TIDMFERG

RNS Number : 6942M

Ferguson PLC

13 May 2020

13 May 2020

FERGUSON PLC

Q3 2020 Trading update

WELL POSITIONED TO SUPPORT OUR ASSOCIATES AND CUSTOMERS THROUGH

THE COVID-19 PANDEMIC.

CONTINUED STRONG FINANCIAL POSITION .

At the time of the half year results on 17 March 2020 we were

trading in line with expectations. As outlined in our trading

update on 15 April 2020 since the middle of March we rapidly

changed our operating procedures to protect the safety and

wellbeing of our associates and our customers. This is against a

background of the unprecedented action taken by governments to

contain the COVID-19 virus and the societal impact which has

resulted in adverse trading conditions within the Group's end

markets. The Group is today outlining quarterly results for the 3

months to 30 April 2020.

Summary of revenue trends

Revenue growth / (decline) % H1 2020 2 months April 2020 Q3 2020(1)

to 31 March(1)

----------------------------- ------- --------------- ---------- ----------

USA +5.0% +8.2% (9.3%) +1.9%

Canada (6.5%) (7.7%) (33.6%) (16.4%)

----------------------------- ------- --------------- ---------- ----------

Ongoing operations +4.3% +7.3% (10.5%) +0.9%

----------------------------- ------- --------------- ---------- ----------

UK (non-ongoing) (4.7%) (10.3%) (60.2%) (26.5%)

----------------------------- ------- --------------- ---------- ----------

Continuing operations +1.1% +5.1% (15.3%) (2.2%)

----------------------------- ------- --------------- ---------- ----------

1) One additional trading day in the current year added 2.5% to

both ongoing operations and US revenue growth in the 2 months to 31

March 2020 and 1.6% to both ongoing operations and US revenue

growth in Q3 2020.

Commenting on the results Kevin Murphy, Group Chief Executive, said:

"Our strong revenue momentum in February and March was adversely

impacted in April as federal, state and local COVID-19 restrictions

and safety measures brought about a reduction in demand. We have

rapidly implemented responsible working practices to protect the

health and wellbeing of our associates and with few exceptions our

traditional branch network remains open. During these challenging

times we remain immensely thankful and very proud of the dedication

of our 35,000 associates as they continue to support our customers

in serving our critical industries.

"We have taken steps to manage our cost base and protect cash

flow given the uncertain outlook both in the short-term during the

crisis phase but also to ensure the business is appropriately sized

for the post COVID-19 environment. We are confident these actions

coupled with the strength of our balance sheet will serve us well

in the coming months and years. As a value-added distributor

Ferguson remains well positioned to support our customers, vendors

and communities during this challenging time while continuing to

build our capabilities for the long-term."

Current trading

In recent weeks the Group has remained focused on three key

areas:

1. Protecting the health and wellbeing of our associates

2. Continuing to serve our customers during the crisis phase of

the virus - a critical time of need

3. Protecting and preserving the strength of our businesses for the long-term

To safeguard the wellbeing of our associates and support our

customers we are operating our business in adherence with the

recommended Center for Disease Control (CDC) guidelines. Cleaning

protocols at all sites are in operation alongside appropriate

social distancing measures. Our branches are operating pick-up and

delivery only with customers encouraged to order ahead with pick up

in store at the curbside and touchless signature at the point of

delivery or pick-up location. Associates who can work re motely

continue to do so. Our showroom networks have remained closed

through April and we have served customers using virtual

consultations. In select markets we are starting to book

face-to-face consultations with the necessary social distancing

measures in place in line with local governmental guidance.

Trading volumes were lower in April as a result of the impact of

the COVID-19 virus pandemic. In the US the revenue decline in April

was 9.3%. The major impact on volume continues to be highly

correlated to the degree of disruption locally which has been

variable across US states and localities. Blended Branches revenue

was down 15.3% in April and in the major hotspots, where infection

rates have been highest, such as New England, New York, Michigan,

the Pacific North West and Northern California revenue was down

significantly. However, Waterworks grew revenue by 8.5% in April

benefiting from fewer restrictions. Standalone eBusiness also grew

well with revenue 14.6% ahead in the month as a result of strong

consumer demand for home improvement products.

