TIDMIRR

RNS Number : 4278A

IronRidge Resources Limited

21 January 2020

21 January 2020

High Purity Battery Grade Lithium Produced from Ewoyaa Spodumene

Concentrate

Lithium Carbonate 99.92% & Lithium Hydroxide 56.5%

Ewoyaa Project - Cape Coast Lithium Portfolio

Ghana, West Africa

IronRidge Resources Limited (AIM: IRR, 'IronRidge' or the

'Company'), the African focussed minerals exploration company, is

pleased to announce that successful battery grade lithium

conversion trials were conducted on coarse spodumene concentrate

samples taken from the Ewoyaa Lithium Project within the Cape Coast

Lithium Portfolio in Ghana, West Africa (refer RNS of 20 August

2019).

HIGHLIGHTS:

Ø Coarse spodumene concentrate containing 6.3% Lithium Oxide

('Li(2) O') from preliminary beneficiation testing sent to ANSTO

for sighter conversion tests

Ø Greater than 99% conversion of alpha spodumene to acid soluble

beta spodumene was achieved in the critical calcination stage

Ø Lithium carbonate at a grade of 99.92% Lithium Carbonate

('Li(2) CO(3) ') was produced, which exceeds most published

specifications for battery grade quality

Ø High purity battery grade lithium hydroxide containing 56.5%

Lithium Hydroxide ('LiOH.H(2) O') was produced from the carbonate

via the conventional hybrid route

Figures and Tables referred to in this release can be viewed in

the PDF version available via this link:

http://www.rns-pdf.londonstockexchange.com/rns/4278A_1-2020-1-21.pdf

Commenting on the Company's latest progress, Noel O'Brien,

Consulting Metallurgist to IronRidge, said:

"These results very clearly demonstrate that, due to the coarse

size and low impurity content of the concentrate, the Ewoyaa

Lithium Project is a world class asset and is a premium feedstock

for converters around the world."

Adding to this, Vincent Mascolo, CEO/MD of IronRidge Resources

said:

"We are very pleased to have achieved these conversion test work

results which demonstrate the Ewoyaa Project's ability to generate

battery grade lithium products from premium feedstock.

"These results are another significant milestone which

underscore the commercial potential of the Project, which also

boasts exceptional logistics; adjacent multiple high-voltage power

lines, sealed roads and lies within 110km of the operating deep sea

port of Takoradi, all within a the pro-mining jurisdiction of

Ghana".

"Whilst the Ewoyaa Project continues to deliver encouraging

results, the Company is working towards releasing its Maiden

Resource Estimate for Q1 2020, and will continue with project

studies and regional exploration programmes."

Conversion Tests

The initial calcination tests were very successful with over 99%

conversion of alpha to the acid soluble beta form of spodumene

being achieved, from which high quality 99.92% lithium carbonate

and 56.5% lithium hydroxide monohydrate were formed.

A 9.5 kg sample of concentrate was sent to the laboratories of

the Minerals Division of Australian Nuclear Science and Technology

Organisation, ('ANSTO'), in Sydney, for the sighter conversion

tests. ANSTO were commissioned by IronRidge to complete a sighter

programme that would demonstrate that the Ewoyaa concentrate could

be converted to lithium hydroxide using a conventional hybrid

process flowsheet, based on the conversion of refined lithium

carbonate to hydroxide (refer Figure 1).

The concentrate sample had a size of 6.3 to 0.5mm and contained

6.29% Li(2) O, 1.07% Iron (III) Oxide ('Fe(2) O(3) '), 0.83%

Potassium Oxide ('K(2) O') and 0.65% Sodium Oxide ('Na(2) O').

Outcomes:

Calcining

The first phase of the conversion process involves calcining the

concentrate to affect a solid state change of alpha spodumene to

the acid soluble form, beta spodumene. The concentrate was calcined

at 1050(o) C for 2 hours and cooled to 150(o) C. At this stage no

signs of fusion were observed.

Subsequent X-Ray Diffraction ('XRD') analysis, after milling to

p100 = 250 microns, showed virtually complete conversion of alpha

to beta phase under laboratory conditions. This is the most

critical phase of the conversion process and the result

demonstrated that Ewoyaa concentrate would be preferred by

downstream processors because of coarse size of concentrate and low

levels of impurities.

