TIDMNWT

RNS Number : 3515B

Newmark Security PLC

30 January 2020

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR).

Newmark Security plc

("Newmark", the "Company" or the "Group")

Interim Results

for the six months ended 31 October 2019

Newmark Security plc (AIM: NWT), a leading provider of

electronic and physical security systems, is pleased to announce

its unaudited interim results for the six months ended 31 October

2019.

HIGHLIGHTS

Financials

-- Revenue from continuing operations increased 3% to GBP10.1m (HY 2018: GBP9.8m)

-- Operating profit from continuing operations of GBP0.7m (HY 2018: GBP0.5m)

-- Profit before tax of GBP0.6m (HY 2018: GBP0.5m)

-- Earnings per share from continuing operations of 0.23 pence (HY 2018: 0.09 pence)

-- Cash outflow from operating activities was GBP0.1m (HY 2018: 0.7m).

Electronic Division

-- Revenue increased by 41% to GBP7.11m (HY 2018: GBP5.06m)

-- Human capital management revenue increased by 60% to GBP4.8m (HY 2018: GBP3.0m)

-- Access control revenue increased by 11% to GBP2.26m (HY 2018: GBP2.03m)

Asset Protection Division

-- Revenue decreased by 36% to GBP3.03m (HY 2018: GBP4.76m)

Commenting on the results, Maurice Dwek, Chairman of Newmark,

said:

"The Board is pleased with the growth achieved in the first half

of the year and the continued Group profitability. The Electronic

Division has achieved improved revenue growth and, whilst its

performance is expected to be slightly first half weighted, it is

anticipated that the profitability of this division will continue

in the second half. The Group's smaller Asset Protection Division's

revenue is also expected to be weighted in the first half of the

year, as in previous years, due to seasonality factors and

therefore having a corresponding impact on full year operating

profit for that division. However, once the initiatives of the

reorganisation and strategic review are fully embedded, Safetell's

performance is expected to improve in the following year. Overall,

the Board expects the Group to show a marginal reduction in revenue

for the full year when compared to last year but with an improved

level of operating profit."

Copies of the interim results for the six months ended 31

October 2019 will shortly be sent to shareholders and will be

available on the Company's website www.newmarksecurity.com.

For further information:

Newmark Security plc

Marie-Claire Dwek, Chief Executive Tel: +44 (0) 20 7355 0070

Officer www.newmarksecurity.com

Graham Feltham, Group Finance Director

Allenby Capital Limited Tel: +44 (0) 20 3328 5656

(Nominated Adviser and Broker)

James Reeve / Liz Kirchner

CHAIRMAN'S STATEMENT

I am pleased to announce the Group's unaudited interim results

for the six months ended 31 October 2019 ("H1 2019"), a period of

continued growth and profitability.

There was an increase in Group revenue of 3.3% to GBP10,147,000

(H1 2018: GBP9,822,000), which included an increase in revenue

within the Electronic Division of 40.7% to GBP7,114,000 (H1 2018:

GBP5,056,000). This continued and extended the strong performance

from the previous financial year. Within this figure, revenue from

Human Capital Management increased by 60.2% to GBP4,851,000 (H1

2018: GBP3,028,000), whilst Access Control revenues increased by

11.6% to GBP2,263,000 (H1 2018: GBP2,028,000). Revenue in the Asset

Protection Division decreased by 36.4% to GBP3,033,000 (H1 2018:

GBP4,766,000). The overall increase in revenue, combined with the

cost cutting measures in the previous year, resulted in an

operating profit of GBP686,000 (H1 2018: GBP486,000). Earnings per

share from continuing operations were 0.23 pence (H1 2018:

0.09p).

Electronic Division - Grosvenor Technology

Revenue GBP7,114,000 (H1 2018: GBP5,056,000)

Grosvenor Technology has two main activities: Human Capital

Management and Access Control. Following significant growth in FY

2018, and following the trend of the last two years, Grosvenor

Technology continued to display good performance, with the period

delivering the highest revenues generated to date in a single

half-year period. This was largely due to the continued ramp-up of

major US customers in the Human Capital Management division.

