Warehouse REIT PLC £220 million institutional refinancing (7943A)

24 Enero 2020 - 1:00AM

UK Regulatory

TIDMWHR

RNS Number : 7943A

Warehouse REIT PLC

24 January 2020

24 January 2020

Warehouse REIT plc

(the 'Company' or 'Warehouse REIT')

Warehouse REIT increases headroom with GBP220 million

institutional refinancing

Warehouse REIT, the AIM-listed specialist warehouse investor,

announces that it has entered into a new five year GBP220 million

debt facility, to replace the existing HSBC facility totalling

GBP210 million. The refinancing, which comprises a GBP157 million

term loan and a GBP63 million Revolving Credit Facility, has been

agreed with a club of lenders consisting of HSBC, Barclays, Bank of

Ireland and Royal Bank of Canada. The facility is at a margin of 2%

per annum above LIBOR, representing a 14bpts saving compared to the

previous blended rate. The new facility provides a five year term

and includes an option to extend the duration by a further two

years, subject to lender consent. The current HSBC facility

expires, in part, in March 2020 and the majority in November

2022.

This new facility not only extends the term and reduces the

margin, but also increases Warehouse REIT's total debt facilities

from GBP210 million to GBP220 million, together with an accordion

of a further GBP80 million whilst maintaining the LTV covenant of

55%. Alongside paying down the previous facility, the debt provides

the Group with extended firepower over current drawings to support

operational flexibility, deliver further portfolio initiatives and

give wider scope for new investments.

Based on drawn Group net debt of c. GBP184 million (as at 30

September 2019), Warehouse REIT's pro forma all in cost of debt

will reduce from 2.14% blended to 2.00%. Debt maturity will

increase from a maximum of two years to five (or seven years if the

two one-year extensions are applied). At current drawings, the

Group is 30% hedged by way of two caps at a blended rate of

1.625%.

Andrew Bird, Managing Director of Tilstone Partners Limited,

commented: "This long term facility, secured from a high quality

club of lenders, further strengthens the Company's balance sheet

and provides greater flexibility to implement the active programme

of portfolio management and take advantage of the attractive

acquisition opportunities that the team continues to source in the

market, underpinned by solid occupational demand. We now move

forward with a highly competitive cost of debt and an attractive

debt maturity profile."

Savills Debt Advisory team acted for Warehouse REIT on this

transaction.

-ENDS-

Enquiries

Warehouse REIT plc via FTI Consulting

Tilstone Partners Limited +44 (0) 1244 470

Andrew Bird 090

G10 Capital Limited (part of the Lawson

Conner Group), AIFM +44 (0) 20 3696

Maria Glew, Gerhard Grueter 1302

Peel Hunt (Financial Adviser, Nominated

Adviser and Broker) +44 (0) 20 7418

Capel Irwin, Harry Nicholas, Carl Gough 8900

FTI Consulting (Financial PR & IR Adviser

to the Company)

Dido Laurimore, Ellie Sweeney, Richard +44 (0) 20 3727

Gotla 1000

Further information on Warehouse REIT is available on its

website:

http://www.warehousereitplc.co.uk

Notes to editors:

Warehouse REIT is an AIM listed UK Real Estate Investment Trust

which owns and manages a diversified portfolio of UK warehouse

assets located in urban areas.

Occupier demand for urban warehouse space is increasing as the

structural growth in e-commerce has driven the rise in internet

shopping and investment by retailers in the "last mile" delivery

sector. The urban warehouse sector continues to be projected to be

the best performing of all UK property sectors.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager. The Investment Manager is

G10 Capital Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGZGZMZFGGGZZ

(END) Dow Jones Newswires

January 24, 2020 02:00 ET (07:00 GMT)

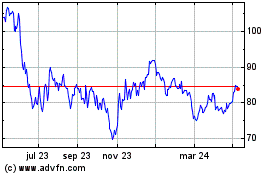

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

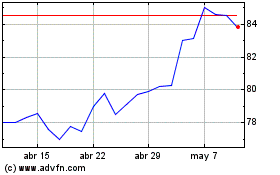

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024