TIDMWINV

RNS Number : 1929F

Worsley Investors Limited

05 March 2020

This announcement is not for release, publication or

distribution, directly or indirectly, in or into the United States,

any Member State of the European Economic Area (other than the

Republic of Ireland), Australia, Canada, Japan or South Africa or

any jurisdiction where to do so might constitute a violation of

local securities laws or regulations.

5 March 2020

Worsley Investors Limited

("Worsley" or "the Company")

Results of Open Offer and revised timetable

Worsley Investors Limited is pleased to announce that is has

received valid acceptances and excess applications from Qualifying

Shareholders for a total of 12,625,346 New Ordinary Shares at the

price of 30 pence per share, raising gross proceeds of GBP3.8

million. Accordingly, the 8,133,095 New Ordinary Shares not taken

up under the Open Offer will be available for subscription under

the Initial Issue.

The Board has received indications of interest in the Initial

Issue inter alia from investors located outside of the United

Kingdom and, to accommodate this interest and allow for more

complex settlement from these jurisdictions, the timetable,

including the time available for the submission of applications

under the Initial Issue and for the commencement of dealings of all

the New Ordinary Shares being issued under the Open Offer and the

Initial Issue, has been slightly extended. The latest time for the

submission of application forms in respect of the Initial Issue is

now 1.00pm on 16 March 2020 (was 1.00pm on 11 March 2020) and

Admission and commencement of dealings in respect of the New

Ordinary Shares being issued under both the Open Offer and the

Initial Issue are expected on 18 March 2020 (was 13 March 2020). A

revised timetable is set out below.

The Initial Issue is subject to the representations and

warranties contained in Part XI (Terms and Conditions of any

Placing and the Placing Programme) of the Prospectus.

The application form in respect of the Initial Issue is

available to Relevant Persons (as defined in the Important

Information section below) on request from the Company's

Administrator, the Investment Advisor and Computershare Investor

Services PLC, and should be completed and returned to Computershare

Investor Services PLC by post (or by hand during normal business

hours) to Corporate Actions Projects, The Pavilions, Bridgwater

Road, Bristol BS99 6AH, or by e-mail to

ofspaymentqueries@computershare.co.uk (with the original or

certified copy to follow by post or hand as set out above), so as

to be received no later than 1:00 p.m. on 16 March 2020.

All capitalised terms in this announcement have the meaning

given to them in the Prospectus, unless otherwise defined

herein.

Revised TIMETABLE

Latest time and date to submit signed application forms 1.00 p.m. 16 March 2020

in respect of the Initial Issue

Results of the Offer announced 17 March 2020

Where applicable, expected date for CREST accounts to be 18 March 2020

credited in respect of New Ordinary

Shares in uncertificated form

Admission and dealings in the New Ordinary Shares 18 March 2020

expected to commence

Where applicable, expected date for despatch of Within 10 Business Days of Admission

definitive share certificates for New Ordinary

Shares in certificated form

Publication of results of each Placing As soon as practicable following the closing of each

Placing

Admission and crediting of CREST accounts in respect of Business Day on which the New Ordinary Shares are issued

each Placing

Despatch of definitive share certificates for the New Approximately two weeks following the Admission of such

Ordinary Shares in certified form New Ordinary Shares

Placing Programme closes 9 February 2021

The times and dates set out in the expected timetable of

principal events above and mentioned throughout this document may

be adjusted by the Company in which event the Company will make an

appropriate announcement to a Regulatory Information Service giving

details of any revised dates and the details of the new times and

dates will be notified to the London Stock Exchange and, where

appropriate, Shareholders. Shareholders may not receive any further

written communication.

Enquiries:

For further information, please contact:

Worsley Associates LLP (Investment Advisor)

Blake Nixon

Tel: +44 (0) 203 873 2288

Shore Capital (Financial Adviser and Broker)

Robert Finlay / Anita Ghanekar / Hugo Masefield

Tel: +44 (0) 20 7408 4050

Praxis Fund Services Limited (Administrator and Secretary)

Matt Falla / Katrina Rowe

Tel: +44 (0) 1481 73760

LEI: 213800AF85VEZMDMF931

IMPORTANT INFORMATION

Except where the context requires otherwise, until the expiry of

the transition period agreed between the United Kingdom and the

European Union as part of the terms of the United Kingdom's exit

from the European Union, a reference to the European Union or the

European Economic Area is a reference to the members of the

European Union or European Economic Area from time to time, as

applicable together with the United Kingdom.

This announcement does not contain or constitute an offer of, or

the solicitation of an offer to buy, or subscribe for, the New

Ordinary Shares or any other securities to any person in Australia,

Canada, Japan or South Africa, or the United States or in any

jurisdiction to whom or in which such offer or solicitation is

unlawful. Subject to certain exceptions, the securities referred to

herein may not be offered or sold in Australia, Canada, Japan or

South Africa or to, or for the account or benefit of, any national,

resident or citizen of Australia, Canada, Japan or South Africa.

The offer and sale of the securities referred to herein has not

been and will not be registered under the US Securities Act or

under the applicable securities laws of Australia, Canada, Japan or

South Africa. The availability of the Open Offer to persons not

resident in the United Kingdom may be affected by the laws of the

relevant jurisdictions. Such persons should inform themselves about

and observe any application requirements.

The New Shares have not been and will not be registered under

the US Securities Act or under the securities laws of any state or

other jurisdiction of the United States or under any securities

laws of Australia, Canada, Japan or South Africa or any other

jurisdiction where to do so would be unlawful and may not be

offered, sold, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States, or

within any of Australia, Canada, Japan or South Africa or any other

jurisdiction where to do so would be unlawful. There will be no

public offer of the New Ordinary Shares in the United States.

