TIDMPOS

RNS Number : 7710H

Plexus Holdings Plc

27 March 2020

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

equipment & services

27 March 2020

Plexus Holdings PLC ('Plexus', 'the Company' or 'the Group')

Interim Results for the 6 months to 31 December 2019

Plexus Holdings plc, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R) method

of wellhead engineering, announces its interim results for the six

months to 31 December 2019.

Financial Results

-- Following the sale of the wellhead Jack-up exploration

application business (the "Jack-up Business") to FMC Technologies

Limited ('TFMC'), a subsidiary of major oil services provider

TechnipFMC (Paris:FTI)(NYSE:FTI), on 1 February 2018, the interim

results and prior periods are reported as required on a continuing

and a discontinued operations basis.

-- Continuing operations sales revenue GBP49k (2018: GBP1,312k)

-- Continuing operations EBITDA loss (GBP1,809k) (2018: GBP1,504k loss)

-- Continuing operations loss before tax (GBP2,763k) (2018: Loss GBP2,337k)

-- Basic loss per share from continuing activities (2.75p) (2018: 2.22p loss)

-- Net cash of GBP4.5m (2018: GBP9.5m).

-- The Group in addition has GBP2.96m in financial assets (2018: GBP2.85m)

-- The Group has no debt following the final repayment (GBP75k)

of a term loan in September 2019.

Overview

Focus on IP led strategy to establish proprietary POS-GRIP

technology in new markets and replicate success achieved in North

Sea jack-up exploration where Plexus equipment raised standards,

generated substantial cost savings for operators and enjoyed a

dominant market position

Surface production wellhead and tree market

-- Strategy centred on offering full-service package following

formation of majority owned Plexus Pressure Control Ltd ('PPC'), a

JV with UK based BEL Valves Ltd, in June 2019

o Enables Plexus for the first time to offer operators of

large-scale production projects POS-GRIP wellheads alongside valves

and Xmas-trees

-- Growing sales pipeline of bidding activity

o Actively participating in the tender process for a range of

projects across the world

o Increased interest being expressed by operators in Plexus

tendering for projects

o Long lead times associated with large surface production

projects

-- Large target market - the award of just one contract in the

surface production market, which is estimated to be worth an

estimated US$2.5 billion over the five-year period 2021-2025, has

the potential to be transformational for Plexus

o Rystad Energy estimates a total of 691 wells are planned to be

drilled between 2021 - 2025 with an average capex spend of nearly

US$50 billion implying a potential production wellhead and tree

market opportunity of c. US$2.5 billion

o If Plexus was able to secure just a 5% share of this market

from its growing sales pipeline, this could translate into revenue

of US$125 million with an estimated average gross margin of around

30%

Russia and the CIS states

-- Strategy centred on supporting licensing partner Gusar's

efforts to secure contracts for POS-GRIP wellheads in the Russian

and CIS markets, a top three hydrocarbon producer in the world with

significant gas reserves

-- Breakthrough first jack-up exploration wellhead successfully

installed as part of the inaugural contract for POS-GRIP rental

wellhead equipment secured by Gusar with global energy giant

Gazprom

o Marks commencement of Gusar's contracted work with Gazprom for

the first year of an up to five-year jack-up gas exploration

drilling programme on the Kara Sea Shelf

o Set to initiate a licence royalty revenue stream for Plexus

under existing Gusar Licence Agreement

o Post period end, sale of additional POS-GRIP(R) wellhead

equipment to Gusar following encouraging discussions with Russian

operators

Outlook

-- The Board anticipates Group revenues for the 12 months to 30

June 2020 ("FY20") to be in line with market expectations.

-- It is important to acknowledge the ongoing disruption to the

general global economy and resultant uncertainty for companies and

workforces caused by the COVID-19 virus and the impact this may

have on Plexus. Like many companies the full extent of the impact

of the COVID-19 pandemic is not yet known, and it is difficult to

evaluate all of the potential implications on the company's trade,

customers, suppliers and the wider economy.

-- The Company also notes the actions of Saudi Arabia and Russia

in terms of increasing production of crude oil to record levels

which has, in conjunction with the impact of coronavirus on demand

for oil, had a material impact on the oil price.

Chief Executive Ben van Bilderbeek said:

"In previous results announcements I have extolled the virtues

of POS-GRIP, Plexus' proprietary wellhead technology: how it

delivers a gas-proof solution and substantial cost savings; how its

superior sealing technology reduces harmful carbon emissions from

the well-site; how it has been successfully deployed on over 400

wells worldwide by over 70 operators; and how our technology can

raise standards wherever metal to metal sealing is required. New

set of interims, same old message? Not quite. Our technology, which

is proven to raise performance, reliability and safety standards,

remains the same. So too do the substantial cost savings generated

by reduced installation and maintenance time. What is different and

what gives us considerable encouragement as we look to establish

POS-GRIP as the go-to technology for gas-proof solutions, is that

debate over the need to move to a carbon neutral world and the oil

and gas industry's place within it has moved from the fringes to

the mainstream. I therefore believe that a major opportunity is

opening up for Plexus, and our POS-GRIP leak-proof technology.

"Over the last 12 months, debate appears to have shifted

decisively away from 'if' to 'when' the world goes carbon neutral.

Indeed, such a goal has now become part of the mainstream strategy

of many major international corporations around the world, and not

just in the oil and gas industry. It therefore follows that to

safeguard its future in a world that is moving towards net-zero

carbon emissions, the oil and gas industry will have to clean-up

its act. As reported in an article in the Daily Telegraph on 24

January 2020, Michael Liebreich, founder of Bloomberg New Energy

Finance and head of Liebreich Associates, said, 'My advice to

companies is that you had better have a 2050 net-zero strategy or

you risk losing your societal licence to operate'. Speaking to

North Sea operators in Scotland in the same month, Oil & Gas

Authority (OGA) chairman, Tim Eggar, stressed the need to act fast,

'We have to act much, much faster and go farther in reducing the

carbon footprint. Our energy systems must keep improving at pace,

to become cleaner and more efficient and this requires ambitious

thinking, capital investment and bold leadership. Action not just

talk or more analysis.'

