TIDMPEN

RNS Number : 1189K

Pennant International Group PLC

20 April 2020

FOR IMMEDIATE RELEASE 20 April 2020

PENNANT INTERNATIONAL GROUP PLC

Preliminary Results for the Year Ended 31 December 2019

A challenging year but grounds for optimism

Pennant International Group plc ("Pennant", the "Group", or the

"Company"), the AIM quoted supplier of integrated training and

support solutions, products and services which train and assist

operators and maintainers in the defence and regulated civilian

sectors, announces Preliminary Results for the Financial Year Ended

31 December 2019.

Commenting on the Group's performance, Simon Moore, Chairman,

said :

"2019 was a challenging year for Pennant. Delays to expected

contract awards and a drawn-out re-basing of a key programme, all

conspired to reduce activity levels, slow progress and place

margins under increasing pressure.

During the year, the necessary steps were taken to mitigate

these issues including implementation of a wide-ranging cost

reduction and restructuring exercise.

Despite these challenges, the Group has continued to deliver its

key services contracts and successfully achieved acceptance of

products on the Qatar contract, recognising budgeted revenues and

profits during the second half of the year.

The Group is posting a consolidated loss before tax of GBP1.62

million (2018: profit before tax GBP3.18 million) which is stated

after significant non-underlying costs. Underlying earnings for

2019 before interest, tax and amortisation (EBITA) were GBP1.6m

(2018: GBP.3.3m) and underlying EBITDA was GBP2.4m (2018:

GBP3.7m)."

Financial Summary

-- Group revenues of GBP20.4 million (2018: GBP21.1 million);

-- Gross profit margin of 36% (2018: 39%)

-- Loss before tax of GBP1.62 million (2018: profit before tax of GBP3.2 million);

-- Underlying EBITA of GBP1.6 million (2018: GBP3.3 million);

-- Loss for the year attributable to shareholders of GBP1.49

million (2018: profit of GBP3.15 million);

-- Basic loss per share of 4.6p (2018: earnings of 9.49p);

-- Unutilised UK tax losses of GBP2.8 million (2018: GBP5.3 million);

-- Group net assets at year-end of GBP14.8 million (2018: GBP14.04 million);

-- Net debt at year-end of GBP2.2 million (2018: net cash of GBP1.85 million);

-- No final dividend recommended (2018: GBPNIL);

-- Three-year order book at year-end stood at GBP33 million (2018: GBP37 million).

Operational Summary

Contracts

-- The successful completion and customer acceptance, on or

ahead of schedule, of various training devices for the Qatar

contract, realising revenues of circa GBP7 million in the second

half.

The award by a UK OEM of a GBP3.4 million contract for the

design and build of a helicopter training aid which will comprise a

full-size representation of the relevant airframe to enable UK

military training on 'anti-surface' weapons systems.

-- Award of a new contract for the provision of additional

training aids to the Middle East, including two new training

solutions, worth circa GBP1.5 million, deliverable predominantly in

2020.

-- Successful rescoping of the Group's key contract with General

Dynamics for electromechanical trainers and computer-based training

for the Ajax vehicle programme, with the contract value increased

by GBP1.5 million to circa GBP13.5 million.

-- Ongoing delivery of the key contract with the Canadian

government, worth circa C$30 million over five years.

Investment and Innovation

-- Acquisitions of Aviation Skills Partnership and Track Access

Services, expanding routes into training in the civil aviation and

rail sectors respectively, as part of the Group's diversification

strategy.

-- Completion of the development of eight new generic products

(part of a development strategy commenced in 2018), all of which

had secured orders by the end of 2019.

-- Completion of capital investment in upgrades and

refurbishments to a number of production facilities in readiness

for new contract awards and the commencement of the build phase for

the electromechanical trainers referred to above.

Management

The end of the period saw the promotion of Mervyn Skates to

Operations Director, in recognition of his achievements in ensuring

successful contract deliveries across the Technical Training

business, a key step in readiness for the build phase of the

electro-mechanical trainers and the expected award of the major

programme.

On current trading and prospects, Mr Moore concluded:

"In light of the ongoing Covid-19 pandemic, the economic outlook

across the globe remains highly uncertain. Much will depend on the

stimulus packages that governments make available to support

impacted businesses and the wider economy.

Indeed, the uncertainty caused by Covid-19 affects Pennant too.

