GlaxoSmithKline PLC Consumer Healthcare product sales category changes (1039I)

30 Marzo 2020 - 9:06AM

UK Regulatory

TIDMGSK

RNS Number : 1039I

GlaxoSmithKline PLC

30 March 2020

Issued: 30 March 2020, London, UK - LSE Announcement

GSK publishes Consumer Healthcare product sales category reporting

changes

GSK keeps its financial reporting under regular review to ensure

that it remains current and in line with both the latest regulatory

requirements and developing best practice within the Pharmaceutical

industry.

Consumer Healthcare product sales categories updated

Following the closing of the transaction that combined the assets

of the legacy GSK Consumer Healthcare business with Pfizer consumer

healthcare on 31 July 2019, GSK completed a review of the segment

sales disclosures applicable to the new Consumer Healthcare Joint

Venture business. A revised and more detailed disclosure of category

sales will provide greater transparency to the main drivers of the

Consumer Healthcare Joint Venture's performance.

Previously reported Nutrition and Skin health categories will no

longer be used as a result of GSK's focus in the portfolio on core

categories via targeted divestments. Nutrition, Skin health and

the category previously called "Wellness" will be replaced by four

more specific categories structured around GSK's global power brand

1 portfolio and closely aligned to consumer healthcare industry

standard definitions:

* Oral health (unchanged) includes the power brands

Sensodyne, Parodontax and the Denture care franchise

comprising approximately 85% 2 of category sales. GSK

leads the therapeutic Oral health segment globally 3

.

* Pain relief includes the power brands Voltaren,

Panadol and Advil comprising 86% 2 of category sales

with an additional 11% of sales from leading regional

brands ('local stars'). GSK holds the global #1

position in this category 4 .

* Respiratory health includes cold & flu, allergy and

cough brands. Combined power brands (Theraflu and

Otrivin) and 'local star' brands comprise over 70% 2

of category sales. GSK holds the global #1 position

in this category 4 .

* Vitamins, minerals and supplements includes power

brand Centrum and 'local stars' Caltrate and

Emergen-C as well as smaller brands that were

previously reported in the Nutrition category. Power

brands and 'local stars' comprise over 70% 2 of

category sales and GSK holds the global #1 position

in this category 4 .

* Digestive health and other includes 'local star'

Digestive health brands Tums, Nexium and Eno; the OTC

Smokers' health franchise; small dermatology brands

previously reported in Skin health; and any other

products not reported elsewhere.

* Brands divested and under review includes those

brands that have been divested but remain in the

comparative sales disclosures for 2019 and earlier

years; previously announced divestments including the

sale of the Horlicks and other family nutrition

brands in India and certain other markets to

Hindustan Unilever Ltd; and brands under review as

part of the divestment programme announced at the

time of the formation of the joint venture with

Pfizer.

The revised Consumer Healthcare turnover tables below set out the

new format for reporting Consumer Healthcare product sales that

will be used beginning with the Q1 2020 Results Announcement and

applied to the 2019 reported and pro forma Consumer Healthcare product

sales.

An Excel version of this data is available on www.gsk.com .

___________________________________________________________________________

1 GSK Consumer Healthcare has a portfolio of nine global power brands

and fifteen leading regional ('local star') brands comprising over

70% 2 of total sales excluding brands divested and under review.

2 Percentages are estimated based on 2019 sales of legacy GSK and

Pfizer consumer healthcare brands.

3 GSK analysis based on Nielsen, IRI and Euromonitor data.

4 Nicholas Hall's DB6 Consumer Healthcare database 2018.

GSK - one of the world's leading research-based pharmaceutical and healthcare

companies - is committed to improving the quality of human life by enabling

people to do more, feel better and live longer. For further information please

visit www.gsk.com

Analyst/Investor enquiries: Sarah Elton-Farr +44 (0) 20 8047 (London)

5194

James Dodwell +44 (0) 20 8047 (London)

2406

Danielle Smith +44 (0) 20 8047 (London)

7562

Jeff McLaughlin +1 215 751 7002 (Philadelphia)

Brand names

Brand names appearing in italics throughout this document are trademarks

of GSK or associated companies or used under licence by the Group.

