total

comprehensive

loss - - - - - (1,018,594) (1,018,594)

Issue of share - - -

capital - - - -

Share and

warrant based

payment - - - - 210,259 - 210,259

Equity element

of

convertible

loan note - - - - 7,489 - 7,489

------------- ------------- ------------- ------------ ------------- ------------- ------------

At 31 March

2019 460,750 2,932,590 10,950,000 (8,005,195) 1,708,252 (4,231,067) 3,815,330

Loss for the

half year

and total

comprehensive

income - - - - - (131,842) (131,842)

Issue of share

capital 8,717 230,988 - - - - 239,705

Share and

warrant based

payment - - - - 56,933 - 56,933

As at 30

September

2019 469,467 3,163,578 10,950,000 (8,005,195) 1,765,185 (4,362,909) 3,980,126

============= ============= ============= ============ ============= ============= ============

Nuformix plc

Unaudited Interim Results

Consolidated Statement of Cash Flows for the Half Year Ended 30

September 2019

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

Note GBP GBP GBP

Cash flows from operating activities

Loss for the year (131,842) (642,633) (1,661,227)

Adjustments to cash flows from

non-cash items

Depreciation and amortisation 27,804 26,377 52,815

Finance costs/ (income) 6,182 (10,986) 32,208

Income tax expense - (20,000) (181,495)

Share and warrant based payment 56,933 765,667 975, 926

Equity element of convertible

loan note - - 7,489

------------ ------------ -----------

(40,923) 118,425 (774,284)

Working capital adjustments

(Increase) decrease in trade

and other receivables 28,713 360,650 17,457

Increase (decrease) in trade

and other payables (249,991) (785,020) 260,604

------------ ------------ -----------

Cash generated from operations (262,201) (305,945) (496,223)

Income taxes (paid)/received 181,495 - 196,881

------------ ------------ -----------

Net cash flow from operating

activities (80,706) (305,945) (299,342)

------------ ------------ -----------

Cash flows from investing activities

Acquisitions of property plant

and equipment (24,314) - (1,277)

Disposals of property plant and

equipment - - 149

Acquisition of intangible assets (24,314) - (26,148)

------------ ------------ -----------

Net cash flows from investing

activities (24,314) - (27,276)

------------ ------------ -----------

Cash flows from financing activities

Proceeds of share issue 239,705 - -

Interest paid (5,112) (774) (3,483)

Foreign exchange gains / (losses) (1,070) 1,212 (3,805)

------------ ------------ -----------

Net cash flows from financing

activities 233,523 438 (7,288)

------------ ------------ -----------

Net increase in cash and cash

equivalents 128,503 (305,507) (333,906)

Cash and cash equivalents at

start of period 4,261 338,167 338,167

------------ ------------ -----------

Cash and cash equivalents at

end of period 132,764 32,660 4,261

============ ============ ===========

Nuformix plc

Unaudited Interim Results

Notes to the Consolidated Financial Statements for the Half Year

Ended

30 September 2019

1. Basis of preparation of interim financial information

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles of

International Financial Reporting Standards as endorsed by the

European Union ("IFRS") and expected to be effective at the

year-end of 31 March 2019.

Accounting policies remain unchanged from the financial

statements for the year ended 31 March 2019.

The interim financial statements are unaudited and do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. Statutory accounts for the year ended 31

March 2019, prepared in accordance with IFRS, have been filed with

the Registrar of Companies. The Auditors' Report on these accounts

was unqualified and included a reference to which the Auditors drew

attention by way of an emphasis of matter, without qualifying their

report, that a material uncertainty existed that might cast

significant doubt on the Group's ability to continue as a going

concern at that time. The Auditors' Report did not contain any

statements under section 498 of the Companies Act 2006.

The consolidated interim financial statements are for the 6

months to 30 September 2019.

The interim consolidated financial information do not include

all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

group's annual financial statements for the year ended 31 March

2019, which were prepared in accordance with IFRS's as adopted by

the European Union.

2. Basis of consolidation

On 16 October 2017 the Company acquired the entire issued

ordinary share capital of Nuformix Technologies Limited and became

the legal parent of Nuformix Technologies Limited. The accounting

policy adopted by the Directors applies the principles of IFRS 3

(Revised) "Business Combinations" in identifying the accounting

parent as Nuformix Technologies Limited and the presentation of the

Group consolidated statements of the Company (the legal parent) as

a continuation of financial statements of the accounting parent or

legal subsidiary (Nuformix Technologies Limited).