Human Capital Management ("HCM")

Revenue increased by 60.2% to GBP4,851,000 (2018:

GBP3,028,000)

HCM sales in North America delivered the most significant

growth, with revenues at GBP3,093,000 (H1 2018: GBP1,468,000), an

increase of 111%. This growth was in line with management's

expectations as major US clients continued the roll out of

Grosvenor Technology's 'next generation' hardware.

Following another successful round of trade shows, the number of

enquiries from Tier 1 target customers increased during the period

and negotiations began with two new major US based HCM software

providers. Both clients have expressed interest in the Android

timeclock, the GT-10.

During the period, the US business was rebranded as 'GT Clocks'

and a number of marketing activities, including the launch of a new

website, were conducted. GT Clocks is felt to be a more relevant

name for the US market. The messaging focuses on the provision of

timeclocks alongside the relevant services to both manage and

maintain the devices remotely, but also - increasingly, the secure

management of clients' data.

The Company has continued to increase its resources in marketing

and business development in North America to further take advantage

of the opportunity that exists for additional revenues from both

timeclocks and services in that region.

Grosvenor's UK HCM business serves the rest of the world

("RoW"), outside North America. RoW HCM sales also showed growth,

increasing by 13% to GBP1,758,000 (H1 2018: GBP1,560,000). This

increase was as a result of a general uplift across a number of

customers largely based across Europe, as opposed to significant

growth from any single client.

Continued development of Cloud platforms

In the HCM markets generally, growth continues to be facilitated

through the technology 'drivers' of high-speed internet

availability and the subsequent mass shift to Cloud based

computing. This shift means that the traditionally challenging to

serve and highly fragmented Small and Medium-Sized Business

("SME/SMB") market is now within the reach of HCM providers, who

were previously more focused on a lower volume, yet higher value,

of Enterprise level end clients.

As a consequence of this shift, the provision of the Company's

own HCM services increased across all clients - with the number of

'edge' devices connected remotely to our cloud provisioned

software, rising to over 3,500 units by the close of the period.

Grosvenor Technology's overarching long-term strategy remains the

increase of recurring revenues through the provision of a higher

proportion and number of software sales under a subscription model.

This is generally known as Software as a Service (SaaS).

Internal software development has continued to focus on the

provision of these added services on an 'as a service' basis,

increasingly cloud-based, aiding software vendors to reap

additional value from their hardware post-deployment. During the

period, we increased the resource dedicated to developing our HCM

software platforms with a Cloud and API first approach.

This shift from 'On Premise' to 'Cloud SaaS' also affords the

opportunity of an alternative or additional business model where

Software, Services and Terminals are bundled as a 'Clock as a

Service' (ClaaS) offering, generating further long-term recurring

revenue potential.

Access Control

Revenue increased by 12% to GBP2,263,000 (2018:

GBP2,028,000)

Overall, Access Control revenues increased 12%, with revenues of

GBP2,263,000 compared to GBP2,028,000 in the corresponding period

of the previous year.

As previously reported, the Janus product is no longer installed

in 'new' systems as the platform utilises an historic and now

unsupported version of the MS Windows(TM) operating system. That

said, with our Janus to Sateon upgrade programme now closed, legacy

sites continue to expand and add our products. This, combined with

a number of price increases, has led to Janus revenues in the

period increasing to GBP845,000, a rise of 48% compared to

GBP570,000 in the corresponding period last year.

We completed the launch of our new Security Management System

(SMS) - Janus C4, which was delivered in conjunction with our

software development partner based in Slovakia. The market is

beginning to move away from stand-alone Access Control solutions

towards integrated Access Control, Intruder, CCTV and Fire and

Building Management within a single platform, such as with SMS. The

solution has been well received by both existing and prospective

customers, with strong pipeline growth and early sales of GBP83,000

in the period. As with all new Access Control sales, there is an

inevitable lag between pipeline generation and revenue

recognition.

In addition to acquiring new partners, we are in the early

stages of migrating existing Sateon customers to the platform. To

help facilitate this, we are investing further resources in our

training function, which will be completed towards the end of the

financial year.

