Boku Inc Total Acquisition Consideration for Danal is $25m (7607Y)

06 Enero 2020 - 1:00AM

UK Regulatory

TIDMBOKU

RNS Number : 7607Y

Boku Inc

06 January 2020

6 January 2020

Boku, Inc.

("Boku" or the "Company" and, together with its subsidiaries,

the "Group")

Total Acquisition Consideration for Danal Inc. is $25m

Boku Inc (AIM: BOKU), the world's leading independent carrier

commerce company, announces that, further to the announcements on 2

January 2019 and 31 January 2019 in relation to the completion of

the acquisition of Danal, Inc. ("Danal"), 2,724,499 common shares

of $0.0001 each in the Company ("Common Shares") have been issued

to Danal shareholders following the release of the Common Shares

that were subject to holdback for 12 months (the "Holdback Shares")

as Boku has not filed any claims for indemnification.

Following the issue of the Holdback Shares the total

consideration paid by the Company to acquire Danal comprised the

issue of 26,700,000 Common Shares, the issue of warrants over

1,634,699 Common Shares exercisable for five years at an exercise

price of GBP1.41 each and US$1.0 million in cash. No additional

earn-out consideration is payable by the Company.

The total purchase price accounted for by the Company for the

acquisition of Danal has now therefore been finalised at

US$25,077,547.13, being approximately 8.6% of the Company's market

capitalisation as at close of business on 31 December 2019.

Admission and Total Voting Rights

Application has been made to the London Stock Exchange for

admission to trading on AIM of the Holdback Shares and these Common

Shares, which will rank pari passu with the Company's existing

issued Common Shares, are expected to be admitted to trading on or

around 7 January 2020 ("Admission"). Following Admission, the total

number of Common Shares of $0.0001 each of the Company in issue is

255,059,706. There are no shares held in Treasury. Therefore, the

total number of voting rights in Boku is 255,059,706. The above

figure of 255,059,705 shares may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the Disclosure Guidance and

Transparency Rules.

Jon Prideaux, CEO of Boku, commented, "The acquisition of Danal

brought Boku a strong US-focused mobile identity business with an

established platform, a great customer base -- including many

global brands -- and a team of experienced identity

professionals.

"Boku is in a favourable position with strong demand worldwide.

European Financial Institutions need to comply with the Strong

Customer Authentication (SCA) requirements of the Payment Services

Directive (PSD2). Asian companies are looking to combat emerging

fraud trends. Boku's products allow them to do this whilst meeting

consumer privacy requirements.

"Our focus is on globalising the offer so that Boku Identity can

meet this substantial demand, further enhancing our platform which

connects more than 190 mobile network operators worldwide."

Enquiries:

Boku, Inc.

Jon Prideaux, Chief Executive Officer

Keith Butcher, Chief Financial Officer +44 (0)20 3934 6630

Peel Hunt LLP (Nominated Adviser and Broker)

Edward Knight / Nick Prowting / Christopher

Golden +44 (0)20 7418 8900

IFC Advisory Limited (Financial PR & IR)

Tim Metcalfe / Graham Herring / Florence Chandler +44 (0)20 3934 6630

Notes to Editors

Incorporated in 2008, Boku is the world's leading independent

carrier commerce company. Boku's Platform, which is linked to

billing, identity and sales systems of more than 190 mobile network

operators, simplifies transacting on mobile devices.

Boku's Payment products enable mobile phone users, of which

there are more than five billion worldwide, to buy goods and

services and charge them to their mobile phone bill or pre-pay

balance. Its Identity Products are used to verify user details.

Companies like Apple, Google, Facebook, Microsoft, PayPal, Spotify,

Square, Sony and Western Union use Boku to simplify sign-up,

acquire new paying users and prevent fraud.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FURDZGGMGFRGGZZ

(END) Dow Jones Newswires

January 06, 2020 02:00 ET (07:00 GMT)

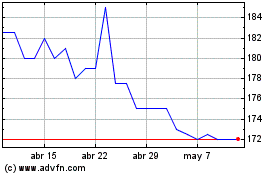

Boku (LSE:BOKU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Boku (LSE:BOKU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024