TIDMWSG

RNS Number : 4980B

Westminster Group PLC

31 January 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014

Westminster Group Plc

('Westminster', the 'Group' or the 'Company')

Trading Update, Notice of Results and Total Voting Rights

Westminster Group Plc (AIM: WSG), a leading supplier of managed

services and technology-based security solutions worldwide, is

pleased to provide a trading and business update, and notice of its

results for the 12 months to 31 December 2019.

Overview

We are pleased to announce that 2019 was a record year and the

Group expects to report, subject to audit, around a 63% year on

year increase in revenues to circa GBP10.9m, an increase of GBP4.2m

on the GBP6.7m reported in 2018. This is the 5th year of

double-digit percentage revenue growth and shows the momentum we

are building.

We continue to invest in our worldwide business development

programmes in order to deliver on our growth potential,

particularly in our long-term major managed services projects.

Operating in frontier markets is time consuming, complex and costly

but the potential rewards are substantial. Despite the cost of

business development, the set up costs for our Ghana project and

the costs associated with setting up our various strategic

alliances and joint ventures in Saudi Arabia, Bahrain and Tunisia

etc., we expect to report a greatly improved EBITDA performance for

the full year as compared with 2018 which was a GBP0.38m EBITDA

loss. As a business we are operationally geared in that we have

relatively fixed operating costs and as our revenues continue to

grow our profitability will grow proportionally faster. In this

respect we believe we are now approaching an inflection point.

Annual Review

Both the Managed Services and Technology divisions performed

well during the year.

Our passenger numbers for our West Africa airport operations for

the year are at record levels and the last few months of 2019 were

consistently some of the highest monthly traffic numbers

experienced since we commenced operations there.

In February we delivered the remainder of the $4.5m US Dollar

vehicle screening contract in the Middle East, which the Company

secured in 2018.

In March 2019 we had entered into a Technical Partnership

Agreement with a Ghanaian company, Scanport Ltd. In June 2019, we

announced a letter of intent had been received acknowledging

Westminster as the Technical Partner and setting out the

preliminary terms regarding the appointment and scope of work

relating to a container screening project at the new container

port, Terminal 3 at Tema, Ghana.

Terminal 3 is a new $1.5 billion investment project by Meridian

Port Services ('MPS') which is creating one of the most advanced

port operations in Africa, if not the world. The first two berths

opened on 28 June 2019 and the first commercial vessel successfully

docked on 3 July 2019. The third berth is expected to be

operational in Q1 2020 and the fourth berth is due for completion

at the end of 2020. When complete it will expand the port's

capacity from around 1 million Twenty-foot Equivalent Units ('TEU')

pa to over 3.5 million p.a.

Scanport-Westminster have been successfully running the

container screening and secondary search operations since the port

opened on 28 June 2019, with Westminster providing the technical

management and operations and Scanport responsible for local costs,

management and employment. Revenues are shared between Scanport and

Westminster and are driven by container traffic volumes passing

through the Port. Westminster's share of revenues during the soft

opening and start-up phase of operations in 2019 amounted to

several hundred thousand USD and we look forward to the operation

producing a meaningful contribution to our revenues in 2020 as the

port continues to expand, the new berths come on stream, capacity

and throughput increases, and new tariffs come into operation.

Recent developments would indicate that the formal exchange of

contracts, which the Board consider a formality given we are

already appointed and operational, are likely to be signed in

February 2020. We are excited by the prospects of this long-term

managed services project and we expect our subsidiary Westminster

International (Ghana) Ltd. to be an important and growing part of

our business.

In April 2019, our Technology division announced the award of a

USD $3.4million contract for the provision of advanced container

screening solutions to two separate ports in an Asian country.

Following manufacture and site preparation works the first of these

was delivered in November 2019 and the second unit was dispatched

in January 2020.

In May 2019, we announced we had acquired Euro Ops, a French

based aviation security and support services company which, through

its sister company, Euro Ops International (also trading as ICare),

provides aviation support services such as Airport Security,

Aircrew Management, Humanitarian Logistics, Operations &

Dispatch, Ground Handling etc. Euro Ops has been fully integrated

into the Group and is developing meaningful business and

opportunities within Francophone territories. Our new French

operation joins our existing German subsidiary, which is also

developing a number of sizeable business opportunities, in

providing us with a European footprint. Whilst Westminster is not

likely to be materially affected by Brexit, having European

operating companies will be beneficial.

In June 2019, we announced we were forming a 50.1% Group owned

joint venture subsidiary, registered in Saudi Arabia, under the

name Westminster Arabia. Our JV partners are Hazar International

who, under their impressive Chairman, Sheikh Salman Bin Mohammed

Bin Khalid Bin Hethlain, are strong and influential partners. An

experienced business development team is now in place within the

country and is already involved in several large-scale project

opportunities in the Kingdom. One of several projects already being

pursued in the Kingdom is Saudi ports and in 2019 at the request of

the authorities we conducted detailed operational and vulnerability

assessments at certain ports following which, the Westminster team

are booked to meet with the port authorities in February 2020 for

more detailed discussions regarding port security solutions. The

business opportunities for Westminster's products and services

within Saudi Arabia are substantial and the formation of

Westminster Arabia represents an important strategic development

for the Group.