With focus now on Janus C4, Sateon revenues decreased to

GBP1,335,000 from GBP1,458,000 in the corresponding period, a fall

of 8.4%. Development of Sateon software is now limited to critical

bug fixes and maintenance. Sateon product family sales continue to

be bolstered by sales of the OEM variant of the Sateon Advance,

which allows third parties to utilise the hardware in a

non-proprietary way on their own access control platforms. We added

a second OEM customer during the period and continue to have

exploratory conversations with a number of global third-party

access control providers in the US and EMEA.

Asset Protection Division - Safetell

Revenue GBP3,033,000 (2018: GBP4,766,000)

Safetell revenue was 36% lower than the corresponding period

last year. This was as a result of the expected reduction in the

volume of work relating to the Post Office Network Transformation

and the continued shrinkage in demand from high street banks and

buildings societies, along with reduced project work in the Service

Division. Compared with the same period last year this has resulted

in reduced revenue in Products by 38% and Service by 34%.

As a result of declining sales in this division and the lack of

repeat programmes of refurbishment from our long- term and

traditional customers, a business reorganisation plan was

implemented in the last quarter of 2019 financial year, resulting

in staff reductions and other cost saving measures.

During the first half of the current financial year, we have

seen the results of the reorganisation being reflected in the

performance of the division delivering improved gross margins and

adding to the profitability of the Group.

Once the business reorganisation was completed, a series of

strategic reviews were undertaken to refocus efforts in sales and

marketing for both the Products and Service divisions. With

increases in crime rates and a continued threat of terrorism,

management believe that there are continued significant

opportunities for Safetell. Following the reviews, management have

identified new markets, products and customers that complement

Safetell's existing product range.

Management have also identified an opportunity to align the

Product and Service resources. Wherever possible, the central teams

have been combined in order to increase efficiency and

effectiveness whilst keeping any Product or Service expertise as

required.

Anton Pieterse, Managing Director of Safetell, resigned on 30

November 2019, after serving 11 years with a focus on the Products

side of the business. I would like to thank Anton for his long

period of service. Paul Lovell takes on the role of Managing

Director. Paul joined Safetell in 1991 working in various

capacities and developing the Service Division from its inception

until today. Paul is a trained accountant, qualifying with KPMG,

and has built up a wealth of experience throughout his career that

will benefit and support Safetell through this period of

change.

Balance sheet and cash flow

During the period, we have recognised the rights of use assets

and related liabilities in accordance with IFRS 16 Leases. This has

had a significant impact on the opening balance sheet with GBP1.2m

being recognised as assets and liabilities with a GBP25,000

differential being adjusted in reserves.

Within working capital, we have consistent inventory levels

compared to the year-end position, increased trade debtors in line

with the trading levels and reduced current liabilities, due to

timing of supplier payments and some impact of reduced trading

levels within Safetell. We continue to utilise our financing

facility to support our working capital requirements.

During the period, we have utilised GBP0.1m of deferred tax

assets and recognised deferred tax assets of GBP0.5m both in

relation to tax losses that we envisage utilising over the short to

mid-term.

Directors

Brian Beecraft retired on 31 October after 21 years with the

Group. The Board thanks him for his tremendous efforts over that

period and wish him a happy retirement. Graham Feltham has been

appointed as Group Finance Director following Brian's retirement.

The Board is pleased to welcome Graham to the Group.

Outlook

The Board is pleased with the growth achieved in the first half

of the year and the continued Group profitability. The Electronic

Division has achieved improved revenue growth and, whilst its

performance is expected to be slightly first half weighted, it is

anticipated that the profitability of this division will continue

in the second half. The Group's smaller Asset Protection Division's

revenue is also expected to be weighted in the first half of the

year, as in previous years, due to seasonality factors and

therefore having a corresponding impact on full year operating

profit for that division. However, once the initiatives of the

reorganisation and strategic review are fully embedded, Safetell's

performance is expected to improve in the following year. Overall,

the Board expects the Group to show a marginal reduction in revenue

for the full year when compared to last year but with an improved

level of operating profit.

