TIDMPRSR

RNS Number : 1345I

PRS REIT PLC (The)

31 March 2020

31 March 2020

PRSR.L

The PRS REIT plc

("PRS REIT" or "the Company" or "the Group")

INTERIM RESULTS

for the six months ended 31 December 2019

Resilient business model in face of coronavirus crisis

KEY POINTS

Coronavirus Update

-- While there is considerable uncertainty as a result of the

coronavirus pandemic, the Board believes that the Company is well

positioned in the face of the crisis;

o delivery model substantially mitigates risk

o balance sheet is robust

o gearing is low at c. 21% and there is considerable headroom on

committed bank facilities

o scale and geographic spread of portfolio of family homes

reduces risk

o cost base is covered by net rental income

-- Dividends of 1.0p per ordinary share were paid for each of Q1

and Q2. The interim dividend in respect of Q3 will be deferred for

review in Q4 when the outlook is likely to be clearer

H1 Trading Summary

-- 444 new rental homes were completed in H1, taking completed

homes to 1,617 at period end, up 109% from a year ago and up 38% on

H2 2019

-- Annualised rental income up to GBP14.9m at period end, a 113%

rise year-on-year, reflecting increased rate of completions and

lettings

-- Completed assets performed well - rents 2% above budget,

confirming strong underlying demand

o 600 homes let or reserved between 1 January and 27 March

2020

Financial

H1 2020 H1 2019 Change

----------------------------- ------------------ ------------------ -------

Rental income (gross) GBP5.6m GBP2.3m +143%

Profit from operations GBP12.4m GBP7.3m +70%

Profit before tax GBP11.0m GBP7.5m +47%

Basic earnings per share 2.2p 1.5p +47%

Net assets at 31 December GBP470.4m GBP477.2m - 1%

IFRS and EPRA NAV per share 95.0p 96.3p

at (after dividends (after dividends

31 December of of 6.0p paid)

11.0p paid)

----------------------------- ------------------ ------------------ -------

Housing Delivery

At At Change

31 Dec 31 Dec %

2019 2018

Completed homes

Number of completed PRS units 1,617 775 +109%

Estimated rental value ("ERV") per

annum GBP14.9m GBP7.0m +113%

Contracted homes

Total number of contracted homes 3,328 2,800 +19%

ERV per annum GBP32.7m GBP26.2m +25%

Total number of sites (completed and

contracted) 62 43 +44%

Number of completed and contracted

units 4,945 3,575 38%

Gross development cost ("GDC") GBP771m GBP530m 45%

ERV per annum GBP47.6m GBP33.2m 43%

Uplift on development cost to market n/a

value, subject to vacant possession

(MV-VP) 15.4%

-------------------------------------- --------- --------- --------

Outlook

-- Full deployment of balance of funding, approximately GBP75m,

has been strategically deferred pending assessment of

opportunities, particularly for acquiring completed assets

-- At 27 March 2020, the completed homes total had risen to

1,947 and c.3,000 homes were underway - together nearly 5,000

family homes once fully completed

o 1,675 homes are let, generating GBP15.4m annualised rental

income

-- In response to the coronavirus crisis, construction work on

all sites has recently been temporarily suspended. Given the

Company's delivery model, which includes fixed price contracts,

there is little adverse cash flow implication for the Company

during this period of suspension

-- Family rental housing market in the UK remains critically

undersupplied. The trend underpins the Company's long term growth

prospects

-- Strong Central and Local Government support, including from Homes England

Steve Smith, Chairman, said:

"While the coronavirus pandemic has created significant

uncertainty in every walk of life, we believe that our business is

resilient. Our delivery model and processes substantially mitigate

the Company's exposure to construction and other operational risks,

and we have a robust balance sheet and low gearing, which are

unaffected by a pause in construction activity. Our customer base

is diversified and the underlying demand for good quality rental

housing is strong.

"Our priority is the welfare of our colleagues, tenants and

communities, and this remains our focus as we continue to adapt to

the changing conditions created by the coronavirus.

"We have added 444 new family rental homes in the first half of

this financial year and a further 330 since then, taking the PRS

REIT's portfolio to 1,947 completed homes across the regions of

England. We are targeting around 5,300 properties once the balance

of the Company's existing funds is fully deployed. Our deployment

approach has now strategically shifted to focus on the acquisition

of completed assets.

"In light of the coronavirus situation, a decision regarding the

payment of a dividend in respect of the third quarter will now be

taken in the fourth quarter of the current financial year, when the

outlook is likely to be clearer.

"Despite the current macro uncertainty, we continue to view

long-term prospects with confidence as we meet the critical need

for quality family houses in the UK."

For further information, please contact:

The PRS REIT plc Tel: 020 3178 6378 (c/o KTZ Communications)

Steve Smith, Non-executive Chairman

Sigma PRS Management Limited Tel: 0333 999 9926

Graham Barnet, Mike McGill

N+1 Singer Tel: 020 7496 3000

James Maxwell, James Moat, Ben

Farrow

G10 Capital Limited (part of the Tel: 020 3696 1302

IQEQ Group as AIFM)

Gerhard Grueter

KTZ Communications Tel: 020 3178 6378

Katie Tzouliadis, Dan Mahoney

NOTES TO EDITORS

About The PRS REIT plc

(www.theprsreit.com)

The PRS REIT is a closed-ended real estate investment trust

established to invest in the Private Rented Sector ("PRS") and to

provide shareholders with an attractive level of income together

with the potential for capital and income growth. It has raised a

total of GBP500m (gross) through its Initial Public Offering, on 31

May 2017, and a subsequent placing in February 2018. Both

fundraisings were supported by the UK Government's Homes England

with direct investments.

LEI: 21380037Q91HU97WZX58

About Sigma Capital Group plc

( www.sigmacapital.co.uk )

Sigma Capital Group plc ("Sigma"), quoted on AIM, is a PRS,

residential development, and urban regeneration specialist, with

offices in Edinburgh, Manchester and London. Sigma's principal

focus is on the delivery of large scale housing schemes for the

private rented sector. It has a well-established track record in

assisting with property-related regeneration projects in the public

sector, acting as a bridge between the public and private sectors.

Its subsidiary, Sigma PRS Management Limited, is Investment Adviser

to The PRS REIT plc. In April 2019, Sigma launched the Sigma

Scottish PRS Fund, the first dedicated vehicle to focus on the

creation of new rental homes for families in the private rented

sector in Scotland, and in October 2019, Sigma announced the

expansion of its build-to-rent activities in London.

About Sigma PRS Management Limited

Sigma PRS Management Limited is a wholly-owned subsidiary of

AIM-quoted Sigma Capital Group plc and is Investment Adviser to The

PRS REIT plc. It sources investments and operationally manages the

assets of The PRS REIT plc and advises the Alternative Investment

Fund Manager ("AIFM") and The PRS REIT plc on a day-to-day basis in

accordance with The PRS REIT plc's Investment Policy. The

Investment Manager is G10 Capital Limited. Sigma PRS Management Ltd

is an appointed representative of G10 Capital Limited, which is

authorised and regulated by the Financial Conduct Authority

(FRN:648953).

