TIDMWEB

RNS Number : 1109E

Webis Holdings PLC

26 February 2020

For immediate release

26 February 2020

Webis Holdings plc

("Webis" or "the Group")

Interim Report and Financial Statements for the period ended 30

November 2019 ("The Report")

Webis Holdings plc, the global gaming group, today announces its

unaudited interim results for the period ended 30 November 2019,

extracts from which are set out below.

The Report is available on the Company's website

www.webisholdingsplc.com and at the Group's registered office:

Viking House, Nelson Street, Douglas, Isle of Man IM1 2AH

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014

For further information:

Webis Holdings plc Tel: 01624 639396

Denham Eke

Beaumont Cornish Limited Tel: 020 7628 3396

Roland Cornish/James Biddle

Chairman's Statement

Introduction

It has been an improved first six months trading for

WatchandWager.com, with an increase in turnover, plus a further

reduction in operating costs, which has helped to reduce our

previously reported losses. In addition, there have been some

positive recent developments for the business in the USA, which are

commented upon below.

Against that, the previously reported loss of a large syndicate

wagering into international pools did have some impact on our

year-on-year comparisons of activity through our platform, with

total amounts wagered reduced. However, as stated, both turnover

and gross profit returned were up on the previous year - an

improved situation. It should be noted that the loss of the

syndicate will no longer impact year-on-year comparisons into the

second half of the year. In addition, the loss of this syndicate

allows us to operate a more balanced business, with less reliance

on one group of customers.

Our other sectors of the business performed well. In particular,

our business-to-consumer Advanced Deposit Wagering operation

surpassed expectations. Our business trading sector held up well

but continues to be impacted by competition and reduced margins in

this sector.

On an equally positive note, our racetrack operation at Cal

Expo, Sacramento, California, performed well during the off-season

racing (May to November), and has started the new season of racing

very well.

In summary, the Board feel the business has turned a corner,

with a better-balanced mix, and an improved retained gross margin.

Initial trends for the second half of the year suggest this

momentum will be maintained. Most importantly, the Company,

particularly through its US array of licenses - especially its

online and racetrack license in California - has created and

secured a unique set of assets in the fastest growing gaming market

in the world. This is commented on in more detail below under

Outlook.

Half Year Results Review

Group turnover increased significantly by nearly 50% to US$ 8.06

million (2018: US$ 5.38 million), with gross profit also increasing

to US$ 1.79 million (2018: US$ 1.70 million). This resulted in a

65% reduction in overall losses to US$ 0.21 million (2018: loss of

US$ 0.59 million) for the period. This again reflects the loss of

syndicate business but has improved our overall margin derived from

more "retail-style" wagering activity, both through our on-line

operations and through the racetrack. This is encouraging for the

future.

Operating costs showed a further decrease to US$ 2.01 million

(2018: US$ 2.17 million) and reflected our continued policy of

controlling costs and generally streamlining the operation. Both

the improvement in the margin derived from wagering and cost

controls have helped to reduce our overall operating losses by

almost threefold. This trend is expected to continue in the second

half of the year.

WatchandWager Advanced Deposit Wagering

Business-to-consumer - this sector performed well over the

period. Whilst we do not see the watchandwager.com/mobile product

as a key brand within our future plans for USA sports betting, it

is critically important that it continues to grow. Over the period,

we saw an increase of 10% in amounts wagered and most importantly a

26% increase in the gross margin derived from the wagers on the

website and mobile product. This is a direct result of some cost

reductions but also targeting promotions at high margin racetracks

and customers. This strategy has worked well and is planned to

continue through the second half of the year, and our business

planning for subsequent years.

Business-to-business - conversely trading was largely flat in

this sector, even discounting the loss of the syndicate. Whilst we

continue to service a wide range of customers on a wide range of

international tracks, this sector is becoming increasingly

competitive in nature. In particular, we compete with a wide range

of operators who seem intent on maximising the volume of amounts

wagered at the expense of margin. This is, of course, something of

a race to the bottom and not commercially attractive, doing little

to increase the value of the Company for shareholders. As a result,

we continue with our strategy of growing our team of players for as

long as a reasonable margin can be maintained, and activity is

permitted within our regulatory obligations.

Cal Expo

During the period we benefited from a higher proportion of

revenues from international amounts wagered in California, as per

the new "international bill" mentioned in our last Annual Report.

