TIDMWJG

RNS Number : 2694N

Watkin Jones plc

19 May 2020

For immediate release 19 May 2020

Watkin Jones plc

('Watkin Jones' or the 'Group')

Half year results for the six months to 31 March 2020

'Strong first half performance, supplemented by measures to

protect people

and the business through the pandemic'

Watkin Jones plc (AIM:WJG), the UK's leading developer and

manager of residential for rent, with a focus on the build to rent

and student accommodation sectors, announces its results for the

six months ended 31 March 2020 (the 'period' or 'H1 2020'). The

Board is pleased to report a successful first six months of the

current financial year, which was largely prior to the disruption

caused by COVID-19.

Financial Highlights

H1 2020 H1 2019 Movement

(Restated(1)

)

Underlying results

Revenue GBP185.7 million GBP159.1 million +16.7%

Gross profit GBP41.9 million GBP38.8 million +8.0%

Adjusted profit before

tax(2) GBP26.6 million GBP25.0 million +6.4%

Adjusted EBITDA(3) GBP34.2 million GBP32.1 million +6.5%

Adjusted basic earnings

per share(2) 8.44 pence 7.77 pence +8.6%

Dividend per share Nil pence 2.75 pence -

Gross cash GBP72.4 million GBP57.9 million -

Net cash(4) GBP37.5 million GBP18.3 million -

Statutory results

Profit before tax GBP26.6 million GBP22.4 million +18.8%

EBITDA (3) GBP34.2 million GBP29.5 million +15.9%

Basic earnings per

share 8.44 pence 6.96 pence +21.3%

Richard Simpson, Chief Executive Officer of Watkin Jones,

said:

"The half year performance was strong and continued the momentum

towards our multi-year growth strategy which we set out in November

2019. Our businesses have all performed well in the period and

in-line with expectations.

We have responded carefully and cautiously to the challenges

presented by the COVID-19 pandemic and subsequent lock-down.

Primarily, we have focused on ensuring the health and safety of

employees, tenants and other stakeholders, with development sites

initially being closed to all non-essential work. Gradually, we

have been able to reopen most of them, to the extent allowed under

social distancing and government rules. I would like to thank all

our employees, tenants and other partners who have responded so

positively to this difficult situation.

Secondly, we have strengthened further our financial position by

conserving cash; reducing costs, suspending the interim dividend

and extending borrowing facilities. We believe that this ensures

the long-term resilience of the business as well as its capability

to respond quickly as markets recover. The Board believes that the

Group is now well-positioned for future growth and to take

advantage of economic opportunities that may arise from the current

unprecedented situation."

Financial headlines

-- 16.7% increase in revenue for the period versus the first

half year of last year, underpinned by both student accommodation

development and, increasingly, build to rent

-- 6.4% increase in adjusted profit before tax(2) to GBP26.6 million

-- Robust gross margin for the half year of 22.6% (H1 2019: 24.4%)

-- Strong liquidity position:

o GBP72.4 million gross cash at 31 March 2020 (31 March 2019:

GBP57.9 million)

o GBP37.5 million net cash (after deducting site specific loans

and HP creditors, but excluding IFRS 16 operating lease

liabilities), up from GBP18.3 million at 31 March 2019

o GBP100.0 million RCF with HSBC renewed for five years to May

2025, of which GBP71.1 million was undrawn at 31 March 2020

-- GBP390.0 million revenue to come from forward sold

contractually committed pipeline FY 2020 & FY 2021

-- As announced on 1 April 2020, the Group suspended the interim

dividend and withdrew its financial guidance as a result of the

current economic uncertainty and disruption caused by the COVID-19

pandemic. The Group will update the market on future guidance once

there is more clarity on the impact of COVID-19 on the Group's

activities and the markets in which it operates

-- The Board recognise the importance of the dividend to our

shareholders and are committed to resuming dividends as soon as

conditions stabilise.

Notes

1. Since 1 October 2019, the Group has applied IFRS 16 "Leases".

The Group has adopted the fully retrospective approach in applying

the standard, recognising its material impact on the Group's

results and statement of financial position. The comparative

results for H1 2019 have therefore been restated according to the

transition arrangements set out in the standard. Further details on

the nature of the changes to the Group's accounting required by

this standard, as well as its main impacts and the adjustments made

to restate the comparative figures are detailed in note 3 to the

interim financial statements.

2. For H1 2020 there is no difference between adjusted and

statutory profit before tax and basic earnings per share. For H1

2019, adjusted profit before tax and adjusted basic earnings per

share are calculated before the impact of an exceptional charge of

GBP2.6 million.

3. EBITDA comprises operating profit from continuing operations

plus the Group's profit from joint ventures, adding back charges

for depreciation and amortisation. For H1 2019, adjusted EBITDA is

stated before the exceptional charge of GBP2.6 million.

4. Net cash is stated after deducting site specific bank loans

and hire purchase creditors, but before deducting IFRS 16 operating

lease liabilities of GBP145.8 million at 31 March 2020 (31 March

2019: GBP152.1 million).

Business Highlights

-- Two further significant BtR sites secured in Birmingham (565

apartments) and Bath (323 apartments) on a subject to planning

basis

-- 2,660 BtR apartments, across 10 sites, now secured with over

1,000 apartments across five sites forward sold for delivery over

the period FY 2020 to FY 2022

-- 348 bed PBSA scheme forward sold at Wilder Street, Bristol

-- 100 additional PBSA beds agreed, with secured planning consent, at Kelaty House, Wembley

-- 591 PBSA beds on two sites secured in Bristol (291 beds) and

Bath (300 beds), both subject to planning

-- 613 bed on-campus partnership agreement with Cranfield

University concluded after 31 March 2020 for delivery in FY 2021

(415 beds) and FY 2022 (198 beds)

-- 7,200 PBSA beds, across 19 sites, now secured with over 5,500

beds across 13 sites forward sold for delivery over the period FY

2020 to FY 2022

-- 17,721 PBSA beds and BtR apartments now under management

across 64 schemes (H1 2019: 15,421 beds and apartments across 56

schemes), underlining the continued development of the Fresh

Property Group portfolio

-- We have taken a proactive and responsible approach to the

revised Government guidance on cladding systems. Despite not being

legally liable, the Group may undertake certain remedial cladding

works. The full cost to the Group, as previously announced, could

be in the range of GBP12 million - GBP15 million over the next two

years, but the final number will depend on the outcome of ongoing

discussions with property owners. Accordingly, a non-underlying

provision for these costs is likely to be made at this

year-end.