Chairman's Statement

Overview

This interim report covers The PRS REIT plc's (the "Company" or

"PRS REIT") results and progress for the six months ended 31

December 2019. The Company made good progress over the period,

however, in recent weeks, the spread of the coronavirus in the UK

has caused unprecedented economic and social disruption. It is

difficult to predict accurately the full impact of the pandemic,

but we believe that the Company's business model and strategy are

resilient and we will adapt as the current situation evolves. Our

overriding priority remains the welfare of our colleagues, tenants

and communities.

The Company has a robust balance sheet, a diversified customer

base and a housing delivery model that limits construction risk.

The Company's cost base is covered by net rental income.

In the first half of the financial year, a further 444 new homes

were completed, which took the PRS REIT's portfolio to 1,617 homes

at the half year end (30 June 2019: 1,173 and 31 December 2018:

775), and housing construction spanned 62 sites across the regions

of England (31 December 2018: 43 sites).

Currently, all construction activity has been suspended across

all sites, a measure put in place by all major house builders in

response to the coronavirus. At present, it is not known when

activity will resume but there should be little adverse cash flow

or balance sheet effect during this period of suspension,

reflecting the Company's delivery model and our fixed price

contracts.

The latest data on our housing activity is at 27 March 2020,

when the number of completed homes stood at 1,947, an additional

330 since January 2020, with approximately 3,000 homes underway.

The number of homes let is 1,675, generating an annualised rental

income of GBP15.4m across six regions.

We reported in early January 2020 that the major part of the PRS

REIT's available funding (GBP900 million gross) had been contracted

and that the balance of approximately GBP75 million was expected to

be fully contracted by the end of March 2020. Given the changing

situation as a result of the coronavirus, we have strategically

deferred deployment of the balance in order to reassess

opportunities, particularly for the acquisition of completed

assets. We expect to contract the balance of funds by the end of

the third quarter of the calendar year, subject to the coronavirus

position. With full deployment, the PRS REIT's initial portfolio is

anticipated to constitute around 5,300 new rental properties,

yielding a potential GBP53.0 million in gross rental income per

annum once all the homes are completed and let.

The PRS REIT's growing portfolio of homes is establishing it as

a leading player in the build-to-rent sector, and the Company

remains the only quoted REIT to focus exclusively on the Private

Rented Sector ("PRS") in the UK and the first to focus on family

homes. This market continues to be underserved, with the majority

of build-to-rent activity concentrated on the development of city

centre flats. Long-term, demand for our family houses is expected

to be strong, reflecting the critical shortage of housing and the

attraction of our high quality, well-located,

professionally-managed homes.

We are pleased to have a strong governmental support, including

from Homes England, the public body sponsored by the Ministry of

Housing, Communities & Local Government.

Financial results

Revenue, which was all derived from rental income, increased by

143% to GBP5.6 million in the six months ended 31 December 2019 (31

December 2018: GBP2.3 million), reflecting the growth in assets in

the portfolio. After non-recoverable property costs, the net rental

income for the period increased by 137% to GBP4.5 million (31

December 2018: GBP1.9 million).

Profit from operations rose by 70% to GBP12.4 million over the

first half (31 December 2018: GBP7.3 million) after gains of

GBP10.9 million from fair value adjustments on investment property

(31 December 2018: GBP8.2 million) and total expenses of GBP2.9

million (31 December 2018: GBP2.8 million). Profit before tax for

the period increased by 47% to GBP11.0 million (31 December 2018:

GBP7.5 million) and basic earnings per share rose by 47% to 2.21p

(31 December 2018: 1.52p).

As at 31 December 2019, the PRS REIT's net assets totalled

GBP470.4 million (30 June 2019: GBP474.3 million). This represents

a net asset value ("NAV") per share of 95.0p, on both the

International Financial Reporting Standards ("IFRS") basis, as

adopted by the European Union, and the European Public Real Estate

Association ("EPRA") basis (30 June 2019: IFRS and EPRA NAV both

95.8p).

The movement in the NAV position, from 95.8p to 95.0p between 30

June 2019 and 31 December 2019, is after the payment of 3p per

share in total dividends (GBP14.9 million). These dividend payments

comprised a final dividend payment of 2.0p per share, relating to

the 2019 financial year, which was paid in August 2019, and a

dividend payment of 1.0p per share, relating to the first quarter

of the 2020 financial year, which was paid in November 2019.

We have reached an inflexion point given the growth of the

portfolio, where operating cash inflows now exceed operating

outflows and cover the Company's cost base.

Six months Six months Year

ended ended ended

31 December 31 December 30 June

KPI 2019 (unaudited) 2018 (unaudited) 2019 (audited)

IFRS EPS (pence per share) 2.21 1.52 2.90

------------------ ------------------ ----------------

EPRA EPS (pence per share) 0.02 (0.10) (0.20)

------------------ ------------------ ----------------

As at As at As at

31 December 31 December 30 June

KPI 2019 (unaudited) 2018 (unaudited) 2019 (audited)

IFRS NAV (pence per share) 95.0 96.3 95.8

------------------ ------------------ ----------------

EPRA NAV (pence per share) 95.0 96.3 95.8

------------------ ------------------ ----------------

Debt Facilities

As at 31 December 2019, the Company has GBP400 million of

committed debt facilities in place. The first GBP100 million has

been drawn, with the balance to be drawn over the next 18 months as

we finish the current phase of construction. The debt facilities

have an average term of 14.3 years and an average weighted cost of

2.72% once fully drawn. Our lending partners are Scottish Widows

(GBP250 million), Lloyds Banking Group plc (GBP50 million) and

Royal Bank of Scotland plc (GBP100 million), to whom we would like

to express our thanks for their support.

The Company's gearing is low at around 21% and it has

significant headroom in its covenants. Our revised strategy for the

balance of the deployment of our funds is focused on acquiring

completed assets, which should accelerate net rental income and

earnings growth.

Dividends

On 31 January 2020, the Board was pleased to declare a dividend

of 1.0p per ordinary share in respect of the second quarter of the

current financial year. The dividend was paid on 28 February 2020

to shareholders on the register as at 7 February 2020, and brought

total dividends paid to date since the Company's inception in May

2017, to 12.0p per share.

Given the current situation caused by the coronavirus crisis,

the Board will consider the payment of an interim dividend in

respect of the three months to 31 March 2020 in the fourth quarter

of the current financial year when the outlook is likely to be

clearer than at present.

Environmental, Social and Governance ("ESG") Practices

The PRS REIT is a member of the UK Association of Investment

Companies and applies its Code of Corporate Governance to ensure

best practice in governance.

The Board of Directors is responsible for determining the

Company's investment objectives and policy, and has overall

responsibility for the Company's activities including the review of

investment activity and performance. The Board consists of four

independent non-executive directors, all of whom bring significant

and complementary experience in the management of listed funds,

equity capital markets, public policy, operations and finance in

the property and investment funds sectors.