This benefit is likely to continue particularly during the

off-season of

Racing. In early November, WatchandWager re-commenced harness

racing at the Cal Expo racetrack in Sacramento for the eighth

successive season. Initial trading during the period has surpassed

expectations.

Licenses

During the period, we have concentrated on obtaining important

licence applications and renewals. I am pleased to report that all

licence applications were successful, and include the key strategic

states of California, New York and Kentucky, amongst others. These

licences are all in good standing through the entirety of 2020 and,

in certain cases, beyond.

Health and Safety

Shareholders should be aware of the larger than normal number of

horseracing fatalities at one of our partner racetracks, namely

Santa Anita, Pasadena, California. This has created a large amount

of negative publicity both state-wide and internationally regarding

horse welfare and is a concern for the future of the industry.

WatchandWager at Cal Expo enjoys an excellent horse welfare

record during our eight years of operation. In particular, as a

standard-bred (harness racing) operation, it has not suffered any

fatalities on the racetrack either during live operations or

training. Nonetheless, we and the management team are very aware of

the impact of negative publicity on the industry generally and,

potentially, live racing in California. As a result, our key

management are paying ever more attention to welfare and also

making involved partners, such as regulators, politicians and

indeed the general public, fully aware of our excellent welfare

record and the importance of live racing in California, especially

in terms of the value of jobs and taxes paid within the State.

Outlook

Short term

I am pleased to report that performance has been a little above

expectation across our key sectors from December to the time of

writing. We have seen particularly good performance from our

business-to-consumer unit and the racetrack in California. Whilst

the final quarter of the year will be very important during peak

racing season in the USA and internationally, at present the Board

are positive that the momentum can be maintained to end May 2020

and beyond.

Longer term

Existing operations

As stated, the Board is confident that existing operations have

now stabilised and can indeed return to profitability. The

operation is run leanly and whilst the external welfare issues

impacting horseracing and greyhound racing are a concern, there

remain significant opportunities, both domestic and international,

for new player content. Our strategy is to grow our platform

through additional content and players, but continually focussing

on higher margin business. However, the Board recognise that the

ultimate goal is to capitalise on the huge opportunities available

within USA expanded gaming landscape.

USA Expanded Gaming

Cal Expo/California

During the period, some significant progress has been made

within California to join the ever-growing number of states

legalising fixed odds sports betting. As a result of this, the

decision was made by the Board to extend our lease at the Cal Expo

racetrack for a further five years (to 2025), with an option to

extend even further to 2030. This was a strategic decision based on

legislative progress in the State Capitol in Sacramento, and to

secure our position in the face of competitive influences.

Since then the situation has coalesced into two major, but

competing, initiatives. The first being the State backed Senator

Gray/Dodd Bill (ACA 16), which continues to be debated in

Sacramento. The adoption of this is our preferred solution as in

draft form it includes our racetrack as an operator who could be

licensed, but also allows for online/mobile operations, plus white

label options to expand. In addition, a sensible tax rate in line

with the successful New Jersey model is suggested. The second

initiative, namely the proposed constitutional amendment tabled by

several Native American tribal casinos is also welcome but much

narrower in definition, including only land-based activity, with no

mobile betting. There are several other restrictions placed upon

the racetracks before they can undertake sports betting. The wider

Gray/Dodd initiative, which will undoubtedly be more attractive for

customers, would create many more jobs and tax payments within

California. In conjunction with other interested parties, we are

working hard to ensure that the key decision makers in Sacramento

are aware of these facts.

In the interim, we are busy developing our strategy for sports

betting. We see WatchandWager as the Licensed Association

responsible for the operation, and as result will work with

selected suppliers in both software, risk management, compliance

and marketing amongst others. We have currently issued a Request

for Proposal (RFP) for these functions to key suppliers and have

been excited by initial responses.

In terms of timing, a date for legal sports betting is difficult

to predict at present. Should either initiative reach the

California ballot on 3 November 2020, legal wagering could commence

in 2021. However, at time of writing, 2022 is more realistic, we

will keep shareholders fully informed as to progress.

Other States

Shareholders should also be aware that the Executive are also

working on other initiatives in relation to expanded gaming not

only in California, but also Arizona, Kentucky and North Dakota,

plus certain potential international developments. We will inform

shareholders should these move forward.

Summary

We are pleased with the overall progress of the Company. We have

restructured the business and, as a result, it is more balanced and

generating a much-improved margin. We will focus on this key

priority going forward.