However, with a three-year contracted order book, valued at more

than GBP33 million, the Board is confident that the Group's

underlying strengths - our long-term customer relationships with

governments and major OEMs, our specialist services and our

quality-assured reputation - will continue to provide a solid

foundation for our long-term success."

Enquiries:

Pennant International Group plc www.pennantplc.co.uk

Philip Walker, CEO

David Clements, Commercial &

Risk Director +44 (0) 1452 714 914

WH Ireland Limited www.whirelandcb.com

Mike Coe +44 (0) 207 220 1666

Walbrook PR (Financial PR) paul.vann@walbrookpr.com

+44 (0)20 7933 8780;

Paul Vann / Tom Cooper +44 (0)7768 807631

CHAIRMAN'S STATEMENT

A challenging year but grounds for optimism

In last year's Annual Report, following an excellent set of

results in 2018, I stated that the Group's 2019 financial

performance was expected to be significantly weighted in favour of

the second half, with the majority of revenues (and all of the

profits) forecast to be realised towards the end of the year.

This was dependent upon the achievement of certain performance

milestones on the Qatar contract combined with a strong second half

weighted Order Book. I can report that these revenues and profits

have indeed been recognised, in large part due to the continued

successful delivery of the Qatar programme.

Key financials

For the year ended 31 December 2019, the Group recorded

consolidated revenues of GBP20.4 million (2018: GBP21.1 million),

underpinned by both the continued delivery of the Group's services

contracts and successful ongoing acceptance of products on the

Qatar contract.

The Group posted a consolidated loss before tax of GBP1.62

million (2018: profit before tax GBP3.18 million) which is stated

after significant non-underlying costs. These non-underlying costs

are explained in detail in the Annual Report and the Chief

Executive's Review below. Underlying earnings before interest, tax

and amortisation (EBITA) were GBP1.6m (2018: GBP.3.3m) and EBITDA

GBP2.4m (2018: GBP3.7m).

Review of operations and re-structuring

During the period under review, a number of significant

customer-driven challenges developed which slowed progress,

incurred additional costs and impacted our overall financial

performance. Most notably the re-basing of the contract for

electro-mechanical trainers for the General Dynamics armoured

vehicle programme and delays to the award of the major programme

first announced in August 2018 which, together, had a negative

impact on revenues, cashflow and profits for the year as a

whole.

I can confirm that the necessary steps have been taken to

address these challenges including a wide-ranging cost reduction

and restructuring exercise.

Post period-end, the successful rebasing and uplift of the

General Dynamics programme, and the announcement of the acquisition

of Absolute Data Group and its complementary R4i suite of software

products (which will increase our penetration of the US market),

and which will be earnings enhancing in the first year, have

underpinned our optimism and confidence for 2020 and beyond.

Board changes

During 2019 there were a number of Board changes.

With effect from 14 June 2019 Philip Cotton was appointed

Non-Executive Director and Chair of the Audit & Risk

Committee.

On 22 November 2019 the Group confirmed the appointment of

Mervyn Skates as Operations Director, with effect from 1 January

2020.

On 22 November 2019 Gary Barnes, Finance Director, stepped down

from the Board. On behalf of the Board, I would like to take this

opportunity to recognise Gary's significant contribution to the

Company and thank him for his 22 years' service.

Dividends

Taking account of the Group's 2019 financial performance, the

trading outlook (including potential Covid-19 challenges) and the

Group's cash position, the Directors believe that it is both

prudent and in the Company's and shareholders' current best

interests to retain cash for working capital.

The Board will therefore not be recommending the payment of a

final dividend for the year ended 31 December 2019. However, it

will continue to review dividend policy throughout 2020 based on

trading performance and working capital requirements.

Governance

The Board is committed to maintaining robust corporate

governance. It has worked closely with its advisors and in 2020

will continue to strengthen governance frameworks to ensure strong,

proportionate governance throughout the Group. The Board has

established appropriate risk management procedures and keeps key

risks to the Group under regular review.

Culture

The Board is likewise committed to embodying and promoting a

strong corporate culture and has endorsed various policies which

require ethical behaviour of staff and relevant counterparties

(such as those mandating anti-corruption, anti-counterfeiting, fair

treatment and equality of opportunity).