COVID-19 operational and financial update

-- We have remobilised construction activities where possible,

with appropriate health & safety practices in place, following

an initial closure of all sites

-- Sites in England, Wales and Northern Ireland now operating at

c.75% of pre COVID-19 resource levels

-- Our two Scottish sites currently remain closed due to Scottish Government instructions

-- Encouraging early progress to mitigate the impacts of the

disruption to our student accommodation deliveries for FY 2020; six

of the seven schemes are targeted for delivery by Q3 2020 and the

seventh is targeted by Q4 2020. The outcome for the residual scheme

is being discussed with the purchaser, with options including

accelerated work and phased delivery being considered

-- We anticipate a modest increase in costs to complete our

committed development programme during COVID-19 disruption

-- The outturn for FY 2020 will be largely dependent on the

completion of the seven student accommodation developments due this

year, the level of progress made with the construction of the

forward sold FY 2021 pipeline and whether the Group decides to

forward sell any of its development sites in the second half given

the uncertain investment environment

-- Activity in the institutional forward sale and land purchase

markets has been subdued since the period end. Whilst we anticipate

that activity in these markets will increase through the second

half, the Group will use its strong financial position to progress

forward sales and site acquisitions in the short term only if

negotiated terms prove satisfactory

-- We are offering support to students in the form of short-term

rent relief and extended periods of occupation, where appropriate,

to help them manage through this period at a voluntary cost of

c.GBP1.0 million. Approximately 50% of students left term time

residences in conjunction with the lock-down

-- The Group implemented comprehensive cash conservation

measures, including accessing the Government's Job Retention Scheme

for furloughed employees. Our remobilisation programme is leading

to a commensurate unwinding of use of the furlough scheme

-- Board fees and senior executive base pay has been temporarily reduced by 20%.

Analyst meeting

A conference call for analysts will be held at 09.30am today, 19

May 2020. A copy of the Half Year Results presentation is available

at the Group's website: http://www.watkinjonesplc.com

An audio webcast of the conference call with analysts will be

available after 12pm today:

https://webcasting.buchanan.uk.com/broadcast/5eb2fc6931da814c9fc6e7d0

For further information:

Watkin Jones plc

Richard Simpson, Chief Executive Tel: +44 (0) 20 3617 4453

Officer

Philip Byrom, Chief Financial www.watkinjonesplc.com

Officer

Peel Hunt LLP (Nominated Adviser Tel: +44 (0) 20 7418 8900

& Joint Corporate Broker)

Mike Bell / Ed Allsopp www.peelhunt.com

Jefferies Hoare Govett (Joint Corporate Tel: +44 (0) 20 7029 8000

Broker)

Max Jones / Will Soutar www.jefferies.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Richard Oldworth

Jamie Hooper / Steph Watson Tel: +44 (0) 20 7466 5000

watkinjones@buchanan.uk.com www.buchanan.uk.com

Notes to Editors

Watkin Jones is the UK's leading developer and manager of

residential for rent, with a focus on the Build to Rent and student

accommodation sectors. The Group has strong relationships with

institutional investors, and a reputation for successful,

on-time-delivery of high quality developments. Since 1999, Watkin

Jones has delivered 41,000 student beds across 123 sites, making it

a key player and leader in the UK purpose-built student

accommodation market. In addition, the Fresh Property Group, the

Group's specialist accommodation management company, manages nearly

18,000 student beds and Build to Rent apartments on behalf of its

institutional clients. Watkin Jones has also been responsible for

over 80 residential developments, ranging from starter homes to

executive housing and apartments. The Group is increasingly

expanding its operations into the Build to Rent sector.

The Group's competitive advantage lies in its experienced

management team and business model, which enables it to offer an

end-to-end solution for investors, delivered entirely in-house with

minimal reliance on third parties, across the entire life cycle of

an asset.

Watkin Jones was admitted to trading on AIM in March 2016 with

the ticker WJG.L. For additional information please visit

www.watkinjonesplc.com

Review of Performance

Results for the six months to 31 March 2020

Revenues for the period were in line with expectations at

GBP185.7 million, up 16.7% compared to GBP159.1 million for the

first half of last year, with all business segments performing

well. Good progress was made on all forward sold developments in

build in the first half of the year, with COVID-19 associated

disruption only starting to impact the Group's operations towards

the end of March 2020.

The revenue growth drove an 8.0% (GBP3.1m) higher gross profit

to GBP41.9 million (H1 2019: GBP38.8 million). The gross margin

remained robust at 22.6%, though below the gross margin achieved

for H1 2019 of 24.4%, reflecting the increased contribution from

the Group's build to rent developments. Build to rent revenues

generated a gross margin of 16.3%, compared to 24.1% for the

student accommodation development revenues in the period.

The higher gross profit fed through into operating profit, which

increased by GBP4.5 million (18.2%) to GBP29.2 million (H1 2019:

GBP24.7 million). Excluding the exceptional charge of GBP2.6

million made in H1 2019, operating profit increased by GBP1.9

million (7.0%).

Finance costs for the period amounted to GBP2.8 million (H1

2019: GBP2.6 million), including GBP2.3 million (H1 2019: GBP2.3

million) in respect of the finance cost of capitalised operating

leases under IFRS 16.

Profit before tax for the period was up 18.8% at GBP26.6 million

(H1 2019: GBP22.4 million), but excluding the last year's

exceptional charge, the growth was 6.4%. Basic earnings per share

for the period increased 8.6% to 8.44 pence, compared to the

adjusted basic earnings per share of 7.77 pence for H1 2019.

Segmental review

Build to Rent ('BtR')

BtR continues to grow in significance for the Group, with

revenue for the period rising to GBP36.5 million (H1 2019: GBP8.8

million). Revenues reflected further construction progress at the

already forward sold developments in Bournemouth for delivery in FY

2020 (159 apartments) and in Reading, Wembley and Sutton for

delivery in FY 2021 (782 apartments).

Gross profit for the period from BtR was GBP6.0 million (H1

2019: GBP1.9 million) at a margin of 16.3%, consistent with the

Group's previous margin guidance of 15%.

Whilst there were no new forward sales in the period, the Group

has secured two new significant sites, both of which are subject to

planning. The first site for 565 apartments is situated in

Birmingham and the second site for 323 apartments is in Bath.

Following these additions, the forward sold and secured BtR

pipeline now totals approximately 2,660 apartments across 10 sites,

of which 1,012 apartments across five sites have been forward sold

and a further site for 184 apartments has planning.

Student accommodation ('PBSA')

Revenues from PBSA were broadly in line with the prior period at

GBP120.8 million (H1 2019: GBP128.8 million). The slight decrease

is due to the lower number of beds in delivery for FY 2020 (2,609

beds), compared to FY 2019 (2,723 beds).

A strong gross margin of 24.1% was maintained on student

accommodation developments, a small decrease on the 24.7% gross

margin in H1 2019.