In terms of strategy, the Board are very aware of our key

assets, namely the securing of our licenses in California,

especially the long-term agreement with Cal Expo. There are still

many hurdles to be overcome, and the next six months will be very

busy with the potential for impending legislation and selecting

partners. One thing is for sure: licensed Sports Betting is coming

to California, and we hold a critical asset in the State Capitol.

We are very aware that there is likely to be a stampede of

commercial interest in gaming in one of the largest economies in

the world. We will keep shareholders fully informed of progress in

this area.

Denham Eke

Non-executive Chairman

Condensed Consolidated Statement of Comprehensive Income

For the period ended 30 November 2019

Period to

30 November

Period to 2018

30 November

2019 (unaudited) (unaudited)

Note US$000 US$000

--------------------------------------------------- ----- ------------------- --------------

Amounts wagered 37,725 61,150

--------------------------------------------------- ----- ------------------- --------------

Turnover 2 8,060 5,382

Cost of sales (6,228) (3,581)

Betting duty paid (42) (100)

--------------------------------------------------- ----- ------------------- --------------

Gross profit 1,790 1,701

--------------------------------------------------- ----- ------------------- --------------

Operating costs (2,006) (2,170)

Share based costs - (18)

--------------------------------------------------- ----- ------------------- --------------

Other losses (10) (163)

Other income 60 79

Operating loss (166) (571)

--------------------------------------------------- ----- ------------------- --------------

Finance costs 3 (41) (20)

--------------------------------------------------- ----- ------------------- --------------

Loss before income tax (207) (591)

--------------------------------------------------- ----- ------------------- --------------

Income tax expense 4 - -

--------------------------------------------------- ----- ------------------- --------------

Loss for the period (207) (591)

--------------------------------------------------- ----- ------------------- --------------

Other comprehensive income for the period - -

--------------------------------------------------- ----- ------------------- --------------

Total comprehensive income for the period (207) (591)

--------------------------------------------------- ----- ------------------- --------------

Basic and diluted earnings per share for loss

attributable to the equity holders of the Company

during the period (cents) 5 (0.05) (0.15)

--------------------------------------------------- ----- ------------------- --------------

The notes set out below form an integral part of these condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Financial Position

As at 30 November 2019

As at Year to

30 November 31 May

2019 2019

(unaudited) (audited)

Note US$000 US$000

--------------------------------------- ----- -------------- ------------

Non-current assets

Intangible assets 6 68 104

Property, equipment and motor vehicles 15 26

Right of use assets 1.4 439 -

Bonds and deposits 100 101

--------------------------------------- ----- -------------- ------------

Total non-current assets 622 231

--------------------------------------- ----- -------------- ------------

Current assets

Bonds and deposits 883 882

Trade and other receivables 965 1,191

Cash and cash equivalents 7 2,758 2,594

--------------------------------------- ----- -------------- ------------

Total current assets 4,606 4,667

--------------------------------------- ----- -------------- ------------

Total assets 5,228 4,898

--------------------------------------- ----- -------------- ------------

Equity

Called up share capital 6,334 6,334

Share option reserve 42 42

Retained losses (5,431) (5,224)

--------------------------------------- ----- -------------- ------------

Total equity 945 1,152

--------------------------------------- ----- -------------- ------------

Current liabilities

Trade and other payables 2,977 2,896

Lease liability 1.4 88 -

--------------------------------------- ----- -------------- ------------

Total current liabilities 3,065 2,896

--------------------------------------- ----- -------------- ------------

Non-current liabilities

Loans 8 85 0 850

Lease liability 1.4 368 -

--------------------------------------- ----- -------------- ------------

Total non-current liabilities 1,218 850

--------------------------------------- ----- -------------- ------------

Total liabilities 4,283 3,746

--------------------------------------- ----- -------------- ------------

Total equity and liabilities 5,228 4,898

--------------------------------------- ----- -------------- ------------

The notes set out below form an integral part of these condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Changes in Equity

For the period ended 30 November 2019

Called up Share option Retained Total

share capital reserve earnings equity

US$000 US$000 US$000 US$000

Balance as at 31 May 2018

(audited) 6,334 4 (4,294) 2,044

Total comprehensive income

for the period:

Loss for the period - - (591) (591)

Transactions with owners:

Share-based payment expense - 18 - 18

Balance as at 30 November

2018 (unaudited) 6,334 22 (4,885) 1,471

---------------------------- --------------- ------------- ---------- --------

Balance as at 31 May 2019

(audited) 6,334 42 (5,224) 1,152

Total comprehensive income

for the period:

Loss for the period - - (207) (207)

Transactions with owners:

Share-based payment expense - - - -

Balance as at 30 November

2019 (unaudited) 6,334 42 (5,431) 945

---------------------------- ----- ------- -----

The notes set out below form an integral part of these condensed

consolidated interim financial statements.