M DWEK

Chairman

30 January 2020

CONSOLIDATED INCOME STATEMENT

For the six months ended 31 October 2019

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 October 31 October 30 April

2019 2018 2019

Notes GBP'000 GBP'000 GBP'000

Revenue 10,147 9,822 19,583

Cost of sales (5,926) (5,891) (11,878)

Gross Profit 4,221 3,931 7,705

Administrative expenses (3,535) (3,445) (7,419)

Profit from operations before exceptional

items 686 486 638

Exceptional impairment provision

of development costs - - -

Exceptional redundancy costs - - (352)

------------------------------------------- ------ ----------- ----------- ---------

Profit from operations 686 486 286

Finance costs (38) (25) (72)

Profit before tax 648 461 214

Tax credit/(charge) 2 434 (29) (25)

Profit/(loss) for the period/year 1,082 432 189

----------- ----------- ---------

Attributable to:

- Equity holders of the parent 1,082 432 189

----------- ----------- ---------

Earnings per share

- Basic (pence) 3 0.23 0.09 0.04

- Diluted (pence) 3 0.23 0.09 0.04

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 31 October 2019

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 October 31 October 30 April

2019 2018 2019

GBP'000 GBP'000 GBP'000

Profit for the period/year 1,082 432 189

Foreign exchange on the retranslation

of overseas operation (13) 1 1

Total comprehensive income for the

period/year 1,069 433 190

----------- ----------- ---------

Attributable to:

- Equity holders of the parent 1,069 433 190

----------- ----------- ---------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 31 October 2019

Unaudited Unaudited Audited

31 October 31 October 30 April

2019 2018 2019

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 1,471 486 491

Intangible assets 4,775 4,737 4,753

Deferred tax 449 - -

Total non-current assets 6,695 5,223 5,244

----------- ----------- ---------

Current assets

Inventory 2,527 2,199 2,599

Trade and other receivables 3,870 4,356 3,262

Cash and cash equivalents 406 658 1,041

Total current assets 6,803 7,213 6,902

----------- ----------- ---------

Total assets 13,498 12,436 12,146

----------- ----------- ---------

LIABILITIES

Current liabilities

Trade and other payables 3,222 3,667 3,987

Other short-term borrowings 814 1,192 796

Total current liabilities 4,036 4,859 4,783

----------- ----------- ---------

Non-current liabilities

Long term borrowings 1,154 115 149

Provisions 100 100 100

Deferred tax - 5 -

Total non-current liabilities 1,254 220 249

----------- ----------- ---------

Total liabilities 5,290 5,079 5,032

----------- ----------- ---------

TOTAL NET ASSETS 8,208 7,357 7,114

----------- ----------- ---------

Capital and reserves attributable

to equity holders of the company

Share capital 4,687 4,687 4,687

Share premium reserve 553 553 553

Merger reserve 801 801 801

Foreign exchange difference reserve (145) (132) (132)

Retained earnings 2,272 1,408 1,165

8,168 7,317 7,074

Minority interest 40 40 40

TOTAL EQUITY 8,208 7,357 7,114

----------- ----------- ---------

CONSOLIDATED CASH FLOW STATEMENT

For the six months ended 31 October 2019

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 October 31 October 30 April

2019 2018 2019

Notes GBP'000 GBP'000 GBP'000

Cash flow from operating activities

Net profit after tax from ordinary activities 1,082 432 189

Adjustments for: Depreciation, amortisation

and impairment 332 357 619

Interest expense 13 25 72

Gain on sale of property, plant and equipment (47) (20) (32)

Income tax (credit)/expense 2 (434) 29 25

Operating profit before changes in working

capital and provisions 946 823 873

(Increase)/decrease in trade and other receivables (601) (1,506) (414)

(Increase)/decrease in inventories (113) (586) (991)

(Decrease)/increase in trade and other payables (356) 572 937

Cash generated from operations (124) (697) 405

Income taxes paid - (4) (45)

Cash flows from operating activities (124) (701) 360

Cash flow from investing activities

Acquisition of property, plant and equipment (203) (117) (196)

Sale of property, plant and equipment 28 20 53

Research and development expenditure (167) (173) (333)