The Group strengthened its forward sold PBSA development

pipeline, completing the forward sale of the 348 bed development at

Wilder Street, Bristol, to a joint venture between KKR and Round

Hill Capital, for delivery in FY 2021. This follows an option

agreement announced in October 2018, which was conditional on full

planning consent being achieved. The consideration payable to

Watkin Jones for Wilder Street is circa GBP33.8 million, net of all

client funding and acquisition costs, and is payable over the

course of FY 2020 and FY 2021 as the development works are

progressed. The Group also obtained planning for and completed an

agreement with DWS to add a further 100 beds to the PBSA scheme at

Kelaty House in Wembley, for delivery in FY 2021.

After the half year end, the Group signed an on-campus

partnership agreement with Cranfield University to develop 613 beds

for delivery in FY 2021 (415 beds) and FY 2022 (198 beds), with a

development value to Watkin Jones of GBP48.0 million payable over

the period FY 2020 to FY 2022. The agreement also contains an

option arrangement for a potential second phase of the development,

comprising a further 252 beds. This represents a significant

addition to the Group's PBSA development pipeline and paves the way

for future similar university partnership arrangements.

In addition, the Group secured two further PBSA sites in the

period, both of which are subject to planning; a 291 bed scheme in

Bristol and a 300 bed scheme in Bath.

As previously reported, the Group has forward sold all seven of

its PBSA developments (2,609 beds) scheduled for delivery in FY

2020 and has now forward sold 2,730 beds across six schemes for

delivery in FY 2021. The Group's current pipeline of forward sold

and secured PBSA development sites totals circa 7,200 beds across

19 sites, of which 5,598 beds are forward sold and 6,060 beds have

planning.

Accommodation management

For the six months ended 31 March 2020, Fresh Property Group

('FPG') increased its revenues to GBP4.1 million (H1 2019: GBP3.9

million) and increased its gross profit to GBP2.6 million (H1 2019:

GBP2.4 million). This was another strong performance and continues

to reflect FPG's success in winning mandates to manage new schemes,

with a net increase of 2,300 student beds and build to rent

apartments under management at the start of FY 2020 (17,721 units

across 64 schemes) compared to a year earlier (15,421 units across

56 schemes).

The gross margin of 61.9% was broadly maintained in line with

the prior half year performance of 62.6%.

By FY 2023, FPG is currently appointed to manage approximately

20,500 student beds and build to rent apartments, including

expected renewals.

Residential

In H1 2020, the residential development business achieved 38

sales completions in line with its targets (H1 2019: 53 sales).

Prior to the half year end, the division also completed the forward

sold development of 35 apartments at Trafford Street, Chester.

In addition, during the period, works progressed under the

development agreement for the delivery of 75 apartments at

Marshgate, Stratford.

As a result, revenues for the residential development business

increased to GBP24.3 million for the half year, compared to GBP17.4

million for the equivalent prior period. The gross margin achieved

was 18.2% (H1 2019: 16.7%).

Cladding Update

In response to the revised Government guidance, issued in

January 2020, on the suitability of certain cladding solutions used

on high-rise residential buildings, the Group is working with the

owners of eight of its previously developed PBSA schemes to

remediate/replace cladding. The majority of the cladding is high

pressure laminate (HPL), which has been under more recent scrutiny

and is covered by the revised guidance. The Group is taking

proactive and responsible steps to ensure the safety of tenants,

working with building owners, even though the buildings concerned

were developed in accordance with all building regulations at the

time of construction and no liability is accepted for the

works.

Discussions with the property owners remain ongoing, but the

Board currently expects that this may result in a sharing of the

costs of certain remedial works with them. The gross cost to the

Group could be in the range of GBP12 million to GBP15 million, over

the next two years. A one-off non-underlying provision for this

cost is likely to be made at the year end, once the outcome of

those discussions has been established. The Group will look to

recover some of this cost from the sub-contractors and consultants

engaged on implementing the particular cladding systems at the

time. This is likely to take an extended period of time to achieve

and the extent of any recovery is currently uncertain.

Working with the COVID-19 risk

The Group's response to COVID-19 was first built on securing the

health and safety of our employees, tenants and partners. Secondly,

we moved to conserve cash and secure our liquidity.

We adopted all relevant guidance from the UK Government, Public

Health England and the World Health Organisation, implementing

remote working and enhanced health and safety protocols for

employees, tenants and stakeholders. The Group has now remobilised

construction activities, after having made comprehensive risk

assessments. We are currently operational in England, Wales and

Northern Ireland at circa 75% of pre COVID-19 disruption resourcing

levels, with significant site progress being maintained. The Group

has worked closely with our construction supply chain and partners

during this period to ensure they are paid as normal and to manage

continuity for remobilising activities. We are currently unable to

reinstate construction activity in Scotland due to the Scottish

Government's ban on non-essential construction work.

Activity in the institutional forward sale and land purchase

markets has been subdued since the period end. Whilst we anticipate

that activity in these markets will increase through the second

half, the Group will be able to use its strong financial position

to decide whether to progress forward sales and site acquisitions

in the short term if negotiated terms prove satisfactory.

The Group is supporting its student tenants through this

difficult time. Watkin Jones has operating leases across several

student accommodation assets. Approximately 50% of students left

their term time residences prior to the lockdown being implemented.

The Group has taken the decision to waive the 2019/20 final rent

instalments for students who left their accommodation prior to the

23 March. We are also providing accommodation after the end of term

for those who need to stay longer as a result of the disruption.

The cost to the Group for these measures is circa GBP1.0

million.

We have implemented comprehensive cash conservation measures,

including accessing the Government's Job Retention Scheme for

furloughed employees, which at its recent peak saw 43% of the

Group's employees (circa 185 employees) furloughed. Since early May

2020, the Group has begun to reemploy staff across most of its

construction sites, as work has recommenced. For furloughed

employees, the Group is topping up salaries to 80% of their base,

where their basic salary is above the Government's cap. The annual

pay increase, which was due on 1 April 2020, has not been made, and

the Board has temporarily reduced director fees and senior

executive base pay by 20%.

Dividend

As announced on 1 April 2020, the dividend has been temporarily

suspended as a pre-emptive response to the as yet unquantifiable

impact arising from COVID-19. The Board recognise the importance of

the dividend to our shareholders and are committed to resuming

dividends as soon as conditions stabilise.

Balance sheet and liquidity

The Group had gross cash at 31 March 2020 of GBP72.4 million (31

March 2019: GBP57.9 million). Net cash stood at GBP37.5 million (31

March 2019: GBP18.3 million), after deducting site specific loans

and hire purchase creditors totalling GBP34.9 million (H1 2019:

GBP39.6 million). This net cash balance is stated before deducting

operating lease liabilities of GBP145.8 million arising as a result

of the application of IFRS 16. The net cash balance stated before

deducting the operating lease liabilities is considered a more

relevant measure for the Group, as the lease liabilities relate

primarily to several historic student accommodation sale and

leaseback properties for which the lease rental liabilities are

covered by the student rental incomes received.