Condensed Consolidated Statement of Cash Flows

For the period ended 30 November 2019

Period to Period to

30 November 30 November

2019 2018

(unaudited) (unaudited)

Note US$000 US$000

----------------------------------------------- ---- ------------- --------------

Cash flows from operating activities

Loss before income tax (207) (591)

Adjustments for:

* Depreciation 47 18

* Amortisation of intangible assets 38 42

* Finance costs 3 41 20

* Share based payment expense - 18

* Other foreign exchange movements (8) 524

Changes in working capital:

* Decrease in receivables 226 1,501

* Increase/(decrease) in payables 81 (13,534)

Cash flows generated from/(used in) operations 218 (12,002)

Bonds and deposits utilised in the course

of operations - 1,962

Net cash generated from/(used in) operating

activities 218 (10,040)

----------------------------------------------- ---- ------------- --------------

Cash flows from investing activities

Purchase of intangible assets - (6)

Purchase of property, equipment and motor

vehicles (5) -

Net cash used in investing activities (5) (6)

----------------------------------------------- ---- ------------- --------------

Cash flows from financing activities

Payment of lease liabilities 1.4 (17) -

Interest and charges paid 3 (41) (20)

Net cash used in financing activities (58) (20)

----------------------------------------------- ---- ------------- --------------

Net increase/(decrease) in cash and cash

equivalents 155 (10,066)

Cash and cash equivalents at beginning of

year 2,594 13,392

Exchange movements on opening cash and cash

equivalents 9 (525)

----------------------------------------------- ---- ------------- --------------

Cash and cash equivalents at end of period 2,758 2,801

----------------------------------------------- ---- ------------- --------------

The notes set out below form an integral part of these condensed

consolidated interim financial statements.

Notes to the Condensed Consolidated Interim Financial

Statements

For the period ended 30 November 2019

1 Reporting entity

Webis Holdings plc (the "Company") is a company domiciled in the

Isle of Man. The address of the Company's registered office is

Viking House, Nelson Street, Douglas, Isle of Man, IM1 2AH. The

Webis Holdings plc unaudited condensed consolidated financial

statements as at and for the period ended 30 November 2019

consolidate those of the Company and its subsidiaries (together

referred to as the "Group").

1.1 Basis of accounting

The unaudited condensed consolidated financial statements of the

Group (the "Financial Information") are prepared in accordance with

Isle of Man law and International Financial Reporting Standards

("IFRS") and their interpretations issued by the International

Accounting Standards Board ("IASB") and adopted by the European

Union ("EU"). The financial information in this report has been

prepared in accordance with the Group's accounting policies. Full

details of the accounting policies adopted by the Group are

contained in the consolidated financial statements included in the

Group's annual report for the year ended 31 May 2019 which is

available on the Group's website: www.webisholdingsplc.com.

The accounting policies and methods of computation and

presentation adopted in the preparation of the Financial

Information are consistent with those described and applied in the

consolidated financial statements for the year ended 31 May 2019,

other than as described further below in Note 1.4.

The unaudited condensed consolidated financial statements do not

constitute statutory financial statements. The statutory financial

statements for the year ended 31 May 2019, extracts of which are

included in these unaudited condensed consolidated financial

statements, were prepared under IFRS as adopted by the EU and have

been filed at Companies Registry.

1.2 Use of judgements and estimates

The preparation of the Financial Information requires management

to make judgements, estimates and assumptions that affect the

application of policies and reported amounts of assets and

liabilities, income and expenses. Actual results could differ

materially from these estimates. In preparing the Financial

Information, the critical judgements made by management in applying

the Group's accounting policies and the key sources of estimation

uncertainty were the same as those that applied to the consolidated

financial statements as at and for the year ended 31 May 2019 as

set out in those financial statements.