Carbonate

The calcined material was roasted in sulphuric acid, leached in

water, purified and converted to lithium carbonate using sodium

carbonate (refer Figure 3). The primary carbonate was dissolved as

lithium bicarbonate and further refined by recrystallisation.

The resulting refined carbonate product exceeded most commercial

specifications for battery grade carbonate and would therefore be

an excellent feedstock for the preparation of lithium hydroxide via

the hybrid route (refer Table 1).

It was particularly pleasing to note that the critical impurity

levels of Silica ('Si') and Calcium ('Ca') in the carbonate were

already below the hydroxide requirements of 30ppm and 15 ppm

respectively.

Hydroxide

The remaining mass of refined lithium carbonate was used to test

the production of lithium hydroxide. Due to the limited amount of

sample available, a single batch test was done without final

refinement by ion exchange (IX) and lithium hydroxide monohydrate

with a high purity and grade of 56.5% was produced (refer Figure

4).

This will be the focus of larger scale testing in the future as

more definitive metallurgical testing progresses, but the testing

to date has highlighted the:

-- Superior quality of Ewoyaa concentrate and its suitability

for the critical calcination step in the conversion process

-- Production of lithium carbonate of very high quality that

exceeds all impurity limits in terms of hydroxide production.

Next Steps

The Company is working towards releasing its Maiden Resource

Estimate for Q1 2020 and will continue with project studies and

regional exploration programmes.

The Board is delighted with the progress that the Company has

made in 2020 to date and looks forward to keeping shareholders

updated as further news becomes available.

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For any further information please contact:

IronRidge Resources Limited Tel: +61 (0)7 3303 0610

Vincent Mascolo (Chief Executive Officer)

Karl Schlobohm (Company Secretary)

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

Nominated Adviser

Jeff Keating

Charlie Bouverat

SI Capital Limited

Company Broker

Nick Emerson Tel: +44 (0) 1483 413 500

Jon Levinson Tel: +44 (0) 207 871 4038

Yellow Jersey PR Limited Tel: +44 (0)20 3004 9512

Harriet Jackson

Dominic Barretto

Henry Wilkinson

Competent Person Statement:

Information in this report relating to the exploration results

is based on data reviewed by Mr Lennard Kolff (MEcon. Geol., BSc.

Hons ARSM), Chief Geologist of the Company. Mr Kolff is a Member of

the Australian Institute of Geoscientists who has in excess of 20

years' experience in mineral exploration and is a Qualified Person

under the AIM Rules. Mr Kolff consents to the inclusion of the

information in the form and context in which it appears.

The information in this announcement that relates to

metallurgical results is based on information compiled by Mr Noel

O'Brien, Director of Trinol Pty. Limited. Mr O'Brien is a Fellow of

the Australasian Institute of Mining and Metallurgy (AusIMM) and

has sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the December 2012 edition of the "Australasian Code

for Reporting of Exploration Results, Mineral Resources and Ore

Reserves" (JORC Code). Mr O'Brien consents to the inclusion in the

report of the matters based upon the information in the form and

context in which it appears.

Notes to Editors:

IronRidge Resources is an AIM-listed, Africa focussed minerals

exploration company with a lithium pegmatite discovery in Ghana,

extensive grassroots gold portfolio in Cote d'Ivoire and a

potential new gold province discovery in Chad. The Company holds

legacy iron ore assets in Gabon and a bauxite resource in

Australia. IronRidge's strategy is to create and sustain

shareholder value through the discovery and development of

significant and globally demanded commodities.

Ghana

The Company entered into earn-in arrangements with Obotan

Minerals Limited, Merlink Resources Limited, Barari Developments

Limited and Joy Transporters Limited of Ghana, West Africa,

securing the first access rights to acquire the historical

Egyasimanku Hill spodumene rich lithium deposit, estimated to be in

the order of 1.48Mt at 1.67% Li2O and surrounding tenements. The

portfolio covers some 684km(2) with the newly discovered Ewoyaa

project including drill intersections of 128m @ 1.21% Li2O from 3m

and 111m @ 1.35% Li2O from 37m, and a further identified 20km

strike of pegmatite vein swarms. The tenure package is also highly

prospective for tin, tantalum, niobium, caesium and gold, which

occur as accessory minerals within the pegmatites and host

formations.

