TIDMPRD

RNS Number : 9521M

Predator Oil & Gas Holdings PLC

14 May 2020

FOR IMMEDIATE RELEASE

14 May 2020

Predator Oil & Gas Holdings Plc / Index: LSE / Epic: PRD /

Sector: Oil & Gas

Predator Oil & Gas Holdings Plc

("Predator" or the "Company" and together with its subsidiaries

"the Group")

Redemption of remaining Arato Global Opportunities LLC ("Arato") Loan Notes

and Placing to raise GBP0.448million

Predator Oil & Gas Holdings Plc (PRD), the Jersey-based Oil

and Gas Company with operations in Trinidad, Morocco and Ireland is

pleased to announce that it has conditionally placed 22,438,842 new

ordinary shares of no par value in the Company (the "Placing

Shares") at a placing price of 2 pence each (the "Placing Price")

to raise GBP0.448million (before expenses) (the "Placing").

The Placing was significantly oversubscribed and utilises all of

the Company's existing headroom shares under the Financial Conduct

Authority restrictions for companies on the Official List (standard

listing segment) of the London Stock Exchange's main market for

listed securities .

Novum Securities are acting as placing agents to the

Company.

Settlement in full of outstanding Arato Convertible Loan

Notes

The well-capitalised position of the Company combined with

significant operational progress towards generating revenues from

the CO2 EOR project in Trinidad, has created the opportunity to

settle in full the outstanding Arato Convertible Loan Notes.

Eliminating debt potentially strengthens the near-term growth

prospects of the Company as COVID-19 restrictions are gradually

relaxed.

The Company has given an irrevocable notice to repay the

remaining GBP746,000 of the Loan Notes (the Outstanding Principal)

together with redemption fees (together, the Redemption Monies) on

or before 15 May 2020. Arato have agreed to accept the Redemption

Monies in cash.

Redemption Monies will be funded from the Placing and from

utilising some cash resources from the Company's well-capitalised

balance sheet.

Impact on working capital requirements

The successful and oversubscribed Placing announced on 14

February 2020 allowed some additional discretionary working capital

to be raised surplus to that required to satisfy all of the

Company's current work programme commitments. Cost reductions have

been achieved during COVID-19 for the Company's operations without

compromising the ability to deliver revenues from Trinidad or the

execution of the Moroccan drilling programme. The additional

release of the Arato security over the first US$1 million of the

Guercif Bank Guarantee, returned after the completion of the

Guercif commitment well, further strengthens the Company's balance

sheet. Going forward that restricted cash can potentially be

leveraged to secure improved commercial terms with some drilling

service companies and equipment providers, with some potential for

risk-sharing and deferred payments given the weakened position of

the services market. This makes for more effective use of such

cash.

The Company remains, after repayment of the outstanding Arato

Convertible Loan Notes, fully funded to progress CO2 EOR in

Trinidad to the point when profits are generated and to execute the

high impact Guercif drilling programme in Morocco targeting the gas

market in Morocco.

Operations summary

Operational, HSE and regulatory progress in Trinidad has been

successfully maintained and managed during the COVID-19 imposition

of social distancing restrictions. As a result, the Company is

confident that profits from enhanced CO2 EOR oil production, even

at a sustained WTI oil price of US$20 per barrel, will make a

positive impact on the Company's cash balances. Such profits are

additional to the working capital raised for the Company to fulfil

its current work programmes.

The Company remains "drill ready" in Morocco, with environmental

approvals granted and in- country rig availability maintained at no

cost to the Company. Well equipment also remains available in

Morocco. The drilling programme can be advanced as soon as COVID-19

restrictions are relaxed and the HSE conditions under which

operations can be carried out are agreed and put into practice.

The Company is working on a faster-track solution to monetise an

initial gas discovery at Guercif in the event of drilling success.

GRF-1 was drilled in 1972 less than two kilometres from the

proposed well to be drilled by the Company. Well logs over an

interval interpreted as gas-bearing by a previous operator in 2006

are now being re-evaluated by Houston-based NuTech, a company

specialising in applying new technology to old well logs. The first

well location has been optimised to ensure that this significant

potential gas target can be added to the existing gas targets. This

will potentially maximise well deliverability in a success case to

support the option being developed for initial monetisation of gas.

Morocco remains a very attractive market for gas and the impact of

COVID-19 only reinforces the importance of focussing on local gas

markets where less carbon intensive gas is competing against more

carbon intensive, higher priced, imported fuel oil.