(342) (270) (476)

----------- ----------- ---------

Cash flow from financing activities

Acquisition and repayment of leased assets (205) (31) (87)

Proceeds from invoice discounting 72 616 246

Interest paid (38) (25) (72)

(171) 560 87

----------- ----------- ---------

Decrease in cash and cash equivalents (637) (411) (29)

Cash and cash equivalents at beginning of

period/year 1,041 1,069 1,069

Exchange differences on cash and cash equivalents 2 - 1

Cash and cash equivalents at end of period/year 406 658 1,041

----------- ----------- ---------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Foreign

Share Share Merger exchange Retained Non-controlling Total

capital premium reserve reserve earnings interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 May 2019 4,687 553 801 (132) 1,165 40 7,114

Impact of IFRS

16 Lease

transition - - - - 25 - 25

Profit for the

period - - - - 1,082 - 1,082

Other

comprehensive

income - - - (13) - - (13)

Total

comprehensive

income for the

period - - - (13) 1,107 - 1,094

--------- --------- --------- ---------- ---------- ---------------- --------

As at 31 October

2019 4,687 553 801 (145) 2,272 40 8,208

--------- --------- --------- ---------- ---------- ---------------- --------

At 1 May 2018 4,687 553 801 (133) 976 40 6,924

Profit for the

period - - - - 432 - 432

Other

comprehensive

income - - - 1 - - 1

Total

comprehensive

income for the

period - - - 1 432 - 433

--------- --------- --------- ---------- ---------- ---------------- --------

As at 31 October

2018 4,687 553 801 (132) 1,408 40 7,357

--------- --------- --------- ---------- ---------- ---------------- --------

NOTES TO THE ACCOUNTS

1. BASIS OF ACCOUNTS

The financial information for the six months ended 31 October

2019 and 31 October 2018 does not constitute the Group's statutory

financial statements for those periods within the meaning of

Section 434(3) of the Companies Act 2006 and has neither been

audited or reviewed pursuant to guidance issued by the Auditing

Practices Board. The annual financial statements of Newmark

Security PLC are prepared in accordance with IFRSs as adopted by

the European Union. The principal accounting policies used in

preparing the interim results are those that the Group expects to

apply in its financial statements for the year ended 30 April 2020

and are unchanged from those disclosed in the Group's Annual Report

for the year ended 30 April 2019.

During the period IFRS 16 Leases was adopted and, as previously

disclosed, GBP1.2m of right of use assets and liabilities were

recognised on 1 May 2019 with GBP25k being adjusted through

retained earnings. In accordance with the standard the lease

payments are set off against the lease liability with both

depreciation and interest relating to the right of use assets being

recognised through the income statement.

The comparative financial information for the year ended 30

April 2019 included within this report does not constitute the full

statutory accounts for that period. The statutory Annual Report and

Financial Statements for 2019 have been filed with the Registrar of

Companies. The Independent Auditors' Report on that Annual Report

and Financial Statement for 2019 was unqualified, did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their report and did not contain

a statement under section 498(2)-498(3) of the Companies Act

2006.

After making enquiries, the directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing the half-yearly condensed consolidated financial

statements.

2. TAXATION

The tax credit includes a utilisation of deferred tax asset

relating to losses of GBP0.1m and a recognition of deferred tax

asset related to previously unrecognised losses of GBP0.5m. The

recognition of the deferred tax assets relating to tax losses is

dependent on management's best estimates of future profitability

and the probability of utilising these losses against the

profits.

3. EARNINGS PER SHARE

The earnings per share has been calculated based on the weighted

average number of shares in issue during the period, which was

468,732,316 shares (2018: 468,732,316).

4. DIVIDS

No interim dividend is proposed (2018: Nil).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BRGDBDXDDGGC

(END) Dow Jones Newswires

January 30, 2020 02:00 ET (07:00 GMT)

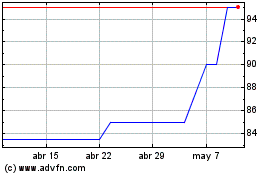

Newmark Security (LSE:NWT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Newmark Security (LSE:NWT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024