The Board delegates the day-to-day management of the business,

including the management of ESG matters, to the Investment Adviser,

Sigma PRS Management Limited ("Sigma PRS"). Sigma PRS is a

specialist in the sourcing, development and management of PRS

assets, with in excess of GBP1 billion under management. It is also

a signatory and participant of the United Nations Global

Compact.

Full details of ESG policies and activities are contained

separately in the Investment Adviser's Report.

Outlook

The coronavirus crisis is evolving and changing rapidly, and its

full effect on the macro environment in the UK and globally is not

easy to predict. We have taken both operational and financial

measures to guide the Company through this difficult period, and

will continue to assess our plans as the situation changes. We

believe that our business model is resilient and that we have the

financial and operational capacity and capability to navigate

challenges successfully while responding to opportunities. Our

partners are well-established and supportive.

The key performance indicators for our completed assets are

encouraging and demonstrate the strength of our delivery model and

the strong underlying demand for our homes. Approximately 600 homes

were let or reserved between 1 January and 27 March 2020.

The Company will continue to roll-out its new houses across the

English regions as soon as on-site construction activity resumes.

In this market, we expect greater potential for acquisitions of

completed assets, and have revised our execution strategy

accordingly. Housing remains a major political and social priority,

and support for our activities from Central and Local Government is

strong as we meet a fundamental societal need in the communities

and local economies in which we operate.

We are fully focused on completing the full deployment of funds

and delivering an estimated 5,300 homes. Despite current

uncertainties caused by the coronavirus, the Board continues to

view the Company's long term prospects very positively.

Steve Smith

Chairman

30 March 2020

Investment adviser's report

Sigma PRS Management Limited ("Sigma PRS"), the Investment

Adviser to the PRS REIT and a wholly-owned subsidiary of Sigma

Capital Group plc ("Sigma"), is pleased to report on the Company's

progress for the six months to 31 December 2019. Our view of the

unfolding coronavirus crisis is in the Summary section of this

report.

We are pleased with our progress in the period. With the volume

of qualifying sites identified and secured, we are in a position to

deploy the balance, approximately GBP75 million, of the Company's

GBP900 million of gross funding. However, in light of the

disruption in the market place, we have taken the strategic

decision to defer deployment in order to reassess opportunities,

particularly for the acquisition of completed assets.

Very recently, reacting to the coronavirus situation in the UK,

national house builders have taken the decision to suspend all work

on construction sites, a move we support, and, therefore work on

all of the Company's sites has ceased. Given our housing delivery

model and the fixed price nature of our contractual agreements,

there is little resultant adverse effect on the Company's cash

flows and balance sheet, and its exposure to construction activity

will only resume when construction recommences.

Investment objective and strategy

The Company is addressing a significant opportunity to create a

large portfolio of newly constructed rental stock that meets

existing demand in the UK for well-located, high quality,

professionally managed rental homes.

In doing so, the Company seeks to provide investors with an

attractive level of income, together with the prospect of income

and capital growth.

The PRS REIT's main focus is on establishing PRS sites composed

of multiple individual family homes, with these homes let under the

'Simple Life' brand to qualifying tenants. The aim is to create a

geographically diverse portfolio of properties that have easy

access to the main road and rail infrastructure and are close to

large employment centres and local amenities. Proximity to good

quality primary education is of particular importance and a major

attraction for families with children. While the Company is focused

on family houses, it will also invest in some low rise flats in

appropriate locations.

The PRS REIT is building its portfolios in two ways:

-- by acquiring undeveloped sites sourced by Sigma PRS. Their

subsequent development is managed by Sigma PRS (or another member

of the Sigma Group as development manager), and the completed PRS

units are let under the 'Simple Life' brand.

The PRS REIT aims to fund a minimum of two-thirds of the new

properties this way. Pre-development risks are identified and

underwritten by Sigma and its partners, and sites will have an

appropriate certificate of title, detailed planning consent and a

fixed price design and build contract with one of Sigma's

housebuilding partners prior to acquisition by the Company. During

the construction phase, many of the properties are pre-let and

subsequently occupied as they complete.

-- by acquiring completed PRS sites from Sigma (and/or one of

its subsidiaries), or from third parties. A pre-requisite is that

these stabilised developments must accord with the PRS REIT's

investment objectives and satisfy both return and occupancy

hurdles. The Company can fund up to a maximum of one third of new

properties in this manner. To date this route represents 15% of the

Company's asset allocation.

The Investment Adviser's parent company, Sigma, has a

well-established PRS delivery platform, which plays a central role

in sourcing and developing investment opportunities. The PRS REIT

has first right of refusal over sites within Sigma's platform

assuming they meet its criteria and it has capital to fund the

opportunities.

The platform comprises well-established relationships with

construction partners, particularly Countryside Properties PLC

("Countryside Properties") but also Engie Regeneration Limited,

Seddon Construction Limited and Vistry Partnerships Limited

(formerly Galliford Try Partnerships Limited), and local

authorities. These relationships enable Sigma to identify, source

and deliver land and properties on behalf of the Company in the

target geographies. Homes England, an executive non-departmental

public body sponsored by the Ministry of Housing, Communities &

Local Government, has been extremely supportive of Sigma, with both

parties sharing the common goal of accelerating new housing

delivery in England.

Delivery progress

Significant progress was made over the first half of the

financial year, and we have identified the remainder of the sites

required to invest the Company's funding of GBP900 million (gross)

when full gearing is included. However, given market flux, we are

reviewing opportunities, and will be looking especially closely at

acquiring completed assets, which has the potential to accelerate

net rental growth and the overall delivery of the portfolio.

The table below provides a summary of development activity,

including the number of PRS units that have been completed since

the launch of the Company on 31 May 2017, the gross development

cost ("GDC") of sites and the estimated rental value ("ERV") of

homes under construction or completed.

At At At At

31 Dec 30 Sept 30 June 31 Dec

2019 2019 2019 2018

Completed homes

--------- --------- --------- ---------

Number of completed PRS units 1,617 1,361 1,173 775

--------- --------- --------- ---------

Rental income per annum GBP14.9m GBP12.3m GBP10.7m GBP7.0m

--------- --------- --------- ---------

Contracted homes

--------- --------- --------- ---------

Total number of contracted homes 3,328 3,422 3,196 2,800

--------- --------- --------- ---------

ERV per annum GBP32.7m GBP33.7m GBP30.3m GBP26.2m

--------- --------- --------- ---------

Total number of sites (completed

and contracted) 62 60 54 43

--------- --------- --------- ---------

Number of completed and contracted

units 4,945 4,783 4,369 3,575

--------- --------- --------- ---------

GDC GBP771m GBP740m GBP661m GBP530m

--------- --------- --------- ---------

ERV per annum GBP47.6m GBP46.0m GBP41.0m GBP33.2m

--------- --------- --------- ---------

By 31 December 2019, the Company's portfolio of completed homes

stood at 1,617, an increase of 109% on the same point in 2018 when

775 homes had been completed, and a 38% increase since 30 June

2019. This has driven a 113% increase in ERV on completed homes to

GBP14.9 million per annum at the half year end, up from GBP7.0

million a year ago and a 39% increase from GBP10.7 million at 30

June 2019.