"Encouragingly, easy wins for the industry are at hand.

Specifically, prioritising cleaner natural gas at the expense of

dirtier oil and coal and eliminating harmful leaks from the supply

chain can make a real difference. As Ben Ratner powerfully pointed

out on the Environmental Defense Fund website in January 2020, 'The

opportunity presented is significant: if the global oil and gas

industry reduced methane emissions by 45% by 2025, it would deliver

the same near-term benefit to the climate as closing 1,300

coal-fired power plants - one-third of all the coal plants in the

world.' Crucially, natural gas and eliminating methane emissions

from the well-site are both areas where POS-GRIP can excel.

"I have often described POS-GRIP wellhead systems as being

'leak-proof' and 'superior' in terms of performance, reliability

and safety. These are tangible, measurable benefits that have been

proven many times over out in the field and in extensive testing to

levels that for the first time can fully match those of premium

couplings. In terms of 'leak-proof', which is defined as life-cycle

integrity for metal wellhead seals, POS-GRIP wellheads have been

used to drill exploration wells in highly challenging operating

environments around the world. This includes the Total Solaris

well, which is believed to be the highest pressure, highest

temperature well ever to be drilled in the North Sea. In terms of

testing, POS-GRIP wellheads are the only ones to have exceeded, let

alone passed without exception, new tougher standards set by a

major operator for wellheads. What lies behind this 'superior'

performance is the method by which POS-GRIP holds and seals

component parts. By harnessing the force of friction from the

outside of a wellhead, POS-GRIP enables a significantly higher

force to be applied over a large contact area to pre-load the

wellhead. This contrasts with the limitations of conventional

wellheads, which require torque to be applied from within to

activate an annular point seal. The result is POS-GRIP delivers a

superior metal to metal seal that prevents gas leakage, even when

dealing with liquids and gases from ultra-high pressure/high

temperature ('U-HP/HT') reservoirs.

"Having raised the bar to such an extent that wellhead equipment

can safely withstand extraordinary pressures and temperatures, our

technology can now offer operators a solution that prevents harmful

methane leaking into the atmosphere, just when the industry is

desperately in need of one as it seeks to eliminate fugitive

emissions throughout the supply chain. The backdrop in which we

operate has therefore changed decisively in a short space of time,

and I believe that our technology will gain wider acceptance as a

result. Together with key R&D testing and corporate

developments over the last 12 months, including a first POS-GRIP

wellhead order from Gazprom in Russia, the sale of a third wellhead

set to our Russian partner in anticipation of further orders in the

country, and the formation of a JV to offer full package solutions

for large production projects, we believe we have never been better

placed to establish POS-GRIP as a superior enabling technology for

the energy sector.

"On a more sober note, it is of course both necessary and

disappointing that I have to temper this report by making reference

to the perfect storm that the oil and gas industry is currently

being subjected to, specifically in terms of pressures associated

with the world's focus on Net Zero and the lowering of the

consumption of hydrocarbons; the material slowdown in economic

activity and therefore energy demand in relation to the impact of

COVID-19; and the breakdown of production level targets between

Saudi Arabia and Russia, linked to the United States ongoing

elevated oil and gas production levels. According to the

International Energy Agency in March 2020, these factors are

expected to lead to a fall in world oil demand this year for the

first time since 2009. However, we have to look beyond what will

hopefully be relatively short-term drivers and recognise that the

world will still need oil and gas for many years to come. With this

in mind, we fully expect to play our part in supplying superior

leakproof equipment, whether organically or through trading

partners and licensees.

"The half year numbers, including revenues of GBP49k, are in

line with internal budgets and the Group's revenues are projected

to be higher in the second half of the current financial year.

Trading for the full year is expected to be in line with market

expectations. Taking into account the confidence expressed above,

the Group's financial results should be set against the context of

the move into the surface production wellhead market being a new

initiative, and the long lead times associated with the contracts

we are looking to secure organically and via the JV with Bel

Valves. Although the JV was only established in June 2019, we are

already seeing an increased level of interest from operators for

our equipment. In the event Plexus was awarded a production

wellhead contract, which can be significant in value, it would

transform the Group's financial performance and broaden our

credentials as a supplier of gas-proof solutions for the surface

production market and the wider energy industry. In addition, we

will continue to support our licensing partner's efforts to secure

further orders in Russia, a top three hydrocarbon region. We are

working hard to grow and diversify our portfolio of revenue streams

and Plexus products, and I look forward to providing further

updates on our progress."

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Derrick Lee Cenkos Securities PLC Tel: 0131 220 9100

Pete Lynch Cenkos Securities PLC Tel: 0131 220 9100

Frank Buhagiar St Brides Partners Ltd Tel: 020 7236 1177

Isabel de Salis St Brides Partners Ltd Tel: 020 7236 1177

Chairman's Statement

Business progress

New decade and new strategy. The 'reset and rebuild' of the

Company into an IP-led research and development licensing business

based on our game-changing POS-GRIP technology is well underway.

The 'reset' followed the sale of the niche jack-up exploration

wellhead rental business to TechnipFMC in 2018. The 'rebuild' has

been multi-layered and includes the establishment of the PPC JV

with Bel Valves Ltd which, for the first time, enables Plexus to

supply 'leak-proof' wellheads as part of a full service package;

supporting our Russian partner's successful efforts to secure the

first of what we hope will be many wellhead orders from Gazprom;

and acquiring a 49% stake in precision engineering business

Kincardine Manufacturing Services Limited ('KMS'), which provides

access to machining capability in support of R&D projects.

Plexus is now in a position to embark on the next phase of its

growth strategy, one that is centred on developing and rolling out

new POS-GRIP-based products, initially targeted at the larger and

lucrative surface production wellhead and Xmas tree market.

