TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

05 June 2020

Armadale Capital Plc ('Armadale' or 'the Company')

DFS update increases Mahenge NPV to $430 million

Armadale Capital plc (LON: ACP), the AIM quoted investment group

focused on natural resource projects in Africa, is pleased to

provide results for the updated Definitive Feasibility Study for

its Mahenge Liandu graphite project ('Mahenge' or 'the Project') in

south-east Tanzania, completed by experienced graphite specialists

BatteryLimits.

The update, which is based upon a revised Mine Schedule using a

higher-grade cut off of 9% Total Graphitic Carbon ('TGC'), a higher

strip ratio of 1.95:1, and a rescheduled Stage 2 expansion, results

in the production profile increasing average annual output from

80ktpa to 109ktpa of concentrate over life of mine, which is a

significant 30% increase on the recently completed Definitive

Feasibility Study ('DFS').

Highlights

-- Updated Mine Schedule reaffirms Mahenge as a long-life low-cost graphite

project

-- 30% increase in average annual production of large flake high-purity

graphite to 109ktpa compared to recently completed DFS annual production

of 80kpta

-- 20% increase in estimated pre-tax NPV to US$430m and IRR of 91%

-- US$985m pre-tax cashflow to be generated from initial 15 year mine life

utilising just 25% of the resource, which remains open in multiple

directionsoffering significant further upside

-- Staged ramp-up planned to facilitate near term production with 60,000tpa

graphite concentrate to be produced for the first three years (Stage 1)

before increasing to LOM average 109,000tpa (Stage 2)

-- A higher-grade cut off is expected to allow the Company to maximise

initial production and build lower grade stockpiles in subsequent years

-- Low capital cost estimate - Stage 1 is US$39.7m, including contingency of

U$S4.1m or 15% of total direct capital cost

-- 1.6 year (after tax) payback period from first production for Stage 1

based on an average sales price of US$1,112/t

-- Stage 2 expansion is expected to be funded from cashflow

-- Application for Mining Licence is planned to commence by the end of June,

with further updates due shortly

-- Projected timeline to first production is expected to be approximately

10-12 months from the start of construction

The delivery of the updated DFS delivery confirms the enormous

commercial potential of Mahenge and will support ongoing

discussions for binding offtake agreements, debt package finance

for construction and project level development funding. Following

these substantially improved economics to an already attractive

Feasibility Study, a number of initiatives are currently advancing

with respect to project financing and the Company hopes to be in a

position to update the market shortly with respect to one or more

of these workstreams.

Armadale Chairman, Nick Johansen, commented:

"The updated DFS demonstrates the exceptional potential of the

Mahenge Liandu Graphite Project. The use of a higher-grade cut off

and mining of a higher-grade material at an increased pace leaves

significant scope for the Project to produce higher volumes of

graphite over the 15 year mine life at a higher EBITDA margin, and

as reflected in the significantly improved NPV figures greatly

enhances its already attractive economics.

"The Mahenge project has a long mine life, low cost of

production and has now been significantly de-risked at a time of

rapidly increasing demand for large-flake graphite. As such it

represents an attractive opportunity for investors who wish to gain

exposure at a crucial inflection point in its development. The

updated DFS reconfirms the enormous commercial potential of the

Mahenge graphite project and lends strong support to our ongoing

discussions for binding offtake agreements, debt package finance

for construction and project level development funding -- all

workstreams which are in flight and advancing well and which we

hope to provide further updates upon in the near future. In

addition, important work continues with progressing workstreams in

relation to Detailed Design Engineering, and the finalisation of

the Company's application for a full Mining Licence (and thus

furthering major permitting milestones).

"Armadale has continued to deliver a number of key value

accretive milestones in recent months and we look forward to

maintaining this momentum in the near term in order to continue to

build value for shareholders."

Project update summary

Mining

An updated Mine Schedule using a higher-grade cut off of 9% TGC

has resulted in a LOM average production increase of 30% to 109

ktpa.

The updated mine schedule is based on the following key

changes;

-- Increase in cut off grade to 9% TGC

-- Revision of phased production expansion profile with stage 2 expansion

moved forward from year 5 to year 4 resulting in average stage 1

production of 61 ktpa increasing to 121 ktpa in year 4.

-- Inclusion of a proportion of high-grade inferred material

Table 1: The updated mining inventory

Area Unit DFS results Update

Mining inventory (Mt) 14.40 13.42

Measured and indicated (Mt) 14.40 10.84

Inferred (Mt) 2.58

Mine grade (TGC%) 9.90 12.50

Strip ratio 1.10 1.95

The revised production profile is shown in table 2, which now

starts at 53.3ktpa ramping up to an average rate of 121ktpa after

year 4.

Table 2: Updated Production Schedule by Year.

