By Sharon Terlep

More Americans are buying cleaning products marketed as

eco-friendly or all-natural, but not necessarily because they want

to.

Cleaning mainstays such as Clorox wipes and Lysol sprays are in

short supply in stores and online amid the coronavirus pandemic,

leading shoppers to seek alternatives such as the so-called green

brands they once passed over, retailers and analysts say.

"There are no mainstream products available, so as a retailer

you look to satisfy consumers' needs with whatever products you can

find," said Jason Kirsch, who operates the Corner Market &

Pharmacy, outside Washington, D.C.

For weeks, he said, he has been unable to secure mainstream

cleaning products, so he began to order any brands that had

products available, such as Seventh Generation, an eco brand.

"Typically, there is available supply of these alternative

products," he said.

Store shelves with a handful of green cleaning products sitting

next to empty shelves that once held big-brand wipes and sprays

have become an increasingly common sight.

On Amazon.com Inc. and Target Corp.'s website, Clorox and Lysol

products are rarely available. While even alternative brands have

limited supply, items from brands such as Mrs. Meyer's and

Babyganics are often in stock.

Some businesses that have used green products are switching to

traditional cleaners, as well, cutting into supplies. Last month,

Santander Bank, in an email to customers, said it was "reverting

back to traditional disinfectant cleaning products."

U.S. sales of mainstream household cleaners jumped 77% for the

four-week period ended April 4 compared with a year ago, according

to Nielsen. Sales of cleaners branded as environmentally friendly,

a still-small slice of the market, had a 71% bump in the same

period.

Chemists and brands say products made with milder or natural

ingredients are just as effective as traditional products in

fighting coronavirus. Many customers feel more comfortable with a

familiar brand right now because of the perception they are

tried-and-tested or include more potent chemicals, analysts

say.

For home cleaning, the Centers for Disease Control and

Prevention recommends cleaning frequently touched surfaces, such as

doorknobs and light switches, throughout the day with products that

meet the Environmental Protection Agency's criteria for use against

SARS-CoV-2, the virus that causes Covid-19.

"We are seeing unprecedented demand in our products, I wish it

were under different circumstances," said Seventh Generation Chief

Executive Joey Bergstein.

The brand, owned by Unilever PLC, has a line of household

cleaners, baby and personal-care products. Its disinfectant

products meet the EPA's criteria, the company says on its

website.

Mr. Bergstein said that while some newcomers to the brand are

buying out of necessity, many people are seeking out natural

products as home cleaning becomes a bigger priority.

"The volume of calls we get from people asking where to buy our

products is through the roof, so that's not just people looking for

anything," he said. "People are cleaning so much now, they are

trying to make good choices."

Procter & Gamble Co., maker of Tide detergent and Pampers

diapers, has lost consumers to rival brands in cases where its

products are in short supply, Jon Moeller, the company's finance

chief, said Friday.

"There are consumers that are trying products that they haven't

tried before but they aren't necessarily ours," he said, referring

to the unit that makes Charmin toilet paper and Bounty paper

towels.

Consumers have increasingly demanded more natural products, from

food to makeup to laundry soap, in recent years. They have been

slower to make the shift when it comes to household cleaners.

Eco cleaners are a niche market in the U.S., comprising roughly

4% of sales in the category, according to Nielsen. Americans spent

more than $200 million on mainstream cleaning brands during the

week ended April 4, and just over $7 million on green

alternatives.

Roughly half of consumers are trying new brands, according to a

PricewaterhouseCoopers LLP survey of 1,600 adult consumers

conducted March 27 to April 1. In many cases, they are switching

because their typical product isn't available or because they are

buying from a different retailer which has different offerings, but

more than 60% of those surveyed said they plan to stick with a new

brand, PwC partner Samrat Sharma said.

Mr. Kirsch, the market owner, said in recent weeks even many

smaller and natural brands aren't available. His advice to

customers: "I've tried to steer people to bleach," he said. "It's

still readily available and, when used properly, it's very

effective."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

April 23, 2020 09:00 ET (13:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

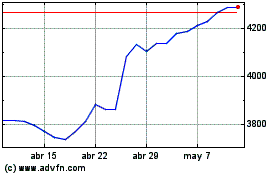

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

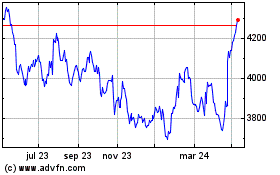

Unilever (LSE:ULVR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024