In Canada revenue was down 33.6% in April with widespread

lockdowns in place although we expect some improvement in sales per

day as some markets including Quebec reopen to construction

activity in May. The UK remained very challenging due to the

national lockdown severely impacting activity levels with revenue

down 60.2% during the month.

Cost actions, cash optimization and liquidity

Ferguson has an agile business model and as we have started to

see short-term revenue pressure our approach has been to protect

our skilled workforce which is critical to the long-term success of

the business. We have already taken a number of prudent cost saving

measures to minimize impact on short-term profitability. This has

included a hiring freeze, reduced overtime and restricting the use

of temporary labor. Currently in markets where there has been a

decline in revenue we are implementing a combination of reduced

associate hours and temporary lay-offs based on business and market

needs. That said, we are in the process of taking action across the

Group to ensure the business is appropriately sized for the post

COVID-19 operating environment.

The Company has also introduced a number of measures to protect

its cash position including suspending the $500 million share buy

back, pausing current M&A activity, withdrawing the interim

dividend and reducing capital expenditure in 2019/20 to around

$280-300 million. Ferguson remains in a strong financial position

with long-term committed facilities. The Company's net debt, which

excluded lease liabilities, at 30 April 2020 was $1.8 billion and

the ratio of net debt to the last 12 months adjusted EBITDA was 1.0

times. As at 30 April 2020 the Group had $3.1 billion of available

liquidity comprising readily available cash of $1.3 billion and

$1.8 billion of undrawn facilities.

Q3 Trading summary

Ongoing operations(1) Q3 2020 Q3 2019 Change

US$ millions

------------------------------------- -------- -------- -------

Revenue 4,750 4,707 +0.9%

Trading profit(2) 351 339

Less impact of IFRS16 (17) -

-------- --------

Underlying trading profit 334 339 (1.5%)

Trading days 64 63

Net debt to Adjusted

EBITDA(3) 1.0x 0.9x

-------------------------------- --- -------- -------- -------

1) 'Ongoing operations' excludes businesses that have been

closed, disposed of or are classified as held for sale. The UK has

been moved to 'Non-ongoing operations'.

2) Before exceptional items and amortization of acquired

intangible assets.

3) Ratio of net debt, which excludes lease liabilities, to

pre-IFRS16 last twelve months EBITDA. Net debt excluding leases as

at 30 April 2020 was $1,823 million and last twelve months adjusted

EBITDA was $1,790 million.

Group results

The Group generated revenue in the ongoing businesses of $4,750

million in the third quarter, 0.9% ahead of last year or 1.7%

behind on an organic basis. Gross margins were 40 basis points

lower at 29.8% in the quarter with underlying trading profit of

$334 million, $5 million behind last year. The impact of IFRS16

contributed a further $17 million to trading profit. There was one

additional trading day in Q3 2020 compared to Q3 2019.

Regional analysis

US$ millions Revenue Revenue Change Trading Less Underlying Trading Change

Q3 2020 Q3 2019 profit impact trading profit

Q3 2020 of IFRS16 profit Q3 2019

Q3 2020 Q3 2020

------------------- -------- -------- ------- -------- ---------- ---------- -------- ------

USA 4,541 4,457 +1.9% 360 (17) 343 346 (0.9%)

Canada 209 250 (16.4%) (1) - (1) 4 (125%)

Central costs - - (8) - (8) (11)

------------------- -------- -------- ------- -------- ---------- ---------- -------- ------

Ongoing operations 4,750 4,707 +0.9% 351 (17) 334 339 (1.5%)

------------------- -------- -------- ------- -------- ---------- ---------- -------- ------