The Directors, in consultation with employees, have established

a clear set of 'Core Values' for the Company that encapsulate the

ethical and cultural expectations of the Company, and which will

guide and inform the actions of the Company (and to which its staff

can be held accountable). These values are aligned with the

Company's strategic objectives.

Our people

As always, I would like to take this opportunity to thank all

Pennant staff across the Group for their hard work and dedication

throughout what has been a challenging year. Their continued

commitment and drive to ensure that the business delivers the

high-quality solutions that our customers require and expect,

operating under tight timescales, are key factors in maintaining

and enhancing the ongoing and longstanding relationships we have

with our customers.

Brexit

The Board has carried out a review of its customer and supplier

base and continues to monitor developments in relation to Brexit

and its potential impact on the Group.

Pennant has no significant contracts with customers in EU member

states, and no material direct suppliers within the EU.

The Group presently expects that Brexit will have minimal effect

on its trading but is keeping this under review as the political

and economic situation develops and the potential impact of Brexit

on the wider supply chain and the business environment generally

becomes clearer.

Coronavirus (Covid-19)

Current Risks

The Group continues to assess and manage the impact of Covid-19

on its business. Three key risks to trading and prospects have been

identified so far.

The first is the challenge of holding review events with

customers. Such review events are held, as physical meetings,

through the lifecycle of an engineering programme and frequently

have milestone payments attached (paid by the customer to Pennant

upon successful completion of the review). If the review cannot be

held due to Covid-19 restrictions, cash and revenue associated with

completion of the milestone may be delayed.

The second risk is the inability to gain access to customer

facilities to deliver services. Our 'integrated logistics support'

consultancy services are typically delivered at a customer's site;

if we cannot access the relevant site due to Covid-19 restrictions,

the ability to deliver the services is severely hampered.

Lastly, there is the broader risk that governments and major

OEMs which award contracts to Pennant are, in the shorter term at

least, consumed by their own efforts to deal with Covid-19 and

therefore expected contract awards are consequently delayed until

the pandemic has abated.

Actions Taken

With the first two risks set out above, we are working closely

with the applicable customers to establish solutions so that

reviews and services can be held and provided via remote means. We

are confident that workarounds will be possible (and in some cases,

these are already being implemented) but the impact on the timing

and amount of any affected revenues is not yet clear. The third,

macro risk is less easy for Pennant to directly influence, but we

remain in close contact with key stakeholders to ensure we are

well-informed and remain well-placed for awards.

Simultaneously, we are prioritising the safety and well-being of

our employees and other stakeholders and have implemented

near-total homeworking.

Financial Position

We are actively focused on cash and cost management across the

business and retain undrawn facilities.

We have welcomed certain governmental initiatives to support

businesses in these exceptional times, and we have already utilised

the UK Government's Coronavirus Job Retention Scheme to protect

(and part-fund) the jobs of those employees who are currently

unable to carry out their usual duties due to Covid-19

interruption.

We are also investigating other potential financial options,

including the Coronavirus Business Interruption Loan Scheme, with a

view to securing access to further funding should it be

required.

Strategy and outlook

A key objective of the Board's stated strategy for future growth

is to increase the visibility and recurrence of earnings,

especially those derived from software and services, and to develop

new products and services complemented by strategic

acquisitions.

Notwithstanding the ongoing uncertainties surrounding the

Covid-19 pandemic, revenues and profits for 2020 are again expected

to be second-half weighted due to the mix of products and the

application of IFRS 15.

With our contracted three-year order book, valued at more than

GBP33 million, the Board is confident that the Group's underlying

strengths - our long-term customer relationships with governments

and major OEMs, specialist services and our quality-assured

reputation - will continue to provide a solid foundation for our

long-term success.

Simon Moore

Chairman

CHIEF EXECUTIVE'S REVIEW

Restructuring and repositioning for future growth

The year under review was a challenging one for both management

and staff with a number of issues involving significant customer

driven changes to contracts, delays to the award of the major

programme, underperformance in the Aviation Skills business and

adverse freehold property valuations, combined to produce an

outcome for the year which was below management's original

expectations.

However, decisive action was taken during the period to

restructure and reposition the business which has involved a

wide-ranging cost reduction exercise, resulting in net annualised

savings of over GBP0.6 million.