At 31 March 2020 the Group had drawn GBP28.9 million against its

revolving credit facility ('RCF') with HSBC. Subsequent to the

period end, the Group renewed the RCF for a further five year term

to May 2025, with an increase in the facility level from GBP60.0

million to GBP100.0 million on existing terms. The increased

facility level therefore gives unutilised headroom of GBP71.1

million. The overdraft facility of GBP10.0 million has also been

maintained.

With the gross cash balance and headroom in its banking

facilities, together with cash conservation measures and the future

cash inflow from the forward sold development pipeline, the Group

has a resilient liquidity position.

The reduction in gross cash for the half year period of GBP43.3

million (H1 2019: GBP48.7 million) reflects the Group's normal

seasonal cashflow profile which sees a cash utilisation in the

first half of the year, including tax and dividend payments of

GBP19.5 million for H1 2020. The Group is cash generative in the

second half of the year, as the final payments due on completion of

the current year's developments are received. The final payments

accrue as the development works progress and this is reflected in

the contract assets and trade receivables balances at 31 March

2020, which stood at GBP100.2 million (30 September 2019: GBP40.0

million).

Inventory and work in progress reduced by GBP25.6 million in the

period to GBP108.6 million, reflecting the realisation of work in

progress.

ESG

In the period, the Group continued to make good progress against

its Environmental, Social and Governance (ESG) initiatives. The

Group adheres to the strictest environmental standards and recorded

zero reportable environmental incidents in the year. More than 90%

of skip waste was diverted from landfill.

Commensurate with targeting higher BREEAM accreditations for our

developments, we are integrating the use of greener, more

sustainable materials into our builds. Low energy use initiatives,

such as Combined Heating and Power (CHP), photovoltaic cells and

air source heat pumps are also being looked at.

Safety is a key performance metric by which we judge operational

success and we are pleased to report a 24% reduction in our

combined reportable and non-reportable (minor) annual accident and

incident rate to 2,855 per 100,000 employees. Training was given to

our mental health first aiders and the Group continues to support

mental health awareness initiatives. The Group continues to uphold

strict compliance principles and procedures and maintained zero

ethical or compliance breaches during H1 2020.

Fire safety remains of paramount importance to Watkin Jones and

we construct our developments to high fire management

specifications.

Watkin Jones is committed to acting and behaving responsibly and

is in the process of scoping a coherent sustainability programme

that builds upon all of its efforts to date.

IFRS 16

The Group has applied IFRS 16 "Leases" for the first time in FY

2020. This standard impacts the Group's six historic student

accommodation sale and leaseback properties and leases for the

rental of office space and motor vehicles. The new standard creates

a right-of-use asset for these leases and a liability for future

lease payment. The Group has adopted the fully retrospective

approach in applying the standard, recognising its material impact

on the Group's results and statement of financial position. The

comparative results for H1 2019 and the statement of financial

position at 31 March 2019 and 30 September 2019 have therefore been

restated according to the transition arrangements set out in the

standard.

The right of use assets recognised at 31 March 2020 amount to

GBP127.2 million (30 September 2019: GBP131.4 million). These

primarily relate to the student accommodation sale and leaseback

properties, which accounted for GBP121.8 million of the balance.

Corresponding lease liabilities of GBP145.8 million have been

recognised (30 September 2019: GBP149.0 million), reflecting the

long term nature of the student accommodation leases, which have

remaining lease terms of between six and 32 years. The two leases

with the longest remaining terms, Dunaskin Mill, Glasgow and New

Bridewell, Bristol, which are strongly profitable, account for

GBP83.3 million of this balance.

The difference between the right of use assets and lease

liabilities at 30 September 2019 of GBP17.6 million, net of a

deferred tax asset of GBP3.3 million, is reflected in a reduction

in retained earnings of GBP14.3 million at that date.

The Group's income statements for the six months to 31 March

2020 and for the six months to 31 March 2019 have been impacted as

follows:

H1 2020 H1 2019

----------------------------- -----------------------------

Pre IFRS IFRS Pre IFRS IFRS

IFRS 16 16 IFRS 16 16

16 Impact Reported 16 Impact Reported

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

Gross profit 40.6 1.3 41.9 37.6 1.2 38.8

Administrative expenses (12.8) 0.1 (12.7) (11.6) 0.1 (11.5)

Operating profit

before exceptional

items 27.8 1.4 29.2 26.0 1.3 27.3

Exceptional items - - - (2.6) - (2.6)

------- -------- ---------- ------- -------- ----------

Operating profit 27.8 1.4 29.2 23.4 1.3 24.7

Net finance charges (0.4) (2.2) (2.6) - (2.3) (2.3)

------- -------- ---------- ------- -------- ----------

Profit before tax 27.4 (0.8) 26.6 23.4 (1.0) 22.4

------- -------- ---------- ------- -------- ----------

Adjusted EBITDA 28.6 5.6 34.2 26.6 5.5 32.1

------- -------- ---------- ------- -------- ----------

Further details on the nature of the changes to the Group's

accounting required by this standard, as well as its main impacts

and the adjustments made to restate the comparative figures, are

provided in Note 3 to the interim financial statements.

Outlook

As previously announced, given the current economic uncertainty

and level of disruption to the Group's operations caused by the

COVID-19 pandemic, the Board has temporarily withdrawn any

financial guidance until the impact on the Group's performance and

sectors in which it operates can be more clearly understood. The

outturn for FY 2020 will be largely dependent on the completion of

the seven student accommodation developments due this year, the

level of progress made with the construction of the forward sold FY

2021 pipeline and whether the Group decides to forward sell any of

its development sites in the second half given the uncertain

investment environment. However, the Group's capital light business

model and robust liquidity enables such decisions to be made from a

position of strength and in the long term interest of shareholders.

Looking beyond this period of uncertainty, the fundamentals

supporting both our core sectors remain strong, and the Group

continues to be in an enviable position to progress as a market

leading developer .

Richard Simpson

Chief Executive Officer

19 May 2020

Consolidated Statement of Comprehensive Income

for the six month period ended 31 March 2020 (unaudited)

6 months to 6 months to 12 months to

31 March 31 March 30 September

2020 2019 2019

(Restated) (Restated)

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 185,672 159,104 374,785

Cost of sales (143,793) (120,282) (295,475)

------------ ------------ --------------

Gross profit 41,879 38,822 79,310

Administrative expenses (12,682) (11,513) (24,431)

Operating profit before exceptional

cost s 29,197 27,309 54,879

Exceptional costs 5 - (2,576) (2,576)

------------ ------------ --------------

Operating profit 29,197 24,733 52,303

Share of profit in joint ventures - - 286

Finance income 200 210 426

Finance costs (2,760) (2,567) (5,350)

------------ ------------ --------------

Profit before tax from continuing operations 26,637 22,376 47,665

Income tax expense 6 (5,061) (4,607) (9,054)