1.3 Functional and presentation currency

The Financial Information is presented in US Dollars, rounded to

the nearest thousand, which is the functional currency and also the

presentation currency of the Group.

1.4 Changes in accounting policies

Except as described below, the accounting policies applied in

these interim financial statements are the same as those applied in

the last annual financial statements.

The changes in accounting policies are also expected to be

reflected in the Group's consolidated financial statements as at

and for the year ending 31 May 2020. The Group has initially

adopted IFRS 16 Leases from 1 June 2019. There are no other new

IFRSs or interpretations effective from 1 June 2019 which have had

a material effect on the financial information included in this

report.

IFRS 16 introduced a single, on-balance sheet accounting model

for lessees. As a result, the Group, as a lessee, has recognised

right of use assets representing its rights to use the underlying

assets and lease liabilities representing its obligation to make

lease payments.

The Group has applied IFRS 16 using the modified retrospective

approach, under which the cumulative effect of initial application

is recognised in retained earnings as at 1 June 2019. Accordingly,

the comparative information presented to 31 May 2019 has not been

restated - i.e. it is presented, as previously reported, under IAS

17 and related interpretations.

The details of the changes in accounting policies are disclosed

below.

A. Definition of a lease

Previously, the Group determined at contract inception whether

an arrangement was or contained a lease under IAS 17. The Group now

assesses whether a contract is, or contains, a lease based on the

new definition of a lease. Under IFRS 16, a contract is, or

contains, a lease if the contract conveys a right to control the

use of an identified asset for a period of time in exchange for

consideration.

On transition to IFRS 16, the Group elected to apply the

practical expedient to grandfather the assessment of which

transactions are leases. It applied IFRS 16 only to contracts that

were previously identified as leases. Contracts that were not

identified as leases under IAS 17 were not reassessed. Therefore,

the definition of a lease under IFRS 16 has been applied only to

contracts entered into or changed on or after 1 June 2019.

B. As a lessee

The Group leases property assets. As a lessee, the Group

previously classified these leases as operating leases based on its

assessment of whether the lease transferred substantially all of

the risks and rewards of ownership. Under IFRS 16, the Group

recognises right of use assets and lease liabilities for leases

that meet the relevant definition, presenting these leases on the

Statement of Financial Position.

The Group does not recognise right of use assets and lease

liabilities for property rental costs that do not meet the

definition of leases under IFRS 16. The Group recognises these

costs as an expense on a straight-line basis.

i. Significant accounting policies

The Group recognises a right of use asset and a lease liability

at the lease commencement date. The right of use asset is initially

measured at cost, and subsequently at cost less accumulated

depreciation and impairment loss and adjusted for certain

remeasurements of the lease liability.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted at the Group's applicable incremental borrowing

rate.

The lease liability is subsequently increased by the interest

cost of the lease liability and decreased by the lease payment

made. It is remeasured when there is a change in future lease

payments arising from a change in an index or rate, a change in the

estimate of the amount expected to be payable under a residual

value guarantee, or as appropriate, changes in the assessment of

whether a purchase or extension option is reasonably certain to be

exercised, or a termination option is reasonably certain not to be

exercised.

The Group has applied judgment to determine the lease term for

some lease contracts in which it is a lessee that include renewal

options. The assessment of whether the Group is reasonably certain

to exercise such options impacts the lease term, which affects the

amount of lease liabilities and right of use assets recognised.

ii. Impacts on transition

Previously, the Group classified property leases as operating

leases under IAS 17. The leases typically run for a period of 1 to

6 years and the operating lease commitment relating to these leases

at 31 May 2019 as disclosed in the Group's consolidated financial

statements was US$294,000. At transition, for relevant leases

classified as operating leases under IAS 17, lease liabilities were

measured at the present value of the remaining lease payments,

discounted at the Group's applicable incremental borrowing rate as

at 1 June 2019. Right of use assets are measured at an amount equal

to the lease liability, adjusted by the amount of any net prepaid

and accrued lease payments, if applicable. The impact on transition

is summarised below.

