TIDMPTEC

RNS Number : 5227N

Playtech PLC

20 May 2020

Playtech plc (the "Company")

Results of Annual General Meeting

Playtech plc announces that at its Annual General Meeting (AGM),

held today, 20 May 2020, resolutions set out in the Notice of

Annual General Meeting dated 23 April 2020 were duly passed by

shareholders by means of a poll vote, with the exception of the

Annual Report on Remuneration.

Following Claire Milne's appointment as Interim Chairman,

effective today, Playtech announces that Claire will also be

Chairman of the Nominations Committee and as a result of the change

of company Chairman, the Board will therefore be reviewing the

structure and membership of all its committees in the near

future.

The Company has considered the reasons for the results of

today's meeting, reflected in the voting outcomes for the

resolutions regarding the directors' remuneration report and the

re-election of Ian Penrose, the Chairman of the Remuneration

Committee.

In implementing the Directors' Remuneration Policy during the

financial year ending 31 December 2019 the Remuneration Committee

has sought to balance the parameters of a publicly listed company's

remuneration policy with the need to retain and incentivise its

leadership team. Playtech confirms it will conduct a thorough

review of the remuneration policy and processes to not only reflect

market and corporate governance best practices, but also ensure

more rigorous implementation and transparent disclosure going

forward for the benefit of the Company's shareholders.

Playtech has made significant progress in developing its

corporate governance and remuneration practices over the last 18

months during Ian's tenure as Chairman of the Remuneration

Committee. As a consequence of an extensive shareholder engagement

programme, to hear and reflect the views of its shareholders, there

have been major improvements to the way in which the Company

approaches remuneration, as reflected in the support for the

remuneration policy last year. However, the Company recognises it

needs to go further. Ahead of the AGM, the Remuneration Committee

consulted further with shareholders to better understand their

views on the remuneration report. There was a mix of feedback and

this will be considered when designing a new remuneration policy,

which will be put to shareholders for approval at the 2021 AGM.

The Company understands from its engagement with shareholders in

advance of today's meeting that the minority vote against the

re-election of Ian Penrose is solely as a consequence of Ian being

Chair of the Remuneration Committee.

The Company will continue to engage with shareholders on this

issue and will provide a full update on progress within the next

six months.

For information, the votes cast were as follows:

Resolutions For % Votes Against % Votes Total Votes Votes Withheld

cast cast Cast (excl.

Votes Withheld)

1. Report and

accounts 223,703,400 99.98 33,823 0.02 223,737,223 224,703

------------ -------- ------------ -------- ----------------- ---------------

2. Remuneration

Report 72,260,453 36.28 127,020,086 63.72 199,280,539 24,681,386

------------ -------- ------------ -------- ----------------- ---------------

3. Reappoint

the auditors 219,945,803 98.21 4,015,183 1.79 223,960,986 939

------------ -------- ------------ -------- ----------------- ---------------

4. Re-Elect

John Jackson 192,089,392 85.77 31,870,542 14.23 223,959,934 1,991

------------ -------- ------------ -------- ----------------- ---------------

5. Re-Elect

Claire Milne 195,686,790 87.38 28,274,644 12.62 223,961,434 491

------------ -------- ------------ -------- ----------------- ---------------

6. Re-Elect

Ian Penrose 149,647,450 67.40 72,413,049 32.60 222,060,499 1,901,426

------------ -------- ------------ -------- ----------------- ---------------

7. Re-Elect

Anna Massion 216,248,021 99.26 1,621,294 0.74 217,869,315 6,092,611

------------ -------- ------------ -------- ----------------- ---------------

8. Re-Elect

John Krumins 217,862,969 99.99 4,846 0.01 217,867,815 6,094,111

------------ -------- ------------ -------- ----------------- ---------------

9. Re-Elect

Andrew Smith 217,495,484 97.18 6,321,451 2.82 223,816,935 1,991

------------ -------- ------------ -------- ----------------- ---------------

10. Re-Elect

Moran Weizer 216,478,266 96.66 7,483,169 3.34 223,961,435 491

------------ -------- ------------ -------- ----------------- ---------------

11. Directors

Power to allot

shares 197,843,313 88.34 26,117,997 11.66 223,961,310 616

------------ -------- ------------ -------- ----------------- ---------------

12. Disapplication

of Pre-Emption

rights 198,870,122 88.80 25,090,509 11.20 223,960,631 1,295

------------ -------- ------------ -------- ----------------- ---------------

13. Further

disapplication

of Pre-Emption

rights 198,842,170 88.79 25,118,461 11.21 223,960,631 1,295

------------ -------- ------------ -------- ----------------- ---------------

14. Market purchase

of own shares 223,673,522 99.89 249,438 0.11 223,922,960 38,966

------------ -------- ------------ -------- ----------------- ---------------

At 20 May 2020, the issued share capital of the Company was

299,328,354 ordinary shares of no par value (excluding 9,965,889

shares held as treasury shares).

In accordance with Listing Rule 9.6.2, copies of the resolutions

(other than those concerning ordinary business) will be submitted

to the National Storage Mechanism and will be available for viewing

at www.morningstar.co.uk/uk/nsm

The NSM can be accessed at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The proxy figures for the resolutions will also displayed on the

Company's corporate website - www.playtech.com

- Ends -

For further information please contact:

Playtech plc +44 (0) 16 2464 5954

Chris McGinnis, Director of Investor Relations &

Strategic Analysis

James Newman, Director of Corporate Affairs

Headland (PR adviser to Playtech) +44 (0) 20 3805 4822

Lucy Legh, Stephen Malthouse

About Playtech

Founded in 1999 and premium listed on the Main Market of the

London Stock Exchange, Playtech is a technology leader in the

gambling and financial trading industries.

Playtech is the gambling industry's leading technology company

delivering business intelligence driven gambling software,

services, content and platform technology across the industry's

most popular product verticals, including, casino, live casino,

sports betting, virtual sports, bingo and poker. It is the pioneer

of omni-channel gambling technology through its integrated platform

technology, Playtech ONE. Playtech ONE delivers data driven

marketing expertise, single wallet functionality, CRM and

responsible gambling solutions across one single platform across

product verticals and across retail and online.

Playtech partners with and invests in the leading brands in

regulated and newly regulated markets to deliver its data driven

gambling technology across the retail and online value chain.

Playtech provides its technology on a B2B basis to the industry's

leading retail and online operators, land-based casino groups and

government sponsored entities such as lotteries. Through the

acquisition of Snaitech, Playtech directly owns and operates a

leading sports betting and gaming brand in online and retail in

Italy, Snai.

Playtech's Financials Division, named TradeTech Group, is a

technology leader in the CFD and financial trading industry and

operates both on a B2B and B2C basis.

Playtech has in total c.6,000 employees across 21 countries and

is headquartered in the Isle of Man.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

RAGZBLFLBELBBBV

(END) Dow Jones Newswires

May 20, 2020 10:30 ET (14:30 GMT)

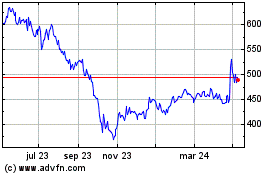

Playtech (LSE:PTEC)

Gráfica de Acción Histórica

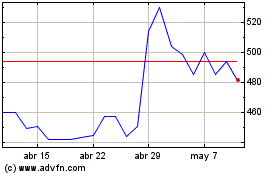

De Mar 2024 a Abr 2024

Playtech (LSE:PTEC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024