UK (non-ongoing) 417 567 (26.5%) (12) - (12) 20 (160%)

=================== ======== ======== ======= ======== ========== ========== ======== ======

Quarterly organic revenue growth

Ongoing operations Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020

------------------- ------- ------- ------- ------- -------

USA +3.3% +3.0% +3.1% +2.1% (1.0%)

Canada (2.9%) (5.2%) (6.4%) (6.7%) (14.9%)

===================== ======= ======= ======= ======= =======

Group +3.0% +2.5% +2.5% +1.6% (1.7%)

===================== ======= ======= ======= ======= =======

USA

Our US business grew well in February and March but revenue was

lower in April due to the impact from COVID-19 related restrictions

and safety measures. Total growth of 1.9% comprised of a 1.0%

organic decline offset by 1.3% of growth from acquisitions and a

further 1.6% from the additional trading day. Price inflation

during the quarter was broadly flat.

Gross margins were slightly lower due to the mix of business

with no discernible pricing changes in the marketplace. Underlying

trading profit of $343 million was 0.9% behind last year.

Before pausing M&A activity, we completed three acquisitions

in the quarter including Columbia Pipe & Supply, which

specializes in PVF, commercial mechanical, commercial plumbing,

industrial, valve automation, engineered products and hydronics;

Rencor Controls, an automated valve distributor in the North East;

and MFP Design, a custom designer of fire sprinkler systems. These

three businesses generated a combined $229 million of annualized

revenue on a pre COVID-19 basis.

Canada

Revenue in Canada was 16.4% lower with markets remaining

challenging in February and March prior to lockdowns in the balance

of the quarter. Gross margins were slightly lower, contributing

towards an u nderlying trading loss

of $1 million, $5 million below last year.

Non-ongoing operations (Wolseley UK)

In the UK, revenue declined 26.5% in the quarter as the national

lockdown severely impacted demand. An underlying trading loss of

$12 million was $32 million lower than last year. We continue to

actively manage the cost base given the challenging market

environment.

The Board's strategic intent to demerge the UK business is

unchanged and we continue to progress the demerger process,

although timing will depend upon the stabilization of market

conditions.

Nine months trading performance

US$ millions Revenue Revenue Change Trading Less Underlying Trading Change

profit Trading profit

profit

2020 2019 2020 impact 2020 2019

of IFRS16

9 months to 30 2020

April 2020

------------------- ------- ------- ------- ------- ----------- ---------- ------- -------

USA 13,859 13,330 +4.0% 1,134 (51) 1,083 1,046 +3.5%

Canada 784 865 (9.4%) 29 (1) 28 42 (33.3%)

Central costs - - (30) - (30) (36)

------------------- ------- ------- ------- ------- ----------- ---------- ------- -------

Ongoing operations 14,643 14,195 +3.2% 1,133 (52) 1,081 1,052 +2.8%

------------------- ------- ------- ------- ------- ----------- ---------- ------- -------

UK (non-ongoing) 1,490 1,694 (12.0%) 18 - 18 53 (66.0%)

=================== ======= ======= ======= ======= =========== ========== ======= =======

Other matters

During the quarter there were cash outflows of $202 million

relating to acquisitions, $74 million relating to capital

expenditure and $101 million of share buy backs. The IFRS 16 lease

liability recognized on the balance sheet as at 30 April 2020 was

$1,405 million. There have been no significant changes to the

financial position of the Group since 30 April 2020.

An exceptional charge of $8 million in the quarter (2019:

exceptional charge of $18 million) included $5 million of demerger

costs relating to the UK business and $2 million of costs relating

to the Group's listing assessment and shareholder consultation.

In May the Group completed the sale of its investment in Meier

Tobler for $31 million completing the exit of all trading

operations in Continental Europe. This is in line with our strategy

to focus the Group's activities on North American markets.