Year Mill Feed Mt Head Grade TGC % Concentrate Kt

Y1 0.4 14.5% 53.3

Y2 0.5 12.1% 71.0

Y3 0.5 12.4% 59.1

Y4 1.0 13.4% 121.5

Y5 1.0 12.1% 131.3

Y6 1.0 11.9% 118.6

Y7 1.0 13.1% 116.3

Y8 1.0 11.7% 128.5

Y9 1.0 12.4% 115.1

Y10 1.0 12.5% 122.0

Y11 1.0 12.6% 122.1

Y12 1.0 12.2% 123.6

Y13 1.0 12.3% 119.1

Y14 1.0 12.5% 120.2

Y15 1.0 13.1% 121.9

Key financial metrics

The recently completed DFS confirmed Mahenge as a long-life

low-cost graphite project with a US$358m NPV and IRR of 91% based

on a two-stage expansion strategy.

The updated mining schedule and revision of the schedule stage 2

expansion from year 5 to year 4 has resulted in a 20% increase in

project NPV to US$430m. The IRR remains at 91% with a modest less

than 3% increase in capital to US$39.7m.

Further, the average LOM product sales price of $1,112/t

reflects a more conservative product pricing assumption adopted for

the update.

Table 3: Updated DFS key financial metrics

DFS results (Mar

Area Unit 2020) Update Results

Mining inventory (Mt) 14.4 13.4

Mine grade (TGC%) 9.9 12.5

Strip ratio 1.1 2.0

Project Life (years) 17 15

Total LOM Net Revenue (US$ M, real) 1,634 1,823

Total LOM EBITDA (US$ M, real) 981 1,085

Total LOM Net Cash

Flows Before Tax (US$ M, real) 883 985

Total LOM Net Cash

Flows After Tax (US$ M, real) 618 690

NPV @ 10.0% - before

tax (US$ M, real) 358 430

NPV @ 10.0% - after

tax (US$ M, real) 242 292

IRR - before tax (%, real) 91% 91%

IRR - after tax (%, real) 67% 68%

Project Capital

Expenditure (US$ M, real) 38.6 39.7

Payback Period -

after tax (years) 1.6 1.6

Average Sales Price

(LOM) Product (US$/t) 1,179 1,112

Cash Costs (FOB DES) (US$/t, real) 385 369

Sensitivity Analysis

Additional financial sensitivity analysis has been undertaken

and is outlined in tables 4 and 5.

Table 4 NPV sensitivity analysis (before tax)

Base

Key metric 30% Unfavourable 20% Unfavourable 10% Unfavourable Case 10% Favourable 20% Favourable

US$ US$M US$M US$M US$M US$M

Capital

Expenditure 407 415 422 430 437 445

Operating

Expenditure 324 360 395 430 465 500

Grade 224 293 361 430 498 567

Price 192 271 350 430 509 588

LOM Average

Sales Price

$/t 778 889 1000 1112 1223 1334

Table 5 IRR sensitivity analysis (before tax)

Base

Key metric 30% Unfavourable 20% Unfavourable 10% Unfavourable Case 10% Favourable 20% Favourable

Capital

Expenditure 71% 77% 83% 91% 100% 111%

Operating

Expenditure 71% 78% 84% 91% 97% 104%

Grade 55% 67% 79% 91% 103% 114%

Price 49% 63% 77% 91% 104% 118%

The DFS updated financial metrics show a significant improvement

in the already compelling economics of the Mahenge project. The

sensitivity analysis furthers shows robustness of the Project,

where a 30% reduce in product pricing still results a US$192m NPV

and IRR of 49%.

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Nick Johansen, Non-Executive Director

Tim Jones, Company Secretary +44 (0) 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Teddy Whiley +44 (0) 20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0) 1483 413500

Press Relations: St Brides Partners Ltd

Charlotte Page / Beth Melluish +44 (0) 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant Indicated and inferred mineral resource estimate of

59.48Mt @ 9.8% TGC, making it one of the largest high-grade

resources in Tanzania, and work to date has demonstrated Mahenge

Liandu's potential as a commercially viable deposit with

significant tonnage, high-grade coarse flake and near surface

mineralisation (implying a low strip ratio) contained within one

contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto

Gold project in the Democratic Republic of Congo and a portfolio of

quoted investments.

More information can be found on the website

www.armadalecapitalplc.com.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200605005183/en/

CONTACT:

Armadale Capital Plc

SOURCE: Armadale Capital Plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

June 05, 2020 06:45 ET (10:45 GMT)

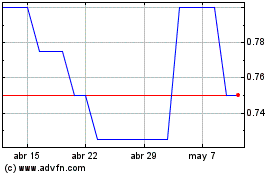

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Armadale Capital (LSE:ACP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024