TIDMWHR

RNS Number : 2997J

Warehouse REIT PLC

09 April 2020

9 April 2020

Warehouse REIT plc

(the 'Company' or 'Warehouse REIT')

Business & COVID-19 Update

Warehouse REIT, the AIM-listed company that invests in and

manages urban and 'last-mile' industrial warehouse assets in

strategic locations in the UK, today provides a business update in

light of the COVID-19 pandemic, ahead of its results for the year

ended 31 March 2020, which are expected to be announced in late

May.

Introduction

During these difficult times caused by the COVID-19 pandemic,

our priority is the safety and wellbeing of all our stakeholders,

especially our colleagues and occupiers. At the same time, our

focus is on ensuring that the Company is well positioned to

navigate any short-term market disruption in order to protect

long-term shareholder value.

Rent collection

As at 7 April 2020, 74% of contracted rent due for the quarter

to 24 June 2020 had been collected and this number increases to 82%

where tenants we have agreed will pay monthly rather than quarterly

are included. The Company has received a small number of support

requests from tenants facing financial hardship and, reflecting the

importance it places on its occupier relationships and the

understandable impact that COVID-19 has had on the cashflow of

small businesses, it has negotiated alternative payment

arrangements where necessary.

Financial position

The Company has continued to exercise financial discipline in

order to ensure that it is well capitalised and has balance sheet

resilience. As at 31 March 2020, the Company has approximately

GBP5.5 million of cash and GBP33.5 million of headroom on its

undrawn facilities, providing it with substantial operational

flexibility.

As part of its commitment to strengthening its balance sheet,

since September 2019 the Company has undertaken a disposal

programme of its non-core assets, raising a combined consideration

of GBP17.6 million, (7.6% ahead of the 30 September 2019

valuation). Based on net debt of GBP181 million as at 31 March 2020

and the latest portfolio valuation as at 31 January 2020, the

Company's loan-to-value is 39.9%.

The Company further strengthened its balance sheet in January

2020, entering into a new five-year (plus one, plus one) GBP220

million debt facility with a club of four banks, replacing an

existing HSBC facility totalling GBP210 million. The refinancing

comprised a GBP157 million term loan and a GBP63 million Revolving

Credit Facility. Based on the current drawn Company net debt,

Warehouse REIT's pro forma margin has reduced from a blended 2.14%

to 2.00% plus LIBOR on all of its bank debt. There are no debt

maturity dates prior to January 2025.

The facilities have significant headroom on both a loan-to-value

and interest coverage ratio basis: valuations would need to fall

c.25% or rent would need to fall c.45% when compared to 30

September 2019 before these covenants are breached.

Portfolio & Lettings

Warehouse REIT has a highly diversified UK portfolio of 95

assets totalling 6.15m sq ft, with 560 tenants operating across a

wide range of sectors including e-commerce, 3PL, manufacturing and

automotive. Over the past 12 months, the Group has focused on

improving the quality of its income, with established businesses

including Amazon, John Lewis and Direct Wines becoming tenants.

To date, the UK occupational market has remained strong, as a

result of the structural trends that have underpinned the rise in

internet shopping and investment by retailers in the 'last mile'

delivery sector, which may even accelerate as a result of the

current crisis. Since 21 January 2020 the Company has completed 24

new lettings and lease renewals across 129,000 sq ft of space,

achieved at 3.7% ahead of 30 September 2019 ERVs, generating

GBP803,400 per annum of contracted rent. Highlights include an

11-year lease extension for 42,000 sq ft agreed with Tristel PLC, a

manufacturer of infection prevention, contamination control and

hygiene products, at Lynx Business Park, Newmarket,

Cambridgeshire.

The COVID-19 pandemic has led to significant pressure being

placed on the UK's logistics and distribution capabilities, and a

number of the Company's tenants are currently experiencing

significantly increased trading volumes due to their involvement in

the supply of critical goods and services to businesses and

consumers. As a result, the Company is seeing ongoing demand for

its warehouse space; since the government-imposed lockdown

commenced on 23 March 2020, it has secured new lettings which are

expected to generate a further GBP183,000 of annual rent.

Furthermore, it is currently in active discussions with both

existing and potential occupiers for additional space across the

current portfolio.

Dividend

The Company is continuing to closely monitor the evolving

COVID-19 situation and will keep shareholders and wider

stakeholders updated as required. Operational and financial

performance to date has been robust and the third quarter dividend

of 1.6 pence per share was paid as planned on 31 March 2020. At

this stage, the Company remains committed to meeting its dividend

target for the financial year to 31 March 2020 of 6.2 pence per

share.

Enquiries

Warehouse REIT plc via FTI Consulting

Tilstone Partners Limited +44 (0) 1244 470

Andrew Bird 090

G10 Capital Limited (part of the Lawson

Conner Group), AIFM +44 (0) 20 3696

Maria Glew, Gerhard Grueter 1302

Peel Hunt (Financial Adviser, Nominated

Adviser and Broker) +44 (0) 20 7418

Capel Irwin, Harry Nicholas, Carl Gough 8900

FTI Consulting (Financial PR & IR Adviser

to the Company)

Dido Laurimore, Ellie Sweeney, Richard +44 (0) 20 3727

Gotla 1000

Further information on Warehouse REIT is available on its

website:

http://www.warehousereitplc.co.uk

Notes

Warehouse REIT is an AIM listed UK Real Estate Investment Trust

that invests in and manages urban and 'last-mile' industrial

warehouse assets in strategic locations in the UK.

Occupier demand for urban warehouse space is increasing as the

structural growth in e-commerce has driven the rise in internet

shopping and investment by retailers in the "last mile" delivery

sector, yet supply remains constrained giving rise to rental

growth.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager. The Investment Manager is

currently G10 Capital Limited.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDFIFFISFIAIII

(END) Dow Jones Newswires

April 09, 2020 02:00 ET (06:00 GMT)

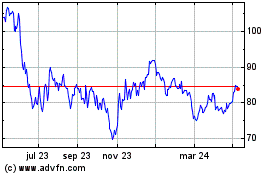

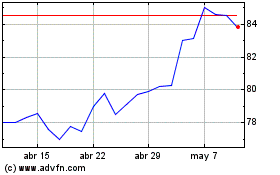

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024