The interim consolidated financial statements cover the six

months ended 30 September 2019. The interim financial statements

for the comparative period ended 30 September 2018 represent the

substance of the reverse acquisition and are those of Nuformix

Technologies Limited.

3. Going concern

The financial statements have been prepared on the going concern

basis of preparation which, inter alia, is based on the directors'

reasonable expectation that the Group has adequate resources to

continue to operate as a going concern for at least twelve months

from the date of their approval. In forming this assessment, the

directors have prepared cashflow forecasts covering the period

ending 31 December 2020 which take into account the likely run rate

on overheads and research expenditure and the prudent expectations

of income from its lead programmes.

Whilst there can be no guarantee of the successful outcome of

future trials, in compiling the cashflow forecasts the directors

have made cautious estimates of the likely outcome of such trials,

when income might be generated and have considered alternative

strategies should projected income be delayed or fails to

materialise. These strategies include postponing non-committed

research expenditure, securing alternative licensing arrangements

from those currently planned and using the Group's established

network of licensed brokers for fundraising.

After careful consideration, the directors consider that they

have reasonable grounds to believe that the Group can be regarded

as a going concern and, for this reason, they continue to adopt the

going concern basis in preparing the Group's financial

statements.

4 Exceptional Item

As part of the reverse acquisition the Group issued a number of

options and warrants to existing directors, new directors and for

the provision of professional services in relation to the

successful completion of the transaction and in respect of the new

directors' future service. Details of the share-based payments can

be found in note 9.

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

GBP GBP GBP

Share option charge 6,175 765,667 828,427

Warrant charge 50,758 - 147,499

------------ ------------ --------

56,933 765,667 975,926

============ ============ ========

5 Loss per Share

Loss per share is calculated by dividing the loss after tax

attributable to the equity holders of the Group by the weighted

average number of shares in issue during the period.

The basic earnings per share for each comparative period is

calculated by dividing the loss of the legal entity in each of

those periods by the legal entities historical weighted average

number of shares outstanding multiplied by the exchange ratio.

30 September 30 September 31 March

2019 2018 2019

Unaudited Unaudited Audited

GBP GBP GBP

Loss after tax (131,842) (642,633) (1,661,227)

Weighted average number of

shares - basic and diluted 467,323,107 460,750,000 460,750,000

Basic and diluted loss per

share 0.03p 0.14p 0.36p

6 Property, Plant and Equipment

Leasehold Laboratory

improvements Computer equipment equipment Total

GBP GBP GBP GBP

Cost or valuation

At 31 March 2018 32,204 17,344 8,762 58,310

Additions - - 970 970

At 30 September 2018 32,204 17,344 9,732 59,280

Additions - 308 - 308

Disposals - (165) - (165)

------------- ------------------ ---------- -------

At 31 March 2019 32,204 17,487 9,732 59,423

Additions - 751 6,448 7,199

At 30 September 2019 32,204 18,238 16,180 66,622

------------- ------------------ ---------- -------

Depreciation

At 31 March 2018 5,367 8,189 7,261 20,817

Charge 3,220 1,930 409 5,559

At 30 September 2018 8,587 10,119 7,670 26,376

Charge 3,220 1,912 409 5,541

Eliminated on disposal - (14) - (14)

