MediaZest Plc Trading and Covid-19 update

03 Abril 2020 - 12:00AM

UK Regulatory

TIDMMDZ

3 April 2020

MediaZest Plc

("MediaZest" or the "Company"; AIM: MDZ)

Trading and Covid-19 update

The Board provides the following update on trading for the second half of the

Group's financial year to 31 March 2020 and also updates shareholders on the

impact on the Group of and subsequent response to, the Covid-19 outbreak.

Due to the significant impact of Covid-19 on trading from February onwards,

this trading update is split to more clearly reflect financial performance.

Trading prior to Covid-19 impact

In the period from October 2019 to January 2020, the business performed well

and trading was much improved from the first half of the financial year.

For these four months alone, revenue was GBP1.2 million and profit at the

operating subsidiary MediaZest International was GBP167,000 at EBITDA level,

generating a net profit of GBP127,000 after tax.

At consolidated level, revenue was GBP1.2 million with EBITDA profit of GBP58,000

and a small loss after tax of GBP5,000.

This progress was driven by the completion of a large project for University of

Central Birmingham, the delivery of nine new Pets at Home store projects and

other work for ongoing clients including Lululemon Athletica, Tiffany & Co.,

HMV and Kuoni. The Group was pleased to see that in March 2020 Pets at Home won

the coveted Store of the Year award at the Retail Week Awards for their

refurbished Stockport store, for which the Company provided the audio-visual

solutions.

Trading post Covid-19 impact

Results for February and particularly March 2020 have been materially adversely

impacted by the Covid-19 outbreak, as clients initially began to defer some

projects and more recently temporarily close stores and other places of

business.

Whilst the UK and certain other countries remain in "lockdown", all deployments

and installations in progress are currently on hold until further notice. In

particular this has affected key projects across the UK and in Milan,

Copenhagen and Berlin, all of which are now expected to complete later in 2020.

Several of these projects were scheduled to fall in February or March 2020 and

would have contributed to the ongoing improving performance across the second

half of the year to 31 March 2020. Due to the disruption caused by Covid-19,

the Board expects revenue for these two months to be lower than forecast and

reduced to approximately GBP300,000 in aggregate (comparable period last year GBP

319,000), with a modest net profit at operational level and a subsequent small

loss at consolidated Group level.

In light of this, rather than the anticipated profit for the 6 months to 31

March 2020 the Group now expects to realise a modest loss after tax (6 months

ended 31 March 2019 loss of GBP201,000) albeit with a profitable EBITDA for the

period (6 months ended 31 March 2019 loss of GBP144,000). Within this the Group's

operating subsidiary MediaZest International is still expected to be profitable

for the 12-month period.

Some recurring revenue streams have been affected by store closures, although

three of the Company's clients are keeping stores open at this current time

being deemed as selling essential goods. The Group is continuing to provide

support and maintenance services to these businesses remotely and in accordance

with the latest Government recommendations and guidelines.

Outlook and Covid-19 Response

At this time, it is not possible to assess the extent to which Covid-19 will

affect forthcoming trading and financial performance and the situation is

evolving rapidly. Further updates will be provided as soon as more information

is known.

The Board is working on the assumption that the "lockdown" period and ongoing

disruption caused by Covid-19 will have an impact for a minimum of six months

and is therefore planning accordingly as best it can.

It is expected that once a more normal business environment resumes, projects

that have been delayed from February, March, April and possibly beyond, will be

required to be completed and as such there will be an initial period post

restrictions when the Company will be extremely busy.

Beyond that, there are several ongoing roll-out programmes for clients with

which the Group is engaged. These are currently on hold but also believed

likely to resume promptly once the current restrictions on movement and store

openings are lifted.

Accordingly, for this period of disruption, the Company has implemented a range

of cost cutting measures to help secure the long term future of the Group,

whilst keeping the hard working and high quality delivery teams that have been

built over recent years intact where possible.

The Group has therefore utilised the Government's Job Retention Scheme to

furlough certain employees and is in discussions with its banks and larger

shareholders regarding other measures.

In addition, approximately GBP150,000 of cost savings have been identified and

executed already with further reductions under consideration should they be

necessary.

Furthermore, the Board has agreed to extend the current accounting period to 30

September 2020 in order to defer audit costs until later in the year so that

cash can be conserved during the current "lockdown" period.

It is the Group's intention to announce information regarding financial

performance for the 6-month period ending 31 March 2020 as soon as practical in

the coming weeks in order to provide shareholders and other stakeholders with

suitable financial detail, albeit not in audited statutory account format.

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) 596/2014.

Enquiries:

Geoff Robertson 0845 207 9378

Chief Executive Officer

MediaZest Plc

David Hignell/Soltan Tagiev 020 3470 0470

Nominated Adviser

SP Angel Corporate Finance LLP

Claire Noyce 020 3764 2341

Broker

Hybridan LLP

Notes to Editors:

About MediaZest

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest

was admitted to the London Stock Exchange's AIM market in February 2005. For

more information, please visit www.mediazest.com

END

(END) Dow Jones Newswires

April 03, 2020 02:00 ET (06:00 GMT)

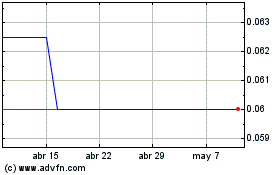

Mediazest (LSE:MDZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mediazest (LSE:MDZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024