Merger to Pay Off for CEO With $111 Million Bonus -- WSJ

12 Febrero 2020 - 2:02AM

Noticias Dow Jones

By Drew FitzGerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 12, 2020).

T-Mobile US Inc.'s John Legere is close to collecting more than

$100 million this spring after spending years guiding the cellphone

carrier's merger with Sprint Corp. through regulatory

obstacles.

While the merger was pending, the departing chief executive

secured a bonus that would vest in 2020 if the company's planned

takeover of smaller rival Sprint was consummated. A federal court

ruling Tuesday put that milestone within sight, though T-Mobile

must still win approval from another U.S. district court in

Washington conducting a routine review of the deal.

The outspoken executive plans to hand over the top job at

T-Mobile to deputy Mike Sievert on May 1, though Mr. Legere will

keep a seat on the company's board.

Mr. Legere's severance, including cash payments and

performance-based stock awards, was worth about $111 million based

on recent T-Mobile share prices, according to an analysis by

compensation-data firm Equilar Inc. That is separate from Mr.

Legere's regular compensation for 2019, the details of which the

company hasn't yet disclosed.

The compensation package "is on the higher side" compared with

other corporate CEOs, said Equilar analyst Courtney Yu, though on

"mergers with a long lead time until completion, it's not uncommon

to see executives receive special transaction grants to incentivize

them to stick around and provide stability in a period of

uncertainty."

The union of the country's No. 3 and No. 4 largest cellphone

carriers has sat in limbo for nearly two years, held back by

lengthy reviews by federal telecom and antitrust regulators. Those

federal officials eventually signed off on the merger with

conditions, but a coalition of state attorneys general said the

transaction would still push up wireless plan prices and sued to

block it.

T-Mobile said in a 2019 securities filing that its awards to

executives reflected "the immense regulatory and advocacy work

associated with a merger of this size and in this industry and

related business planning activities."

T-Mobile parent Deutsche Telekom AG hired Mr. Legere in 2012

after the company abandoned a planned merger with AT&T Inc.

Federal antitrust enforcers at the time said adding T-Mobile, then

the country's fourth-largest cellphone carrier, to AT&T would

lead to higher wireless prices.

Armed with a multibillion-dollar breakup fee and valuable

wireless spectrum licenses, the Bellevue, Wash., company closed a

reverse merger with prepaid service provider MetroPCS and went

public in 2013. T-Mobile's integration of the business now known as

Metro allowed both brands to quickly steal customers from rivals

like Sprint and AT&T.

Mr. Legere's total realized pay from 2013 through 2018 topped

$182 million, according to Equilar. That excludes his first year

with the German-owned company and his still-undisclosed 2019 pay

package.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

February 12, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

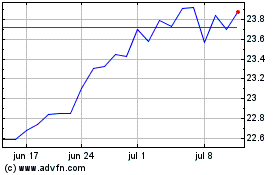

Deutsche Telekom (TG:DTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

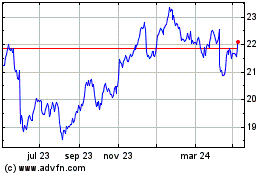

Deutsche Telekom (TG:DTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024