This communication is only addressed to, and directed at,

persons in member states of the European Economic Area (other than

the United Kingdom) who are "qualified investors" within the

meaning of Article 2(e) of the Prospectus Regulation ("Qualified

Investors"). For the purposes of this provision, the expression

"Prospectus Regulation" means Regulation (EU) 2017/1129. In

addition, in the United Kingdom, this communication is being

distributed only to, and is directed only at, Qualified Investors:

(i) who have professional experience in matters relating to

investments who fall within the definition of "investment

professional" in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"), or (ii) who are high net worth companies, unincorporated

associations and partnerships and trustees of high value trusts as

described in Article 49(2) of the Order, and (iii) other persons to

whom it may otherwise lawfully be communicated (all such persons

together being referred to as "Relevant Persons"). Any investment

or investment activity to which this communication relates is

available only to and will only be engaged in with such persons.

The application form to be completed in connection with the Initial

Issue will only be issued to Relevant Persons. The Company will not

accept applications for shares in connection with the Initial Issue

from anyone other than a Relevant Person. This communication must

not be acted on or relied on in any member state of the European

Economic Area other than the United Kingdom and Republic of

Ireland, by persons who are not Qualified Investors.

The distribution of this announcement and the offering of the

New Ordinary Shares in jurisdictions other than the United Kingdom

and Republic of Ireland may be restricted by law. No action has

been taken by the Company or Shore Capital and Corporate Limited

that would permit an offering of such shares or possession or

distribution of this announcement or any other offering or

publicity material relating to such shares in any jurisdiction

where action for that purpose is required. Persons into whose

possession this announcement comes are required by the Company and

Shore Capital and Corporate Limited to inform themselves about, and

to observe, any such restrictions. Any failure to comply with these

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

This announcement may not be used in making any investment

decision. This announcement does not contain sufficient information

to support an investment decision and investors should ensure that

they obtain all available relevant information before making any

investment. This announcement does not constitute and may not be

construed as an offer to sell, or an invitation to purchase or

otherwise acquire, investments of any description, nor as a

recommendation regarding the possible offering or the provision of

investment advice by any party. No information in this announcement

should be construed as providing financial, investment or other

professional advice and each prospective investor should consult

its own legal, business, tax and other advisers in evaluating the

investment opportunity. No reliance may be placed for any purposes

whatsoever on this announcement or its completeness. Nothing in

this announcement constitutes investment advice and any

recommendations that may be contained herein have not been based

upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

Potential investors should be aware that any investment in the

Company is speculative, involves a high degree of risk, and could

result in the loss of all or substantially all of their investment.

Results can be positively or negatively affected by market

conditions beyond the control of the Company or any other person.

The returns set out in this document are targets only. There is no

guarantee that any returns set out in this document can be achieved

or can be continued if achieved, nor that the Company will make any

distributions whatsoever. There may be other additional risks,

uncertainties and factors that could cause the returns generated by

the Company to be materially lower than the returns set out in this

announcement.

This announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied is, or will be made as to, or in relation to,

and no responsibility or liability is, or will be, accepted by

Shore Capital and Corporate Limited or by any of their affiliates

or agents as to, or in relation to, the accuracy or completeness of

this announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Shore Capital and Corporate Limited, which is authorised and

regulated in the United Kingdom by the Financial Conduct Authority,

has been appointed to act as sponsor and financial adviser to the

Company in connection with the Open Offer and Initial Issue. Shore

Capital and Corporate Limited is authorised and regulated in the

United Kingdom by the Financial Conduct Authority, Persons viewing

this announcement should note that, in connection with the Open

Offer and Initial Issue, Shore Capital and Corporate Limited is

acting exclusively for the Company and no one else. Apart from the

responsibilities and liabilities, if any, which may be imposed on

Shore Capital and Corporate Limited. by FSMA, Shore Capital and

Corporate Limited will not be responsible to anyone other than the

Company for providing the protections afforded to clients of Shore

Capital and Corporate Limited or for advising any other person on

the transactions and arrangements described in this announcement.

No representation or warranty, express or implied, is made by Shore

Capital and Corporate Limited. as to any of the contents of this

announcement for which the Company and the Directors are solely

responsible. Shore Capital and Corporate Limited. has not

authorised the contents of, or any part of, this announcement and

(without limiting the statutory rights of any person to whom this

announcement is issued) no liability whatsoever is accepted by

Shore Capital and Corporate Limited for the accuracy of any

information or opinions contained in this announcement or for the

omission of any material information, for which the Company and the

Directors are solely responsible. Accordingly, Shore Capital and

Corporate Limited disclaim (to the extent permitted by law) any

liability which they might otherwise have in respect of any of the

information or opinions contained in this announcement, whether

arising in tort, contract or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIFLFVEVFIEIII

(END) Dow Jones Newswires

March 05, 2020 10:36 ET (15:36 GMT)

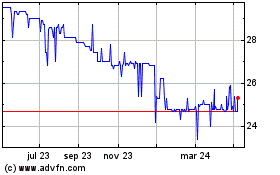

Worsley Investors (LSE:WINV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

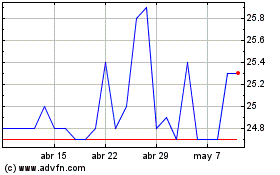

Worsley Investors (LSE:WINV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024