Barclays Profit Drops as It Braces for Soured Loans -- Update

29 Abril 2020 - 2:26AM

Noticias Dow Jones

By Simon Clark

LONDON -- Barclays PLC said its profit fell in the first quarter

as the U.K. bank set aside GBP2.1 billion ($2.6 billion) in

provisions for losses from loans affected by the coronavirus

pandemic.

Net profit dropped 42% to GBP605 million in the first quarter

from the same period last year, Barclays said. Provisions for bad

loans in the first quarter of last year totaled GBP448 million.

Banks across the world are increasing provisions to account for

the impact of the virus on companies and the economy. HSBC Holdings

PLC, Europe's biggest bank by assets, set aside $3 billion in the

first quarter. The largest U.S. banks have taken billions of

dollars in new credit provisions.

The virus is the latest challenge to banks in Europe, which have

been hobbled by low and negative interest rates that have made

lending particularly challenging.

"Given the uncertainty around the developing economic downturn

and low interest rate environment, 2020 is expected to be

challenging," Barclays Chief Executive Jes Staley said.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

April 29, 2020 03:11 ET (07:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

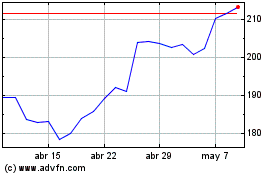

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

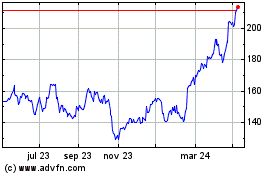

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024