Predator Oil & Gas Holdings Plc CEO Paul Griffiths

commented:-

"I am very pleased to announce that through this Placing and the

well-capitalised position of the Company we have removed the debt

created by the Convertible Loan Notes. We have achieved this by

reaching a secure position whereby cash can be prudently used to

achieve this purpose without compromising delivering our work

programme commitments.

Focus can now be exclusively on utilising our lean team to

deliver near-term operational results and to further develop growth

potential, by using our debt-free balance sheet, restricted cash

asset, and accumulated specialist expertise in Trinidad and Morocco

as leverage to secure attractive commercial deals."

Completion of the Placing

Completion of the Placing is conditional on, inter alia:-

the Placing Shares being admitted to listing on the Official

List (standard listing segment) and to trading on the London Stock

Exchange's main market for listed securities ("Admission") on or

before 29 May 2020 (or such later date as may be agreed by the

Company and Novum Securities).

Agreement with Arato Global Opportunities LLC

-- An Orderly Market Agreement remains in place

-- Arato releases security over the USD 1 million cash in the

form of the returnable Bank Guarantee from ONHYM following

completion of the Moulouya well.

Admission, Settlement and Dealings in Placing Shares

Applications will be made to the FCA and to the London Stock

Exchange for Admission in respect of all the Placing Shares

proposed to be issued on completion of the Placing. It is expected

that Admission will become effective, and that dealings in the

Placing Shares are expected to commence, at 8.00 a.m. on 29 May

2020.

The rights attaching to the Placing Shares will be uniform in

all respects and all of the Placing Shares will rank pari passu,

and form a single class for all purposes with, the existing issued

shares of no par value in the Company.

Following Admission of the Placing Shares, the enlarged Share

Capital will be 239,678,517 ordinary shares of no par value.

Enquiries:

Predator Oil & Gas Holdings Tel: +44 (0)1534 834600

plc

Paul Griffiths Chief Executive

Officer

Carl Kindinger Non-Executive

Chairman

Novum Securities Limited Jon Tel: + 44(0) 207 399 9425

Belliss

Optiva Securities Limited Tel: +44(0) 203 137 1902

Christian Dennis

Follow us also on VOX Market

https://www.voxmarkets.co.uk/

This announcement contains inside

information for the purposes

of Article 7

of the Regulation (EU) No 596/2014

on market abuse

Qualified Person's statement:

The information contained in this document has been reviewed and

approved by Mr. Paul Griffiths, Chief Executive Officer. Mr

Griffiths has a BSc in Geology from Imperial College London and is

an Associate of the Royal School of Mines. Mr. Griffiths has over

43 years of relevant experience in the upstream oil industry.

Notes to Editors:

Predator is operator of the Guercif Petroleum Agreement onshore

Morocco which is prospective for Tertiary gas in a prospect 4

kilometres from the Maghreb gas pipeline, and deeper Triassic gas.

A well location has been selected for drilling and a rig option

agreement has been entered into.

Predator is an oil and gas exploration company with the

objective of participating with FRAM Exploration Trinidad Ltd. in

further developing the remaining oil reserves in the producing

Inniss Trinity oil field onshore Trinidad, primarily through the

application of C02 EOR technology. Potential for cash flow exists

by executing the Pilot Enhanced Oil Recovery project using locally

sourced carbon dioxide for injection into the oil reservoirs ("C02

EOR"). Near-term expansion and growth potential is focussed on

upscaling the C02 EOR operations in the Inniss-Trinity oil

field.

In addition, Predator also operates exploration and appraisal

assets in licensing options offshore Ireland, for which Successor

Authorisations have been applied for, adjoining Shell's Corrib gas

field in the Slyne Basin on the Atlantic Margin and east of the

Kinsale gas field in the Celtic Sea. Ireland however remains a very

challenging regulatory environment for business investment in the

oil and gas sector and is not the immediate focus of the Company's

near-term operations.

The Company has a highly experienced management team with a

proven track record in the oil and gas industry.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FURGPUGCAUPUGPC

(END) Dow Jones Newswires

May 14, 2020 08:46 ET (12:46 GMT)

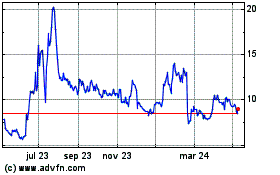

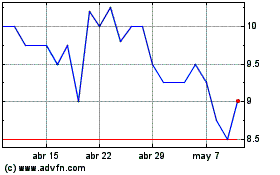

Predator Oil & Gas (LSE:PRD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Predator Oil & Gas (LSE:PRD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024