Our core objective is to replicate the success our POS-GRIP

technology enjoyed in the jack-up exploration market in other

sub-sectors of the energy industry, including surface production,

subsea exploration, abandonment and renewables, including

geothermal. By the time the Group sold the jack-up rental wellhead

exploration business, Plexus had become established as the dominant

supplier of wellheads for HP/HT applications in the North Sea. A

benchmark for future success has therefore been set, one that is

based on Plexus' superior method of engineering - POS-GRIP

technology. POS-GRIP wellheads not only set new performance,

reliability and safety standards but also generated considerable

cost savings for operators in the form of reduced installation and

maintenance time, a major cost component in the life cycle of a

conventional wellhead due to the need for additional trips at the

installation stage, as well as disruption to and loss of production

when remedial intervention is required. Once installed, a POS-GRIP

wellhead should require no maintenance and therefore delivers a

cost-effective, leak-proof solution. POS-GRIP based equipment

therefore not only benefits the environment by demonstrably helping

prevent methane emissions throughout the life of a well, but also

the industry's profitability by reducing downtime caused by

maintenance work. We are confident our technology can do the same

across the wider energy industry.

Our leak-proof metal sealing technology has an opportunity to be

in the right place at the right time. In response to increased

scrutiny, more and more operators are pledging to substantially

limit harmful carbon emissions from the energy supply chain. For

example, BP's new CEO, Bernard Looney, recently set a new target

for the supermajor to become a net zero company by 2050 or sooner:

"The world's carbon budget is finite and running out fast; we need

a rapid transition to net zero. We all want energy that is reliable

and affordable, but that is no longer enough. It must also be

cleaner. To deliver that, trillions of dollars will need to be

invested in replumbing and rewiring the world's energy system. It

will require nothing short of reimagining energy as we know it.

This will certainly be a challenge, but also a tremendous

opportunity. It is clear to me, and to our stakeholders, that for

BP to play our part and serve our purpose, we have to change. And

we want to change - this is the right thing for the world and for

BP." Importantly BP is not alone. Repsol has also pledged to become

a net zero emissions company by 2050, and the list is growing.

If operators are serious about tackling methane gas leakage, and

there is no reason to believe they are not, then state-of-the-art

equipment is needed. When it comes to the well-site, the POS-GRIP

wellhead is one such piece of critical equipment, one which has

been proven out in the field many times over. This is beginning to

resonate much more strongly with operators, and we are confident

that the underlying value of our unique IP will eventually be

realised. While these interims have come too soon for the numbers

to reflect the progress being made, we believe it is only a matter

of time before Plexus' future financial results do so.

On a note of caution, it would be remiss not to refer to the

ongoing COVID-19 outbreak ('coronavirus'). Demand for hydrocarbons

is directly related to general levels of economic activity. For

example, at the height of the quarantines in China oil demand fell

by circa 25% from what had been normal levels. How long the

outbreak lasts, how far it spreads, and the final number of

infections are of course all unknown at this stage. Until there is

greater clarity, concerns over the impact of coronavirus on supply

chains, the global economy and demand for oil will likely continue

to weigh heavily on global stock and energy markets: oil prices are

currently trading around the US$25 per barrel level, over 40% below

the highs of early January. These demand pressures are exacerbated

on the supply side by the conflict between Saudi Arabia and Russia

regarding production levels, which has resulted in what Jan Stuart,

the Credit Suisse global energy economist recently described as "a

freakish amount of oil". However, for now we must rely on forecasts

and anecdotal evidence. Energy consultancy FGE has forecast zero

global demand growth for oil in 2020, and the IEA negative growth.

Significantly, UBS recently noted the collapse of capital spending

expectations in America in 2020 from 10% growth to a 15%

contraction. These metrics are reflected across a range of

industries and businesses and have led to a raft of sales warnings

and stock market collapse. The oil and gas industry is not immune,

and it is reasonable to assume that the longer the outbreak

persists, projects could be delayed or even cancelled which would

potentially disrupt Plexus' new IP-led strategy.

Operating Review

When we first set out to prove our technology in the North Sea

jack-up exploration market, we had our POS-GRIP wellhead designs,

the science behind our technology, a highly competent and

experienced team, and not much else. As we enter the new decade and

focus on breaking into much larger and more lucrative markets, such

as surface production, we are in a far more advanced position.

Plexus has a suite of developed POS-GRIP products for multiple

markets including production, subsea and abandonment.

Plexus now has a long list of blue-chip customers. The likes of

BP, Gazprom, Shell, and Total have all experienced the benefits of

our technology for themselves.

Plexus has a debt free, cash rich balance sheet, along with a

fixed and operating cost base that is much reduced following the

sale of the rental business, and which can be further addressed if

required.

Plexus is no longer the only voice extolling the benefits of

POS-GRIP. We have now positioned ourselves to work with a number of

partners, each of whom is well established in their respective

markets: Bel Valves is our JV partner in PPC which, by adding Xmas

tree and valve technology to the product portfolio, strengthens our

ability to penetrate the substantial production wellhead and tree

market; Gusar is our licensing partner for the Russian and CIS

markets; and TFMC which, in addition to acquiring the jack-up

business, signed a collaboration agreement with us to advance

future product design and development, thereby demonstrating the

validity of our technology. This means that when talking to

potential customers Plexus is able to offer a package solution' in

terms of wellheads/valves/and trees, whilst also being able to

point at companies like TFMC and Gusar/Gazprom who have validated

the advantages of the technology.

In terms of penetrating our initial major target market, namely

surface production, progress is being made. We are increasingly

being invited to tender for projects and have a number of enquiries

ongoing not only in relation to POS-GRIP wellheads for oil and gas,

but also geothermal wellheads and Crown Plugs. It should be noted

that such projects generally involve longer sales cycles and

although we have no control over the timings of such contract

awards, it is worth pointing out that securing just one of these

would be of major significance for Plexus. Significant not just in

terms of what it would do to our revenue profile, but also in terms

of demonstrating to the industry that Plexus can supply major

projects with state-of-the-art equipment as part of a full-service

package that would likely include trees and valves.

