TIDMSAGA

RNS Number : 0752B

SAGA PLC

28 January 2020

28 January 2020

Saga plc

("Saga" or "the Group")

Trading update

Saga plc ("Saga" or "the Group"), the UK's specialist in

products and services for life after 50, provides the following

update on trading covering the period from 1 August 2019 to 27

January 2020.

Current year trading

We continue to focus on disciplined execution of the strategy

set out in April, against a backdrop of a challenging external

environment in Insurance and Travel. We expect full year Underlying

Profit Before Tax ("Underlying PBT") to be in line with our

previous guidance.

Insurance

The Insurance Broking business continues to show clear signs of

progress:

-- As of 26 January 2020, we had sold 317k 3-year fixed price

policies, with over 60% of direct new business customers choosing

this product since it was fully launched.

-- Around 57% of new business customers are coming to us on a

direct basis, compared to 50% in the year ended 31 January

2019.

-- Customer retention across home and motor business of 75% is

around two percentage points better than in the prior period,

reflecting a range of initiatives.

For the full year ended 31 January 2020 we expect Saga branded

home and motor policies to be approximately 3% lower than the prior

year, reflecting a highly competitive market and a disciplined

approach to new business. Home and motor margins are expected to be

at the higher end of our GBP71-GBP74 range, reflecting the lower

new business strain.

For the Insurance Underwriting business, reserves in aggregate

are tracking in line with expectations, with continued favourable

experience on large bodily injury claims. In line with other

insurers, we are seeing higher inflation on third party damage and

theft costs, with overall inflation running at around 7% compared

to longer-term expectations of around 5%. This trend is not

expected to have a significant impact on the current year but will

have a modest adverse impact on future year margins if retail

pricing conditions remain competitive.

Travel

In Cruise, we are building on the excellent progress over the

first half of the year:

-- The first six months of operation for the Spirit of Discovery

have been successful. Customer feedback has been very positive and

we expect the new ship to achieve EBITDA of more than GBP20 million

for the second half.

-- The build programme for the Spirit of Adventure is on track

and we remain on time and on budget for delivery in August

2020.

-- We have forward bookings for 2020/21 of 76% of full year

target levels and we remain fully on track with our expectations

for GBP40 million of EBITDA per new ship.

For Tour Operations, revenues are expected to be down around 5%

compared to the prior year, in line with trading at the half year.

We are seeing a much more resilient picture in those parts of the

business where our customer proposition is truly differentiated,

notably in escorted tours. The administration of Thomas Cook in the

second half has resulted in approximately GBP4 million of one-off

costs which will be taken below Underlying PBT.

FCA Market Study

Saga welcomes the work being undertaken by the FCA and believes

that, over the long-term, it will be positive for Saga's customers

and our place in the market. As previously announced, we have been

implementing a proactive strategy to improve renewal pricing for

our long-standing customers and improve pricing practices.

The FCA published its interim report in October 2019 and the

final report is expected to be published in Q1 2020. There is a

wide range of potential outcomes for the industry and the Board

will consider these once the final report has been published.

Strategy

The strategy we set out in April was focused on returning Saga

to its heritage as a company that delivers high quality,

differentiated products and services that resonate with its core

customers. Our experience since April gives us confidence that the

Group is taking the right actions, and we are seeing good progress

and a significant improvement in the quality of execution. The

Insurance business is in a much more stable position than a year

ago and our Cruise business is fully on track. Our customers are

responding well to what we are doing and it is clear that the Saga

brand remains strong with our core target market.

There remains much to do to continue to improve our capabilities

in all areas of the business and to respond to changing customer

behaviours, across both Insurance and Travel.

With the recent appointments of Euan Sutherland as Group CEO,

Cheryl Agius as Insurance CEO and Gilles Normand as Group COO, we

have a strong team in place to improve Saga's operational and

financial performance. The Board and the executive team, with

Euan's leadership, are looking at where performance and cost

efficiency can be improved. The Group is also reviewing all aspects

of its capital allocation priorities and where balance sheet

deleveraging can be accelerated. We will update on our progress

with the announcement of our preliminary full year results.

Euan Sutherland, Group CEO, said

"I'm delighted to have joined Saga and to be working with a

strong executive team. Although Saga continues to face challenging

markets in Insurance and Travel, we have a clear focus on improving

performance and cost efficiencies within the Group, while

strengthening our financial position and reducing debt."

ENDS

For further information please contact:

Saga plc

Mark Watkins, Director of Investor Relations Tel: 07738 777 479

Email: mark.watkins@saga.co.uk

MHP Communications

Tim Rowntree/Simon Hockridge Tel: 020 3128 8789/ 8742

Email: saga@mhpc.com

Notes to editors

About Saga

Saga is a specialist in the provision of products and services

for life after 50. The Saga brand is one of the most recognised and

trusted brands in the UK and is known for its high level of

customer service and its high quality, award winning products and

services including cruises and holidays, insurance, personal

finance and publishing. www.saga.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTKKOBKKBKBBDB

(END) Dow Jones Newswires

January 28, 2020 02:00 ET (07:00 GMT)

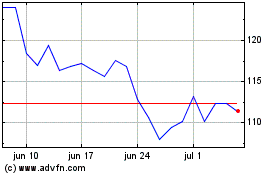

Saga (LSE:SAGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

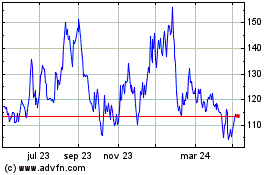

Saga (LSE:SAGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024