TIDMMERC

RNS Number : 6045H

Mercia Asset Management PLC

25 March 2020

RNS

The information contained within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be

in the public domain.

For immediate release 25 March 2020

Mercia Asset Management PLC

("Mercia", the "Group" or the "Company")

COVID-19 Business Update

Mercia Asset Management PLC (AIM: MERC), the proactive,

regionally focused specialist asset manager, provides the following

business update in light of COVID-19.

-- Business continuity plan implemented with previously tested

remote working capabilities functioning well

-- Assessing and supporting c.400 portfolio companies in own and third-party managed funds

-- Strong balance sheet with GBP30.4million unrestricted cash as at 20 March 2020

-- No bank or other indebtedness and c.GBP190million of

available fund capital from long-term investors to selectively

support portfolio companies and provide financial stability

-- Short-term impact to asset management revenues and portfolio

valuations as a result of the drop in asset values across all

markets and overall economic conditions

COVID-19 priorities and actions

In response to the challenges posed by COVID-19, the Group's

focus is on three priorities: the safety of our employees, the

continued support for our portfolio companies and maintaining

long-term value creation potential for our shareholders and

investors in our managed funds.

Mercia's employees are our strength

Our first priority is the wellbeing and safety of our employees

and their families. Well in advance of government guidance Mercia

had developed full virtual systems (including end-to-end investment

and fund transfer processes) to operate in a remote environment and

we had already closed all eight offices for a day to trial this

virtual operating in real time. We have no staff overseas and all

of our employees are now working remotely. We have established

regular, coordinated investment and support team video check-ins as

we anticipate an extended period of remote working to ensure that

our employees' welfare, and that of their families, is catered for.

We are passionate about our #OneMercia community which now, more

than ever, is critical to Mercia's continued and efficient

operations.

Commitment to regional SMEs

In addition to promoting employee safety, our remote working

capabilities allow us to provide ongoing support to our portfolio

companies at this critical time. The Group has c.400 companies

within its venture, private equity, debt and balance sheet

investment portfolios and we are deploying our operational

specialists and platform of services to assess their needs. We have

a talented, committed and experienced investment and support team

across all of Mercia's asset classes and they are actively engaging

with our portfolio companies.

Our commitment to regional SMEs is long term, and we will deploy

all of our resources to support them through this period. This will

in turn ensure that we protect long-term value for our shareholders

and managed fund investors alike. Mercia's funds under management

are typically long-term and closed-end in nature, including some

with supportive investors such as British Business Bank and

regional pension funds.

Strong balance sheet to meet funding needs

The Company has a strong balance sheet with GBP30.4million of

unrestricted cash as at 20 March 2020 and no bank borrowings or

other debt obligations. In addition, Mercia has c.GBP190million of

available investment capital in its managed funds. Together, this

provides sufficient liquidity to selectively support our portfolios

and provide financial stability to the Group as a whole. Mercia's

focus has always been on sectors where investee companies have

relatively low investment needs to achieve cash flow breakeven and,

at this time of limited liquidity, Mercia's significant cash

resources across both its funds and balance sheet is a key

asset.

Likely short-term financial impact on the Group

With almost all asset classes worldwide falling in value it is

inevitable that valuations for Mercia's managed funds will be

impacted. Where contracted revenues are directly linked to those

asset values, they will be consequently affected. Today the three

Northern Venture Capital Trusts, whose portfolios are now managed

by Mercia, announced reduced net asset values of c.22% on average.

Similarly, it is inevitable that the fair value of Mercia's direct

investment portfolio will be impacted.

Outlook

The Group will continue to invest carefully to preserve the

significant potential future value in all portfolios and has the

necessary capital to do so. Whilst it is not possible to provide

more explicit guidance at this time we do now expect revenues over

the next financial year to be lower than originally anticipated.

The Group remains very well placed financially, however, and has a

degree of flexibility in its cost base, to partially mitigate lower

anticipated revenues.

As a result of these key strengths, Mercia's medium-term future

prospects remain unchanged.

Mark Payton, Chief Executive Officer of Mercia, commented:

"Mercia was established with the knowledge that capital supply

and market performance is cyclical in nature. Over more than a

decade we have built a proactive, supportive ecosystem where we

have invested in businesses with relatively modest capital needs

and sensible entry valuations. I have the privilege of working with

an exceptionally talented and experienced team who themselves have

successfully invested through such cycles. I am confident that we

will come out of this cycle in good health. We are well prepared

with strong liquidity (c.GBP220million of uninvested cash across

our asset classes) and long-term, supportive fund investors. Mercia

has only invested on a domestic and largely regional basis, and we

are here to support our portfolio companies as we chart our way

together through these difficult times."

For further information, please contact:

Mercia Asset Management PLC +44 (0)330 223 1430

Mark Payton, Chief Executive Officer

Martin Glanfield, Chief Financial

Officer

www.mercia.co.uk

Canaccord Genuity Limited (NOMAD

and Joint Broker) +44 (0)20 7523 8000

Simon Bridges, Richard Andrews

N+1 Singer ( Joint Broker )

Harry Gooden, James Moat +44 (0)20 7496 3000

Buchanan Communications +44 (0)20 7466 5000

Giles Stewart, Chris Lane, Vicky

Hayns

www.buchanan.uk.com

About Mercia Asset Management PLC:

Mercia is a proactive, specialist asset manager focused on

supporting regional SMEs to achieve their growth aspirations.

Mercia provides capital across its four asset classes of balance

sheet, venture, private equity and debt capital; the Group's

'Complete Capital Solution'. The Group initially nurtures

businesses via its third-party funds under management, then over

time Mercia can provide further funding to the most promising

companies, by deploying direct investment follow-on capital from

its own balance sheet.

The Group has a strong UK regional footprint through its eight

offices, 19 university partnerships and extensive personal

networks, providing it with access to high-quality deal flow.

Mercia has over GBP700million of assets under management and, since

its IPO in December 2014, has invested over GBP90million across its

direct investment portfolio.

Mercia Asset Management PLC is quoted on AIM with the epic

"MERC".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFLFIEVEIEFII

(END) Dow Jones Newswires

March 25, 2020 11:08 ET (15:08 GMT)

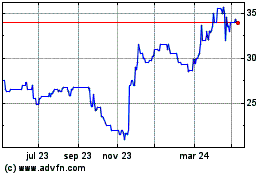

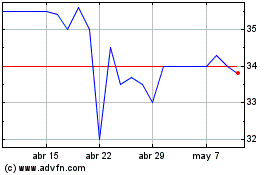

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mercia Asset Management (LSE:MERC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024