As at 1 June 2019 US$000

-------------------- ------

Right of use assets 262

Lease liabilities (262)

Retained earnings -

--------------------- ------

iii. Impacts for the period

Right of use assets

The carrying amount of right of use assets at the end of the

period is as follows:

Right of

Property use assets

US$000 US$000

------------------------------------ -------- -----------

Balance at 1 June 2019 262 262

Depreciation expense (34) (34)

Modification to right of use assets 211 211

------------------------------------ -------- -----------

Balance at 30 November 2019 439 439

------------------------------------ -------- -----------

Lease liability

The carrying amount of lease liability at the end of the period

is as follows:

Property Lease liability

US$000 US$000

---------------------------------- -------- ---------------

Balance at 1 June 2019 262 262

Interest expense 10 10

Lease payments (27) (27)

Modification to lease liabilities 211 211

---------------------------------- -------- ---------------

Balance at 30 November 2019 456 456

---------------------------------- -------- ---------------

The Group has classified cash payments for the principal portion

of lease payments as financing activities. During the period under

review, an extension was agreed to the lease term of one of the

finance leases, which has resulted in a modification to the

relevant right of use asset and lease liability.

iv. Exemptions taken

The Group used the following practical expedient when applying

IFRS 16 to leases previously classified as operating leases under

IAS 17:

-- Applied the exemption not to recognise right of use assets

and lease liabilities for leases with less than 12 months of lease

term.

1.5 Going Concern

As noted within the statutory financial statements for the year

ended 31 May 2019, the Directors have undertaken several strategies

to support and sustain the Group as a going concern. These include,

seeking to broadening its client base and expand its business to

customer base, renewing various US state licenses, extending the

lease terms of the Cal Expo racetrack, reducing operational costs

and continuing to monitor the status of sports betting legislation

within the State of California, all of which are key priorities for

the Group in achieving its goal of profitability and maintaining

adequate liquidity in order to continue its operations. While the

Directors continue to assess all strategic options in this regard,

the ultimate success of strategies adopted is difficult to predict.

Notwithstanding the losses incurred in the last financial year,

along with the continued support of the Company's principal

shareholder, via Galloway Limited, a related party, the Directors

believe that the Group has adequate resources to meet its

obligations as they fall due.

2 Operating Segments

A. Basis for segmentation

The Group has the below two operating segments, which are its

reportable segments. The segments offer different services in

relation to various forms of pari-mutuel racing, which are managed

separately due to the nature of their activities.

Reportable segments and operations provided

Racetrack operations - hosting of races through the management

and operation of a racetrack facility, enabling patrons to attend

and wager on horse racing, as well as utilise simulcast

facilities.

ADW operations - provision of online ADW services to enable

customers to wager into global racetrack betting pools.

The Group's Board of Directors review the internal management

reports of the operating segments on a monthly basis.

B. Information about reportable segments

Information relating to the reportable segments is set out

below. Segment revenue along with segment profit / (loss) before

tax are used to measure performance as management considers this

information to be a relevant indicator for evaluating the

performance of the segments.

Reportable segments

All other

Racetrack ADW segments Total

Period to 30 November 2019 (unaudited) US$000 US$000 US$000 US$000

---------------------------------------- ----------- -------- --------- -------

External revenues 6,879 1,181 - 8,060

Segment revenue 6,879 1,181 - 8,060

---------------------------------------- ----------- -------- --------- -------

Segment loss before tax (37) (149) (21) (207)

Finance costs (8) (2) (31) (41)

Depreciation and amortisation (21) (64) - (85)

Period to 30 November 2019 (unaudited)

---------------------------------------- ----------- -------- --------- -------

Segment assets 852 2,900 1,476 5,228

---------------------------------------- ----------- -------- --------- -------

Segment liabilities 636 2,694 953 4,283

---------------------------------------- ----------- -------- --------- -------

Reportable segments

All other

Racetrack ADW segments Total

Period to 30 November 2018 (unaudited) US$000 US$000 US$000 US$000

--------------------------------------- ----------- -------- --------- -------

External revenues 4,128 1,254 - 5,382

Segment revenue 4,128 1,254 - 5,382

--------------------------------------- ----------- -------- --------- -------

Segment loss before tax (76) (436) (79) (591)

Finance costs - - (20) (20)

Depreciation and amortisation (4) (56) - (60)

--------------------------------------- ----------- -------- --------- -------

Period to 31 May 2019 (audited)

--------------------------------------- ----------- -------- --------- -------

Segment assets 423 2,612 1,863 4,898

--------------------------------------- ----------- -------- --------- -------

Segment liabilities 181 2,666 899 3,746

--------------------------------------- ----------- -------- --------- -------

C. Reconciliations of information on reportable segments to the

amounts reported in the financial statements

Period to Period to

30 November 30 November

2019 2018

(unaudited) (unaudited)