This Announcement does not constitute statutory accounts of the

Group within the meaning of sections 434(3) and 435(3) of the Companies

Act 2006. The information for 2019 and 2018 has been derived from

the full Group accounts published in the Annual Report 2019.

CER growth

In order to illustrate underlying performance, it is the Group's

practice to discuss its results in terms of constant exchange rate

(CER) growth. This represents growth calculated as if the exchange

rates used to determine the results of overseas companies in Sterling

had remained unchanged from those used in the comparative period.

Pro-forma growth

The acquisition of the Pfizer consumer healthcare business completed

on 31 July 2019 and so GSK's reported results for 2019 include five

months of results of the former Pfizer consumer healthcare business

from 1 August 2019.

The Group has presented pro-forma growth rates at CER for turnover

taking account of this transaction. Pro-forma growth rates are calculated

for comparing reported results for the periods from 1 August 2019,

calculated applying the exchange rates used in the comparative period,

with the results for periods from 1 August 2018 adjusted to include

the equivalent results of the former Pfizer consumer healthcare

business during 2018, as consolidated (in US$) and included in Pfizer's

US GAAP results.

Cautionary statement regarding pro-forma growth rates

The pro-forma growth rates at CER in the press release have been

provided to illustrate the position in Q3 2019, nine months 2019,

Q4 2019 and year-ended 31 December 2019 relative to the position

in Q3 2018, nine months 2018, Q4 2018 and year-ended 31 December

2018 as if, for the purposes of the Q3 2018, nine months 2018, Q4

2018 and year-ended 31 December 2018, the acquisition of the Pfizer

consumer healthcare business had taken place as at 31 July 2018.

Accordingly, two months of results of the former Pfizer consumer

healthcare business were included in Q3 2018 and nine months 2018,

three months of results of the Pfizer consumer healthcare business

were included in Q4 2018 and five months of results of the former

Pfizer consumer healthcare business were included in the year-ended

31 December 2018. The results of the former Pfizer consumer healthcare

business included for Q3 2018, nine months 2018, Q4 2018 and year-ended

31 December 2018 are as consolidated (in US$) and included in Pfizer's

US GAAP results. The results for Q3 2019, nine months 2019, Q4 2019

and the year-ended 31 December 2019 used to calculate the pro-forma

growth rates are as reported at CER.

The pro forma growth rates have been provided for illustrative purposes

only and, by their nature, address a hypothetical situation and

therefore do not represent the Group's actual growth rates. The

pro-forma growth rates do not purport to represent what the Group's

results of operations would have actually been if the Pfizer acquisition

had been completed on the date indicated, nor do they purport to

represent the results of operations at any future date. In addition,

the pro-forma growth rates do not reflect the effect of anticipated

synergies and efficiencies or accounting and reporting differences

associated with the acquisition of the Pfizer consumer healthcare

business.

Registered in England & Wales:

No. 3888792

Registered Office:

980 Great West Road

Brentford, Middlesex

TW8 9GS

Revised format for reporting Consumer Healthcare product sales

The revised format for the reporting of Consumer Healthcare product

sales applied to the 2019 quarterly and 2018 full year Consumer Healthcare

sales is as follows:

Consumer Healthcare turnover - year ended 31 December 2019

2019

--------------------------------------

Reported Pro-forma

Growth Growth Growth

------

GBPm GBP% CER% CER%

------ ------- --------- ----------

Oral health 2,673 7 7 7

Pain relief 1,781 24 24 4

Respiratory health 1,186 9 8 (2)

Vitamins, minerals and supplements 611 >100 >100 (3)

Digestive health and other 1,646 15 13 -

7,897 20 20 3

Brands divested and under review 1,098 - (1) (4)