Outlook

Due to the dynamic situation unfolding with COVID-19 the Company

has withdrawn formal guidance. We continue to operate as an

essential business with the majority of our branches open and

serving customers as much as possible. Ferguson remains well

positioned for long-term success operating in attractive and

fragmented markets with a robust business model and backed by a

strong balance sheet and liquidity position.

For further information please contact Ferguson plc

Mike Powell, Group Chief Financial Officer Tel: +44 (0) 1189 273800

Mark Fearon, Director of Corporate Communications

and IR Mobile: +44 (0) 7711 875070

Media enquiries

Mike Ward, Head of Corporate Communications Mobile: +44 (0) 7894 417060

+44 (0) 20 7404

Nina Coad / David Litterick (Brunswick) Tel: 5959

Investor conference call and webcast

A call with Kevin Murphy, Group Chief Executive and Mike Powell,

Chief Financial Officer will commence at 10.00 UK time (05.00

Eastern) today. The call will be recorded and available on our

website after the event www.fergusonplc.com .

Dial in number UK: +44 (0)330 336 9105

US: +1 323 794 2093

Please join the event conference 5-10 minutes prior to the start

time and ask for the Ferguson call quoting 3171991.

To access the call via your laptop, tablet or mobile device

please click here . If you have technical difficulties, please

click the "Listen by Phone" button on the webcast player and dial

the number provided.

About Ferguson

Ferguson plc is a value-added distributor of plumbing and

heating products to professional contractors principally operating

in North America and the UK. Ongoing revenue for the year ended 31

July 2019 was $21.8 billion and ongoing trading profit was $1.6

billion. Ferguson plc is listed on the London Stock Exchange (LSE:

FERG) and is in the FTSE 100 index of listed companies. For more

information, please visit www.fergusonplc.com or follow us on

Twitter https://twitter.com/Ferguson_plc.

Legal disclaimer

Certain information included in this announcement is

forward-looking and involves risks, assumptions and uncertainties

that could cause actual results to differ materially from those

expressed or implied by forward-looking statements. Forward-looking

statements cover all matters which are not historical facts and

include, without limitation, projections relating to results of

operations and financial conditions and the Company's plans and

objectives for future operations, including, without limitation,

discussions of expected future revenues, financing plans, expected

expenditures and divestments, risks associated with changes in

economic conditions, the strength of the plumbing and heating

markets in North America and Europe, fluctuations in product prices

and changes in exchange and interest rates. Forward-looking

statements can be identified by the use of forward-looking

terminology, including terms such as "believes", "estimates",

"anticipates", "expects", "forecasts", "intends", "plans",

"projects", "goal", "target", "aim", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

variations or comparable terminology. Forward-looking statements

are not guarantees of future performance. All forward-looking

statements in this announcement are based upon information known to

the Company on the date of this announcement. Accordingly, no

assurance can be given that any particular expectation will be met

and readers are cautioned not to place undue reliance on

forward-looking statements, which speak only at their respective

dates. Additionally, forward-looking statements regarding past

trends or activities should not be taken as a representation that

such trends or activities will continue in the future. Other than

in accordance with its legal or regulatory obligations (including

under the UK Listing Rules, the Prospectus Rules, the Disclosure

Guidance and the Transparency Rules of the Financial Conduct

Authority), the Company undertakes no obligation to update publicly

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Nothing in this

announcement shall exclude any liability under applicable laws that

cannot be excluded in accordance with such laws.

-ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTDLLFFBELFBBD

(END) Dow Jones Newswires

May 13, 2020 02:00 ET (06:00 GMT)

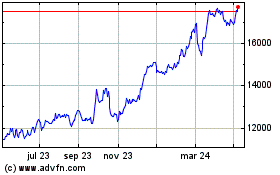

Ferguson (LSE:FERG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

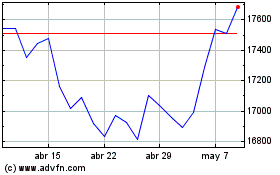

Ferguson (LSE:FERG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024