Between 1 January and 27 March 2020, a further 330 rental homes

were completed with an ERV of approximately GBP3 million per annum.

This has taken the Company's portfolio of completed homes to 1,947

homes, with an ERV of around GBP17.9m. Since the beginning of 2020,

600 properties were let or reserved, a record amount to date. At 27

March 2020, 1,675 homes were let across six regions, generating a

rental income of GBP15.4m per annum.

The number of sites and geographical distribution continued to

expand and stood at 62 sites at 31 December 2019 (31 December 2018:

43). To date, 21 of these sites are now fully complete and

producing income, and 12 are partially complete, with some homes

already let and income-producing.

Construction work on any development site is planned such that

as tranches of homes complete, they can be released for letting

while work continues elsewhere on the site. This means that

development sites are capable of becoming income-generating

relatively quickly and before they are fully completed.

Looking across the portfolio of existing and planned homes,

approximately 60% are in the North West, with the Midlands

accounting for approximately 17%, and Yorkshire and the North East

representing around 15%. The number of homes in the South of

England has increased to 381 from 248 homes at the same point last

year and make up 8% of current completed and planned sites. The

wide geographical spread of our sites across the regions and our

diversified customer base help to mitigate risk, particularly in

the current situation brought on by the coronavirus.

Rental performance and key performance measures

The Company's completed properties continued to perform well,

with rental income 2% higher than management budget across the let

properties. The re-letting average, when a vacancy arose, was a

little over 8 days, which confirms strong underlying demand.

Overall rental income has grown by 143% to GBP5.6 million

(gross) year-on-year, reflecting the increase in asset delivery and

good demand.

The Company's cost base is covered, with operating cash inflows

expected to increase as rental income from the completed homes

comes on stream. Any acquisition of completed assets should

accelerate this growth.

Legislative change, in the form of the Tenant Fees Act 2019,

which came into force on 1 June 2019, has added additional cost to

the lettings process, and contributed to an increase in overall

running costs. However, this cost will be partially offset by a

reduction in agency fees, which reduce as the portfolio grows.

Currently, costs are at 1.2% over the target 17% of gross rent

during the development phase. However, the Gross to Net deduction

during the development phase is well below published averages, at

18.2%, reflecting the benefits of our model. All other costs are in

line with management's targets.

At stabilisation we are targeting the Gross to Net deduction to

be 22.5%, under the sector average of 25%.

The table below summarises key performance measures on completed

assets as at 31 December 2019:

Average gross yields on completed assets 6.2%

Average capital uplift on completed assets

to Investment Value 6.1%

-----------------

Average capital uplift on completed assets

to Vacant Possession Value 15.4%

-----------------

Cost management of Gross to Net during development

phase 18.2%

-----------------

Re-letting period 8.3 days average

-----------------

Rents 2% above budget

-----------------

The Investment Valuation completed in December 2019 showed an

average uplift in the value of completed assets over the costs of

delivery of 6.1%. Benchmarked against vacant possession value, the

average uplift in the value was 15.4%. Both of these uplifts

provide significant headroom between cost and value, underlining

the benefits of the PRS REIT's model.

ESG statement

The PRS REIT delegates the day-to-day management of ESG matters

to the Investment Adviser, who assesses how ESG should be managed

and integrated at Company and asset level on an ongoing basis. ESG

information is reported on a quarterly basis to the PRS REIT's

Board.

We recognise that the Company's, and our activities, have an

impact on the environment and can also affect the lives of tenants

and the wider community. We therefore wish to incorporate

environmental, social and governance factors into decision-making

processes and the way in which we operate. In order to better

direct our ESG efforts, we have signed up to the UN Global Compact,

and committed to its 10 principles, based on human rights, labour,

environment and anti-corruption. We deploy a robust management

structure to manage ESG issues effectively throughout the lifecycle

of PRS assets. This is summarised below.

Opportunity review

-- ESG risks are assessed, based on commitment, capacity, track

record and features of the site

-- Mitigation plans are identified

Investment decision

-- ESG issues are listed and addressed in a summary investment

paper that informs decision-making at the Investment Committee

stage

-- ESG costs, including ongoing community and charitable

involvement, continue to be determined and factored in to the

investment decision process

Asset management

-- Appropriate governance structures are established

-- Relevant laws and regulations are adhered to

-- Ongoing monitoring and management of ESG issues is established

-- Impacts on the natural habitat surrounding PRS assets are managed

-- Local community engagement and support plans are established

-- Due diligence is performed on third parties

-- Anti-corruption and money-laundering policies are established

-- Best practice is established

-- Carbon reduction opportunities are sought

-- Investment restrictions are screened

-- Investment's ability to comply with the ESG standards is assessed

Environmental

Processes and strategies

Whilst the Company's activities do not directly impact the

environment, the Company takes account of the potential impact of

its key business partners. We therefore work with partners who

share our values and can demonstrate a commitment to working

sustainably. We require all of our delivery partners to have

policies on the management and origination of their supply chain,

usage of resources and approach to biodiversity, and to integrate

effective design into the houses and developments they build on the

Company's behalf.

Countryside Properties, with whom we work most closely, has a

strong track record in sustainable development. In its last

reporting year, Countryside Properties diverted 99.4% of its waste

away from landfill. As a result of its approach to ESG, it features

in the FTSE4Good Index Series, which measures the performance of

companies demonstrating strong ESG practices.

Physical environment

Sigma PRS planted 1,000 trees over the course of 2019 and

intends to plant a further 1,000 trees over the course of 2020. The

initiative makes a positive environmental contribution as well as

enhancing our developments and the local neighbourhood. We are also

working with landscapers to commence a programme of wildflower

planting in our developments that will promote a greater volume of

invertebrate life, which will support the wild bird population and

greater overall biodiversity.

An exciting development in 2019 was the opening of Countryside's

new modular panel factory in Warrington. At full capacity, the

factory will be capable of manufacturing up to 1,500 homes per

year. The homes are produced with sustainable timber, from

certified forests, and as the homes are constructed in a factory

setting, tracking and quality control processes are more efficient.

The factory does not generate any landfill, with 96.4% of waste

recycled and the remainder used as refuse-derived fuel in power

generation. By the end of the first half of the financial year, the

Company had taken delivery of over 350 of these modular homes,

which are quicker to construct once on site and require less labour

than a traditionally built home. They also create fewer vehicular

movements, reducing greenhouse gas emissions.

Clothes banks

We have initiatives in place to encourage tenants to act

sustainably. Notably, we are establishing clothes banks on each

completed development, with collected garments either redistributed

to good causes or recycled. We also include reusable shopping bags

and water flasks in the 'Welcome' boxes provided to new

tenants.

