TIDMIII

RNS Number : 3540B

3i Group PLC

30 January 2020

30 January 2020

3i Group plc

FY2020 Q3 performance update

Solid underlying performance

* Increase in NAV per share to 877 pence (30 September

2019: 873 pence) despite the negative translation

effect of sterling strengthening in the quarter

(GBP314 million), and total return of 10.1% for the

nine months to 31 December 2019.

* Very strong growth in the quarter from Action drove a

solid result from the Private Equity portfolio.

* Private Equity generated cash proceeds of GBP189

million in the quarter, mainly from the partial

divestment of Basic-Fit and the distributions from

Audley Travel and Hans Anders.

* Signed the disposal of Aspen Pumps at an overall

money multiple of 4.1x and a 34% IRR.

* Completed two new Private Equity investments in

Evernex and a bioprocessing platform and four further

bolt-on acquisitions for ICE, Formel D, WP and Q

Holding.

* Another strong quarter from our Infrastructure team

with the highly accretive sale of Wireless

Infrastructure Group ("WIG") out of 3i Infrastructure

plc ("3iN") and further rail investment in North

America.

* Transaction to provide liquidity to Eurofund V

("EFV") investors from the sale of their holding in

Action, which successfully closed on 17 January 2020.

Simon Borrows, Chief Executive, commented:

"This was a very busy quarter for the 3i team. We executed two

outstanding realisations in the sale of Aspen Pumps from our

Private Equity portfolio and WIG from 3iN. New investment and

bolt-on activity has continued across both portfolios, as has

refinancing activity. And, importantly, we successfully provided

liquidity to the EFV investors in Action while the company has

continued to drive sector-leading sales and profit growth as it

expands across Europe."

Private Equity

Portfolio performance

The Private Equity portfolio generated good returns for the

quarter. Action finished the year very strongly. In the twelve

months to the end of December 2019, Action generated revenue growth

of 21%, like-for-like ("LFL") sales growth of 5.6% and opened 230

new stores, taking its total to 1,552 stores across seven

countries.

At 31 December 2019, our valuation methodology for Action

remained unchanged, using run-rate earnings to 31 December 2019, a

post discount run-rate multiple of 18.0x (30 September 2019: 18.0x)

and the capital structure at 31 December 2019.

The challenging conditions in the automotive sector continued to

weigh on a few of our portfolio companies and in December Schlemmer

filed for administration in Germany. Schlemmer had continued to

suffer from operational challenges in its North American plants as

well as a significant decline in volumes in its European plants in

the second half of 2019. As a result, we have written down our

investment to zero. This write down has resulted in an unrealised

value loss of GBP67 million in the quarter and a cumulative loss of

GBP170 million since investment in 2016.

In the quarter we recognised a significant uplift on our

investment in Aspen Pumps following the announcement of the signed

exit. We also signed an agreement to sell our investment in ACR at

a value close to our September 2019 valuation. The significant

majority of the proceeds, subject to regulatory clearance, are

expected in the second half of 2020 with further proceeds, subject

to various escrows, expected in 2021.The remaining portfolio showed

resilient performance in a tightening macro environment with

notable value growth increases from Basic-Fit, Tato, Royal Sanders

and Cirtec. We have, however, seen value reductions in some

companies including Q Holding (sale of Silicone Altimex to 3i's new

bioprocessing platform and softer trading, particularly automotive)

and WP (softer trading).

Action transaction

On 17 January 2020, we closed the transaction to provide

liquidity to investors in Eurofund V from a sale of the Fund's

entire investment in Action, funded by a combination of rolling

LPs, new LPs and 3i. At the same time, Action completed its new

EUR625 million Term Loan refinancing. Action used the proceeds of

the Term Loan and some excess cash to pay a pre-closing dividend to

its shareholders. 3i has reinvested its share of this dividend plus

its proportion of the Eurofund V carried interest arising from the

sale back into Action. The impact of this transaction will be

reflected in the Group's valuation of Action at 31 March 2020 with

the consequent changes to the Group's carried interest position

being reported on the balance sheet. We expect 3i's interest in

Action, net of its ongoing carried interest liability, to have

increased to c.49% as at 31 March 2020.