------------ ------------ --------------

Profit for the period attributable to ordinary equity holders of

the parent 21,576 17,769 38,611

============ ============ ==============

Other comprehensive income

Net gain on equity instruments

designated at fair value through other comprehensive income - - (2)

------------ ------------ --------------

Total comprehensive income for the period attributable to

ordinary equity holders of the parent 21,576 17,769 38,609

============ ============ ==============

Earnings per share for the period attributable to ordinary equity Pence Pence Pence

holders

of the parent

Basic earnings per share 7 8.437 6.961 15.119

============ ============ ==============

Diluted earnings per share 7 8.404 6.945 15.080

============ ============ ==============

Adjusted basic earnings per share (excluding exceptional costs) 7 8.437 7.769 16.028

============ ============ ==============

Adjusted diluted earnings per share (excluding exceptional costs) 7 8.404 7.751 15.987

============ ============ ==============

Consolidated Statement of Financial Position

as at 31 March 2020 (unaudited)

31 March 31 March 30 September

2020 2019 2019

(Restated) (Restated)

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 13,564 14,123 13,844

Right of use assets 9 127,241 135,442 131,367

Property, plant and equipment 4,964 4,670 4,966

Investment in joint ventures 2,794 2,558 2,794

Deferred tax asset 3,639 3,384 3,639

Other financial assets 1,139 1,162 1,139

----------- ------------ -------------

153,341 161,339 157,749

----------- ------------ -------------

Current assets

Inventory and work in progress 108,640 153,085 134,226

Contract assets 79,211 40,825 25,578

Trade and other receivables 21,012 9,216 14,443

Cash and cash equivalents 11 72,394 57,906 115,652

----------- ------------ -------------

281,257 261,032 289,899

----------- ------------ -------------

Total assets 434,598 422,371 447,648

=========== ============ =============

Current liabilities

Trade and other payables (69,294) (61,496) (81,431)

Contract liabilities (4,462) (8,849) (5,164)

Interest-bearing loans and

borrowings (1,021) (1,524) (1,324)

Lease liabilities (3,239) (3,239) (6,478)

Provisions (1,068) (933) (863)

Current tax liabilities (6,839) (9,412) (7,056)

----------- ------------ -------------

(85,923) (85,453) (102,316)

----------- ------------ -------------

Non-current liabilities

Interest-bearing loans and

borrowings (33,861) (38,089) (37,481)

Lease liabilities (142,517) (148,883) (142,558)

Provisions (2,389) (1,277) (2,594)

Deferred tax liabilities (1,042) (1,049) (1,042)

----------- ------------ -------------

(179,809) (189,298) (183,675)

----------- ------------ -------------

Total Liabilities (265,732) (274,751) (285,991)

=========== ============ =============

Net assets 168,866 147,620 161,657

=========== ============ =============

Equity

Share capital 2,553 2,553 2,553

Share premium 84,612 84,612 84,612

Merger reserve (75,383) (75,383) (75,383)

Fair value reserve of financial assets at FVOCI 434 436 434

Share-based payment reserve 2,263 2,166 2,311

Retained earnings 154,387 133,236 147,130

----------- ------------ -------------

Total Equity 168,866 147,620 161,657

=========== ============ =============

Consolidated Statement of Changes in Equity

for the six month period ended 31 March 2020 (unaudited)

Fair value

of financial Share-based

Share Share Merger assets payment Retained

Capital Premium Reserve at FVOCI reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP000 GBP'000 GBP'000

Balance at 30 September

2018 2,553 84,612 (75,383) 436 84 141,217 153,519

Effect of initial

application of IFRS

16 (note 3) - - - - - (12,655) (12,655)

Profit for the period - - - - - 17,769 17,769

Share-based payments - - - - 2,063 - 2,063

Dividend paid (note

8) - - - - - (13,095) (13,095)

Deferred tax equity

movement - - - - 19 - 19

--------- -------- ---------- ------------- ----------- ---------- ---------

Balance at 31 March

2019

(restated) 2,553 84,612 (75,383) 436 2,166 133,236 147,620

========= ======== ========== ============= =========== ========== =========

Profit for the period - - - - - 20,842 20,842

Share-based payments - - - - 145 - 145

Dividend paid (note

8) - - - - - (7,018) (7,018)

Deferred tax equity

movement - - - - - 70 70

Other comprehensive

income - - - (2) - - (2)

--------- -------- ---------- ------------- ----------- ---------- ---------

Balance at 30 September

2019 (restated) 2,553 84,612 (75,383) 434 2,311 147,130 161,657

========= ======== ========== ============= =========== ========== =========

Profit for the period - - - - - 21,576 21,576

Share-based payments - - - - (48) - (48)

Dividend paid (note

8) - - - - - (14,319) (14,319)

--------- -------- ---------- ------------- ----------- ---------- ---------

Balance at 31 March

2020 2,553 84,612 (75,383) 434 2,263 154,387 168,866

========= ======== ========== ============= =========== ========== =========

Consolidated Statement of Cash Flows

for the six month period ended 31 March 2020 (unaudited)

6 months 6 months 12 months

to to to

31 March 31 March 30 September

2020 2019 2019

(Restated) (Restated)

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash (outflow)/inflow from

operations 10 (13,058) (40,164) 38,942

Interest received 200 210 428

Interest paid (2,953) (2,760) (5,502)

Interest element of hire purchase

payments (23) (23) (48)

Tax paid (5,211) (2,871) (9,769)

--------- ---------- -------------

Net cash (outflow)/inflow from

operating

activities (21,045) (45,608) 24,051

========= ========== =============

Cash flows from investing activities

Acquisition of property, plant

and equipment (672) (185) (361)

Proceeds on disposal of property,

plant and equipment 19 39 87

Cash distribution received

from other financial assets - 188 209

Net cash (outflow)/inflow from

investing activities (653) 42 (65)

========= ========== =============

Cash flows from financing activities

Dividend paid 8 (14,319) (13,095) (20,113)

Capital element of hire purchase

payments (526) (621) (1,307)

Payment of lease liabilities (3,239) (3,204) (6,492)

Drawdown of bank loans 1,302 16,042 46,244

Repayment of bank loans (4,778) (2,290) (33,306)

Net cash outflow from financing

activities (21,560) (3,168) (14,974)

========= ========== =============

Net (decrease)/increase in

cash (43,258) (48,734) 9,012

Cash and cash equivalents at

beginning of the period 115,652 106,640 106,640

--------- ---------- -------------

Cash and cash equivalents at

end of the period 11 72,394 57,906 115,652

========= ========== =============

Notes to the consolidated financial information

1. General information

Watkin Jones plc (the 'Company') is a limited company

incorporated in the United Kingdom under the Companies Act 2006

(Registration number 09791105). The Company is domiciled in the

United Kingdom and its registered address is Units 21-22, Llandygai

Industrial Estate, Bangor, Gwynedd, LL57 4YH.