Notwithstanding these challenges (and the additional challenges

now presented by Covid-19), the Group continues to focus on its

strategic objective of increasing the proportion of its revenues

which derive from software and services, particularly those of a

recurring nature

Financial review

The results for the year are set out in detail in the Annual

Report and Accounts, with the key financial performance indicators

set out below.

Performance

The gross profit margin for the period was 36% (2018: 39%)

reflecting the broadly consistent mix of products and services

delivered across the two years.

The operating margin has, however, significantly decreased to a

loss of GBP1.5m (2018: 15%). This was due to 'gearing up' (through

investment in people and facilities) for the major programme for

which Pennant was down selected in August 2018, recognition of the

revaluation of certain freehold properties in line with the current

market, the goodwill impairment of Aviation Skills Partnership, and

increased overheads and restructuring expenses, which together

contributed to a consolidated loss before tax of GBP1.6

million.

Underlying EBITA, excluding non-underlying costs, was GBP1.6

million. Details are given below:

GBP000

---------------------------------------------- --------

Operating Loss (1,517)

Impairment of Freehold Properties 819

Restructuring Expense 654

Amortisation (including Goodwill Impairment) 1,638

ADG Acquisition costs 54

---------------------------------------------- --------

Underlying EBITA 1,648

Impairment of freehold properties

In order to gear up for major contracts, the Group invested over

GBP3 million in freehold property. The properties acquired are

currently being utilised on the Qatar programme and on the

helicopter trainer contract announced on 31 October 2019 and they

are essential for the further expansion of the business.

Following a revaluation for the purposes of the annual accounts,

it has become apparent that, due to the general softening of the

commercial property market both locally and more broadly, certain

of the properties were overvalued in the Company's balance sheet.

While the net effect of the revaluation across Pennant's entire

freehold portfolio is a reduction of GBP0.4 million (being an

impairment of GBP0.8 million against certain properties and an

increase in value of GBP0.4 million against others), due to

applicable accounting standards the Group is required to expense

the gross amount of the impairment (GBP0.8 million), which is

regarded as non-underlying, with the upwards revaluations being

credited to reserves.

Restructuring expense

During the year, the Group implemented a wide-ranging cost

reduction exercise and various roles were removed from the

business. The aggregate cost associated with terminations of

employment resulting from this exercise was GBP0.7 million which is

regarded as a non-underlying expense.

It is anticipated that this programme will realise gross

annualised savings of over GBP1 million. Taking into account new

roles and capabilities implemented in the revised structure, the

net annualised cost saving will be circa GBP0.6 million.

Goodwill impairment

On 6 February 2019, the Company acquired the entire issued share

capital of Aviation Skills Holdings Limited, the parent company of

The Aviation Skills Partnership Limited ("ASP").

During the period it became apparent that commercialisation of

the ASP model would be significantly slower and more challenging

than expected.

Whilst opportunities to develop new academies are still being

progressed it is not anticipated that any will come to fruition nor

generate sustainable revenue within the next two years.

Following consultation with various stakeholders, the elements

of the ASP business related to campaigning and delivering aviation

skills (for young people and more broadly) were transferred to a

newly-incorporated not-for-profit entity, Aviation Skills

Foundation Limited. The 'NFP' status of this new entity is

perceived to be critical to 'unlocking' the wider participation of

key OEMs, primes and education sector participants. The commercial

activities of ASP continue to be carried on by Pennant.

Based on its assessment of the short-term prospects of realising

new academies, and the aforementioned restructuring, the Board has

concluded that a full write-off of the GBP1.2m ASP goodwill is

appropriate.

Year-end Order Book

At the end of the period, the year-end order book stood at GBP33

million (2018: GBP37 million), of which GBP16 million of revenue

(2018: GBP19 million) is scheduled for recognition within one year

based on anticipated completion of generic products and progress

made on engineered-to-order contracts. Of the total order book, 61%

(2018: 51%) is denominated in sterling and 28% (2018: 36%) is

denominated in Canadian dollars. Any movement of sterling to the

Canadian dollar would potentially impact the OmegaPS business.

Taxation

The Group's tax position shows a tax credit of GBP133,812 (2018:

tax charge GBP32,712), representing an effective tax rate of nil

(2018: 1%). The Group has unrelieved UK tax losses carried forward

of GBP2.9 million (2018: GBP5.3 million).