We are delighted that GIC, AlpInvest Partners, Coller Capital,

HarbourVest Partners, J.P. Morgan Asset Management, Pantheon, as

well as investment funds managed by each of Aberdeen Standard

Investments, Goldman Sachs Asset Management and Neuberger Berman,

amongst others, have decided to either roll their existing

investment or make a significant new investment in the next chapter

of Action's remarkable growth story.

Private Equity investments

Private Equity Investment

Investment Type Business description Date GBPm

------------------------------- ----------------------- ------------------------------ --------------- -----------

International provider of

third-party maintenance

services for data centre

Evernex New infrastructure October 2019 214

Single use bioprocessing

platform serving the

Bioprocessing platform New biopharmaceutical sector November 2019 60

ICE's acquisition of We Make

People Happy Vacations

("WMPH"), a cruise travel

ICE Further agency December 2019 7

Value for money optical

Hans Anders Return of overfunding retailer December 2019 (35)

Other n/a 4

------------------------------- ------------------------------------------------------------------------ -----------

Total Q3 FY2020 investment 250

========================================================================================================= ===========

H1 FY2020 investment 221

========================================================================================================= ===========

Total investment as at 31 December 2019 471

========================================================================================================= ===========

In the quarter, we completed the GBP214 million investment in

Evernex and GBP60 million investment in a bioprocessing platform,

formed by the initial acquisition of Cellon and carve out

acquisitions of TBL Performance Plastics (acquired by Q Holding in

October 2019) and Silicone Altimex from our existing portfolio

company Q Holding.

We have continued to grow portfolio value through our

buy-and-build strategy with WP's bolt-on acquisition of Orange

Poland, a manufacturer of deodorant packaging systems and Formel

D's bolt-on acquisition of CPS Quality, a specialist in quality

control activities with a focus on the automotive industry, with no

additional investment from 3i. We also supported ICE's acquisition

of WMPH, a cruise travel agency, for which we provided GBP7 million

of further funding.

In December 2019, following its acquisition of eyes + more which

closed in January 2019, Hans Anders completed a refinancing,

returning proceeds of GBP35 million to 3i. The proceeds from the

refinancing have been treated as a reduction in the further

investment made for eyes + more.

Private Equity realisations

Private Equity Realisation proceeds

GBPm

------------------------------------------------ ---------------------

Basic-Fit 76

Audley Travel 47

BoConcept 12

Other 1

================================================ =====================

Total Q3 FY2020 realised proceeds 136

================================================ =====================

H1 FY2020 realised proceeds 1

================================================ =====================

Total realised proceeds as at 31 December 2019 137

================================================ =====================

In December 2019, we generated GBP76 million of proceeds from

the partial divestment of 2.9 million shares in Basic-Fit, at a

price of EUR31.25 per share. We retain a 12.7% stake (30 September

2019: 18.0%) in the business, valued at GBP198 million at 31

December 2019 (30 September 2019: 18.0% holding valued at: GBP249

million).

We generated GBP65 million of cash from the Audley Travel

refinancing, GBP18 million of which was recognised as cash income

and the remainder as realisation proceeds. We also received GBP12

million of proceeds from BoConcept following the repayment of a

shareholder loan.

In December 2019, we announced the sale of Aspen Pumps, for

proceeds of c.GBP208 million, and including the GBP52 million of

proceeds already received, generated an overall money multiple of

4.1x and an IRR of 34%. At 31 December 2019, Aspen Pumps was held

on an imminent sale basis and valued at GBP203 million, reflecting

the 2.5% discount to exit value in line with our valuation policy,

compared to its 30 September 2019 valuation of GBP134 million.

Infrastructure

The Infrastructure business had another busy quarter. In

December 2019, 3iN announced the sale of its UK projects portfolio

for proceeds of c.GBP194 million and the sale of its 93% stake in

WIG for proceeds of c.GBP387 million. Following 3iN's successful

placing of 81 million shares in October 2019 at a price of 275

pence per share, its share price closed at 294 pence at 31 December

2019 (30 September 2019: 295 pence) valuing 3i's 30% stake (30

September 2019: 33%) at GBP791 million (30 September 2019: GBP794

million). In addition, we also recognised dividend income of GBP12

million from 3iN in the quarter.