In terms of the size of the addressable production market that

Plexus is initially targeting, Rystad Energy recently estimated,

ahead of the COVID-19 pandemic that a total of 691 wells are in

plan for drilling over the five-year period 2021 - 2025 with an

average capex spend of nearly US$50 billion. The proportion of well

development capex spent on production wellheads and trees is around

5%, although the final figure is dependent on a number of factors

and differs from one project to another. However, using this 5%

average figure implies a potential production wellhead and tree

market opportunity of c. US$2.5 billion over the next five years

from 2021. If Plexus was able to secure just a 5% share of this

market, this could translate into revenue of US$125 million with an

average gross margin of around 30%.

While our focus is on breaking into the global surface

production market, Plexus continues to be interested in its proven

jack-up exploration wellhead equipment via the earn-out agreed with

TechnipFMC as part of the sale of the Jack-Up Business in 2018, and

also via our licensing agreement with Gusar for the important

Russian and CIS markets. During the period, a breakthrough first

jack-up exploration wellhead was successfully installed on the Kara

Sea Shelf as part of the inaugural contract for POS-GRIP rental

wellhead equipment secured by our Russian licensing partner Gusar

with global energy giant Gazprom. Gusar's contracted work with

Gazprom covers just the first year of an up to five-year jack-up

gas exploration drilling programme and therefore has the potential

to generate a valuable licence royalty revenue stream for Plexus.

In line with this, the post period end sale of additional wellhead

equipment to our partner Gusar bodes well for further awards in the

country being forthcoming, and we are hopeful that further orders

will follow from Gazprom in due course in view of the success of

the first well project.

Following the sale of the jack-up exploration wellhead rental

business, Plexus has maintained high quality operating standards.

Together with the Company's PPC joint venture this ought to be seen

by customers as a statement of intent that Plexus is capable of

tendering, supplying, executing and servicing contracts for

projects that fit the current tender pipeline. In line with this,

Plexus has maintained a staffing and engineering team resource that

is at a level capable of both supporting increased business

activity, as well as carrying out research, testing and development

work for new POS-GRIP based products.

Key functions that support our operations are Human Resources

('HR'), Quality Health and Safety ('QHSE'), Information technology

('IT') and Intellectual Property (IP').

For the six months in review and following the annual monitoring

audit in August 2019, HR has successfully maintained OPITO

accreditation for the Competency Management System,

Competency@Plexus (C@P). In the wake of the review and revision of

C@P, attention has been turned to the in-house training modules.

These were initially developed as a complete training programme, in

order to develop the knowledge and skills required for their role

and which are later assessed on through C@P.

QHSE continues to be an important area, and recently posted zero

incidents and occupational health claims for 2019. Plexus, driven

by QHSE will continue to deliver the highest safety standards, and

this discipline has been further improved following the

introduction of Senior Management safety tours.

The overall health and safety culture continues to improve and

progress, allowing the company to meet its requirements for

compliance with important regulatory standards. Plexus recently

achieved accreditation to API Q1 which is viewed as an important

milestone. Looking ahead, Plexus will move towards achieving

compliance and accreditation to ISO 45001 (as OHSAS 18001 becomes

obsolete) with a compliance audit planned for May/June 2020 with

the aim of achieving full compliance and certification to ISO

45001.

Robust IT systems, and the delivery of a safe and secure service

to customers and Plexus itself is paramount, especially

as is widely reported there is no reduction in external threats

of hacking and viruses. Ensuring confidentiality, integrity

and accessibility of information is essential, and Plexus

continually reviews and develops its computer network and security

monitoring systems capability as part of its cyber security

protocols. Precautions include penetration testing and network

monitoring to ensure our IT systems have not been breached, while

our anti-virus software is continually updated to newer version

malware protection, and internet filtering is used to keep our data

secure. Active monitoring of network activity and infrastructure

ensures downtime is minimised. Plexus relies on its own in-house

developed software systems, and these have the advantage of

allowing the Company to develop software solutions that can react

quickly to any IT issues that may arise. Following the recent

coronavirus outbreak, the IT department has ensured that the

current infrastructure will enable the Group's operations to

function satisfactorily, whilst allowing the majority of the

workforce to work from home should this be required.

Innovative IP is at the core of Plexus, with a focus on oil and

gas equipment design and development utilising our proprietary

POS-GRIP friction grip method of engineering. POS-GRIP was designed

to address limitations associated with conventional technology

particularly in terms of metal sealing, and this has led to the

raising of safety standards for HP/HT wellhead applications whilst

delivering significant operational and cost advantages. The ongoing

development of our extensive IP suite, in conjunction with partners

where appropriate, continues to be a priority for the Company, and

ongoing investment in research and development in a wide range of

areas and applications outside of Jack-up rental wellhead

exploration including surface production and subsea wellhead

equipment, as well as proprietary connector technology, is an

important part of this strategy. It is envisaged that in time this

strategy will enable Plexus to introduce its technology to sectors

outside of oil and gas, such as geothermal and nuclear. Since the

formation of PPC there has also been significant work undertaken to

design a tree to add to the Plexus suite of products.

Significantly, in November 2019 Plexus announced that its POS-GRIP

"HG" metal sealing system successfully completed an extreme

temperature test verification programme from -75 to +400 degree F

in accordance with API 6A PR2F standards at 10,000 psi pressure.

This test exceeded both conventional API 6A temperature class

ranges and was independently verified by Lloyds Register. Plexus

believes that this qualification was an industry first as the

entire test was performed within a single test and passed first

time, whereas typically, multiple tests are required, possibly

using different test fixtures or different sealing systems.

Ongoing operational activities and necessary R&D and capex

continue to be funded from cash reserves.

Interim Results

The six months to December 2019 results and activities reflect

the Group's movement towards the development of new revenue

streams, including targeting the significantly larger surface

production wellhead market.

Continuing operations revenue for the six-month period ended 31

December 2019 decreased to GBP49k, compared to the previous year's

figure of GBP1,312k, reflecting the fact that last year's

comparison period included revenue in relation to a production well

contract for Spirit Energy .

