Woodbois Limited Quarterly Update (9106Y)

07 Enero 2020 - 1:00AM

UK Regulatory

TIDMWBI

RNS Number : 9106Y

Woodbois Limited

07 January 2020

7 January 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

Woodbois Limited

("Woodbois", the "Group" or the "Company")

(AIM: WBI)

Quarterly Update

Woodbois, the African focused forestry and timber trading

company, is pleased to provide a quarterly update on operations for

the three months ended 31 December 2019 (Q4 of the Group's 2019

financial year). All numbers below are from unaudited management

accounts.

-- Record quarterly revenues with $5.6m generated in Q4 2019

-- Record quarterly revenues of $3.8m in Q4 from trading division

-- Record annual revenues of c$20m for 2019, 48% increase year-on-year

-- Upgraded sawmill completed and operational on time and within

budget, confirmed yield improvement

Paul Dolan (CEO) commented, "The business has continued its

rapid and consistent growth path throughout 2019 with revenues once

again rebased year-on-year. Management have also executed

effectively on the Group's capital expenditure led strategic plans,

building Woodbois brand value and positioning the Group to achieve

significant levels of growth and profitability in the decade ahead.

While aiming to continue the delivery of significant levels of

top-line growth during 2020, the Group will also implement measures

to strengthen its cash balance and improve margins, while further

leveraging its fixed cost base to improve overall

profitability."

Accelerated revenue growth and brand recognition

Record quarterly revenues of $5.6m during Q4 represent a 65%

increase from 2018's average quarterly run-rate. Continued quarter

on quarter growth accelerated into the year-end, enabling the Group

to deliver a fifth consecutive record quarter. Revenue gains were

recorded by both the forestry and trading divisions, driving total

revenues for the year to almost $20m and year-on-year growth of

48%. These increased revenues have been achieved without increasing

administration expenses, and with a year-on-year decrease of

approximately 20% in operating expenses.

The re-tooling of our sawmill in Mouila, Gabon has been

successfully completed on time and within budget, and a step-change

in recovery rates from the new bandsaws has been immediately

realized. Increased future profit margins from better rates of

recovery fully justifies the capital expenditure and management

time committed to this project in 2019. Furthermore, we believe the

premium quality sawn timber now being produced will materially

enhance recognition of the Woodbois brand.

Trading division

As anticipated, the increased utilization of the Internal

Trading Fund facility helped drive further growth in trading

revenues for the quarter to a record $3.8m, representing a 90%

increase from the average quarterly run-rate of 2018. Margins

within the trading division also improved during Q4, raising the

2019 margin for the division to 11%, up from 10% during the first

half of the year. With a proven record of growing the business

through attracting and utilising trade finance, the trading team

has continued to focus on expanding the supplier network to meet

the global demand for traceable, sustainable hardwood products

generated by our sales team. 2019 total trading revenues of $13m

are equivalent to approximately 0.3% of the total African timber

export market, leaving significant room for the Group to capture

market share and continue to grow as we strive for a position of

market leadership.

Forestry division

With the installation of kiln drying facilities in Gabon

completed during September 2019, the race was on to complete all

civil works required to house new heavy-duty sawmilling equipment

arriving from China and Slovenia. In challenging conditions, our

in-house construction and maintenance team once again delivered

impressively, both on time, ahead of the year-end deadline, and

within budget. Data gathered during the testing of the new

production lines while staff were trained during November and

December showed an improvement in yield from 33% to 41%. As the

team becomes more familiar with operating the new equipment,

further improvement can be expected and an internal target of 44%

recovery has been set for Q1 2020. Sawmill yield is a critical KPI

since improved yields imply higher levels of output, and therefore

revenue, for the same unit cost of input.

The transformation of our facility in Mouila during the course

of 2019 enables Woodbois to produce superior, premium-grade product

while extracting improved levels of recovery from our raw material.

Taken in combination with the kiln drying of our sawn timber being

brought in-house, we expect the division to deliver both an

increase in revenues and an improvement in margins during 2020,

providing a solid and fundamental pillar to future Group

profitability.

Mozambique

While investment and management focus within the Group has

largely been concentrated on expansionary projects in West Africa

during 2019, the team in Mozambique has strictly followed a more

conservative, domestic led agenda. Encouragingly, the cost

management, reforestation and limited production goals that were

set for the business in Mozambique at the beginning of 2019 have

largely been met, which may encourage the Board to be more

receptive to proposals from the local management team to follow a

more expansionary agenda going forward. 2020 is set to be a big

year for Mozambique with IMF financial support set to resume after

being suspended in 2016 following the disclosure of undeclared

debts. The Fund has already clarified availability, an important

validation for the country's accounts. Investments related to the

liquefied natural gas megaprojects include a "gas city" to house

150,000 inhabitants. Works requiring timber as a construction

material have already started, and our sales team is focused on

generating orders from the contractors involved as these projects

continue to take shape in 2020 in preparation for the start of

liquefaction and export of natural gas in 2024.

Tanzania

Envision, the Tanzanian entity which purchased the Tanzanian

agriculture business from us, has not yet paid the initial proceeds

in accordance with the payment schedule agreed in the Sale and

Purchase agreement ("SPA"). The legal action that we had commenced

against Envision was stayed until the end of 2019 to allow for

mediation between the parties with the objective of giving Envision

the time required to secure the funds required to meet their

commitments as set out within the SPA. Given the lack of resolution

to date, we will now be guided by our legal advisers on next steps.

Apart from minimal winding up expenses, the Group has no ongoing

cost commitment in Tanzania

Enquiries:

Woodbois Limited

Paul Dolan - CEO

Kevin Milne - Interim Chairman

www.woodbois.com

+44 (0)20 7099 1940

Arden Partners Plc (Nominated adviser and broker)

Richard Johnson

+44 (0)20 7614 5900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDSSUFAMESSESF

(END) Dow Jones Newswires

January 07, 2020 02:00 ET (07:00 GMT)

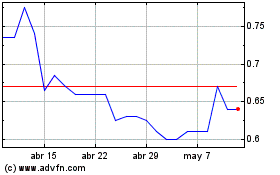

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024