Our training business continues to grow and, in addition to our

direct contracts with airports and governmental bodies around the

world, and the opening of the training centre in the UK in 2019, we

have entered into two important Strategic Alliances. In July 2019,

we announced we had signed a strategic alliance agreement with the

Gulf Aviation Academy ('GAA'), a leading provider of professional

aviation training in Bahrain and the wider Middle East and North

Africa ('MENA') region. This alliance has already produced tens of

thousands USD in new business and recently GAA secured an important

new contract with the Bahrain Airport Company ('BAC'), the operator

and managing body of Bahrain International Airport ('BIA') to

provide civil aviation security training to hundreds of

airport-stationed Ministry of Interior ('MOI') personnel each year

and which will involve Westminster in the delivery of this

service.

In November 2019, Euro Ops entered into a strategic alliance

with the Tunisian Academy for Civil Aviation Safety and Security

Training ('AFSAC'). From its impressive training centre in Tunisia,

AFSAC provides certified aviation security training workshops on

behalf of the International Civil Aviation Organization ('ICAO')

and is an AACO approved training centre.

In December 2019, we finalised the sale of the Sierra Queen

which has a book value of GBP170,000. The vessel has been sold for

a total consideration of $643,000 US Dollars, payable by $40,000

deposit and the balance by 36 equal monthly payments. Under the

sale agreement the Company will, at its own cost, ship the vessel

to the purchaser in Greece in Q1 2020 and it will be secured by a

mortgage charge over the vessel until final payment has been

received.

On a wider front we continue to progress various existing and

new large-scale managed services project opportunities around the

world. As we have previously advised, project opportunities of this

size and nature, particularly in emerging markets, are not only

time-consuming and involve complex negotiations with numerous

commercial and political bodies but discussions can ebb and flow

over many months, with periods of intense activity which can be

followed by long periods of inactivity. An example of this is the

African airport project we referred to in our trading update in

January 2019 that we were waiting on counter signature from the

government. This project opportunity remains alive a year later but

was delayed due to an unrelated issue leading to reorganisation

within the government which has largely now taken place and we

expect to recommence discussions in the coming months.

We operate in a market that requires strict confidentiality and

we are not able to provide detailed updates or explanations for

delays which, if made public, may cause issues with our clients and

be prejudicial to discussions. However, whilst there is never

certainty as to timing or outcome of the many project opportunities

we are pursuing, we are making progress on a number of fronts and

we will provide market updates on material developments when

appropriate and in line with our regulatory responsibilities.

In summary, 2019 was a busy year and a year of growth during

which we have made significant strides forward.

Cash

At 31 December 2019, the Group had free cash available of circa

GBP557k. Since the year end the Company has entered into a

GBP3million financing facility as reported on 23 January 2020, of

which it has drawn down GBP1.5m and has commenced a staged

redemption programme of the Company's existing GBP2.245m

Convertible Secured Loan Notes ('CSLNs') which is planned to be

completed well before the CSLNs maturity date of 30 June 2020,

saving on both interest and management fees.

Outlook

Trading for 2020 has started on a positive note, building on the

success of 2019.

Our Technology division has experienced a higher than normal

order intake in both December and January for a wide range of

security equipment, which together with shipment of the second

container screening system for a port in Asia, as part of the

$3.48m USD contract announced in April 2019, bodes well for Q1

revenues.

Our Managed Services division not only has more large-scale

project opportunities under discussions than ever before, but we

commence the year with our expected annual recurring revenues from

our managed services projects, our Ghana project and our existing

guarding and maintenance contracts, already at a level greater than

our entire 2018 revenues.

Both our Managed Services and Technology divisions continue to

have a healthy and active enquiry bank and we anticipate 2020 will

be another year of significant growth. We look forward to making

progress on our more significant managed services contract

opportunities during the year.

Notice of Results

Westminster will announce its Final Results for the 12 months to

31 December 2019 on Thursday 30 April 2020.

Total Voting Rights

In accordance with the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules ('DTRs'), the Company hereby

announces that it has 159,402,511 ordinary shares of 10p each in

issue, none of which are held in treasury. Therefore, the total

number of voting rights in the Company is 159,402,511.

The above figure of 159,402,511 may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change in their interest in, the share capital of the Company

under the DTRs.

For further information please contact:

Westminster Group Plc Media enquiries via Walbrook

PR

Rt. Hon. Sir Tony Baldry - Chairman

Peter Fowler - Chief Executive Officer

Mark Hughes - Chief Financial Officer

S. P. Angel Corporate Finance LLP (NOMAD

& Broker)

Stuart Gledhill 020 3470 0470

Caroline Rowe

Walbrook (Investor Relations)

Tom Cooper 020 7933 8780

Paul Vann

Nick Rome Westminster@walbrookpr.com

Notes:

Westminster Group plc is a specialist security and services

group operating worldwide via an extensive international network of

agents and offices in over 50 countries.

Westminster's principal activity is the design, supply and

ongoing support of advanced technology security solutions,

encompassing a wide range of surveillance, detection, tracking and

interception technologies and the provision of long-term managed

services contracts such as the management and running of complete

security services and solutions in airports, ports and other such

facilities together with the provision of manpower, consultancy and

training services. The majority of its customer base, by value,

comprises governments and government agencies, non-governmental

organisations (NGO's) and blue-chip commercial organisations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBIGDBLBXDGGG

(END) Dow Jones Newswires

January 31, 2020 02:00 ET (07:00 GMT)

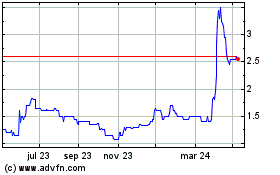

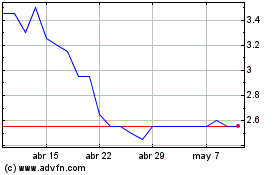

Westminster (LSE:WSG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Westminster (LSE:WSG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024