During the period Plexus continued to focus on preserving Group

cash by minimising spending and investment on

capex, opex and non-essential R&D, without compromising

operations.

Continuing activities administrative expenses have increased for

the 6 months to December 2019 to GBP3.02m (2018: GBP2.83m) and

includes a part reinstatement of previously reduced salaries.

Personnel numbers for continuing staff are in line with the prior

year at 37. This staff structure has been balanced in anticipation

of ongoing and future organic operational opportunities, whilst

also being able to further develop and support our POS-GRIP IP led

strategy involving external partners in Plexus. The current staff

levels are also required to maintain the operational infrastructure

that has been developed to date, including maintaining the Group's

Business Management System, and retaining all relevant

accreditations, in addition to operational requirements.

For continuing operations, the Group has reported a loss of

GBP2.7m which is an increase on the prior year loss of GBP2.3m. The

increased loss is driven by the fall in revenues. The loss comes

after absorbing similar rental asset and other property, plant and

equipment depreciation and amortisation costs of circa GBP0.9m, an

increase of GBP0.1m when compared to the prior year as a result of

the amortisation charge in introduced following the adoption of

IFRS 16.

The Group has not provided for a charge to UK Corporation tax at

the prevailing rate of 19%. Basic loss per share for

continuing operations was 2.75p per share which compares to a

2.22p loss per share for the same period last year.

The balance sheet continues to remain strong, and the current

level of intangible and tangible property, plant and equipment

asset values at GBP10.6m and GBP3.6m respectively illustrate the

amount of cumulative investment that has been made in the business.

Total asset values at the end of the period stood at GBP34.4m. The

non-essential R&D spend is in line with the prior year at

GBP0.1m. Such control on investment activity will not compromise

our IP and its ongoing development, or our ability to provide

customers with a high standard of equipment and service. The Group

has no debt, following the final repayment of a property term loan

in September 2019 (GBP75k) and closed the period with net cash of

approximately GBP4.48m and in addition has financial assets with a

value of GBP2.96m at 31 December 2019.

Outlook

Over the course of the last two hundred years the oil and gas

industry has fuelled three industrial revolutions. Each one has

played a major part in generating the prosperity the world enjoys

today. Arguably, all three revolutions have sown the seeds for the

next phase of progress. The technological revolution the world is

in the midst of today would seem to fit into the historic pattern.

As well as transforming the way we live and the way businesses

operate, technology is driving the rapid growth of new industries

such as electric vehicles and alternative / renewable energy

generation which are themselves at the forefront of efforts to

slash carbon emissions and tackle climate change. While progress is

being made, there is a considerable way to go before the world

becomes carbon neutral and because of this, hydrocarbons are

forecast to continue to be an important component of the energy mix

for years and even decades to come. As Ben Ratner writes in a post

on the Environmental Defense Fund website entitled: 'The next major

ESG opportunity for investors in Europe', "Although the EU is

aggressively moving off fossil fuels and aims to become carbon

neutral by mid-century, the transition to net-zero, low-carbon

energy sources will still require natural gas in the energy

mix."

Certainly, if the quantum of capital invested in oil and gas

projects around the world is anything to go by, the industry is

putting its money where its collective mouth is. In the North Sea

alone, the Investor's Chronicle reports BP and Chevron are

investing GBP6.78 billion into six new projects, while Total is

investing GBP10 billion over the next five years. Although the long

term impact of the current disruption to the oil and gas industry

and wider global economy by COVID-19 is still to be determined,

investment indicators such as these can only have helped to inform

the conclusion of an independent report from the Committee on

Climate Change which states: 'oil and gas will remain an important

part of the UK's energy mix for decades to come.' The North Sea is

not an outlier. Looking at the global picture, analysts at McKinsey

& Co expect a wave of 'sanctioning of new deep-water projects

thanks to recent cost compression trends in offshore, resulting in

an additional $654bn (GBP504bn) of cumulative deep-water oil

project expenditure until 2030.'

It would of course be wrong to infer that high levels of

investment translate into business as usual for the oil and gas

industry. Increasingly, the carbon footprint of operations right

across the energy spectrum, from the drill bit to the consumer, are

being subjected to thorough and urgent scrutiny by environmental

lobbyists and activist investors. Times have changed and the energy

industry is having to change with them. As the Financial Times' Lex

Column noted in February 2020, 'Carbon emissions were once thought

of as a costless "externality" by business. But as evidence of

climate change has mounted and public opinion shifted, energy

companies have begun to look at the real financial consequences.

This has been most notable in the rising cost of capital for

hydrocarbons groups and ever-cheaper money for renewables.' The

column goes on to point out that 'After much hand-wringing,

BlackRock, the world's largest investment manager, signed up to the

Climate Action 100+ initiative, a group of 370 fund managers

controlling at the time of that report some $35 trillion of assets.

These investors want and indeed demand action on greenhouse gases,

and energy producers with large stores of hydrocarbon reserves are

an obvious target.' In an interview with EnergyVoice in January

2020, Kevin Alexander, director of procurement solutions at

consultancy Achilles, said "In our communities, we are seeing a

continued focus on transparency of operations. Buyers are

initiating carbon audits for themselves and their supply chains to

get absolutely clear on the carbon impact of their own organisation

and where and how they can improve."

Access to development capital on commercial terms is one

pressure point that can be applied to the energy industry to ensure

it cleans up its act in terms of reducing harmful carbon emissions

from operations. If the targets being set by international oil and

gas companies to reduce methane emissions all along the supply

chain are anything to go by, together with the various industry-led

efforts, such as the Oil and Gas Climate Initiative ('OGCI'), the

energy industry clearly recognises the need to change. Certainly,

at the well-site, Plexus' area of focus, the race is on among oil

and gas industry participants to decarbonise hydrocarbons before

they enter the supply chain. Sound and verifiable technical

solutions have a key role to play. According to an article in the

Financial Times on 11 February 2020, Mr Fatih Birol, head of the

International Energy Agency, said, "We have the energy technologies

to do this, and we have to make use of them all".