The principal activities of the Company and its subsidiaries

(collectively the 'Group') are the development and management of

multi-occupancy residential rental properties.

The consolidated interim financial statements of the Group for

the six month period ended 31 March 2020 comprises the Company and

its subsidiaries. The basis of preparation of the consolidated

interim financial statements is set out in note 2 below.

The financial information for the six months ended 31 March 2020

is unaudited. It does not constitute statutory financial statements

within the meaning of Section 434 of the Companies Act 2006. The

consolidated interim financial statements should be read in

conjunction with the financial information for the year ended 30

September 2019, which has been prepared in accordance with IFRSs as

adopted by the European Union. The report of the auditors on those

financial statements was unqualified, did not contain an emphasis

of matter paragraph and did not contain any statement under section

434 of the Companies Act 2006.

This report was approved by the directors on 18 May 2020.

2. Basis of preparation

The interim financial statements have been prepared based on

IFRS that are expected to exist at the date on which the Group

prepares its financial statements for the year ended 30 September

2020. To the extent that IFRS at 30 September 2020 do not reflect

the assumptions made in preparing the interim financial statements,

those financial statements may be subject to change.

The interim financial statements have been prepared on a going

concern basis and under the historical cost convention.

The interim financial statements have been presented in pounds

sterling and all values are rounded to the nearest thousand

(GBP'000), except when otherwise indicated.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The interim financial statements do not include all financial

risk information and disclosures required in the annual financial

statements and they should be read in conjunction with the

financial information that is presented in the Company's audited

financial statements for the year ended 30 September 2019. There

has been no significant change in any risk management policies

since the date of the last audited financial statements.

3. Accounting policies

The accounting policies used in preparing these interim

financial statements are the same as those set out and used in

preparing the Company's audited financial statements for the year

ended 30 September 2019 with the exception of IFRS 16 "Leases".

IFRS 16 supersedes IAS 17 "Leases" and IFRIC 4 "Determining

whether an Arrangement contains a Lease". The standard introduces

new or amended requirements with respect to lease accounting under

a single on-balance sheet model. It introduces significant changes

to lessee accounting by removing the distinction between operating

and finance leases, requiring the recognition of a right of use

asset and a lease liability at commencement of all leases, except

for leases for a term of less than twelve months and leases of low

value assets. In contrast to lessee accounting, the requirements

for lessor accounting are largely unchanged.

The Group adopted IFRS 16 "Leases" from 1 October 2019. The

Group has chosen to apply the full retrospective approach under

which the retrospective restatement of each prior reporting period

is presented. The Group has elected to only apply IFRS 16 to

contracts previously identified as a lease under IAS 17

"Leases".

Nature of the effect of adoption of IFRS 16

The Group has six historic student accommodation sale and

leaseback properties and leases for the rental of offices and motor

vehicles. Before the adoption of IFRS 16, the Group classified

these leases as operating leases as they did not transfer

substantially all of the risks and rewards incidental to the

ownership of the respective leased assets. As such, the leased

assets were not capitalised and the lease payments were recognised

as rent expense in the statement of comprehensive income on a

straight-line basis over the lease term.

Upon adoption of IFRS 16, the Group has applied the following

approach :

-- to recognise right-of-use assets in the consolidated

statement of financial position. These were initially measured at

the present value of the future minimum lease payments from the

inception of each lease discounted at the Group's incremental

borrowing rate at the lease commencement date. Depreciation is

recognised in relation to this right-of-use asset with the initial

asset valuation calculated on the basis that depreciation has been

applied from the inception of the lease;

-- to recognise lease liabilities in the consolidated statement

of financial position. These were initially measured at the present

value of the future minimum lease payment from the inception of

each lease discounted at the Group's incremental borrowing rate at

the lease commencement date. After the commencement date, the

amount of lease liabilities has been increased to reflect the

accretion of interest and reduced for the lease payments made up

until the earliest reporting period presented; and

-- the difference between the right-of-use assets and lease

liabilities have been recognised as an adjustment to equity at the

beginning of the earliest comparative period presented. This

difference has been partially offset by the recognition of a

deferred tax asset due to the changes in assets and liabilities

resulting from IFRS 16.

The consolidated interim financial statements as of 31st March

2019 have been restated and the restated consolidated statement of

financial position as of 30th September 2019 is also presented. The

impacts of IFRS 16 are summarised hereafter and note 9 summarises

the right-of-use assets which have been recognised upon the

standard's adoption:

Impact on the consolidated income statement

Period for the six months ended 31 March 2019:

Published IFRS 16 Restated accounts

accounts Impact

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 159,104 - 159,104

Cost of sales (121,469) 1,187 (120,282)

---------- ---------- ------------------

Gross profit 37,635 1,187 38,822

Administrative expenses (11,612) 99 (11,513)

Operating profit before exceptional costs 26,023 1,286 27,309

Exceptional costs (2,576) - (2,576)

---------- ---------- ------------------

Operating profit 23,447 1,286 24,733

Finance income 210 - 210

Finance costs (223) (2,344) (2,567)

---------- ---------- ------------------

Profit before tax from continuing operations 23,434 (1,058) 22,376

Income tax expense (4,787) 180 (4,607)

---------- ---------- ------------------

Profit for the period attributable to

ordinary equity holders of the parent 18,647 (878) 17,769

========== ========== ==================

Total comprehensive income for the period attributable to ordinary equity

holders of the parent 18,647 (878) 17,769

========== ========== ==================

Earnings per share for the period attributable to ordinary equity holders Pence Pence Pence

of the parent

Basic earnings per share 7.305 (0.344) 6.961

========== ========== ==================

Diluted earnings per share 7.288 (0.343) 6.945

========== ========== ==================

Adjusted basic earnings per share (excluding exceptional costs) 8.113 (0.344) 7.769

========== ========== ==================

Adjusted diluted earnings per share (excluding exceptional costs) 8.094 (0.343) 7.751

========== ========== ==================

Impact on the consolidated statement of financial position

Position as at 31 March 2019:

Published accounts IFRS 16 Restated accounts

Impact

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 14,123 - 14,123

Right of use assets - 135,442 135,442

Property, plant and equipment 4,670 - 4,670

Investment in joint ventures 2,558 - 2,558

Deferred tax asset 236 3,148 3,384

Other financial assets 1,162 - 1,162

------------------- ---------- ------------------

22,749 138,590 161,339

------------------- ---------- ------------------

Current assets

Inventory and work in progress 153,085 - 153,085

Contract assets 40,825 - 40,825

Trade and other receivables 9,216 - 9,216

Cash and cash equivalents 57,906 - 57,906

------------------- ---------- ------------------

261,032 - 261,032

------------------- ---------- ------------------

Total assets 283,781 138,590 422,371

=================== ========== ==================

Current liabilities

Trade and other payables (61,496) - (61,496)

Contract liabilities (8,849) - (8,849)