Promotion of electric cars and transport policy

During 2020, we plan to introduce a subsidised electric vehicle

car policy to encourage staff to switch away from fossil fuels, and

all our contractor partners have agreed to the adoption of targets

to electrify their workforce transport.

Social

Strong social values underpin the Company's engagement with

tenants and the local communities in which the Company's

developments are situated. These values include integrity, trust

and respect for others. We intend the Simple Life brand to

represent a new, higher standard of rental experience, and our aim

is for tenants to feel secure in their tenancy and enjoy their home

and neighbourhood with total piece of mind.

We also believe in investing in the wider community. During the

current financial year, we are funding projects across ten schools

that are close to a number of our developments. Over GBP66,000 has

been provided to equip these schools with facilities, including

sensory rooms, playground landscaping, ponds, fitness and play

equipment. We look forward to assisting further schools and

projects in due course.

We continue to support a range of charities, including: Park

Palace Ponies, a charity that enables young children in Liverpool

to experience horse riding; Loaves and Fishes, a homeless charity

based in Salford; and The Big Help Project, an anti-poverty charity

based in Knowsley. We also support three food banks, in the North

West and the Midlands, and various local sports clubs near our

developments, including The Albert Tennis Club in Wolverhampton,

Sale Rugby Club U18's and Sale United Football Club.

Our calendar of events for our customers is growing and this

year our pizza nights, Easter egg hunts, ice cream dashes and

visits from Santa Claus and his reindeer will reach over 3,000

households across over 30 sites. These activities foster friendly

and engaged neighbourhoods, and promote social interaction across

the age ranges.

Health and Safety

In order to maintain high standards of health and safety for

those working on our sites, we commission monthly checks by

independent project monitoring surveyors to ensure that all

potential risks are identified and mitigated. These checks

supplement those undertaken by our development partners. The data

is reported to the Board on a quarterly basis in the event of a nil

return, and immediately in the event of an incident. We are pleased

to announce that there have been no reportable incidents in the

period.

Equality

As an employer, Sigma PRS and its parent company, Sigma, aim to

provide a collaborative and supportive working environment for all

of their employees. Equality of opportunity is a core value and we

wish to ensure that the best person for any role has the

opportunity to apply for and excel in it.

Governance

Strong governance is essential to ensuring that risks are

identified and managed, and enabling the delivery of returns in

line with expectations whilst protecting the interests of

shareholders.

Sigma and the Company are subject to statutory reporting

requirements and to rules and responsibilities prescribed by the

London Stock Exchange. The Boards of both Companies have

independent non-executive directors who provide oversight, and

challenge decisions and policies as they see fit. Both Boards

believe in robust and effective corporate governance

structures.

Summary

Progress over the first half of the PRS REIT's current financial

year was pleasing, and the PRS REIT's portfolio now stands at 1,947

completed homes.

We have reached a point where the growth in the Company's rental

income has resulted in net operating cash inflows. The shift in

focus to deploy the balance of the Company's funding on the

acquisition of completed assets should help to accelerate net

operating cash generation.

We continue to carefully monitor the coronavirus situation and

are responding appropriately. Our partnership with Countryside

Properties, as well as preparations for Brexit, means that we had

already undertaken significant advance bulk-purchasing of building

materials before the current crisis, which will help to ensure cost

stability and supply. Countryside Properties' new factories,

producing modular homes, also improves efficiencies in the delivery

process. The delivery model, including fixed price contracts, also

substantially reduces the PRS REIT's exposure to development risk.

During construction suspension, the Company bears little cash flow

exposure.

The Company's completed assets have increased in number and

performed well to date, supported by strong rental demand across

the portfolio. Its scale and geographic spread also reduces risk.

Between 1 January and 27 March 2020, we recorded our highest months

of lettings and reservations, a very encouraging indication of the

attraction of our homes. Our letting brand, Simple Life, aims to

set a new, higher standard of customer experience in the private

rental market.

While there is no doubt that we are operating in an uncertain

macro environment due to the coronavirus crisis, we have a

resilient model and financial stability. We therefore feel

confident about our ability to navigate the current market

disruption, and safely steer the successful delivery of the

Company's housing plans.

The Board will consider the payment of an interim dividend in

respect of the three months to 31 March 2020 in the fourth quarter

of the current financial year when the outlook is likely to be

clearer than at present.

Sigma PRS Management Limited

30 March 2020

DEFINITIONS

The following terms shall have the meanings specified below:

"Average capital uplift on completed assets to investment value"

means the difference between investment value and gross development

cost divided by gross development cost.

"Average capital uplift on completed assets to vacant possession

value" means the difference between vacant possession value and

gross development cost divided by gross development cost.

"Average gross yields on completed assets" means current

expected rental value divided by gross development cost

"Committed" means development sites that have been approved or

are under formal appraisal by the Investment Adviser, and where

planning consent is being sought, and/or are in the process of

being acquired.

"Contracted" means sites under construction (under a design and

build contract), which have been purchased by the PRS REIT or the

PRS REIT's Investment Adviser (forward sold to the PRS REIT).

"EPRA NAV" means net asset value adjusted to include properties

and other investment interests at fair value and to exclude certain

items not expected to crystallise in a long terms property business

model.

"EPS" means unadjusted earnings per share.

"EPRA EPS" means earnings per share excluding investment

property revaluations, gains and losses on disposals, changes in

the fair value of financial instruments and associated close out

costs and their related taxation

"IFRS NAV" means unadjusted net asset value.

"Pipeline" means sites that have been identified as being

suitable for appraisal. These sites are typically sourced from

Sigma's PRS Platform, and are typically under a Framework Agreement

or Collaboration Agreement with a construction partner.

CONDENSED CONSOLIDATED Statement of COMPREHENSIVE INCOME

For the six months ended 31 December 2019

Six months Six months Year ended

ended ended 30 June

31 December 31 December

2019 2018 2019

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Rental income 5,607 2,320 5,970

Non-recoverable property costs (1,140) (376) (1,054)

------------- ------------- -----------

Net rental income 4,467 1,944 4,916

Administrative expenses

Directors' remuneration (70) (61) (123)

Investment advisory fee (2,164) (2,195) (4,402)

Administrative expenses (680) (552) (1,354)

------------- ------------- -----------

Total expenses (2,914) (2,808) (5,879)

Gain from fair value adjustment

on investment property 4 10,867 8,157 15,609

------------- ------------- -----------

Operating profit 12,420 7,293 14,646

Finance income 188 488 789

Finance costs (1,651) (246) (864)

------------- ------------- -----------

Profit before taxation 10,957 7,535 14,571

Taxation - - -

------------- ------------- -----------

Total comprehensive income for the

period / year attributable to the

equity holders of the Company 10,957 7,535 14,571

============= ============= ===========

Earnings per share attributable

to the equity holders of the Company:

Basic IFRS earnings per share 6 2.2p 1.5p 2.9p

All of the Group activities are classed as continuing and there

were no comprehensive gains or losses in the period other than

those included in the statement of comprehensive income.