At the well-site at least, one solution already exists, our

leak-proof POS-GRIP metal-to-metal sealing technology, a unique

method of engineering which can be deployed for surface and subsea

well applications. Thanks to POS-GRIP, we believe eliminating the

leakage of dangerous pollutants at the well-site is among the low

hanging fruit in the battle to achieve a 'net zero emissions' oil

and gas supply chain. Encouragingly, the role of digital

technologies, and the digitisation of information in minimising

global oil and gas methane emissions is becoming ever more

important. Plexus believes that such granular data analysis will

expose more clearly the integrity issues associated with the design

of conventional wellhead equipment and seals, and logic dictates

that this should result in greater interest in and demand for

leak-proof equipment and technologies, especially for hard to

access locations such as subsea.

Based on sealing principles derived from Hertzian Stress Theory,

POS-GRIP is the only known technology to have without exception

passed and exceeded tough new standards for wellhead equipment set

by a major operator. It can accurately deliver and maintain an

equal amount of contact interface stress, around each point of the

full perimeter of a metal seal, within a prescribed set of limits.

It is this unique quality that has seen our technology successfully

installed on ultra-HP/HT projects up to 20,000 psi at 375 degree F.

Proven to withstand extreme operating conditions, POS-GRIP is

particularly relevant for natural gas exploration and production.

This is important. As the cleanest hydrocarbon to combust in terms

of CO2 emissions, natural gas is widely regarded as a key

transitional fuel as the world moves towards net zero. "With

natural gas we have proven that economic growth and the reduction

of carbon emissions are not mutually exclusive," said American

Petroleum Institute (API) chief economist Dean Foreman. "The fact

that the U.S. has led the world in the reduction of carbon

emissions for nearly two decades wouldn't have been possible had it

not been for the abundant supply of affordable and clean natural

gas made possible by the shale revolution." The combination of

helping satisfy the world's insatiable demand for energy while at

the same time reducing harmful carbon emissions, lies behind

forecasts of strong growth in demand for natural gas in the years

ahead.

According to BP's International Energy Outlook, demand for

natural gas is expected to increase by almost 50% to c. 5,500 bcm

over the next two decades, compared to 3,700 bcm in 2017.

Importantly, for natural gas to fulfil its promise, however,

harmful methane leaks across the production and distribution chain

need to be addressed. The challenge is clear. Although natural gas

emits only half the level of CO2 compared to oil and coal when it

burns, even relatively low levels of leakage of un-combusted

methane during the process of extraction and delivery of gas along

the supply chain can wipe out gas' advantage over other fossil

fuels. In an interview with the Environmental Defense Fund, Tim

Goodman, Director for Hermes EOS at Hermes Investment Management in

London, stated, "Methane is a far more potent greenhouse gas than

carbon dioxide - the more that we can minimise its effects, the

greater the window the world has to transition to a low carbon

economy. Methane's effects don't last as long as carbon, but if we

don't tackle methane, we aren't taking meaningful action to move to

a low-carbon economy." Thanks to POS-GRIP's leak-proof solution,

eliminating methane emissions at the well-site is a challenge that

can be overcome.

Of course, it is one thing to offer a technology that prevents

methane emissions from occurring in the first place, but another

for it to be firstly adopted and then to become the industry

standard. Our strategy is focused on making life as easy as

possible for operators to elect to use POS-GRIP-enabled equipment

so that they can experience for themselves the superior performance

and cost savings on offer. With this in mind, and to cater for

operators' preference to award contracts for packaged solutions, we

established the PPC JV with Bel Valves Ltd in June 2019, so that

for the first time Plexus can offer high performance, low

maintenance POS-GRIP wellheads, xmas trees and outlet valves.

Tackling methane emissions at the well-site, being able to

withstand extreme temperatures and pressures, generating cost

savings, offering a full service package, there are more and more

reasons for operators to deploy POS-GRIP equipment for surface

production projects, and fewer (if any) reasons not to. Together

with an active licensing agreement for our jack-up exploration

technology in Russia where an order has recently been completed for

Gazprom, the potential for us to play a key role in reducing the

industry's carbon footprint, generate material cost savings for

operators and at the same time build significant value for Plexus

shareholders is clear.

J Jeffrey Thrall

Non-Executive Chairman

26 March 2020

Plexus Holdings Plc

Unaudited Interim Consolidated Statement of Comprehensive

Income

For the Six Months Ended 31 December 2019

Six months Six months Year to

to 31 December to 31 December 30 June

2019 2018 2019

GBP 000's GBP 000's GBP 000's

Revenue 49 1,312 3,611

Cost of sales (51) (828) (1,865)

--------------- --------------- ---------

Gross profit (2) 484 1,746

Administrative expenses (3,024) (2,833) (5,756)

--------------- --------------- ---------

Operating loss (3,026) (2,349) (4,010)

Finance income 100 100 218

Finance costs (43) (88) (41)

Other income 126 - -

Share in profit of associate 80 - 122

Loss before taxation (2,763) (2,337) (3,711)

Income tax credit (note 6) - - 484

Loss after taxation from continuing

operations (2,763) (2,337) (3,227)

(Loss) after taxation from discontinued

operations - - (88)

--------------- --------------- ---------

Loss for Year (2,763) (2,337) (3,315)

Other comprehensive income - - -

Total comprehensive income (2,763) (2,337) (3,315)

=============== =============== =========

Loss per share (note 7)

Basic from continuing operations (2.75p) (2.22p) (3.12p)

Diluted from continuing operations (2.75p) (2.22p) (3.12p)

Basic from discontinued operations - - (0.09p)

Diluted from discontinued operations - - (0.09p)