Research & Development

Research and Development tax credits claimed in the UK during

the year amounted to GBP2.2 million (2018: GBP1.9 million) with

further claims on current projects expected to be made during

2020.

Cashflow

Cash used in operations amounted to GBP2.2 million (2018: cash

generated in operations GBP5.0 million), reflecting the position on

major programmes and the significant movement in working capital

with many products reaching completion in the final quarter of

2019.

The Group had net borrowings at the year-end of GBP2.2 million

(2018: Net cash of GBP1.5 million).

Divisional performance

Divisional financial performance is set out below and further

information about the business of each division is provided in the

Annual Report.

Technical Training

The Group's Technical Training division (formerly known as

Training Systems) is focused on the design and build of generic and

platform-specific training solutions and the provision of related

technical and support services.

During the period, the Group made significant investment in

products, people and infrastructure in preparation for further

growth expected to be driven by potential future contract

awards.

The Technical Training division continues to be the main driver

of revenues within the Group and has delivered a satisfactory

performance given the challenges set out previously. Revenues for

the year, which were significantly H2 weighted, were strong at

GBP16.1 million (2018: GBP16.8 million) as a direct result of the

successful delivery of major Middle East contracts.

2019 2018

GBPm GBPm

------------------------- ------ ------

Revenue 16.1 16.8

Divisional Contribution (1.6) 2.9

Revenues from the Technical Training division were predominantly

generated from product sales, which accounted for 70% of the

divisional revenues, with the balance generated from technical and

support services.

The underlying contribution from Technical Training, ignoring

non-underlying costs, accounted for 100% of the Group's underlying

EBITDA for the period (2018: 90%).

Track Access Services

During the period the Group acquired the assets of Track Access

Services ("TAS"). TAS provides safety-critical services to train

operating companies and rail infrastructure providers. TAS's

current capabilities include rail driver training, rail survey

services, laser and video scanning, 3D track models, signal siting

and a subscription-based route video and mapping service. Customers

include Network Rail and DB Cargo. It is anticipated that TAS will

provide the Group with additional opportunities to increase

recurring revenues.

Integrated Logistics Support (ILS)

The Group's ILS division (formerly known as Software Services)

focuses on the development of the OmegaPS LSAR software product and

the provision of consultancy, training and support services in

relation thereto.

2019 2018

GBPm GBPm

------------------------- ------ ------

Revenue 4.3 4.3

Divisional Contribution - 0.3

Revenues from the ILS division in both 2019 and 2018 were

primarily generated from consultancy services 80% and long-term

software maintenance agreements 20%. This contracted, recurring

revenue is integral to the Group's forward visibility and quality

of earnings and forms a key component of Group Strategy.

Absolute Data Group

Post year end the Group announced the completion of the purchase

of Absolute Data Group ("ADG"), based in Brisbane, Australia. ADG

owns the R4i suite of technical documentation software. The

acquisition will enable the integration of R4i with the Group's

OmegaPS suite of products and provide much greater traction in two

of the Group's principal target markets, the United States and

Australia.

Strategic & Operational review

Our mission is to generate sustainable long-term growth for the

business. In order to deliver this objective, we continue to invest

in areas that we consider are the main drivers for business success

and to ensure the business has the tools and flexible skilled

workforce required to deliver new, major and complex contracts.

Innovation

In line with the Group's core strategic objective, investment in

innovation has been targeted to expand the Group's market coverage,

addressing gaps in the product range and improving the overall

customer proposition. During the period, the Group invested over

GBP2m in the development of new and enhanced solutions.

To date eight new products have been successfully launched and

orders have been secured for all of these solutions:

-- Crew Escape & Safety Systems Trainer;

-- Omega Rail software tool;

-- Basic Helicopter Maintenance Trainer;

-- Generic Stores Loading Trainer;

-- Generic Fastener Installation Trainer;

-- Genskills Mk 2;

-- Virtual Aircraft Training System; and

-- Virtual Loadmaster Training System.

The Company anticipates that it will continue to invest in new

solutions during 2020 and beyond. The Group has an active pipeline

of potential product innovations and improvements that are going

through an assessment process with a view to obtaining funding

approval if a business case is proven. Together, these new products

offer the potential for further significant growth.

Infrastructure

The Group has continued to modernise and improve both production

and administrative facilities with investment in a planned

programme to upgrade our operations. During 2019 the Group invested

GBP0.4 million in modernising and improving production

capability.