CONDENSED CONSOLIDATED Statement of financial position

As at 31 December 2019

Notes As at

As at 30 June

As at 31

December 31 December

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Investment property 4 519,870 269,232 362,275

------------- ------------- -----------

519,870 269,232 362,275

------------- ------------- -----------

Current assets

Trade receivables 227 56 89

Other receivables 2,718 5,024 5,379

Cash and cash equivalents 74,962 230,295 229,946

------------- ------------- -----------

77,907 235,375 235,414

------------- ------------- -----------

Total assets 597,777 504,607 597,689

------------- ------------- -----------

LIABILITIES

Non-current liabilities

Accruals and deferred income 2,976 2,475 2,954

Interest bearing loans and borrowings 96,807 - 100,000

------------- ------------- -----------

99,783 2,475 102,954

Current liabilities

Trade and other payables 27,570 24,937 20,410

------------- ------------- -----------

27,570 24,937 20,410

Total liabilities 127,353 27,412 123,364

------------- ------------- -----------

Net assets 470,424 477,195 474,325

============= ============= ===========

EQUITY

Called up share capital 5 4,953 4,953 4,953

Share premium account 245,005 245,005 245,005

Capital reduction reserve 191,701 216,465 206,559

Retained earnings 28,765 10,772 17,808

------------- ------------- -----------

Total equity attributable to

the equity holders of the Company 470,424 477,195 474,325

============= ============= ===========

IFRS net asset value per share 7 95.0p 96.3p 95.8p

As at 31 December 2019, there was no difference between IFRS NAV

per share and the EPRA NAV per share.

condensed Consolidated statement of changes in equity

For the six months ended 31 December 2019

Share Capital

Share premium reduction Retained Total

capital account reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2018 4,943 244,025 233,800 3,237 486,005

Share capital issued

in the period 10 961 - - 971

Share capital issue

costs paid - 19 - - 19

Dividend paid - - (17,335) - (17,335)

Profit for the period - - - 7,535 7,535

At 31 December 2018 4,953 245,005 216,465 10,772 477,195

--------- --------- ----------- ---------- ---------

Dividend paid - - (9,906) - (9,906)

Profit for the period - - - 7,036 7,036

At 30 June 2019 4,953 245,005 206,559 17,808 474,325

--------- --------- ----------- ---------- ---------

Dividend paid - - (14,858) - (14,858)

Profit for the period - - - 10,957 10,957

At 31 December 2019 4,953 245,005 191,701 28,765 470,424

--------- --------- ----------- ---------- ---------

condensed CONSOLIDATED STATEMENT OF Cash Flows

For the six months ended 31 December 2019

Year

ended

Six months Six months

ended ended 30 June

31 December 31 December

2019 2018 2019

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 10,957 7,535 14,571

Finance income (188) (488) (789)

Finance costs 1,651 246 864

Fair value adjustment on investment

property 4 (10,867) (8,157) (15,609)

-----------

Cash generated from / (used

in) operations 1,553 (864) (963)

Increase in trade and other receivables (1,730) (1,367) (1,684)

(Decrease) / Increase in trade

and other payables (3,634) 1,218 3,026

Net cash (used in) / generated

from operating activities (3,811) (1,013) 379

------------- ------------- -----------

Cash flows from investing activities

Acquisition of subsidiaries 4 (8,170) (21,980) (34,665)

Purchase of investment property (126,328) (103,173) (181,627)

Finance income 221 507 823

------------- ------------- -----------

Net cash used in investing activities (134,277) (124,646) (215,469)

------------- ------------- -----------

Cash flows from financing activities

Bank and other loans - - 100,000

Finance costs (2,038) (1,864) (2,877)

Issue of shares - 971 971

Cost of share issue - (157) (156)

Dividends paid (14,858) (17,335) (27,241)

------------- ------------- -----------

Net cash (used in) / generated

from financing activities (16,896) (18,385) 70,697

------------- ------------- -----------

Net decrease in cash and cash

equivalents (154,984) (144,044) (144,393)

Cash and cash equivalents at

beginning of period 229,946 374,339 374,339

------------- ------------- -----------

Cash and cash equivalents at

end of period 74,962 230,295 229,946

============= ============= ===========

Notes to the Financial Statements

1. General Information

The PRS REIT plc (the "Company") is a public limited company

incorporated on 24 February 2017 in England and having its

registered office at Floor 3, 1 St. Ann Street, Manchester, M2 7LR

with company number 10638461.

The Company is quoted on the Specialist Fund Segment of the Main

Market of the London Stock Exchange.

This interim condensed consolidated financial information was

approved and authorised for issue by the Board of Directors on 30

March 2020.

2. Basis of Preparation and changes to the Group's accounting policies

Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 31 December 2019 have been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the EU.

The interim condensed consolidated financial statements do not

include all the information and disclosures required in the annual

financial statements, and should be read in conjunction with the

Group's annual consolidated financial statements as at 30 June 2019

which have been prepared in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the EU. The Group's

annual consolidated financial statements are available on the

Company's' website, www.theprsreit.com .

Adoption of new and revised standards

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 30 June 2019,

except for the adoption of new standards effective as of 1 July

2019. A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective for the

current accounting period. None of these are expected to have a

material impact on the consolidated financial statements of the

Group. The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

IFRS 16 Leases

IFRS 16 supersedes IAS 17 Leases. The new standard results in

almost all leases held as lessee being recognised on the balance

sheet, as the distinction between operating and finance leases is

removed. IFRS 16 applies to leases previously classified as

operating leases where the Group is lessee. IFRS 16 has not

impacted operating leases held by the Group where the Group is

lessor, therefore the standard does not have a material impact on

the Group. The accounting for lessors has not significantly

changed.

The Group adopted IFRS 16 using the modified retrospective

method of adoption with the date of initial application of 1 July

2019. Under this method, the standard is applied retrospectively

with the cumulative effect of initially applying the standard

recognised at the date of initial application.

The Group has entered into ground leases on some of its sites.

The impact of IFRS 16 is a GBP1 million increase in investment

property and a corresponding increase in liabilities of GBP1

million.

The adoption of IFRS 16 has an immaterial impact on net assets

and underlying profit before tax. Therefore, the adoption of IFRS

16 will have an immaterial impact on alternative performance

measures.

Summary of new accounting policies

Set out below are the new accounting policies of the Group upon

adoption of IFRS 16, which have been applied from the date of

initial application, 1 July 2019:

-- Right-of-use ("ROU") assets

The Group recognises ROU assets at the commencement date of the

lease. ROU assets are measured at fair value. The cost of ROU

assets includes the amount of lease liabilities recognised, initial

direct costs incurred, and lease payments made at or before the

commencement date less any lease incentives received.

