TIDMPEY TIDMPEYS

RNS Number : 6285L

Princess Private Equity Holding Ltd

01 May 2020

News Release

Guernsey, 1 May 2020

Princess Private Equity Holding Limited - publication of March

NAV including impact of COVID-19 on valuations and updated dividend

guidance

Princess Private Equity ("Princess" or "the Company") today

announces its unaudited net asset value as at 31 March 2020 (the

March NAV). The Company has reported a March NAV of EUR 10.71 per

share, representing a NAV total return of -14.1% during the month

(-14.8% during Q1 2020). Further to the Company's announcement on

26 March 2020, the March NAV reflects the impact of the volatility

observed in financial markets during March and associated

mark-to-market adjustments. In addition to the monthly factsheet

which can be downloaded from the Company's website (link), this

statement provides additional commentary on the largest portfolio

exposures, the Company's liquidity position and guidance on the

FY2020 dividend.

The impact of COVID-19 remains unprecedented and the situation

continues to evolve rapidly. In order to slow the spread of the

virus, governments around the world have implemented sweeping

stay-at-home and social distancing measures. These protocols have

led to, not only a slowdown in economic activity, but a 'sudden

stop' in certain sectors. Government measures appear to be starting

to yield results, with signs that the number of new cases in

several countries may be peaking, and governments starting to

consider a staggered relaxation of restrictions. However, global

economic activity has already slowed sharply and is likely to take

an extended period to fully resume, with a higher rate of

unemployment and a more cautious corporate sector.

Despite the significant mark-to-market movements during March,

Partners Group ("the Investment Advisor") remains positive on the

long-term outlook for the portfolio, even in a lower growth

economic environment. As a consequence of its selective investment

approach, the Company has underweighted, or avoided, many of the

more cyclical sectors that have been hardest hit. Princess is

invested in a range of businesses operating in sub-sectors which

benefit from long-term growth drivers, such as demographics and

technology, and which provide a long-term value proposition to

their customers. The full resources of the Investment Advisor's

global investment platform, including dedicated in-house operating

and capital markets teams, remain focused on preserving value in

the Company's investments and ensuring that they emerge from this

challenging period in a position of relative strength.

Sector breakdown of the portfolio as at 31 March 2020:

Education Services 17.9%

Health Care 15.4%

Information Technology 14.9%

Retail* 13.7%

Financials 8.9%

Industrials 8.1%

Consumer Staples 7.5%

Consumer Discretionary 4.0%

Energy 3.7%

Materials 3.6%

Utilities 1.4%

Telecommunication Services 0.9%

*Includes Action which represented 11.0% of portfolio (12.0% of

NAV) as at 31 March 2020. An exit has been agreed and is expected

to close during the second quarter of 2020.

Valuations

In calculating the Company's March NAV, the Investment Advisor

conducted a rigorous bottom-up revaluation of the portfolio, taking

into account the impact of the decline in the multiples of

comparable companies, or other market data, used to value the

Company's direct investments. Additionally, the Investment Advisor

adjusted the valuations in the latest available reports from

Princess' legacy third party fund investments (mainly dated Q3/Q4

2019) to reflect the declines observed in financial markets during

March.

Commentary on largest exposures

Commentary on the Company's largest investment exposures,

excluding Action for which a sale has been agreed, is provided

below covering 37.0% of the Company's net asset value at 31 March

2020.

Permotio International Learning (trading as International

Schools Partnership)

Permotio is an investment vehicle formed to create a leading

international private schools group through a "buy and build"

strategy. The company owns and operates a diversified platform of

46 schools across the Americas, Europe, the Middle East and Asia.

Permotio has temporarily closed all 46 schools in response to

government social-distancing measures, and to ensure the health and

safety of students and employees. Despite school closures, the

financial impact to-date has been limited. Tuition fees are paid in

advance and the schools are able to meet their contractual

commitments through "distance learning" and, if necessary, changes

in holiday schedule. Over the medium term, a negative impact on

enrollments and ancillary fees is expected if schools are unable to

re-open for an extended period. Non-capex and other non-committed

expenditure have been restricted at the present time. Management is

preparing a detailed plan to re-open each school, subject to the

lifting of government restrictions. Permotio maintains a healthy

cash balance with no material risk to covenants at present.

GlobalLogic

Global Logic is a global provider of outsourced software product

engineering services, with approximately 12'000 employees across

the globe. Business continuity measures have been implemented. Over

98% of employees globally are able to work remotely and procedures

have been put in place to ensure project teams can still

collaborate to meet client deliverables. Revenues are predominantly

linked to project-based, long-term contracts and consequently there

has been no immediate impact on profitability. An assessment of the

potential impact of an extended global economic slowdown on client

stability and new projects is being undertaken. A precautionary

drawdown of the company's revolving credit facility has been

implemented. The company maintains a healthy liquidity position

with low covenant risk.

Foncia

Foncia is a France-headquartered company that provides property

management and real estate services. It has a network of more than

600 branches located throughout France, Switzerland, Germany and

Belgium. Foncia operates in a resilient sector and to-date the

impact on operations and financials has been limited. Management

has rolled out business continuity plans and most of the employees

are working from home. The majority of revenues stem from

residential property management services and are recurring in

nature as they are based on the company's stock of dwellings under

management. As such the main impacts are expected to be on the

brokerage and rental activities. Cost reduction measures have been

implemented and employees have been put under temporary

unemployment schemes where applicable. The company maintains a

healthy liquidity position.