------------- ------------------ ---------- -------

At 31 March 2019 11,807 12,017 8,079 31,903

Charge 3,220 1,741 1,130 6,091

At 30 September 2019 15,027 13,758 9,209 37,994

------------- ------------------ ---------- -------

Carrying amount

At 30 September 2018 23,617 7,225 2,062 32,904

============= ================== ========== =======

At 31 March 2019 20,397 5,470 1,653 27,520

============= ================== ========== =======

At 30 September 2019 17,177 4,480 6,971 28,628

============= ================== ========== =======

7 Intangible Assets

Goodwill Patents Total

GBP GBP GBP

Cost

At 31 March 2018 4,023,484 390,993 4,414,477

Additions - 16,448 16,448

--------- ------- ---------

At 30 September 2018 4,023,484 407,441 4,430,925

Additions - 9,700 9,700

--------- ------- ---------

At 31 March 2019 4,023,484 417,141 4,440,625

Additions - 17,115 17,115

--------- ------- ---------

At 30 September 2019 4,023,484 434,256 4,457,740

--------- ------- ---------

Amortisation

At 31 March 2018 - 138,557 138,557

Amortisation charge - 20,111 20,111

--------- ------- ---------

At 30 September 2018 - 158,668 158,668

Amortisation charge - 21,604 21,604

--------- ------- ---------

At 31 March 2019 - 180,272 180,272

Amortisation charge - 21,713 21,713

--------- ------- ---------

At 30 September 2019 - 201,985 201,985

Net book value

At 30 September 2018 4,023,484 248,773 4,272,257

========= ======= =========

At 31 March 2019 4,023,484 236,869 4,260,353

========= ======= =========

At 30 September 2019 4,023,484 232,271 4,255,755

========= ======= =========

For impairment testing purposes, management consider the

operations of the Group to represent a single cash-generating unit

("CGU") focused on research and development. Consequently, the

goodwill is effectively allocated and considered for impairment

against the business as a whole being the single CGU.

8 Share Capital

Allotted, called up and fully paid shares

30 September 30 September 31 March 2019

2019 2018 Audited

Unaudited Unaudited

No. GBP No. GBP No. GBP

----------- ------- ----------- ------- ----------- -------

Ordinary shares of

GBP0.001 each 469,466,512 469,467 460,750,000 460,750 460,750,000 460,750

----------- ------- ----------- ------- ----------- -------

On 16 May 2019 8,716,512 Ordinary shares of GBP0.001 each were

issued fully paid at an exercise price of 2.75p each under the

terms of a Convertible Loan Agreement dated 18 April 2017 (as

amended).

On 24 October 2019 following the receipt of Notice of Exercise,

250,000 Ordinary shares of GBP0.001 each were issued to the warrant

holder following exercise at the agreed price of 4p per share.

On 23 December 2019 a share placing raising cash of GBP1.25

million before expenses via the issue of 17,857,142 new Ordinary

Shares of GBP0.001 each. Additionally the Group issued 1,321,429

new Ordinary Shares in settlement of certain expenses of the

placing and other corporate overheads.

9 Share Options and Warrants

The Group operates share-based payments arrangements to

remunerate directors and key employees in the form of a share

option scheme. Equity-based share-based payments are measured at

fair value (excluding the effect of non-market based vesting

conditions) at the date of grant. The fair value is determined at

the grant date of the equity-settled share-based payments is

expensed on a straight line basis over the vesting period, based on

the Group's estimate of shares that will eventually vest and

adjusted for the effect of non-market based vesting conditions.

On 10 May 2019 Dr Chris Blackwell was granted warrants to

subscribe for 3,000,000 new Ordinary shares of GBP0.001 at an

exercise price of 4p each and exercisable at any time within two

years under the terms of his appointment as director of the Group.

The fair value of the warrants was determined using the

Black-Scholes option pricing model at 1.085p per warrant.

On 16 May 2019 warrants to subscribe for 8,716,512 new Ordinary

shares of GBP0.001 were issued at 2.75p each exercisable at any

time within five years under the terms of a Convertible Loan

Agreement dated 18 April 2017 (as amended). 134,694 of these

warrants were awarded during this period and the fair value of the

warrants was determined using the Black-Scholes option pricing

model and was an average of 4.515p per warrant.

On 3 September 2019 the Group agreed to grant Dr Muhunthan

Thillai options to subscribe for up to 6,000,000 new ordinary

shares of GBP0.001 conditional upon the achievement of various

clinical development milestones. The directors' assessment of the

accounting value of the likelihood of achievement attributable to

the period from 3 September to the period end is GBP6,175.

Statement of Directors Responsibilities

We confirm that to the best of our knowledge:

1. the interim condensed set of financial statements has been

prepared in accordance with IAS 34 'Interim Financial Reporting' as

issued by the IASB and adopted by the EU;

2. the interim management report includes a fair review of the information required by:

2.1. DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

2.2. DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

The directors of Nuformix PLC are listed in the Group's 2019

Annual Report and Accounts.

D Gooding

Chief Executive

Further copies of this document are available from the company's

registered address and will be available on the company's website

later today.

Nuformix plc

Registration number: 09632100

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR PGGGAPUPBUQC

(END) Dow Jones Newswires

December 24, 2019 02:00 ET (07:00 GMT)

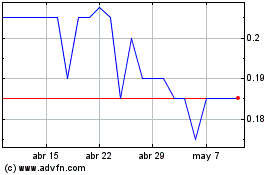

Nuformix (LSE:NFX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Nuformix (LSE:NFX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024