These new facilities provide the capability to deliver complex

and larger scale engineering programmes in the future.

People

Our employees remain core to our future business success.

Without talented people, there are no product innovations or

technical solutions.

During the early part of 2019, we strengthened and grew the

teams across our UK, Canadian and Australian operations with

significant investment made in senior skills and we made a number

of strategic appointments designed to improve operational delivery,

manage risk and gear up for the major programme.

However, following delays to certain contract awards and other

costs incurred, the necessary wide-ranging cost reduction exercise

implemented during the year has resulted in a number of other roles

being removed from the business, thereby streamlining operations

without compromising the ability to deliver.

Across the Group, we have implemented various measures

(including wide-spread homeworking) to protect our people during

the Covid-19 pandemic.

Contracts

New contract awards, amendments and achievements during the year

are set out below:

-- Award of a new contract in October 2019 to design and build a

full-size representation of a helicopter training aid for Leonardo

Helicopters worth approximately GBP3.4 million, deliverable across

2020 and 2021.

-- The successful completion and customer acceptance of devices

on the Qatar contract delivering strong second half revenues.

-- Successful rescoping of the Group's key contract for

electromechanical trainers and computer-based training for General

Dynamics, with contract value increased by GBP1.5 million to circa

GBP13.5 million.

-- Award of a new contract for the provision of additional

training aids to the Middle East, including two new training

solutions, worth circa GBP1.5 million, deliverable predominantly in

2020.

-- A new contract for the supply of training aids and associated

services for aviation technician training for the Australian

Defence Force, valued undisclosed.

-- An order from a Middle East customer for two software products, worth circa GBP500,000.

-- An order from BAE Systems Australia for 50 Generic Fastening

Instruments Trainers, a new solution created under the Groups

product development strategy.

-- Additional orders secured for multiple Genskills devices (marks 1 and 2).

-- A renewed contract in the Middle East for technical and

support services to be provided in region.

Implementing the strategy

The underlying strengths of Pennant - our long-term customer

relationships, our specialist services and our quality-assured

reputation - remain the solid foundations of our proposition.

In accordance with our stated strategy, the focus remains firmly

on increasing the proportion of the Group's revenues which derive

from the sale of software and services, particularly those of a

recurring nature.

Steps taken this year include:

-- the acquisition of Track Access Services at the start of the Second Half;

-- the ongoing development of a new variant of OmegaPS

(deployable on a 'software-as-a-service' basis);

-- promoting unique VR software products in North America

(deployable on a 'software-as-a-service' basis);

-- our focus on securing additional, long-term product support contracts;

-- the post period-end acquisition of Absolute Data Group and

its R4i suite of software products; and

-- continued investment and development of a training delivery capability.

The Group continues to progress other strategic opportunities to

partner with or acquire complementary businesses.

The restructuring and repositioning of the business through the

year, together with operational improvements implemented across the

Group and our strong order book, provide a firm platform for future

success.

Philip Walker

Group CEO

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 December 2019

Notes 2019 2018

Continuing operations GBP GBP

Revenue 20,429,990 21,069,223

Cost of sales (13,079,052) (12,806,223)

-------------- -----------------

Gross profit 7,350,938 8,263,000

Land & buildings impairment (819,496) -

Goodwill impairment (1,169,072) -

Restructuring expenses (654,248) -

Other Administration expenses (6,545,440) (5,093,520)

-------------- -----------------

Administrative Expenses (9,188,256) (5,093,520)

Other Income 319,663 -

Operating (Loss)/Profit (1,517,655) 3,169,480

Finance costs (110,655) (1,700)

Finance income 156 10,857

-------------- -----------------

(Loss)/Profit before taxation (1,628,154) 3,178,637

Taxation (charge) / credit 1 133,812 (32,712)

-------------- -----------------

(Loss)/Profit for the year attributable

to the equity

holders of the parent (1,494,342) 3,145,925

============== =================

Earnings per share

Basic (4.16p) 9.49p

Diluted (4.16p) 8.67p

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2019

Notes 2019 2018

GBP GBP

(Loss)/Profit for the year attributable

to the equity

holders of the parent (1,494,342) 3,145,925

Items that may be reclassified to

profit or loss

Exchange differences on translation

of foreign operations (49,259) (34,086)