-- Lease liabilities

At the commencement date of the lease, the Group recognises

lease liabilities measured at the present value of lease payments

to be made over the lease term. The lease payments include fixed

payments less any lease incentives receivable and variable lease

payments that depend on an index or a rate. The variable lease

payments that do not depend on an index or a rate are recognised as

expense in the period on which the event or condition that triggers

the payment occurs. In calculating the present value of lease

payments, the Group uses the incremental borrowing rate at the

lease commencement date if the interest rate implicit in the lease

is not readily determinable. After the commencement date, the

amount of lease liabilities is increased to reflect the accretion

of interest and reduced for the lease payments made. In addition,

the carrying amount of lease liabilities is remeasured if there is

a modification, a change in the lease term, or a change in the

in-substance fixed lease payments.

Critical judgements in applying the Group's accounting

policies

In the process of applying the Group's accounting policies, the

Directors have made the following judgements which have the most

significant effect on the amounts recognised in the consolidated

financial statements.

Acquisition of subsidiaries - as a group of assets and

liabilities

During the period, the Group acquired a further five property

owning special purpose vehicles. The Directors considered whether

these acquisitions met the definition of the acquisition of a

business or the acquisition of a group of assets and liabilities.

It was concluded that the acquisitions did not meet the criteria

for the acquisition of a business, as outlined in IFRS 3, because

they did not have an integrated set of activities and assets that

were capable of being conducted and managed for the purpose of

providing a return in the form of dividends, lower costs or other

economic benefits directly to investors. Furthermore, a business

consists of inputs and process applied to those inputs that have

the ability to create outputs. All assets acquired and liabilities

assumed in acquisition of a group of assets and liabilities are

measured at acquisition date fair value. The Directors have

reviewed the fair value of the assets and liabilities as at the

date of the acquisitions which were as follows:

Sigma PRS

Investments Sigma PRS

Sigma PRS (Houghton Investments Sigma PRS

Investments Regis (Houghton Sigma PRS Investments

(Houghton Parcel Regis Investments (Owens

Regis II) 8A II) Parcel (Brackenhoe) Farm II)

Limited Limited 8 II) Limited Limited Limited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Investment properties

acquired 5,360 4,954 1,405 2,757 8,170

Other receivables - - - - -

Other payables - - - - -

Total consideration

paid 5,360 4,954 1,405 2,757 8,170

============= ============= =============== ============== =============

Sigma PRS Investments (Owens Farm II) Limited was acquired from

Sigma in December 2019 as a stabilised asset meeting with the PRS

REIT's investments objectives, satisfying both return and occupancy

hurdles. The acquisition is therefore shown separately within the

Condensed Consolidated Statement of Cash Flows as an Acquisition of

subsidiary.

-- Investment property is measured at fair value as at the date

of the acquisition of the subsidiary by an independent valuation

expert.

-- Other receivables are taken as being the value recorded in

the accounts of the Company acquired, being the best estimate of

the amounts actually recoverable.

-- Other payable balances are measured at the amounts actually payable.

3. Going concern

The interim condensed consolidated financial statements have

been prepared on a going concern basis. The Group's cash balances

at 31 December 2019 were GBP75 million of which GBP43 million was

readily available. The Group had debt borrowing as at 31 December

2019, of GBP100 million, and has secured further facilities of

GBP300 million. Capital commitments outstanding as at 31 December

2019 were GBP189 million. Due to the coronavirus crisis,

construction has temporarily halted on all of our sites. We will

work closely with our delivery partners in the efficient deployment

of capital and resources when construction recommences. The Group's

ERV as at 31 December 2019, was GBP14.9 million from 1,617 homes

and has increased to GBP17.9 million from 1,947 homes as at 27

March 2020. This has increased the Company's recurring income and

at this level is more than sufficient to cover monthly cash costs.

However, we will keep this under review over the next few months in

light of the coronavirus crisis and the potential impact on our

customers.

Therefore, the Directors believe the Group is well placed to

manage its business risks successfully. After making enquiries, the

Directors have a reasonable expectation that the Group will have

adequate resources to continue in operational existence for the

foreseeable future and for a period of at least 12 months from the

date of the approval of the Group's interim condensed consolidated

financial statements for the period ended 31 December 2019. The

Board is therefore of the opinion that the going concern basis

adopted in the preparation of the interim condensed consolidated

financial statements for the period ended 31 December 2019 is

appropriate.

4. Investment property

In accordance with International Accounting Standard, IAS 40

Investment Property, investment property has been independently

valued at fair value by Savills (UK) Limited, an accredited

external valuer with a recognised relevant professional

qualification and with recent experience in the locations and

categories of the investment properties being valued. The valuation

basis conforms to International Valuation Standards and is based on

market evidence of investment yields, expected gross to net income

rates and actual and expected rental values.

The valuations are the ultimate responsibility of the Directors.

Accordingly, the critical assumption used in establishing the

independent valuations are reviewed by the Board.

Completed Assets under

assets construction Total

GBP'000 GBP'000 GBP'000

As at 1 July 2018 43,635 77,474 121,109

Properties acquired on acquisition

of subsidiaries 21,980 11,787 33,767

Property additions - subsequent

expenditure - 106,199 106,199

Change in fair value 1,534 6,623 8,157

Transfers to completed assets 35,657 (35,657) -

---------- -------------- --------

As at 31 December 2018 102,806 166,426 269,232

Properties acquired on acquisition

of subsidiaries 12,685 - 12,685

Property additions - subsequent

expenditure - 72,906 72,906

Change in fair value 71 7,381 7,452

Transfers to completed assets 37,363 (37,363) -

---------- -------------- --------

As at 30 June 2019 152,925 209,350 362,275

Properties acquired on acquisition

of subsidiaries 8,170 14,476 22,646

Property additions - subsequent

expenditure 9 123,073 123,082

Right-of-use assets on transition 1,000 - 1,000

Change in fair value 1,373 9,494 10,867

Transfers to completed assets 48,765 (48,765) -

---------- -------------- --------

As at 31 December 2019 212,242 307,628 519,870

========== ============== ========

The historic cost of completed assets and assets under

construction as at 31 December 2019 was GBP486.9 million (30 June

2019: GBP341.2 million).

Fair values

IFRS 13 sets out a three-tier hierarchy for financial assets and

liabilities valued at fair value. These are as follows:

Level 1 quoted prices (unadjusted) in active markets for identical assets and liabilities;

Level 2 inputs other than quoted prices included in Level 1 that

are observable for the asset or liability, either directly or

indirectly; and

Level 3 unobservable inputs for the asset or liability.

