By Mike Colias and Ben Foldy

The United Auto Workers and Detroit car companies reached

agreements on coronavirus-mitigation efforts that for now will

avoid a two-week shutdown of U.S. factories.

The UAW had been pressing General Motors Co., Ford Motor Co. and

Fiat Chrysler Automobiles NV to idle their plants to protect

workers from the virus. The union said late Tuesday that company

executives had agreed to partial shutdowns of plants to allow for

cleaning between shifts and longer periods for shift changeovers,

along with other measures to minimize worker contact.

A GM spokesman declined to comment on the new measures and said

the company has been working on mitigation efforts for weeks. A

Fiat Chrysler spokesman confirmed the company agreed to additional

safety precautions. Ford didn't immediately reply to requests for

comment.

Meanwhile, Ford confirmed Tuesday evening it temporarily closed

the company's Chicago assembly plant because of a parts shortage. A

nearby Lear Corp. plant that supplies parts to the Ford factory is

closing temporarily after two employees tested positive for

Covid-19, people familiar with the matter said. The plant was

closed for disinfection after one worker tested positive and

another is likely to have contracted the disease, a Lear spokesman

said.

The Ford factory, which makes the Ford Explorer and Lincoln

Aviator sport-utility vehicles, is expected to be down for at least

Tuesday night's eight-hour shift and for part of Wednesday, the

people said.

Shutting off production across U.S. factories would deal another

financial blow to the Detroit auto makers, which have been

grappling with virus-related disruption globally. The outbreak in

China has decimated vehicle sales there and caused ripple effects

through the global automotive supply chain.

Ford is considering cutting shifts at some of its U.S. factories

to limit the risk to employees, although no final decision has been

made, people familiar with the matter say. If the cuts are enacted,

it would mark the first time an auto maker in the U.S. has

significantly curtailed production because of the outbreak.

Eliminating a shift at a factory that works round the clock on

three shifts would allow more time for disinfecting the facility, a

person with knowledge of the company's deliberations said. It also

would reduce the mingling that occurs between workers on shift

change, the person said.

In Europe, Ford and other major car companies have temporarily

closed their factories as the outbreak has spread there.

On Tuesday, local authorities told Tesla Inc. that it must stop

production at its Fremont, Calif., factory as part of an order by

Alameda County to have people shelter at their homes to prevent the

spread of coronavirus.

Shutting down plants results in an immediate hit to the bottom

line for car companies, which book revenue as soon as they ship

vehicles from the factory to dealerships. A 40-day strike at GM's

U.S. plants last fall drained $3.6 billion from GM's bottom

line.

Some factory workers have complained on social media that they

feel unsafe showing up for work, particularly as many of the

companies' white-collar employees were told to work from home.

"There is serious concern from our employees and rightfully so,"

said Todd Dunn, president of the union's chapter representing

Ford's Louisville, Ky., plants. "If I could send them home and give

them money, I would."

Global auto makers have been relying on the health of the U.S.

market this year, as China and more recently Europe have seen car

sales and production collapse as a result of the pandemic.

So far, car companies have fended off parts shortages to keep

plants running in the U.S., which accounts for the lion's share of

profits at GM, Ford and Fiat Chrysler. The prospect of auto makers

cutting U.S. production has Wall Street analysts scrutinizing their

balance sheets to gauge how well they could weather a prolonged

shutdown.

The Detroit companies are in a much stronger cash position than

they were heading into the financial crisis a decade ago, which

ultimately forced GM and Chrysler into bankruptcy.

At the end of last year, GM and Ford each had at least $35

billion of cash and liquidity, while Fiat Chrysler had about EUR15

billion ($16.5 billion), according to securities filings.

In an investor note Tuesday, Morgan Stanley analyst Adam Jonas

said the companies "are categorically in a strong position to

absorb several months of a near shut-down."

Matthew Schulte, who works in the body shop at a Ford truck

plant in the company's hometown of Dearborn, Mich., said many of

his co-workers were anxious about exposure to the virus at

work.

"If the schools and restaurants and everyone else is hunkering

down, and we're still making trucks for people who likely aren't

buying them, it doesn't quite add up," said Mr. Schulte, 47 years

old.

He added, though, that many workers are also worried about

losing their paychecks without any clarity over when the factories

might come back online.

Ian Lovett contributed to this article.

Write to Mike Colias at Mike.Colias@wsj.com and Ben Foldy at

Ben.Foldy@wsj.com

(END) Dow Jones Newswires

March 17, 2020 23:52 ET (03:52 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

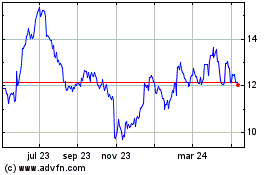

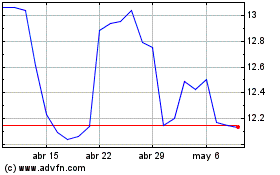

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024