Chad

The Company entered into an agreement with Tekton Minerals Pte

Ltd of Singapore concerning its portfolio covering 900km(2) of

highly prospective gold and other mineral projects in Chad, Central

Africa. IronRidge acquired 100% of Tekton including its projects

and team to advance the Dorothe, Echbara, Am Ouchar, Nabagay and

Kalaka licenses, which host multiple, large scale gold projects.

Trenching results at Dorothe, including 84m @ 1.66g/t Au (including

6m @ 5.49g/t & 8m @ 6.23g/t), 4m @ 18.77g/t Au (including 2m @

36.2g/t), 32m @ 2.02g/t Au (including 18m @ 3.22g/t), 24m @ 2.53g/t

Au (including 6m @ 4.1g/t (including 2m @ 6.2g/t) and 2m @

6.14g/t), 14.12g/t Au over 4m, 34.1g/t over 2m and 63.2g/t over 1m,

have defined significant gold mineralised quartz veining zones over

a 3km by 1km area including the steep dipping 'Main Vein' and

shallow dipping 'Sheeted Vein' zones.

Côte d'Ivoire

The Company entered into conditional earn-in arrangements in

Côte d'Ivoire, West Africa; securing access rights to highly

prospective gold mineralised structures and pegmatite occurrences

covering a combined 3,584km(2) and 1,172km(2) area respectively.

The projects are well located within access of an extensive bitumen

road network and along strike from multi-million-ounce gold

projects and mines.

Australia

Monogorilby is prospective for province scale titanium and

bauxite, with an initial maiden resource of 54.9MT of premium DSO

bauxite. Monogorilby is located in central Queensland, within a

short trucking distance of the rail system leading north to the

Port of Bundaberg. It is also located within close proximity of the

active Queensland Rail network heading south towards the Port of

Brisbane.

May Queen is located in Central Queensland within IRR's wholly

owned Monogorilby license package and is highly prospective for

gold. Historic drilling completed during the 1980s intersected

multiple high-grade gold intervals, including 2m @ 73.4 g/t Au

(including 1m at 145g/t), 4m @ 38.8g/t Au (at end of hole) and 3m @

18.9g/t Au, over an approximate 100m strike hosting numerous

parallel vein systems, open to the north-west and south-east.

Gabon

Tchibanga is located in south-western Gabon, in the Nyanga

Province, within 10-60km of the Atlantic coastline. This project

comprises two exploration licenses, Tchibanga and Tchibanga Nord,

which cover a combined area of 3,396km(2) and include over 90km of

prospective lithologies and the historic Mont Pele iron

occurrence.

Belinga Sud is Located in the north east of Gabon in the

Ogooue-Ivindo Province, approximately 400km east of the capital

city of Libreville. IRR's licence lies between the main Belinga

Iron Ore Deposit, believed to be one of the world's largest

untapped reserves of iron ore with an estimated 1bt of iron ore at

a grade >60% Fe, and the route of the Trans Gabonese railway,

which currently carries manganese ore and timber from Franceville

to the Port of Owendo in Libreville.

Corporate

IronRidge made its AIM debut in February 2015, successfully

securing strategic alliances with three international companies:

Assore Limited of South Africa, Sumitomo Corporation of Japan and

DGR Global Limited of Australia. Assore is a high-grade iron,

chrome and manganese mining specialist. Sumitomo Corporation is a

global resources, mining marketing and trading conglomerate. DGR

Global is a project generation and exploration specialist.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEAKFFAEDEEEA

(END) Dow Jones Newswires

January 21, 2020 02:00 ET (07:00 GMT)

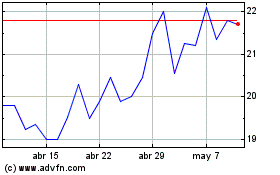

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024