Interest-bearing loans and borrowings (1,524) - (1,524)

Lease liabilities - (3,239) (3,239)

Provisions (933) - (933)

Current tax liabilities (9,412) - (9,412)

------------------- ---------- ------------------

(82,214) (3,239) (85,453)

------------------- ---------- ------------------

Non-current liabilities

Interest-bearing loans and borrowings (38,089) - (38,089)

Lease liabilities - (148,883) (148,883)

Provisions (1,277) - (1,277)

Deferred tax liabilities (1,049) - (1,049)

------------------- ---------- ------------------

(40,415) (148,883) (189,298)

------------------- ---------- ------------------

Total Liabilities (122,629) (152,122) (274,751)

=================== ========== ==================

Net assets 161,152 (13,532) 147,620

=================== ========== ==================

Equity

Share capital 2,553 - 2,553

Share premium 84,612 - 84,612

Merger reserve (75,383) - (75,383)

Fair value reserve of financial assets at FVOCI 436 - 436

Share-based payment reserve 2,166 - 2,166

Retained earnings 146,768 (13,532) 133,236

------------------- ---------- ------------------

Total Equity 161,152 (13,532) 147,620

=================== ========== ==================

Position as at 30 September 2019:

Published accounts IFRS 16 Restated accounts

Impact

GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 13,844 - 13,844

Right of use assets - 131,367 131,367

Property, plant and equipment 4,966 - 4,966

Investment in joint ventures 2,794 - 2,794

Deferred tax asset 290 3,349 3,639

Other financial assets 1,139 - 1,139

------------------- ---------- ------------------

23,033 134,716 157,749

------------------- ---------- ------------------

Current assets

Inventory and work in progress 134,226 - 134,226

Contract assets 25,578 - 25,578

Trade and other receivables 14,443 - 14,443

Cash and cash equivalents 115,652 - 115,652

------------------- ---------- ------------------

289,899 - 289,899

------------------- ---------- ------------------

Total assets 312,932 134,716 447,648

=================== ========== ==================

Current liabilities

Trade and other payables (81,407) (24) (81,431)

Contract liabilities (5,164) - (5,164)

Interest-bearing loans and borrowings (1,324) - (1,324)

Lease liabilities - (6,478) (6,478)

Provisions (863) - (863)

Current tax liabilities (7,056) - (7,056)

------------------- ---------- ------------------

(95,814) (6,502) (102,316)

------------------- ---------- ------------------

Non-current liabilities

Interest-bearing loans and borrowings (37,481) - (37,481)

Lease liabilities - (142,558) (142,558)

Provisions (2,594) - (2,594)

Deferred tax liabilities (1,042) - (1,042)

------------------- ---------- ------------------

(41,117) (142,558) (183,675)

------------------- ---------- ------------------

Total Liabilities (136,931) (149,060) (285,991)

=================== ========== ==================

Net assets 176,001 (14,344) 161,657

=================== ========== ==================

Equity

Share capital 2,553 - 2,553

Share premium 84,612 - 84,612

Merger reserve (75,383) - (75,383)

Fair value reserve of financial assets at FVOCI 434 - 434

Share-based payment reserve 2,311 - 2,311

Retained earnings 161,474 (14,344) 147,130

------------------- ---------- ------------------

Total Equity 176,001 (14,344) 161,657

=================== ========== ==================

Impact on the consolidated statement of cash flows

Period for the six months ended 31 March 2019:

Published IFRS Restated

accounts 16 Impact accounts

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash (outflow)/inflow from operations (45,712) 5,548 (40,164)

Interest received 210 - 210

Interest paid (416) (2,344) (2,760)

Interest element of finance

lease rental payments (23) - (23)

Tax paid (2,871) - (2,871)

--------- ---------- ---------

Net cash (outflow)/inflow from

operating activities (48,812) 3,204 (45,608)

========= ========== =========

Cash flows from investing activities

Acquisition of property, plant

and equipment (185) - (185)

Proceeds on disposal of property,

plant and equipment 39 - 39

Cash distribution received from

other financial assets 188 - 188

Net cash inflow from investing

activities 42 - 42

========= ========== =========

Cash flows from financing activities

Dividend paid (13,095) - (13,095)

Capital element of finance lease

rental payments (621) - (621)

Payment of lease liabilities - (3,204) (3,204)

Drawdown of bank loans 16,042 - 16,042

Repayment of bank loans (2,290) - (2,290)

Net cash inflow/(outflow) from

financing activities 36 (3,204) (3,168)

========= ========== =========

Net decrease in cash (48,734) - (48,734)

Cash and cash equivalents at

beginning of the period 106,640 - 106,640

--------- ---------- ---------

Cash and cash equivalents at

end of the period 57,906 - 57,906

========= ========== =========

4. Segmental reporting

The Group has identified four segments for which it reports

under IFRS 8 'Operating segments'. The following represents the

segments that the Group operates in:

a. Student accommodation - the development of purpose-built student accommodation;

b. Build to rent - the development of build to rent accommodation;

b. Residential - the development of traditional residential property; and

c. Accommodation management - the management of student

accommodation and build to rent property.

Corporate - revenue from the development of commercial property

forming part of mixed use schemes and other revenue and costs not

solely attributable to any one operating segment.

All revenues arise in the UK.

Performance is measured by the Board based on gross profit as

reported in the management accounts. Apart from inventory and work

in progress, no other assets or liabilities are analysed into the

operating segments.

Build

6 months to 31 Student to Accommodation

March 2020 (unaudited) Accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 120,766 36,543 24,311 4,147 (95) 185,672

--------------- -------- ------------ -------------- ---------- ---------

Segmental gross

profit 29,150 5,959 4,432 2,565 (227) 41,879

Administration

expenses - - - - (12,682) (12,682)

Finance income - - - - 200 200

Finance costs - - - - (2,760) (2,760)

Profit/(loss)

before tax 29,150 5,959 4,432 2,565 (15,469) 26,637

Taxation - - - - (5,061) (5,061)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

for the period 29,150 5,959 4,432 2,565 (20,530) 21,576

=============== ======== ============ ============== ========== =========

Inventory and

WIP 22,067 42,807 33,599 - 10,167 108,640

--------------- -------- ------------ -------------- ---------- ---------

Build

6 months to 31 Student to Accommodation

March 2019 (unaudited) Accommodation rent Residential management Corporate Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental revenue 128,754 8,767 17,433 3,857 293 159,104

--------------- -------- ------------ -------------- ---------- ---------

Segmental gross

profit 31,765 1,904 2,918 2,413 (178) 38,822

Administration

expenses - - - - (11,513) (11,513)

Exceptional costs - - - - (2,576) (2,576)

Finance income - - - - 210 210

Finance costs - - - - (2,567) (2,567)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

before tax 31,765 1,904 2,918 2,413 (16,624) 22,376

Taxation - - - - (4,607) (4,607)

--------------- -------- ------------ -------------- ---------- ---------

Profit/(loss)

for the period 31,765 1,904 2,918 2,413 (21,231) 17,769

=============== ======== ============ ============== ========== =========

Inventory and

WIP 44,464 55,543 43,948 - 9,130 153,085

--------------- -------- ------------ -------------- ---------- ---------

5. Exceptional costs

6 months to 6 months to 12 months to

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

C ost of compensating the Group's CEO, Richard Simpson, for his forfeit

Unite Group plc ("Unite")

2018 bonus - (411) (411)

Cost of Watkin Jones plc share awards issued in compensating Richard

Simpson for his forfeit

Unite 2015 - 2017 share awards - (2,165) (2,165)

Total exceptional costs - (2,576) (2,576)

============= ============ ==============

6. Income taxes

The tax expense for the period has been calculated by applying

the estimated tax rate for the financial year ending 30 September

2020 of 19.0 % to the profit for the period.