8,995 17 17 2

Consumer Healthcare turnover - three months ended 31 December

2019

Q4 2019

--------------------------------------

Reported Pro-forma

Growth Growth Growth

------

GBPm GBP% CER% CER%

------ ------- --------- ----------

Oral health 651 4 7 7

Pain relief 501 42 45 2

Respiratory health 354 21 22 (3)

Vitamins, minerals and supplements 332 >100 >100 (7)

Digestive health and other 473 35 38 2

2,311 41 43 1

Brands divested and under review 260 (3) - (10)

2,571 35 37 -

Consumer Healthcare turnover - nine months ended 30 September 2019

9 months 2019

--------------------------------------

Reported Pro-forma

Growth Growth Growth

------

GBPm GBP% CER% CER%

------ ------- --------- ----------

Oral health 2,022 8 6 6

Pain relief 1,280 18 17 5

Respiratory health 832 5 3 (2)

Vitamins, minerals and supplements 279 >100 >100 2

Digestive health and other 1,173 8 5 (1)

5,586 14 12 3

Brands divested and under review 838 1 (1) (3)

6,424 12 10 2

Consumer Healthcare turnover - three months ended 30 September

2019

Q3 2019

--------------------------------------

Reported Pro-forma

Growth Growth Growth

------

GBPm GBP% CER% CER%

------ ------- --------- ----------

Oral health 709 14 10 10

Pain relief 526 43 40 6

Respiratory health 344 15 12 (1)

Vitamins, minerals and supplements 224 >100 >100 2

Digestive health and other 425 20 15 (3)

2,228 33 29 4

Brands divested and under review 298 8 3 (3)

2,526 30 25 3

Consumer Healthcare turnover - six months ended 30 June 2019

6 months 2019

----------------------------

Reported

Growth Growth

------

GBPm GBP% CER%

------ ------- ---------

Oral health 1,313 5 5

Pain relief 754 5 5

Respiratory health 488 (1) (3)

Vitamins, minerals and supplements 55 2 4

Digestive health and other 748 2 1

3,358 3 3

Brands divested and under review 540 (2) (3)

3,898 2 2

Consumer Healthcare turnover - three months ended 30 June

2019

Q2 2019

----------------------------

Reported

Growth Growth

------

GBPm GBP% CER%

------ ------- ---------

Oral health 651 7 5

Pain relief 383 11 10

Respiratory health 197 4 2

Vitamins, minerals and supplements 29 7 11

Digestive health and other 398 4 2

1,658 7 5

Brands divested and under review 259 (5) (7)

1,917 5 4

Consumer Healthcare turnover - three months ended 31 March 2019

3 months 2019

----------------------------

Reported

Growth Growth

------

GBPm GBP% CER%

------ ------- ---------

Oral health 662 4 4

Pain relief 371 (1) -

Respiratory health 291 (5) (5)

Vitamins, minerals and supplements 26 (4) (4)

Digestive health and other 350 - -

1,700 - -

Brands divested and under review 281 - 1

1,981 - 1

Consumer Healthcare turnover - twelve months ended 31 December

2018

2018

------

GBPm

------

Oral health 2,496

Pain relief 1,440

Respiratory health 1,085

Vitamins, minerals and supplements 103

Digestive health and other 1,435

6,559

Brands divested and under review 1,099

7,658

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEASDEDEDEEFA

(END) Dow Jones Newswires

March 30, 2020 11:06 ET (15:06 GMT)

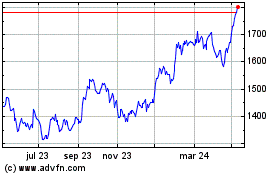

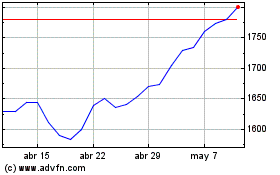

Gsk (LSE:GSK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Gsk (LSE:GSK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024