Deferred tax charge - share based (102,762) -

payments

Items that will not be reclassified 370,197 -

to profit or loss

Net revaluation gain

Deferred tax credit - property, (62,933) -

plant and equipment and intangibles

-------------- ------------

Total comprehensive income for the

period attributable to the equity

holders of the parent (1,339,099) 3,111,839

============== ============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER

2019

Notes 2019 2018

GBP GBP

Non-current assets

Goodwill 923,349 951,939

Other intangible assets 3,391,411 1,660,292

Property, plant and equipment 6,284,769 6,889,346

Right-of-use assets 971,296 -

Deferred tax assets - 198,432

----------- -------------

Total non-current assets 11,570,825 9,700,009

----------- -------------

Current assets

Inventories 570,724 1,923,639

Trade and other receivables 9,372,767 5,184,533

Corporation tax recoverable 869,247 -

Cash and cash equivalents 497,039 1,848,954

Total current assets 11,309,777 8,957,126

Total assets 22,880,602 18,657,135

Current liabilities

Trade and other payables 3,929,527 4,478,039

Bank overdraft 2,739,278 -

Current tax liabilities - 42,247

Obligations under finance leases 209,113 5,350

Total current liabilities 6,877,918 4,525,636

Net current assets 4,431,859 4,431,490

Non-current liabilities

Obligations under finance leases 833,616 20,383

Trade and other payables - 23,105

Deferred tax liabilities 325,215 -

Warranty provisions - 50,000

----------- -------------

Total non-current liabilities 1,158,831 93,488

----------- -------------

Total liabilities 8,036,749 4,619,124

Net assets 14,843,853 14,038,011

=========== =============

Equity

Share capital 1,805,730 1,685,177

Share premium account 5,100,253 3,168,870

Capital redemption reserve 200,000 200,000

Retained earnings 6,686,581 8,225,321

Translation reserve 248,667 297,926

Revaluation reserve 802,622 460,717

Total equity 14,843,853 14,038,011

=========== =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2019

Capital

Share Share red-emption Retained Translation Revaluation Total equity

capital Premium reserve earnings reserve reserve

---------- ---------- ------------- ------------- ------------- ------------- -----------------

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2018 1,647,177 2,677,571 200,000 7,982,360 332,012 489,007 13,328,127

Total

Comprehensive

Income for

the year - - - 3,145,925 - - 3,145,925

Adjustment

on initial

application

of IFRS 15 - - - (3,151,644) - - (3,151,644)

Other

comprehensive

income - - - - (34,086) - (34,086)

---------- ---------- ------------- ------------- ------------- ------------- -----------------

Total

comprehensive

income 1,647,177 2,677,571 200,000 7,976,641 297,926 489,007 13,288,322

Issue of New

Ordinary

Shares 38,000 491,299 - - - - 529,299

Recognition

of share

based

payment - - - 103,983 - - 103,983

Deferred tax

on share

options - - - 116,407 116,407

Transfer from

revaluation

reserve - - - 28,290 - (28,290) -

At 31 December

2018 1,685,177 3,168,870 200,000 8,225,321 297,926 460,717 14,038,011

(Loss) for

the year - - - (1,494,342) - - (1,494,342)

Other

comprehensive

income - - - (165,695) (49,259) 370,197 155,243

---------- ---------- ------------- ------------- ------------- ------------- -----------------

Total

comprehensive

income 1,685,177 3,168,870 200,000 6,565,284 248,667 830,914 12,698,912

Issue of New

Ordinary

Shares 120,553 1,931,383 - - - - 2,051,936

Recognition

of share

based

payment - - - 93,005 - - 93,005

Transfer from

revaluation

reserve - - - 28,292 - (28,292) -

-----------------

At 31 December

2019 1,805,730 5,100,253 200,000 6,686,581 248,667 802,622 14,843,853

========== ========== ============= ============= ============= ============= =================

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2019

Notes 2019 2018

GBP GBP

Net cash from operations (2,210,706) 5,012,123

------------ ------------

Investing activities

Interest received 156 10,857

Payment for acquisition of subsidiary, (406,496) -

net of cash acquired

Purchase of intangible assets (2,200,775) (1,583,760)

Purchase of property, plant and equipment (405,095) (3,561,439)

Proceeds on disposal of property, plant

& equipment - 1,600

Net cash used in investing activities (3,012,210) (5,132,742)