US$000 US$000

---------------------------------------------- ------------ ------------

i. Revenues

Total revenue for reportable segments 8,060 5,382

---------------------------------------------- ------------ ------------

Consolidated revenue 8,060 5,382

---------------------------------------------- ------------ ------------

ii. Loss before tax

Total loss before tax for reportable segments (186) (512)

Loss before tax for other segments (21) (79)

---------------------------------------------- ------------ ------------

Consolidated loss before tax (207) (591)

---------------------------------------------- ------------ ------------

iii. Other material items

Finance costs (41) (20)

Depreciation and amortisation (85) (60)

---------------------------------------------- ------------ ------------

Period to Period to

30 November 31 May

2019 2019

(unaudited) (audited)

iv. Assets US$000 US$000

Total assets for reportable segments 3,752 3,035

Assets for other segments 1,476 1,863

---------------------------------------------- ------------ ------------

Consolidated total assets 5,228 4,898

---------------------------------------------- ------------ ------------

v. Liabilities

Total liabilities for reportable segments 3,330 2,847

Liabilities for other segments 953 899

---------------------------------------------- ------------ ------------

Consolidated total liabilities 4,283 3,746

---------------------------------------------- ------------ ------------

D. Geographic information

The below table analyses the geographic location of the customer

base of the operating segments.

Period to

Period to 30

30 November November

2019 (unaudited) 2018 (unaudited)

Turnover US$000 US$000

--------------------- -------------- ----------------- -----------------

Racetrack operations North America 6,879 4,128

ADW operations North America 765 669

British

Isles 404 1

Asia Pacific 12 583

Europe - 1

8,060 5,382

------------------------------------ ----------------- -----------------

3 Finance costs

Period to Period to

30 November 30 November

2019 2018

(unaudited) (unaudited)

US$000 US$000

--------------------------------- ------------ ------------

Loan interest payable (31) (20)

Lease liability interest payable (10) -

--------------------------------- ------------ ------------

Finance costs (41) (20)

--------------------------------- ------------ ------------

4 Income tax expense

(a) Current and Deferred Tax Expenses

The current and deferred tax expenses for the period were US$Nil

(2018: US$Nil). Despite having made losses, no deferred tax was

recognised as there is no reasonable expectation that the Group

will recover the resultant deferred tax assets.

(b) Tax Rate Reconciliation

Period to Period to

30 November 30 November

2019 2018

(unaudited) (unaudited)

US$000 US$000

-------------------------------------------- ------------ ------------

Losses before tax (207) (591)

Tax charge at IOM standard rate (0%) - -

Adjusted for:

Tax credit for US tax losses (at 15%) (65) (100)

Add back deferred tax losses not recognised 65 100

-------------------------------------------- ------------ ------------

Tax charge for the period - -

-------------------------------------------- ------------ ------------

The maximum deferred tax asset that could be recognised at

period end is approximately US$875,000 (2018: US$744,000). The

Group has not recognised any asset as it is not reasonably known

when the Group will recover such deferred tax assets.

5 Earnings per ordinary share

The calculation of the basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period.

The calculation of diluted earnings per share is based on the

basic earnings per share, adjusted to allow for the issue of

shares, on the assumed conversion of all dilutive share

options.

An adjustment for the dilutive effect of share options and

convertible debt in the previous period has not been reflected in

the calculation of the diluted loss per share, as the effect would

have been anti-dilutive.

Period to Period to

30 November 30 November

2019 2018

(unaudited) (unaudited)

US$000 US$000

-------------------- ------------ --------------

Loss for the period (207) (591)

-------------------- ------------ ------------

No. No.

---------------------------------------------------- ----------- -------------

Weighted average number of ordinary shares in issue 393,338,310 393,338,310

Dilutive element of share options if exercised 14,000,000 14,000,000

---------------------------------------------------- ----------- -------------

Diluted number of ordinary shares 407,338,310 407,338,310

---------------------------------------------------- ----------- -------------

Basic earnings per share (cents) (0.05) (0.15)

---------------------------------------------------- ----------- -----------

Diluted earnings per share (cents) (0.05) (0.15)

---------------------------------------------------- ----------- -----------

The earnings applied are the same for both basic and diluted

earnings calculations per share as there are no dilutive effects to

be applied.