In October 2019, we announced a US Infrastructure investment in

the significant bolt-on acquisition of Pinsly Railroad Company's

Florida operations for Regional Rail. This investment of GBP76

million completed at the end of December 2019.

The 3i European Operational Projects Fund completed the EUR70

million acquisition of an 80% stake in Sociedad Concesionaría

Autovía Gerediaga Elorrio, S.A. ("AGESA"), a Spanish motorway PPP.

The Fund continued its investment momentum into January 2020 with

the announced agreement to acquire a portfolio of eight operational

projects in France from DIF Infrastructure III. On completion of

this transaction, the Fund will have deployed c.60% of its total

commitments.

Top 10 investments by value at 31 December 2019

Valuation Valuation

Valuation Valuation Sep-19 Dec-19

basis currency GBPm GBPm Activity in the quarter

=============== =========== ========== ========== ==============================================

Action Earnings EUR 3,243 3,461

=============== =========== ========== ========== ==============================================

3iN Quoted GBP 794 791 Accrued a GBP12 million FY2020 interim

dividend

=============== =========== ========== ========== ==============================================

Scandlines DCF EUR 485 464 Received a GBP10 million dividend

=============== =========== ========== ========== ==============================================

Cirtec Medical Earnings USD 262 256

=============== =========== ========== ========== ==============================================

Hans Anders Earnings EUR 303 249 Received GBP35 million of refinancing

proceeds reducing the initial investment in

eyes + more

=============== =========== ========== ========== ==============================================

Q Holding Earnings USD 277 245 Sale of Silicone Altimex and TBL Performance

Plastics (acquired by Q Holding in October

2019)

to 3i's newly established Bioprocessing

platform

=============== =========== ========== ========== ==============================================

WP Earnings EUR 253 237

=============== =========== ========== ========== ==============================================

Audley Travel Earnings GBP 270 217 Received GBP65 million of refinancing

proceeds

=============== =========== ========== ========== ==============================================

Evernex Earnings EUR - 206 New investment completed

=============== =========== ========== ========== ==============================================

Aspen Pumps Imminent sale GBP 134 203 Announced signed exit

=============== =========== ========== ========== ==============================================

The 10 investments in this table comprise 72% (30 September

2019: 70%) of the total Proprietary Capital portfolio value of

GBP8,814 million (30 September 2019: GBP8,551 million).

Total return and NAV position

We recognised a net GBP314 million loss on foreign exchange in

the quarter, or 32 pence per share, as both the US dollar and euro

weakened against sterling. Based on the balance sheet at 31

December 2019, a 1% movement in the euro and US dollar would result

in a total return movement of GBP51 million and GBP13 million

respectively, net of any hedging. The diluted NAV per share

increased to 877 pence (30 September 2019: 873 pence) or 859.5

pence after deducting the 17.5 pence per share first FY2020

dividend, which was paid on 8 January 2020.

Balance sheet

At 31 December 2019 net debt was GBP145 million and gearing of

1.8%. The 17.5 pence first FY2020 dividend of GBP169 million was

paid on 8 January 2020.

- ENDS -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 31 December 2019 in this update have been calculated at a currency exchange

rate of EUR1.1798:GBP1 and $1.3247:GBP1 respectively. At 31 December 2019, 65% of the Group's

net assets were in euro and 16% were in US dollar.

2. At 31 December 2019 3i had 971 million diluted shares.

3. Action was valued using a post discount run-rate EBITDA multiple of 18.0x based on its run-rate

earnings to 31 December 2019.

For further information, please contact:

Silvia Santoro

Group Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com.

All statements in this performance update relate to the three

month period ended 31 December 2019 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2019 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBLMPTMTBTBIM

(END) Dow Jones Newswires

January 30, 2020 02:00 ET (07:00 GMT)

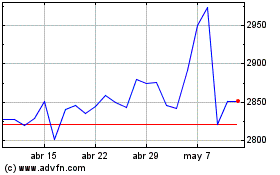

3i (LSE:III)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

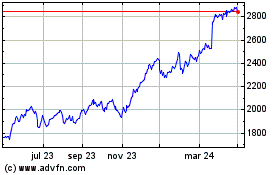

3i (LSE:III)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024