------------ ------------

Financing activities

Proceeds from sale of ordinary shares 2,051,936 529,299

Cancellation of B & C Shares (598,776) -

Net funds from obligations under finance

leases (272,178) (4,647)

Net cash from/(used in) financing activities 1,180,982 524,652

------------ ------------

Net increase/(decrease) in cash and cash

equivalents (4,041,934) 404,033

Cash and cash equivalents at beginning

of year 1,848,954 1,502,655

Effect of foreign exchange rates (49,259) (57,734)

Cash and cash equivalents at end of year (2,242,239) 1,848,954

============ ============

Abbreviated notes to the consolidated financial statements

for the year ended 31 December 2019

1. Taxation

2019 2018

GBP GBP

Recognised in the income statement

Current UK tax expense 303,891 -

Foreign tax (30,978) (103,819)

Adjustment in respect of prior tax years

foreign 7,722 (9,770)

In respect of prior years 211,129 (5)

----------------------------- ----------------------------

491,764 (113,594)

Deferred tax expense relating to origination

and reversal of temporary differences

Deferred tax prior year adjustment (235,500) 84,463

(121,175) -

Exchange rate difference (1,277) (3,581)

----------------------------- ----------------------------

Total P&L tax credit / (expense) 133,812 (32,712)

----------------------------- ----------------------------

Other Comprehensive Income charge for (165,695) -

the period - Deferred tax

----------------------------- ----------------------------

Reconciliation of effective tax rate

----------------------------- ----------------------------

(Loss)/Profit before tax (1,628,154) 3,178,641

----------------------------- ----------------------------

Tax at the applicable rate of 19.00%

(2018: 19.00%) 309,348 (604,199)

Fixed asset differences (206,322) -

Income not taxable for tax purposes - 598,812

Tax effect of expenses not deductible

in determining taxable profit (262,322) (88,885)

Surrender of tax losses for R&D expenditure (94,311) -

R&D expenditure credits 31,342 -

Additional deduction for R&D expenditure 233,489 365,604

Foreign tax credits (25,495) 30,125

Share Option deduction 27,392 79,933

Effect of different tax rates of subsidiaries

operating in other jurisdictions 74 (21,329)

Effect of lower rate of deferred tax 38,765 9,852

Deferred tax not recognised (68,017) (340,001)

Effect of adjustments for prior years 218,851 (13,351)

Effect of adjustments for prior years (121,175) -

- deferred tax

Deferred tax charged directly to equity 165,695 -

Temporary differences not recognised

in computation (113,564) 10,977

Total tax expense 133,812 (32,712)

============================= ============================

2. Publication of non-statutory accounts

The financial information presented in this announcement does

not constitute the Group's financial statements for either the year

ended 31 December 2019 or the year ended 31 December 2018, but is

derived from those financial statements. The Group's statutory

financial statements for 2018 have been delivered to the Registrar

of Companies and those for 2019 will be delivered following the

Company's annual general meeting. The auditors' reports on both the

2018 and 2019 financial statements were not qualified or modified,

however the 2019 financial statements drew attention to a material

uncertainty in respect of going concern arising from the impact of

the Covid-19 pandemic. The directors' assessment of the uncertainty

is set out in note 3 of the notes to the financial statements as

contained the 2019 Annual Report and Accounts. Following such

assessment, the Directors concluded that it was appropriate to

prepare the financial statements using the 'going concern'

basis.

Copies of the 2019 Annual Report and Accounts will be

distributed to shareholders shortly in accordance with notified

communications preferences and will be available on the Company's

website from 20 April 2020: www.pennantplc.co.uk. Further copies

may be obtained by contacting the Company Secretary at Pennant

Court, Staverton Technology Park, Cheltenham GL51 6TL.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR KKCBKBBKBKQD

(END) Dow Jones Newswires

April 20, 2020 02:00 ET (06:00 GMT)

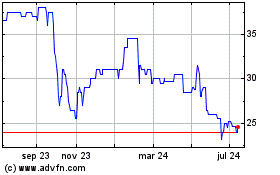

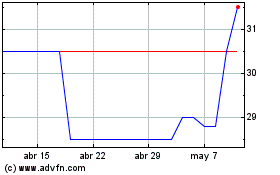

Pennant (LSE:PEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pennant (LSE:PEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024