6 Intangible assets

Intangible assets include goodwill which relates to the

acquisition of the pari-mutuel business which is both a cash

generating unit and a reportable segment, including goodwill

arising on the acquisition in 2010 of WatchandWager.com LLC, a US

registered entity licenced for pari-mutuel wagering in North

Dakota.

The Group tests intangible assets annually for impairment, or

more frequently if there are indicators that the intangible assets

may be impaired. The goodwill balance was fully impaired in the

financial year ended 31 May 2015.

7 Cash and cash equivalents

30 November 31 May

2019 2019

(unaudited) (audited)

US$000 US$000

--------------------------------------------------- ------------- -----------

Cash and cash equivalents - company and other

funds 1,516 1,363

Cash and cash equivalents - protected player funds 1,242 1,231

Total cash and cash equivalents 2,758 2,594

--------------------------------------------------- ------------- -----------

The Group holds funds for operational requirements and for its

non-Isle of Man customers, shown as 'company and other funds' and

on behalf of its Isle of Man regulated customers, shown as

'protected player funds'.

Protected player funds are held in fully protected client

accounts within an Isle of Man regulated bank.

8 Loans

30 November 31 May

2019 2019

(unaudited) (audited)

US$000 US$000

-------------------- ------------ ----------

Loan - Galloway Ltd 850 850

850 850

-------------------- ------------ ----------

A loan of US$500,000 was received from Galloway Ltd in February

2017, to provide financing for cash-backed bonding agreements. The

loan is for a term of five years, attracts fixed interest at 7.75%

per annum and is secured over the unencumbered assets of the

company (see note 9). The loan was issued at a market rate with no

issue costs and the interest is settled on a quarterly basis. At

period end there are two month's outstanding interest of US$6,476

(2018: US$6,476), which is recorded in other payables.

A further loan of US$350,000 was received from Galloway Ltd in

May 2019, to provide additional financing for cash-backed bonding

agreements. The loan is for a term of five years, attracts fixed

interest at 7.00% per annum and is secured over the unencumbered

assets of the company (see note 9). The loan was issued at a market

rate with no issue costs and the interest is settled on a quarterly

basis. At period end there is one month's outstanding interest of

US$2,014 (2018: US$Nil), which is recorded in other payables.

9 Related party transactions

Identity of related parties

The Group has a related party relationship with its

subsidiaries, and with its directors and executive officers and

with Burnbrae Ltd (common directors and significant

shareholder).

Transactions with and between subsidiaries

Transactions with and between the subsidiaries in the Group

which have been eliminated on consolidation are considered to be

related party transactions.

Transactions with entities with significant influence over the

Group

Rental and service charges of US$5,205 (2018: US$25,714) and

directors' fees of US$22,586 (2018: US$23,562) were charged in the

period by Burnbrae Ltd of which Denham Eke and Nigel Caine are

common directors. The Group also had a loan of US$850,000 (2018:

US$500,000) from Galloway Ltd, a company related to Burnbrae

Limited by common ownership and Directors (see note 8).

Transactions with other related parties

There were no transactions with other related parties during the

period.

10 Events after the Balance Sheet Date

As previously announced on 4 December 2019, the company signed

an extension of the lease for the Cal Expo racetrack facility,

located in Sacramento, California, through to 1 May 2025. This

modified the terms of the lease and resulted in an uplift of

US$211,245 to both the right of use asset and lease liability at

the period end (see note 1.4).

11 Approval of interim statements

The interim statements were approved by the Board on 25 February

2020. The interim report is expected to be available for

shareholders on 26 February 2020 and will be available from that

date on the Group's website www.webisholdingsplc.com.

The Group's nominated adviser and broker is Beaumont Cornish

Limited, 10th Floor, 30 Crown Place, London EC2A 4EB.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FLFLDFRIEFII

(END) Dow Jones Newswires

February 26, 2020 02:00 ET (07:00 GMT)

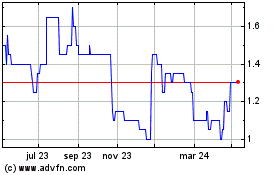

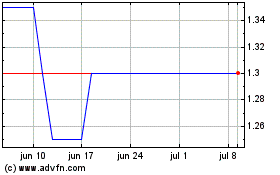

Webis (LSE:WEB)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Webis (LSE:WEB)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024