7. Earnings per share

Basic earnings per share ("EPS") amounts are calculated by

dividing the net profit or loss for the year attributable to

ordinary equity holders of the parent by the weighted average

number of ordinary shares in issue during the year.

The following table reflects the income and share data used in

the basic EPS computations:

6 months to 6 months to 12 months to

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit for the period attributable to ordinary equity

holders of the parent 21,576 17,769 38,611

Adjusted profit for the period attributable to

ordinary equity holders of the parent (excluding

exceptional costs after tax) 21,576 19,831 40,932

Number of shares Number of shares Number of shares

Number of ordinary shares for basic earnings per share 255,722,099 255,268,875 255,382,181

Adjustments for the effects of dilutive potential

ordinary shares 1,016,400 580,198 658,650

Weighted average number for diluted earnings per

share 256,738,499 255,849,073 256,040,831

Pence Pence Pence

Basic earnings per share

Basic profit for the period attributable to ordinary

equity holders of the parent 8.437 6.961 15.119

Adjusted basic earnings per share (excluding

exceptional costs after tax)

Adjusted profit for the period attributable to

ordinary equity holders of the parent 8.437 7.769 16.028

Diluted earnings per share

Basic profit for the period attributable to diluted

equity holders of the parent 8.404 6.945 15.080

Adjusted diluted earnings per share (excluding

exceptional costs after tax)

Adjusted profit for the period attributable to diluted

equity holders of the parent 8.404 7.751 15.987

8. Dividends

6 months to 6 months to 12 months to

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Final dividend paid in February 2019 of 5.13 pence - 13,095 13,095

Interim dividend paid in June 2019 of 2.75 pence - - 7,018

Final dividend paid in February 2020 of 5.6 pence 14,319 - -

------------ ------------ --------------

14,319 13,095 20,113

============ ============ ==============

The interim dividend that would have been paid in June this year

has been suspended, due to the impact of Covid-19 on the

business.

9. Right of use assets

Student Accommodation Leases Motor Vehicle Leases

Office Leases

Total

GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 30 September 2018 172,228 9,411 1,577 183,216

Additions - - 125 125

Disposals - - (105) (105)

----------------------------- ---------------- --------------------- --------

At 31 March 2019 172,228 9,411 1,597 183,236

Additions - - 247 247

Disposals - - (183) (183)

----------------------------- ---------------- --------------------- --------

At 30 September 2019 172,228 9,411 1,661 183,300

Additions - - 283 283

Disposals - - (248) (248)

----------------------------- ---------------- --------------------- --------

At 31 March 2020 172,228 9,411 1,696 183,335

----------------------------- ---------------- --------------------- --------

Depreciation

At 30 September 2018 39,658 3,412 562 43,632

Charge for the period 3,598 396 227 4,221

Disposals - - (59) (59)

------- ------ ------ -------

At 31 March 2019 43,256 3,808 730 47,794

Charge for the period 3,598 396 268 4,262

Disposals - - (123) (123)

------- ------ ------ -------

At 30 September 2019 46,854 4,204 875 51,933

Charge for the period 3,598 396 305 4,299

Disposals - - (138) (138)

------- ------ ------ -------

At 31 March 2020 50,452 4,600 1,042 56,094

------- ------ ------ -------

Net Book Value

At 31 March 2020 121,776 4,811 654 127,241

-------- ------ ------ --------

At 30 September 2019 125,374 5,207 786 131,367

-------- ------ ------ --------

At 31 March 2019 128,972 5,603 867 135,442

-------- ------ ------ --------

At 30 September 2018 132,570 5,999 1,015 139,584

-------- ------ ------ --------

10. Reconciliation of profit before tax to net cash flows from operating activities

12 months

6 months to 6 months to to

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Profit before tax 26,637 22,335 47,688

Depreciation 4,676 4,526 9,318

Amortisation of intangible assets 280 280 559

Loss on sale of plant and equipment (3) (17) (42)

Finance income (200) (210) (428)

Finance costs 2,760 2,567 5,335

Share of profit in joint ventures - - (286)

Decrease/(increase) in inventory

and work in progress 25,586 (20,306) (1,948)

Interest capitalised in development

land, inventory and work in

progress 216 216 216

(Increase)/decrease in contract

assets (53,633) (32,067) (16,820)

(Increase)/decrease in trade

and other receivables (7,686) 9,606 4,682

(Decrease)/increase in contract

liabilities (702) (5,465) (9,150)

(Decrease)/increase in trade

and other payables (10,941) (23,231) (3,196)

(Decrease)/increase in provision

for property lease commitment - (461) 787

(Decrease)/Increase in share-based

payment reserve (48) 2,063 2,227

----------- ----------- -------------

Net cash (outflow)/inflow from

operating activities (13,058) (40,164) 38,942

----------- ----------- -------------

11. Analysis of net (debt)/cash

31 March 31 March 30 September

2020 2019 2019

GBP'000 GBP'000 GBP'000

Cash at bank and in hand 72,394 57,906 115,652

Hire purchase creditors (866) (1,403) (1,392)

Lease liabilities (145,756) (152,122) (149,036)

Bank loans (34,016) (38,210) (37,413)

-------------- -------------- ----------------

Net debt (108,244) (133,829) (72,189)

-------------- -------------- ----------------

Net cash (excluding lease liabilities) 37,512 18,293 76,847

============== ============== ================

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KVLFFBELZBBK

(END) Dow Jones Newswires

May 19, 2020 02:00 ET (06:00 GMT)

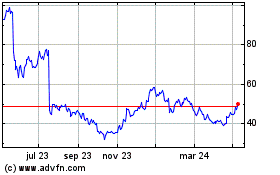

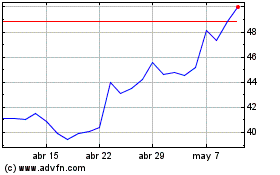

Watkin Jones (LSE:WJG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Watkin Jones (LSE:WJG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024