Investment property falls within Level 3. The investment

valuations provided by the external valuation expert are based on

RICS Professional Valuation Standards, but include a number of

unobservable inputs and other valuation assumptions. The

significant unobservable inputs and the range of values used

are:

Completed assets:

Type Range

Investment yield 4.15% - 4.85%

(net)

Gross to net assumption 22.50% - 25.00%

5. Share capital

No. of Shares Share Capital

GBP'000

Balance as at 31 December 2017 250,000,000 2,500

Shares issued in relation to management

contract 445,578 4

Shares issued in relation to Placing Programme 243,902,440 2,439

-------------- --------------

Balance as at 30 June 2018 494,348,018 4,943

Shares issued in relation to management

contract 929,276 10

-------------- --------------

Balance as at 31 December 2018 495,277,294 4,953

============== ==============

Balance as at 30 June 2019 495,277,294 4,953

============== ==============

Balance as at 31 December 2019 495,277,294 4,953

============== ==============

6. IFRS Earnings per share

Earnings per share ("EPS") amounts are calculated by dividing

profit for the period attributable to ordinary equity holders of

the Company by the weighted average number of ordinary shares in

issue during the period. As there are no dilutive instruments, only

basic earnings per share is quoted below.

The calculation of basic earnings per share is based on the

following:

Net profit

attributable Weighted average

to ordinary number of Earnings

shareholders Ordinary Shares per share

GBP'000 Number Pence

For the period ended 31 December

2019 10,957 495,277,294 2.21

For the year ended 30 June 2019 14,571 495,180,547 2.90

For the period ended 31 December

2018 7,535 495,085,378 1.52

-------------- ----------------- -----------

7. IFRS Net Asset Value per share

Basic Net Asset Value ("NAV") per share is calculated by

dividing net assets in the condensed consolidated statement of

financial position attributable to ordinary equity holders of the

parent by the number of ordinary shares outstanding at the end of

the period. As there are no dilutive instruments, only basic NAV

per share is quoted below.

Net asset values have been calculated as follows:

As at As at As at

31 December 31 December 30 June

2019 2018 2019

Net assets at end of period (GBP'000) 470,424 477,195 474,325

Shares in issue at end of period

(number) 495,277,294 495,277,294 495,277,294

Basic IFRS NAV per share (pence) 95.0 96.3 95.8

============= ============= ============

The NAV per share calculated on an EPRA basis is the same as the

Basic IFRS NAV per share.

8. Capital commitments

The Group has entered into contracts with unrelated parties for

the construction of residential housing with a total value of

GBP478.0 million (30 June 2019: GBP 525.8 million) . As at 31

December 2019, GBP189.0 million (30 June 2019: GBP 260.2 million)

of such commitments remained outstanding.

9. Transactions with Investment Adviser

On 31 March 2017, Sigma PRS Management Limited ("Sigma PRS") was

appointed as the Investment Adviser ("IA") of the Company.

For the period from 1 July 2019 to 31 December 2019, fees of GBP

2.2 million (1 July 2018 to 31 December 2018: GBP2.2 million) were

incurred and payable to Sigma PRS in respect of investment advisory

services. At 31 December 2019, GBP 0.4 million remained unpaid (30

June 2019: GBP0.4 million).

For the period from 1 July 2019 to 31 December 2019, development

fees of GBP 5.3 million (1 July 2018 to 31 December 2018: GBP4.5

million) were incurred and payable to Sigma PRS. At 31 December

2019, GBP 1.9 million (30 June 2019: GBP0.7 million) remained

unpaid.

During the period from 1 July 2019 to 31 December 2019, Sigma

PRS acquired 750,000 shares in the Company, increasing the total

shares held by Sigma PRS in the Company to 4,389,852, which

represents 0.89% of the issued share capital in the Company. The

shares were acquired in the market at an average price of 94.9

pence per share. All the shares acquired to date were in accordance

with the Development Management Agreement between the Company and

Sigma PRS.

During the period from 1 July 2019 to 31 December 2019, the

Company acquired the following subsidiaries from Sigma Capital

Group plc, the ultimate holding company of the IA:

Name of Entity Consideration

Sigma PRS Investments (Houghton Regis II) GBP5.36 million

Limited

------------------

Sigma PRS Investments (Houghton Regis Parcel GBP1.41 million

8 II) Limited

------------------

Sigma PRS Investments (Houghton Regis Parcel GBP4.95 million

8A II) Limited

------------------

Sigma PRS Investments (Brackenhoe) Limited GBP2.76 million

------------------

Sigma PRS Investments (Owens Farm) Limited

& GBP8.17 million

Sigma PRS Investments (Owens Farm II) Limited

------------------

10. Dividends paid and proposed

Six months Six months Year

ended ended ended

31 December 31 December 30 June

2019 (unaudited) 2018 (unaudited) 2019 (audited)

GBP'000 GBP'000 GBP'000

Dividends on ordinary shares

declared and paid:

3 months to 30 June 2018: 2.5p

per share - 12,382 12,382

3 months to 30 September 2018:

1.0p per share - 4,953 4,953

3 months to 31 December 2018:

1.0p per share - - 4,953

3 months to 31 March 2019: 1.0p

per share - - 4,953

3 months to 30 June 2019: 2.0p 9,905 - -

per share

3 months to 30 September 2019: 4,953 - -

1.0p per share

------------------ ------------------ ----------------

14,858 17,335 27,241

================== ================== ================

Proposed dividends on ordinary

shares:

3 months to 31 December 2019: 4,953 - -

1.0p per share

3 months to 30 June 2019: 2.0p

per share - - 9,905

3 months to 31 December 2018: - 4,953 -

1.0p per share

------------------ ------------------ ----------------

4,953 4,953 9,905

================== ================== ================

The proposed dividend was paid on 28 February 2020, to

shareholders on the register at 7 February 2020.

11. Post balance sheet events

Dividends

On 31 January 2020, the Company declared a dividend of 1.0p per

ordinary share in respect of the second quarter of the current

financial year. The dividend was paid on 28 February 2020 to

shareholders on the register as at 7 February 2020.

Coronavirus

Subsequent to the year end, the COVID-19 pandemic has led to

uncertainty in all walks of life. The impact on the Company and how

it is placed is discussed throughout these interim financial

statements. The Directors believe that the business is resilient,

the delivery model and processes substantially mitigate the

Company's exposure to construction and other operational risks, and

we have a robust balance sheet and low gearing. Our customer base

is diversified and the underlying demand for good quality rental

housing is strong.

The Directors continue to carefully monitor the coronavirus

situation and are responding appropriately. Our partnership with

Countryside Properties, as well as preparations for Brexit, means

that we had already undertaken significant advance bulk-purchasing

of building materials before the current crisis, which will help to

ensure cost stability and supply. Countryside Properties' new

factories, producing modular homes, also improves efficiencies in

the delivery process. The delivery model, including fixed price

contracts, also substantially reduces the PRS REIT's exposure to

development risk. During construction suspension, the Company bears

little cash flow exposure with spend being tied to work undertaken

and independently certified.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SDDEFSESSELD

(END) Dow Jones Newswires

March 31, 2020 02:00 ET (06:00 GMT)

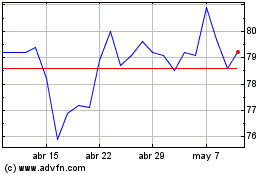

Prs Reit (LSE:PRSR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Prs Reit (LSE:PRSR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024