Plexus Holdings Plc

Unaudited Interim Consolidated Statement of Financial Position

As at 31 December 2019

31 December 31 December 30 June

2019 2018 2019

GBP 000's GBP 000's GBP 000's

ASSETS

Goodwill 767 767 767

Intangible assets 10,569 11,129 10,876

Property, plant and equipment

(note 9) 3,618 3,673 3,804

Non-current financial asset 2,964 2,849 2,835

Investment in associate 937 785 907

Deferred tax asset 1,259 984 1,259

Other Receivables 4,515 6,337 4,515

Right of use asset 1,700 - -

Total non-current assets 26,329 26,524 24,963

----------- ----------- --------------------------

Inventories 733 1,350 698

Trade and other receivables 2,822 3,187 4,948

Cash and cash equivalents 4,481 9,765 5,152

Current income tax asset - 371 617

Total current assets 8,036 14,673 11,415

----------- ----------- --------------------------

TOTAL ASSETS 34,365 41,197 36,378

=========== =========== ==========================

EQUITY AND LIABILITIES

Called up share capital (note

13) 1,054 1,054 1,054

Shares held in treasury (2,500) - (2,500)

Share premium account - 36,893 -

Share based payments reserve 674 674 674

Retained earnings 32,110 (42) 34,873

To tal equity attributable to

equity holders

----------- ----------- --------------------------

of the parent 31,338 38,579 34,101

----------- ----------- --------------------------

Lease liabilities 1,557 - -

Other non-current liabilities - 493 -

Total non-current liabilities 1,557 493 -

----------- ----------- --------------------------

Bank loans - 225 75

Trade and other payables 1,198 1,900 2,202

Current income tax liability 14 - -

Lease liabilities 258 - -

Total current liabilities 1,470 2,125 2,277

----------- ----------- --------------------------

Total liabilities 3,027 2,618 2,277

----------- ----------- --------------------------

TOTAL EQUITY AND LIABILITIES 34,365 41,197 36,378

=========== =========== ==========================

Plexus

Holdings Plc

Unaudited Interim Statement of Change

in Equity

For the Six Months Ended 31 December

2019

Called Shares Share Share Based Retained Total

Up Share Held in Premium Payments Earnings

Capital Treasury Account Reserve

GBP 000's GBP 000's GBP 000's GBP 000's GBP 000's GBP 000's

Balance as at

1 July

2018 1,054 - 36,893 674 2,295 40,916

Total

comprehensive

income for

the period - - - - (3,315) (3,315)

Cancellation

of share

premium - - (36,893) - 36,893 -

Buyback of

shares - (2,500) - - - (2,500)

Dividends paid - - - - (1,000) (1,000)

------------- ----------- ----------- ------------ ------------ ----------

Balance as at

30 June

2019 1,054 (2,500) - 674 34,873 34,101

============= =========== =========== ============ ============ ==========

Total

comprehensive

income for

the period - - - (2,763) (2,763)

Balance as at

31 December

2019 1,054 (2,500) - 674 32,110 31,338

============= =========== =========== ============ ============ ==========

Plexus Holdings Plc

Unaudited Interim Statement of Cash Flows

For the six months ended 31 December 2019

Six months Six months Year to

to 31 December to 31 December 30 June

2019 2018 2019

GBP 000's GBP 000's GBP 000's

Cash flows from operating activities

Loss before taxation from continuing

activities (2,763) (2,337) (3,711)

Loss before taxation from discontinued

activities - - (108)

--------------- --------------- ---------

Loss before tax (2,763) (2,337) (3,819)

Adjustments for:

Depreciation, amortisation and

impairment charges 962 833 1,625

Gain on sale of discontinued

operation - - (122)

Fair value adjustment of on financial

assets (20) 72 3

Share in profit of associate (80) - -

Other income (126) - -

Investment income (80) (100) (218)

Interest expense 43 88 8

Changes in working capital:

(Increase)/Decrease in inventories (35) 521 1,173

Decrease in trade and other receivables 2,126 1,701 1,762

Decrease in trade and other payables (912) (2,470) (2,661)

Cash generated from operations (885) (1,692) (2,249)

Net income taxes received 631 43 26

Net cash used in operating activities (254) (1,649) (2,223)

--------------- --------------- ---------

Cash flows from investing activities

Investment in associate - (785) -

Funds invested in financial instruments (109) (797) (714)

Other income 126 - -

Dividend received from associate 50 - -

Associated cost on sale of discontinued

operation - - (311)

Purchase of intangible assets (147) (110) (231)

Investment in associate - - (785)

Interest received 80 100 218

Purchase of property, plant and

equipment (166) (52) (530)

Net proceeds of sale of property,

plant and equipment - - 9

Net cash used from investing

activities (166) (1,644) (2,113)

--------------- --------------- ---------

Cash flows from financing activities

Repayment of loans (75) (150) (300)

Repayments of lease liability (157) -

Buyback of shares held in treasury - - (2,500)

Dividends paid - - (1,000)

Interest paid (19) (88) (8)

Net cash outflow from financing

activities (251) (238) (3,808)

--------------- --------------- ---------

Net decrease in cash and cash

equivalents (671) (3,531) (8,144)

Cash and cash equivalents at

brought forward 5,152 13,296 13,296

Cash and cash equivalents carried

forward 4,481 9,765 5,152

=============== =============== =========

Notes to the Interim Report December 2019

1. This interim financial information does not constitute

statutory accounts as defined in section 435 of the Companies Act

2006 and is unaudited.

The comparative figures for the financial year ended 30 June

2019 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the company's

auditors, Crowe U.K LLP, and delivered to the registrar of

companies. The report of the auditors was (i) unqualified, (ii) did

not include a reference to any matters to which the auditors drew

attention by way of emphasis without qualifying their report and

(iii) did not contain a statement under section 498(2) or (3) of

the Companies Act 2006.

The interim financial information is compliant with IAS 34 -

Interim Financial Reporting.

The accounting policies are based on current International

Financial Reporting Standards ("IFRS"), International Financial

Reporting Interpretation Committee ("IFRIC") interpretations and

current International Accounting Standards Board ("IASB") exposure

drafts that are expected to be issued as final standards and

adopted by the EU such that they are effective for the year ending

30 June 2020. These standards are subject to on-going review and

endorsement by the EU and further IFRIC interpretations and may

therefore be subject to change.