KinderCare Education

KinderCare is the largest for-profit provider of early childhood

education in the US and operates over 1'500 centers nationwide.

Currently, more than 400 KinderCare centers remain open to provide

child-care for essential workers. However, due to health advisories

from national, state and local health departments, as well as the

concerns of many employees and the families KinderCare serves, the

company has had to temporarily close many of its other centers to

protect its staff and the children for which it cares. The center

closures are expected to have a material impact on 2020 sales and

earnings and a cost reduction plan has been implemented. The

company maintains a positive cash position and has completed a

precautionary draw-down on its revolving credit facility.

Fermaca

Fermaca is an operator of gas infrastructure in Mexico. The

company is engaged in the development, construction, ownership and

operation of midstream natural gas infrastructure. The company

generates revenues primarily through the sale of pipeline capacity

under USD-denominated "take-or-pay" contracts with medium to

long-term tenors, fixed prices and no volume exposure. A business

continuity plan has been put in place and to-date there has been no

disruption to operations. There are currently no projected

liquidity or covenant issues.

PCI Pharma Services

PCI is a global provider of outsourced pharmaceutical services.

The business operates in a resilient sector and has suffered only a

marginal impact to-date. It is designated as providing essential

services and has therefore been able to remain open. There has been

no significant disruption to operations and the company's supply

chains continue to function. March was a record sales month and PCI

is raising inventory levels to meet increased customer demand. As

well as ensuring a supply of critical drugs for patients with

exiting conditions, PCI is supporting the supply of several drugs

used to treat conditions arising from COVID-19. Management

continues to monitor the company's liquidity position and a

precautionary revolving credit facility draw-down has been

completed. There are currently no projected liquidity or covenant

issues.

Liquidity position

The Investment Advisor continues to closely monitor the

Company's liquidity position and the potential capital requirements

of its portfolio companies. Detailed cash flow forecasts have been

prepared under both a base-case and a downside-case scenario. The

downside-case models an extended period of social-distancing

measures that suppress portfolio company revenues until the end of

the third quarter of 2020, followed by a gradual recovery. Based on

this analysis the Investment Advisor has identified those portfolio

companies which may require additional capital in the months and

quarters ahead. In the current environment, both realization and

investment activity are expected to slow materially. The Company

maintains a long-term investment horizon and is under no pressure

to realize investments in this environment.

As of 31 March 2020, the Company held liquidity of EUR 29.6

million, having drawn the remaining balance of its EUR 80 million

committed credit facility on a precautionary basis during March.

The Company continues to expect to receive EUR 80.9 million during

the second quarter from the previously announced sale of its stake

in Action (having received a EUR 7.8 million distribution from

Action during March).

The Investment Advisor remains confident that the Company has

access to sufficient liquidity to support its portfolio companies

during this challenging period.

Statement on dividend

The Company notes an increasing number of dividends cuts and

suspensions from companies seeking to preserve liquidity in the

current environment, or following the recommendations of

regulators. This statement provides guidance to shareholders on the

Company's FY2020 dividend.

The Company has a dividend objective to distribute 5-8% of

opening NAV via semi-annual payments. In FY2019 it paid a total

dividend of EUR 0.58 per share via interim dividends in June and

December. However, while the economic outlook remains uncertain,

the Company does not believe it would be prudent to maintain the

dividend at this level.

The Company expects to pay a total dividend of not less than EUR

0.29 per share for FY2020. The timing of dividend payments will

reflect the Investment Advisor's ongoing assessment of the

potential capital requirements to support the portfolio. The

Company may pay a partial first interim dividend, or the first

interim dividend may be suspended if visibility has not improved.

It remains the Company's intention to pay a second interim dividend

in December, in part or in full, such that the total dividend for

the year is not less than EUR 0.29 per share.

The Company recognizes the importance of the dividend for

shareholders. However, while material uncertainty remains over the

duration and impact of Covid-19 on the economy, the preservation of

liquidity is considered the most prudent course of action to enable

the Company to support its portfolio companies as required, and to

protect long-term value for shareholders. The Company intends to

resume a normal cycle of dividend payments when visibility has

improved. A further announcement will be made regarding the first

interim dividend in due course.

Investor conference call

The Company will hold its quarterly investor conference call on

12 May 2020 10:00 BST / 11:00 CET to present the Q1 2020 results

and to provide an update on the development of the portfolio.

Please find the dial-in details on the Company's webpage.

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is advised in its investment

activities by Partners Group, a global private markets investment

management firm with USD 94 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRABMATMTBMMPM

(END) Dow Jones Newswires

May 01, 2020 02:00 ET (06:00 GMT)

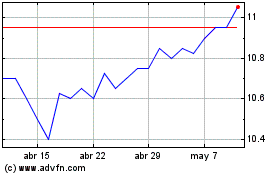

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

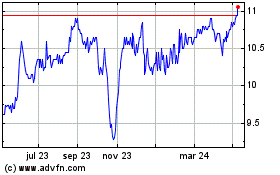

Princess Private Equity (LSE:PEY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024