2. Except as described below the accounting policies applied in

these interim financial statements are the same as those applied in

the Group's consolidated financial statements as at and for the

year ended 30 June 2019 and which are also expected to apply for 30

June 2020.

The changes in accounting policy set out below will also be

reflected in the Group's consolidated financial statements for the

year ended 30 June 2020.

IFRS 16

IFRS 16, which supersedes IAS 17, sets out principles for the

recognition, measurement, presentation and disclosure of leases for

both parties to a contract, i.e. the customer ('lessee') and the

supplier ('lessor'). Lessee accounting has changed substantially

under this new standard while there has been little change for the

lessor. IFRS 16 eliminates the classification of leases as either

operating leases or financing leases and, instead, introduces a

single lessee accounting model. A lessee is required to recognise

assets and liabilities for all leases with a term of more than 12

months (unless the underlying asset is of low value) and is

required to present depreciation of leased assets separately from

interest on lease liabilities in the consolidated statement of

comprehensive income. A lessor continues to classify its leases as

operating leases or financing leases, and to account for those two

types of leases separately. IFRS 16 is effective for fiscal periods

beginning on or after 1 January 2019. On inception an asset and

liability of GBP1.9m were recognised.

3. This interim report was approved by the board of directors on

26 March 2019.

4. The directors do not recommend payment of an interim dividend

in relation to this reporting period.

5. There were no other gains or losses to be recognised in the

financial period other than those reflected in the Statement of

Comprehensive Income.

6. No corporation tax provision has been provided for the six

months ended 31 December 2019 (2018: nil). As a result, there is no

effective rate of tax for the six months ended 31 December 2019

(2018: 0%) after adjustments made to reflect R&D tax credits

received relating to the current and prior years and offsets for

disallowable expenditure.

7. Basic earnings per share are based on the weighted average of

ordinary shares in issue during the half-year of 100,435,744 (2018:

105,386,239). In February 2019, Plexus Holdings PLC ("the Company")

completed the acquisition of 4,950,495 Ordinary Shares held by LLC

Gusar. The Buyback Shares have been transferred to the CREST

account of the Company and will be held in treasury and will not

rank for any future dividends and no voting rights will be

exercised in respect of such Ordinary Shares. Following the

transaction, the Company's issued share capital comprises

105,386,239 Ordinary Shares, of which 4,950,495 Ordinary Shares are

held in treasury. The Company now has a total of 100,435,744

Ordinary Shares in issue with voting rights.

8. The Group derives revenue from the sale of its POS-GRIP

friction-grip technology and associated products, the rental of

wellheads utilising the POS-GRIP friction-grip technology and

service income principally derived in assisting with the

commissioning and on-going service requirements of its equipment.

These income streams are all derived from the utilisation of the

technology which the Group believes is its only segment. Business

activity is not subject to seasonal fluctuations.

9. Property, plant and equipment

Assets

Tenant under

Improve-ments Constru-ction Motor

Buildings GBP'000 Equipment GBP'000 Vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

As at 30 June 2018 3,607 716 5,509 10 17 9,859

Additions 92 - 391 47 - 530

Transfers - - 57 (57) - -

Disposals - - (525) - - (525)

As at 30 June 2019 3,699 716 5,432 - 17 9,864

Additions 41 - 125 - - 166

As at 31 December

2019 3,740 716 5,557 - 17 10,030

Depreciation

As at 1 July 2018 1,158 381 4,315 - 1 5,855

Charge for the

year 180 85 450 - 3 718

On disposals - (513) - (513)

As at 30 June 2019 1,338 466 4,252 - 4 6,060

Charge for the

period 76 36 238 - 2 352

On disposals

As at 31 December

2019 1,414 502 4,490 - 6 6,412

Net book value

As at 31 December

2019 2,326 214 1,019 - 11 3,618

As at 30 June 2019 2,361 250 1,180 - 13 3,804

As at 30 June 2018 2,449 335 1,194 10 16 4,004

10. Investments

Six months to 31 December 2019

Investment in associate at 30 June 2019 907

-------------------------------

Share of profit for the period 80

-------------------------------

Dividend received (50)

-------------------------------

Investment in associate at 31 December 2019 93 7

-------------------------------

In December 2018 Plexus Ocean Systems Limited acquired a 49%

interest in Kincardine Manufacturing Services Limited ('KMS') for a

GBP735k plus associated legal fees.

The summary financial information of KMS, extracted on a 100%

basis from the accounts for the 12 months ended 31 December 2019

are as follows:

2019

GBP'000

Assets 2,260

---------

Liabilities 2,070

---------

Revenue 5,533

---------

Profit after tax 413

---------

11. Discontinued operations

Six months to 31 December 2019 Six months to 31 December 2018 Year to

30 June

2019

GBP'000 GBP'000 GBP'000

Revenue - - -

Expenses - - ( 108)

-------------------------------- -------------------------------- ---------

(Loss)/Profit before tax of

discontinued operations - - (108)

I ncome tax credit - - 20

-------------------------------- -------------------------------- ---------

(Loss)/Profit after tax of

discontinued operations - - (88)

================================ ================================ =========

12. Share Capital

Six months to 31 December 2019 Six months to 31 December 2018 Year to

30 June

2019

GBP'000 GBP'000 GBP'000

Authorised:

Equity: 110,000,000 (2018: 110,000,000)

Ordinary shares of 1p each 1,100 1,100 1,100

Allotted, called up and fully paid:

Equity: 105,386,239 (Dec 2018:

105,386,239, June 19: 105,386,239)

Ordinary shares of 1p each 1,054 1,054 1,054

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BLGDXLDDDGGL

(END) Dow Jones Newswires

March 27, 2020 03:00 ET (07:00 GMT)

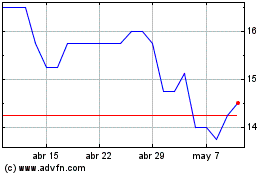

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024